What Changes Your Credit Score

These 5 factors provide a glimpse into your financial habits and history and help lenders assess your financial health.

Home buyers with lower credit scores are typically assigned a higher interest rate.

There is no way to get around a credit check. It is one of the things you need to buy a home during the mortgage pre-approval stage so be sure to learn more about how a mortgage pre-approval affects your credit score.

Get pre-approved for a mortgage today.

You Should Have A Debt

Debt-to-income ratio is your monthly take-home income versus what you pay out towards debt. For instance, if you have $5000 take home pay every month, and your minimum payments on all your debts total $2500 every month, you have a debt-to-income ratio of 50%. Getting it as low as possible will show the lender you have plenty of income to put towards mortgage payments.

What Is The Minimum Credit Score To Qualify For A Mortgage

There is no official minimum credit score since lenders can take other factors into consideration when determining if you qualify for a mortgage. You can be approved for a mortgage with a lower credit score if, for example, you have a solid down payment or your debt load is otherwise low. Since many lenders view your credit score as just one piece of the puzzle, a low score wont necessarily prevent you from getting a mortgage.

Also Check: How To Figure Mortgage Payments With Taxes And Insurance

Is Getting A No

A no-money-down home loan may sound like an attractive option for many would-be homebuyers. A whopping 68% of respondents to an Urban Institute survey reported an inability to afford a down payment as the primary reason they cant buy a house.2

Unfortunately, you may end up paying a lot more in interest and fees over the life of the loan without a down payment.

For example, suppose that you have a credit score of 750 and want to buy a $300,000 house with a 30-year loan. With that FICO score, youd qualify for a rate of 2.772%.

All else being equal, if you chose to finance all $300,000 instead of putting down a 20% payment of $60,000, youd pay an extra $28,432 in interest over the life of the loan.

In practice, if you purchase a home with a no-money-down loan, your interest rate might be slightly lower. Only a USDA loan or VA loan would let you skip the down payment, and they have lower interest rates than conventional loans.

Unfortunately, with a USDA loan, youll also owe mortgage insurance until you reach 20% equity, which can reduce or eliminate any interest savings.

Ultimately, everyones credit profile and borrowing options are going to be unique. You should always shop around with various lenders and get prequalified to make an informed decision.

How Long Will It Take To Improve My Credit Score

Its tricky to say how long it will take for you to see improvements in your credit score. If youve picked up a negative mark, such as a missed payment or a time when you went over your credit limit, it will stay on your report for six years.

Even if youre taking all the right steps to improve your credit score, delays in reporting from lenders can mean it takes a good few months to see your score move in the right direction. For example, it could take weeks for a positive action like registering on the electoral roll to show up on your credit report.

You May Like: How To Find Out If A Mortgage Is In Default

Can I Get A Mortgage If My Credit Score Is: : :

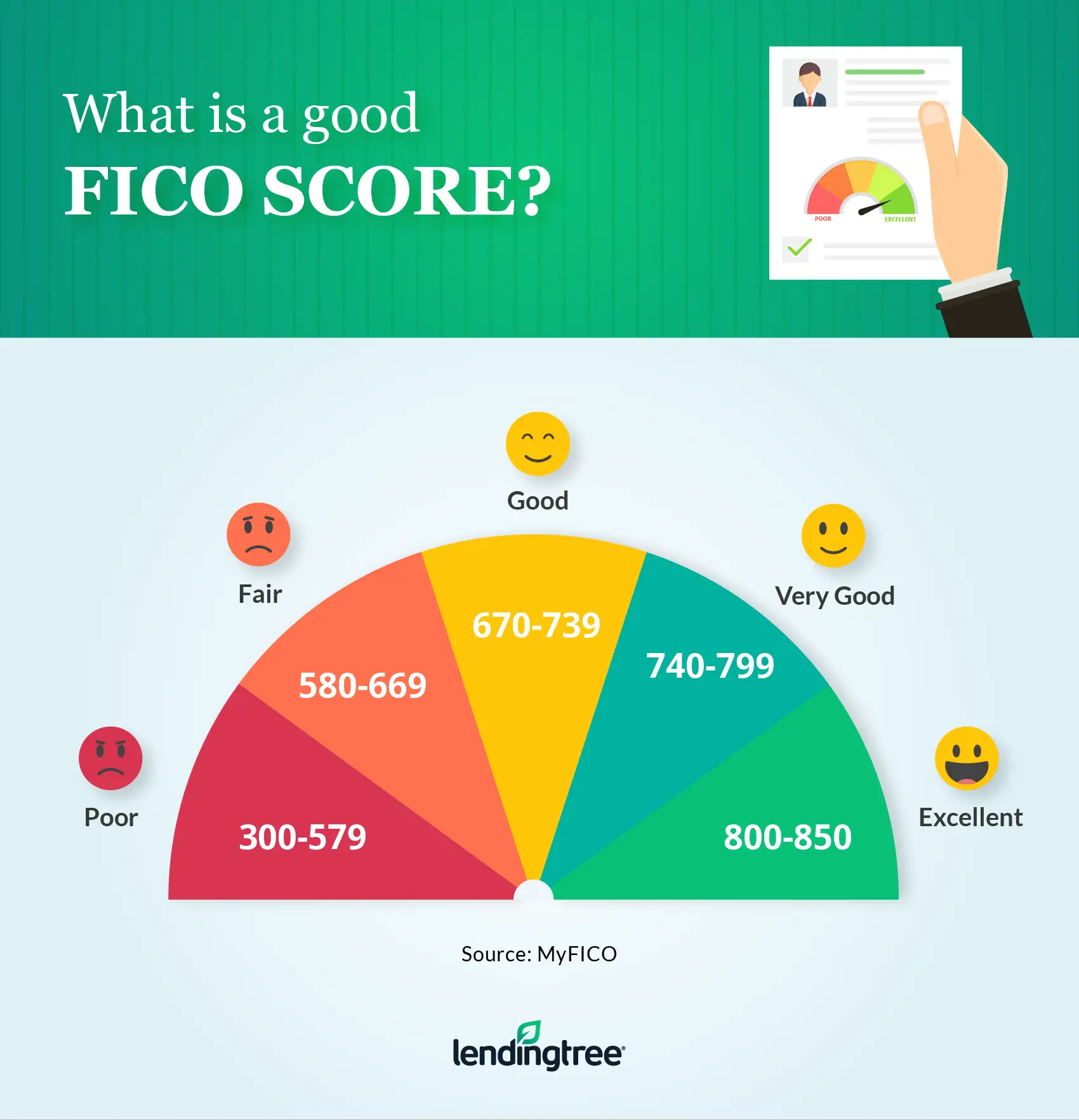

Because credit reference agencies have different scoring systems, it can be hard to understand what credit score you need to get a mortgage. Generally, most lenders prefer a high credit score categorised as being good or excellent than a low credit score categorised as being fair or poor.

For example, a high credit score if you check your credit score with Experian would be between 881 and 999. If you checked with TransUnion, a high credit score 604 to 710. And if you checked with Equifax, a high credit score would be anywhere between 410 and 700.

If you have a fair or poor credit score, you can still get a mortgage, but youll have less options of mortgage lenders willing to give you a mortgage. Read our Guide on How to improve your credit score before you apply for a mortgage if you want to know how to improve it before applying. If you need to get a mortgage soon and are worried you wont be able to due to a poor credit score, get in touch with us for expert bad credit mortgage advice.

So Can You Get A Mortgage With A Credit Score Of 600

Does a poor credit score mean that you wont be able to obtain a mortgage? Not necessarily. The loan may just have to come from somewhere other than a traditional lender . Luckily in Canada, there are other credit unions you can turn to. These types of places can help people with mortgage approval, especially if they cant get it at traditional credit bureaus, like TD Bank, RBC, BMO, etc. Theyre typically owned by individuals and are much more forgiving for people with lower credit scores and a lower income. They can offer lower interest rates and just lower fees in general.

There are also non-bank lenders that can accommodate your specific needs, like Loans Canada, Easy Financial, Fairstone, and many more. We know youve probably asked the question is a non-traditional lender safe? before, and yes, they are safe and secure. Both traditional and non-traditional lenders must comply with the same rules. In fact, in July 2019 in Canada, it was reported that non-bank lenders were the go-to for mortgages rather than traditional lenders. And its important to note that these mortgage loans werent just for those with bad credit scores. They can be a great place to lean on for those who are self-employed, single, going through a divorce, have health problems, and other issues.

Read Also: Is A Mortgage A Line Of Credit

You Dont Want To Have Too Many Recent Credit Inquiries Showing On Your Credit Report

If youve applied for a few credit cards, or car loans or lines of credit recently, your credit report and credit score is going to show that. If there is even just a few of them in a small period of time, its going to make you look like youre desperate to get your hands on some money. Its going to look like you might be a big risk to lend to.

Can I Get A Home Loan With A 450 Credit Score

A credit score of 450 is categorised differently depending on the credit checking agency youre using. For example, a credit score of 450 on Experian or TransUnion is categorised as Very Poor, which means youll have less options available to you when you apply for a mortgage than you would if you had an Excellent rating. But, there are specialist mortgage lenders who will consider your application. You just need a specialist broker. We can help with that. Get in touch and get matched to the perfect mortgage broker for you now.

If your credit score is 420 and youre with Equifax, youre categorized as having an Excellent rating, so shouldnt struggle to get a mortgage from most lenders.

Recommended Reading: How Do You Know If You Can Get A Mortgage

Can I Check My Credit Score For Free

Yes. Sites like Clearscore let you see your monthly credit report for free. All you need to do is make an account and you can track how your actions are helping or hindering your credit score. Bear in mind that this score isnt definitive again, its just one agencys interpretation of your borrowing and repaying behaviours.

Mortgage Lenders Pull All Three Reports But Only Use This One

According to Darrin Q. English, a senior community development loan officer at Quontic Bank, mortgage lenders pull your FICO score from all three bureaus, but they only use one when making their final decision.

“A bank will use all three bureaus,” tells CNBC Select. “It’s called a tri-merge.”

If all three of your scores are the same, then their choice is simple. But what if your scores are different?

“We’ll use that median score as the qualifying credit score,” says English. “Not the highest or lowest.”

If two of the three scores are the same, lenders use that one, regardless of whether it’s higher or lower than the other one.

And if you are applying for a mortgage with another person, such as your spouse or partner, each applicant’s FICO 2, 4 and 5 scores are pulled. The bank identifies the median score for both parties, then uses the lowest of the final two.

Recommended Reading: What Kind Of Mortgage Loan Should I Get

Work With A Trusted Mortgage Loan Officer

Your mortgage lender is the ideal resource for asking questions about any part of the homebuying process before you are even ready to apply.

The professional loan officers at Homefinity can get you pre-approved so you can solidify your budget and take the proper next steps. or apply now to get started.

Can You Get A Home Loan With Bad Credit

Its possible to qualify for a mortgage even if your credit score is low. Its more difficult, though. A low credit score shows lenders that you may have a history of running up debt or missing your monthly payments. This makes you a riskier borrower.

To help offset this risk, lenders will typically charge borrowers with bad credit higher interest rates. They might also require that such borrowers come up with larger down payments.

If your credit is bad, be prepared for these financial hits. You may qualify for a mortgage with a low credit score, youll just have to pay more for it.

You May Like: Can You Refinance Mortgage Without A Job

Should I Apply For A Mortgage If I Have A Low Credit Score

If you have a low credit score, getting a mortgage wont be easy. That being said, lenders will look at more than just your credit score. Some applicants may have a credit score of zero, but this doesnt necessarily mean theyre not mortgage-worthy candidates.

There are some applicants that have never used credit, so although this can give them a very low score, it actually means theyve taken little or no loans in the past. Explaining this to a lender and showing clear evidence of this may support your application. Having a deposit of at least 15% can also boost your chances of approval.

Learn more: Can I get a mortgage with no credit history?

Interest Rates And Your Credit Score

While theres no specific formula, your credit score affects the interest rate you pay on your mortgage. In general, the higher your credit score, the lower your interest rate, and vice versa. This can have a huge impact on both your monthly payment and the amount of interest you pay over the life of the loan. Heres an example: Let’s say you get a 30-year fixed-rate mortgage for $200,000. If you have a high FICO credit scorefor example, 760you might get an interest rate of 3.612%. At that rate, your monthly payment would be $910.64, and youd end up paying $127,830 in interest over the 30 years.

Take the same loan, but now you have a lower credit scoresay, 635. Your interest rate jumps to 5.201%, which might not sound like a big differenceuntil you crunch the numbers. Now, your monthly payment is $1,098.35 , and your total interest for the loan is $195,406, or $67,576 more than the loan with the higher credit score. A mortgage calculator can show you the impact of different rates on your monthly payment.

You May Like: Is Fico Score 8 Used For Mortgages

Mortgages Without A Credit History

Mortgage lenders accept borrowers without any credit history in certain circumstances. Some major banks, such as TD and CIBC, offer specialmortgage programs for new immigrantsthat have a limited or no Canadian credit history, or for foreign workers on a work permit. Private mortgage lenders may also accept borrowers without any credit history.

How To Get Your Credit Score Ready For A Mortgage

No matter what type of mortgage you seek, its always advantageous to apply with the highest credit score you can manage. Meeting the minimum score requirement for a loan is just the start. Lenders also use your credit score to help set interest rates and fees on the loan, and generally speaking, the higher your credit score, the better your borrowing terms will be and the less youll pay in interest and fees over the life of the loan.

If youre planning to apply for a mortgage in the next 12 months, you may be able to take steps starting today to spruce up your credit score so your loan application reflects the best credit score you can get.

Any credit score that helps you qualify for a mortgage you can afford can be considered a good score. Even so, most of us have room to improve our scoresand reap potential savings over the lifetime of a mortgage loan.

Also Check: Why Switch To A 15 Year Fixed Mortgage

How Your Credit Score Affects Your Mortgage Eligibility

When it comes to getting a mortgage, your credit score is incredibly important. It determines:

- What loan options you qualify for

- Your interest rate

- Your loan amount and home price range

- Your monthly payment throughout the life of the loan

For example, having a credit score of excellent versus poor could save you over $200 per month on a $200,000 mortgage.

And if your credit score is on the lower end, a few points could make the difference in your ability to buy a house at all.

So, it makes sense to check and monitor your credit scores regularly especially before getting a mortgage or other big loan.

The challenge, however, is that theres conflicting information when it comes to credit scores.

There are three different credit agencies and two credit scoring models. As a result, your credit score can vary a lot depending on whos looking and where they find it.

Dont Miss: What Is Loss Mitigation Mortgage

What Credit Score Do I Need To Buy A House

Quick Answer

While credit score requirements vary based on loan type, mortgage lenders generally require a 620 credit score to buy a house with a conventional mortgage.

Through December 31, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

In this article:

The minimum credit score needed to buy a house can range from 500 to 700, but will ultimately depend on the type of mortgage loan you’re applying for and your lender. While it’s possible to get a mortgage with bad credit, you typically need good or exceptional credit to qualify for the best terms.

Read on to learn what credit score you’ll need to buy a house and how to improve your credit leading up to a mortgage application.

Don’t Miss: Are Closing Costs Added To Mortgage

What Mortgage Lenders Look For When Approving A Home Loan

When you apply to get pre-approved, your lenders will review your credit history and consider your current credit outlook. This includes looking at:

- How on-time have you been with your payments and obligations?

- What does your current debt load look like, and how is it spread out?

- How much experience do you have managing credit?

- Have you been recently trying to acquire access to new sources of credit?

- Do you let items go into collections?

- Have you previously filed for bankruptcy?

Lenders ask these questions to get comfortable with you. Your financial health isnt the only consideration lenders make, but how you manage your bills tells a large part of your story.

Lenders also look for specific credit events known as derogatory items, like bankruptcy or delinquent accounts.

Derogatory items dont disqualify a mortgage approval. Generally, its only required that theyre historical events and not current ones. For example, you can get approved for a mortgage if youve declared bankruptcy in the past, or if youve lost a home due to foreclosure.

Lenders know that life is unexpected and bad things happen. Whats important is whats happened in the time since the derogatory event occurred.

What Is A Fair Credit Score Range

Fair credit score = 620- 679: Individuals with scores over 620 are considered less risky and are even more likely to be approved for credit.

In the mid-600s range, consumers become prime borrowers. This means they may qualify for higher loan amounts, higher credit limits, lower down payments and better negotiating power with loan and credit card terms. Only 15-30% of borrowers in this range become delinquent.

You May Like: How Much Would A Mortgage Be On 130 000

What Credit Score Is Needed To Buy A House

You dont need flawless credit to get a mortgage. But because credit scores estimate the risk that you wont repay the loan, lenders will reward a higher score with more choices and lower interest rates.

For most loan types, the credit score needed to buy a house is at least 620. However, a higher score significantly improves your chances of approval, as borrowers with scores under 650 tend to make up just a small fraction of closed purchase loans. Applicants with scores of 740 or higher will also get the lowest interest rates.