Pass The Required Test

Beginning with the passage of The Secure and Fair Enforcement for Mortgage Licensing Act in 2008 , all mortgage brokers must pass a pre-licensing exam. Most will take the National Test with Uniform State Content, which applies to brokers in most states. In states that havent adopted this test as the only examination requirement, brokers will have to pass an additional State Component Test with questions specific to that states mortgage laws. Be prepared to pay a fee for the universal test and for the state test . Both tests require a grade of 75% or higher to pass.

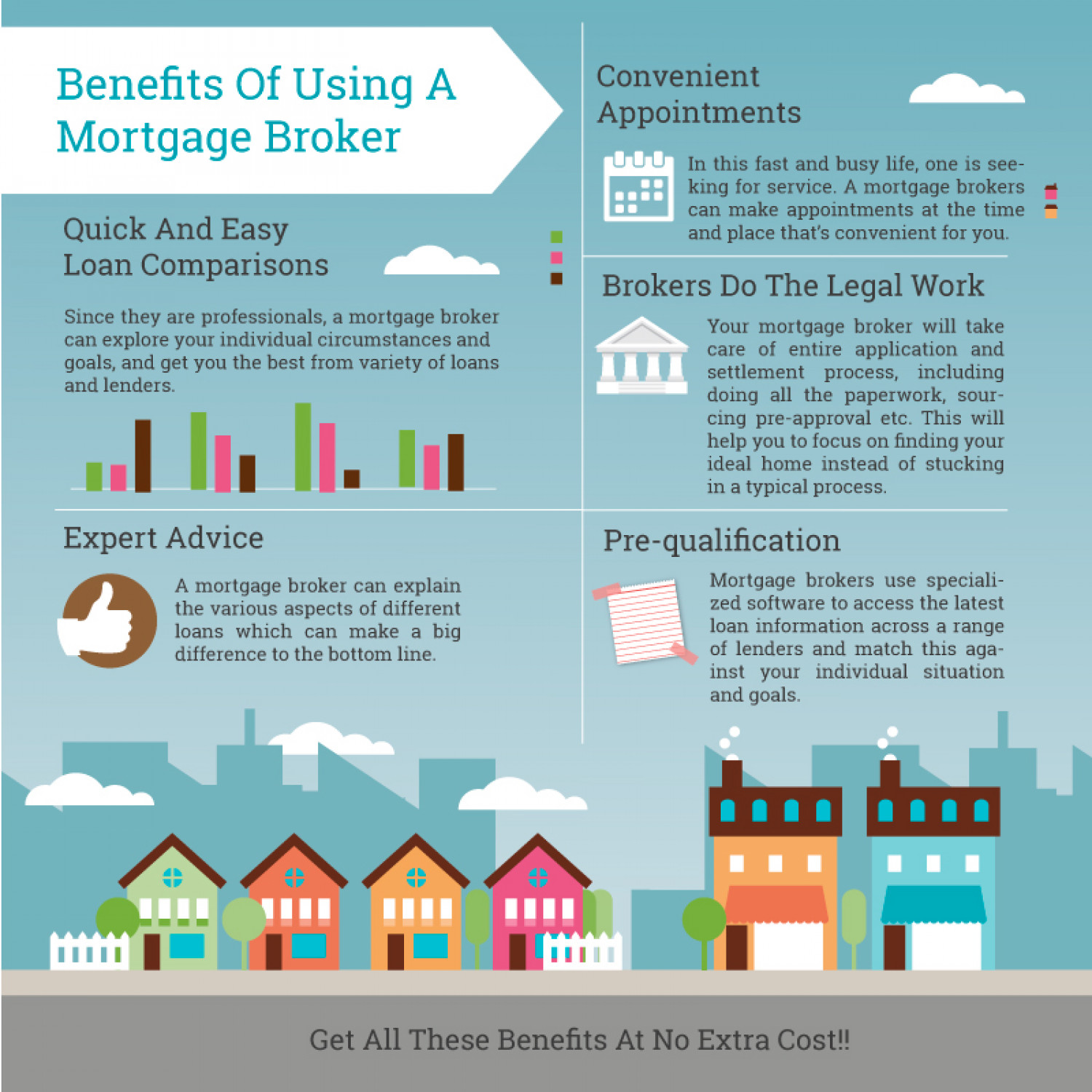

Advantages Of Using A Mortgage Broker

A broker can assist a client with fee management concerning their desire to obtain a mortgage or approach a new lender. The fees include the application fees, potential appraisal fees, and origination fees .

The broker saves their client work and time because they usually possess a great deal of information about lenders, repayment terms, and administrative fees or other fees that can be disguised in their contracts. However, borrowers are still encouraged to perform their own research.

Brokers tend to be well acquainted with lenders and are trusted by lenders. This makes the process easier because some lenders prefer to work only with clients. Brokers can also obtain good rates from lenders because they bring in clientele for the lender.

We Will Support You Through The Process

MC offers comprehensive training and support, as well as the systems and industry knowledge to help you build your own thriving mortgage broking business. Dont have finance industry experience or qualifications? No problem. Many of our high- performing franchisees and business owners have come from outside the industry. Experience is not essential. Well provide the training and accreditation you need to be successful in your new franchise.

The most important prerequisite to becoming a Mortgage Choice broker is the desire to help people achieve their property and investment dreams.

Fast track your application now

Read Also: How To Become A Mortgage Underwriter In Arizona

Payg Employee Versus Self

New brokers considering whether to start their career as a PAYG employee or to go it alone as a sole trader often way up the benefits of job security versus the unlimited potential to rapidly grow their income, respectively.

Unfortunately, many fail to consider the upfront and ongoing costs associated with being self employed versus having a base salary and working for a mortgage brokerage.

There are many key elements you need to factor in before making decision and getting advice is crucial.

Check out the Should I Be A PAYG Or Self Employed Mortgage Broker? page where we list the pros and cons of each employment model.

Mortgage Choice And You

If youre prepared to roll your sleeves up, your Mortgage Choice franchise can be an outstanding investment and the way to take control of your future.You have the potential to enjoy the rewards of your own effort backed by our extensive support, and experience the financial and personal benefits of a growing business.Find out more about how to become a Mortgage Choice franchise owner.

Also Check: How Calculate Pmi In A Mortgage

Who Makes A Good Mortgage Broker

Mortgage brokering is basically a sales career. If you cannot see yourself as a salesperson, this may not be the position for you. Even though sales-based, the fact that you will have customers at one of the most exciting points in their life means that your likely to be met with a little more enthusiasm than the average telemarketer.

Attention to detail, and the ability to think quickly on your feet are also important qualities in a mortgage broker. The typical mortgage broker will have 30 to 50 lending institutions that they deal with, and must be familiar with each. When a new client comes in shopping for a mortgage, you will need to access the situation, determine their strengths and weaknesses, and offer them a loan package that will best meet their needs.

Take More Brokerage Training

Finally, being a successful mortgage broker is an ongoing process that requires training and education along the way. There are several courses you can take, either online or in person, that improve your knowledge of the industry, state and federal regulations, and trends impacting the market. You may also want to build relationships with other mortgage brokers to stay up to date with best practices and industry shifts, all meant to improve your business and value you add to your client’s mortgage search.

You May Like: How Much Mortgage Can I Afford For 1400 A Month

How To Become A Mortgage Broker In 6 Steps

If youre curious how to become a mortgage broker, a good place to start is by defining what they do and the state of the mortgage industry. Mortgage brokers ensure the mortgage lending process goes smoothly for all involved and serves the interests of both parties.

Estimates suggest that around 16% of all mortgages originate through a broker. Considering that tens of millions of mortgages originate each year, thats quite a large number. Plus, reliance on mortgage brokers rather than borrowers and lenders working together directly has increased for 10 quarters in a row. For ambitious individuals, those growth figures suggest an in-demand occupation with unlimited earning potential. Mortgage brokers can also take pride in knowing theyre helping people find a place to live. If this sounds like an appealing career, now is an ideal time to join the industry and become a mortgage broker but there are requirements you must complete first.

Follow the steps below to put your mortgage broker career on the fast track:

After You Get Licensure

Once you receive your license, you can begin work as a home loan originator. Some MLOs work independently, but newbies often prefer to begin with an established business that has an existing client base, such as a bank, mortgage lending institution, or credit union.

With all the bureaucracy involved in the licensure process, it is important to keep your focus on the goal you had in mind when you first started looking into how to become a loan officer helping people move into their dream homes.

Buying property can be a complicated and stressful process for your average person, but a qualified and supportive MLO can make the experience easier, allowing homebuyers to enjoy their investment with the knowledge they have secured the best home loan possible.

The work doesn’t end here, though. It is important that MLOs keep up with professional development to keep their license and stay current with mortgage lending practices.

Recommended Reading: Can You Mortgage A House You Own

Question: How Hard Is It To Become A Mortgage Broker

There are no hard-and-fast requirements for becoming a mortgage broker, but you will need some type of training. Many brokers are former loan officers who decided to strike out on their own, or real estate agents who decided they wanted to try the financial side of things. A background in sales is often helpful.

What Skills Do You Need To Become A Mortgage Broker

A mortgage broker should be able to understand the market, be up-to-date on current loan options and interest rates, and have the research skills necessary to complete the process of securing a loan for their client. They should also possess problem-solving skills to help clients navigate challenges during the buying process.

Mortgage brokers should be able to communicate clearly and effectively with their clients, as well as with lenders, and also hone in on their listening skills to hear their clients concerns. Negotiation skills are also important for mortgage brokers when working with lenders to secure the best possible deal for their clients.

The ability to network and remain in good standing with a solid circle of lenders can also lead to success for mortgage brokers. They can often make and maintain relationships with lenders and community members by providing outstanding customer service skills and staying organized.

What is the average salary for a mortgage broker?

The average salary for a mortgage broker in the U.S. is $77,202 annually, according to data from ZipRecruiter. Mortgage brokers located in Massachusetts and Hawaii have the highest average annual salaries at $82,480 and $81,487 respectively.

How much a mortgage broker makes on any given deal will vary based on home values, the housing market as a whole, and the area where theyre located.

Read Also: How To Calculate Yearly Mortgage Interest

You May Owe A Broker Fee

Mortgage brokers are paid either by the lender or by you. If the fee is covered by the lender, you need to be concerned about whether you’ll be steered to a more expensive loan because the commission to the broker is more lucrative. If you pay the fee, figure it into the mortgage costs before deciding how good a deal you are getting. And be sure to settle all fee issues upfront before you start working with a broker or sign anything.

Spend some time contacting lenders directly to obtain an understanding of which mortgages may be available to you.

Submit Your Mortgage Broker Application

After receiving your bond certificate, you will then sign it and send it along with your license application to the state. The mortgage broker application requires you to provide information about your business name and location, any web address you may use in the operation of your business, your registered agent of the business, and answers to specific disclosure statements per your state guidelines. You will also be subjected to a criminal background check.

New mortgage brokers may also need to provide details about their business, including a business plan, an organizational chart, and a list of executives or managers who are part of the business structure. These details and the application forms can be found on NMLS.

Recommended Reading: How Big A Mortgage Can I Get With My Salary

Viking Bond Service A Partner To Mortgage Brokers

Meeting the requirements to obtain a mortgage broker bond and become a mortgage broker are both common and important but managing them can often be confusing and tedious. Thats where Viking Bond Service comes in. As a nationwide surety that can issue appropriate mortgage broker bonds in all 50 states, we can help anyone meet their bond requirements. More than that, we go above and beyond to offer fast and friendly service backed by exceptional support. How much would your mortgage broker bond cost? Request a no-cost, no-obligation quote to explore the answer, and expect to get a number back in under 24 hours! Do you have more questions about how to become a mortgage broker or surety bonds more generally? Call us to answer your questions at 1-888-278-7389 or contact us at your convenience.

Become A Mortgage Broker

Thinking you might like to pursue a career in the mortgage business? Then being a mortgage broker might be the right path for you. Successful mortgage brokers earn a pretty good living and often work independently, being their own boss. It can be an attractive alternative for someone who wants to work in the financial field but not for a big corporation.

The term “mortgage broker” is not just another name for a mortgage lender or loan officer. A mortgage broker doesn’t make loans directly, but acts as an intermediary to help borrowers obtain mortgages from lenders.

Whereas a loan officer represents the bank or lender he or she works for, and will offer only the loan products they carry, a mortgage broker will often work with several dozen different lenders and be able to arrange loans with any of them. This means a mortgage broker can be more versatile than a single lender can be, matching clients to the lender and loan product that best serves their needs.

A mortgage broker can be a company that employs multiple agents who arrange mortgages for customers under the company’s shingle, or a single individual working independently or for a firm.

Read Also: What Is The Difference Between A Mortgage Rate And Apr

Process Of Mortgage Brokerage

Since a mortgage broker serves as the middleman between lenders and borrowers, the process often begins with a client wishing to buy a new home or seeking to refinance.

The client approaches a mortgage broker, and the broker approaches different lenders and finds out the requirements and rates to provide options suited to their situation.

The broker collects documents such as proof of employment, proof of income, credit reports, details of the clients assets , and any other important details that may be required to determine the borrowers ability to secure financing from the lender.

The mortgage broker makes an estimation of the appropriate loan amount and type for the borrower and the loan-to-value ratio. The broker then submits the financing application to a lender for approval, acting as a liaison for the lender and the borrower during the entire process.

Once approved, the funds are loaned , and the broker collects an origination fee from the lender for the services rendered. The payment is only received by the broker once the transactions been finalized.

How To Choose A Mortgage Broker

- Start by making sure you understand what a mortgage broker does.

- Then, ask friends, relatives, and business acquaintances for referrals.

- Take a look at online reviews and check for complaints.

- When meeting prospective brokers, get a feel for how much interest they have in helping you get the loan you need.

- Ask about their experience, the precise help that they’ll provide, the fees they charge, and how they’re paid .

- Also ask whether they can help you in particular, given your specific financial circumstances.

You May Like: What Is The Highest Interest Rate For Mortgage

What Skills Does A Mortgage Broker Need

Not only do mortgage brokers need to know the lending process, lending rates and lending institutions, but they also have to have a variety of hard and soft skills to help them perform their job successfully. Here are some skills a mortgage broker needs:

Attention to detail

Mortgage brokers usually have strong attention to detail. This can help them when reviewing loan options, rates and terms. The better they read the fine print, the easier it can be for them to present their clients with profitable mortgage opportunities.

Interpersonal skills

Most mortgage brokers have friendly and outgoing personalities that allow them to effectively communicate with clients and financial institutions. Having good social skills can make it easier to get along with everyone you work with and might make your job more enjoyable. To develop your interpersonal skills, consider being an active listener and practicing ways to speak positively and professionally to others.

Related: Interpersonal Skills: Definitions, Examples and How To Improve

Patience

Mortgage brokers can also benefit from having enough patience to find lenders who are willing to work with their prospective borrowers. Patience can also help them accommodate their client’s various schedules and be willing to wait for them to make a decision about their loan options. Having patience can also help a mortgage broker remain positive when they receive rejections from lenders.

Negotiation skills

Organizational skills

Develop A Network Of Lenders And Buyers

You must continually develop your professional connections. This is an essential element of how to become a mortgage broker.

First and foremost, you need to create relationships with lending institutions, as well as with real estate agents. You can attend housing or mortgage industry events and seek contacts at key loan providers to enrich your portfolio. This is also a valuable use of your time working as a mortgage broker in an established company prior to working independently.

Also Check: What Is Reverse Mortgage Meaning

Why Should I Be A Loan Officer

If so, pursuing a career as a loan officer may be for you. Loan officers work in mortgage companies and are responsible for evaluating the loan applications and documents of applicant seeking to purchase a home. Fully and accurately explain loan provisions to clients. Maintaining customer confidence.

Work Environment For A Mortgage Broker

While some mortgage brokers work in an office space alongside other mortgage brokers and mortgage professionals, others work alone in their own homes. Though each broker may have a different working environment, they share many of the same working conditions.

For example, mortgage brokers typically meet with clients in office spaces and communicate with lenders either in person or over the phone. Mortgage brokers may also have irregular hours, working nights or weekends depending on their clients’ needs.

Related: A Career in Real Estate: Frequently Asked Questions

Don’t Miss: What To Look For Mortgage Loan

Loan Officers Vs Mortgage Brokers

Loan officers are normally associated with one institution. They offer mortgage loan deals and rates from the institution they are tied to.

On the other hand, mortgage brokers work on the client or borrowers behalf to find a lender well-suited for the clients needs. They screen various options for the client. It is important, however, to note that not all lenders will work with a broker.

Take And Pass The Nmls Exam

When you have completed your pre-licensing courses and personal preparations, its time to take the NMLS exams. Also known as the SAFE exam, it will test you in five major categories:

- General knowledge of mortgage origination

- Loan origination activities

- Uniform state content

Most states have adopted the uniform state content to be included in the national test. These are 25 questions that gauge the applicants knowledge of state-specific facts and policies related to the SAFE Act.

Before taking the test, you need to create an online account in NMLS for enrollment. Once youve enrolled, you have 180 days to schedule an exam appointment.

Note that registration has a non-refundable fee of $110 as of June 2021. Additionally, the UST portion costs $69.

After scheduling your test sessions, you will receive an email confirmation about the time and location. If you need special accommodations due to certain disabilities, you need to indicate them on your enrollment form.

A test appointment has a strict time allocation of 225 minutes. You will have 190 minutes to answer a total of 120 questions, while 30-35 minutes will be allocated for a tutorial and an optional applicant survey.

The test should not be taken lightly as takers usually find it difficult. Only 58% of aspiring brokers who took it for the first time passed in 2020, according to the NMLS. The passing rate is slimmer for second-timers at 47%.

Also Check: Who Can Get A Fha Mortgage