Dispute Credit Report Errors

You should start by getting a copy of your credit report and looking for any mistakes, Walsh said. There may be errors on your credit report that could negatively impact your score. In fact, one report by the Federal Trade Commission found that one in five consumers had an error on at least one of their credit reports.

To review your credit reports for errors, start by visiting annualcreditreport.com. This is the only website thats federally authorized to provide free credit reports. Look through each report for mistakes such as incorrect name or address, credit lines that dont belong to you, duplicate entries, incorrect account status and other errors that could lead to a lower score.

Since each credit bureau collects and reports credit information independently, youll need to check all three reports. If you find a mistake, youll also need to dispute it with each bureau. Each one has a slightly different process for disputing errors, but instructions can easily be found on their websites.

Consider Consolidating Your Debts

If you have a number of outstanding debts, it could be to your advantage to take out a debt consolidation loan from a bank or credit union and pay off all of them. Then youll just have one payment to deal with, and, if youre able to get a lower interest rate on the loan, youll be in a position to pay down your debt faster. That can improve your credit utilization ratio and, in turn, your credit score.

A similar tactic is to consolidate multiple credit card balances by paying them off with a balance transfer credit card. Such cards often have a promotional period when they charge 0% interest on your balance. But beware of balance transfer fees, which can cost you 3%5% of the amount of your transfer.

Reduce Credit Card Debt

If avoiding new debt helps burnish your credit, it’s probably no surprise to learn that lowering existing debt can also help your credit standing. Paying down credit card balances is a great way to address this. Paying them off altogether is an ideal goal, but that isn’t always feasible within the span of a year or less. In that case, it’s wise to be strategic about which balances to tackle when paying off your credit cards.

One of the biggest influences on your credit scores is the percentage of your credit card borrowing limits represented by your outstanding balances. Understanding how credit utilization affects your credit scores can help you determine the smartest approach to paying down your current balances.

Your overall credit utilization ratio is calculated by adding all your credit card balances and dividing the sum by your total credit limit. For example, if you have a $2,000 balance on Credit Card A, which has a $5,000 borrowing limit, and balances of $1,000 each on cards B and C, with respective borrowing limits of of $7,500 and $10,000, your total your utilization ratio is:

Most credit scoring models start to ding your scores once utilization ratios near or exceed 30%. Total utilization is the most important factorand paying down any portion of a card’s balance reduces thatbut the guideline also applies to utilization ratios on individual cards.

You May Like: How Do Mortgage Brokers Get Leads

Check Your Credit Reports

When you apply for a home loan, the mortgage lender will look for three main things. The first is that youand your spouse if you apply jointlyhave a steady income. The next consideration will be how much of a down payment you can make. The final piece is whether you have a solid .

Your credit history lets lenders know what sort of borrowing you’ve done and whether you’ve repaid your debts on time. It also tells them whether you’ve had any events such as a foreclosure or bankruptcy.

Checking your credit report will let you see what the lenders see. You’ll be able to find out whether theres anything thats hurting your credit.

To check your credit report, request reports from the three credit bureaus: Experian, TransUnion, and Equifax. Since you don’t know which credit reporting agency your bank will use to evaluate your credit history, you should get a report from all three.

You can get a free copy of your credit report from each of the three credit bureaus by visiting annualcreditreport.com. Federal law allows you to request one free report each year from each agency.

Consider A Debt Consolidation Loan

A debt consolidation loan or balance transfer takes all of your outstanding debts on different accounts and combines them into a single monthly payment. They may help improve your credit utilization rates and can help you avoid missed payments. A debt consolidation loan or balance transfer can be a great option for you if you have multiple lines of credit that you have trouble keeping up with.

You make a hard inquiry on your credit report when you apply for a debt consolidation loan. This means that your credit score will usually drop by a few points immediately after your inquiry. Focus on making on-time payments above the minimum required amount after you get your debt consolidation loan.

Recommended Reading: Do I Need To Get Prequalified For A Mortgage

Check Your Credit And Monitor Your Progress

While you’re working your way toward the credit score needed to buy a house, check your progress with a free score some credit cards and many personal finance websites offer them.

Free credit scores often are VantageScores, a competitor to FICO. Either type of score can be used to track your progress they both emphasize the same factors, with slight differences in weighting, so they tend to move in tandem.

Mortgage lenders check older versions of the FICO score . If you want to see where you stand on those so you know exactly what mortgage lenders will see, youll have to purchase a comprehensive FICO report. You can do that at myFICO.com, then cancel the monthly service rather than pay an ongoing fee. Be sure to cancel before the next billing cycle starts the monthly subscription fee will not be prorated.

However, if youre near or in the excellent credit score range on a free score source, you dont need to pay to check your FICO scores. You almost certainly have good enough credit to qualify for the best rates.

No : Know Where You Stand

Your first stop on the path to a better mortgage deal is creating a baseline. You have to know where you stand in order to improve. Get started by running your credit reports and getting your credit score.

“Managing a good credit score should be approached like an annual health exam: It is important to do this at least every year, and more frequently, if there is a change in financial condition,” says Rich Arzaga, CFP, founder and CEO of Cornerstone Wealth Management in San Ramon, California.

You May Like: How To Calculate Commercial Mortgage Payment

Ask Your Mortgage Lender About A Rapid Rescore

If you need errors corrected quickly, ask your lender about rapid rescore services.

Disputing errors on your credit report can take months. Similarly, it can also take a long time for credit card issuers to report changes once you pay down debt.

Rapid rescoring can issue you a new credit score in a matter of days, instead of months, once youve done the hard work of credit repair.

Keep in mind that only your mortgage lender can get this for you because rapid rescore services dont deal directly with home buyers.

Rapid rescoring can be ideal because your lender can run a simulation to tell you the best course of action to bump up your credit scores, says Jon Meyer, The Mortgage Reports loan expert and licensed MLO.

How To Improve Your Credit Score & Optimize Your Mortgage Interest Rate

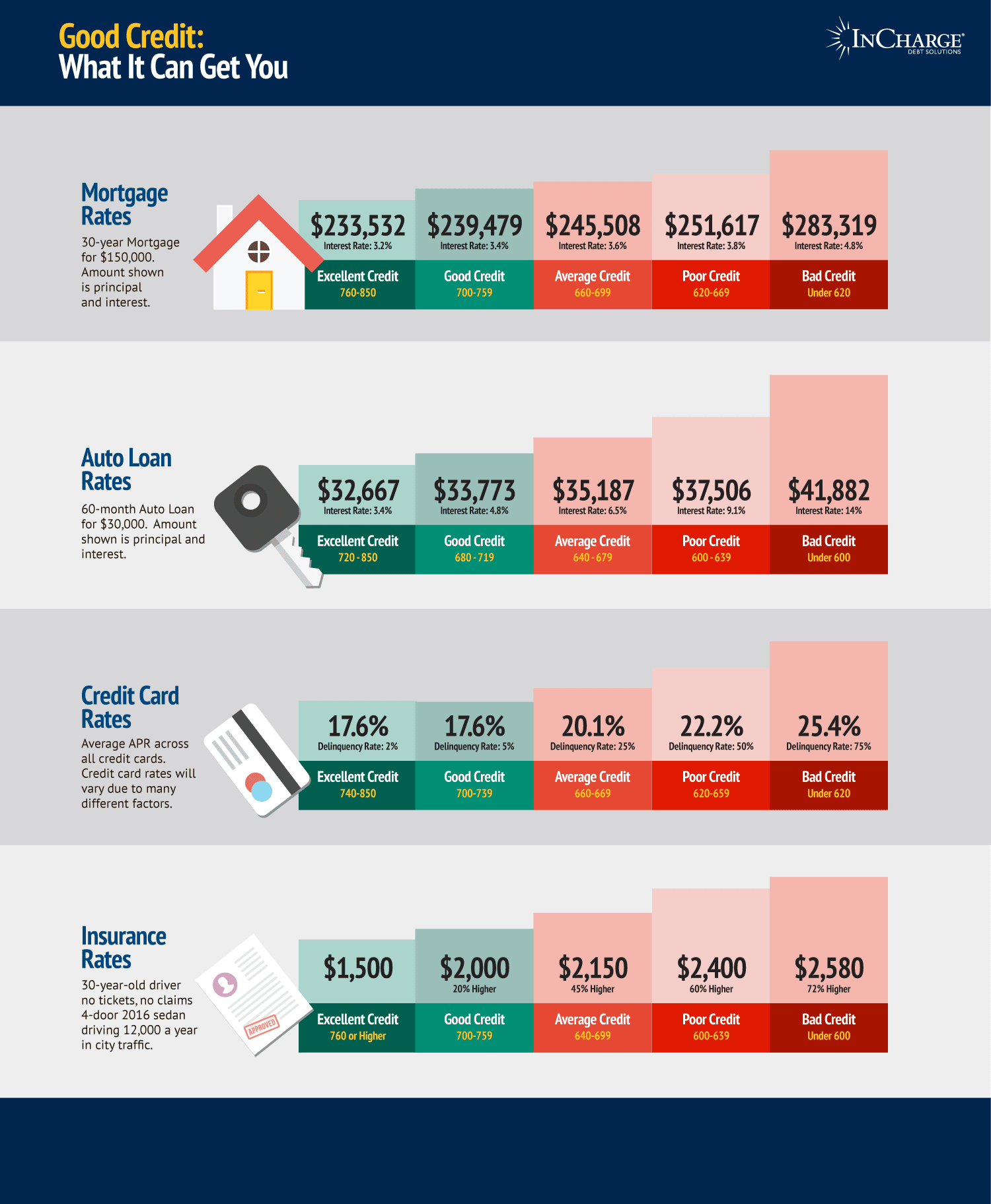

Your credit score rating can feel painful or magical. Far from a true measure of your human worth, the number has the power to open or shut financial doors. And when it comes to determining your mortgage interest rate, your credit score is the single most important factor. Borrowers can expect to get qualified if they have a score of 680 or higher, but getting the best interest rate is different from getting approved. To get qualified at the lowest rates, borrowers need to have excellent credit with scores 740 or higher.

The problem is many people dont know their credit score until they run a check before a loan approval. Sometimes borrowers use apps like Credit Karma that give them a higher credit rating than the one they earn on their mortgage application. The reason for this difference is found in mortgage industry standards, which require the average of your 3 credit reports.

Many borrowers become understandably frustrated the average doesnt match their own reports, but the process is the same for everyone and unfortunately our lending guidelines dont allow us to utilize a preferred credit rating. At Mortgage Zen, we encourage borrowers who need better scores to translate their frustration into action. Here are some resources we share to help our clients boost their credit scores.

You May Like: Can You Get Preapproved For A Mortgage Through 2 Banks

It’s Not Credit Repair

Rapid rescoring isn’t credit repairits just an express lane for getting information to credit bureaus. You can’t dispute anything and everything that brings down your score , and the service won’t help you negotiate settlements with creditors. You’ll need to take action to improve your credit legitimately and then get a rapid rescore to have those actions reflected in your credit reports and credit score quickly.

Optimize Your Account Age Credit Mix And Credit Inquiries

The remaining components of the credit score algorithm include the average age of your credit accounts, the variety of accounts that you have, and the number of new inquiries into your credit.

As the average age of your accounts increases, youll receive a bump to your credit score. This is because having more established accounts shows that youve maintained credit for a longer period and are therefore a better borrower.

This doesnt mean that you should close your newest cards, or refuse to ever open another credit account, but you should be conscious of how many new accounts you have. This is especially important if you have a large upcoming transaction like purchasing a home and need to have your score as high as possible.

My twin brother, Francisco Maldonado, who is also my co-founder at The Finance Twins, and I signed up for on our 18th birthday. We didnt realize the impact that this decision would have on our credit, but we are now reaping the benefits of having a long credit history.

Our oldest cards have no annual fee and we use them enough to keep them active . This allows us to raise the average age of our accounts, and this, coupled with always making on time payments has allowed us to have credit scores around 800, which is excellent.

Also Check: What Is Refinancing Your Mortgage

How Long Does Negative Info Remain On Your Credit Report And Affect Your Credit Score

This depends on what the credit issue is. For instance, credit delinquencies will typically remain on your credit report for seven years. Bankruptcies will remain on your credit report for 10 years. Credit inquirieswhere someone pulls your credit report like a lender or credit card companyremain on your report for two years.

Want to learn more? Heres more detailed info on how long it takes to improve your credit score.

Identify Why You Have A Credit Problem

If you obtain a copy of your credit report along with your credit score, you can find out if you have bad credit. Knowing that you dont have good credit is not enough. You need to know why you have bad credit.

For many people their credit problems may have been brought on by circumstances largely beyond their control like an injury or illness, unemployment, reduced income, or a separation or divorce. If this is what has happened to you, then skip ahead to point number 2. If you arent exactly sure why you have credit problems, then read on.

Some people focus on easy credit solutions like and dont take the time to figure out how they got into a financial mess until they are facing the prospect of a second or third bankruptcy. It is important to figure out why you got into the trouble you are in so that you can learn from your mistakes and not repeat the same mistake twice.

If you cant figure out why you are having financial or credit problems, speak with someone who can help you. Talk with a trusted friend or family member, a Financial Planner or a Credit Counsellor.

You May Like: Does Usaa Have Mortgage Loans

Tip : Pay Off Your Debt

Large quantities of debt make prospective lenders less enthusiastic about lending you more money. Its okay to be in debt, but its also important to make an effort to pay it off, even if it seems impossible.

Consider including debt payments in your budget , and make an effort to reduce the amount you owe to improve your credit score.

How To Use Rapid Rescoring

Rapid rescoring is a service that your lender requests on your behalf, so you’ll need to ask your lender if you want to obtain a rapid rescore. Youll need to have the ability to make a legitimate improvement to your credit reports. If you can do so, take the action needed to improve your score. Your lender will then submit proof of the update to the credit-reporting agency, which will update your credit reports in an accelerated time frame. The next time you request your score, it should be higher.

If your lender isnt aware that you have the ability to improve your credit in a meaningful way, you might need to bring this up yourself. Similarly, if your lender does not offer rapid rescoring, youll either have to wait for things to update the old-fashioned way or work with a different lender.

You May Like: How To Amortize A Mortgage In Excel

Make Payments On Time

How do you bring your score back up to its pre-mortgage level? By making on-time payments every time. Dont sign up for those services that say they can raise your credit score fast. Simply make your mortgage paymentsand all other payments, for that matteron time. As you prove that youre a responsible borrower, your score will naturally rise.

Pay your bills on time and in full. If your busy lifestyle sometimes forces bill-paying lower on your priority list, set up an automatic payment through your bank so you never forget.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

Recommended Reading: Can You Get A Mortgage With 0 Down

Use The Optimal Utilization Strategy

When maximizing your personal credit score, you should look at your utilization of available credit for each individual credit facility. By this I mean what percentage of your available credit is the balance being reported?

Percentage utilization can have a significant impact on your personal credit score. Equifax Canada states utilization has a 30% weighting on your personal credit score.

One scenario: maybe a furniture store or a home improvement store offered you dont pay for one year. The balance you are carrying on this card might be relatively small, but if its at or over the actual card limit, this is dragging down your personal credit score. Consider paying it off now!

Another scenario: suppose you have three credit cards, each with a limit of $10,000.

And lets say one card has a balance owing of $9,900 and the other two have zero balances. This might happen because you are trying to earn rewards on one particular card, or maybe you said yes to a balance transfer promotional offer.

Chances are your credit score is lower than if the usage was spread across the three cards equallyi.e., each with a balance owing of $3,300, or 33% of the limit.

Overall, your usage remains unchanged, but now you no longer have an individual card reporting at 99% utilization.

If you can afford to cover or reduce the balance owing on the one with a balance of $9,900, you should see a nice little score boost.

Open A New Credit Account

To some extent, you can help raise your credit score by opening a new credit account a new credit card account, a personal loan, an auto loan, an installment loan, refinancing a student loan, etc. This helps in a couple of ways, but only in small doses:

- CUR reduction: By getting a new revolving credit card account, the CUR denominator increases. For this to have the desired effect, you should not carry a balance on the new credit card, which would offset the gain by increasing the CURs numerator .

- Increase credit mix: Ten percent of your FICO score stems from your mix of different credit types: an auto loan, credit cards, mortgages, online loans, retail accounts, and finance company accounts. FICO reasons that you are more creditworthy if you can successfully juggle multiple account types. But dont open a new account just for FICOs sake, as this is only a minor factor.

The problem with opening new accounts is that the benefits just described are somewhat offset by the hard credit inquiries required for new credit, a 10% component of your FICO score. For a single new account, the impact is minor: A five-to-10-point drop in your credit score for up to one year.

Opening a new account is probably a net positive, but multiple new accounts in a relatively short time frame may do more harm than good.

Read Also: What Is The Mortgage On A 280 000 Home