Check Your Credit Score Too

Its important to note that credit reports dont include your actual . But uncovering this number which can range anywhere between 300 and 800 is much easier than it was even in 2015.

This score might be the single most important number you need to secure a mortgage preapproval. According to a 2013 survey of mortgage originations, nearly two-thirds of mortgages went to borrowers with a score over 720. And not only will your score determine whether you get a mortgage at all, it will also determine what interest rate you can get, which can translate into a huge difference in a monthly mortgage payment.

Most credit card companies offer access to your credit score for free if you have an account with them. There are also a host of third-party services, most of which will provide an unofficial credit score without charging you anything. You can also get your FICO score at myfico.com, for a fee, or from any of the credit three major credit bureaus.

If your score is lower than you or your lender would prefer, the best thing you can do is pay down your debt and keep making any payments on time. Late payments and high credit utilization are the two single biggest drags on a credit score.

The Buyers Credit Score Dropped Below The Minimum

Mortgage pre-approvals are test runs for a buyers actual mortgage approval. So, if the buyers credit score drops before finding a home, the buyers pre-approval may be invalidated.

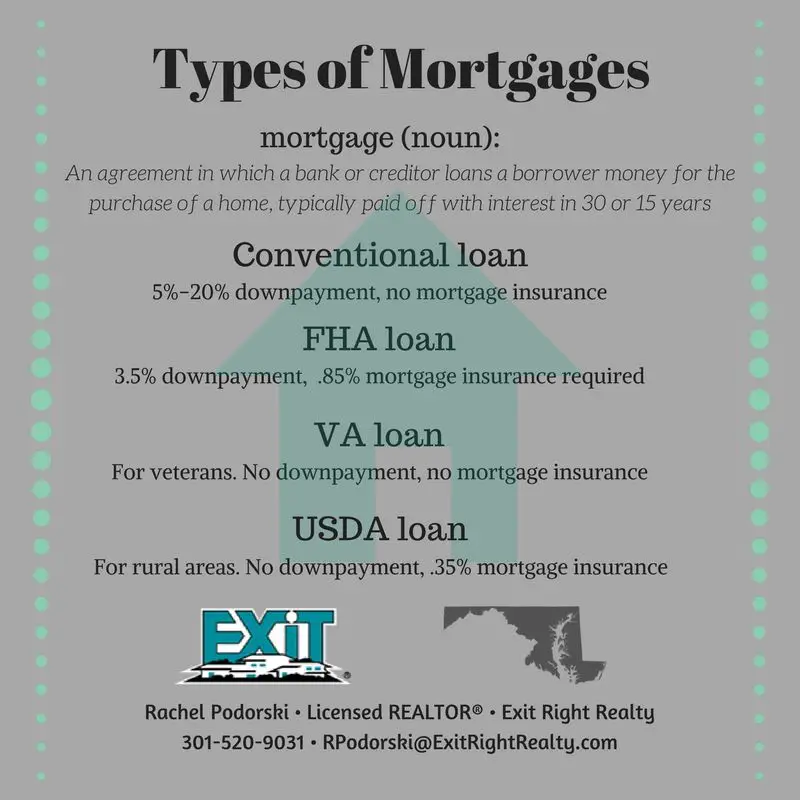

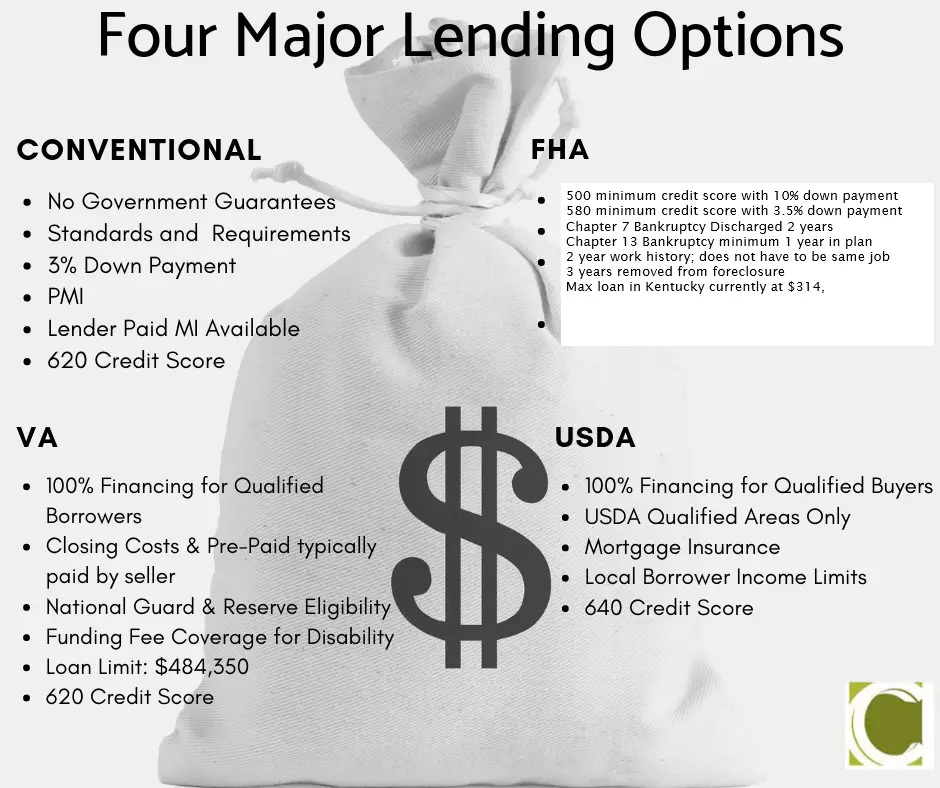

In general, the minimum credit score requirements are:

- FHA: 500 credit score

Learn more about how to fix your credit score to buy a home.

How Do I Get Pre

Once you’ve compared multiple lenders and selected the lender you’d like to work with, you can apply for pre-approval by filling out a loan application. To complete the application, you will likely need to provide several pieces of documentation, including your W-2, bank statements, credit report and tax returns. These documents will help the lender evaluate your financial ability to make payments on time.

Your lender will look at your application and determine how much you may be qualified to borrow based on the 4 Cs: capacity, capital, collateral and credit. If your lender determines you qualify for a loan, they will provide you with the pre-approval letter stating how much they are willing to lend you.

Note that you can and should talk to multiple lenders before committing to a pre-approval amount. Take the time to find the lender that will provide you with the best offer.

You May Like: How To Take A Mortgage Out On Your Home

Why Is It Important To Get Pre

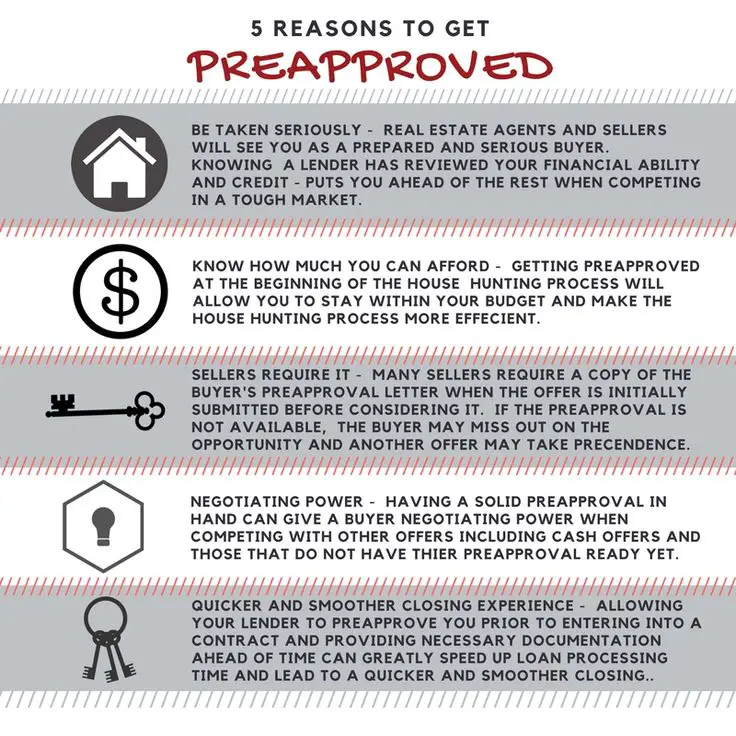

Getting pre-approved for a mortgage gives a home buyer bargaining power since they already have mortgage financing and can therefore make a reasonable offer to the seller of a home in which they are interested. Otherwise, the prospective buyer would have to apply for a mortgage before making an offer and potentially lose the opportunity to bid on a home.

Whats The Difference Between Prequalification And Preapproval

At best, prequalification gets you a feel-good number that you can use to ballpark your house-buying budget. But heres the important part: It doesnt carry any weight with sellers.

A preapproval, on the other hand, can sway a sellers decision when sifting through multiple offers on their house.

A prequalification is a good but optional starting point in the approval process. Its a higher-level look at your finances. An overhead snapshot that uses basic information to figure out a rough estimate of how much house you can afford.

Mortgage preapprovals dig deeper, incorporating a thorough credit check and a full mortgage application. With all your money details, a lender can:

- Review your credit history and credit scores to gauge your creditworthiness.

- Calculate a debt-to-income ratio and loan-to-value ratio. Both are used to determine loan type and interest-rate eligibility.

Also Check: How To Get Out Of Your Mortgage

Does Preapproval Affect Your Credit Score

Getting preapproved for a mortgage has an impact on your credit score. Thats because when lenders check your credit, they perform a hard inquiry, which can drop your score by a few points. The good news is that the effect is small, and gets even smaller as time passes: Hard inquiries come off your report entirely after two years.

If youre planning to get a preapproval from more than one lender, aim to do it within a 45-day window to avoid more damage to your score than necessary. Inquiries within this time frame will be counted as one inquiry, instead of multiple.

Does A Preapproval Letter Expire

Once you have your preapproval letter, you may be wondering how long it lasts. Your income, credit history, interest rate think about all the different ways your finances can change after you get your letter. For this reason, a mortgage preapproval typically lasts for 60 to 90 days.

Once it expires, youll need to connect with your lender again with your updated paperwork and apply for a new preapproval letter. The good news is, this typically doesnt take too much time since they have most of your information on file. But bear in mind that re-applying requires another hard inquiry on your credit rating, and your credit score can be further impacted.

Recommended Reading: How To Apply For Mortgage Assistance

There’s No Need To Choose A Lender Just Yet

Getting preapproved is important because it helps you shop for a home. But at this stage, lenders arent in a position to give you enough information for you to make a decision about which lender offers the best deal. Getting a preapproval doesnt commit you to using that lender for your loan. Wait to decide on a lender until you’ve made an offer on a house and received official Loan Estimates from each of your potential lenders.

When Should You Get Preapproved For A Mortgage

Prospective homebuyers know the importance of “location, location, location,” but timing can be critical too. Securing mortgage preapproval at the right moment in your house-hunting journey can help seal the deal, preserve your credit and spare you unnecessary expenses. Here’s the lowdown on when to seek preapproval.

Don’t Miss: How To Estimate My Mortgage Payment

How Long Does It Take To Get Pre

As long as you have all your documents ready, you should be able to get a mortgage pre-approval on the same day you visit your lender.

However, lots of debt, a history of previous foreclosures, and a low credit score can slow down the process. If any of these apply to you, the pre-approval process can be much longeranywhere from a few days to several monthsdepending on the complexity of your finances.

The only way to speed up the process is to give your lender all the documents listed above. Dont forget anything!

Can You Get Preapproved For A Mortgage Multiple Times

You bet! You can get preapproved for a home loan as often as you need.

Every preapproval letter comes with an expiration date. And, once the preapproval has expired, youll need a fresh one to continue house hunting and making offers.

In todays hot real estate market, where house hunting can take many months, its quite common to need multiple preapprovals. And you should be sure to stay current because youll need a valid letter in hand when you find the home you want.

In this article

Don’t Miss: Can You Prequalify For A Mortgage Without Credit Check

Receive Your Mortgage Preapproval Letter

When you get preapproved, you usually get a preapproval letter. There are a few reasons the preapproval letter is important. First, real estate agents typically want to see your preapproval letter before they show you houses. This ensures they dont waste time showing you homes outside your budget.

Second, the preapproval letter is something you can share with the homes seller when you make an offer. It shows you wont have problems getting financed for the amount youre offering.

What To Provide To Your Lender Or Mortgage Broker

Before preapproving you, a lender or mortgage broker will look at:

Youll need to provide the following:

- proof you can pay for the down payment and closing costs

- information about your other assets, such as a car, cottage or boat

- information about your debts or financial obligations

For proof of employment, you may have to provide:

- a proof of your current salary or hourly pay rate

- your position and length of time with the employer

- notices of assessment from the Canada Revenue Agency for the past 2 years, if youre self-employed

Your lender or mortgage broker may ask you to provide recent financial statements from bank accounts or investments. This will help them determine if you have the down payment.

Your debts or financial obligations may include your monthly payments for:

Recommended Reading: How Many Years Can I Knock Off My Mortgage Calculator

Factors That Impact Your Preapproval

Several variables go into the loan application process, including:

- Income and employment history

MoneyHack

The higher your credit score, the better the loan terms youre likely to get. A score of 740 or above will score you more favorable interest rates.

- Monthly income and combined housing expense information

- Assets and liabilities

- Transaction details and declarations

How Do I Choose A Mortgage Lender For Preapproval

It is best to apply for preapproval at a few different lenders so that you can have more options when it comes to choosing the mortgage loan thats right for you. While that might be a painstaking process, you may find that one lender is willing to offer you a better deal after youve been preapproved than it was before, or you might find that your favored lender requires conditions on your loan that you were not aware of before being preapproved.

You May Like: Is It Possible To Get An Interest Only Mortgage

When Should I Get Pre

Mo, take it away. When should I get pre-approved?

Mujtaba Syed:

Absolutely, Karl.

The best time to get pre-approved for a mortgage is technically when you’re shopping around.

You want to do it ideally before you’re shopping around, so you can get an idea of exactly how much you can afford, what your monthly payments are, what your monthly obligations are.

You want to make sure that it’s comfortable for you that it fits in your monthly budget that you’ve set for yourself.

Definitely you want to be able to do that before the shopping part .

Karl Yeh:

Document Your Income And Assets

Your lender will require documentation to support the info in your loan application. This is what makes getting preapproved different from getting prequalified.

Typically, your lender will require the following documents for mortgage preapproval:

- Identifying documents such as a valid drivers license or photo ID

- Last two years W-2s and/or 1099s

- Last two years tax returns

- Profit & Loss statement if self-employed

- Pay stubs for last 30 days, if applicable

- Statements from bank accounts, retirement accounts, and other asset accounts

- Divorce decree or separation agreement, if applicable

- Contact information for your landlord for the last two years, if youre a first-time home buyer. If you are currently a homeowner, your housing payment history will show up on your credit report

To speed up the preapproval process, it helps to have these documents in hand before you get started.

Some lenders can pull documents directly from your employer and bank, but not all. Some can also verify your income with the IRS, with your consent.

Recommended Reading: What Is The 30 Year Mortgage Rate Now

How Long Does A Mortgage Preapproval Last

Your preapproval letter will state that the preapproval is valid for a limited period of time, such as 60 or 90 days from the date it was written.

The lending terms spelled out in a preapproval document may not be guaranteed sometimes a preapproval application fee includes a rate lock-in that’sguaranteed for the life of the preapproval letter.

Absent that, if prevailing interest rates rise or your income or credit score drops between the preapproval process and when you apply for your mortgage, you may be charged a higher interest rate or offered a lower total loan amount than the one specified in the preapproval letter.

If you decide to finalize a mortgage from the lender that issued your preapproval, you may need to submit updated versions of that information to thelender before the loan can be completed. Whether that’s required depends on the lender’s policies and the amount of time between the preapproval and your acceptance of a loan offer.

Find A Mortgage Company To Pre

Mortgage pre-approvals are available for free through most mortgage websites with no obligation to proceed. Many home buyers get their mortgage from a different mortgage company that pre-approved them. So, dont overthink this step.

The critical part of getting your pre-approval is that you get it. Without a pre-approval, you cannot buy a home.

Also Check: Can I Get A Mortgage Making 30000

What Documents Are Needed For A Mortgage Preapproval

- Pay stubs from at least the past 30 days Your current income is a major consideration in getting preapproved for a loan, so your lender wants to see that you have a reliable, predictable cash flow coming in.

- Federal income tax returns from the last two years These will help verify your employment history and show the lender a longer-term track record of your income.

- Bank statements from at least the past two months Lenders like to make sure all your money is accounted for, so they want to check your bank statements to see that there arent any major unexplained deposits or withdrawals that could affect your loan.

- Investment account statements Returns on your investments can count as income, and lenders need to know about all your sources of money, not just your day job.

- Documentation related to any gift funds youre receiving If a family member or friend is giving you money to help you buy a home, put together a document signed by them explaining the gift and the amount, and that the gift will not need to be repaid.

- ID (such as a drivers license or passport Lenders need to make sure they know who theyre giving their money to, so theyll want to verify your identity and that youre a U.S. citizen. Foreign nationals can get financing, but its much more complicated.

Get Quotes From Different Mortgage Lenders

Just as you want to get the best deal on the house you buy, you also want to get the best deal on your home loan.

Every lender has different guidelines and interest rate options, which can have a big effect on your monthly payments. If you only get preapproved with one lender, youre stuck with what it has to offer. When you get preapproved with multiple lenders, you can choose the offer thats best for you. Many lenders offer the ability to apply for preapproval, including Bank of America,Better Mortgage and Rocket Mortgage.

Its important to do your homework before choosing potential lenders. You should research each lender and even the loan officer who would be handling your mortgage there can be a big difference in knowledge and experience, depending on who processes your application.

After you choose some lenders, youll provide the information needed to complete the preapproval application process. An underwriter may examine your preapproval application to determine how much you can borrow. If an underwriter hasnt reviewed your application, you havent been fully preapproved so be sure to ask about the status of your application during the process.

Once the lender has all the documents it needs, it typically only takes a few days for the lender to let you know whether youre preapproved and how much youve been approved for. But the preapproval process can take longer if you have a past foreclosure, bankruptcy, IRS lien or poor credit.

Don’t Miss: Is It Worth It To Refinance To 15 Year Mortgage

What If Your Financial Situations Changes After Getting Pre

Karl Yeh:

What happens if, after those three or four months, that things change? Maybe not for you, but just situations change, the next step would be you’re just locked into another rate, right? After the next three months? Is that correct?

Mujtaba Syed:

The way it works is that if situations have changed for you even on a personal level, we will reassess it once again, like I said.

Our pre-approval is important because we look at everything. We look at your situation, we look at the market situation, we look at the interest rate situation.

Let’s say from the first time you got pre-approved to the second time, things have changed, we will reassess it at that time and once again talk about what works best for you. You might change your amounts.

You might get pre-approved for more. You might get pre-approved for less.

That’s a very important discussion to have during that process, but it’s nothing to worry about.

If you get pre-approved, we don’t want you to rush and find a house within those three months.

A pre-approval can always be extended. Your situation might’ve changed, but we can always change a situation to kind of meet your needs and have a little bit more of a real discussion with you.

Never feel rushed that you need to buy just because you feel like your pre-approval is expiring.

Karl Yeh:

Understand How Long Preapproval Lasts

Preapproval doesn’t last forever. Check your expiration date and keep it in mind as you look at homes. Though it varies from lender to lender, preapproval is typically valid for 60 90 days. If you haven’t settled on a house, you can request a renewal by giving your lender your most up-to-date financial and credit information.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

You May Like: How Banks Determine Mortgage Loan Amounts