How Can I Minimize Cmhc Insurance Premiums

For example, on a $500,000 home, here are the insurance premiums for various down payment percentages.

| Down Payment | |

|---|---|

| 20% | $0 |

Using a down payment of 20% or more exempts you from paying CMHC insurance. However, mortgage lenders may require you to get CMHC insurance even if you make a down payment greater than 20%, depending on your financial situation. Lenders can still be responsible for CMHC insurance premiums, but they generally pass it on to you by putting it on the mortgage, and that can increase your monthly payment slightly. That is a reason why the mortgage rate that you can get for a 35% down payment is lower than for a 20% down payment, since lenders need to pay less CMHC mortgage default insurance.

What Is A Down Payment And How Much Will It Cost

*As of July 6, 2020, Rocket Mortgage® is no longer accepting USDA loan applications.

A down payment is one of the largest costs youll face upfront when buying a home.

Understanding what a down payment is, when youll need one and how much to put down will help you get the most out of your mortgage.

Explaining Mortgage Down Payments

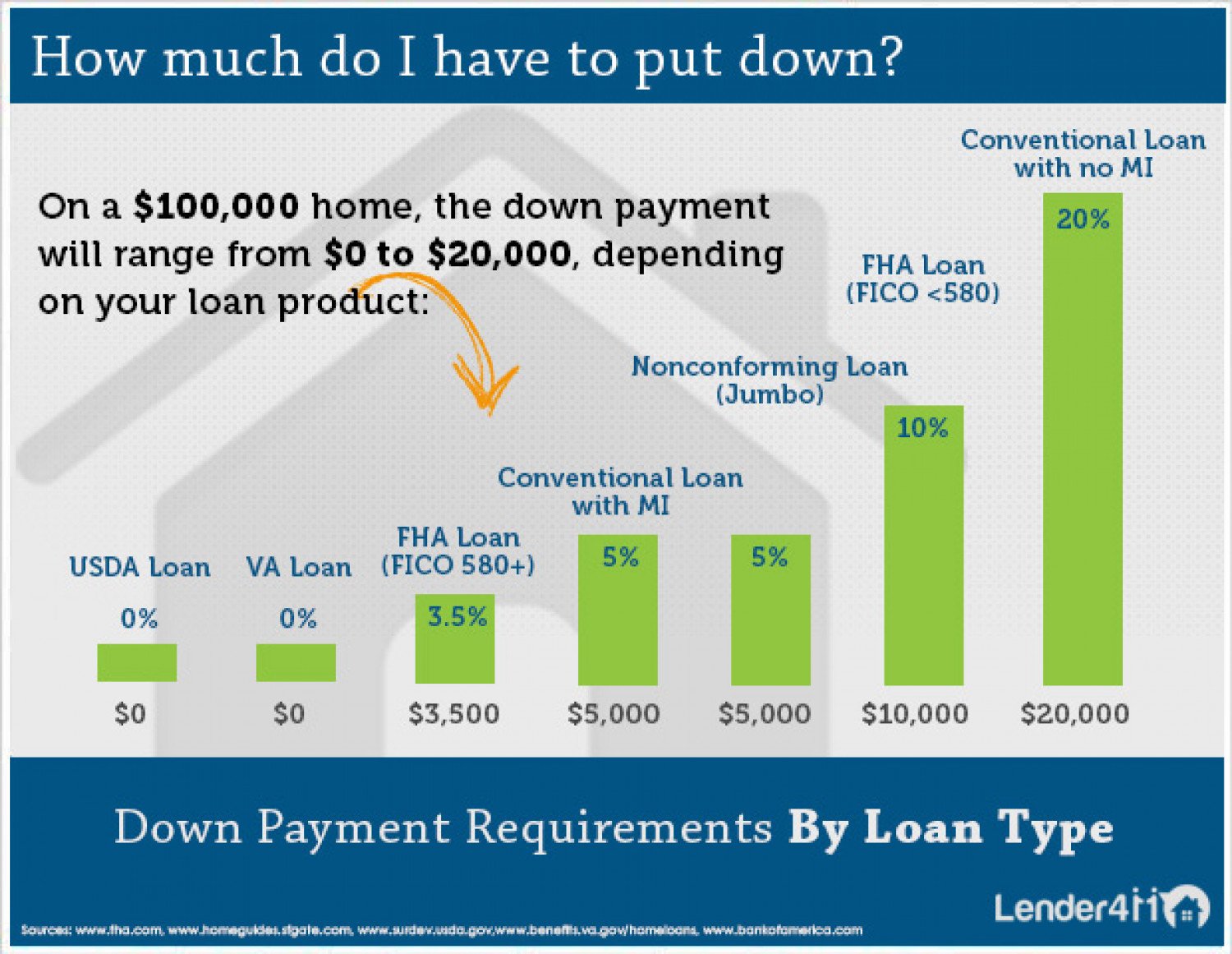

For mortgages provided by banks and credit unions, known as “conventional loans,” government guidelines require a down payment of at least 3% of a home’s purchase cost. For example, for a $250,000 home, you’d be required to pay at least $7,500 in upfront cash. Homes that cost more than the legal conforming limit on mortgages a figure usually around $424,100 are known as “jumbo loans” and come with stricter qualifying requirements, including higher down payments. Government backed FHA loans require down payments of 3.5%, while VA loans for veterans have no down payment requirements.

| Mortgage Type | ||

|---|---|---|

|

||

| FHA Mortgage |

|

|

| VA Mortgage | 0% |

|

Also Check: Who Is Rocket Mortgage Owned By

The Reality Of Down Payments

A recent Freddie Mac survey found that nearly a third of prospective homebuyers think they need a down payment of 20% or more to buy a home. This myth remains one of the largest perceived barriers to achieving homeownership.

What most people don’t realize is that you have choices when it comes to your down payment, even the possibility of putting as little as 3% down through Freddie Mac’s Home Possible® or HomeOne® mortgages.

Ways To Save More For A Down Payment

It can be a challenge to save money for a down payment on a home. Here are some quick tips to get you there:

Read Also: Rocket Mortgage Vs Bank

Alternatives To A Large Down Payment

If a large down payment is beyond your reach, there are alternatives. As mentioned earlier, loans with lower-than-customary down payments are widely available, although they can be more costly over time.

One money-saving tactic if you can’t come up with a large down payment on a home is to borrow as much as you need to but plan to make additional payments toward your mortgage principal as time goes by. That will reduce the amount you owe and also allow you to pay off your mortgage faster if that’s your goal. You may be able to do that, for example, if your income rises over the years. This is often referred to as making accelerated payments or accelerated amortization.

Another money-saving move is to refinance your mortgage when you’re in a financial position to do so and to make a larger down payment on the new loan.

What To Do If Your Mortgage Application Is Denied

If your mortgage application is declined, your plans to buy a home could be thrown off course. Hopefully, it will only be a minor setback and you can quickly resolve the issue and close on the home. But if that doesn’t work, you may need to look for a different type of mortgage, find a new lender or improve your creditworthiness before trying again. Here’s what to know about why your mortgage may have been denied and what steps you can take next.

You May Like: Who Is Rocket Mortgage Owned By

How Much Should I Put Down On A House

There are many factors to consider when deciding how much money to put down on the house. Of course, the type of loan you get will ultimately determine the minimum down payment requirement. Is it better to put a large down payment on a house?

You dont want to use all of your savings, borrow money or dip into other areas of your budget to make the payment. That said, the larger the down payment, the lower your monthly private mortgage insurance bills. If you have the money to make a bigger down payment, it will be up to you to decide if you wish to save money upfront by making a smaller down payment, or save more money over time by making a big down payment.

Different Loans Different Down Payment Requirements

In the U.S., most conventional loans adhere to guidelines and requirements set by Freddie Mac and Fannie Mae, which are two government-sponsored corporations that purchase loans from lenders. Conventional loans normally require a down payment of 20%, but some lenders may go lower, such as 10%, 5%, or 3% at the very least. If the down payment is lower than 20%, borrowers will be asked to purchase Private Mortgage Insurance to protect the mortgage lenders. The PMI is normally paid as a monthly fee added to the mortgage until the balance of the loan falls below 80 or 78% of the home purchase price.

To help low-income buyers in the U.S., the Department of Housing and Urban Development requires all Federal Housing Administration loans to provide insurance to primary residence home-buyers so that they can purchase a home with a down payment as low as 3.5% and for terms as long as 30 years. However, home-buyers must pay an upfront mortgage insurance premium at closing that is worth 1.75% of the loan amount, on top of the down payment. In addition, monthly mortgage insurance payments last for the life of the loan unless refinanced to a conventional loan. For more information about or to do calculations involving FHA loans, please visit the FHA Loan Calculator.

Read Also: Bofa Home Loan Navigator

Does A Bigger Down Payment Really Equal More House

Not exactly. This all depends on whether or not you meet all of the other requirements when applying for a mortgage. For example, if dont have a job, then you wont qualify for a mortgage, even if you have $100,000 saved for a down payment.It helps to decide how much you can afford and save by looking at your debt-to-income ratio . Because lets face it, more than likely you have other expenses every month aside from a mortgage payment, like a car loan, student loan, child support, etc. Start by choosing an amount you prefer not to exceed each month on debts. Then combine all of your current debts and expenses plus your potential mortgage payment. If youre uncomfortable with that amount, you should consider looking for less house, even if you have a lot saved.

How much you put down, with all other criteria met, will affect how much you pay each month on a mortgage for the next 15-30 years.

So, if youre saving up for a down payment, keep in mind that ideally at least 20% down will help you get the house you want and avoid other fees, as long as you meet the other requirements such as income, credit, etc. You can also put less than 20% down, but keep in mind you will have mortgage insurance premiums if you do so, which may still fall into a monthly payment amount that youre comfortable with.Finally, if youre having a difficult time saving for a down payment, speak with a mortgage banker about potential grant and down payment assistance programs.

Down Payment Sources: 4 Things To Provide The Lender

You need to know what your down payment options are because this will help you decide whether to buy now, save more money, or find another source of funds for the down payment.

There are several ways to secure the funds you need. The lender will typically require that the first 5 to 10% of the down payment come from your own resources. Except for borrowing money, all of the options below are considered to be your own resources.

Heres what youll need to provide to show your lender you have the down payment:

Don’t Miss: How Does The 10 Year Treasury Affect Mortgage Rates

Set Aside Some Money To Cover Initial Home Expense

New homeowners often find things that need fixing, or discover that they need an additional piece of furniture to make the new home work for their family. Moving expenses and utility set-up fees can also add up. When thinking about how much you can afford for a down payment, make sure to set aside some money to cover these expenses.

Check Your Credit Before Applying

Your credit scores can have a direct impact on whether you qualify for a mortgage and the rates you receive. You can check your Experian credit report and a FICO® Score for free from Experian. The free score could help you estimate where you’re at and monitor your progress if you’re working to improve your credit. The Experian credit tools also give you personalized insights into what’s impacting your credit score the most.

Recommended Reading: Requirements For Mortgage Approval

Low Down Payment: Conventional Loan 97

The Conventional 97 program is available from Fannie Mae and Freddie Mac. Its a 3% down payment program and, for many home buyers, its a less expensive loan option than an FHA mortgage.

Basic qualification requirements for a Conventional 97 loan include:

- Loan size may not exceed $, even if the home is in a highcost market

- The property must be a singleunit dwelling. No multiunit homes are allowed

- The mortgage must be a fixedrate mortgage. No adjustablerate mortgages are allowed via the Conventional 97

The Conventional 97 program does not enforce a specific minimum credit score beyond those for a typical conventional home loan. The program can be used to refinance a home loan, too.

In addition, the Conventional 97 mortgage allows for the entire 3% down payment to come from gifted funds, so long as the gifter is related by blood or marriage, legal guardianship, domestic partnership, or is a fiance/fiancee.

Low Down Payment Loan Programs

The old standard used to be that homebuyers needed 20% down to buy a home. Times have changed. Many homebuyers, especially first-time buyers, simply dont have a 20% down payment saved. This is becoming increasingly the case as home prices soar in many U.S. housing markets. For example, the median existing-home price in October 2021 was $353,900, a 13.1% increase from $313,000 in October 2020, according to the latest data from the National Association of Realtors.

In fact, homebuyers who financed their home put down an average of 12% of the purchase price, according to NARs 2021 Home Buyers and Sellers Generational Trends Report. First-time buyers using financing typically put down just 7% of the purchase price, the survey found.

For those who cant afford a 20% down payment, several types of mortgages offer a low down payment option.

Don’t Miss: 10 Year Treasury Vs 30 Year Mortgage

What Is A Mortgage Pre

Getting a mortgage pre-approval from a bank means that your lender has examined your financial situation and has offered you a specific mortgage amount. A pre-approval is not a contractual commitment from a bank. However, receiving the preapproval offer reflects positively on your creditworthiness and your financial resources to purchase a home.

Receiving mortgage preapproval can take several days. You apply for a mortgage, and then the bank checks your financial information including your credit. If they preapprove your application, they will send you a letter with the mortgage offer.

You may be asked to give the lender information regarding:

- Recent pay stubs

- Desired mortgage amount

- Recent tax returns

If your mortgage is preapproved, youre poised to make an offer on that lovely house youve been wanting.

How Does A Down Payment Work In Real Estate

When you buy a house with a mortgage, the down payment is the portion of the purchase price that you pay upfront, like a good-faith deposit on the home. The rest of the payment price is covered by your mortgage loan. The larger your down payment, the less you have to borrow from your lender.

For example, if youd like to buy a $200,000 home and are eligible to borrow $180,000 from a mortgage lender, youd make a down payment of $20,000 upfront. Youd then repay the lender the remaining $180,000, with interest, over time.

Read Also: Chase Recast Calculator

Contact Your Loan Officer Or Broker

The lender will send you an adverse action letter with reasons the application was denied, but these aren’t always simple to understand. Reach out to your loan officer or broker, who should be able to explain the details of your letter.

In some cases, the denial could be due to an easily addressable issue, such as a typo, missing form or request for additional information. Quickly clearing these up could save the deal. If there’s a larger issue, your loan officer or broker may be able to explain your options.

Determining Your Down Payment

How much do you need for a down payment, then? Use an affordability calculator to figure out how much you should save before purchasing a home. You can estimate the price of a home by putting in your monthly income, expenses and mortgage interest rate. You can adjust the loan terms to see additional price, loan and down payment estimates.

Here are some steps you can take before determining how much home you can afford and how much you can put down on a house:

Read Also: Can You Do A Reverse Mortgage On A Mobile Home

Is Making Just The Minimum Down Payment For A Mortgage Bad

The amount of your down payment affects what opportunities youll have for your mortgage. With the minimum down payment of 5% for properties under $500,000, you will have a larger mortgage and have to pay aCMHC insurance premiumof up to 4%. While you will have to pay less upfront today, you will have to pay more in interest over the long run compared with making a higher down payment at the same interest rate.

Another disadvantage shows up in themortgage stress testwhere you must show that you can still afford mortgage payments even if the interest rate rises. If you have a larger outstanding mortgage owing, your monthly mortgage payments could be significantly higher. Having less equity in your home also means that it will be more difficult to qualify for a mortgage refinance or products such as ahome equity line of credit, which can haveloan-to-value requirements.

On the other hand, a down payment of 20% or greater gives mortgage lenders more flexibility in case you default on your mortgage or property prices go down. As a result, you can avoid paying for mortgage insurance.

Alternative Down Payment Options

The reason many financial experts recommend putting down 20% is because it means avoiding mortgage insurance, securing a better interest rate, paying less total interest on the loan balance, and paying off the loan sooner. But its not always necessary, according to Green, Valdes, and Arevalo. There are many mortgage products that cater to less traditional homebuyers and those often challenged by the older standards, says Arevalo.

Recommended Reading: Can You Get A Reverse Mortgage On A Manufactured Home

What You Need To Know About Mortgage Down Payments

One of the most important parts of your home purchase is your down payment. Whether you diligently save for a few years, borrow money from family, or use your RRSP, maximizing your down payment will save you money on your mortgage and give you more choice.

Heres everything you need to know about mortgage down payments in Canada, and how the size of your down payment affects your mortgage.