Get Your Connections In Order

You wont be able to go it alone in the mortgage industry. You will need to build connections with real estate agents, mortgage lenders, consumer credit report vendors and, of course, clients. Ensuring you have a solid Mortgage CRM will help you to manage all your relationships and stay on top of your communications, remaining professional and punctual at all times, even if youre feeling overwhelmed at this stage. Take your time to select your partners and work with them to build your offering for your clients so you have the best deals and solutions available, setting you off on a good grounding for building your business.

Essential Software And Tools

Being an entrepreneur often means wearing many hats, from marketing to sales to accounting, which can be overwhelming. Fortunately, many websites and digital tools are available to help simplify many business tasks.

You may want to use industry-specific software, such as Floify, meridianlink, or ARIVE, to manage your loan origination, rate quotes, and lender relationships.

Start Your Mortgage Broker Business

Once you have collected or prepared everything detailed in this article, you will be ready to begin your journey as a mortgage broker. Whether you wish to work by yourself, or are hoping to establish a corporation, these guidelines should give you a firm head start.

If you have any further questions about the requirements for becoming a mortgage broker, or the process of posting a mortgage broker bond, dont hesitate to get in touch. You can contact us via our chatbot, or over the phone at 877.514.5146

Don’t Miss: Is There A Penalty For Paying Off Mortgage Early

How To Get Into The Mortgage Industry: What Is A Mortgage Brokers Salary

In return for helping home buyers shop different banks and financial institutions for the best mortgage loan options, you can make a decent salary in a mortgage broker job. But like most jobs, the pay depends on where you live and your experience.

If youre an independent broker, youll probably work on commission per mortgage loan brokered. But if you work for an established mortgage brokerage, you might also earn a salary and benefits on top of commission for each loan.

Because pay varies significantly from job to job, be sure you understand the real estate and home loan markets for your area and the salary range youre most likely to earn for your desired position.

How To Start A Lending Business According To Boris Batine

Alternative finance is reshaping the financial landscape and taking over the world. Becoming a profitable niche for business, entrepreneurs choose to start a loan company and provide digital services for customers. However, starting a loan company is a challenge with many unpredictable trials. Even if you think out your business plan, choose the niche, and find an investor, it doesnt guarantee a risk-free path from a startup to an SME business. So, the HES team decided to ask one of our loyal clients about challenges on the way to success because who knows better how to start a loan business than an owner of such a company?

We are talking about starting a loan company, risky decisions on the way, and market expansion with Boris Batine, Co-Founder & CEO of the international micro-credit provider ID Finance and one of HESs most valued partners.

ID Finance is the holding behind MoneyMan and AmmoPay companies, as well as Plazo brands in Spain, Mexico, and Brazil. As of October 2019, the company reported 3 million users with over 40,000 new users joining each week. Based on the insights, the company has gained 60 million since 2015 including 5.8 million of equity and 54 million through debt.

Also Check: How Much Interest Is Charged On A Mortgage

How Much Does It Cost To Start A Micro Lending Business

If you are planning to start a micro-lending business, the costs are relatively low. This, of course, depends on if you decide to start the business with lean expenses or bringing in a large team and spending more money.

Weve outlined two common scenarios for pre-opening costs of starting a micro-lending business and outline the costs you should expect for each:

- The estimated minimum starting cost = $2,515

- The estimated maximum starting cost = $23,259

| Startup Expenses: Average expenses incurred when starting a micro-lending business. | Min Startup Costs: You plan to execute on your own. Youre able to work from home with minimal costs. | Max Startup Costs: You have started with 1+ other team members. |

|---|---|---|

| Office Space Expenses | ||

| Rent: This refers to the office space you use for your business and give money to the landlord. To minimize costs, you may want to consider starting your business from home or renting an office in a coworking space. | $0 | $5,750 |

| Utility Costs For Office Space: Utility costs are the expense for all the services you use in your office, including electricity, gas, fuels, telephone, water, sewerage, etc. | $0 | $1,150 |

| WiFi & Internet: Whether you work from home or in an office space, WiFi is essential. Although the cost is minimal in most cases, it should be appropriately budgeted for each month! | $0 |

Choose A Physical Location Or Online Mortgage Brokerage

As a mortgage broker, you have the option to select a physical location where you will provide services to clients or an online business where no brick-and-mortar space is needed. However, its important to understand the guidelines of your state to help determine if an online brokerage business is possible.

Some states require you to have a physical location to get licensed and operate legally. When selecting any physical location, think through the ease of accessibility for your customers, price of renting space, and your available hours. If you have the option to work through an online brokerage, plan for a home office space that allows you to effectively work.

Don’t Miss: Can I Get A Mortgage At Age 70

How To Be A Mortgage Broker Plus Advantages Of A Career In The Mortgage World

Of course, snagging a comfy salary isnt everything . Is brokering loans rewarding or even fun?

Shayna Rabaiotti, an Arizona mortgage loan officer with Guardian Mortgage, has this to say about it: Its such an amazing feeling when I get to see my clients reactions after they get their keys to their new home.

Rabaiotti also notes that mortgage loan brokering is a good transition career.

After being in the customer service and sales industry for over 15 years, I find that I really enjoy helping people, which is why I was so drawn to this, she says.

Here are the basic steps you need to take to become a licensed broker:

Hard Money Pros And Cons

One very attractive feature of becoming a hard money lender is that you can make a living investing someone elses money. Thats not to say that it doesnt take any investment of your own capital to start a lending business, but most of your income will come from using investors to generate business. This means you can get into real estate and financial sectors without needing to have accumulated a tremendous amount of wealth yourself.

Since you are essentially a broker between the investors and the borrowers, you get paid upfront. Youre not usually the one investing in the loan. So, you have less risk than the lender does. If a deal goes bad, its your reputation on the line, but not necessarily your finances. Youre not responsible for paying the loan back to the lender.

Another advantage of getting into this business is that hard money lenders arent subject to the same set of rules and restrictions that banks are. Generally, that means you dont have as much red tape to cut through and can negotiate more flexible loan terms. Hard money loans are usually processed and approved in a month or so. Shorter processing times can mean doing more business faster and making more connections.

Are you a good fit for this industry?

Take a PROFITABILITY ASSESSMENT to find out.

Read Also: What Is Estimated Escrow On A Mortgage

How To Start A Mortgage Company

This article was co-authored by Ryan Baril. Ryan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.There are 14 references cited in this article, which can be found at the bottom of the page. This article has been viewed 61,545 times.

A mortgage is a specific type of debt taken on by people buying real estate. A mortgage company can work as an intermediary between individuals and banks secure mortgages for their clients. Such companies work with a variety of clients to aid in the stages of qualifying for and paying off a mortgage depending on their circumstances. With a little time and effort, you can become a loan originator and begin helping people who want to purchase property.

Find A Business Mentor

One of the greatest resources an entrepreneur can have is quality mentorship. As you start planning your business, connect with a free business resource near you to get the help you need.

Having a support network in place to turn to during tough times is a major factor of success for new business owners.

Don’t Miss: How Much Money Down For Conventional Mortgage

Start Run And Manage A Successful Mortgage Business

- You will be able to understand how mortgage businesses work

- You will be able to start a new business with high profit potential

- You will understand what is needed to start a mortgage brokerage business

- You will understand what is needed to start a correspondent lender and lender business

- You will understand what is needed to start a lender servicer business

- You will learn how to get approved with lenders to start doing business

- You will learn how to get approved with credit companies to start pulling credit and reviewing credit reports

- You will be able to submit loans, close loans, and be compensated for doing this

- You will learn how to hire, run quality control checks, create a hiring agreement, and prepare a payment structure

- You will understand what it takes to process a mortgage loan

- You will learn how to close a mortgage loan from beginning to end

- You will learn why starting a mortgage business can be a great financial decision

- You will learn how to complete an application to get approved for a mortgage brokerage business

- You will learn how to complete an application to get approved for a correspondent lender and lender business

- You will learn how to complete an application to get approved for a lender servicer business

- You will understand what it takes to run a completely virtual mortgage business

- You will understand how each mortgage business type profits from each transaction and how to can be a part of this

- High School Diploma level Mathematics

How To Start A Loan Company Like Moneyman

Its always easier to learn by considering good practices instead of studying a theory. So, we decided to ask some questions to Boris Batine about his lending experience with MoneyMan and the challenges of expanding business in Europe. Keep following the interview to find some advice on how to start a cash loan business and develop cash lending software.

You May Like: What Is Amortization Schedule Mortgage

What Are Alternative Options To A Small Business Loan

There are many alternative options to a small business loan that can help you get the proper funding for your specific business needs. This includes lenders that specialize in bad credit loans. Some alternative small business loan options include:

- Borrowing from friends or family

- Using business credit cards

- Applying for a government grant

Build Relationships With Real Estate Agents And Other Partners

A significant part of becoming a mortgage broker after receiving your license is creating and cultivating relationships with business partners. For some mortgage brokers, relationships with real estate agents and lenders prove to be the most rewarding. These individuals or companies can provide a steady stream of clients to your mortgage brokerage business, helping you maintain a steady flow of work. You may also consider building partnerships with financial advisors or tax accountants, as they often work with people who are in the market to buy or refinance a home.

Also Check: How Long Does A Mortgage Take To Pay Off

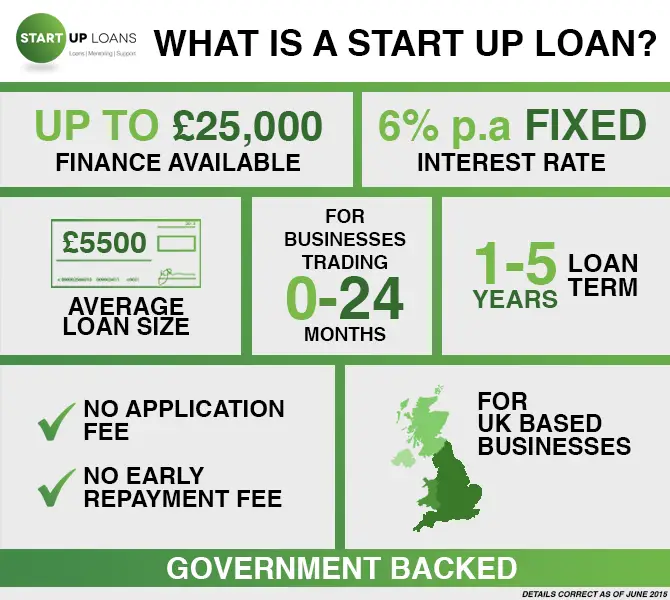

What Is A Startup Business Loan

A startup business loan is a type of financing thats accessible to businesses with limitedor nobusiness or credit history. While the most common startup loans are term loans or U.S. Small Business Administration loans, startups may also opt for business credit cards or asset-based financing. Startup founders also can opt for less traditional financing tools like crowdfunding to get the working capital they need to start and grow their businesses.

How Much Does It Cost To Start A Mortgage Brokerage Business

Startup costs for a mortgage brokerage if you run your business from home are about $3,000. Costs include a computer and a marketing budget. If you start your brokerage from an office, costs will be about $10,000.

Visit the resource center of the Nationwide Mortgage License System for help with education and licensing.

| Start-up Costs |

|---|

| $6,475 |

Also Check: How Does Paying Mortgage Work

Prepare A Detailed Cost Analysis

If you think you must have gotten enough experience working as a loan originator or loan officer for a mortgage company, you may indeed have the basics and insight of what youll need to start up your own mortgage lending business. As a mortgage lender, your may not solely provide the loans but also help you supposed clients to obtain it.

- Obtaining mortgage license through the state $1000

- Rent and lease $300

- Office Furniture and accessories $550

- legal procedures involved in starting the business $650

- Developing a product offering and Marketing $2100

- Insurance and all other miscellaneous $2350

From our detailed analysis above, you will require $6,950 to start a small scale Mortgage lending business and $53,085 to start a medium size mortgage lending business. A large scale mortgage lending business is estimated to need a mouth-watering $345,000 as start up capital.

S To Starting Your Own Mortgage Company

Launching a startup mortgage company involves going through a number of steps, none of which you can afford to miss. Lets dive in!

1. Meet the mortgage licensing requirements

Youll need a mortgage broker license via the Nationwide Mortgage Licensing System & Registry before you can start practicing as a broker. Per the NMLS, you must undergo a mandatory training course which consists of 20 hours of pre-licensure classes as follows:

- 3 hours of ethics

- non-traditional mortgage lending

- 12 hours of electives

There are several mortgage broker schools that can help you meet these education requirements, as well as help you expand your knowledge base about the mortgage industry. Its only after obtaining the required licensees that you can start thinking of launching your own business. Youll also need to pass a background check, submit a credit report, and be in good standing with the IRS before being accredited by the NMLS.

In addition to these licensing requirements, you should have at least three years of relevant experience at an established mortgage company before setting up your own business. This allows you to gain first-hand exposure to how things are done in the industry. Use this time to also build your professional network of lenders and mortgage bankers, which youll need later on.

2. Pass the SAFE mortgage loan originator test

3. Create your business plan

4. Register the business entity

5. Obtain your mortgage broker surety bond

6. Set up your office space

Don’t Miss: How To Compare Two Mortgage Offers

How Much Can You Earn From A Mortgage Brokerage Business

Mortgage brokers are paid by the lender a commission of 1% to 2% of the loan amount, for an average of 1.5%. The average mortgage loan size in the United States is $450,000. Your profit margin if youre working from home should be high, around 90%.

In your first year or two, you could work from home and close one mortgage loan per month, bringing in $81,000 in annual revenue. This would mean $73,000 in profit, assuming that 90% margin.

As your business gains traction and you get referrals, sales could climb to five loans a month. At this stage, youd rent a commercial space and hire staff, reducing your margin to around 40%. With annual revenue of $405,000, youd make a tidy profit of $162,000.

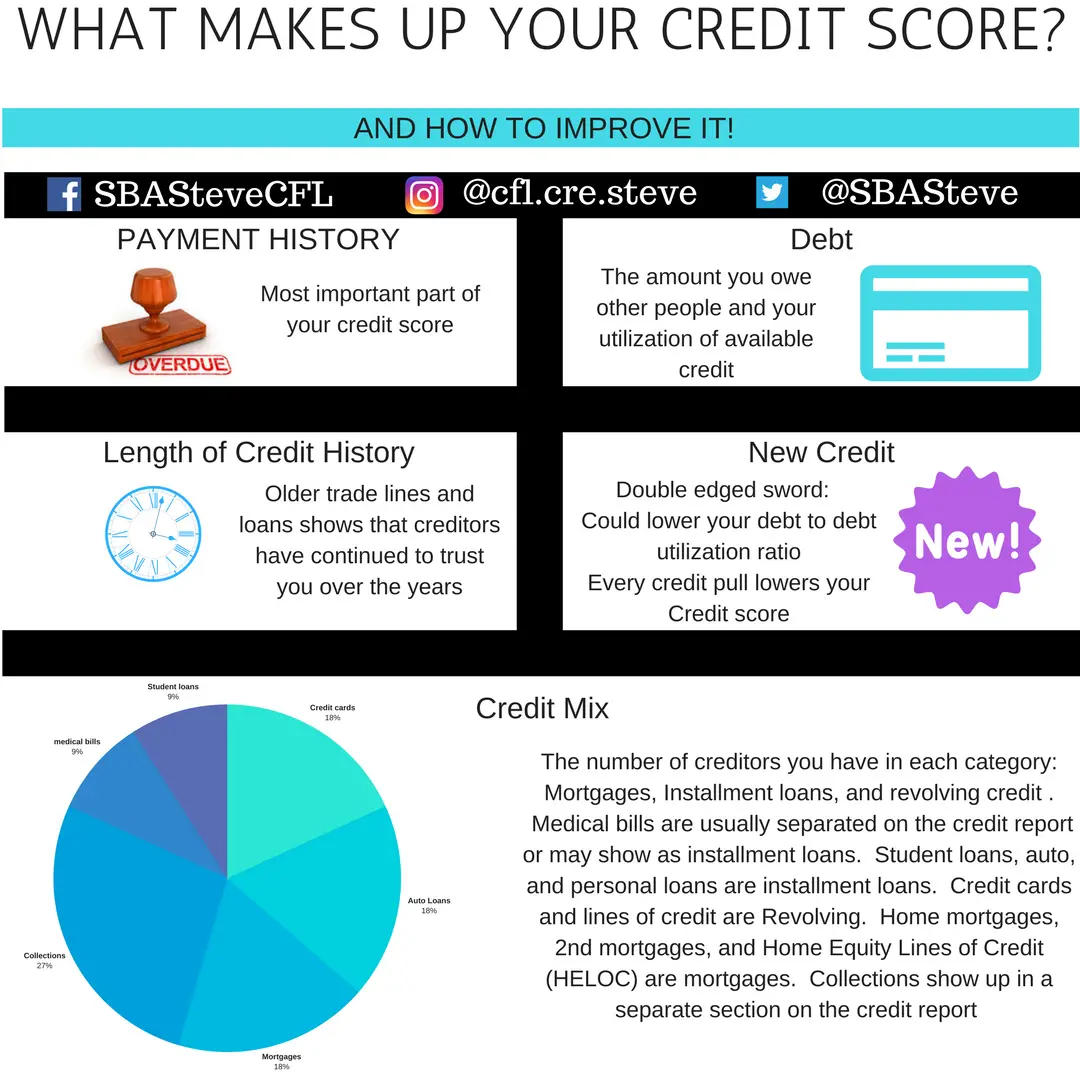

How To Price Your Micro Lending Service

One of the most challenging aspects to starting a micro-lending business is determining how much to charge for your micro-lending service.

When businesses under-price their product, this can be extremely detrimental to their bottom line and reputation.

Often times, businesses under-price their products to drive demand and volume, but that last thing you want is for customers to view your product/service as “cheap.” Additionally, this can have a big impact on the type of customer you attract, which can be difficult to recover from.

On the other hand, when businesses over-price, this tends to be just as damaging to the business.

When customers buy, it’s likely that they will explore the internet and look at other competitors to ensure they’re getting the best value + deal. This is why it’s so important that you research your competition and understand where you land in the marketplace.

Here are some factors to consider when pricing your product:

Understand your customer

It’s important that out of the gates, you identify the type of customer you want to attract and how much they’re willing to pay for your service. One great way to do this is by surveying your customers. Here are some important items you’ll want to takeaway:

- Customer demographic: Age, gender, location, etc.

- Buying habits of your customer: What they buy + when they buy

- Level of price sensitivity with your customer

Understand your costs

The actual cost of your micro-lending service may include things like:

Recommended Reading: How To Calculate Mortgage Eligibility