Consequences Of Failing To Lock In Your Mortgage Rate

If you donât lock in your interest rate, rising interest rates could force you to make a higher down payment or pay points on your closing agreement. When you pay an up-front feeâor mortgage pointsâto a lender, youâre providing more money initially in order to get a lower interest rate.

For example, the cost for a $200,000 loan at a 30-year fixed rate could go up by more than $60 per month if the rate goes up from 5% to 5.5%, resulting in $22,000 more in interest over the loan term.

âRate locks provide consumers certainty when it comes to the economic terms of their loanâmost importantly, their monthly payment,â says Sebastian Hart, capital markets associate at online homeownership company Better. âWithout rate locks, borrowers would not know the final terms of their loan until the very end of the process.â

Should You Pay To Extend A Mortgage Rate Lock

When buying a house, affordability doesnt only involve the price of a propertyit also involves the interest rate. Your monthly payments include repayment of principal and interest, so a low rate is just as important as the sale price.

Different factors determine your mortgage rate, such as your , the amount of your down payment, and current mortgage rates.

But, mortgage rates can shift on a day-by-day basis.

Therefore, the interest rate your mortgage lender quotes at the time of your pre-approval might be different from your actual rate at closing.

A rate lock is usually enforced to protect you from these fluctuations.

However, rate locks expire. This is where you might consider an extension, which could come at a fee.

Find out if this fee is worth paying.

How Do I Know If My Interest Rate Is Locked

The federal government requires lenders to disclose whether the interest rate is “locked” on the loan estimate form.

The “Loan Estimate” is a new form that went into effect on October 3, 2015. It must be provided to applicants no later than three business days after they enter into a loan application.

Your lender will inform you of whether the interest rate is locked or not, and you can find documentation in the upper right corner of your loan estimate.

Also Check: Do Any Mortgage Lenders Use Fico 8

When Should You Request A Mortgage Rate Lock

Some mortgage lenders allow you to lock in rates as soon as your mortgage has been pre-approved, while others will not offer a mortgage lock until you present a purchase agreement to buy a home.

Unless rates are extraordinarily low, the best time to lock in a rate is after you’ve signed a purchase agreement, not the second your loan application is approved. That’s because you want your lender to have more than enough time to process your loan before the rate lock period expires. Ask your lender how long it normally takes to get your home loan to closing and build in extra days for unforeseen circumstances — that will help you determine how long a rate lock you need.

When Should You Lock In Your Rate

For most people, it makes sense to first sign a purchase agreement on a specific property before trying to lock in a mortgage rate. Then, find a mortgage loan with a good interest rate and consider asking your lender to lock in the rate. But before you formalize the rate lock, consider these things: First, you dont want to lock in the rate too early on, as rate locks are usually only good for between a few weeks to 60 days, so if your loan doesnt process within that period, your rate lock offer will no longer be good. Therefore, you need to make sure that the duration of your lock-in will give the lender enough time to process the loan. To do that, ask the lender to share the average loan processing time and try to get the lender to lock-in your rate for as long as possible to protect yourself.

You May Like: How To Make Mortgage Lenders Compete

Is A Mortgage Rate Lock Worth It

The benefits of a rate lock far outweigh the risks. An interest rate lock isnt about getting the best loan deal its about protecting your homebuying power.

As long as you shopped to find the best mortgage lenders and rates, the rate lock is about preventing your mortgage payment from going up due to a rash of rate hikes before your closing.

Consider a $300,000 home financed for 30 years at 4%, with a 20% down payment. Just a quarter point rise in interest rates will kick your payments up $44 a month, from $1,432 to $1,476. If you stay in your home just five years, that adds up to more than $2,600.

Over a six- to eight-week period, from entering into a contract to signing the closing documents, its quite possible for rates to move much more than a quarter point.

Worst of all, not locking in a rate can mean having to come up with a higher down payment. If your payment increases because of higher interest rates, a lender may require more money upfront to meet its lending requirements.

Extending Mortgage Locks For New Construction

When you want to lock a rate for a new construction set to be built months from now, a 15-day lock wont give you peace of mind on your expected monthly payments. Thats why some lenders offer 180-day lock programs for new constructions.

Making the decision to go with a longer lock period is about weighing two things against each other:

|

The risk of rates increasing in the future |

The extra cost youll pay for a longer lock |

Talk to your lender about what whether or not you should purchase an extended lock for a new construction. Your mortgage adviser will consult with you to provide the best advice and options to protect you throughout the process.

Recommended Reading: How Much Do You Pay On A 30 Year Mortgage

Mortgage Rate Lock Float Down Vs Convertible Adjustable

The mortgage rate lock float down starts with the rate lock or with a fixed-rate mortgage, but the borrower can exercise the option to take a lower rate if rates fall. The option to get the lower rate expires typically within 30 to 60 days. A convertible adjustable-rate mortgage , on the other hand, allows the borrower to take advantage of lower rates for a few years before converting to a fixed-rate mortgage.

An adjustable-rate mortgage begins with a much lower introductory teaser rate, but after a set periodtypically three to 10 yearsthe rate is adjusted according to an index plus a . The rate is generally adjusted every six months and can go up or down depending on the terms outlined in the contract.

Convertible ARMs are marketed as a way to take advantage of falling interest rates and usually include specific conditions. The financial institution generally charges a fee to switch the ARM to a fixed-rate mortgage.

What If You Lock In A Mortgage Rate And The Rate Goes Down

When an interest rate is locked, the rate is guaranteed for a specific period of time.

Lenders guarantee the interest rate based on the amount of time that it will take to process the mortgage, so if a lender estimates 45 days to process the mortgage, a conservative lock time is 60 days. Lenders are able to extend the lock period for a premium.

Even if interest rates go up during that period, your locked interest rate will be protected.

And if the interest rates go down, will the lender give you the lower rate? Unfortunately, probably not. You will still close at the locked rate.

Interest rates that are not locked are called âfloatingâ rates. Your loan will close at the current interest rate just prior to closing, and your lender will assign the current rate to the mortgage.

Read Also: What Are The Rates On A 30 Year Fixed Mortgage

Does Locking In Your Mortgage Rate Cost Money

There are often costs, either hidden or plainly stated, that are associated with locking in your mortgage rate. Normally these costs are expressed by the lender in terms of points. If you do pay for a rate lock, the fee will vary depending on your lender, the loan amount, the terms of the loan, and the length of the lock-in period. The costs associated with rate locks can include nonrefundable fees, flat fees, and fees based on a percentage of the mortgage.

While a mortgage is for a set amount, the full homebuying process usually incurs additional fees and transactions. Want to know more? Find out how much a home really costs.

While some lenders offer rate locks for free, make sure to thoroughly investigate the service and rate being offered because, while there is sometimes no charge for the rate lock itself, a fee may be incorporated into the rate youâre offered.

What Happens If Your Rate Lock Expires

A common question homebuyers will ask is – what happens if my rate lock expires before my loan closes?

And the answer is it depends on the lender. In some cases, borrowers will be given the option to pay an additional fee to extend the lock period. However, this may not be an option if mortgage rates have increased significantly.

If an extension of the rate lock period is not available, the borrower will receive the interest rate thatâs available when locking it prior to closing. This is a compelling reason why borrowers should move quickly through the underwriting process to avoid the risk that their rate lock expires.

Recommended Reading: What Mortgage Rate With 650 Credit Score

How Much Does A Mortgage Rate Lock Cost

Some lenders charge a separate fee for a rate lock. This fee varies and can be expressed as a dollar amount, such as $1,000, or as a percentage of the loan amount, such as 0.25% of the total loan value.

Other lenders might not charge a fee for a rate lock, but this usually just means its included in the rate youre offered.

Recommended Reading: What Is A Mortgage Modification Agreement

When To Lock In Your Mortgage Rate

If youve received a rate youre comfortable with and know you can afford, your best bet is to lock it in.

A common question is Is there a best day of the week to lock in mortgage rates? The short answer is no. There isnt a single best day to lock in your rate. Mondays tend to be slower, and less volatile, so if rates are already low, you should lock in then. However, rates fluctuate more in the middle of the week, and you could take advantage of this if they dip.

You might be tempted to wait it out, float your rate and see if you can get a lower rate before locking in. However, the risk likely wont be worth the potential savings. If you want to take this route, you’ll need to check mortgage rates regularly and be ready to move quickly. You should also check with your lender to see if you have a deadline for locking in.

How do you decide whether to lock or float? The safest bet is usually to lock, but if you really want to take the risk, the best time to float is typically when rates are falling.

Recommended Reading: How To Add A Name To A Mortgage

What It Means To Lock A Mortgage Rate

When you lock a mortgage rate, it means you and your lender have reached an agreement on your loans interest rate and discount points, and the lender has put its commitment in writing.

Rate locks protect you from an increase in mortgage rates between today and your closing date. They offer peace of mind that even if mortgage rates rise, the bank cant assign you the new, higher rate.

But the mortgage rate lock works both ways: If mortgage rates dip, the bank wont assign you the new, lower rate.

Disadvantages Of A Mortgage Rate Lock

Rate locks can be helpful but are not perfect. Here are two of the reasons buyers think twice before locking in an interest rate:

- Rates can change by the hour, and you have no way of knowing if rates will go down before you close on your loan.

- If interest rates do go down, you are stuck with the rate you locked in — you can’t get a lower rate. The exception is if the original rate lock has a “float-down” provision written in to cover such a situation. If a lender does provide a float-down provision, you can expect to pay more for the rate lock.

When it’s time to lock in your mortgage rate, figure out how long you’re likely to need the lock in place. Then, oversee deadlines so that your lock does not expire before you close on your mortgage.

Also Check: How To Calculate Percentage Of Mortgage

The Bottom Line: Locking In Is Usually The Right Move

Is locking in your mortgage rate worth it? It can be, depending on the cost and what rates are doing.

Talk to your lender and find out exactly what their rate lock policy is. Ask what it would cost to extend the period and what would happen if you face delays and your rate lock expires. If youre interested, ask about float-down options.

In general, the security of protecting yourself from any rate spikes will be worth it. Its hard to time the market to perfectly suit your needs. Turning your mortgage process into a game of trying to get the lowest possible rate is risky, and you could end up losing a comfortable rate.

When youre ready to begin, you can start your mortgage application online through Rocket Mortgage.

When Can You Lock In An Interest Rate On New Construction

Most home buyers can get by with 45- or 60-day rate locks, but what if youre buying new construction and your new home wont be ready for months or even a year? What do you do about your mortgage rate?

Most new construction mortgage lenders will allow you to lock todays mortgage rates for periods of 180 days, 270 days, 360 days, or longer.

But should you lock in a rate so far in advance?

Don’t Miss: Can I Get A Mortgage With A 730 Credit Score

Be Proactive On Your Mortgage

Lenders juggle multiple mortgage applications at once, so check in with your lender frequently. Ask how your loan application is moving forward and if any more information is needed.

Keep in mind that lenders are human and can make mistakes. Youll want to read the details of your mortgage and if youre buying a home your sale contract closely. Make sure that the closing date falls within the window of your locked interest rate.

Shop Around For Lenders

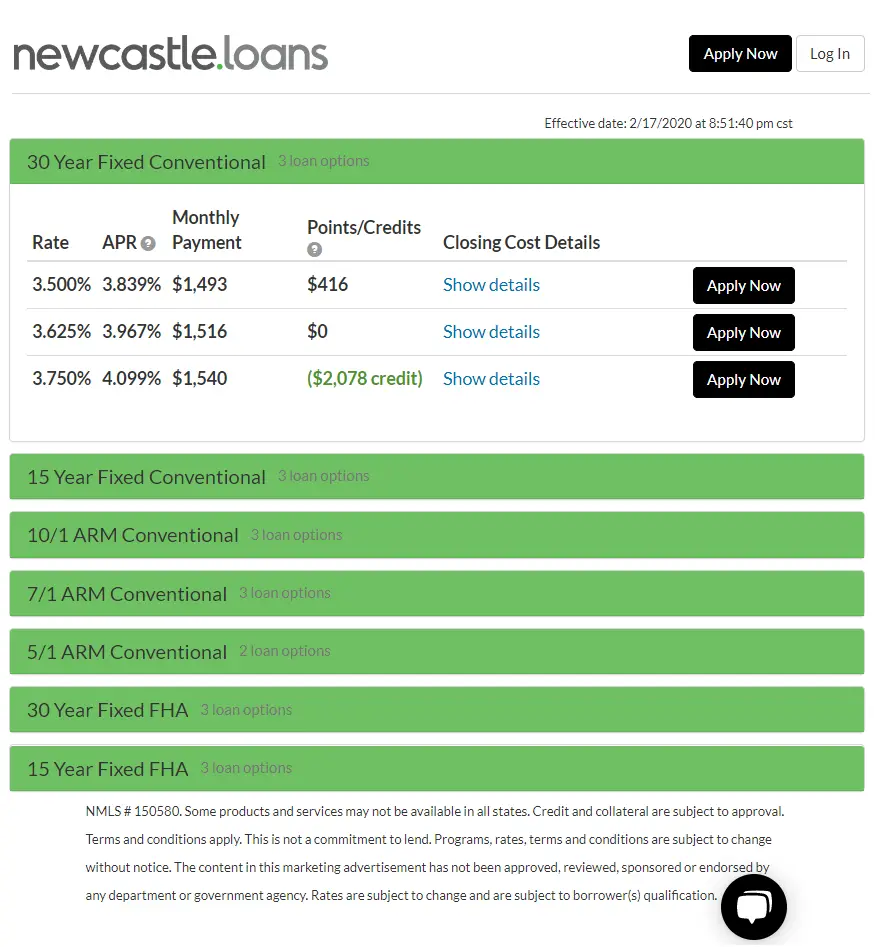

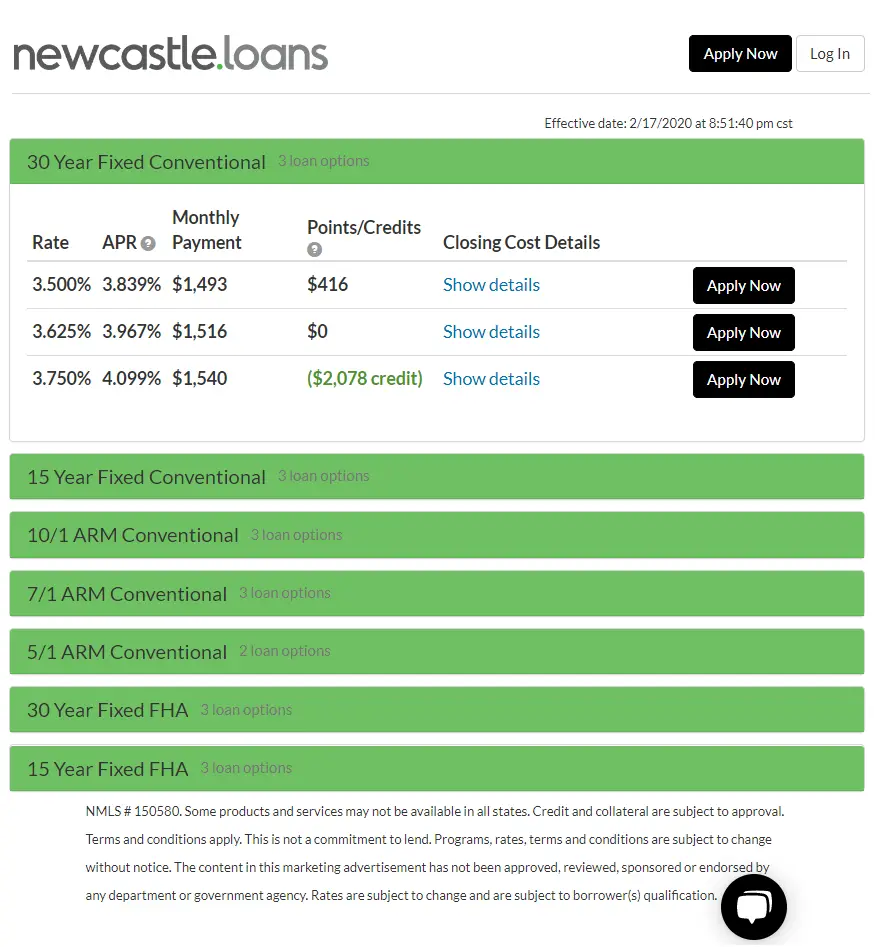

As the buyer, you get to choose which mortgage company you want to work with. Dont be afraid to take some time to shop around for lenders.

Contact a few competing loan providers and ask what types of fees they charge. Choose a lender that offers low fees and competitive interest rates for lower overall closing costs.

You May Like: What Is Mortgage Insurance For Fha Loan

Can You Change Lenders After Locking A Rate

Yes, you can change lenders even after locking a rate. Its legal and doesnt carry a specific fee or penalty.

Sometimes borrowers choose to switch lenders in the middle of the transaction. While this isnt ideal for you, it may be necessary if your mortgage adviser is unresponsive or slow and if they lose paperwork or cant close on time.

Mortgage Rate Lock: How And When To Lock In Your Mortgage Rate

Dont let a good interest rate be the one that got away. If youre comfortable with the mortgage payment, go ahead and lock your rate.

Edited byChris JenningsUpdated August 8, 2022

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. By refinancing your mortgage, total finance charges may be higher over the life of the loan. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

As a homebuyer, you always want the lowest possible interest rate on your mortgage and with good reason, too. Even a small rise in interest rates can cause you to pay more in costs over the life of your loan.

But rates fluctuate daily even by the hour so its a good idea to lock in your mortgage rate when you have a good one. Generally, you want to lock in when youre comfortable with the rate and the monthly payment.

Heres what else you should know about a mortgage rate lock:

You May Like: How Much Loan Can I Afford Mortgage

Who Pays Closing Costs

Both buyers and sellers pay closing costs. However, the buyer usually pays most of them. You can negotiate with a seller to help cover closing costs, which are called seller concessions. Seller concessions can be extremely helpful if you think youll have trouble coming up with the money you need to close. There are limits on the amount that sellers can offer toward closing costs. Sellers can only contribute up to a certain percentage of your mortgage value, which varies by loan type, occupancy and down payment. Weve broken this down below:

Limited Window To Request An Extension

If your deadline is approaching and you know you wont close in time, you have two options: Let the rate lock expire and accept the current market rate on your mortgage. Or ask for a rate lock extension.

If you choose the latter, make sure you request this extension before the original lock expires.

You May Like: How Interest Is Calculated On Mortgage