How Do You Choose Which Credit Score To Use

-

During pre-approval, we typically use the Experian FICO-II credit score from Experian. This is a soft credit check and won’t affect your credit score. If you apply with a co-borrower, we use the lower of your two scores.

When you want to continue with your loan application, with your authorization we pull your credit scores from all three major credit bureaus and use the median of the three scores received.

Ready to get pre-approved?Get started

Related questions

Better is a family of companies serving all your homeownership needs.

We cant wait to say Welcome home. Apply 100% online, with 24/7 customer support.

Connect with a local non-commissioned real estate agent to find out all the ways you can save.

Shop, bundle, and save on insurance coverage for home, auto, life, and more.

Get a loan up to $50,000 for all your home needs, including moving, renovations, and furniture.

Get free repair estimates, 24-hour turnarounds on reports, and rest easy with our 100-day inspection guarantee.

Get transparent rates when you shop for title insurance all in one convenient place.

Better Home Line of Credit Terms and Conditions

Home lending products offered by Better Mortgage Corporation. Better Mortgage Corporation is a direct lender. NMLS #330511. 3 World Trade Center, 175 Greenwich Street, 57th Floor, New York, NY 10007. Loans made or arranged pursuant to a California Finance Lenders Law License. Not available in all states. Equal Housing Lender.NMLS Consumer Access

Which Fico Score Is Used When Purchasing A Home

Commonly used FICO® scores for mortgage loans are: FICO® Score 2, or Experian/Fair Isaac Risk Model v2. FICO® Score 5, or Equifax Beacon 5. FICO® Score 4, or TransUnion FICO® Risk Score 04.

Is FICO score 8 used for mortgages?

Scoring model used in mortgage applications While the FICO® 8 model is the most widely used scoring model for general lending decisions, banks use the following FICO scores when you apply for a mortgage: FICO® Score 2 FICO® Score 5

Is Fico Score 8 Used For Mortgages

Scoring model used in mortgage applications While the FICO® 8 model is the most widely used scoring model for general lending decisions, banks use the following FICO scores when you apply for a mortgage: FICO® Score 2 FICO® Score 5

Can FICO 8 be used for mortgage?

FICO 8 and 9 are not the only versions that work. Some lenders and industries use older versions like FICO 2, 4, and 5. In fact, this is still used by the mortgage industry when assessing creditworthiness for new mortgages and deciding on interest rates.

Do most lenders use FICO score 8?

FICO Score 8: Overview. Most lenders look at a borrowers FICO score , but there are even multiple FICO scores for each borrower. 1 FICO Score 8 is the most common, especially with credit card companies, but FICO Score 5 can be popular among car lenders and mortgage providers.

Also Check: Can I Apply For Mortgage With Multiple Lenders

Do Banks Use Fico Or Vantage

Mortgage lenders typically use FICO Scores 5, 2 and 4 when determining whether or not to approve a loan. Additionally, one type of credit score to keep an eye on moving forward is the VantageScore, a score that was developed by the three main credit bureaus and currently serves as a competitor to FICO.

Stay Away From Hard Credit Inquiries

When you apply for any conventional loan or credit card, the lender will ask one or more of the credit bureaus for a copy of your credit report. The credit bureau will make a note of this on your credit report as a hard inquiry.

Each hard inquiry on your report drops your credit score by a few points. Lots of hard inquiries in a short period of time can really damage your score. This is because a borrower who is applying for a lot of loans in a short period is probably having financial problems.

When youre thinking about applying for a big loan, especially a mortgage, make sure you try to avoid any unnecessary hard inquiries.

The good news is that most credit scoring models wont punish you for rate shopping. If you apply for a mortgage from multiple lenders within a short period of time, typically a few weeks, most models will treat all of those applications as a single inquiry.

Also Check: Does Down Payment Affect Mortgage Rate

Is Fico Score 8 Good Or Bad

FICO 8 scores range between 300 and 850. A FICO score of at least 700 is considered a good score. There are also industry-specific versions of credit scores that businesses use. For example, the FICO Bankcard Score 8 is the most widely used score when you apply for a new credit card or a credit-limit increase.

What It Takes To Get A Good Fico Score

When you apply for credit, you dont get to choose what credit score is used. But the way to get a good score is the same no matter which scoring model is used:

-

Pay bills on time, every time.Late payments hurt your score, and the later they are, the worse the damage.

-

Use credit lightly. Lower can make a big difference in your score.

-

Check your credit reports. You can dispute errors or negative information thats too old to be reported and have it removed.

Other credit score factors, including how recently youve applied for credit, the mix of your credit accounts and how long youve had credit also affect your score. But if you consistently pay your bills on time and keep balances low, youre likely to have a good score no matter what model is used.

Recommended Reading: How To Qualify For Zero Down Mortgage Loan

The Scoring Model Used In Mortgage Applications

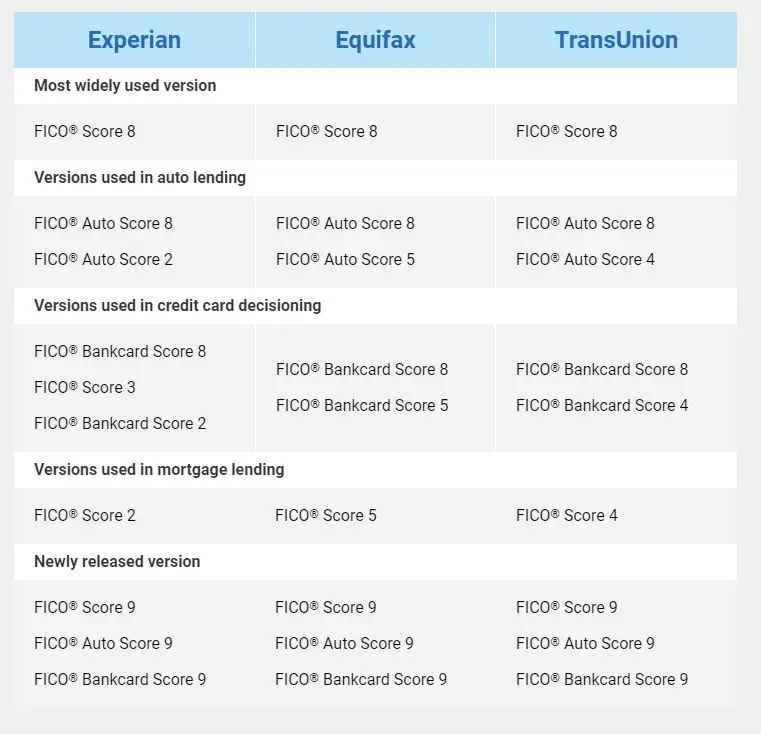

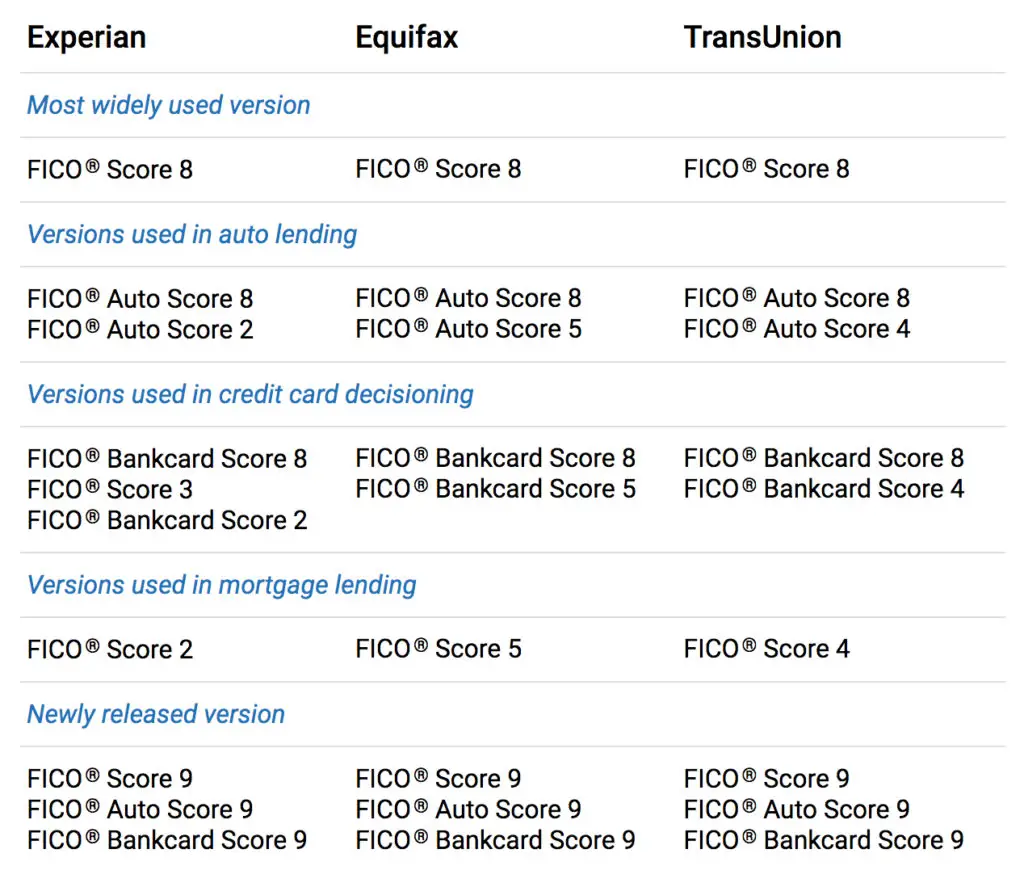

While the FICO® 8 model is the most widely used scoring model for general lending decisions, banks use the following FICO scores when you apply for a mortgage:

As you can see, each of the three main credit bureaus use a slightly different version of the industry-specific FICO Score. That’s because FICO tweaks and tailors its scoring model to best predict the creditworthiness for different industries and bureaus. You’re still evaluated on the same core factors , but the categories are weighed a little bit differently.

It makes sense: Borrowing and paying off a mortgage arguably requires a different mindset than keeping track of and using a credit card responsibly.

The FICO 8 model is known for being more critical of high balances on revolving credit lines. Since revolving credit is less of a factor when it comes to mortgages, the FICO 2, 4 and 5 models, which put less emphasis on , have proven to be reliable when evaluating good candidates for a mortgage.

How Do Lenders Use Credit Scores

Mortgage lenders mainly use credit scores to evaluate whether you will be able to repay your mortgage loan.

They often will order your full credit report, which contains various scores based on the types of credit you have.

Lenders evaluate your credit score to determine which loans you can get, and the interest rates you will pay. If you have a low score, it could mean anything from paying more for a loan to not qualifying for one altogether.

When refinancing, your credit score is used in a similar way to determine the rates and terms of your new mortgage and whether you are able to refinance at all.

Thats why its important to keep your credit score in check and work closely with your lender to determine the best time to refinance.

Recommended Reading: How Long Does It Take To Do A Reverse Mortgage

Recommended Reading: What Is A Cd In A Mortgage Process

Which Fico Score Do Mortgage Lenders Use

John Ulzheimer is an expert on credit reporting, credit scoring, and identity theft. The author of four books on the subject, Ulzheimer has been featured thousands of times in media outlets including the Wall Street Journal, NBC Nightly News, New York Times, CNBC, and countless others.With over 30 years of credit-related professional experience, including with both Equifax and FICO, Ulzheimer is the only recognized credit expert who actually comes from the credit industry.He has been an expert witness in over 600 credit-related lawsuits and has been qualified to testify in both federal and state courts on the topic of consumer credit. In his hometown of Atlanta, Ulzheimer is a frequent guest lecturer at the University of Georgia and Emory University’s School of Law.

Edited by: Lillian Guevara-Castro

Lillian brings more than 30 years of editing and journalism experience, having written and edited for major news organizations, including The Atlanta Journal-Constitution and the New York Times. A former business writer and business desk editor, Lillian ensures all BadCredit.org content equips readers with financial literacy.

When you apply for a loan or credit card, its practically a given that a lender will check one of your credit reports and one of your credit scores as part of the underwriting process. Credit scores help lenders assess the risk of doing business with you and ultimately decide whether its a wise investment to loan you money.

Why Are There Multiple Fico Score Versions

Since FICO® Scores were introduced to lenders over 25 years ago, they have become an industry standardthe best-known and most widely used credit score. But quite a bit has changed since lenders first started using FICO® Scores in 1989. Lender credit-granting requirements, data reporting practices, consumer demand for credit, and consumer use of credit have all evolved.

FICO has redeveloped its scoring formula several times to keep pace with this changing credit landscape, ensuring that it remains an intuitive predictor of credit risk. FICO® Score models are updated to keep lending fast and fair for both the lender and consumer. When we update our model, we make sure that the score reflects changing consumer credit behavior, includes our newest analytic technology, and is adjusted for recent data reporting enhancements.

When a new FICO® Score version is developed, we release it to the market. From there, each lender determines if and when it will upgrade to the latest version. Some lenders make the upgrade quickly, while others may take several years. This is why some lenders are currently using different versions of the FICO® Score. An example, FICO® Score 5 at Equifax is the FICO® Score version previous to FICO® Score 8 at Equifax.

You May Like: What Would A Mortgage Payment Be On 175 000

Fico Score Types: Fico Is The Score Used By 90% Of Lenders

To learn more, click the more info options below each score

Most Widely Used Version: FICO 8

Score Range: 300 850

Used in Mortgage Lending: Beacon 5.0 from Equifax, FICO-II from Experian, and FICO Classic 04 from TransUnion

Score Range: 300 850

Used in Auto Lending: FICO Auto Score 2, 4, 5, 8

Score Range: 250 900

Used in Credit Card Decisions: FICO Bankcard Score 2, 3, 4, 5, 8

Score Range : 250 900

Score Range : 300 850

Newest Versions: FICO 9, 10, 10 T

Score Range: 300 850

More Info: How to check your FICO 9 Score? | What is Ultra FICO? | FICO 8 vs FICO 9 | What new changes are in FICO 10?

Key: All scores above that contain a 5 are exclusive to Equifax. Scores with a 2 are exclusively from Experian. Scores with a 4 are exclusively from Transunion. Please note: Many people have three separate scores for FICO 8, 9, 10, 10 T, along with FICO Bankcard Score 8 and FICO Auto Score 8. FICO derives one score from each of the big three credit bureaus, Experian, TransUnion, and Equifax. FICO Bankcard Score 3 is exclusive to Experian.

While FICO is the most important, weve got many more score types to cover.

If youve asked:

- Whats the difference between Experian, TransUnion, and Equifax?

- Why do I have 3 scores?

- Why is my FICO Score important?

- What score do I check if Im applying for a home or auto loan?

- And what the heck is this VantageScore?

Youre in the perfect place!

Which Fico Score Generation Do Mortgage Lenders Use

The best-known credit scores are going to fall under either the FICO or VantageScore brands. There are multiple generations of each score brand, as every few years, the score developers create newer versions. So, for example, theres a VantageScore 1.0, 2.0, 3.0, and 4.0.

In most lending environments outside of mortgages, its hard to know which specific credit score a lender will use to evaluate your application. And, even if you knew your lender used a FICO Score or a VantageScore credit score, you still would not know which generation of the score it is using.

For example, you may apply for an auto loan with one lender that checks your FICO Auto Score 8 based on your Experian credit report. Yet, if you apply for financing with a different auto lender, it may opt to check your VantageScore 3.0 score based on TransUnion data.

The only way to know for sure is to ask the lender which credit report and which credit score version it plans to check, but that isnt a guarantee that theyll tell you.

The mortgage industry is different. Because of the aforementioned FHFA mandate, mortgage lenders must use the following versions of FICOs scoring models:

- Experian: FICO Score 2, sometimes referred to as FICO V2 or FICO-II

- TransUnion: FICO Score 4, sometimes referred to as FICO Classic 04

- Equifax: FICO Score 5, sometimes referred to as BEACON 5.0

Recommended Reading: Are Rocket Mortgage Rates Competitive

Why Is My Vantagescore So Much Higher Than My Fico Score

VantageScore counts multiple inquiries, even for different types of loans, within a 14-day period as a single inquiry. Multiple inquiries on your reports for the same type of loan or credit, spanning more than a 14-day period, may have a greater impact to your VantageScore® credit scores than to your FICO® scores.

How Do The Big 3 Credit Bureaus Fit Into Your Fico Scores

Now lets quickly discuss how Experian, Equifax, and TransUnion fit into your FICO scores.

Remember in our food metaphor, FICO was our master chef.

The big 3 credit bureaus have the ingredients .

How do they get this info about you? Various entities may furnish credit information to the credit bureaus such as by banks, debt collectors, loan companies, and other creditors.

But heres the thing.

Sometimes these entities only report your credit activity to one or two of the credit bureaus so the ingredients that make up your score could be different at Experian than it is at, say, TransUnion.

FICO then comes in and overlays its unique credit scoring model on top of the information at the credit bureaus which results in you guessed it three separate credit scores, which often do not match.

Notice these real scores provided by my brother, Mark. In some scoring models , they differ by more than 50 points.

TransUnion FICO Scores

Experian FICO Scores

Equifax FICO Scores

Thats why you hear people ask why their TransUnion score is different than their Experian score.

You see, the chef prepared the scores like always, but it was the ingredients that were different!

You May Like: How To Find Mortgage Note

Can I Buy A House With A 630 Fico Score

If your credit score is 630 or higher, and you meet other requirements, you should not have a problem getting a mortgage. The types of programs available to borrowers with a credit score of 630 are: conventional loans, FHA loans, VA loans, USDA loans, jumbo loans, and non-prime loans.

What credit score do you need to buy the earth in 2021? The Federal Housing Administration, or FHA, requires a credit score of at least 500 to buy a home with an FHA loan. At least 580 is required to make a minimum payment of 3.5%. However, many lenders require a score of 620 to 640 to qualify.

What Are The Fico Score Versions

The FICO® Score, introduced in 1989, revolutionized the credit application process by enabling credit issuers to give qualified borrowers quick approval on loans, credit cards and in-store financing programs. As you’d expect for any decades-old system, the FICO® Score has seen many updates since its introduction. It has also spawned multiple specialized spinoff versions designed for specific industries. Today there are at least 16 versions, or models, of the FICO® Score, which is used by 90% of top lenders.

All versions of the FICO® Score, as well as competitors like the VantageScore®, perform statistical analysis on the contents of your credit report from one of the three national consumer credit bureaus . The FICO® Score algorithm generates a three-digit score that predicts how likely you are to default on a loanor go more than 90 days without making a paymentwithin two years.

A higher FICO® Score indicates a lower statistical likelihood of failing to repay a loan. In other words, lenders view a higher FICO® Score as an indicator of greater creditworthiness. Widely used versions of the standard FICO® Scores range from 300 to 850, though models tailored to specific borrowers or industries may differ.

You May Like: How To Figure Out How Much Mortgage You Qualify For

How Your Credit Scores Are Made And Why They Matter

Since there are few numbers that matter as much to your financial well-being as your credit score, it helps to know what your scores mean and how they work.

First, know that theres a big difference between a credit report and a credit score.

- Your credit report is a record of your borrowing history Each loan or line of credit youve opened, dates on those accounts, payment history , and so on. Overall, it shows how reliably you manage and pay back your debts

- Your credit score sums up your credit report in a single number It weighs every item on your credit report to come up with an overall score that sums up how responsible of a borrower you are

The big three credit bureaus Equifax, Transunion, and Experian operate in the realm of credit reporting.

Each one keeps a separate record of your borrowing history, based on the information your creditors send them.

The other players in the game FICO and VantageScore are responsible for credit scoring. They determine your score based on whats included in those credit reports.

For example, keeping your credit utilization ratio low can help your credit scores, while repeatedly neglecting to pay your credit card bills on time can hurt them.