Make Biweekly Mortgage Payments

While you can choose to pay any amount over your minimum mortgage payment each month, you can also opt for biweekly mortgage payments instead of paying monthly. With biweekly payments, youll wind up making 26 half-payments toward your mortgage over the course of a year, versus the 12 full payments you would normally make which is the equivalent of only 24 half-payments.

Since a calendar year is technically made up of 52 weeks and not 48 weeks, you end up making two extra half-payments each year using this strategy. Thats equivalent to one full extra mortgage payment each year, which can help you reduce interest payments and own your home faster.

Based on this example, an extra mortgage payment would ultimately save you $21,418 in mortgage interest and shave three years and six months off your mortgage repayment timeline.

Just make sure you do not pay a fee to your mortgage company in order to make biweekly payments. If your mortgage servicer doesnt offer this option, you can roughly accomplish the same goal by mailing in one extra mortgage payment each year, or by taking the principal and interest of your mortgage payment, dividing it by 12, and adding that amount to your monthly payment.

So, in the example above, you would divide $1,264 by 12, which equals $105, and add that amount as an overage toward your principal balance each month. Its not exactly the same result as making biweekly payments, but its very similar.

Current Mortgage Refinance Rates

Refinancing became a bit more expensive today as 30-year fixed and 15-year fixed refinance mortgages saw their mean rates trend upward. If youve been considering a 10-year refinance loan, just know average rates also made gains.

The refinance averages for 30-year, 15-year, and 10-year loans are:

Find current mortgage rates for today.

Extend Your Loan Term

Another option is to refinance and extend your term, which is the amount of time you have to pay off your loan. The advantage here is that you will lower your monthly payment and provide additional monthly cash flow.

Lets assume you have a current loan balance of $250,000, at a 3.25% interest rate, with 18 years remaining on your loan. Your current monthly payment is approximately $1,532, says Derks.

By refinancing to a new term of 30 years, still at a 3.25% interest rate, your new monthly payment would be approximately $1,088, providing extra monthly cash flow of about $442.

This strategy can work even if you already have a low interest rate. Just note, you could end up paying more in total interest. But if your main goal is a lower monthly mortgage payment, that might not matter.

Recommended Reading: How Much Mortgage Can I Afford Florida

Make An Extra Mortgage Payment Every Year

Throw all or a portion of new-found money like a year-end bonus or inheritance at the mortgage. The earlier into the loan you do this, the more of an impact it will have. In a typical 30-year mortgage, about half the total interest you pay will accumulate in the first 10 years of your loan. That is because your interest rate is calculated against the very high principal amount you owe in the early years.

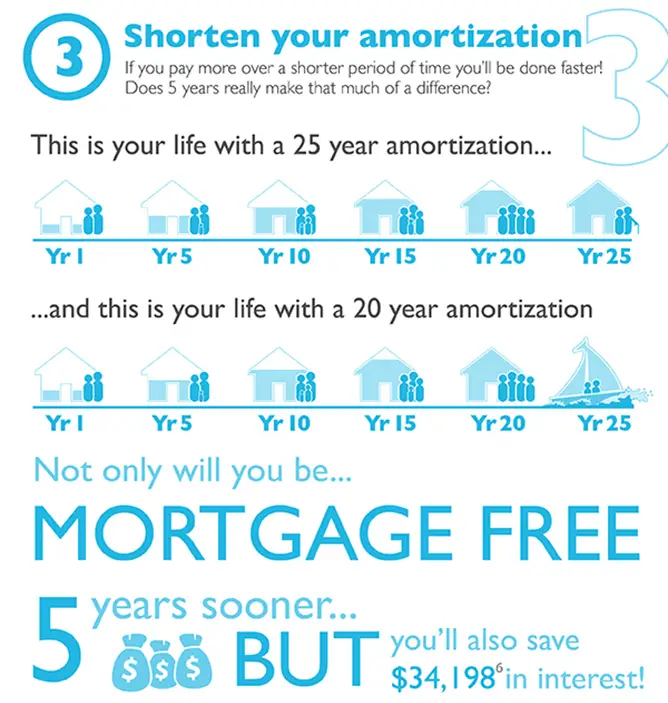

Shorten Your Amortization Period:

You can also use the time to renew as an opportunity to shorten your amortization period without paying a prepayment charge. Remember, your amortization period is the time it takes to pay off your mortgage completely at the same interest rates and payment. The shorter the amortization, the quicker youll pay off your mortgage.

Keep in mind, a shorter amortization often means a higher regular payment amount. For instance, if your mortgage is $500,000 and your interest rate is 2.14%, your payment would change based on your amortization length:

| Amortization period |

|---|

You May Like: How Much Per Thousand On A Mortgage

Can You Quickly Sell Your Home Today

Depending on how you define fast. Is it as quick as using the Uber app or booking an Airbnb holiday rental? Oh, no. Can you obtain a mortgage to purchase a new home on a website like Lending Tree as quickly as you can sell your current one? By any standard, you cannot sell your house that quickly unless you want to offer it for pennies. You have a lot of hurdles and hoops to leap through today. Red tape flows on and on, commissions, agents likewise ongoing expenses.

Real estate has changed slowly compared to other industries like transportation, business, and entertainment. There are several legal nuances and difficulties. There are, indeed, faster ways to sell your house. They entail visiting companies that we refer to as iBuyers. i.e., they purchase the asset themselves. OpenDoor, OfferPad, and even Zillow have all entered the competition. But does it allow you to sell it directly for top dollar? Definitely not.

Make More Frequent Payments

It could be one extra mortgage payment a year, two extra mortgage payments a year, or an extra payment every few months. Whatever the frequency, your future self will thank you. Maintain these additional payments over an extended period of time and you’ll likely eliminate several years from your term.

A quick note here: there is no best day of the month to pay your mortgage. Both the principal and interest amounts decrease over time, whether you make payments on the 1st, 15th, or a date in between.

You May Like: How Much Does An Average Mortgage Cost

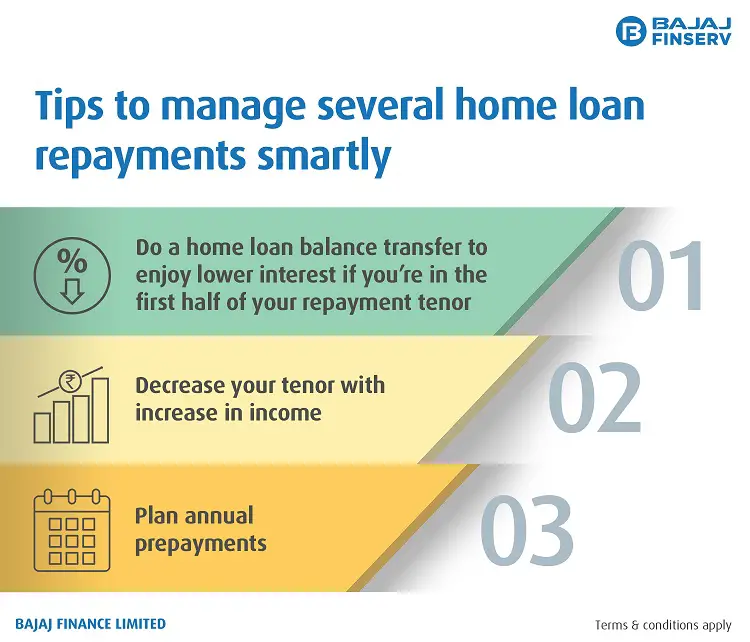

Refinance To A Shorter Loan

Has your income increased? If so, you may want to consider refinancing to a shorter term. Refinancing your mortgage allows you to save money on interest without worrying about penalties or scheduling extra payments. It also allows you to fully own your home much faster.

Keep in mind that refinancing your mortgage to a shorter term will increase your monthly payments. Do the math and make sure you can cover the extra financial burden before you make that move.

Consolidate debt with a cash-out refinance.

Your home equity could help you save money.

How To Pay Off A 30

There are a few ways to pay off a mortgage sooner than the 30-year term.

Options to pay off your mortgage faster include:

- Pay extra each month

- Pay off other debts

There are advantages to each approach. The choice comes down to careful study and a decision based on your financial position and ability to repay what will be higher monthly payments.

Also Check: What Is Mortgage Insurance Vs Homeowners Insurance

Increase Your Mortgage Payment

Increase the size of your regular mortgage payment to take a large chunk off your mortgage principal. Choose a higher payment amount when you arrange your mortgage, or at any time during the term. This lets you pay down the principal faster.

Example: If you increase your monthly mortgage payment amount by $170 from $830 to $1,000, you’ll save almost $48,000 in interest over the amortization period. And you’ll own your home about 8 years sooner.1

Americans Have Fallen Behind On Their Credit Card Payments Amid High Inflation

Amidst high inflation, Americans are struggling to pay off their credit card debt.

Credit card debt burdens about 46% of Americans and the average person has an outstanding balance of $6,093, according to a survey by the real estate data company, Clever.

The survey also said that credit card debt disproportionally affects older Americans. Baby boomers hold 157% more credit card debt than Gen Zers and 33% more than millennials. Baby boomers also owe $8,208 on average in credit card debt, while millennials owe an average of $6,182 and Gen Zers carry an average balance of $3,196.

In September, the Federal Reserve hiked interest rates for the fifth time this year by 0.75 percentage points. And it’s expected to continue raising rates to combat inflation into next year, which could increase the interest rate on your credit cards.

If youre struggling with high-interest debt, a personal loan could help you pay it off at a lower interest rate and reduce your monthly payments. You can visit Credible to compare personal loan rates from multiple lenders at once without affecting your credit score.

Also Check: How Much Does Your Credit Score Affect Your Mortgage Rate

Extend Your Mortgage Term

Stretching out your mortgage payments over a longer term will lower your payment, but youll owe more interest over that longer term.

One way to extend your term is to refinance with a new 30-year loan. Another way is to contact your lender and ask for a loan modification.

To be approved, youll typically need to show you suffered a hardship that impacts your ability to make your payment. Examples include divorce, job loss, illness, disability or the death of a family member.

Take Advantage Of Lower Interest Rates:

If you renew into a lower interest rate, instead of paying less each month, consider keeping your regular payments the same as before you renewed. This is similar to increasing your payment amount. Youll be putting more toward your principal each month and chipping away at your mortgage balance faster.

Also Check: What’s The Difference Between A Mortgage And A Loan

Key Questions To Ask Before You Pay Off Your Mortgage

Before you decide to pay off your mortgage early, ask yourself these questions:

If you can answer yes to all three, paying your mortgage off early may be a good financial move. Just keep in mind that some lenders charge a prepayment penalty if yours does, be sure to factor in that cost, too.

Hit The Principal Early

âOver the first few years of your mortgage, it may seem that you are only paying interest and the principal isnt reducing at all,â says Nila Sweeney, managing editor or Property Market Insider. âUnfortunately, youre probably right, as this is one of the unfortunate effects of compound interest. So you need to try everything you can to get some of the principal repaid early and youll notice the difference.â

âEvery dollar you put into your mortgage above your repayment amount attacks the capital, which means down the track youll be paying interest on a smaller amount. Extra lump sums or regular additional repayments will help you cut many years off the term of your loan.â

Don’t Miss: How Does Mortgage Appraisal Work

Adding Extra Each Month

Simply paying a little more towards the principal each month will allow the borrower to pay off the mortgage early. Just paying an additional $100 per month towards the principal of the mortgage reduces the number of months of the payments. A 30 year mortgage can be reduced to about 24 years this represents a savings of 6 years! There are several ways to find that extra $100 per month taking on a part time job, cutting back on eating out, giving up that extra cup of coffee each day, or perhaps some other unique plan. Consider the possibilities it may be surprising how easily this can be accomplished.

What Does Paying Your Mortgage Biweekly Do

Some mortgage lenders allow you to sign up for biweekly mortgage payments. This means you can make half of your mortgage payment every two weeks. That results in 26 half-payments, which equals 13 full monthly payments each year. Based on our example above, that extra payment can knock four years off a 30-year mortgage and save you over $25,000 in interest.

Also Check: How To Lower My Mortgage Interest Rate Without Refinancing

Will You Be Charged For Overpaying Your Mortgage

Check your mortgage deal to get an accurate picture of how charges can cut into any savings that result from overpaying your mortgage.

You could be charged for paying your mortgage off early or making a monthly payment, which goes over your agreed monthly limit.

Many lenders will let you overpay up to 10% a year without penalties.

Should I Pay Off My Mortgage

Just because you can pay off your mortgage early doesnât necessarily mean that you should. Of course, it would feel great to rid yourself of a huge financial burden like a mortgage. But if you really want to know if itâs a good decision, you have to look at the math.

There are pros and cons to paying off your mortgage early. Whether the pros outweigh the cons will depend on your overall financial situation.

Recommended Reading: Will Section 8 Help Pay Mortgage

Use A Wholesaler To Sell Your Home

Most people are unaware that approximately 40% of all real estate sales in our nation are all-cash deals. Therefore, no banks are engaged. It also implies that the majority of the earlier obstacles to underwriting have been removed. However, wholesalers use a somewhat different approach. They assist the middleman in your home. However, youll get a decent sum. That much is certain. They have cash purchasers set up that communicate with them about the houses they are interested in buying. You can find cash buyers by searching for cash buyers real estate or other similar terms on LinkedIn or Facebook Groups.

Come Up With A Credit Card Repayment Plan

If you have multiple credit cards, there are several ways to approach paying down your debt. For example, cardholders can focus on paying off the one with the smallest balance first, known as the debt snowball method. Or they can first pay off the card with the highest interest rate, known as the debt avalanche method. Credit card companies are required to report the interest rate and APRs of your cards on your statements. Take a look at these and begin chipping away at the biggest ones.

Consumers should also strive to make more than the minimum credit card payment. This will help you pay less interest over time and improve your credit score.

You May Like: How To Be A Mortgage Broker

Cons Of Paying Off Your Mortgage Early

- Lose your mortgage tax deduction: Homeowners can deduct what they pay in mortgage interest from their taxable income. Paying off your mortgage means losing this benefit and could mean a larger tax bill in the future.

- Could earn more by investing: This is especially true if you have a low-interest mortgage. The amount you spend paying it off could have been allocated towards investments, which may yield a greater return in the long run.

- Lose liquidity and hinder cash flow: When you throw all your money into paying off a mortgage, there may not be much leftover in case of an emergency purchase.

Transcript: How Paying Extra On Your Mortgage May Help You Pay Less Interest Over Time

At some point after you purchase your home, your financial situation may change. You may get a raise and have more income every month or you may pay off a credit card and have fewer monthly expenses. When this happens, you might consider paying more than your monthly mortgage bill to reduce your debt and gain equity in your home faster.

Making extra payments on your principal mortgage balance, which is the amount you borrowed, may help you reduce the amount of interest you pay over the life of your mortgage.

Its worth remembering, though, that your mortgage may have a lower interest rate than other types of debt, such as credit cards. So, paying extra on your mortgage may not always be the best way to use your extra income you may choose instead to pay off different credit accounts with higher interest rates or boost your emergency savings.

But what strategies are available if you do decide to try to pay down your mortgage faster?

Meet Ryan and Amber. Each of them purchased a home with a 30-year mortgage of $194,000 at a fixed rate of 4%, giving them a monthly principal and interest payment of $926.

For this hypothetical scenario, were not including potential additional costs, such as private mortgage insurance, taxes, or homeowners insurance. Were also assuming they make these decisions at the very start of their mortgage loan, and continue on with them every month.

Scenario 1: Paying more than is required each month.

Related articles

Recommended Reading: What Is A Normal Mortgage Rate

Make Extra Mortgage Payments

Another way you may be able to save money on interest, while reducing the term of your loan is to make extra mortgage payments. If your lender doesnt charge a penalty for paying off your mortgage early, consider the following early mortgage payoff strategies.

Just remember to inform your lender that your extra payments should be applied to principal, not interest. Otherwise, your lender might apply the payments toward future scheduled monthly payments, which wont save you any money.

Also, try to prepay in the beginning of the loan when interest is the highest. You may not realize it, but the majority of your monthly payment for the first few years goes toward interest, not principal. And interest is compounded, which means that each months interest is determined by the total amount owed .

Tips To Pay Off Your Mortgage Faster

While its not the right decision for every homeowner and not possible for those on a tight budget paying off a mortgage in its entirety is a goal for many people.

Whether its just for the psychological freedom of eliminating what is most households largest budget line item or to reduce expenses before retirement, accelerating your mortgage payoff can be a smart financial move.

We sought advice from Pete Boomer, executive vice president of mortgage at PNC Bank and Melody Robinson Wright, director of financial education at Kinly. Both replied via email, and their answers were edited.

Don’t Miss: How Much Mortgage Can I Get On 30 000 Salary