View Affordability From Two Perspectives:

- Your overall monthly payments which included household expenses, mortgage payment, home insurance, property taxes, auto loans and any other financial considerations

- How lenders determine what you can afford. Just like lenders, our Affordability Calculator looks at your Debt-to-Income Ratio to determine what home price you can afford.

Documentation Required To Get Pre

To get a full pre-approval, youll need to be prepared to provide the following documentation:

- Pay stubs Youll need to provide your most recent pay stub, which must show your year-to-date earnings. Youll need a pay stub for each job you have, and for each person applying for the pre-approval.

- W2s Many mortgage lenders will require your W-2 for at least the most recent calendar year. However, some lenders may require them for the past two years.

- Completed, signed income tax returns Youll need to provide these if youre self-employed, or have substantial real estate, investment, or partnership income. They should include all pages of IRS Form 1040, including schedules.

- Asset statements For bank accounts or taxable investment accounts, youll need to provide statements covering the most recent two months, or the most recent quarter. For retirement accounts, youll need to provide something similar.

- Gift information If some or all your down payment will come from a gift, youll need to provide the amount of the gift, when it will be available, who the donor will be, and what their source of funds for the gift will be. The lender will likely request that the donor complete a formal mortgage gift letter, that will request specific details.

- This can usually be satisfied by providing your drivers license. In some cases, the lender may request a copy of your Social Security card. These documents will be requested to verify your identity for federal compliance purposes.

Understanding Your Mortgage Payment

Monthly mortgage payment = Principal + Interest + Escrow Account Payment

Escrow account = Homeowners Insurance + Property Taxes + PMI

The lump sum due each month to your mortgage lender breaks down into several different items. Most homebuyers have an escrow account, which is the account your lender uses to pay your property tax bill and homeowners insurance. That means the bill you receive each month for your mortgage includes not only the principal and interest payment , but also property taxes, home insurance and, in some cases, private mortgage insurance.

You May Like: Reverse Mortgage Mobile Home

How Much House Can I Afford

5-min read

So, youre thinking of buying your first home. Thats exciting. As you begin your house hunting adventure, do your homework and figure out how much you can comfortably afford.

Lets look at three key factors before you start shopping: your monthly mortgage payment, closing costs and ongoing expenses.

When Do Consumers Choose An Arm

Adjustable-rate mortgages , on the other hand, have interest rates that change depending on market conditions. ARMs usually start with a low introductory rate or teaser period, after which the rate changes annually for the remaining term.

ARMs come in 30-year terms that can be taken as a straight adjustable-rate mortgage with rates that change annually right after the first year. However, borrowers usually take them as a hybrid ARM, which come in 3/1, 5/1, 7/1, and 10/1 terms. For example, if you get a 5/1 ARM, your rate remains fixed for the first 5 years of the loan. After the 5-year introductory period, your rate adjusts every year for the rest of the payment term.

When does taking an ARM make sense? ARMs are usually chosen by consumers who plan to sell their house in a few years or refinance their loan. If you need to move every couple of years because of your career, this type of loan might work for you. ARMs usually have a low introductory rate which allows you to make affordable monthly payments, at least during the teaser period. Before this period ends, you can sell your home, allowing you to avoid higher monthly payments once market rates start to increase.

Don’t Miss: Mortgage Rates Based On 10 Year Treasury

Figure Out How Much Mortgage You Can Afford

As a general rule, lenders want your mortgage payment to be less than 28% of your current gross income. Theyll also look at your assets and debts, your credit score and your employment history. From all of this, theyll determine how much theyre willing to lend to you.

However, the amount you may qualify to borrow isnt necessarily what you should borrow. Why? Because lenders are only looking at your past and present situation. They dont take into account your future plans.

Are you thinking of a career change? Do you expect a substantial increase in debt or expenses? Use our mortgage affordability calculator to consider multiple scenarios. Or talk with a mortgage loan officer. They can help you figure out a price range that makes sense for the long term.

How Does A Mortgage Work

A mortgage is a secured loan that is collateralized by the home it is financing. This means that the lender will have a lien on your home until the mortgage is paid in full. After closing, youll make monthly paymentswhich covers principal, interest, taxes and insurance. If you default on the mortgage, the bank will have the ability to foreclose on the property.

You May Like: How Much Is Mortgage On A 1 Million Dollar House

I Don’t Know What To Enter For Property Taxes Or Homeowners’ Insurance

You can leave these and most other boxes blank if you don’t know what those costs might be, and the Mortgage Qualifying Calculator will generate an answer without them. The same for the inputs under Down Payment and Closing Costs, and Total Monthly Debt Payments. But your results will be more accurate and useful if you can provide these figures.

Save A Larger Down Payment

Buying a home will always require some amount of cash upfront, also known as a down payment. The bigger your down payment is the better, for a few reasons. The main reason is simply that the larger your down payment, the less youâll need to borrow, and the less interest youâll pay. However, just getting approved for a mortgage relies on the down payment as well.

Whatâs the minimum down payment for mortgage approval? In Canada, there are minimum down payment requirements based on the homeâs price:

- Less than $500,000: The minimum down payment is 5% of the purchase price.

- $500,000 to $999,999: Youâll need 5% of the first $500,000, and 10% for the portion of the purchase price above $500,000.

- $1 million+: 20% of the total purchase price.

In Canada, a down payment of less than 20% of the homeâs purchase price requires the buyer to buy mortgage loan insurance. Paying these insurance premiums will increase your monthly mortgage payment.

Overall, youâll want to save up as much as you can for your down payment. Of course, thatâs easier said than done when homes in cities like Toronto and Vancouver can run north of a million dollars! However, the more cash you put down upfront, the more likely you are to get approved by a mortgage lender. Using our mortgage payment calculator can help you test down payment and amortization scenarios, and compare variable and fixed mortgage rates.

Recommended Reading: Does Prequalifying For A Mortgage Affect Your Credit

The Annual Salary Rule

The ideal mortgage size should be no more than three times your annual salary, says Reyes.

So if you make $60,000 per year, you should think twice before taking out a mortgage that’s more than $180,000. However, if you have a partner, and your combined income is $120,000, you can comfortably increase your loan amount to $360,000.

That’s not to say you should always opt for the most expensive mortgage you can qualify for. If you settle on something below your max, you’ll have more wiggle room to put money into a savings account or pay for other costs like home renovations.

Using The Mortgage Qualifying Calculator

The Mortgage Qualifying Calculator is designed to be easy to use and largely self-explanatory. Just fill in the various fields with the information requested. Start by choosing if you want to base the calculation on your annual income, the purchase price of the home you’re looking at or the monthly payment you can afford. Then work down the page entering your other information and the calculator will figure out the other two values for you and display them in gray.

For example:

- Enter your annual income and the Mortgage Qualifying Calculator will determine the maximum purchase price you can afford and the associated monthly payment.

- Enter the purchase price and the calculator will tell you the income you need and the monthly payment required. Or,

- Enter the monthly payment you’re thinking of and the Mortgage Qualifying Calculator will tell you the income needed to qualify and the home purchase price that will cover.

Then go down the rest of the page entering the information requested. Your answers will be displayed in gray at the top of the page. Click “View report” for a detailed breakdown and an amortization report.

Read Also: Rocket Mortgage Payment Options

How To Determine How Much Home You Can Afford

Buying a house is exciting, especially as you tour new places and eventually fall in love with a home. But how do you determine your price range? To set realistic expectations, consider your personal finances, borrowing options, and the total costs of buying.

Heres what well cover:

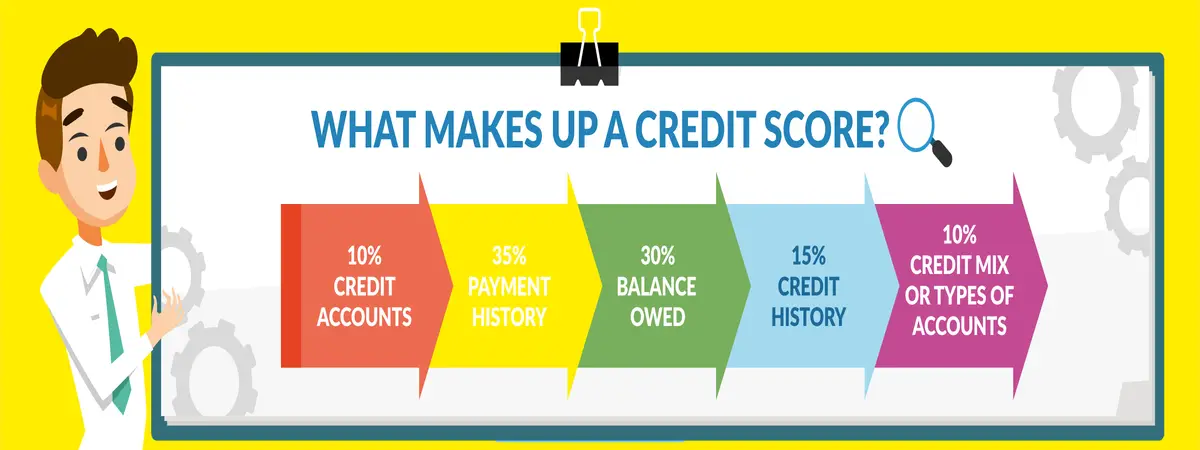

How To Improve Your Credit Rating

- Having a balance too close to your limit can decrease your credit score. Keeping your overall usage low by paying down your balance even if its only the minimum amount.

- Carrying high credit card balances can decrease your credit score. Keeping your balances low by paying down or consolidating your credit cards will improve your credit score.

- Making at least the minimum payment on time is important to maintain or improve your credit score. It’s a good idea to set up automatic payments to make sure you are never late.

- Maintain a mix of credit, such as a credit cards, an auto loan, and a line of credit. Responsible use of credit cards and loans will produce a better credit rating than no history at all.

You May Like: Rocket Mortgage Loan Types

The Ascent’s Best Mortgage Lenders

If you want to uncover more about the best mortgage lenders for low rates and fees, our experts have created a shortlist of the top mortgage companies. Some of our experts have even used these lenders themselves to cut their costs.

We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. The Motley Fool has a Disclosure Policy. The Author and/or The Motley Fool may have an interest in companies mentioned.

The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters.

How To Use The Mortgage Affordability Calculator

To use our mortgage affordability calculator, simply enter you and your partnerâs income , as well as your living costs and debt payments. The calculator can estimate your living expenses if you donât know them.

With these numbers, youâll be able to calculate how much you can afford to borrow. You can change your amortization period and mortgage rate, to see how that would affect your mortgage affordability and your monthly payments.

Read Also: Reverse Mortgage On Condo

Why Calculate Mortgage Affordability

When you’re looking to buy a home, it’s handy to know how much you can afford. Being able to calculate an estimate of how much you’re able to borrow is an important part of setting your budget.

You also need to determine if you have enough cash resources to purchase a home. The cash required is derived from the down payment put towards the purchase price, as well as the closing costs that must be incurred to complete the purchase. We can help you estimate these closing costs with the first tab under the mortgage affordability calculator above.

Taken together, understanding how large a mortgage you can afford to borrow and the cash requirements involved will help you determine what kind of home you should be on the look out for. To learn more about mortgage affordability, and how our calculator works, have a read of the information below.

How Do I Use The Maximum Mortgage Calculator +

To use our maximum mortgage calculator, all you have to do is:

- Input the interest rate you expect to pay on your mortgage.

- Select your loan term from the drop-down menu. The loan term represents the number of years itll take you to repay your mortgage.

- Input your monthly income and that of your co-borrower. That could be your spouse, next-of-kin, etc.

- Under the Monthly Liabilities section, put in any usual repayments that you have to make on a monthly basis.

- Under the Monthly Housing Expenses section, select the appropriate answers from the list provided.

Read Also: Rocket Mortgage Launchpad

Use The Mortgage Affordability Calculator To Help Determine What You Could Pre

Getting pre-qualified for a mortgage is an informal way for you to get an idea of how much you can afford to spend on a home purchase. Mortgage pre-qualification is an important first step for anyone who is considering buying a home and is unsure if they are financially ready. Our mortgage pre-qualification calculator will look at several factors and indicate whether you meet minimum requirements for a home loan as well as tell you the maximum amount you can afford and how much you can be pre-qualified to borrow.

Results

How Much Down Payment Should You Save

Before buying a house, be sure to give yourself enough time to save for a down payment. While the amount depends on your budget, the homes price, and the type of loan you have, most financial advisers recommend saving for a 20% down payment. This is a sizeable amount, which is more expensive if your homes value is higher.

In September 2020, the median sales price for new homes sold was $326,800 based on data from the U.S. Census Bureau. If this is the value of your home, you must save a down payment worth $65,360. Paying 20% down lowers risk for lenders. Its a sign that you can consistently save funds and reliably pay back your debts.

Down Payments Vary

Down payment requirements are different per type of loan. However, many conventional mortgage lenders require at least 5% down. For government-backed loans such as an FHA loan, a borrower with a credit score of 580 can make a down payment as low as 3.5% on their loan. Take note: A smaller down payment subjects you to a higher interest rate.

Nonetheless, its still worth making a larger down payment on your mortgage. Heres why paying 20% down is more beneficial for homebuyers.

Recommended Reading: Can You Do A Reverse Mortgage On A Condo

What Kind Of Mortgage Is Right For Me +

The answer to this question is totally dependent on your present situation. To determine what kind of mortgage is right for you, you would need to realistically consider your financial situation. Some important questions you would need to answer include whether you are able to make a down payment, the length of time you would spend in the house, the state of things with your annual salary for the period of the mortgage as well as your credit history.

Your Savings And Investments

Now that youve looked at your DTI and any debt you may have, think about your budget. How does a mortgage payment fit in? If you dont have a budget, keep track of your income and expenses for a couple of months. You can create a personal budget spreadsheet or use any number of budgeting apps or online budgeting tools.

In the mortgage process, its important to look at your budget and savings for a couple of reasons. One, you might need savings for a down payment, which well discuss in a later section. However, for now, lets go over something called reserves. These may be required, depending on the type of loan youre getting.

Recommended Reading: Monthly Mortgage On 1 Million

How Are Mortgage Repayments Calculated

To calculate a mortgages monthly repayment, youll need to know the value of the home youre buying, your deposit, the interest rate and the length of term.

For example:

- Deposit – £50,000

- Mortgage amount – £200,000

- Mortgage term 30 years

- Mortgage rate 2%

If the mortgage rate in this example was fixed for the length of the 30-year term, youd pay 360 monthly instalments of £739.24. This pays off the £200,000 loan in full, along with a total interest amount of £66,126.

Its important to remember that, as you begin to pay off your mortgage, the interest owed begins to fall in line with the outstanding amount on your mortgage thats owed. This means youll slowly be charged less in interest as the years go on. During a fixed term however, youll be charged a fixed, regular amount.

| Year of mortgage |

comparethe.com is a trading name of Compare The Market Limited. Registered in England No. 10636682. Registered Office: Pegasus House, Bakewell Road, Orton Southgate, Peterborough, PE2 6YS. Compare The Market Limited is authorised and regulated by the Financial Conduct Authority for insurance distribution . Energy and Digital products are not regulated by the FCA.

*To obtain a reward, a qualifying product must be taken out. 1 membership per year.Rewards T& Cs apply. Meerkat Meals: App only. Participating outlets. Restrictions, limitations & T& Cs apply.

Meerkat Movies: Participating cinemas. Tues or Weds. 2 standard tickets only, cheapest free.