Early Repayment And Extra Payments

In many situations, mortgage borrowers may want to pay off mortgages earlier rather than later, either in whole or in part, for reasons including but not limited to interest savings, wanting to sell their home, or refinancing. Our calculator can factor in monthly, annual, or one-time extra payments. However, borrowers need to understand the advantages and disadvantages of paying ahead on the mortgage.

Early Repayment Strategies

Aside from paying off the mortgage loan entirely, typically, there are three main strategies that can be used to repay a mortgage loan earlier. Borrowers mainly adopt these strategies to save on interest. These methods can be used in combination or individually.

Reasons for early repayment

Making extra payments offers the following advantages:

Drawbacks of early repayment

What Is A Prepayment Penalty

A prepayment penalty is a fee that your mortgage lender may charge if you:

- pay more than the allowed additional amount toward your mortgage

- break your mortgage contract

- transfer your mortgage to another lender before the end of your term

- pay back your entire mortgage before the end of your term, including when you sell your home

Your lender may also call the prepayment penalty a prepayment charge or breakage cost.

Prepayment penalties can cost thousands of dollars. Its important to know when they apply and how your lender calculates them.

If you have an open mortgage, you can make a prepayment or lump-sum payment without paying a penalty.

Loan Deposit And Credit Records

Most borrowers that qualify for financing save substantial funds for deposit. They also have a good credit history showing on-time payments without large outstanding balances. In the fourth quarter of 2020, only 0.37% of mortgages from borrowers with impaired credit history were approved by lenders.

What is Loan-to-value Ratio?

LTV stands for loan-to-value. Its a ratio that compares the size of the loan against the value of the dwelling.

For example, if you saved a £50,000 deposit for a £200,000 home, your loan amount would be £150,000. To calculate the LTV ratio, divide £150,000 by £200,000. In this example, the LTV ratio is 75%.

In the fourth quarter of 2020, a tiny 0.16% of gross advances went to loans with an LTV over 95%. Meanwhile, 1.06% went to loans with an LTV between 90% and 95%. An estimated 38.76% of advances were granted to loans between 75% and 90% LTV, while 60.02% of gross advances went to loans with an LTV below 75%.

Lenders prefer to extend credit to borrowers with relatively low LTV values. If a borrower obtained funding at 100% LTV, any weakness in the local property market could expose the lender to outright potential losses. For this reason, borrowers in the highest LTV quartile may pay 1% APR higher than borrowers in the lower half of the market.

Read Also: Mortgage Rates Based On 10 Year Treasury

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How Long Will It Take Me To Pay Off My Student Loan: Uk

In the UK, student loans are repaid as a percentage of earnings, and only when your annual income is over a certain threshold. So when youre not earning or not earning much you dont need to make any loan repayments.

Of course, interest still accrues over this time, so any downtime where youre not paying off your loan means that there will be more to repay in the long run. However, and this is the critical part, the slate is wiped clean in the end there will never be a knock at the door demanding a huge, snowballed sum of money if youve been making low or no repayments.

Depending on the year in which you took out your loan, it will simply be written off after 25 years, 30 years, or when you turn 65. Phew. For this reason, repaying a student loan in the UK can be considered to work a bit like a graduate tax, applied in a similar way as income tax or national insurance.

You May Like: Rocket Mortgage Conventional Loan

Structural Mortgage Market Shifts: Increasing Loan Duration & Explicit Government Backing

While the stamp duty holiday was widely discussed, the UK also pushed through other structural shifts to the mortgage market in the wake of the COVID-19 crisis.

“In the UK, usually the longest term fixed mortgage you could normally get was five years. Boris Johnson has now. Nobody can pretend that this has anything to do with Covid, and in fact when Johnson announced it, his stated aim was to give young people access onto the housing ladder. This is a good example of how the magic money tree was discovered for Purpose A, i.e. Covid, and is being used for Purpose B, furthering social justice.” – Russell Napier

When governments guarantee loans they lower the risk of making the loans, which in turn increases the flow of capital into the associated market. That typically leads to faster appreciation.

Programs created to “help” people get into the market are initially effective, but after prices adjust to reflect said capital shifts and risk-free profits the market becomes structurally dependent on such programs & the incremental help they offer declines as prices rise.

The property market has been frenzied throughout the first half of 2021 with Rightmove stating the first half of the year has been the busiest since 2000. Average home prices across England, Wales and Scotland rose to £338,447, an increase of £21,389 or 6.7% since the end of 2020.

Bring Your Lunch Into Work

Sure, bringing an egg salad sandwich to work every day isnt as fun as going to a restaurant with your coworkers. But trading lunch out for eating in can make you a lean, mean, mortgage-free machine.

Suppose packing your lunch frees up $100 to use toward your mortgage every month. Based on our example above of the $220,000 loan, that $100 in lunch money will help you pay off your mortgage four years ahead of schedule and save you nearly $27,000 in interest!

Cant quite spare a whole $100 from your food budget? No worries. Even small sacrifices can go a long way to help pay off your mortgage early. Put Andrew Jackson to work for you by adding just $20 to your mortgage payment each month. Based on our example, youll pay your mortgage off a year early, saving over $6,000 in the process.

Read Also: 70000 Mortgage Over 30 Years

Refinance To A Shorter Term

Another option involves refinancing, or taking out a new mortgage to pay off an old loan. For example, a borrower holds a mortgage at a 5% interest rate with $200,000 and 20 years remaining. If this borrower can refinance to a new 20-year loan with the same principal at a 4% interest rate, the monthly payment will drop $107.95 from $1,319.91 to $1,211.96 per month. The total savings in interest will come out to $25,908.20 over the lifetime of the loan.

Borrowers can refinance to a shorter or longer term. Shorter-term loans often include lower interest rates. However, they will usually need to pay closing costs and fees to refinance. Borrowers should run a compressive evaluation to decide if refinancing is financially beneficial. To evaluate refinancing options, visit our Refinance Calculator.

What Are Hoa Fees

Homeowners association fees are common when you buy a condominium or a home thats part of a planned community. Generally, HOA fees are charged monthly or yearly. The fees cover common charges, such as community space upkeep and building maintenance. When youre looking at properties, HOA fees are usually disclosed upfront, so you can see how much the current owners pay per month or per year. HOA fees are an additional ongoing fee to contend with, they dont cover property taxes or homeowners insurance in most cases.

Read Also: Does Prequalifying For A Mortgage Affect Your Credit

Make An Extra Mortgage Payment Every Year

Throw all or a portion of new-found money like a year-end bonus or inheritance at the mortgage. The earlier into the loan you do this, the more of an impact it will have. In a typical 30-year mortgage, about half the total interest you pay will accumulate in the first 10 years of your loan. That is because your interest rate is calculated against the very high principle amount you owe in the early years.

What Is A Prepayment Privilege

A prepayment privilege is the amount you can put toward your mortgage on top of your regular payments, without having to pay a prepayment penalty.

Your prepayment privileges allow you to:

- increase your regular payments by a certain percentage

- make lump-sum payments up to a certain amount or percentage of the original mortgage amount

Prepayment privileges vary from lender to lender.

Check the terms and conditions of your mortgage contract to find out:

- if your lender allows you to make prepayments

- when your lender allows you to make prepayments

- if there’s a minimum or a maximum amount that youre allowed to prepay

- what fees or penalties apply

- if there are other conditions

Most lenders limit the allowed prepayment amount per year. Typically, you cant carry a prepayment amount from one year to the next. This means you usually cant add the amount you didnt use in previous years to the current year.

Also Check: Rocket Mortgage Loan Types

Use A Lump Sum To Pay Off Your Loan Faster

Tax refund, bonus, commission, inheritance, yard sale, gift or lottery win? Whatever it may be, an unexpected windfall can be used to pay off a chunk of the principal in one fell swoop.

So there you have it. Check out our loan payoff calculator to see how overpayments can help you save money in the long run.

What Is A Mortgage Balance

A mortgage balance is the amount owed at a particular moment in time during the mortgage loan term.

Here’s an example:

Mrs. Davis finances a home by taking out a fixed-rate $150,000.00 mortgage at 4% interest with a 30-year term. She has agreed to make payments of $900 per month. At this point in time, the mortgage balance is $150,000.00.

Mrs. Davis pays her mortgage for 10 years, and checks her mortgage balance using the Mortgage Balance Calculator. She knows that she has been paying every month for 10 years, so she enters 120 as the number of payments into the calculator, along with the rest of the required variables. She finds her mortgage balance at this point in time to be $91,100.05.

While Mrs. Davis was able to use the Mortgage Balance Calculator in our example, there are some things to keep in mind . . .

Read Also: Who Is Rocket Mortgage Owned By

Pay Off Your Mortgage On Your Desired Date

To see the amount of prepayment you’ll need, please enter your loan amount, loan term, interest rate and date you made the first payment on your mortgage. Now add the date when you want to start making prepayments and the date you want your mortgage to end, then click “calculate”.

The calculator will show results that include how much additional monthly payment you’ll need, the total monthly payment, how much interest you’ll save and how much time has been trimmed from your original loan term.

How To Pay Off Your House Faster

Understanding amortization can help you get creative with paying off your mortgage early. For example, you could throw extra payments at your mortgage that go toward the principal instead of the interestwhich would also save you thousands of dollars!

To see how this plays out, try our mortgage payoff calculator. Lets use the same example from earlier of the $240,000 mortgage at a 15-year term with a 3.5% interest rate.

After 15 years paying the minimum monthly payment of $1,716, youll have paid nearly $69,000 in total interest. But if you squeeze another $100 out of your monthly budget to make your monthly payment $1,816, youll save more than $5,000 in interest and be debt-free a whole year sooner!

Read Also: Can You Do A Reverse Mortgage On A Condo

Make Extra House Payments

Lets say you have a $220,000, 30-year mortgage with a 4% interest rate. Our mortgage payoff calculator can show you how making an extra house payment every quarter will get your mortgage paid off 11 years early, and save you more than $65,000 in interestcha-ching!

But before you start making extra payments, lets go over some ground rules:

- Check with your mortgage company first. Some companies only accept extra payments at specific times or may charge prepayment penalties.

- Include a note on your extra payment that you want it applied to the principal balancenot to the following months payment.

- Dont shell out your hard-earned cash for a fancy-schmancy mortgage accelerator program. You can accomplish the same goal all by yourself.

What Does Paying Your Mortgage Biweekly Do?

Some mortgage lenders allow you to sign up for biweekly mortgage payments. This means you can make half of your mortgage payment every two weeks. That results in 26 half-payments, which equals 13 full monthly payments each year. Based on our example above, that extra payment can knock four years off the 30-year mortgage and save you over $25,000 in interest.

Are Biweekly Mortgage Payments a Good Idea?

How Much Can You Afford To Borrow

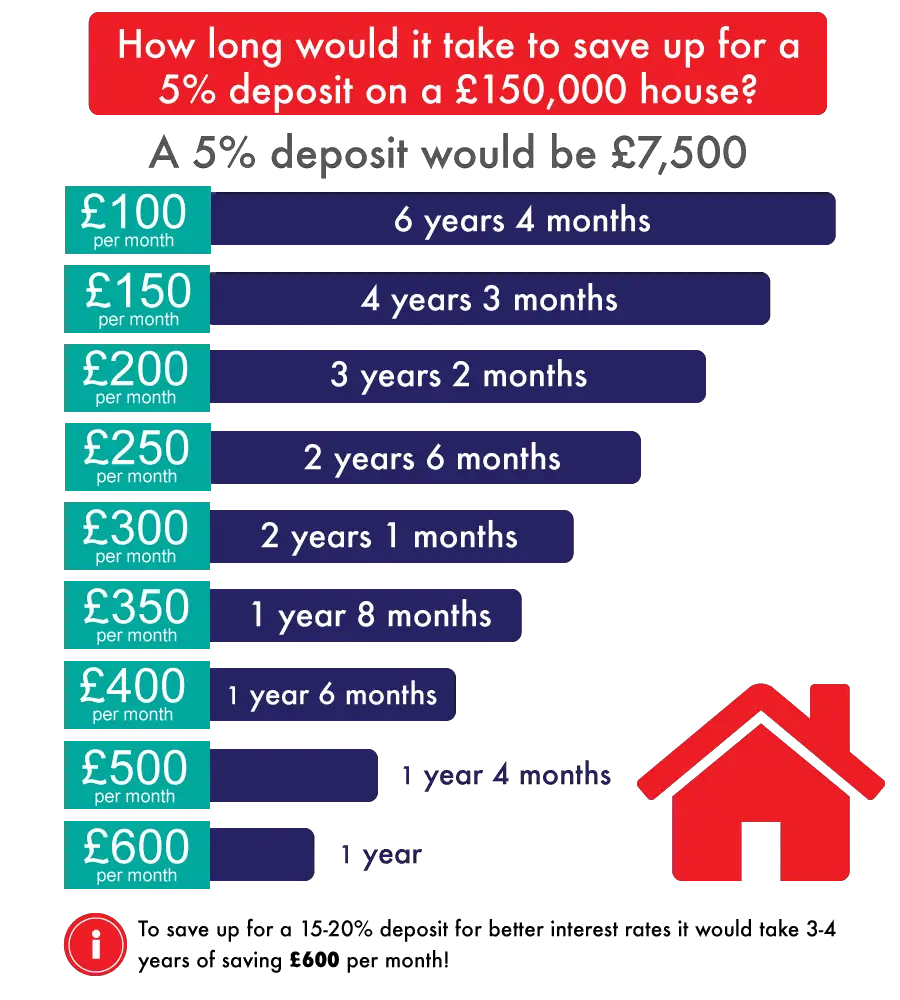

Lenders generally prefer borrowers that offer a significant deposit. They typically request at least 5% deposit based on the value of the property. If a house is valued at £180,000, a lender would expect a £9,000 deposit. In this example, the lender would be willing to offer a loan amount of £171,000. Meanwhile, some lenders may offer first-time buyers a 100% mortgage with a £0 deposit. However, obtaining this sort of deal usually forces a borrower to pay a much higher interest rate on their loan. This is usually one percent higher than a mortgage that requires a deposit. Consider this expensive trade-off before choosing a zero-deposit deal.

If you know the interest rate youll be charged on a loan, you can easily use the above calculator to estimate how much home you can afford. For example, at 2.29% APR on a £180,000 home loan, it will require £788.61 of full repayment per month, or £343.50 per month with an interest-only payment. If your maximum monthly budget for a home payment is £1,000 per month, you would then divide this amount by the above payments to get the equivalent loan capital. The example is shown in the table below.

Default Calculation

| £551,596 £524,016 = £27,580 | £240,272 £228,258 = £12,014 |

If you had £200 in other monthly home ownership related fees, then this might take a renter equivalent of £1,000 down to £800.

You May Like: Can You Do A Reverse Mortgage On A Mobile Home

How To Use The Mortgage Repayment Calculator For Overpayments

Simply enter your details into the overpayment mortgage calculator.

We work out how much interest your mortgage deal is likely to charge over the remaining term if you don’t make any overpayments. We then compare this with the interest you could pay if you make the overpayments entered. Using this information, we can then show you how much you would save in interest by making those overpayments.

We also calculate how long it would take to pay off your mortgage if you overpay. Comparing this to your remaining mortgage term lets us show you how much sooner you could pay off your mortgage balance.If you dream of achieving an early mortgage payoff, this calculator could help you get on the right track.

What The Mortgage Payoff Calculator Tells You

The Summary Results section has two subheadings:

How to reach your goal describes how much you would have to pay in principal and interest every month to meet the payoff goal. It lists the original principal-and-interest payment, and how much you would have to add to the minimum monthly payment to meet your goal.

Loan comparison summary describes the total cost of the mortgage in principal and interest payments, the original monthly principal-and-interest payment, the total cost in principal and interest if you pay it off early, and the new monthly principal-and-interest payment to reach your payoff goal.

“New monthly P& I” and “Original monthly P& I” comprise only the principal and interest portions of your monthly payments. Your full monthly payment will include principal and interest, plus the other monthly costs, such as taxes, homeowners insurance and mortgage insurance .

The early mortgage payoff calculator also lets you enter different numbers into the “In how many years from now do you want to payoff your mortgage?” box to see how those changes affect your total savings.

For more information about how the process of gradually paying off a mortgage works, see this explanation of mortgage amortization.

Recommended Reading: Can You Get A Reverse Mortgage On A Manufactured Home