How To Get Pre Approved For A Mortgage

Most mortgage pre-approvals last between 60 90 days. Your mortgage pre-approval will list how much you are allowed to borrow, your interest rate, and other terms and conditions. Typically, borrowers must wait until they are ready to actively search for a home before they are pre-approved. This will ensure that their pre-approval letter does not expire and they can apply for their future home with confidence. Buying a home is an exciting process. Make sure you take all the necessary steps to start your home buying journey by getting approved with Rocket Mortgage. ¹Participation in the Verified Approval Program is based on a detailed analysis of the writers credit, income, employment status, credit, assets, insurance, ratings and a satisfactory claim/search report. If new information changes the underwriting decision that would result in the rejection of your loan application, if Rocket Mortgage fails to close the loan for reasons beyond its control, or if you do not wish to continue with the loan, your participation in the program will cease. . If your eligibility for the program does not change and the home loan is not paid off, you will receive $1,000. This offer does not apply to new sales loans submitted to Rocket Mortgage through a mortgage broker. Additional terms or exclusions may apply

When Do I Have To Pay Back A Reverse Mortgage Loan

Reverse mortgage loans typically must be repaid either when you move out of the home or when you die. However, the loan may need to be paid back sooner if the home is no longer your principal residence, you fail to pay your property taxes or homeowners insurance, or do not keep the home in good repair.

Most reverse mortgage loans are Home Equity Conversion Mortgages . A HECM must be paid off when the last surviving borrower or Eligible Non-Borrowing Spouse:

- Sells their home, or

- No longer lives in the home as their principal residence, meaning where they live for a majority of the year.

If the you are away for more than 12 consecutive months in a healthcare facility such as a hospital, rehabilitation center, nursing home, or assisted living facility and there is no co-borrower living in the home, anyone living with you will have to move out unless they are able to pay back the loan or qualify as an Eligible Non-Borrowing Spouse.

An Eligible Non-Borrowing Spouse is a term used for your spouse when they are not a co-borrower, but qualify under the U.S. Department of Housing and Urban Developments rules to stay in your home after you have died.

Types Of Reverse Mortgages

As you consider whether a reverse mortgage is right for you, also consider which of the three types of reverse mortgage might best suit your needs.

Single-purpose reverse mortgages are the least expensive option. Theyre offered by some state and local government agencies, as well as non-profit organizations, but theyre not available everywhere. These loans may be used for only one purpose, which the lender specifies. For example, the lender might say the loan may be used only to pay for home repairs, improvements, or property taxes. Most homeowners with low or moderate income can qualify for these loans.

Proprietary reverse mortgages are private loans that are backed by the companies that develop them. If you own a higher-valued home, you may get a bigger loan advance from a proprietary reverse mortgage. So if your home has a higher appraised value and you have a small mortgage, you might qualify for more funds.

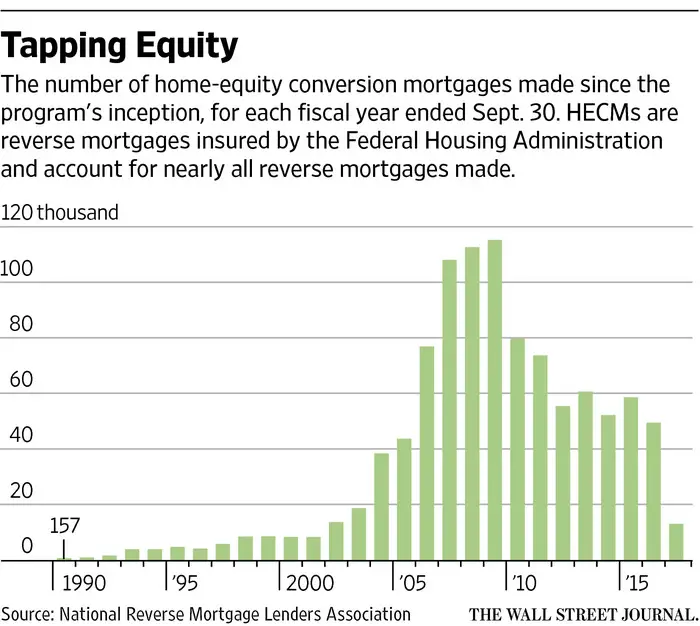

Home Equity Conversion Mortgages are federally-insured reverse mortgages and are backed by the U. S. Department of Housing and Urban Development . HECM loans can be used for any purpose.

HECMs and proprietary reverse mortgages may be more expensive than traditional home loans, and the upfront costs can be high. Thats important to consider, especially if you plan to stay in your home for just a short time or borrow a small amount. How much you can borrow with a HECM or proprietary reverse mortgage depends on several factors:

Recommended Reading: How To Shop For A Mortgage

How Much Will I Get With A Reverse Mortgage

Reverse mortgages can be paid to you:

- All at once in cash

- As a monthly income

- As a credit line that lets you decide how much you want and when

- In any combination of the above

The amount you get usually depends on your age, your home’s value and location, and the cost of the loan. The greatest amounts typically go to the oldest owners living in the most expensive homes getting loans with the lowest costs.

Most people get the most money from the Home Equity Conversion Mortgage , a federally insured program.

I Have A Reverse Mortgage And I No Longer Wish To Live In My Home What Should I Do

Living in the mortgaged property as your primary residence is a condition of any reverse mortgage loan. If you no longer wish to live in your home or doing so is no longer possible, you should speak to your lender/servicer as soon as possible to discuss your options. You should also speak to an attorney or housing counselor. To locate a free housing counselor in your area, please visit the Departments website.

Also Check: How To Prequalify For A Mortgage Loan

Mortgagee Optional Election Assignment

If your lender or servicer decides not to foreclose and instead enters the MOE Assignment process, to qualify as an Eligible Non-Borrowing Spouse, your spouse must:

- Have been married to you at the time the loan documents were signed and remain married to you in situations in which you move into a healthcare facility for more than 12 consecutive months, or remain married up until your death. If you and your spouse were unable to be legally married at the time the reverse mortgage loan was made, your spouse must show that you were legally married to each other at the time of your death.

- Have lived in the home since the beginning of the loan and continue to live in the home as their principal residence ever after you die or move into a healthcare facility for more than 12 consecutive months.

- Provide their Social Security number or Tax Identification Number.

- Agree that they will no longer receive any payments from the reverse mortgage loan.

- Continue to meet all loan obligations, including paying property taxes and homeowners insurance.

Who Pays My Property Insurance And Taxes After I Get A Reverse Mortgage

As the homeowner, you will still be responsible for maintaining your property insurance and taxes. This may be different than a traditional mortgage you have had in the past, for which property insurance and taxes are often included in the monthly payment and are remitted by your servicer. However, based on the results of a financial fitness test, you may be required to have a set-aside account containing proceeds from your reverse mortgage that have been set aside for payment of your property insurance and taxes. If this is the case, you should be notified by your lender and your lender would be responsible for ensuring that timely payments are made toward your property insurance and taxes.

Also Check: What Are Interest Rates On A 15 Year Mortgage

How Do Reverse Mortgages Work

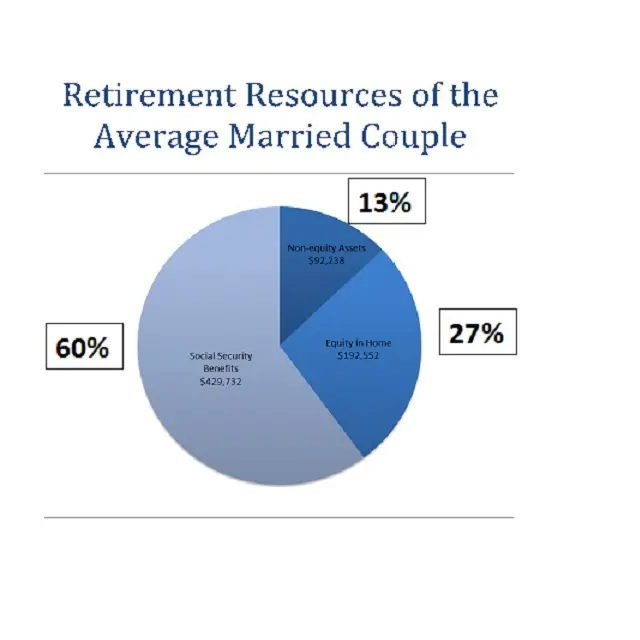

When you have a regular mortgage, you pay the lender every month to buy your home over time. In a reverse mortgage, you get a loan in which the lender pays you. Reverse mortgages take part of the equity in your home and convert it into payments to you a kind of advance payment on your home equity. The money you get usually is tax-free. Generally, you dont have to pay back the money for as long as you live in your home. When you die, sell your home, or move out, you, your spouse, or your estate would repay the loan. Sometimes that means selling the home to get money to repay the loan.

There are three kinds of reverse mortgages: single purpose reverse mortgages offered by some state and local government agencies, as well as non-profits proprietary reverse mortgages private loans and federally-insured reverse mortgages, also known as Home Equity Conversion Mortgages .

What Happens At The End Of A Reverse Mortgage

A reverse mortgage is a home equity loan for 62 or older homeowners. With this, you can borrow against the value of your home and can receive the amount as a lump sum, fixed monthly income, line of credit, or a combination of all.

With a reverse mortgage, instead of you making the payments to the lender, the lender pays you. You can choose how to receive these payments. The interest on payments rolled into the loan balance, therefore, you do not need to pay anything upfront. In addition, you can keep the title of the home as well.

Among many benefits, reverse mortgages offer convenient and easy terms for repayment. As long as you pay property taxes, insurance, and maintenance expenses, you will never be asked for payments on the loan balance during the reverse mortgage time period.So, when will you have to pay back the loan amount, or what happens at the end of a reverse mortgage? Lets discuss this.

Recommended Reading: Is 4.5 A Good Mortgage Rate

If Your Spouse Is Not A Co

Your non-borrowing spouse may stay in the home if they pay off the loan. They may also be able to stay in the home without paying off the loan, depending on when the loan was originated and whether they qualify as an Eligible Non-Borrowing Spouse under HUDs rules. An Eligible Non-Borrowing Spouse will not get any money from the reverse mortgage. The process of qualifying to be an Eligible Non-Borrowing Spouse may be difficult. Your non-borrowing spouse may want to get help from an attorney or a HUD-approved housing counseling agency.

When Does A Reverse Mortgage Loan Become Due

The loan becomes due when the homeowner dies, sells the home, or no longer uses it as a primary residence.

It may also come due should the owner not keep up with property taxes, homeowners insurance, and other maintenance expenses, but these defaults are generally rare.

Most defaults on reverse mortgages in the United States are due to borrowers not paying property taxes or homeowners insurance, or for not performing regular maintenance on the property.

The big problem with this is that in the US, these defaults can result in foreclosure.

Recommended Reading: How Much Does A 400000 Mortgage Cost

How A Reverse Mortgage Loan Works

With a traditional reverse mortgage loan, borrowers can access their home equity without having to pay principal and interest.* Its called a reverse mortgage because, unlike a traditional loan where the borrower makes payments to the lender, the lender makes payments to the borrower. The loan is repaid when the last borrower or eligible non-borrowing spouse passes away or leaves the house.

- The borrower remains the owner of the home and retains title.*

- The amount you can borrow depends on your age, property value, and interest rate. The older you are, the more equity youll have access to.

- The borrower must continue to pay property taxes and homeowners insurance, and must keep the house in good repair.

- As a non-recourse loan, the borrower will never owe more than the house is worth. If the loan balance exceeds the homes value, the Federal Housing Administration will cover the difference.

- There are different types of reverse mortgages and the funds can be disbursed in a number of ways.

Can I Get A Fixed Interest Rate On A Reverse Mortgage

Yes, borrowers can get a fixed rate. However, you will have to choose a lump-sum distribution of proceeds.

About the Author

Gina Pogol writes about mortgages and personal finance for several national publications. Pogol is a licensed Nevada mortgage lender with more than 20 years of experience. Gina is a well-rounded business professional with experience as an estate planning and bankruptcy paralegal, a systems consultant for Experian and a tax accountant with Deloitte. She loves teaching and empowering consumers.

You May Like: How Low Can Mortgage Interest Rates Go

Term Reverse Mortgage Payment Plan

Term payment plans provide equal monthly payments with a predetermined stop date. If the end of your term is up before you pass away, then you have outlived your reverse mortgage proceeds.

With a term payment plan, you reach your loans principal limitthe maximum that you can borrowat the end of the term. After that, you wont be able to receive additional proceeds from your reverse mortgage.

Why Do I Need Reverse Mortgage Counseling

To be considered for a reverse mortgage, HUDs Federal Housing Administration requires that you participate in a counseling session with an approved nonprofit housing counseling agency. At completion of the session, the counselor will issue you a certificate that must be provided to the lender you choose to work with. At MMI, we have counselors certified by HUD who specialize in helping consumers, 62 years of age or older, explore and evaluate this financial tool.

Also Check: How Much Mortgage Might I Qualify For

What Are The Differences Between A 280 280

In New York, there are two types of reverse mortgage loans available to senior borrowers. The first, referred to as a HECM reverse mortgage , is a mortgage loan that is made in accordance with the requirements of the Home Equity Conversion Mortgage program operated by the Federal Housing Administration. HECMs are the only reverse mortgages insured by the Federal Government. The second, referred to as a proprietary reverse mortgage, is a mortgage loan that is made in accordance with the requirements of New Yorks Real Property Law Section 280, or 280-a. Part 79 applies to both proprietary and HECM reverse mortgage loans.

The most important distinction between a HECM and proprietary reverse mortgage concerns the maximum loan amount available under each type of loan. Under the HECM program, the maximum loan amount is capped. Proprietary reverse mortgages, on the other hand, do not have a cap. It is for this reason that they are often referred to as jumbo reverse mortgages.

What Happens & Who’s Responsible For A Reverse Mortgage After Death

Theres a lot to think about following the death of a loved one. Is there a will in place that legally states who in the family receives certain belongings? Does it mention how to go about dividing the profits from a future real estate transaction?

One thing that can really complicate this process is if your loved one had a reverse mortgage on their house. While they hopefully enjoyed years of mortgage-free living thanks to a significant amount of equity in their home, its now up to you to determine the next steps. Yet many heirs in this situation have no idea how to handle a reverse mortgage, let alone the possible implications if they fail to act swiftly.

Lets take a closer look at what heirs can expect when it comes to this type of loan.

Recommended Reading: Where Can I Find My Mortgage Account Number

My Parents Have A Reverse Mortgage What Should I Know

If youâre an heir whose parents have a reverse mortgage, figure out how it will work when they die. Work with them now on a will, repayment and property plan. Then, ensure that the right people are on the reverse mortgage loan documents.

For instance, if only one parent is on the loan because the other wasnât 62 when the reverse mortgage was taken out, make sure the non-borrowing parent is listed as a non-borrowing spouse. That can help them stay in the home without having to immediately repay the mortgage if the borrower dies. The last thing you want is for them to worry about what to do about the reverse mortgage after the death of their partner.

As far as your inheritance goes, think through how youâll handle repaying the loan. That could mean paying it in full, selling, or refinancing to a traditional forward loan.

Really consider whether you want or will be able to keep the home. Do you plan to move into the home after inheriting it? If not, can you afford the payments and upkeep on an inherited home plus your current home?

Thinking about letting go of your parentsâ home, especially if itâs the one you grew up in, can be tough. But itâs important to think through some of these scenarios now so youâre prepared to make decisions when the time comes.

Is A Reverse Mortgage Right For Me

A reverse mortgage is a complex financial product and you should carefully consider whether it is right for you. When considering whether to apply for a reverse mortgage, you should consider, among other things, whether:

- you want to remain in your home

- you are healthy enough to continue living in your home

- other alternatives, such as selling your home and purchasing a smaller, less expensive home, would be better for you

- your children, or other heirs, want to inherit the home

- the loan proceeds will be enough, with any other source of income you have, will be enough to enable you to live in your home

This is not an exclusive list of topics to consider, and everyones situation is unique. It is important for you to weigh whether a reverse mortgage is right for your situation and, you should consult with a legal or financial advisor or a housing counselor to help you assess your options.

A list of New York non-profit housing counseling agencies is available.

Don’t Miss: What Percentage Of Income Can Be Used For Mortgage

Avoiding Reverse Mortgage Scams

With a product as potentially lucrative as a reverse mortgage and a vulnerable population of borrowers who may either have cognitive impairments or be desperately seeking financial salvation, scams abound. Unscrupulous vendors and home improvement contractors have targeted seniors to help them secure reverse mortgages to pay for home improvementsin other words, so they can make bank. The vendor or contractor may or may not actually deliver on promised, quality work they might just steal the homeowners money.

Relatives, caregivers, and financial advisors have also taken advantage of seniors either by using a power of attorney to reverse mortgage the home, then stealing the proceeds, or by convincing them to buy a financial product, such as an annuity or whole life insurance policy, that the senior can only afford by obtaining a reverse mortgage. This transaction is likely to be only in the so-called best interest of the financial advisor, relative, or caregiver. These are just a few of the reverse mortgage scams that can trip up unwitting homeowners.