Submitting The File To The Underwriter

How To Become A Mortgage Loan Officer: The Definitive Guide

Are you interested in learning about how to become a mortgage officer? Known in the industry as a mortgage loan originator, or MLO, these professionals play a key part in the process of helping buyers find homes that are right for them typically, they are the primary contact person when a borrower completes a mortgage transaction.

More specifically, they help buyers find home loans that are right for them mortgages that fit their budget and will allow them to stay in the homes they purchase for the long term.

MLOs do all of the following:

- Identify potential homebuyers through advertising, connections, seminars, and other means

- Compile all the borrower information necessary for a loan application

- Present borrowers with loan options that make sense for them

- Keep accurate, thorough records on mortgage transactions

- Coordinate with other mortgage professionals like underwriters and appraisers

Not only do MLOs support homebuyers, they serve a vital function in the real estate industry. With responsible MLOs, mortgage fraud and foreclosures drop significantly. Great MLOs are on the front lines in maintaining a stable home-buying market.

Many people find this to be an attractive career path. Mortgage loan officer is listed #14 in U.S. News & World Reports rankings for business jobs. The median salary for the position is $64,660 and it doesnt require any graduate-level education.

You May Like: What Was The Mortgage Interest Rate In 2017

What Is A Mortgage Loan Processor

A mortgage processor, also known as a mortgage loan originator or loan processor, sets up the borrower with the proper documents for the loan program they want to use. They guide the borrower through the first step of loan processing. Once the paperwork is finalized, the mortgage processor then passes it through to the underwriter.

Read Also: Can I Borrow Extra On My Mortgage For Furniture

Loan Processor Vs Loan Officer

A mortgage loan officer and a mortgage processor are often confused for the same position. However, its important to understand that they hold separate responsibilities in the loan application process. A mortgage loan officer is a licensed mortgage expert who helps navigate the borrower through the loan application process.

The loan officer will recommend the type of mortgage loan program that fits the borrowers financial needs. Once the borrower decides on the loan terms, type and size, the information goes to the mortgage processor, who then files the paperwork.

Basically, a mortgage processor acts as the go-between between the loan officer and the underwriter.

These three key positions work together when pushing a mortgage loan request through, each with a unique set of responsibilities.

Choosing The Right Mortgage Lender

As you likely expect, the steps of the mortgage loan process can be lengthy and feel cumbersome. Its not surprising considering everything at stake. But the reality is that when you choose the right lender, what may seem complicated is actually quite simple.

When you work with American Financings mortgage consultants, you receive guidance every step of the way. So your questions are answered, you have a clear understanding of what is due when, and most importantly, your financial goals are met.

Let’s talk if you’re ready to become a homeowner or start saving money on your mortgage. You can schedule an appointment for a free mortgage review or begin the process online with our fast and easy digital mortgage.

Recommended Reading: What Are Current Mortgage Rates

Confidently Navigate This Process

The process of buying your first home is more manageable if you take steps to prepare for the purchase . Once first-time buyers get to the stage of applying for a mortgage loan, itâs important to be well-informed. These tips can help you navigate the mortgage loan application process.

Consider shopping for your mortgage loan firstâ¦before you find your house

Knowing your loan options before you start looking at houses will help you in your home search by providing the amount a lender will loan you to buy a house. This information will help you target homes in a price range you can afford. When you find a lender and mortgage thatâs right for your situation, you can get a preapproval for the loan, which will save time later when youâre ready to make an offer on a house, since lenders will have most of the information they need to move forward with the loan.

Find the mortgage that works best for you

There are many different types of mortgages to choose from, and an important aspect of the process is to choose the mortgage that works for you now and in the future. When shopping for a mortgage, consider the type of interest rate and whether a conventional loan or a government-guaranteed or insured loan is best for you.

Rates

Loan types

For suggestions on how to save money with worksheets to help you plan to save visit: Money Smart Your Savings.

Loan estimate

Moving forward with the loan

Closing the loan

Additional resources

Apply For Mortgage Pre

Most sellers in Montana will require pre-approval before showing you their home. To get pre-approved for a mortgage, all you need to do is fill out an application and provide some financial details.

From there, youll get a peek at your mortgage pre-approval amount and can receive a pre-approval letter. A pre-approval letter lets sellers know you are financially able to make an offer on their home.

Factors that determine your pre-approval amount:

- Total Income: You want to aim for your monthly housing costs to be under 30% of your total monthly income. This lets lenders know you earn enough to make consistent mortgage payments.

- Personal Debt:We mentioned needing to calculate your DTI earlier. If you dont already have that number, lenders will consider your credit card, student loan, and other types of debt and divide it by your total income to measure this.

- Cash Reserves: Again, this falls under the category of assets and accounts. Lenders will want to know you have enough money in the bank to cover the down payment and closing costs without going broke.

You May Like: How Much To Buy Mortgage Points

Finalizing Your Mortgage Loan:

After you have got a purchasing agreement from the seller, it is time for you to apply for the loan finally and get it finalized. Complete all the paperwork that is required. However, there wont be much paperwork for you because you have already done most of it in the preapproval process. Submit all the documents whatever the lender may need to close the loan.

Also Check: What Will Mortgage Rates Do Next Week

Complete Inspections And Appraisals

This part of the homebuying process allows you to better evaluate the condition of the house before officially purchasing it. After this step, you may be able to renegotiate the terms of your contract with the seller.

Inspections

An inspection is when a licensed professional comes and evaluates the home for any potential issues. In Montana, your inspector should check the roof, foundation, electrical system, HVAC system, and plumbing of your future home. However, a septic inspection may have to be done separately.

While its not a requirement in Montana, its recommended that buyers complete radon testing and termite inspection before purchasing a home. Investing in some of these more niche inspections can possibly save you quite a bit of money and avoid a huge headache in the future.

Appraisals

Your lender will hire an appraiser to examine the home and determine how much its valued at. This is to ensure the house is worth the money being loaned to you.

Should the appraisal come back lower than expected, you might have to renegotiate the price with the seller or possibly fork over a larger down payment.

Don’t Miss: Can I Get A Mortgage Without A Full Time Job

Mortgage Lender Training For California

California Bureau of Real Estate1651 Exposition Blvd.

California Department of Financial Protection and InnovationOne Sansome St, Suite 600San Francisco, CA 94104-4428

To register for a California NMLS licensing class phone 415-587-5435 or 650-294-8750

California Mortgage Loan Officers can be licensed through either The California Bureau of Real Estate or The California Department of Financial Protection and Innovation Both agencies require the national 20-hour class. Department of Financial Protection and Innovation regulated loan officers require 2 hours of CA state law.

All states require a national exam for licensing. California does not require an additional state test, requires 2 hours of CA state law for those that are currently NMLS-licensed elsewhere, and requires 8 hours of continuing education annually for NMLS-licensed mortgage loan officers, 1 of which must be state law.

Dont Miss: Can You Get A Mortgage Loan On Unemployment

Finalize Your Choice For Your Mortgage Lender

Once your offer is accepted on a new home, you can move forward and choose a mortgage lender. Its best practice to shop around with at least a couple different lenders to find the best interest rates and fees for your specific loan.

Keep in mind that your interest rate depends on your mortgage application and also the type of loan you are applying for. For example: Department of Veterans Affairs loan mortgage rates are usually better than average conventional mortgage rates while Federal Housing Administration loans tend to have more competitive rates. Its important to ask mortgage lenders any questions you have regarding this to make sure you understand what they are offering.

Don’t Miss: Is Mortgage Interest Rate Going Up Or Down

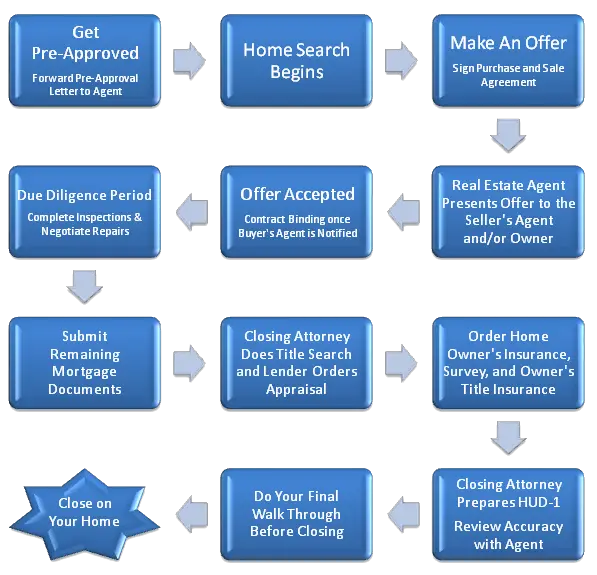

Understanding The Mortgage Loan Process

When looking to purchase a home, navigating the mortgage process can be stressful and confusing, especially if youre a first-time home buyer. Its helpful to know what you can expect as you enter into the mortgage process. Lets explain some of the essential steps youll need to take in order to obtain your new home loan.

Submit Your Mortgage Application

After youve selected what mortgage lender youre going to work with, its time to completely fill out a mortgage application. Once youve submitted all of the necessary documents to complete your application, youll get a loan estimate in a couple days that will disclose the terms, rates, and fees of your home loan.

Also Check: How Do You Work Out Monthly Mortgage Payments

How To Mortgage Loan Originators & Real Estate Agents Work Together

While mortgage loan originators and real estate agents have different roles, they both work to educate the client and help them buy the house of their dreams. Throughout the mortgage process, realtors will likely be communicating with the mortgage loan originators on behalf of the client.

They will be checking on the status of the loan, facilitating back and forth questions, and keeping the clients from experiencing a lot of stress. Mortgage loan originators and real estate agents are resources for borrowers, during both pre-closing and post-closing.

For this reason, they need to be familiar with each others roles so they can support each other throughout the process. At the end of the day, both parties want the home seeker to find a home they like and that they can afford and receive a home loan for.

Do You Need A License To Be A Mortgage Processor

Yes, you need a license to be a mortgage processor. Most employers require it, although it varies on which one they may ask you to complete.

For example, there is the Certified Master Loan Processor through the National Association of Mortgage Processors . On the website, it states that this certification is best for entry-level processors who want to advance their careers. It has seven online training classes and an exam, costing $1,495.

Recommended Reading: Will Mortgage Rates Continue To Drop

Advanced Mortgage Loan Processor: Essential Skills Training

- Learn how to calculate a salaried borrowers income.

- Learn how to read and understand an appraisal and how property values are obtained.

- Become a pro at locking rates and understanding how rates affect a loans approval.

- Develop a deeper knowledge of verifications of employment to get more loans approved.

- Learn how to become more valuable as a processor by completing more of the necessary task to close more loans.

- Read and know what to request on a homeowners declaration page to get more loans closed.

- Understand the importance of a survey and when it should be ordered and by who.

- Learn how to obtain invoices for third party fees so that you loan is compliant and the lenders clears your loan to close.

The 8 Steps To Buying A House In Montana

Whether youre a first-time homebuyer or are looking to purchase an additional property, knowing the steps to buying a house in Montana will help you show up prepared. Here, we discuss the eight steps to buying a home in Montana.

| Documents for the sale of any assets | |

| Divorce decrees or child support decisions | Verification of gift funds deposited into your account |

| Six months of legal documentation of alimony or child support received |

Proof of Income

You must verify your income with your lender. Often, they will require at least two years of financial documentation. This way, they can ensure that your finances are stable and not at risk of encountering trouble in the near future.

Types of proof of income lenders look for:

- At least two years of tax forms most likely just federal, but bring your state taxes too, just in case.

- Two of your most recent W-2s and pay stubs.

- If youre self-employed, theyll need either 1099 forms or profit and loss statements.

- Legal documentation that confirms youll continue to receive any alimony or child support for at least the next three years.

- If youve been receiving alimony, child support, or any other type of income, youll need to provide documentation of this income for the past six months.

As stated earlier, your credit score plays a vital role in securing you a home loan. Your lender will need your permission to view your credit report they will ask for either verbal or written permission.

Proof of Assets and Liabilities

You May Like: Will Applying For A Mortgage Affect My Credit

Choose A Mortgage Lender

Now that youve found a home and your offer has been accepted, its time to make a final decision about your lender.

You can stick with the lender you used during the pre-approval process or you can choose another lender. Its always a good idea to shop around with at least three different lenders.

When shopping for a mortgage, remember your rate doesnt depend on your application alone. It also depends on the type of loan you get.

Of the four major loan programs, VA mortgage rates are often the cheapest, typically beating conventional mortgage rates. USDA and FHA loan rates also look low at face value, but remember these loans come with obligatory mortgage insurance that will increase your monthly mortgage payment. Conventional loans also have PMI, but only if you put less than 20% down.

So look at a few different lenders rates and fees, but also ask what types of loans you qualify for.

There may be much better deals available than what you see advertised online, especially if youre a veteran who qualifies for the VA home loan program.

Dont Miss: What Is Needed For A Mortgage Loan

How To Learn Mortgage Loan Processing

When someone applies for a loan application, their information and application get sent to a loan processor. The loan processor is responsible for processing mortgage applications and getting them prepared for the mortgage underwriter. The loan processor gathers all the necessary documentation required to receive the loan, including employment verification, bank statements, monthly bills and other income information, if applicable. They then organize the information in the customers file so the underwriter can locate the information quickly. Other duties include:

- Collecting and organizing the required documentation and place it in a file for submission to the underwriter

- Making sure all conditions are satisfied with the underwriter

- Communicating with the title company, county clerk, attorneys or other professionals as required

- Making sure the approval is within lending guidelines

Recommended Reading: How To Pay Your Mortgage Quicker

Become A Mortgage Loan Processor

- You will be able to understand how mortgage processing works

- You will be able to start working as a mortgage loan processor

- You will be able to prepare and submit a loan package to underwriting for approval

- You will learn how to review specific documents including a 1003 and disclosures

- You will learn how to become a contract processor as well as a salaried processor

- You will understand how to prepare a loan package for auditing

- You will be able to complete compliance checks and know exactly what needs to be in each file

- You will learn how to view and make changes on Calyx Point

- You will learn how to submit a loan on a lenders website