What Is A Mortgage In Principle

A mortgage in principle is a statement from a lender that says they will lend you a specific amount based on the information you have provided. It is not a guarantee, but an indication that they would be willing to lend you the money in principle. It can be used to show estate agents or sellers that you do in fact have the funds to buy a property

What About Contractors Freelancers And The Self

If youre a contractor, freelancer, or youre self-employed, youll face the same affordability assessment as those who are employed.

However, proving your income will be slightly different. After all, if youre self-employed you probably wont be able to provide lenders with payslips like an employee of a company.

Whats more, if youre a contractor, freelancer, or self-employed your income is much more likely to fluctuate every month meaning theres a much higher risk that your income could change significantly, with very little warning.

If youre applying for a mortgage, you can expect the lenders proof-of-income process to be much more comprehensive. Essentially, you will need to be able to provide the documentary evidence as proof that you have a stable financial track record and that youll be able to meet your monthly repayments for the duration of the loan.

What To Do Once Youve Found Your Dream Property

The next important step is then to actually find a property that is suitable for you and within the budget you have set out, this might include getting a survey, which will evaluate the condition of the house you wish to buy.

Once youve found the right house and want to go ahead with the purchase, you would go back to the lender and begin the actual mortgage application. This will involve detailed research into your financial situation, including earnings, expenditure and a full credit check with a . Youll need to supply certain documents as proof of your income and outgoings, so that banks have an idea of how well you would be able to cope if the size of your repayments increases in the future. Before you get a final decision, the lender will most likely insist on a valuation of the property, to ensure it matches how much they are lending you.

Also Check: How To Eliminate Mortgage Insurance Premium

Good Credit Purchase Under $1000000 With 10% Down Payment

The first review that I do when I meet my self-employed clients is to determine if they qualify for a traditional mortgage. What I mean is that if my self employed client shows enough income on her income tax return to qualify for the mortgage she wants. I check her credit and credit score, that’s also important.

Once we determine that a traditional mortgage, like an employee would, at best rates with 5% or 10% or 20% or whatever amount down doesn’t work, then I look at other options.

The next option for a self-employed client is an insured self-employed mortgage. With an insured program, the minimum requirement is 10% down and good credit .

The insured program can be set up with 10% to 35% down and any amount in between. The premium charged reduces the more down payment is applied to the purchase. The insured program is not available for refinancing an existing mortgage.

Qualification calculations are made based on gross and net business income and are compared to personal taxable income. The lenders asks the self-employed client how much income they “actually” earn. This number is also compared to industry averages to evaluate how reasonable that income is.

There are a number of lenders who will qualify you for a mortgage under the self employed insured programs. However, only 2 of the 3 insurers offer specific insured programs for self employed applicants.

Let’s compare a couple of situations to see how a lender may evaluate your income.

What If I Have Bad Credit

Most mortgage lenders will want you to have an acceptable credit score before theyll be willing to offer you a mortgage. But there are specialist mortgage lenders who will consider you with a very low or even no credit score if you’ve not managed to build a credit history yet.

If you need a mortgage but are worried about your credit score, the door of your dream home isnt necessarily closed to you. Youll probably just need a specialist mortgage broker to get you the right mortgage. Get matched to your perfect mortgage broker by making an enquiry.

Don’t Miss: Can You Skip A Mortgage Payment

Ten Important Factors To Consider When Applying For A Mortgage

Before hunting for your dream home, if youre not paying cash, youll need to be approved for a mortgage. Key factors, like knowing which type of loan works best for you and how a down payment affects your monthly mortgage payment, can help you narrow things down. Other key factors, like knowing your credit score and having proof of income, can help you get approved.

How To Get A Mortgage: A Step

You probably already know that a mortgage is a type of loan that you use to buy a home. Its a good idea to learn as much as you can about getting a mortgage before you start shopping for a home.

The best way to avoid wasting time is to know the players and the process. That means working with a lender to get the best possible loan.

In this article, well get you ready to go mortgage shopping by going over what lenders are looking for, the paperwork involved and the five steps it takes to complete the mortgage process.

Don’t Miss: Can You Mortgage A Boat

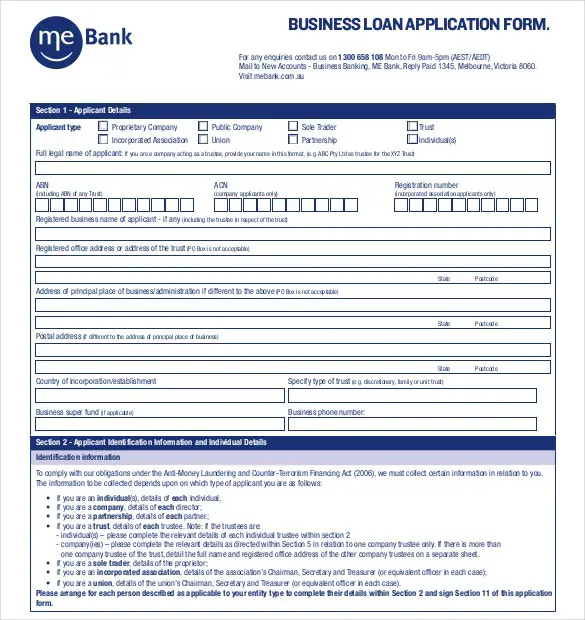

What Is Included In A Mortgage Application

The Uniform Residential Loan Application is used by the overwhelming majority of lenders in the U.S., but you might come across another similar application in the process of finding financing for a home. All applications have the same purpose: to gauge whether a potential borrower is financially stable enough to pay back a home loan, explains Chuck Meier, senior vice president and mortgage sales director at Sunrise Banks in Minnesota.

The application will ask borrowers for information regarding their financial situation, including income and assets, as well as personal information like Social Security number. You will also be required to provide documentation corroborating the information you provide.

The Uniform Residential Loan Application, specifically, includes the following sections:

The 4 Cs Of Qualifying For A Mortgage

Whether you are a first-time home buyer or are re-entering the housing market, qualifying for a mortgage can be intimidating. By learning what lenders look at when deciding whether to make a loan, you’ll be more confident in navigating the mortgage application process.

Standards may differ from lender to lender, but there are four core components the four C’s that lender will evaluate in determining whether they will make a loan: capacity, capital, collateral and credit.

Don’t Miss: Can You Get Preapproved For A Mortgage Through 2 Banks

Next Steps: Can You Afford To Buy A House

Your lenders goal is to assess you as a borrower and ensure you can make your payments on time.

If youre thinking about a home purchase in the near future, these are some good questions to ask yourself to prepare for the home-buying process.

- How much down payment can you afford? A higher down payment is often a good sign for the lender about your finances.

- What is your debt-to-income ratio? Youll likely need to keep this number below 43%.

- What monthly mortgage payment can you comfortably afford in your budget?

- Are you prepared for closing costs, such as an appraisal or prepaid property taxes?

Bank Statements And Other Assets

When assessing your risk profile, lenders may want to look at your bank statements and other assets. This can include your investment assets as well as your insurance, such as life insurance.

Lenders typically request these documents to make sure you have several months worth of reserve mortgage payments in your account in case of an emergency. They also check to see that your down payment has been in your account for at least a few months and did not just show up overnight.

Read Also: Should I Refinance My Home Mortgage Calculator

What Credit Score Do Mortgage Companies Look For

Surprisingly, you dont have a one-size-fits-all credit score. Youre ranked differently by different credit agencies who have their own scales. Lenders will usually check your credit score from the three big UK credit agencies: Equifax, Experian, and TransUnion. Each agency has a slightly different way of ranking you, so its a good idea to be informed of your score with all of them.

A few different factors can contribute to how you rank with credit agencies. These include:

-

Your borrowing history what youve borrowed, who youve borrowed it from, and how youve paid it back

-

Public court records any negative notes like county court judgements or bankruptcy

-

Linked finances if you have any joint accounts, the credit history of the person youre linked to can be taken into account

-

Your addresses if youve had a lot of previous addresses in a short space of time, this could work against you

To give you an idea of what an average UK credit score might look like:

Equifax: 0 700

Experian: 0 999

TransUnion: 0 710

These numbers are just a guide, its possible to get a mortgage whatever your credit score, but generally the higher the score, the easier it can be to get approved.

Just because you have bad credit, doesn’t mean you can’t get a mortgage. We recommend using Checkmyfile to find your score. Checkmyfile shows your credit information from four major credit reference agencies, and is the most thorough way to check your history in the UK.

What Can You Do If Your Mortgage Application Is Refused

If your mortgage application is declined, there may be a few different reasons the lender has made this decision. Firstly, it might be a good idea to check that all the information you provided is correct, its not impossible for either a borrower or a lender to make a mistake, so review everything carefully.

If you are not earning enough, or you are spending too much, the lender might have decided that you would not be able to afford your repayments. In this case, it might be wise to rethink the size of the mortgage you are able to get and to also think about how to better budget your spending. It is also possible to get something called a guarantor mortgage, this is when another person, usually a relative or close friend, agrees to accept responsibility for the debt, in the event that you are unable to keep up repayments.

Also Check: How Soon Can You Lock In A Mortgage Rate

What Do Mortgage Lenders Look For On Bank Statements

When you apply for a mortgage, lenders look at your bank statements to verify that you can afford the down payment, closing costs, and mortgage payments.

Youre much more likely to get approved if your bank statements are clear of anything questionable.

Red-flag issues for mortgage underwriters include:

- Bounced checks or non-sufficient funds fees

- Large deposits without a clearly documented source

- Monthly payments to an individual or non-disclosed credit account

Fortunately, you can fix a lot of issues before they become, well, issues. Heres what to look for and how to deal with problems you find.

In this article

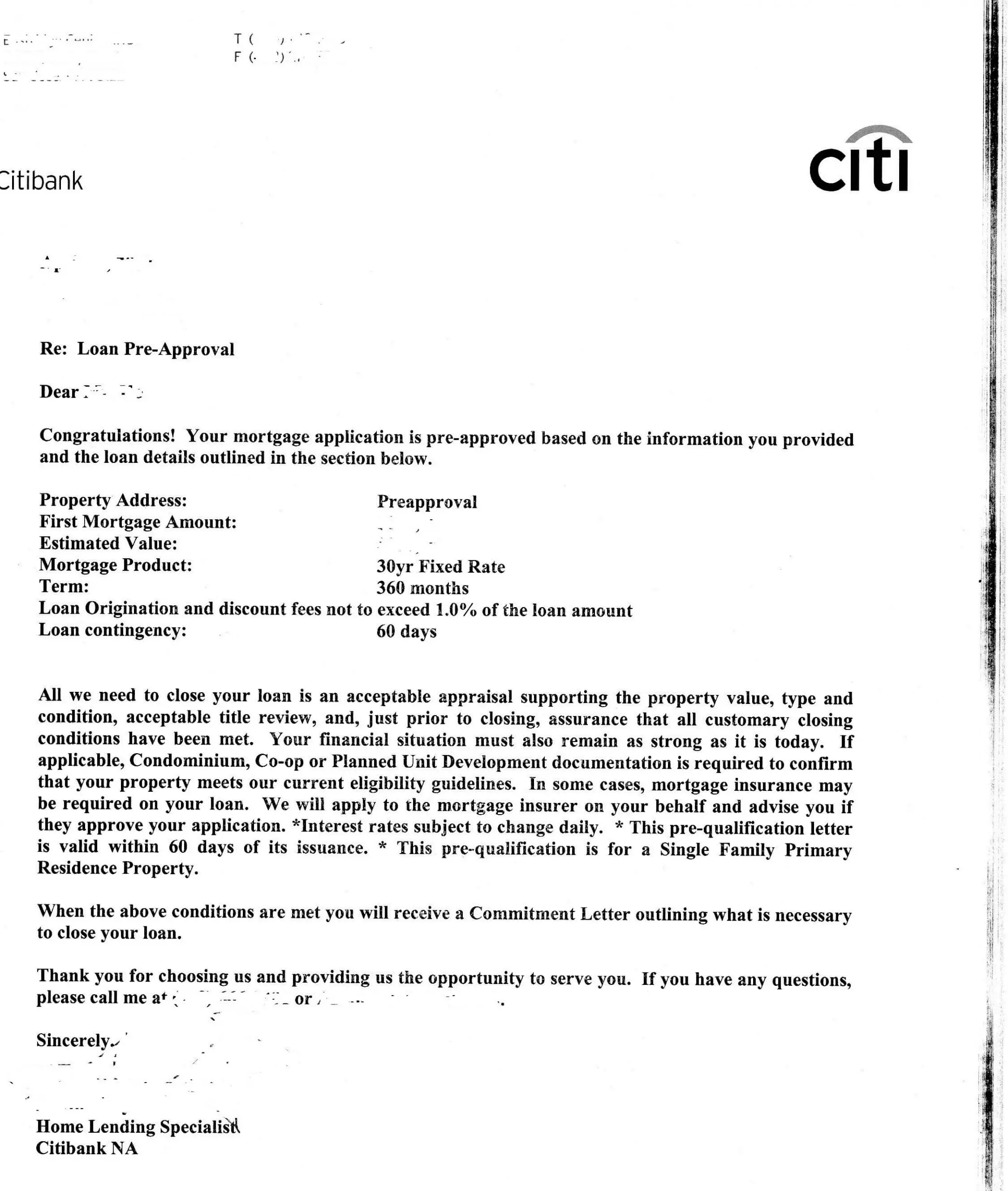

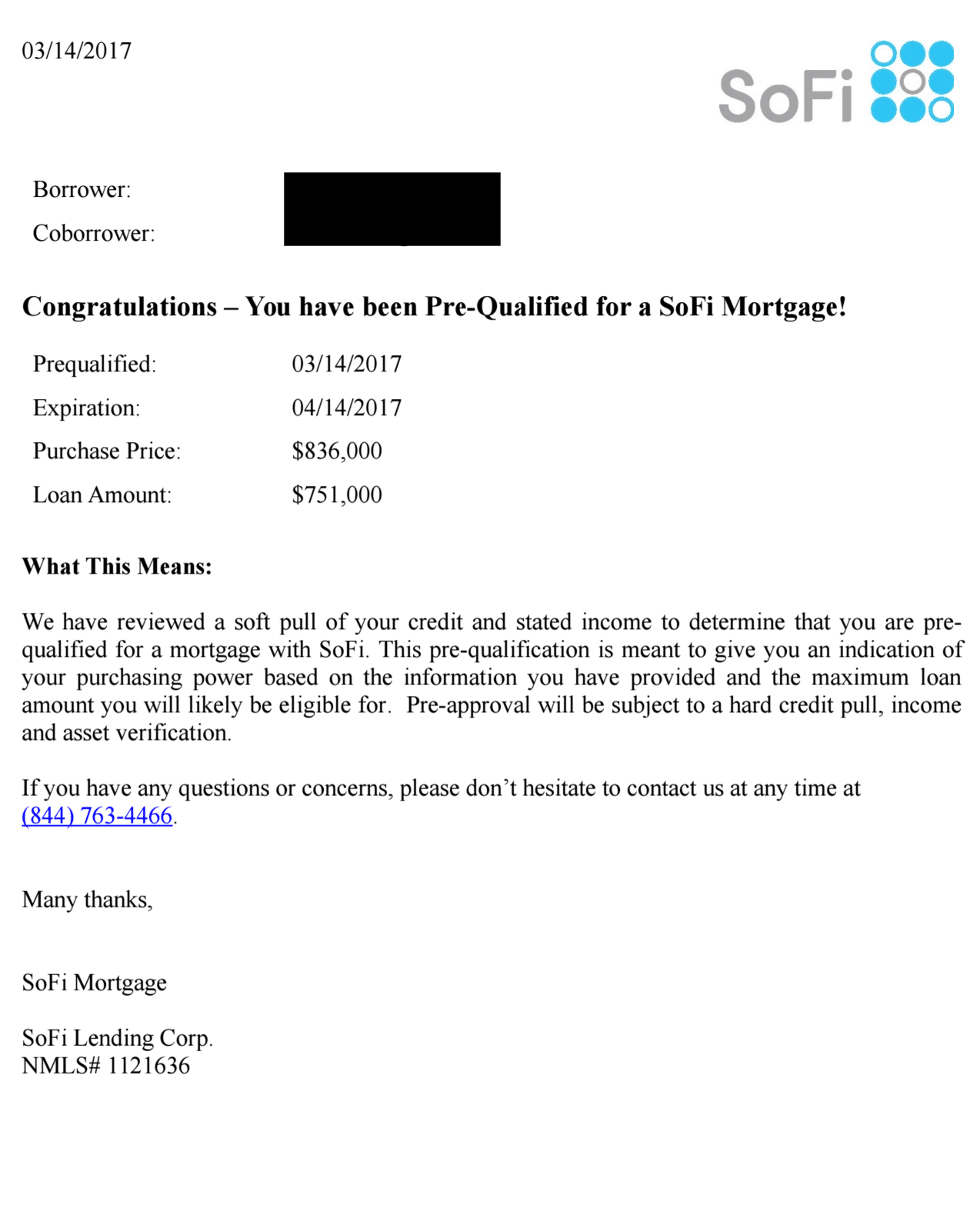

Two Smart Homebuying Moves: Mortgage Prequalification And Preapproval

Find out how much house you can borrow before you start looking and how you can make the strongest offer possible on the property you choose.

If youre ready to make your dream of owning a home a reality, youve probably already heard that you should consider getting prequalified or preapproved for a mortgage. Its time to understand exactly what each of those terms means and how they might help you. And when youre working toward a goal this big, you want every advantage.

Ready to prequalify or apply? Get started

You May Like: How To Calculate Monthly Mortgage Payment Formula

Check Your Credit Before You Apply For A Mortgage

If youre waiting until you apply for a mortgage to check your credit history, then youre waiting too long. Thats because mortgage interest rates and mortgage qualification depend on your credit. And the stakes are pretty high.

If you check your credit when you apply and find out its lower than you thought, youll likely end up with a higher interest rate and more expensive monthly payment than you were hoping for. And if your credit score is too low you might not qualify for a mortgage at all.

Higher credit means lower interest rates

Keep in mind, a higher credit score usually means a lower mortgage rate. So if you check your score and learn that its strong, you might still want to work on improving your credit score before you buy.

Consider that mortgage rates are based on credit tiers, and a higher credit tier means a cheaper mortgage. If your credit score is currently 719, for example, raising it by just one point could put you in a higher tier and earn you a lower interest rate.

Check your credit early

Ideally, you should start checking your credit early. It can easily take 12 months or more to reverse serious credit issues. So the sooner you get started, the better.

So you need to crawl yours, making sure theyre 100% accurate. The Consumer Financial Protection Bureau has useful advice for disputing errors in your credit history.

Raise your credit score before you apply if possible

Apply For A Mortgage With Multiple Lenders

Its a huge mistake to accept the first mortgage quote you get.

Many first-time home buyers dont know it, but mortgage rates arent set in stone. Lenders actually have a lot of flexibility with the interest rate and fees they offer.

That means a lender youre looking at might be able to offer a lower rate than the one its showing you.

In order to get those lower rates, you have to shop around and get a few different quotes. If you get a lower rate quote from one lender, you can use it as a bargaining chip to talk other lenders down.

Shopping around for mortgage rates also lets you know whether youre getting a good deal.

For example, a 3.5% rate and $3,000 in fees might sound all right if its the first quote youve gotten. But another lender might be able to offer you 3.0% and $2,500 in fees.

That makes the first offer a lot less appealing but you wont know it until you look around.

Get at least three mortgaeg quotes

Compare personalized rate quotes from at least three lenders to make sure youre getting the best deal. A mortgage broker could help you compare multiple quotes at once.

And make sure youre comparing apples-to-apples quotes. Things like discount points can make one offer look artificially more appealing than another if youre not watching out.

Different down payment amounts, loan terms, loan amounts, and mortgage loan types will skew loan estimates, too.

You May Like: How Is Debt To Income Ratio Calculated For A Mortgage

Also Check: What Are The 3 Types Of Mortgages

What Is Needed As Proof Of Income For A Mortgage

For proof of income, typically, lenders will need to collect:

- Employment pay stubs

Stay in the know with our latest home stories, mortgage rates and refinance tips.

In your inbox every Thursday

- A valid email address is required.

- You must check the box to agree to the terms and conditions.

Thanks for signing up!

What Mortgage Lenders Look For: 2022 Must

Buying a home can be a dream come true for many of us. After all, youve worked hard and saved to be able to afford it. The majority of us cannot afford to pay for the house upfront. This is why many decide to apply for a home mortgage. But how do you make sure you get one?What do mortgage lenders look for when deciding whether to give you a loan? Knowing this can help you get a step closer to your dream home.

Recommended Reading: Are Mortgage Rates Going Down

How Do Mortgage Lenders Verify Your Income

When youre applying for a mortgage, it sadly isnt as easy as just letting the lender know your annual salary. Youll need to prove you earn what you say you do so they can verify your income and work out what kind of a mortgage you can afford. Youll usually do this by submitting payslips, tax returns, or employer references. But there are a few differences in the way you prove your income depending on if youre employed by a company, or youre self-employed.

Good Credit Purchase With 20% Or More Down

The more money you have down the more flexible lenders can be. If you can’t use traditional income confirmation with 20% down, then either we choose to insure the purchase and go with an insured self-employed program. You would, therefore, pay the premium.

The advantage to that program is that the rates are very close to best rates. There is a premium but it’s reduced when you have 20% down. The same criteria apply as described above. Gross and net business income will be used to determine whether your stated income is reasonable.

If your credit is bruised or isn’t high enough to qualify for an insured self-employed mortgage, then another option is to work with an alternative lender.

With an alternative lender, they use a little more common sense. Not a lot more, but a little bit more. They will evaluate your business income. Most of the time, they want to see your business bank statements. They will look at the deposits to see if there is enough going into your business account to justify the income you told them you earn.

For alternative lenders, you will be looking at interest rates from 1.5% higher than best rates or more. The rate really depends on your credit. The worse your credit, the higher the rate you will pay. There will also be lender fees and broker fees. This could be 1% to 5% of the mortgage amount in total.

Read Also: What Mortgage Rate With 650 Credit Score