How Much House Can I Afford

While you may have heard of using the 28/36 rule to calculate affordability, the correctDTI ratiothat lenders will use to assess how much house you can afford is 36/43. This ratio says that your monthly mortgage costs should be no more than 36% of your gross monthly income, and your total monthly debt should be no more than 43% of your pre-tax income.

For example, if you make $3,000 a month , you can afford a mortgage with a monthly payment no higher than $1,080 . Your total household expense should not exceed $1,290 a month .

How Much House Can I Afford 50k Salary

A person who makes $50,000 a year might be able to afford a house worth anywhere from $180,000 to nearly $300,000. Thats because salary isnt the only variable that determines your home buying budget. You also have to consider your credit score, current debts, mortgage rates, and many other factors.

then How much income do you need to buy a $450 000 house? Assuming the best-case scenario you have no debt, a good credit score, $90,000 to put down and youre able to secure a low 3.12% interest rate your monthly payment for a $450,000 home would be $1,903. That means your annual salary would need to be $70,000 before taxes.

How much do I need to make to afford a 450k house? You need to make $138,431 a year to afford a 450k mortgage. We base the income you need on a 450k mortgage on a payment that is 24% of your monthly income. In your case, your monthly income should be about $11,536. The monthly payment on a 450k mortgage is $2,769.

Heres How You Can Buy A House With A $50k Salary

Its definitely possible to buy a house on a $50K salary. For many borrowers, low-down-payment loans and down payment assistance programs are putting homeownership within reach.

But everyones budget is different. Even people who make the same annual salary can have different price ranges when they shop for a new home.

Thats because your budget doesnt just depend on your annual salary, but also on your mortgage rate, down payment, loan term, and more. Heres how to find out what you can afford.

In this article

> Related:How to buy a house with $0 down: First-time home buyer

Read Also: Can I Get A Mortgage At Age 70

How To Find Your Maximum Loan Amount

Use our mortgage calculator to estimate how much you can borrow, just as we did earlier. But dont miss the three tabs near the top of the page:

Income Isnt The Only Factor For Mortgage Qualifying

Of course, mortgage lenders take your income into account when deciding how much they are prepared to lend you. But income is only one factor in a long list that lenders look at to approve your home loan amount.

Other important factors for mortgage qualifying include:

You dont need to be perfect in all these areas to get a home loan. But improving one area of your finances can often help make up for a weaker area .

Read Also: What Type Of Mortgage For Rental Property

Borrow Up To 6 Times Your Salary If You Have No Other Debt

Take a look at two borrowers, whose profiles are identical except for their debt-to-income ratios.

| $668,000 | $445,000 |

*Home buying budgets estimated using The Mortgage Reportsmortgage calculator. Your own rate and budget will vary

In this scenario, Borrower One has been admirably prudent and has no ongoing debt.

Borrower Two, on the other hand, has a car payment and personal loan payment totaling $1,000 per month. This drastically affects how much they can borrow for a mortgage.

Note, both loans aim for a 36% DTI, which is typical for a conventional mortgage. However, many popular loans with a max DTI of 43% to 45%.

Its even possible to buy a home with a DTI of close to 50%. But many mainstream lenders wont approve such loans.

And remember, the higher your DTI, the higher your mortgage rate.

So its in your best interest to keep debts low and even pay some off if possible when youre shopping for a mortgage.

How Much Mortgage Payment Can I Afford

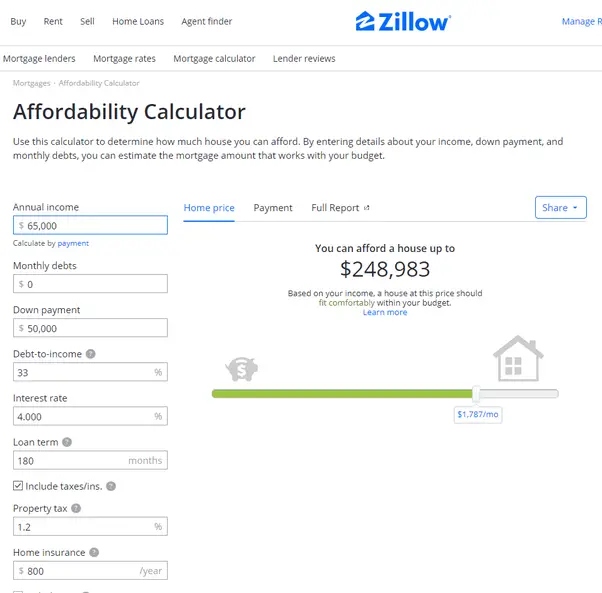

To calculate how much house you can afford, we take into account a few primary items, such as your household income, monthly debts and the amount of available savings for a down payment. As a home buyer, youll want to have a certain level of comfort in understanding your monthly mortgage payments.

While your household income and regular monthly debts may be relatively stable, unexpected expenses and unplanned spending can impact your savings.

A good affordability rule of thumb is to have three months of payments, including your housing payment and other monthly debts, in reserve. This will allow you to cover your mortgage payment in case of some unexpected event.

Recommended Reading: How Much Mortgage Protection Insurance Cost

Also Check: How To Check Daily Mortgage Interest Rates

I Dont Know What To Enter For Property Taxes Or Homeowners Insurance

You can leave these and most other boxes blank if you dont know what those costs might be, and the Mortgage Qualifying Calculator will generate an answer without them. The same for the inputs under Down Payment and Closing Costs, and Total Monthly Debt Payments. But your results will be more accurate and useful if you can provide these figures.

Also Check: Can You Get A Mortgage On A Foreclosed Home

Percentage Of Income Toward Monthly Payment

While the 28% rule is a good starting guideline, there are other factors to think about. Lenders are legally obligated to learn about your assets, expenses and credit history before offering you a mortgage. How reliable your income is can also matter. If much of your earnings come from a source that varies from month to month, like commissions, a lender might not be willing to lend as much to you as it would to someone who earns a consistent salary.

Consider what you can comfortably afford to spend on a monthly basis without affecting other financial goals, such as saving for an emergency fund or investing toward retirement.

Don’t Miss: Who Should I Get Mortgage Pre Approval From

Exploring The Interest Rate

Having chosen a mortgage term, the lender checks your credit report. Most lenders require borrowers to have to have a credit score in excess of 620, but you can get a Federal Housing Administration insured loan if you have a credit score of 580 or higher. However, in the eyes of lenders, low credit scores equate to higher default risk, while people with high credit scores are more likely to make their mortgage payments on time. The interest rate you pay, in conjunction with your mortgage term, determines your proposed monthly payment amount.

Shop Around For Your Mortgage

Yes, you can get a better mortgage rate when you choose the right type of mortgage. But you could save at least as much sometimes more simply by comparison shopping for your mortgage.

Federal regulator the Consumer Financial Protection Bureau has studied the potential savings:

Mortgage interest rates and loan terms can vary considerably across lenders. Despite this fact, many homebuyers do not comparison shop for their mortgages, said the CFPB.

Research suggests that comparison shopping for a mortgage loan saves the average buyer about $300 per year and many thousands over the life of the loan.

In recent studies, more than 30 percent of borrowers reported not comparison shopping for their mortgage, and more than 75 percent of borrowers reported applying for a mortgage with only one lender.

Previous Bureau research suggests that failing to comparison shop for a mortgage costs the average homebuyer approximately $300 per year and many thousands of dollars over the life of the loan.

Thanks to the internet, comparison shopping doesnt take all that long. You can begin with The Mortgage Reports Find the Best Lender for You” service.

But also check with your bank or credit union and follow up on any recommendations you get from friends and family. Remember, the more quotes you receive from different lenders, the more likely you are to find your lowest possible rate.

Don’t Miss: When To Get A Reverse Mortgage

How To Get Your Finances Ready To Buy A House

Take stock of your finances to see if youre ready to apply for a mortgage. Make sure that you can provide evidence of at least two years worth of regular income, and figure out your total assets, debt and monthly expenses.

Check your credit reports. If you want to apply for new credit cards or other loans, keep in mind that these applications may add inquiries to your credit history and could lower your scores. Plan to apply for other types of credit well in advance of applying for a mortgage or wait until after youve closed on your home loan.Home affordability calculator

Ask lenders what information they need from you to issue a mortgage preapproval letter, and confirm that you have the documents on hand.

Income Requirements To Buy A Home

Your income is a baseline that defines how much monthly installment you can afford to pay every month. Buying a home is not as easy as it might seem to you. Keep in mind that mortgage Lenders have to look at various other parameters than only your paycheck or down payment. Theyll check whether or not youre capable of paying the monthly installments. For example:

- The first and most important factor is your debt-to-income ratio.

- How much do you earn on an annual basis?

- Size of your down payment.

- Your Credit Score.

Not sure whether you can get a mortgage on your present income? The basic step is to get pre-approved for the mortgage.

You May Like: How To Get A Mortgage After Chapter 7

Factors That Impact Affordability

When it comes to calculating affordability, your income, debts and down payment are primary factors. How much house you can afford is also dependent on the interest rate you get, because alower interest ratecould significantly lower your monthly mortgage payment. While your personal savings goals or spending habits can impact your affordability,getting pre-qualified for a home loancan help you determine a sensible housing budget.

Can You Borrow With Your Current Income

Though you may feel that your finances are ready for a new home, the bank may not feel the same way. Mortgage lenders use a complex set of criteria to determine whether you qualify for a home loan and how much you qualify for, including your income, the price of the home, and your other debts.

The pre-qualification process can provide you with a pretty good idea of how much home lenders think you can afford given your current salary, but you can also come up with some figures on your own by learning the criteria that lenders use to evaluate you.

Also Check: How Long Are Condo Mortgages

How Do You Apply For A Mortgage

Mortgages are available through traditional banks and credit unions as well as a number of online lenders. To apply for a mortgage, start by reviewing your credit profile and improving your credit score so youll qualify for a lower interest rate. Then, calculate how much home you can afford, including how much of a down payment you can make.

That Makes Sense I Think My Credit Score Is In Good Shape Thankfully Is There Anything Else That Happens Before I Get The Mortgage

As far as the lenders work goes, not really. When determining the answer to How much mortgage can I afford?, the lender can tell you what theyre willing to give you, but it is very important that you take stock of your current situation and assess your future before committing to a loan. In other words, were back to the question of what size debt are you comfortable taking on.

Dont Miss: Why Are Mortgage Rates Lower Than Prime

Also Check: How Do You Know If You Can Get A Mortgage

How Much Can I Afford To Spend On A House

The home affordability calculator will provide you with an appropriate price range based on your situation. Most importantly, it takes into account all of your monthly obligations to determine if a home is comfortably within financial reach.

However, when banks evaluate your affordability, they take into account only your present outstanding debts. They do not take into consideration if you want to set aside $250 every month for your retirement or if youre expecting a baby and want to save additional funds.

NerdWallets Home Affordability Calculator helps you easily understand how taking on a mortgage debt will affect your expenses and savings.

Estimating How Much House You Can Afford

How much house you can afford depends on several factors, including your monthly income, existing debt service and how much you have saved for a down payment. When determining whether to approve you for a certain mortgage amount, lenders pay close attention to your debt-to-income ratio .

Your DTI compares your total monthly debt payments to your monthly pre-tax income. In general, you shouldnt pay more than 28% of your income to a house payment, though you may be approved with a higher percentage.

Keep in mind, however, that just because you can afford a house on paper doesnt mean your budget can actually handle the payments. Beyond the factors your bank considers when pre-approving you for a mortgage amount, consider how much money youll have on-hand after you make the down payment. Its best to have at least three months of payments in savings in case you experience financial hardship.

Along with calculating how much you expect to pay in maintenance and other house-related expenses each month, you should also consider your other financial goals. For example, if youre planning to retire early, determine how much money you need to save or invest each month and then calculate how much youll have leftover to dedicate to a mortgage payment.

Ultimately, the house you can afford depends on what youre comfortable withjust because a bank pre-approves you for a mortgage doesnt mean you should maximize your borrowing power.

Recommended Reading: Do Credit Unions Offer Reverse Mortgages

Additional Costs You Need To Pay When Buying A House:

While buying a house, monthly installments and down payment are not the only expenses, there are other costs also you need to know about including the closing costs.

Once the loan is approved, lenders charge an extra service fee for providing the services. Below are some of the closing costs you need to pay on finalizing the loan.

How To Use Credit Karmas Home Affordability Calculator

If youre planning to buy a house, youll need to get a sense of how much home you can afford.

Our home affordability calculator could help you estimate how much you can afford to pay for a home as well as your estimated monthly mortgage payment and closing costs. This calculator provides an estimate based on the information you provide. It doesnt consider other costs associated with home ownership, such as maintenance and utilities.

Keep in mind that home price isnt the only factor that affects affordability. The interest rate on your home loan, your down payment and your loan term can all affect how much you end up paying for your home.

Our home affordability calculator considers the following factors:

Also Check: How To Borrow Money From Your Mortgage

Cfpb Shifting From Dti Ratio To Loan Pricing

Both Fannie Mae and Freddie Mac have allowed higher DTI ratios for buyers carrying significant student debt.

While measuring debt-to-income is useful for getting a baseline feel for what you may qualify for, the CFPB proposed shifting mortgage qualification away from DTI to using a pricing based approach.

What Change did the CFPB Propose?

“the Bureau proposes to amend the General QM definition in Regulation Z to replace the DTI limit with a price-based approach.”

Why Did They Suggest the Change?

“The Bureau is proposing a price-based approach because it preliminarily concludes that a loans price, as measured by comparing a loans annual percentage rate to the average prime offer rate for a comparable transaction, is a strong indicator and more holistic and flexible measure of a consumers ability to repay than DTI alone.”

How Does This Impact Loan Qualification for Low-income Buyers?

“For eligibility for QM status under the General QM definition, the Bureau is proposing a price threshold for most loans as well as higher price thresholds for smaller loans, which is particularly important for manufactured housing and for minority consumers.”