Amerisave Mortgage Corporation: Best For Refinancing

AmeriSave Mortgage Corporation is an online mortgage lender, available in every state except New York, offering an array of loan products. Along with conventional loans and refinancing, the lender also offers government loans, and is one of Bankrates best FHA lenders in 2021.

Strengths: Like other online mortgage lenders, AmeriSave Mortgage Corporation has some of the most competitive rates out there, and about half of consumers have had their loans closed in 25 days. The lender also doesnt charge a separate origination fee.

Weaknesses: Youll still need to pay a flat $500 fee.

> > Read Bankrate’s full AmeriSave Mortgage Corporation review

How Much Can I Borrow For A Mortgage

How much you can borrow for a mortgage varies by person, and depends on your financial situation: your credit, your income, and the amount of cash you have available for a down payment. The general rule of thumb for a conforming mortgage is a 20% down payment. On a $400,000 home, that would mean you need $80,000 up front.

Note that this calculation may be different if you qualify for a different type of mortgage like an FHA or VA loan, which require smaller down payments, or if you’re looking for a “jumbo loan” over $548,250 in most parts of the US in 2021 .

You don’t have to go with the first bank to offer you a mortgage. Like anything else, different servicers offer different fees, closing costs, and products, so you’ll want to get a few estimates before deciding where to get your mortgage.

How Do I Compare Current Mortgage Rates

Because mortgage rates are so individual to the borrower, the best way to find the rates available to you is to get quotes from multiple lenders. If you’re early in the homebuying process, apply for prequalification and/or preapproval with several lenders to compare and contrast what they’re offering.

If you want a broader idea without yet talking to lenders directly, you can use the tool below to get a general sense of the rates that might be available to you.

Read Also: Can I Get A Reverse Mortgage On A Condo

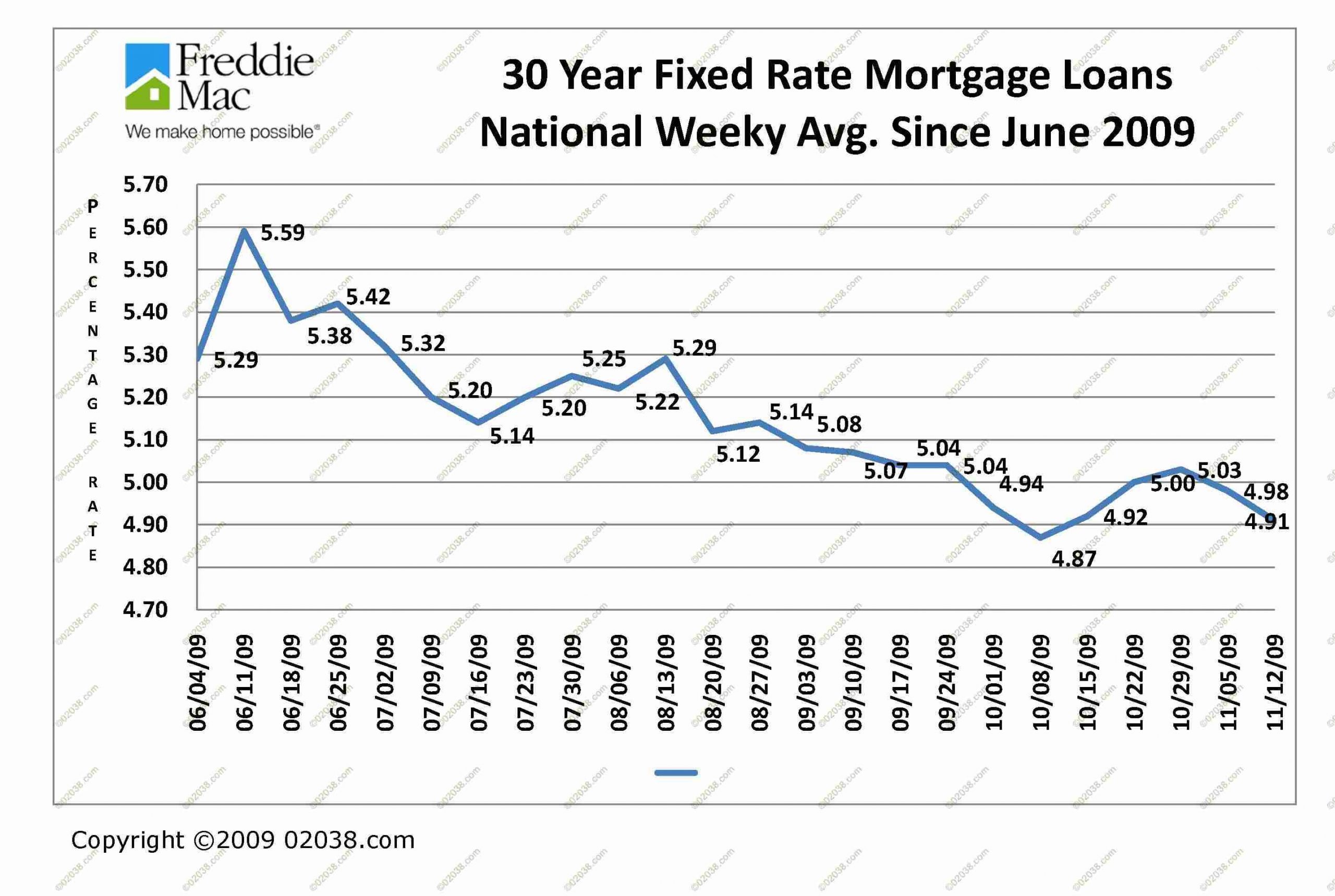

Historical Mortgage Rates: Todays Rates Are Still Favorable

Heres a visual look at how current mortgage rates compare to the last 22 years.

Rates have risen a lot in the past few months, but if you zoom out a few years, youll see that these rates arent high from a historical perspective. Rates this high were common before the pandemic, around the end of 2018 and beginning of 2019, and rates around 4.5% would have been remarkably low before 2011.

How To Shop For The Best Mortgage Rate

To find a personalized mortgage rate, speak to your local mortgage broker or use an online mortgage service. In order to find the best home mortgage, you’ll need to take into account your goals and overall financial situation. Things that affect what the interest rate you might get on your mortgage include: your credit score, down payment, loan-to-value ratio and your debt-to-income ratio. Having a good credit score, a larger down payment, a low DTI, a low LTV, or any combination of those factors can help you get a lower interest rate. Apart from the interest rate, other factors including closing costs, fees, discount points and taxes might also factor into the cost of your house. Be sure to talk to a variety of lenders — such as local and national banks, credit unions and online lenders — and comparison shop to find the best mortgage loan for you.

Also Check: Bofa Home Loan Navigator

As Mortgage Rates Keep Climbing Homes Are More Expensive For Both Renters And Buyers

In fact, that’s quite a steep increase just over the course of, you know, less than three months, and so when interest rates go up then, of course, you know payments people have to make on the mortgages also increase, and that means that it becomes less affordable to enter the market, UCSD Professor Allan Timmerman said.

Stay informed about local news and weather. Get the NBC 7 San Diego app foriOS or Androidand pick your alerts.

The increase in mortgage interest rates is causing some buyers to game plan for future home purchases.

I have some, some pretty active buyers at the moment that are already anticipating, theyre trying to be more conservative about their budget, San Diego Realtor Allan Uy said.

As a result of the interest rate hikes, some economists are lowering their home sales forecasts for 2022.

The Federal Reserve signaled that they will be raising the interest rate at each of the remaining meetings for the year.

This article tagged under:

Very Low Mortgage Rates

Fixed rates are currently near record lows but they are rising. As mortgage rates rise, they reduce homebuying budgets.

The impact of early rate increases on homebuying budgets will be greater than the subsequent rate increases. Prospective homebuyers can take advantage of this effect by getting a pre-approved mortgage 4 months before making a purchase. By the time they find a place they like, rates may have risen, and competing bidders who didnt get a pre-approved committed rate might be saddled with smaller homebuying budgets. If your bank doesnt offer a 4-month rate guarantee with their pre-approval, then talk to a mortgage broker.

Read Also: Does Rocket Mortgage Sell Their Loans

What Is A Mortgage Rate Hold

A mortgage rate hold is the locking in of a specified mortgage rate for a set period of time. This only applies to fixed rate mortgages, since the interest rate of variable rate mortgages can fluctuate.

Once you have a TD Mortgage Pre-Approval, you get a 120-day rate hold which holds the interest rate on your pre-approval term for 120 days subject to all the conditions, even if interest rates go up.

Typical Ontario Mortgage Amounts

Finding the right mortgage has a lot to do with determining what you can afford. And that depends on where you live.

Below are typical mortgage amounts for someone putting down 20% in select Ontario cities. Theyre based on a 30-year amortization and average purchase prices as tracked by the Canadian Real Estate Association :

- Barrie and District: $570,800

| 2,130 | 0.10% |

Thanks to Ontarios stable economy and housing market, it tends to have lower arrears rates than other provinces.

Don’t Miss: Rocket Mortgage Launchpad

Expert Forecast: What Will Happen To Mortgage Rates In March

Mortgage rates were expected to keep rising in March, experts told us. Thats to be expected this year, as rates emerge from a historically low environment during the pandemic. The rates will continue to climb in 2022, and I dont think March will be any exception, Mitria Wilson-Spotser, director of housing policy for the Consumer Federation of America, told us.

Rates will also be shaped by what the Fed does, and that will rely on what happens with inflation, the war in Ukraine and other factors, experts said. My expectation is that theyll take a moderate approach and watch this very carefully and continue to raise rates, Rob Cook, vice president for marketing, digital, and analytics for Discover Home Loans, told us.

Fixed Interest Rate Mortgage

Fixed interest rates stay the same for your entire term. They are usually higher than variable interest rates.

A fixed interest rate mortgage may be better for you if you want to:

- keep your payments the same over the term of your mortgage

- know in advance how much principal youll pay by the end of your term

- keep your interest rate the same because you think market interest rates will go up

Recommended Reading: How Much Is Mortgage On 1 Million

How Do I Get A Mortgage

Getting a mortgage is the most important part of the homebuying process. Its likely the largest loan youll ever take out. So finding the right lender and getting the best deal can save you thousands of dollars over the life of the loan.

Heres what you need to do.

There are lots of different types of lenders. Looking at the loans and programs that banks, credit unions, and brokers offer will help you understand all of your options.

If youre looking for a specific type of loan, like a VA loan or a USDA loan, then make sure that the lender offers these mortgages.

2. Apply for preapproval

Before you start shopping for a home, youll need a preapproval letter. A mortgage preapproval is different from a formal loan application in that it doesnt affect your credit and doesnt guarantee youre approved. But it does give you an idea of your likelihood of approval.

3. Submit an application

Once youre ready to start comparing loan offers, submit an application. Until you apply, the lender wont be able to give you an official estimate of the fees and interest rate you qualify for.

To find the lowest rate and fees, you should submit applications with two or three lenders. Once you have each Loan Estimate in hand, its easier to compare and determine which offer is best for you.

4. Underwriting and closing

Mortgage Rate Trends: Where Rates Are Headed

Mortgage rates plunged early in the pandemic and scraped record lows below 3 percent at the start of 2021. The new year, however, has been characterized by rising rates. The days of sub-3 percent mortgage interest on the 30-year fixed are behind us, and many experts think the average rate on this loan will be 3.5 to 4 percent by the end of 2022. Thats still great by historical standards though. The ultra-low rates of 2020 and 2021 were an anomaly, but even 4 percent is a deal in the scheme of things.

Mortgage rates continue to surge, as they have since the beginning of the year, as the outlook takes shape for Fed rate hikes that are sooner and faster than previously expected, McBride says. Mortgage rates are still well below 4 percent but in an environment of already sky-high home prices, more would-be homebuyers are priced out with each move higher in mortgage rates.

Recommended Reading: How Does 10 Year Treasury Affect Mortgage Rates

Is A Variable Rate Better

If youre comparing a variable rate and a fixed rate at the same point in time, a variable rate will almost always be lower than a fixed rate. Just as how a longer term mortgage will have a higher rate when compared to a shorter term mortgage, borrowers will pay a premium for locking-in a fixed rate.

Historically, variable rates have performed better than fixed rates, as found in a 2001 study by theIndividual Finance and Insurance Decisions Centre. Thats because interest rates have generally fallen over the past few decades, meaning that borrowers with a variable mortgage rate would have benefited from falling interest rates.

In todays low interest rate environment, its not certain if interest rates can continue to decrease further. While the focus can be on the direction of the change, you should also pay attention to how large the interest rate changes can be.

Since variable rates are often already priced at a discount to fixed rates, variable rates would be a better choice if interest rates dont move at all. Variable rates might still be a better choice if interest rates only increase slightly and later on in your mortgage term.

A fixed mortgage rate would be better if you think interest rates will significantly rise in the near future. Many borrowers also place value on the peace of mind that a fixed mortgage rate gives. The slightly higher mortgage rate might be worthwhile in exchange for not having to worry about interest rate fluctuations.

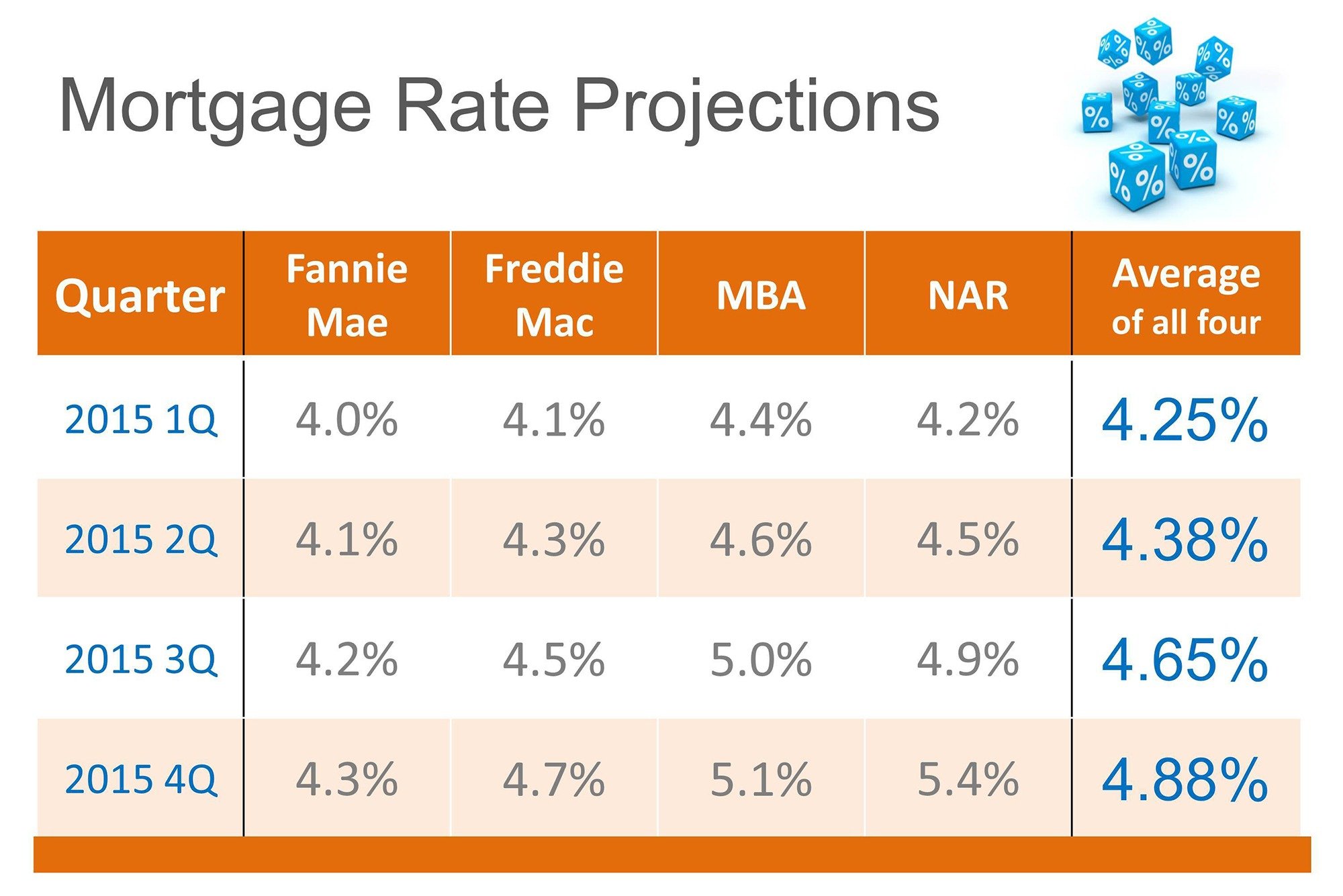

Year Mortgage Rate Forecast For 2021 2022 2023 2024 And 2025

| Month |

| 31.1% |

30 Year Mortgage Rate forecast for .Maximum interest rate 3.14%, minimum 2.96%. The average for the month 3.05%. The 30 Year Mortgage Rate forecast at the end of the month 3.05%.

Mortgage Interest Rate forecast for .Maximum interest rate 3.07%, minimum 2.89%. The average for the month 3.00%. The 30 Year Mortgage Rate forecast at the end of the month 2.98%.

30 Year Mortgage Rate forecast for .Maximum interest rate 3.02%, minimum 2.84%. The average for the month 2.94%. The 30 Year Mortgage Rate forecast at the end of the month 2.93%.

Mortgage Interest Rate forecast for .Maximum interest rate 2.98%, minimum 2.80%. The average for the month 2.90%. The 30 Year Mortgage Rate forecast at the end of the month 2.89%.

30 Year Mortgage Rate forecast for .Maximum interest rate 3.10%, minimum 2.89%. The average for the month 2.97%. The 30 Year Mortgage Rate forecast at the end of the month 3.01%.

Mortgage Interest Rate forecast for May 2022.Maximum interest rate 3.25%, minimum 3.01%. The average for the month 3.11%. The 30 Year Mortgage Rate forecast at the end of the month 3.16%.

30 Year Mortgage Rate forecast for .Maximum interest rate 3.37%, minimum 3.16%. The average for the month 3.24%. The 30 Year Mortgage Rate forecast at the end of the month 3.27%.

Mortgage Interest Rate forecast for .Maximum interest rate 3.42%, minimum 3.22%. The average for the month 3.31%. The 30 Year Mortgage Rate forecast at the end of the month 3.32%.

Read Also: Rocket Mortgage Vs Bank

Comparing Different Mortgage Terms

The 30-year fixed-rate mortgage is the most popular loan for homeowners. This mortgage has a number of advantages. Among them:

- Lower monthly payment: Compared to a shorter term, such as 15 years, the 30-year mortgage offers lower payments spread over time.

- Stability: With a 30-year mortgage, you lock in a consistent principal and interest payment. Because of the predictability, you can plan your housing expenses for the long term. Remember: Your monthly housing payment can change if your homeowners insurance and property taxes go up or, less likely, down.

- Buying power: With lower payments, you can qualify for a larger loan amount and a more expensive home.

- Flexibility: Lower monthly payments can free up some of your monthly budget for other goals, like saving for emergencies, retirement, college tuition or home repairs and maintenance.

- Strategic use of debt: Some argue that Americans focus too much on paying down their mortgages rather than adding to their retirement accounts. A 30-year fixed mortgage with a smaller monthly payment can allow you to save more for retirement.

That said, shorter term loans have gained popularity as rates have been historically low. Although they have higher monthly payments compared to 30-year mortgages, there are some big benefits if you can afford the upfront costs. Shorter-term loans can help you achieve:

What Is A Mortgage Rate Lock

A mortgage rate lock allows you to lock in the interest rate your lender quotes you for a certain period of time. This gives you a chance to close on the loan without risking an increase in the mortgage interest rate before you finalize the loan process.

Once you find a rate you like, lock it in as soon as possible because rates can change overnight. If they rise, then you could end up paying more on your mortgage.

If you get a floating rate lock, then you can lock in a lower interest rate if rates fall, but you wont be obligated to pay higher interest rates than you were quoted if they go up.

While 30-day rate locks are typically included in the cost of a mortgage, a floating rate lock could cost extra. Depending on how volatile the rate environment is, you might find that a floating lock is worthwhile.

Also Check: Rocket Mortgage Requirements

Average Mortgage Interest Rate By Credit Score

National rates aren’t the only thing that can sway your mortgage rates personal information like your credit history also can affect the price you’ll pay to borrow.

Your is a number calculated based on your borrowing, credit use, and repayment history, and the score you receive between 300 and 850 acts like a grade point average for how you use credit. You can check your credit score online for free. The higher your score is, the less you’ll pay to borrow money. Generally, 620 is the minimum credit score needed to buy a house, with some exceptions for government-backed loans.

Data from credit scoring company FICO shows that the lower your credit score, the more you’ll pay for credit. Here’s the average interest rate by credit level for a 30-year fixed-rate mortgage of $300,000:

| FICO Score |

According to FICO, only people with credit scores above 660 will truly see interest rates around the national average.

Cardinal Financial Company: Best For Low

Cardinal Financial Company, which also does business as Sebonic Financial, is a national mortgage lender that offers both an in-person and online experience and a wide variety of loan products.

Strengths: Borrowers have a range of options with Cardinal Financial, with the lender able to accept credit scores as low as 620 for a conventional loan, 660 for a jumbo loan, 580 for an FHA or USDA loan and 550 for a VA loan. The lender also offers speedy preapprovals, and some borrowers have been able to close in as little as seven days .

Weaknesses: Cardinal Financials current mortgage rates and fees arent listed publicly on its website, so youll need to consult with a loan officer for specifics pertaining to your situation.

> > Read Bankrate’s full Cardinal Financial Company review

Recommended Reading: Reverse Mortgage Mobile Home

What Are The Average Mortgage Rates Today

Mortgage rates regularly fluctuate, so the average rate today may not be relevant next week, next month, or next year. The best way to get a sense of the current mortgage rate environment is to check the mortgage data maintained by the Federal Reserve Bank of St. Louis. These charts offer daily and weekly snapshots of various mortgage averages, including the average 15-year and 30-year fixed mortgage rates, as well as details on origination fees and discount points.