Will Mortgage Rates Go Back Down

Theres a real push-and-pull in the market right now, creating a lot of volatility in mortgage rates. Thats why weve seen large spikes followed by equally significant drops in recent weeks.

As Freddie Mac explained on August 4, Mortgage rates remained volatile due to the tug of war between inflationary pressures and a clear slowdown in economic growth. The high uncertainty surrounding inflation and other factors will likely cause rates to remain variable, especially as the Federal Reserve attempts to navigate the current economic environment.

In other words, its nearly impossible to predict what will happen to mortgage rates in late 2022.

The Fed is likely to keep hiking interest rates, which often leads to higher mortgage rates. But if the Feds actions lead to a recession, that could actually tug mortgage interest rates down.

As a borrower, it doesnt make much sense to try to time your rate in this market. Our best advice is to buy when youre financially ready and can afford the home you want regardless of current interest rates.

Remember that youre not stuck with your mortgage rate forever. If rates drop significantly, homeowners can always refinance later on to cut costs.

Get A More Accurate Estimate

Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment.

-

How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home.

- Pig

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Award Ribbon VA mortgage calculator

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

Example Mortgage Amortization Schedule

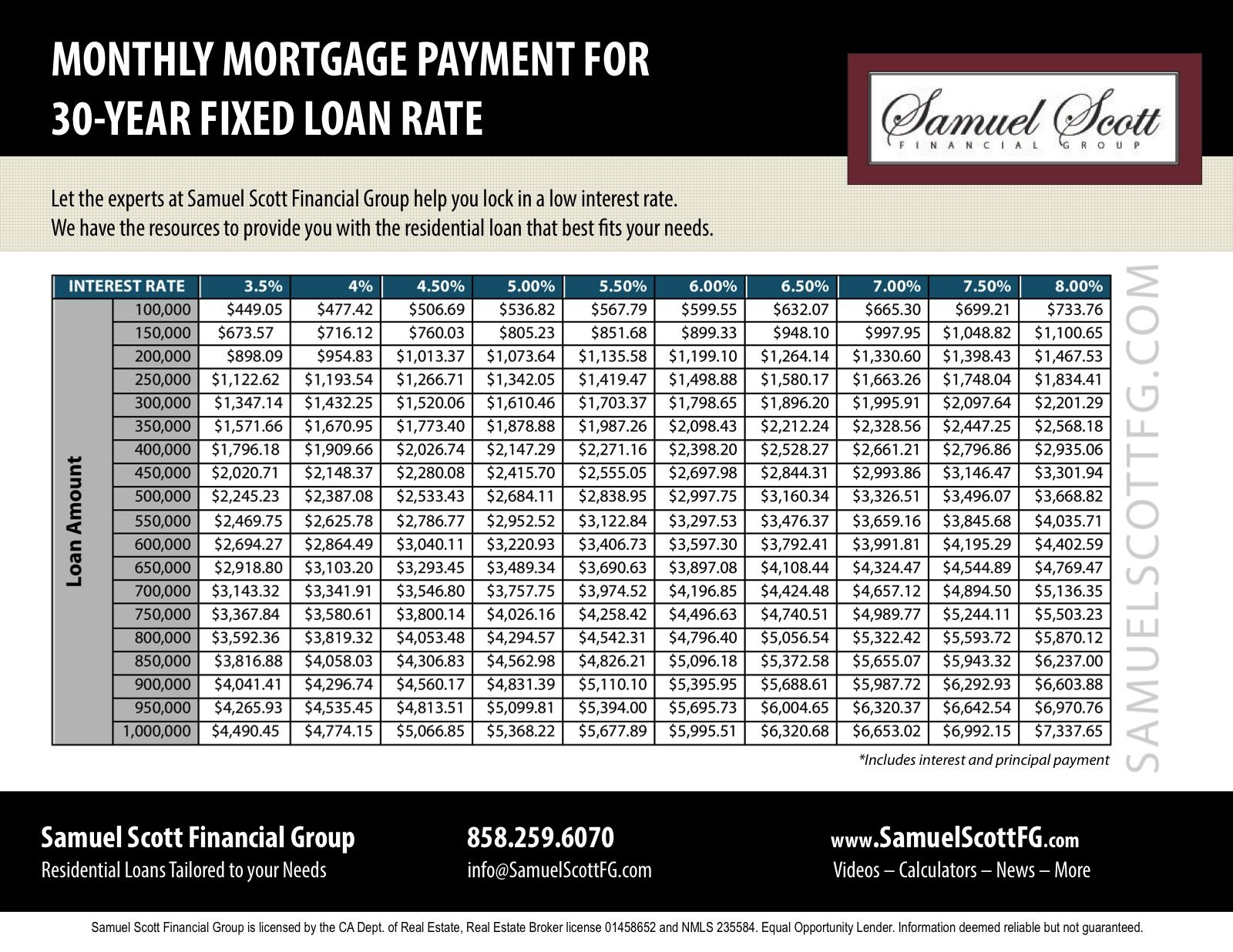

Lets assume you took out a 30-year mortgage for $250,000 at a fixed interest rate of 4 percent. At those terms, your monthly mortgage payment would be $1,193.54, and the total interest over 30 years would be $179.673.77.

Heres a snippet of what your amortization schedule in this example would look like in the first year of the loan term :

Heres what your amortization schedule would look like in the final year:

As shown, the amount of your payment thats allocated to the principal increases as the mortgage moves toward maturity, while the amount applied to interest decreases.

Note that this is the case for a typical 30-year fixed-rate mortgage. Amortization schedules and how the payment is distributed to the interest and principal can vary based on factors like how much youre borrowing and your down payment, the length of the loan term and other conditions. Using Bankrates calculator can help you see what the outcomes will be for different scenarios.

Also Check: How Much Are The Fees To Refinance A Mortgage

Other Loan Costs To Consider

In addition to paying principal and interest on your loan, you may have to pay other costs or fees. For example, a mortgage payment might include costs such as property taxes, mortgage insurance, homeowners insurance, and homeowners association fees.

The amortization calculator doesnt consider these added costs, so its estimate of your payments may be lower than the amount youll actually owe each month. To get a clearer picture of your loan payments, youll need to take those costs into account.

What Is Homeowners Insurance

Homeowners insurance is a policy you purchase from an insurance provider that covers you in case of theft, fire or storm damage to your home. Flood or earthquake insurance is generally a separate policy. Homeowners insurance can cost anywhere from a few hundred dollars to thousands of dollars depending on the size and location of the home.

When you borrow money to buy a home, your lender requires you to have homeowners insurance. This type of insurance policy protects the lenders collateral in case of fire or other damage-causing events.

Don’t Miss: What Would My Mortgage Be On A 300 000 House

How Mortgage Recasting Works

In order to do a loan recast, borrowers must make a large lump-sum payment toward the loan principal. Lenders usually require $5,000 or more to recast a mortgage. The remaining balance is then amortized reduce the monthly payments.

Typically, you have to pay a fee to recast your mortgage. The fee varies by lender, but usually doesnt exceed a few hundred dollars.

That fee can be worth it, however, when compared with your potential interest savings. Recasting not only results in lower monthly payments, but borrowers will also pay less interest over the life of the loan.

For example, if your 30-year mortgage carries a principal balance of $200,000 with a 5 percent interest rate, you might pay $1,200 per month. If you pay $50,000 in a lump sum to recast your mortgage, plus a $250 recasting fee, youll end up saving almost $35,000 in interest payments and about $300 per month in monthly mortgage payments.

Keep in mind, recasting doesnt reduce the term of your mortgage just how much you pay each month.

Mortgage Rates Chart For 2022

Mortgage interest rates fell to record lows in 2020 and 2021 during the Covid pandemic. Emergency actions by the Federal Reserve helped to push mortgage rates below 3% and keep them there.

But with inflation surging to four-decade highs, mortgage interest rates have risen in 2022. And policy tightening by the Fed could push them higher still.

Those who are in a position to lock an interest rate sooner rather than later may be wise to do so.

Read Also: What Is The Difference Between A Mortgage Rate And Apr

What Is The Best Mortgage Term For You

A mortgage term is the length of time you have to pay off your mortgagestated another way, its the time span over which a mortgage is amortized. The most common mortgage terms are 15 and 30 years, though other terms also exist and may even range up to 40 years. The length of your mortgage terms dictates how much youll pay each monththe longer your term, the lower your monthly payment.

That said, interest rates are usually lower for 15-year mortgages than for 30-year terms, and youll pay more in interest over the life of a 30-year loan. To determine which mortgage term is right for you, consider how much you can afford to pay each month and how quickly you prefer to have your mortgage paid off.

If you can afford to pay more each month but still dont know which term to choose, its also worth considering whether youd be able to break evenor, perhaps, saveon the interest by choosing a lower monthly payment and investing the difference.

Us Department Of Agriculture Loans

USDA loans are geared towards homebuyers with low to moderate incomes. It provides a zero downpayment option to borrowers with credit scores not lower than 640. The USDA home financing program was designed to aid economic development in areas with low populations in the country.

To be eligible for a USDA loan, you must purchase a house in a USDA rural area. This may seem like a limitation if you want to live in a city. However, 97 percent of land in the U.S. is actually qualified for USDA home financing. You just might find a house near a good location. Consider this option before you cross it out your list.

Qualifying for USDA Loans

To qualify for a USDA loan, borrowers should have a minimum credit score of 640. If your credit rating is lower than 640, you must provide additional documentation of your payment history to get approval. For front-end DTI ratio, you must not go beyond 29 percent. Likewise, your back-end DTI ratio must not be over 41 percent.Be sure to check the USDA income limits in your preferred home location. This will also determine if you can obtain a USDA loan. There are different income limits for households with 1 to 4 members and larger families with 5 to 8 family members. For example, under the 2008 Housing and Economic Recovery Act , high-cost areas for 1 to 4 member households are set at $212,55.

Read Also: How Long Is A Credit Report Good For Mortgage

How To Use Credit Karmas Loan Amortization Calculator

When youre deciding how much to borrow or comparing loans, its helpful to get an estimate of your monthly payment and the total amount youll pay in principal versus interest. You can use our loan amortization calculator to explore how different loan terms affect your payments and the amount youll owe in interest. You can also see an amortization schedule, which shows how the share of your monthly payment going toward interest changes over time.

Keep in mind that this calculator provides an estimate only, based on your inputs. It doesnt consider other variables, such as mortgage closing costs or loan fees, that could add to your loan amount and increase your monthly payment. It also doesnt consider the variable rates that come with adjustable-rate mortgages.

To get started, youll need to enter the following information about your loan:

The Surprise Mortgage Rate Drop

In 2018, many economists predicted that 2019 mortgage rates would top 5.5%. That turned out to be wrong.

In fact, rates dropped in 2019. The average mortgage rate went from 4.54% in 2018 to 3.94% in 2019.

- At 3.94% the monthly cost for a $200,000 home loan was $948

- Thats a savings of $520 a month or $6,240 a year when compared with the 8% longterm average

In 2019, it was thought mortgage rates couldnt go much lower. But 2020 and 2021 proved that thinking wrong again.

You May Like: How To Calculate Upfront Mortgage Insurance Premium

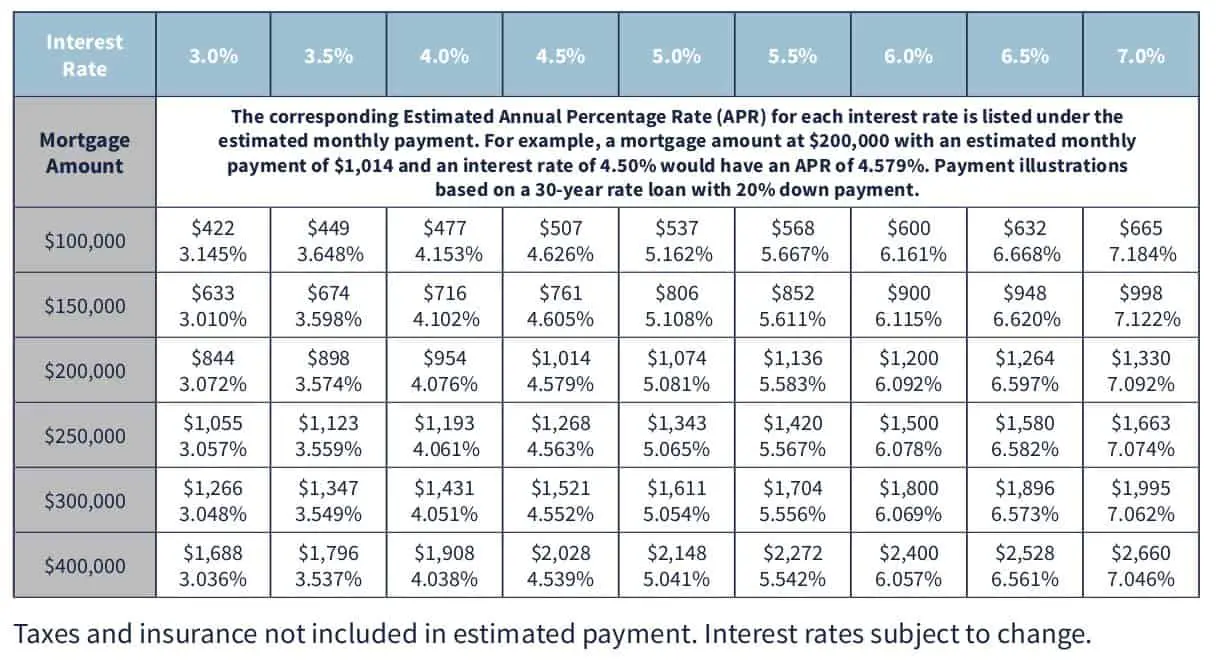

My Expanded Mortgage Rate Charts

- I created two additional mortgage rate charts that factor in the record low rates

- And the possibility of them drifting even lower over coming months and years

- The charts are more granular because rates are broken down by eighths as opposed to quarters

- Also available in 50k increments if your loan amount is closer to that

These charts can make it quick and easy to compare rate quotes from mortgage lenders, or to see the impact of a daily rate change in no time at all.

After all, mortgage rate updates can happen frequently, both daily and intraday. And rates are especially erratic at the moment.

So if you were quoted a rate of 3.5% on your 30-year fixed mortgage two weeks ago, but have now been told your home loan rate is closer to 4%, you can see what the difference in monthly payment might be, depending on your ballpark loan amount.

This is pretty important when purchasing real estate or seeking out a mortgage refinance, as a significant jump in monthly mortgage payment could mean the difference between a loan approval and a flat out denial.

Or you might be stuck buying less house. Or perhaps driving until you qualify!

Getting Your First Mortgage

The traditional period for amortization of a mortgage is 25 years. But this is done in periods of five years at a time, though it is possible to pay the mortgage down in a shorter period, just not longer. The longer the amortization period, the smaller the monthly payments will be, but the more the loan will cost in total.

Most mortgages have a five year term, though shorter terms are possible. The five-year mortgage term is the amount of time a mortgage contract is in effect. At the end of each term, the mortgage must be renewed for another term, at which point there is an opportunity to consider making any changes. Possible changes include renegotiating the rate as well as other details of the contract for the next term. The agreed-upon interest rate remains in effect for the term.

It is possible to choose between an open mortgage, which provides a person the flexibility of being able to repay all or part of a mortgage at any time without a prepayment charge, or a closed mortgage, which limits prepayment options. The latter usually has a lower interest rate.

Traditionally, mortgage payments are made every month. It is possible to arrange biweekly payments which permit faster repayment and a lower loan cost. A biweekly payment means making a payment of one-half of the monthly payment every two weeks. This results in 26 payments a year instead of 24.

There are also options for flexible or skipped payments.

Don’t Miss: How Much Are Monthly Payments On A 200 000 Mortgage

Add All Fixed Costs And Variables To Get Your Monthly Amount

Figuring out whether you can afford to buy a home requires a lot more than finding a home in a certain price range. Unless you have a very generous and wealthy relative who’s willing to give you the full price of your home and let you pay it back without interest, you can’t just divide the cost of your home by the number of months you plan to pay it back and get your loan payment. Interest can add tens of thousands of dollars to the total cost you repay, and in the early years of your loan, the majority of your payment will be interest.

Many other variables can influence your monthly mortgage payment, including the length of your loan, your local property tax rate and whether you have to pay private mortgage insurance. Here is a complete list of items that can influence how much your monthly mortgage payments will be:

What Would You Like To Do

Your approximate payment is $*.

|

Mortgage default insurance protects your lender if you can’t repay your mortgage loan. You need this insurance if you have a high-ratio mortgage, and its typically added to your mortgage principal. A mortgage is high-ratio when your down payment is less than 20% of the property value. Close. |

|---|

Don’t Miss: What’s An Affordable Mortgage

Be Sure To Look At The Big Picture

- Most advertised mortgage payments only include principal and interest

- There is a lot more that goes into a monthly housing payment

- Including property taxes, homeowners insurance, HOA dues, PMI, and so on

- Dont buy more home than you can afford without considering all of these items

Lastly, note that my mortgage payment graphs only list the principal and interest portion of the loan payment.

You may also be subject to paying mortgage insurance and/or impounds each month. Property taxes and homeowners insurance are also NOT included.

Youll probably look at this chart and say, Hey, I can get a much bigger mortgage than I thought.

But beware, once all the other costs are factored in, your DTI ratio will probably come under attack, so tread cautiously.

And dont forget all the maintenance and utilities that go into homeownership. Once you hire a gardener, pool guy, and run your A/C and/or heater nonstop, the costs might spiral out of control.

I referenced this problem in another post that focused on if mortgage calculators were accurate, in which I found that housing payments are often greatly underestimated.

So you might want to drop your loan amount by $100,000 if you think you can just get by, as those other costs will certainly play a role.

And with the housing market so competitive today, you may want to lower your max purchase price in apps like Redfin and Zillow too, knowing the final sales price will likely be above asking.

Fixed Rate Vs Adjustable Rate

A fixed rate is when your interest rate remains the same for your entire loan term. An adjustable rate stays the same for a predetermined length of time and then resets to a new interest rate on scheduled intervals. A5-year ARM, for instance, offers a fixed interest rate for 5 years and then adjusts each year for the remaining length of the loan. Typically the first fixed period offers a low rate, making it beneficial if you plan to refinance or move before the first rate adjustment.

Also Check: What Questions Should I Ask Mortgage Lender

Brief History Of Mortgages In The Us

In the early 20th century, buying a home involved saving up a large down payment. Borrowers would have to put 50% down, take out a three or five-year loan, then face a balloon payment at the end of the term.

Only four in ten Americans could afford a home under such conditions. During the Great Depression, one-fourth of homeowners lost their homes.

To remedy this situation, the government created the Federal Housing Administration and Fannie Mae in the 1930s to bring liquidity, stability, and affordability to the mortgage market. Both entities helped to bring 30-year mortgages with more modest down payments and universal construction standards.

These programs also helped returning soldiers finance a home after the end of World War II and sparked a construction boom in the following decades. Also, the FHA helped borrowers during harder times, such as the inflation crisis of the 1970s and the drop in energy prices in the 1980s.

Government involvement also helped during the 2008 financial crisis. The crisis forced a federal takeover of Fannie Mae as it lost billions amid massive defaults, though it returned to profitability by 2012.

The FHA also offered further help amid the nationwide drop in real estate prices. It stepped in, claiming a higher percentage of mortgages amid backing by the Federal Reserve. This helped to stabilize the housing market by 2013. Today, both entities continue to actively insure millions of single-family homes and other residential properties.