How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Canada’s Most Popular Mortgage: The 5

In Canada, out of the $1.2 trillion CAD in outstanding residential mortgages in May 2021, the 5-year fixed rate mortgage takes the crown with over $660 billion, or more than 50%, of all mortgages in Canada. There are more 5-year fixed rate mortgages than all variable rate mortgages combined. The 5-year fixed rate mortgage is so popular that the CMHC uses the Bank of Canada’s 5-Year Benchmark Posted Rate for itsmortgage stress test.

Mortgage Rates & Deals Faqs

Comparing mortgages isnt easy. Sometimes deals look attractive because they have a low initial rate, but you also need to take into account any fees that come with the mortgage deal. We recommend annual cost as the best way to see which mortgage deal offers the best value for the size of mortgage youre looking to take.

This is how we calculate the annual cost:

- We add up all the fees associated with the mortgage deal and deduct any cash back to find total fees

- We then divide the total fees by the number of months the initial mortgage rate lasts to find the total fees per month

- We add the total fees per month to your monthly mortgage payment and multiply by 12 to calculate the annual cost

Recommended Reading: Does Rocket Mortgage Service Their Own Loans

What Affects Your Mortgage Rate In Canada

There are a few different types of mortgage interest rates in Canada: Fixed interest rates, variable interest rates, or a hybrid combination of the two. These mortgage rate options will affect how your interest rate changes over time. Your mortgage rate will also be affected by certain factors that your mortgage lender will look at.

What Is A Good Mortgage Interest Rate

The best mortgage rate for you will depend on your financial situation. A home loan with a shorter term may have a lower interest rate but a higher monthly payment, while a home loan with an adjustable interest rate may have a lower interest rate at first but then change annually after a set period of time. For example, a 7-year ARM has a set rate for the initial 7 years then adjusts annually for the remaining life of the loan , while a 30-year fixed-rate mortgage has a rate that stays the same over the loan term.

You May Like: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

How Are Mortgage Rates Set

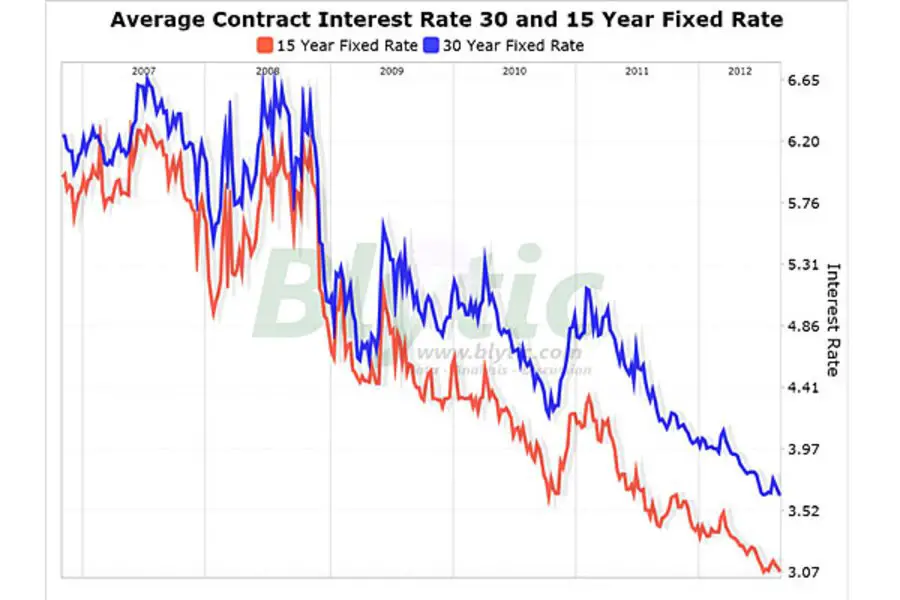

Mortgage rates fluctuate for the same reasons home prices change supply, demand, inflation, and even the U.S. employment rate can all impact mortgage rates. The demand for homes isnt necessarily a sign of where mortgage rates are headed. The best indicator of whether rates will go up or down is the 10-year Treasury bond rate.

When a lender issues a mortgage, it takes that loan and packages it together with a bunch of other mortgages, creating a mortgage-backed security , which is a type of bond. These bonds are then sold to investors so the bank has money for new loans. Mortgage bonds and 10-year Treasury bonds are similar investments and compete for the same buyers, which is why the rates for both move up or down in tandem.

Thats why, in a slumping economy, when more investors want to purchase safer investments, like mortgage-backed securities and treasury bonds, rates tend to go down. The Federal Reserve has been purchasing MBS and treasury bonds, and this increased demand has led to the lowest mortgage rates on record.

What Is The Difference Between A Fixed And A Variable Interest Rate At Td

A fixed interest rate means your interest rate, along with your principal and interest payments, will stay exactly the same during your mortgage term.

With a variable interest rate, your interest rate can fluctuate based on changes in our TD Mortgage Prime Rate. While your payments will remain the same, the amounts from each payment that go toward the principal and interest can vary.

Read Also: Recast Mortgage Chase

Comparing Mortgage Amortization Periods

| $165,315 |

When comparing 20-year and 30-year amortizations to the 25-year amortization at a 2% mortgage rate:

- A 20-year amortization increases your monthly mortgage payment by $412/month, but reduces your total interest cost by $28,116

- A 30-year amortization reduces your monthly mortgage payment by $269/month, but increases your total interest cost by $30,139

If you can handle higher monthly mortgage payments, a shorter amortization period can save you thousands of dollars. Many banks and mortgage lenders also allow you to shorten your amortization period by making additional mortgage prepayments, such as through lump-sum principal prepayments, doubling your regular payment amount, and increasing your payment schedule.

Should I Use An Ontario Mortgage Broker

Ontario mortgage brokers often have the lowest rates in the province, particularly for default-insured mortgages. And theyre generally free of charge for qualified borrowers. Ontario brokers also tend to provide better advice than many lender representatives since they specialize in mortgages and deal with multiple lenders. Note that all brokers must be licensed by the Financial Services Regulatory Authority of Ontario. Heres a link to see if your broker is licensed.

Also Check: How Does The 10 Year Treasury Affect Mortgage Rates

Where To Live In Ontario

There are many options in the province for those who want to take advantage of the best mortgage rates. Ontario cities such as Ottawa and Toronto are obvious choices, as they are perennial centers of job creation. Buying a home in these cities is almost never a bad idea, as their livability and desirability mean that real estate investments therein are likely to increase in value over time. There are some other population centers, however, that are also worth a look:

Peterborough Peterborough is an important economic center in Ontario that features a large number of available jobs in the public and private sectors. Significant employers include Trent University, General Electric, Quaker Oats and others. Many people are attracted to Peterborough because it is an easy commute from the city to Oshawa and the eastern portion of Toronto. Its close proximity to the provincial capital means that homes should continue to appreciate and remain in demand for years to come.

Windsor Windsor has a thriving tourist industry as well as a large number of jobs in education, pharmaceuticals, insurance and other sectors. Recently, the city was ranked number two in the listing of large cities with economic potential in North America, so housing should continue to be in high demand for some time to come.

What Are Todays Mortgage Rates

With a frequently-mobile Bank rate and inflation rate, keeping track of mortgage costs is challenging especially given they can change on a daily basis. One simple way is use our mortgage tables, powered by Trussle a trusted online mortgage broker and our mortgage partner.

To find out what deals are available at todays rates for the kind of mortgage youre after, youll need to enter your personal criteria into the table below. Heres what to do:

- Select whether the mortgage is to fund a house purchase or if its a remortgage for an existing property

- Enter the property value and the mortgage amount you require. This will automatically generate a percentage which is known as your loan to value. The lower your loan to value, the cheaper the mortgage rates available

- Tick the relevant box if its a buy-to-let or interest-only mortgage , or if youre looking for a mortgage to fund a property

- Finally, filter your search by the type of mortgage you want, for example a two- or five-year fix or tracker. The filter is set to a complete mortgage term of 25 years but you can change this if required.

You May Like: Reverse Mortgage For Mobile Homes

What To Know About Mortgage Rates

Mortgage rates are the rate of interest the lender charges on your mortgage balance, which affects how much you pay each month. A lower interest rate can mean lower monthly payments. These rates can be fixed or variable during the agreed mortgage term.

-

Fixed-rate mortgages have a fixed interest rate for a set period of time, so your monthly payments and interest rate will stay the same. When that initial term ends, the interest rate usually moves to the lenders standard variable rate.

-

Variable rate mortgages, on the other hand, come with an interest rate that can rise and fall, usually in line with the Bank of England base interest rate. Tracker mortgages are variable rate mortgages that follow at a certain percentage above the base rate.

To choose between a fixed rate and a variable rate, ask yourself:

- Do I want to know exactly what my mortgage will cost each month?

- Do I mind if my repayments increase and decrease without warning?

- Do I want to take advantage of potential drops in the base interest rate?

- Am I willing to remortgage after my fixed-rate period expires?

/1 Arm Rate Climbs +020%

The average rate on a 5/1 ARM is 4.29 percent, adding 20 basis points from a week ago.

Adjustable-rate mortgages, or ARMs, are home loans that come with a floating interest rate. In other words, the interest rate can change from time to time throughout the life of the loan, unlike fixed-rate loans. These loan types are best for those who expect to sell or refinance before the first or second adjustment. Rates could be much higher when the loan first adjusts, and thereafter.

While borrowers shunned ARMs during the pandemic days of super-low rates, this type of loan has made a comeback as mortgage rates have risen.

Monthly payments on a 5/1 ARM at 4.29 percent would cost about $489 for each $100,000 borrowed over the initial five years, but could increase by hundreds of dollars afterward, depending on the loans terms.

Read Also: How Does Rocket Mortgage Work

What Are Mortgage Rates

Mortgage rates are the rate of interest charged by a mortgage lender . The interest is charged by the lender as compensation for the money they have lent them in order to purchase a property.

Interest rates are determined by the lender in most cases, and can be either fixed or variable . Before you compare mortgages, you need to understand the different types. For more information see what type of mortgage should I get?

Are Mortgage Rates Going Up

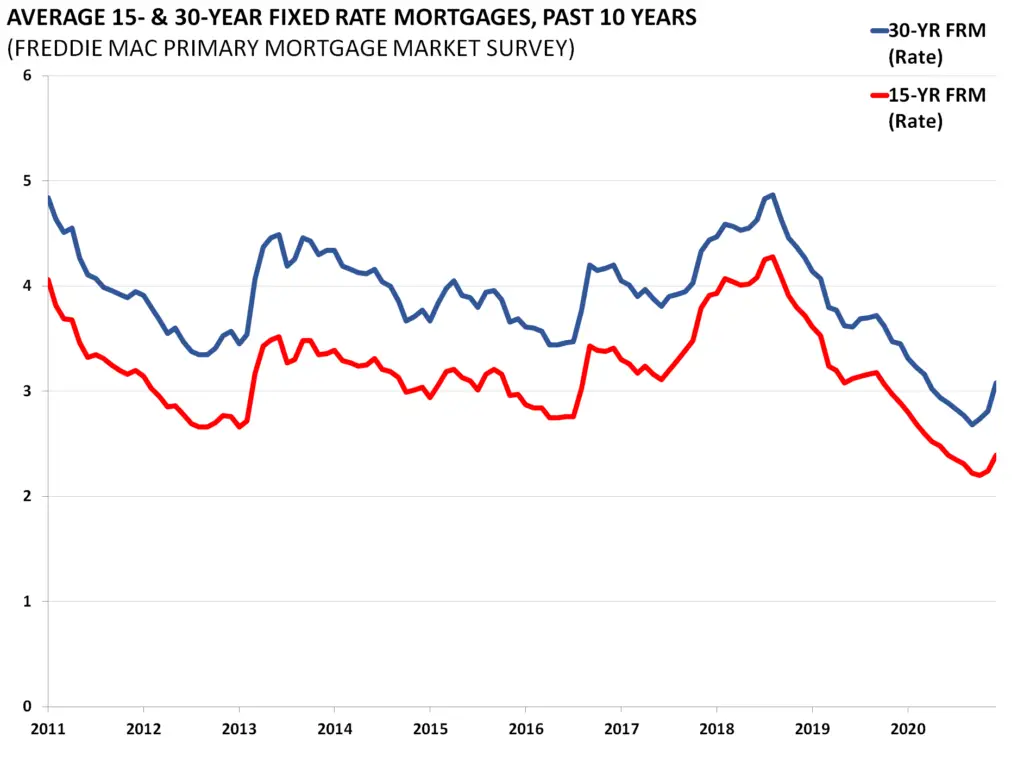

Throughout 2021, mortgage rates are expected to begin rising again. The National Association of Realtors expects rates to average 3.1% and the Mortgage Bankers Association says mortgage rates will average 3.3% in 2021. These rate estimates are both up from the 3.0% mortgage rate average in 2020 but lower than 2019s average rates. Many experts say it could be years before mortgage rates return to their pre-pandemic levels.

- National Association of Real Estate Editors

- Freddie Mac Federal Home Loan Mortgage Corporation

Don’t Miss: Reverse Mortgage Mobile Home

First Time Buyer Mortgage

First time buyer mortgages are mortgages that are designed for people buying their first home. Usually this means that you can get a mortgage with a relatively small deposit , though the interest rates will be higher than if you saved up a larger deposit.

First time buyer mortgages can be fixed rate or variable rate – it’s up to you. It is very unlikely that you’ll be offered a buy to let or interest only mortgage as a first time buyer.

What Are Prepayment Options

Prepayment options outline the flexibility you have to increase your monthly mortgage payments, or pay down your mortgage principal as a whole. The monthly prepayment option is a percentage increase allowance on your original monthly mortgage payment.

For example, if your monthly mortgage payment is $1,000 and your prepayment allowance is 25%, then you can increase your monthly payments up to $1,250. The lump sum prepayment option on the other hand, applies to the original mortgage amount. So, if your lump sum prepayment allowance is 25% on a $100,000 mortgage amount, then you can pay $25,000 off the principal every year.

Recommended Reading: 10 Year Treasury Vs Mortgage Rates

Mortgage Critical Illness Insurance

Mortgage critical illness insurance provides a benefit if you suffer a life-threatening issue, such as cancer, heart attack, or stroke. Critical illness insurance usually has a smaller coverage benefit, and it has slightly higher premiums. Some policies might not cover pre-existing conditions up to 24 months before the start of your coverage. You might also need to complete a health interview.

What Term Should I Choose

The most common term length in Canada is 5 years. Unless you have specific concerns, a 5-year term generally works well. Longer terms will have higher mortgage rates, which can be bad for those struggling to pass themortgage stress testas you may be tested at a higher mortgage rate. This is a particularly significant issue for homebuyers inTorontos housing marketor inVancouvers housing market. However, you wont have to worry about requalifying for a mortgage as often as a short mortgage term. Each lender will offer different options for term length and rates contact your lender or broker for more details.

Recommended Reading: Rocket Mortgage Loan Requirements

Whats Going To Happen To Interest Rates In 2022

Some experts believe that the base rate wont increase this year some say its unlikely so close to Christmas while others cite the new Omicron variant and the potential impact that could have as a reason why the rise will be delayed until next year.

But whenever the first rate rise happens there is already speculation there will be two further rate rises next year, with the base rate reaching 1% by the end of 2022.

A rising base rate means youll pay more on your mortgage each month if youre on a tracker mortgage or if youre on your lenders SVR and your lender passes on the increase. If youre on a fixed deal it wont impact you until you come to remortgage.

Find out more in our guide How can I protect myself against rising interest rates?

Ontarios Housing Market Trend

Ontarios new tagline is A Place to Grow, which is also whats expected for the provinces population. The Ontario Ministry of Finance projects the population of Ontario will increase some 30.2% over the next two decades, bringing the total population to 18.5 million by July 1, 2041.

There are so many incredible aspects to Canadas most populous province, from its lush natural resources to its growing cities. That and solid job growth make the population boom less of a surprise.

As a result of its popularity, home prices in Southern Ontario are expected to continue rising. Prices are particularly prone to inflation in Ontarios Golden Horseshoe region where immigration is high, land is limited by the protected green belt and homes remain in short supply.

That, in turn, implies that Ontario mortgage amounts will grow faster than the national average.

Read Also: Chase Mortgage Recast

Cardinal Financial Company: Best For Low

Cardinal Financial Company, which also does business as Sebonic Financial, is a national mortgage lender that offers both an in-person and online experience and a wide variety of loan products.

Strengths: Borrowers have a range of options with Cardinal Financial, with the lender able to accept credit scores as low as 620 for a conventional loan, 660 for a jumbo loan, 580 for an FHA or USDA loan and 550 for a VA loan. The lender also offers speedy preapprovals, and some borrowers have been able to close in as little as seven days .

Weaknesses: Cardinal Financials current mortgage rates and fees arent listed publicly on its website, so youll need to consult with a loan officer for specifics pertaining to your situation.

> > Read Bankrate’s full Cardinal Financial Company review

How Does My Amortization Period Affect My Mortgage

When deciding between a short amortization or a long amortization, you will need to take into account your financial situation. A long amortization means that your individual mortgage payments will be smaller, which might allow you to qualify for a larger mortgage amount based on your futuredebt service ratios. Likewise, higher mortgage payments from a shorter amortization may reduce themortgage amount that you can afford.

You wont be able to get a CMHC-insured mortgage if your amortization is more than 25 years. While your monthly mortgage payment might be higher with an amortization that is 25 years or less, youll be able to make a smaller down payment that can be as low as 5%. Otherwise, youll need to make a down payment of at least 20% for an uninsured mortgage with an amortization greater than 25 years.

You can use ourmortgage amortization calculatorto see how changing your amortization period can affect the cost of your mortgage. For example, the table below compares the cost of a mortgage and the amount of each monthly mortgage payment for different amortization periods.

Don’t Miss: Monthly Mortgage On 1 Million