Mortgage Insurance Vs Life Insurance

Mortgage life insuranceis an optional insurance policy that you can purchase from your mortgage lender that protects your mortgage balance. If you pass away, a death benefit will be paid to your mortgage lender to pay off some or all of the mortgage balance. If you get a critical illness, disability, or lose a job, youll receive a payout that helps cover some or all of your monthly mortgage payments. In all of these cases, your lender is the one that receives the insurance payouts.

With life insurance, youre purchasing a policy with a beneficiary that you get to choose. You can also choose to purchase a policy with a certain payout benefit, rather than having it tied to the balance of your mortgage.

Mortgage life insurance premiums are based on the borrowers age and the balance of their mortgage. Premiums are charged as a certain rate per $1,000 of mortgage balance. Mortgage life insurance in Canada is completely optional. A lender cant force you to purchase mortgage life insurance, no matter your down payment. However, if you make a down payment less than 20%, your lender can require you to purchase mortgage default insurance.

Mortgage life insurance can be easier to obtain, but having a potential insurance benefit that gradually decreases as you make mortgage payments means that the benefit gets smaller while your insurance premiums stay the same.

Why It’s Smart To Follow The 28/36% Rule

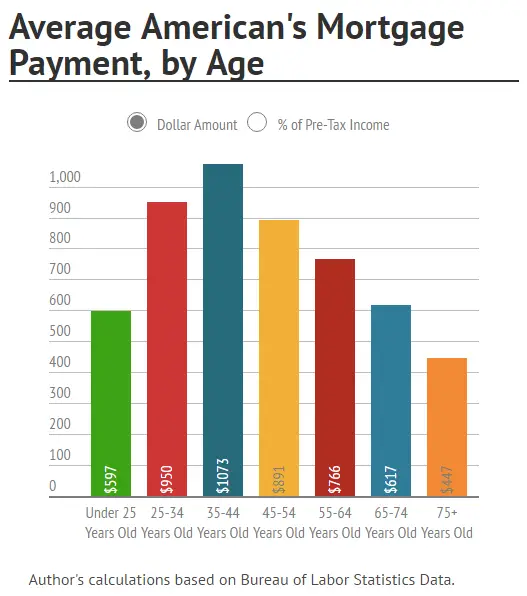

Most financial advisors agree that people should spend no more than 28 percent of their gross monthly income on housing expenses, and no more than 36 percent on total debt. The 28/36 percent rule is a tried-and-true home affordability rule of thumb that establishes a baseline for what you can afford to pay every month.

For example, lets say you earn $4,000 each month. That means your mortgage payment should be a maximum of $1,120 , and your other debts should add up to no more than $1,440 each month . What do you do with whats left? Youll need to determine a budget that allows you to pay for essentials like food and transportation, wants like entertainment and dining out, and savings goals like retirement.

Pmi: The Cost And How To Stop Paying It

MoMo Productions / Getty Images

Buying a house is exciting, but finding out youll have to pay for private mortgage insurance can be a bit of rain on your parade. If youâre making a down payment of less than 20% with a conventional mortgage, your lender will roll a PMI charge into your monthly mortgage payment.

The cost of PMI can vary based on several factors. Lets take a closer look at how much you might pay in PMI, as well as ways to get rid of it entirely.

You May Like: Is A Mortgage Pre Approval A Soft Inquiry

Understanding Your Mortgage Payment

Monthly mortgage payment = Principal + Interest + Escrow Account Payment

Escrow account = Homeowners Insurance + Property Taxes + PMI

The lump sum due each month to your mortgage lender breaks down into several different items. Most homebuyers have an escrow account, which is the account your lender uses to pay your property tax bill and homeowners insurance. That means the bill you receive each month for your mortgage includes not only the principal and interest payment , but also property taxes, home insurance and, in some cases, private mortgage insurance.

What Is Principal And Interest

The principal is the loan amount that you borrowed and the interest is the additional money that you owe to the lender that accrues over time and is a percentage of your initial loan. Fixed-rate mortgages will have the same total principal and interest amount each month, but the actual numbers for each change as you pay off the loan. This is known as amortization. You start by paying a higher percentage of interest than principal. Gradually, youll pay more and more principal and less interest. See the table below for an example of amortization on a $200,000 mortgage.

Recommended Reading: What Is The Difference Between A Bank And Mortgage Broker

How To Get Rid Of Fha Mortgage Insurance

One of the main ways to get rid of FHA MIP is to make at least a 10% down payment at closing. Youll still pay the premiums, but just for 11 years.

Another way to get an FHA MIP removal it is to refinance into a conventional loan however, there are several things youll need to do to prepare for a refi, including:

- Having a credit history thats free from any blemishes that could stop you from qualifying for a refinance

- Improving your credit score to 620 or higher

- Building at least 20% home equity

Still, FHA mortgage insurance may not bother you much if youre a first-time homebuyer. The benefit of making a small down payment and achieving homeownership sooner rather than saving up for a 20% down payment may outweigh the disadvantage of carrying this extra loan cost.

Find The Right Mortgage Broker For Your Next Home Purchase

Ready to start shopping for a mortgage broker but not sure where to look? Weve got you covered.

Head over to the SuperMoney mortgage broker review and comparison page. Youll find a collection of industry-leading brokers who you can easily compare. Read reviews, compare offerings, and cut down on your research time!

Jessica Walrack is a personal finance writer at SuperMoney, The Simple Dollar, Interest.com, Commonbond, Bankrate, NextAdvisor, Guardian, Personalloans.org and many others. She specializes in taking personal finance topics like loans, credit cards, and budgeting, and making them accessible and fun.

Read Also: Can You File Bankruptcy On A Second Mortgage

Whats The Difference Between A Fixed And Variable Rate

- A fixed interest rate is guaranteed to remain unchanged for the length of your mortgage term.

- A variable interest rate can change during your mortgage term. This will not affect your mortgage payment for the duration of the term, but adjusts what percentage of your payment goes to paying off the mortgage principal.

When Is Private Mortgage Insurance Required

Private mortgage insurance protects lenders in case the borrower cant afford their mortgage payments. The lender will probably require that the borrower pay mortgage insurance if they take out a mortgage and put 20% or less down for their down payment. Or, in other words, if the loan-to-value ratio is 80% or higher. Loan-to-value ratio is determined by dividing your mortgage loan amount by the appraised property value of your home.

When a mortgage lender gives you a loan, theyre essentially investing in you. They trust that youll pay back the loan, with interest. A down payment is one way borrowers establish trust with a lender, so when a down payment is 20% or lower, the lender might want some additional insurance to protect their investment.

Its worth noting that private mortgage insurance does not protect you from foreclosure if you fail to make your loan payments.

Also Check: How Much Mortgage Can I Get With 50k Salary

Recommended Reading: How Is Interest Applied To A Mortgage

How A Rise In Interest Rates Could Affect Your Personal Loan Monthly Payments

Suppose you have a personal loan of $10,000 with a variable interest rate and a 2-year term. Your interest rate is 14.99%.

Your loan payment will increase by $24 a month if interest rates rise by 5%. That adds up to $552 more in interest over the 2 years.

Figure 2: Example of monthly payments for a personal loan of $10,000 with a 2-year term at various interest rates

| $559 | $612 |

How To Calculate Pmi

Example 1: Calculating PMI cost with PMI rate

Assuming you want to purchase a home for $100,000 and you can make a $12,000 down payment. You can calculate your PMI amount as follows:

Step 1â Determine your loan-to-value ratio.

LTV = mortgage loan / home purchase priceMortgage loan = $100,000 â $12,000 = $88,000LTV = $88,000 / $100,000 = 0.88LTV = 0.88 * 100 = 88%

It means you have 88% of the home amount left to pay off.

Step 2â Multiply the mortgage loan amount by your specific PMI rate according to the lenders chart. You can look up the PMI rate or ask your lender directly. Lets assume your LTV of 88% tallies a PMI of 1.2 %.

PMI = $88,000 * 1.2/100

You will owe an annual PMI of $1,056.

Step 3â Divide annual PMI by 12 to find the monthly PMI amount.

Monthly PMI = $1,056 / 12

Monthly PMI = $88

Example 2: How Credit score, LTV, and Adjustments can affect PMI cost

Two friends, Clyde and Trent, each wants to buy homes valued at $500,000 and $200,000, respectively. Clyde is purchasing the house as his second home, and he can make a down payment of 5% of the purchase price. While Trent is buying the house as an investment, and he can make a 10% down payment.

- We can assume Trent will get a better deal on PMI rate than Clyde based on his down payments or LTV ratio.

But if Clyde has a FICO credit score of 720 and Trent has a credit score of 630, their PMI can differ significantly depending on how the mortgage insurer prices the policy.

The OMNInsure PMI chart

You May Like: How To Get Mortgage Forgiveness

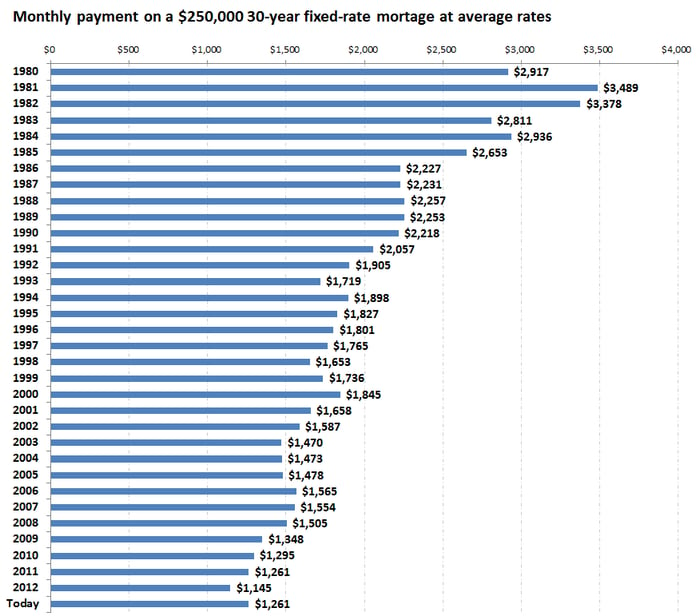

Discount Points Versus Temporary 2

If you utilize discount points, you are pre-paying interest upfront to receive a lower interest rate for the entirety of the mortgage loan. While that sounds like a great option, in todays market conditions, it is nearly impossible to buy your rate down 2% or even 1% in rate. The temporary rate buydown will offer more savings in a shorter amount of time compared to utilizing discount points to buy the rate down permanently.

Is Mortgage Protection Insurance Better Than Term Life Insurance

If you have a mortgage and you dont qualify for traditional life insurance due to health issues, mortgage protection insurance is a good option. Like other no medical exam term life insurance policies, MPI will be more expensive because there is no health exam to determine your insurance risk.

Your MPI policy terminates when your mortgage is paid off. If you pay off your mortgage early or pay it before you die, then youll be left without a death benefit unless you have other life insurance. Is it worth it to have two premiums for separate MPI and term life insurance policies? Probably not, especially if you have a large death benefit from your term life insurance policy that can cover your mortgage and other expenses.

The best life insurance policy for you depends on your budget and financial situation. Its wise to consult an accountant and financial advisor to determine which policy fits your financial needs and goals. Its worth taking the time to find the best policy for you, because once youve signed on the dotted line, its a lot more difficult to make changes if you need to adjust your coverage.

Ronda Lee is an associate editor for insurance at Personal Finance Insider covering life, auto, homeowners, and renters insurance for consumers. She is also a licensed attorney who practiced litigation and insurance defense.

Also Check: Does Prequalifying For A Mortgage Affect Your Credit

Don’t Miss: What Factors Affect Mortgage Interest Rates

How To Get Rid Of Pmi

If you opt for BPMI when you close your loan, you can write to your lender in order to avoid paying it once you reach 20% equity. If youre a Rocket Mortgage® client, you can avoid the process of finding a stamp altogether and just give us a call at 508-0944.

Your letter should be sent to your mortgage servicer and include the reason you believe youre eligible for cancellation. Reasons for cancellation include the following:

- Reaching 20% equity in your home.

- Based on significant improvements to your home. If youve made home improvements that substantially increase the value of your home, you can have mortgage insurance removed. If your loan is owned by Fannie Mae, you must have 25% equity or more. The Freddie Mac requirement is still 20%.

- Based on increases in your home value not related to home improvements. If youre requesting removal of your mortgage insurance based on natural increases in your property value due to market conditions, Fannie Mae and Freddie Mac require you to have 25% equity if the request is made 2 5 years after you close on your loan. After 5 years, you only have to have 20% equity. In any case, youll be paying for BPMI for at least 2 years.

For your request to cancel mortgage insurance to be honored, you have to be current on your mortgage payments and an appraisal has to be done to verify property value.

You May Like: How To Take Out A 2nd Mortgage

How To Calculate Your Mortgage Payment

Mortgage calculators take into account a variety of different factors when determining your monthly mortgage costs. They can include the price of your home, your down payment, your monthly interest rate and the term length of your mortgage. If your math skills are a little rusty, a mortgage calculator does the hard work for you in order to determine your monthly payment and associated costs.

The basic formula for calculating your mortgage costs: P = A/

- P stands for your monthly payment

- A stands for your loan amount

- T stands for the term of your loan in months

- R stands for the monthly interest rate for your loan

For example, lets say that John wants to purchase a house that costs $125,000 and has saved up a $25,000 down payment. His loan amount is $100,000, the term length is 15 years and the monthly interest rate is 4.20%. In this scenario, Johns monthly mortgage payment will be $749.75.

Johns mortgage cost formula will look like: 749.75 = 100,000[4.2^180/[^180-1)

If John wants to purchase the same house with a 30-year term length, the formula works in much the same way. In this scenario, his loan amount is $100,000, term length is 30 years and monthly interest rate is 4.20%. With a 30-year mortgage, Johns monthly mortgage payment will be $489.02.

Johns mortgage cost formula will look like: 489.02 = 100,000[4.2^360/[^180-1)

Read Also: Will Debt Consolidation Affect My Mortgage

Does Where You Live Affect Your Insurance Premiums

Is there a price difference between home insurance in Ontario and home insurance in British Columbia? There most certainly is. Where you live in Canada will have a bearing on your premiums, but its not as simple as looking up rates in your province.

While its true that rates in Ontario are generally higher than rates in B.C., home insurance quotes do get a lot more specific than that. The precise region, city and neighbourhood you live in can affect your premiums. A home in a dense urban area of Toronto, for example, may be seen as more of a risk than a home in the Ontarian countryside, so the insurance rate might be higher. On the other hand, if the house in the country is in an earthquake zone, the home owner may need to pay for additional earthquake coverage.

What Happens If You Skip A Payment

Skipping a mortgage payment doesn’t mean that the lender is giving it to you for free. Skipping a payment just means that you’ll be paying it back later. When you skip a mortgage payment, interest that would have been charged would be added to your mortgage balance instead of being paid off. This increases your mortgage balance, which means that you’ll be paying interest on your added interest.

If you dont repay the skipped mortgage amount plus accumulated interest, then youll be paying interest on the interest for the rest of your mortgages amortization. This could make skipping a mortgage payment a very costly option to take. Fortunately, many lenders allow you to repay your skipped payments without any prepayment penalties.

Also Check: What’s An Affordable Mortgage

What Are The Types Of Mortgages

In addition to there being multiple mortgage terms, there are several common types of mortgages. These include conventional loans and jumbo mortgages, which are issued by private lenders but have more stringent qualifications because they exceed the maximum loan amounts established by the Federal Housing Finance Administration .

Prospective homebuyers also can access mortgages insured by the federal government, including Federal Housing Administration , U.S. Department of Agriculture , U.S. Department of Veterans Affairs and 203 loans. Minimum qualifications for these mortgages vary, but they are all intended for low- to mid-income buyers as well as first-time buyers.

How To Determine How Much House You Can Afford

Your housing budget will be determined partly by the terms of your mortgage, so in addition to doing an accurate calculation of your existing expenses, it’s important to get an accurate picture of your loan terms and shop around to different lenders to find the best offer. Lenders tend to give the lowest rates to borrowers with the highest credit scores, lowest debt and substantial down payments.

Recommended Reading: How Much Is A Fixed Rate Mortgage

Top 5 Cheapest States For Homeowners Insurance

The least expensive states for homeowners insurance are Hawaii, New Jersey, Oregon, Utah, and New Hampshire. The average annual premium in these states is $855 around 45% less than the national average.

| State |

|---|

| $81 |

Your rates may be higher if you need extra coverage

Keep in mind the above rates dont tell the full story, as they dont take into account coverage add-ons or separate policies you may need to purchase for protection against earthquakes, wildfires, hurricanes, or windstorms.

For example, while rates are extremely low in Hawaii, this doesnt factor in the cost of separate hurricane insurance youll be required to purchase if you have a mortgage.

And homeowners in Oregon who live in areas at high risk of wildfires may be denied coverage from a standard home insurance company altogether. In this case, youd be forced to find coverage through a specialty insurer or the Oregon FAIR Plan, which are both typically more expensive.

Recommended Reading: How Do I Know If My Mortgage Is Fha