The Benefits Of An Escrow Account

The biggest benefit of having a Rocket Mortgage® escrow account is that youll be protected during a real estate transaction whether youre the buyer or the seller. It can also protect you as a homeowner, ensuring you have the money to pay for property taxes and homeowners insurance when the bills arrive. Youll find that there are a few other great benefits for home buyers, owners and lenders, too.

All Parts Of A Monthly Mortgage Payment

Once youre paying for a monthly mortgage payment, you might feel as if it is larger than you expected when calculating principal and interest. Thats most likely because you are paying money that goes into your escrow account.

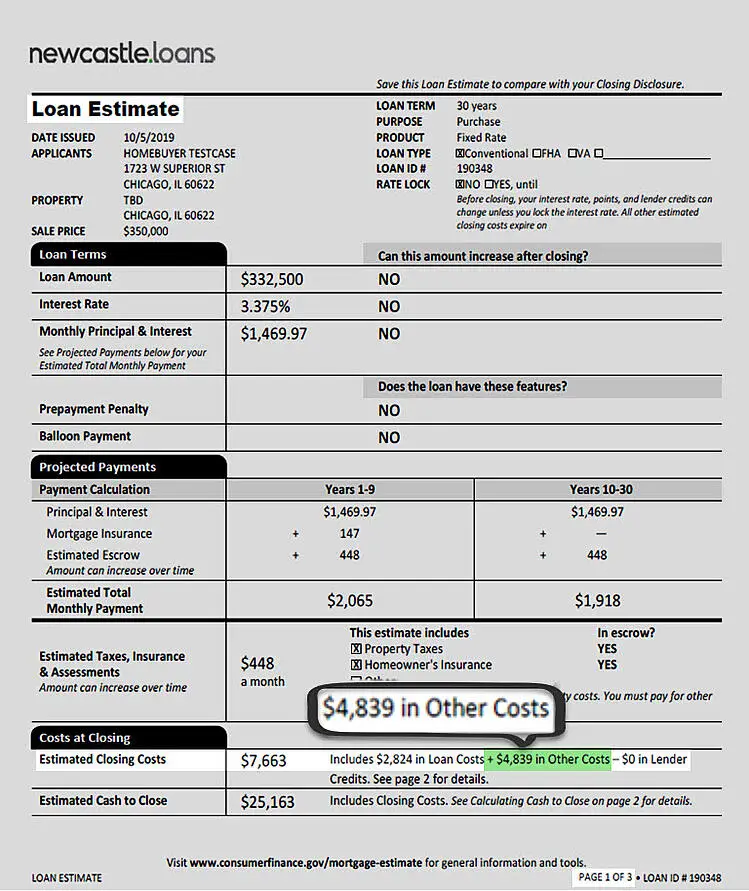

Your monthly installment payment covers much more than just principal payback. Here is a visual of an average monthly payment.

Establishing An Escrow Account At Closing

When you close on your loan, your lender will collect enough funds to establish an escrow account.

Each month, a portion of your mortgage payment will go into your escrow account, and your mortgage servicer will use that money to pay your taxes, mortgage and homeowners insurance bills when they are due. This spreads the amount over 12 months, making it easier on your bank account. And since your servicer is making the payments, you wont have to worry about remembering when theyre due.

Your mortgage servicer is the company that you make your payments to. This may or may not be the same as the lender you closed your mortgage loan with.

You May Like: What Is The Monthly Mortgage On A 350 000 Home

What To Know Before Opening A Mortgage Account

You need to know a few things before opening your mortgage escrow account.

First, you will need to find an escrow company willing to work with you. You may also want to make sure that the company is licensed and has a good reputation.

Second, you will need to provide information about your property and the purchase contract. This includes information like the purchase price and date of sale, as well as the amount of money that is being borrowed.

Third, you will need to provide basic personal information such as your name, address, Social Security number, and other contact information.

Finally, there are fees associated with opening an account – so make sure you budget for it.

Should You Set Up An Escrow Bank Account

The answer to this question depends on whether or not you are disciplined about your finances and able to set aside the funds needed for property taxes and insurance payments. If youre not a good saver or are tempted to spend extra cash perceived as left over, then you are probably better off having your lender handle these payments, especially since failure to pay can result in penalty charges, a lapse in insurance coverage or even a lien on your home. If you are disciplined at saving, you may prefer to control the process since tax payments usually are due only once or twice a year.

Also Check: Should I Use A Mortgage Broker To Refinance

What If My Escrow Account Has Excess Funds

If your escrow account ends up with more money than needed for taxes and insurance, you may get a refund â usually if you have more than a $50 excess.

When you pay off your mortgage, your lender will refund the money in your escrow account. If you refinance, your lender has up to 30 days to refund your escrow funds.

You can’t borrow or withdraw funds from an escrow account.

More Questions About Escrow We Can Help

Whether you’re buying a home, refinancing, or already in the process of paying your mortgage, escrow accounts are meant to offer you financial protection. Understanding how they work and what benefits they offer can give you peace of mind during the closing process and when you start making your first loan payments. At Better, were here to streamline the process from beginning to end. Get pre-approved in as little as 3 minutes with Better Mortgage.

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

- More

Don’t Miss: How Much Is Monthly Payment On 600 000 Mortgage

Downsides To Having An Escrow Account

Servicers sometimes fail to make timely disbursements from borrowers’ escrow accounts for property taxes, homeowners’ insurance, or other charges. As a result, you might be on the hook to pay penalties or fees. In a worst-case scenario, you could lose your home to a tax sale if the servicer doesn’t pay the taxes or you might have to deal with uninsured damage if the servicer neglects to pay the insurance premiums. So, if you’re worried about these bills getting paid, an escrow account might not be ideal. However, as noted earlier, if you have an escrow account, you can and should keep tabs on the account to ensure that the servicer pays the tax and insurance bills. That way, you’ll know if any bills aren’t getting paid.

Also, you’ll probably miss out on earning interest on the money you send to the servicer. However, some states require loan servicers to keep borrowers’ escrow money in interest-bearing accounts. Many states also have a law requiring the servicer to keep escrow funds in an insured bank account and not commingle the escrow funds with the servicer’s own funds.

What’s An Escrow Account

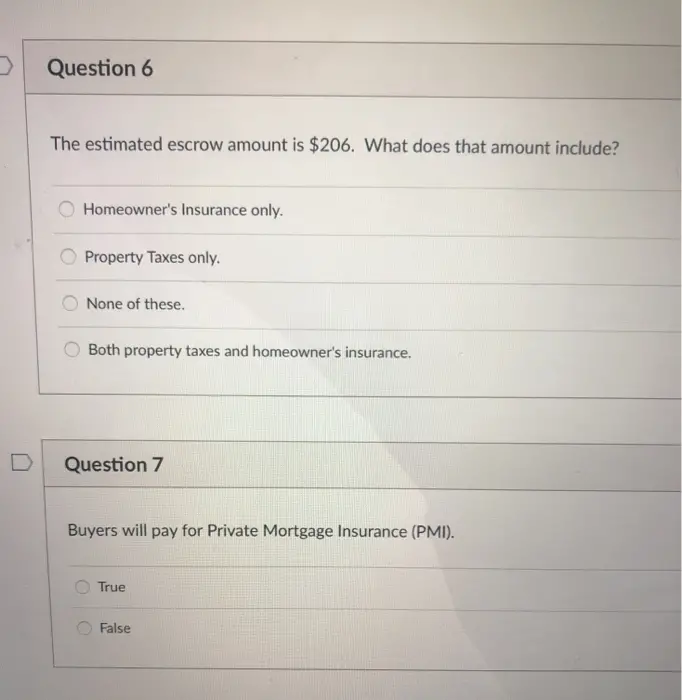

An escrow account allows us to pay the required insurance and/or taxes on your property for you. You pay a portion of your taxes and/or insurance premiums as part of your monthly mortgage payment. Then, when taxes and/or premiums are due, well pay them on your behalf with the money in your escrow account.

Read Also: Is Bank Of America Good For Mortgages

What Is Mortgage Escrow

Escrow refers to a financial instrument, generally an account, held by a neutral third party on behalf of two parties engaged in a transaction. With an escrow account, the funds are held or managed by the third party until the transaction is complete or a contract is fulfilled.

Though escrow accounts are commonly used in real estate, they also can be used for any other transactions that require an agreement between a buyer and seller, or require time to inspect whats being purchased before payment is made.

What Is Homeowners Insurance

Homeowners insurance is a policy you purchase from an insurance provider that covers you in case of theft, fire or storm damage to your home. Flood or earthquake insurance is generally a separate policy. Homeowners insurance can cost anywhere from a few hundred dollars to thousands of dollars depending on the size and location of the home.

When you borrow money to buy a home, your lender requires you to have homeowners insurance. This type of insurance policy protects the lenders collateral in case of fire or other damage-causing events.

Also Check: How Is A Mortgage Payoff Calculated

How Are Tax And Insurance Projections Calculated For The Next Year

Each year we project how much youll need in your escrow account for the upcoming year. We base it on the amount of taxes and/or insurance you paid during the past 12 months. The total paid is divided by 12 to get your projected monthly escrow payment.

Sometimes, your payment must be adjusted to ensure your monthly balance remains above a required minimum balance during the next 12 months. This minimum balance is typically equal to two months of escrow payments.

If your taxes and/or insurance change during the next year or your monthly escrow balance falls below the required minimum amount, you could have a shortage or surplus in your account when we do an Annual Escrow Analysis next year.

Escrow Companies And Escrow Agents

When youre buying a home, escrow may be managed by a mortgage servicing company or agent. The escrow agent or company is sometimes the same as the title company.

The escrow company not only manages the buyers deposit, but they may also be responsible for holding on to the deed and other documents related to the sale of the home.

Because the escrow company is working for both the buyer and the seller in the real estate transaction, the fee for their services is usually split evenly between the two parties.

You May Like: What Do You Need To Provide For A Mortgage

What Are The Benefits Of A Mortgage Escrow Account

There are many benefits of having a mortgage escrow account. One of the biggest advantages is that it helps to protect you from defaulting on your mortgage. If you fall behind on your payments, the money in your escrow account can be used to bring your payments up to date. This can help you avoid foreclosure and keep your home.

Another benefit of a mortgage escrow account is that it can help you budget for your annual property taxes and insurance premiums. The funds in your escrow account are typically used to pay these expenses when they are due. This can help you avoid late fees and penalties, and make sure that these important bills are paid on time.

What Does In Escrow Mean

When you hear the phrase in escrow, it means that all items placed in the escrow account are held with an escrow agent until all conditions of the escrow arrangement have been met. The conditions usually involve receiving an appraisal, title search and approved financing.

While the earnest money is in escrow, neither you nor the seller can touch it. Once conditions are met, the earnest money will likely be applied toward the purchase price or your down payment on the home.

Recommended Reading: How Long Can I Not Pay My Mortgage

What Is Escrow Analysis

Since insurance premiums and property taxes can change over time, your mortgage lender will conduct a yearly review, called an escrow analysis, to ensure that there are enough funds in your escrow account. Your lender will analyze the amount youll need to have in your account over the next year, breaking it down by month. From there, your lender will project if youll have a shortage or an overage. Youll be informed of any changes to your account in a statement after the analysis.

How Does An Escrow Account Work With A Mortgage

After closing on your house, your lender will create a new escrow account. Each month, your lender will set aside a portion of your mortgage payment to pay your annual property taxes, home insurance premiums, and private mortgage insurance .

Understanding your escrow account in simple terms

» MORE:First Time Home Buyer Mortgage Calculator

You May Like: How Do I Find My Mortgage Interest Rate

Pros And Cons Of Escrow Accounts

The biggest advantage to an escrow account is that it takes the responsibility out of your hands. You cant forget to save money to pay your property taxes because youve been required to save money every month and send it to your mortgage servicer. You cant lose the bill and forget to pay your homeowners insurance because your servicer is doing it on your behalf.

The biggest disadvantage to an escrow account: the loss of control over the funds. While its great to put money away, the fact is youre paying bills before you need to. Maybe you have other good uses for those funds like putting them in a savings account or investing them. So youre losing out on potential gains or interest, a chance to make your money work for you, or even just have handy if an emergency arises.

Another disadvantage with escrow accounts is that, since youre not handling bills directly, you may not be aware of the individual costs. You may not notice how much youre paying for homeowners insurance, so youre less likely to shop around and get the best deal. You may not pay as much attention to how much youre paying in property taxes so you may not remember to vote against a property tax increase.

Faqs About Escrow Basics

Where can I find more information about my escrow account?

- Access your mortgage account online through Servicing Digital

- Check your annual escrow account disclosure statement mailed to you in January

Can I delete my escrow account and pay my own taxes and insurance? Does ServiSolutions pay interest on escrow?How is my monthly escrow amount determined?

- Estimate the amount well have to pay over the next 12 months for your real estate tax and homeowners insurance bills. We base this estimate on information from your loan closing documents, your taxing authority and insurance company, or your previous tax and insurance bills.

- Divide the estimated amount by 12 and add the result to your monthly payment.

- Determine whether any adjustments, such as shortage payments, are necessary to keep your escrow account in balance.

Will my monthly escrow amount ever change?It may. We conduct an escrow analysis annually to make sure were collecting the right amount to cover your projected taxes and insurance premiums. If these payments increase or decrease, well recalculate your escrow payment. This is separate from the calculation to determine whether you have a shortage or overage, so your payment amount could increase even if you pay your shortage in full.

Read Also: What’s A Normal Mortgage Interest Rate

Escrow And Real Estate

The buyer can undertake due diligence during a potential transaction by putting the funds in escrow. Escrow accounts also assure the dealer that the purchaser is perfectly able to fulfill the transaction.

An escrow account, for example, can be utilized for the selling of a home. The buyer and seller may agree to employ escrow if the sale is subject to conditions such as passing an inspection. In this situation, the property buyer places the down payment on the house in an escrow account with a third party.

The seller may proceed with the house inspections knowing the money is there and the buyer can pay. Once all of the criteria for the transaction have been met, the escrow money is transferred to the seller.

How Monthly Escrow Payments Work

The amount of escrow due each month into the impound account is based on your estimated annual property tax and insurance obligations, which may vary throughout the life of your loan. Because of this, your mortgage servicer may collect a monthly escrow payment, along with your principal and interest, and use those collected funds to pay taxes and insurance on your behalf.

Your lender will notify you 30 days before your next payment if the amount changes. You can also ask your mortgage servicer to walk you through the local impound account funding schedule that applies to your loan. If there are insufficient funds in your impound account to cover the taxes and insurance, your monthly mortgage payment may increase .

You May Like: Why Is My Credit Score Different For A Mortgage

What Are Escrow Fees

Its common for the escrow agent involved in the sale of a home to take a fee of 1 percent of the purchase price, though this percentage can vary widely depending on location.

In addition, some mortgage lenders might allow you to waive the escrow requirement and pay your insurance and tax bills directly for a fee.

What Are Warranties In Real Estate

A warranty is a promise to the buyer of a property that the seller will fix or replace any significant problems with the property. It is also called a guarantee.

The seller of the property may be required to provide a warranty under local law, or it may be offered voluntarily. Buyers need to understand what is covered by the warranty, how long it lasts, and who they need to contact if there are problems with the property.

Also Check: How Long Does It Take To Prequalify For A Mortgage

Is An Escrow Account Required For My Mortgage

Escrow accounts are pretty standard, and many lenders and loan programs require you to keep an escrow account until youhave at least 20% equity.

If you don’t want an escrow account, you should work with a lender that doesn’t require one, make a 20% down payment, or close the account once you pay off 20% of your home value.

| â Pros of an escrow account | â Cons of an escrow account |

|---|---|

| Simpler budgeting | |

| Lender-handled payments and fees | No access to escrow money |

If you donât want to worry about saving up enough money for annual taxes or insurance, an escrow account will let you make smaller monthly payments rather than handing over annual lump sums.

With an escrow account, you pay your lender a little more each month to automatically make property tax, home insurance, and fee payments for you. And if your lender makes a late payment, they’ll pay that fee as well.

Some homeowners prefer to keep more cash on hand throughout the year and then budget for annual payments themselves. So if you want more control over your money and have at least 20% equity, you can nix the escrow account.

How Mortgage Escrow Payments Are Calculated

The calculation of the monthly mortgage escrow amount is done by simply taking an estimate of what you have to pay in taxes and insurance and dividing it by 12. This is the amount that is taken from your mortgage payment each month and put into escrow. Most states also require you to have a minimum escrow balance equal to two months worth of escrow payments.

We use the word estimate because the amount you actually have to pay may be higher or lower than whats being kept in escrow. The value of your property is assessed each year, and this is used to calculate your taxes. If the taxes are higher than expected, you may have to pay more.

Conversely, if the taxes end up being lower, you may get a refund from the escrow account. If your estimated tax amount is too low, and you end up owing more than whats in the escrow account, you can typically spread the payments out over the next year.

Heres an example of a basic escrow calculation. Lets say your taxes and insurance for the year break down like this:

- Property taxes = $3,000

- The total amount is $3,000 + $1,000 + $800 = $4,800

This means your escrow amounts will look like this:

- Total escrow payments = $4,800

- Monthly escrow payment = $4,800/12 = $400

- Minimum escrow balance = $400 x 2 = $800

Recommended Reading: What Is The Current Interest Rate For A Reverse Mortgage