Factors That Determine Your Mortgage Rate

When it comes to securing the best rate possible, show your lender that you are a reliable borrower. The less risky you are as a borrower, the lower the interest rate you will likely be able to obtain. To get the best rate that you can, consider the following:

High credit score: Having a favorable credit score will show you pay your bills back on time and manage your credit responsibly, and likely correlate with a lower rate.

Larger down payment: The more skin in the game you have, the less risk an investor assumes when buying your loan.

Stable Income: A steady income, such as a salaried or full-time employment, demonstrates consistent revenue when applying for a mortgage loan and may help you get a lower rate.

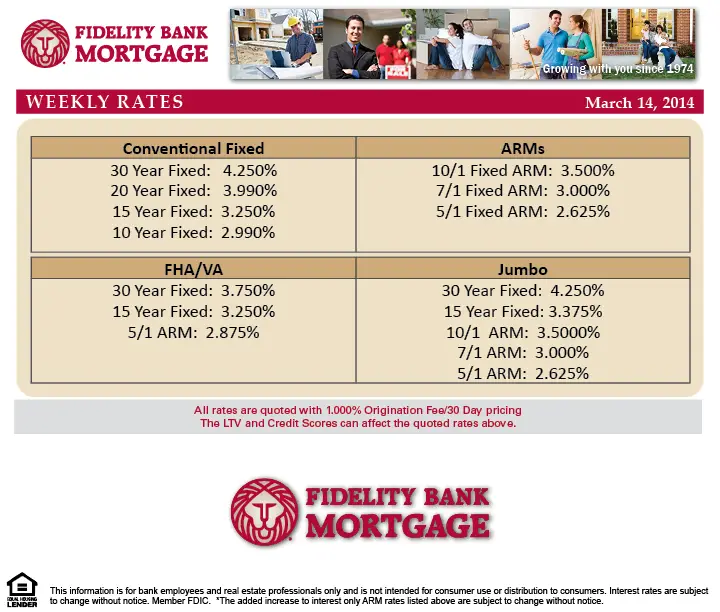

My Expanded Mortgage Rate Charts

- I created two additional mortgage rate charts that factor in the record low rates

- And the possibility of them drifting even lower over coming months and years

- The charts are more granular because rates are broken down by eighths as opposed to quarters

- Also available in 50k increments if your loan amount is closer to that

These charts can make it quick and easy to compare rate quotes from mortgage lenders, or to see the impact of a daily rate change in no time at all.

After all, mortgage rate updates can happen frequently, both daily and intraday. And rates are especially erratic at the moment.

So if you were quoted a rate of 3.5% on your 30-year fixed mortgage two weeks ago, but have now been told your home loan rate is closer to 4%, you can see what the difference in monthly payment might be, depending on your ballpark loan amount.

This is pretty important when purchasing real estate or seeking out a mortgage refinance, as a significant jump in monthly mortgage payment could mean the difference between a loan approval and a flat out denial.

Or you might be stuck buying less house. Or perhaps driving until you qualify!

Does Refinancing Hurt Your Credit

Refinancing will hurt your credit score a bit initially, but might actually help in the long run. Refinancing can significantly lower your debt amount and/or your monthly payment, and lenders like to see both of those. Your score will typically dip a few points, but it can bounce back within a few months.

Recommended Reading: Is The Payoff Amount On A Mortgage Less Than Balance

How Do Banks Make Money From Mortgage

Loans are sold to institutions such as an investment bank. When an investor buys a mortgage loan, he basically lends money to home buyers. This may interest you : Can you buy a house with a promissory note?. In return, the investor acquires the value of the mortgage, including interest and the principal payments made by the lender.

Who owns the most mortgage-backed securities?

Most mortgage support loans are provided by the Government Mortgage Association , a US government agency, or the Federal Loan Mortgage Corporation and the Federal Home Loan Mortgage Corporation , businesses that funded by the United States government. .

Why do banks issue mortgage-backed securities?

Basically, loan-backed security turns the bank into a mediator between the home buyer and the investment industry. The bank can lend to its customers and then sell it at a discount to add MBS.

How do banks make money off of mortgages?

Lenders can make money in a variety of ways, including basic fees, extension fees, discount points, closing costs, mortgage securities, and mortgage service. Lenders can also get money to pay off their mortgage loans and sell MBS.

What Is A Mortgage

A mortgage is a way of borrowing money to buy or refinance a property. These loans are generally repaid over relatively long periods, often 25 years or more, to spread out the large cost of buying a home.

- Mortgages are generally available from banks and other financial institutions, known as lenders. These lenders charge interest and sometimes other fees, on top of the amount borrowed.

- The lender will also secure or guarantee the repayment of the loan, interest and fees by placing a charge or security on the title to property. This would allow the lender to sell the property in the event that the mortgage cannot be repaid.

Also Check: What Is A Mortgage Contingency Date

What Are Mortgage Points And How Much Do They Cost

A mortgage point sometimes called a discount point is a fee you pay to lower your interest rate on your home purchase or refinance.

One discount point costs 1% of your home loan amount. For example, if you take out a mortgage for $100,000, one point will cost you $1,000. Purchasing a point means youre prepaying the interest to have a smaller monthly payment.

Points are paid at closing, so your lender will calculate the cost of any points you agree to purchase and add those charges to your other closing costs.

For each discount point you buy, your interest rate will be reduced by a set percentage point. The per-point discount youll receive varies by lender, but you can generally expect to get a .25% interest rate reduction for each point you buy. Most mortgage lenders cap the number of points you can buy. Generally, points can be purchased in increments down to eighths of a percent, or 0.125%.

For example, lets say you take out a $200,000 30-year fixed-rate mortgage at 5.125%. Your lender offers you an interest rate of 4.75% if you purchase 1.75 mortgage points. On a $200,000 loan, each point costs $2,000, which means that 1.75 points will cost $3,500.

If you choose not to buy mortgage points, your interest rate will remain at 5.125%. Over 30 years, without paying down the loan early, the cost of the loan, with interest, is $391,809.

How Does A Mortgage Work

A mortgage is a secured loan that is collateralized by the home it is financing. This means that the lender will have a lien on your home until the mortgage is paid in full. After closing, youll make monthly paymentswhich covers principal, interest, taxes and insurance. If you default on the mortgage, the bank will have the ability to foreclose on the property.

Recommended Reading: How Much Would Payments Be On A 70000 Mortgage

Is It Better To Go Fha Or Conventional

FHA loans are great for lowtoaverage credit. They allow credit scores starting at just 580 with a 3.5% down payment. … Conventional loans are often better if you have great credit, or plan to stay in the house a long time. With credit in the mid to high600s, you can get a Conventional 97 loan with just 3% down.

First How Do Rates Work

As anyone shopping for a new home or looking to refinance a home loan can tell you, it pays to lock in the lowest possible mortgage rate. Thats because a lower mortgage interest rate directly translates into smaller mortgage payments each month.

In simple terms, a mortgage is a type of home loan offered to those who wish to borrow a set amount of funds for the purchase of a piece of real estate property. These funds typically awarded to prospective buyers who either lack the cash to purchase a property outright or prefer to finance the purchase price of a home over time are secured by the property being purchased. Existing homeowners also have the opportunity to refinance a current home mortgage by taking out a new loan if they find that interest rates have fallen and that they can obtain better financing terms.

In other words, the government is a primary driving force in helping set and maintain mortgage rates in the market. Lenders tend to follow the general direction of the market, though they may also extend more favorable mortgage rates to certain home buyers at their discretion. As a rule of thumb, the higher that your mortgage interest rate, the more you can expect to pay in mortgage-related fees each month.

Several factors may impact the total interest that you can expect to pay over the life of your loan as well, including the term of the loan , your credit profile, down payment amount, and more.

Read Also: What Of Salary Should Go To Mortgage

Interest Rates Rises And Pensions

Interest rate rises can be good news for people about to buy an annuity. Annuity rates are linked to gilt yields and pay a guaranteed income for life or a fixed term. The income you receive can be locked in on the day you purchase your annuity , so current annuity rates can make a big difference to your long-term financial security.

If youre looking to buy an annuity, an interest rate rise can be very good news as it means youll get a better rate of return.

Find out more in our guide Guaranteed retirement income explained

People who have already taken out an annuity cant switch, however, you can still benefit from better interest rates by putting the money from the annuity into a savings account.

How Much Income Is Needed For A 250k Mortgage +

A $250k mortgage with a 4.5% interest rate for 30 years and a $10k down-payment will require an annual income of $63,868 to qualify for the loan. You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator. The calculator also gives a graphical representation of required income for a wider range of interest rates.

Recommended Reading: Can You Take Out Two Mortgages

When A Rise In Interest Rates May Affect You

A rise in interest rates often means that it will cost you more to borrow money.

A rise in interest rates may affect you if:

- you have a mortgage, a line of credit or other loans with variable interest rates

- youll need to renew a fixed interest rate mortgage or loan

Your financial institution could also increase your interest rate if you do not make payments on your credit card or loan.

How Much Of A Mortgage Can I Afford Based On My Salary

The amount of a mortgage you can afford based on your salary often comes down to a rule of thumb. For example, some experts say you should spend no more than 2x to 2.5x your gross annual income on a mortgage . Other rules suggest you shouldn’t spend more than 28-29% of your gross income per month on housing.

Also Check: Can You Use Mortgage Loan For Renovations

Mortgage Rates Matter Heres How Much Just A 1% Difference Could Make

Yes, size does matter when it comes to interest rates. Check out how much you could save.

When you purchase a home, the real estate listing price and down payment is only a small part of the equation. Once youve signed the dotted line, paid the closing cost and turned the key to your home, you have some new numbers to consider.

One of the smallest numbers home buyers need to understand is the interest rate and how it applies to your financial goals.

Your Own Best Interest

Its fair for consumers to question whether mortgage loan officers are acting in their best interests. A useful starting point is to ask: How are these loan officers compensated?

Loan officers typically get paid in two ways: 1. Commission, calculated as a percentage of the total loan amount 2. Incentives for selling certain financial products or reaching quotas

Both sources of compensation can create a conflict of interest. Lets think about commission. Since its a percentage of the total loan amount, the bigger the loan they sell you, the bigger the commission. This issue played itself out for years leading up to the 2008 subprime mortgage crisis. Banks and mortgage brokers aggressively pushed mortgages that borrowers couldnt afford, while loan officers got paid handsomely to intermediate. If youve seen the 2015 film The Big Short, youll be familiar with this scenario.

In the case of sales incentives, youve probably seen that Wells Fargo was ordered to pay over $185 million to resolve allegations that the banks sales quotas and incentives pushed employees to open millions of unauthorized accounts and now faces an inquiry by the U.S. Department of Justice. While this case does not involve mortgages, it clearly demonstrates the problem with sales incentives.

Read Also: How To Calculate Your Mortgage

How Much Does A 1% Difference In A Mortgage Rate Make

Homes have been flying off the market because the supply is so low and buyers greatly outnumber sellers in most markets. Many people are jumping into the market in hopes of becoming a homeowner before mortgage rates rise.

Lets say rates do rise a full 1 percent by the end of the year. How much does a 1% difference in a mortgage rate make? How about a 0.5% difference? 0.25%? 0.125%?

Before we dive in to the numbers, lets go through some basic info on mortgages.

Mortgage rates are usually offered in increments of 0.125%. You might see rates advertised as 3.96 or 3.99% APR, but the rate you be paying will probably be 3.875% or 4%. APR factors in the total cost of the loan including fees and other costs such as processing fees, underwriting fees, discount points, origination points, etc. Sometimes lenders give a credit for those fees up front if you agree to take a higher rate.

There are many different mortgage products, but the 30-year fixed is the most common. Some other common mortgages are the 15-yr fixed, 7/1 ARM , and the 5/1 ARM. In my experience as a realtor, almost all first-time homebuyers have opted for the 30-year fixed. Personally, I have two mortgages right now. One is a 30-yr fixed. The other is a 7/1 ARM. Im planning to pay the ARM off early or sell that property. ARMs are especially risky right now. Dont get one unless you know what they are.

Related: Paying Off a 30 Year Mortgage in 5 Years

Should I Lock In My Mortgage Rate Today

Locking in a rate as soon as you have an accepted offer on a house can help guarantee a competitive rate and affordable monthly payments on your home mortgage. A rate lock means that your lender will guarantee you an agreed-upon rate for typically 45 to 60 days, regardless of what happens with average rates. Locking in a competitive rate can protect the borrower from rising interest rates before closing on the mortgage

It may be tempting to wait to see if interest rates will drop lower before getting a mortgage rate lock, but this may not be necessary. Ask your lender about float-down options, which allow you to snag a lower rate if the market changes during your lock period. These usually cost a few hundred dollars.

Read Also: Can Your Mortgage Go Up

Current Mortgage Rate Trends

Through the past few years, the US experienced historically low interest rates, causing a massive boom in the housing market. Rates have been on the rise since the 4th quarter of 2021 due to higher inflation in the economy. Interest rates for homes typically follow inflation. When it goes up, so do interest rates. When it comes down, thats when home loan rates typically fall as well.

Mortgage Required Income Calculator

The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit a mortgage payment plus your other debts to a certain percentage of your monthly income, which can be approximately 41%.

The amount a borrower agrees to repay, as set forth in the loan contract.

Also Check: How To Learn Mortgage Loan Processing

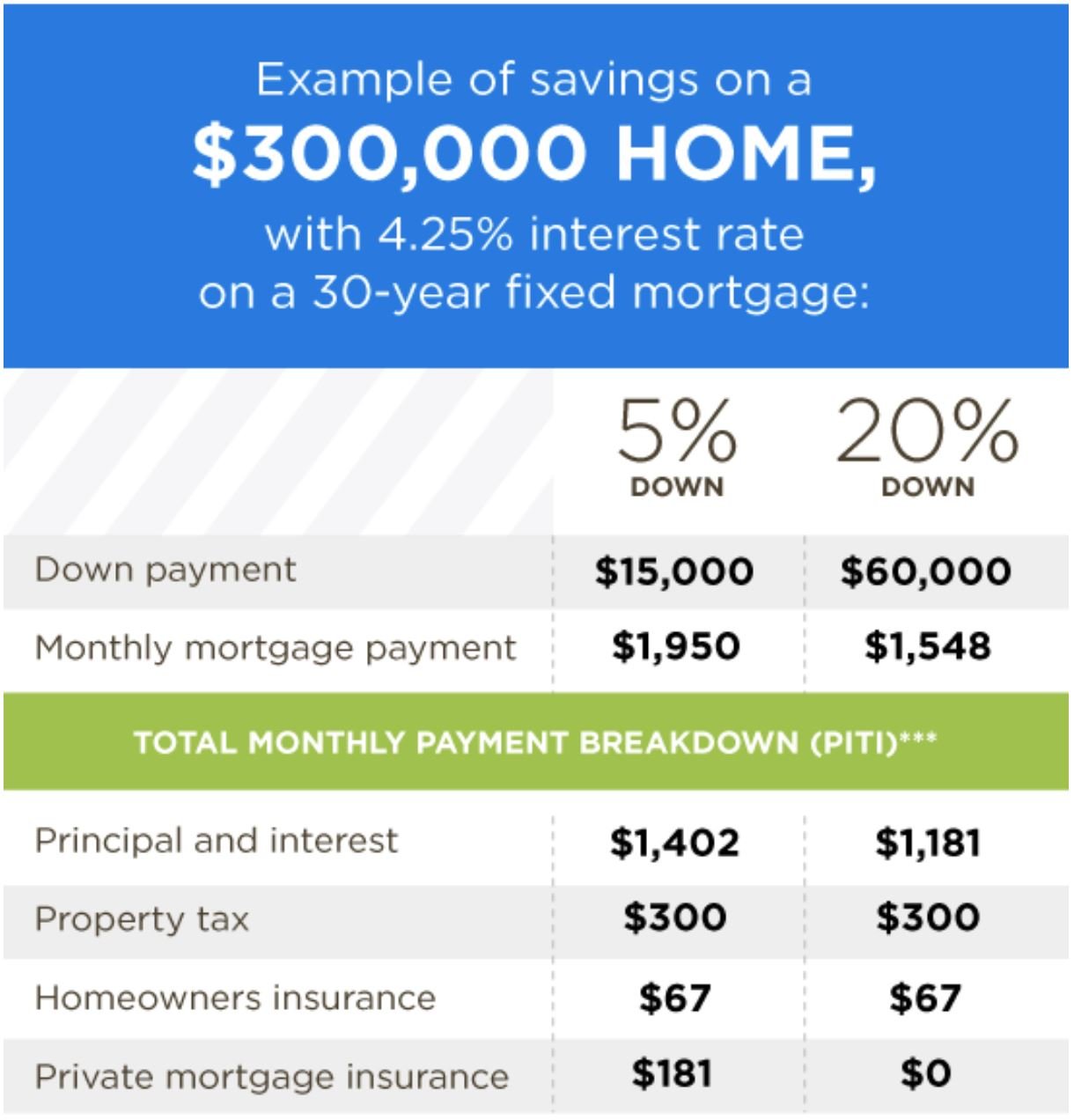

Be Sure To Look At The Big Picture

- Most advertised mortgage payments only include principal and interest

- There is a lot more that goes into a monthly housing payment

- Including property taxes, homeowners insurance, HOA dues, PMI, and so on

- Dont buy more home than you can afford without considering all of these items

Lastly, note that my mortgage payment graphs only list the principal and interest portion of the loan payment.

You may also be subject to paying mortgage insurance and/or impounds each month. Property taxes and homeowners insurance are also NOT included.

Youll probably look at this chart and say, Hey, I can get a much bigger mortgage than I thought.

But beware, once all the other costs are factored in, your DTI ratio will probably come under attack, so tread cautiously.

And dont forget all the maintenance and utilities that go into homeownership. Once you hire a gardener, pool guy, and run your A/C and/or heater nonstop, the costs might spiral out of control.

I referenced this problem in another post that focused on if mortgage calculators were accurate, in which I found that housing payments are often greatly underestimated.

So you might want to drop your loan amount by $100,000 if you think you can just get by, as those other costs will certainly play a role.

And with the housing market so competitive today, you may want to lower your max purchase price in apps like Redfin and Zillow too, knowing the final sales price will likely be above asking.

Is Mortgage Banking A Good Career

Mortgage lenders generally make good money. Though some are on a flat salary, most make the bulk of their income on commissions. The low end hovers around $35,000 annually, while median pay is about $60,000. … If you have the right temperament for the job, mortgage lending can be an incredibly rewarding career path.

Read Also: What Is A Mortgage Loan Number