How Are Mortgage Points Factored Into Advertised Rates

Whether you find a rate on a mortgage lenders website or through a third party, the mortgage rates you see advertised might or might not include points. One rate might even seem attractively low, but that could be due to points already factored in that you might not want to pay. On Bankrate, we specify whether advertised mortgage rates include points so you can make a fair comparison between lenders.

What Is The Breakeven Point

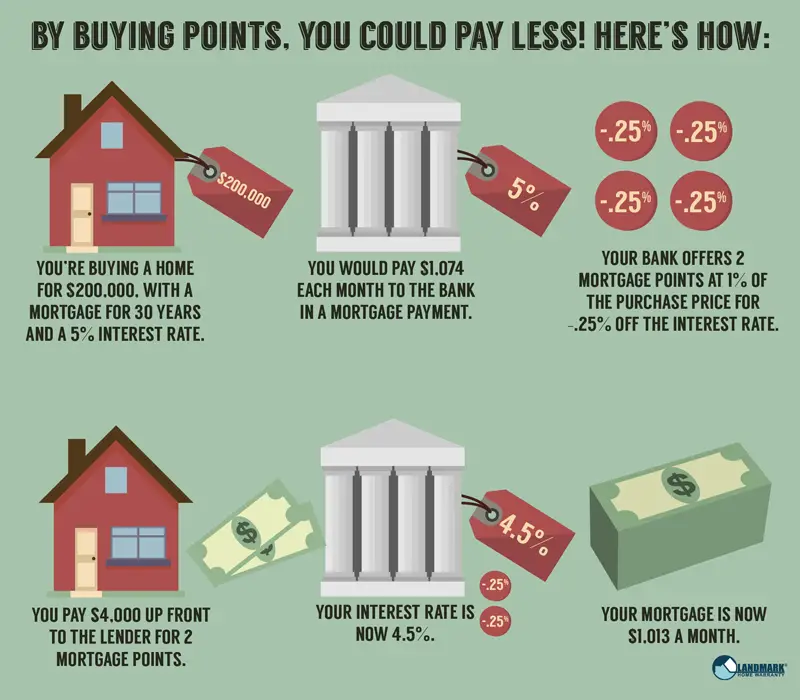

To calculate the breakeven point at which this borrower will recover what was spent on prepaid interest, divide the cost of the mortgage points by the amount the reduced rate saves each month:

$4,000 / $56 = 71 months

This shows that the borrower would have to stay in the home 71 months, or almost six years, to recover the cost of the discount points.

The added cost of mortgage points to lower your interest rate makes sense if you plan to keep the home for a long period of time, says Jackie Boies, a senior director of Partner Relations for Money Management International, a nonprofit debt counseling organization based in Sugar Land, Texas. If not, the likelihood of recouping this cost is slim.

You can use Bankrates mortgage points calculator and amortization calculator to figure out whether buying mortgage points will save you money.

Can I Lower My Monthly Payment

There are a few ways to lower your monthly payment. Our mortgage payment calculator can help you understand if one of them will work for you:

-

Increase the term of the loan. The longer you take to pay off the loan, the smaller each monthly mortgage payment will be. The downside is that youll pay more interest over the life of the loan.

-

Get to the point where you can cancel your mortgage insurance. Many lenders require you to carry mortgage insurance if you put less than 20% down. This is another charge that gets added to your monthly mortgage payment. You can usually cancel mortgage insurance when your remaining balance is less than 80% of your homes value. However, FHA loans can require mortgage insurance for the life of a loan.

Look for a lower interest rate. You can think about refinancing or shop around for other loan offers to make sure youre getting the lowest interest rate possible.

Read Also: How Much Should You Pay A Mortgage Broker

Recommended Reading: How Much Of Your Monthly Income For Mortgage

How To Shop For Loans With Mortgage Discount Points

Heres an example. Say one national lender offers a 30-year fixed-rate mortgage at 4.5% with no points. You can knock 0.25% off that and get 4.25% by paying half a discount point.

But a 4.125% rate costs an additional point. Paying more doesnt necessarily get you a better deal.

When shopping for a mortgage with discount points, the easiest way to compare offers is to decide how much you want to spend, then see who offers the lowest rate at that price.

Alternatively, you can decide what mortgage interest rate you want, and see which lender charges the least for it.

Mortgage Points Vs Origination Fees

As mentioned above, mortgage points are tax deductible. Loan origination fees are not.

Loan origination fees can be expressed in Dollar terms or as points. A $200,000 loan might cost $3,000 to originate & process. This can be expressed either in Dollars or as 1.5 origination points.

Origination fees are negotiable but they help a lender cover their basic overhead & mitigate the risk a consumer may pre-pay their mortgage before the overhead is covered. On conforming mortgages this fee typically runs somewhere between $750 to $,1200.

These fees are typically incremented by half-percent. The most common fee is 1%, though the maximum loan origination fee is 3% on Qualified Mortgages of $100,000 or more.

- Smaller homes may see a higher origination fee on a percentage basis since the mortgage broker will need to do a similar amount of work for a smaller loan amount. On loans of $60,000 or below the cap can be as high as 5%.

- VA loans have a 1% cap on origination fees.

- FHA reverse mortgages can charge a maximum of the greater of $2,500, or 2% of the maximum mortgage claim amount of $200,000 & 1% of any amount above that.

Recommended Reading: How To Find The Cheapest Mortgage Rates

How Mortgage Points Differ From Mortgage Origination Points

You might have also heard the term mortgage origination points. This refers to the origination fees paid to your mortgage lender for the processing and assessment of your loan. Sometimes you can negotiate these charges with your loan officer, depending on your credit score and down payment. However, these points will not lower your interest rate.

Do Mortgage Points Affect Taxes

Mortgage points may be tax deductible as home mortgage interestbut that still doesnt make them worth buying. In order to qualify, the loan must meet a slew of qualifications on a lengthy list of bullet points, all of which are determined by the IRS.

If youve already bought mortgage points, check with a tax advisor to make sure you qualify to receive those tax benefits.

Read Also: What Is A Conversion Mortgage

Should I Pay For Points On My Mortgage

If you cant afford to make sizable upfront payments at the closing of your mortgage application, you may want to keep the current interest rate and refinance your mortgage at a later date. Refinancing a mortgage is basically taking out a new loan to pay off your first mortgage, but you shop for a better interest rate and terms on the new one. This makes sense if youve made timely payments on your old mortgage, have paid off a decent amount of your principal, and improved your credit score since you first obtained the initial mortgage.

If youve got some money in your reserves and can afford it, buying mortgage points may be a worthwhile investment. In general, buying mortgage points is most beneficial when you both intend to stay in your home for a long period of time and can afford mortgage point payments.

If this is the case for you, it helps to first crunch the numbers to see if mortgage points are truly worth it. A financial advisor can help you through this process if you dont know where to start.

Student Loan Interest Paid In A Lifetime: $599407

The average public university student borrows $30,030 to attain a bachelors degree. Because average interest rates vary widely depending on the type of student loan you have, we used federal loan data since these loans make up about 92% of all student loans.

For the purposes of our calculation, we used this years fixed federal interest rate for direct subsidized and unsubsidized loans for undergraduate students, which was 3.73%.

At this rate, using Bankrates student loan calculator, we found that the average student loan borrower on a standard 10-year repayment plan will pay $5,994.07 in interest alone over the course of 10 years.

Don’t Miss: Can I Refinance My 2nd Mortgage

Mortgage Points: Frequently Asked Questions

1. Is it possible to deduct mortgage points from your taxes?

Your points may be tax-deductible because they are considered prepaid interest. However, there are some restrictions, so consult the IRS. For example, youll be required to itemize your deductions. If you can deduct all of your mortgage interest, you may also be able to deduct all of the points paid.

2. Is there a limit to the number of points one can buy?

While there is no formal limit on how many points you can acquire, federal and state laws limit how much you can spend on closing costs. As a result, most lenders will not allow you to buy more than 4 points.

How We Got Here

To use the Should I buy points? mortgage calculator, type your information into these fields:

-

Desired loan amount

-

Interest rate without points

-

Number of points

-

Interest rate with points This shows what your rate would be if you paid for points. In general, lenders drop the interest rate by a quarter of a percentage point for each point purchased, up to a limit. But maybe a lender has offered you a rate thats different for buying this number of points. If so, type in that rate to ensure the accuracy of your results.

Read Also: How Much Should You Budget For Mortgage

Fixed Interest Rate Mortgage

Fixed interest rates stay the same for your entire term. They are usually higher than variable interest rates.

A fixed interest rate mortgage may be better for you if you want to:

- keep your payments the same over the term of your mortgage

- know in advance how much principal youll pay by the end of your term

- keep your interest rate the same because you think market interest rates will go up

How Discount Points Affect A $400000 30

Number of PointsCost of PointsInterest RateMonthly Principal and Interest PaymentTotal Savings After 30 YearsBreak-Even Point

Zero points$0-4.5%$2,027$0NA

1 point $4,0004.25%$1,968-$17,228-68 months

2 points$8,000-4%$1,910$34,04769 months

3 points$12,0003.75%-$1,852-$50,92569 months

Disclaimer: The purpose of this table is to show how mortgage points function in general. It is not meant for financial advice or to calculate the actual costs of a particular mortgage.

Comparing mortgage costs can also be as simple as looking at the annual percentage rate of a loan. The annual percentage rate is a calculation that takes into account the loans interest rate, discount points, and other lender fees.

Read Also: Will Mortgage Rates Continue To Drop

Should You Pay For Mortgage Points

It seems odd to say, but buying mortgage points to lower your interest rate could actually be a complete rip off. Say what? How can a lower interest rate be a bad deal?

For starters, it could be years before you really save any money on interest because of your mortgage points. To see what this would look like, youd first need to calculate whats known as your break-even point.

Mortgage Interest Payment Calculator Tools

One way to find out how much interest youll owe in a given month, over the life of the mortgage or during other time periods is to use a mortgage interest payment calculator, such as the mortgage and interest calculator provided byNerdwallet. These are computer programs that you can find on numerous financial news and information sites. Some mortgage lenders may also provide one on their websites.

To use one of these tools, follow the instructions to enter your current mortgage principal amount and annual interest rate. Find these numbers in your mortgage documentation. Then, follow the instructions to calculate your monthly, annual or lifetime interest payments.

If youre putting any confidential information into a mortgage amortization calculator, make sure that you trust the organization running it and that youre confident that you dont have any malware on your device. Only enter the data in a secure place where nobody is looking over your shoulder.

You May Like: Are Current Mortgage Rates Good

Mortgage Points: What Are They And Are They Worth It

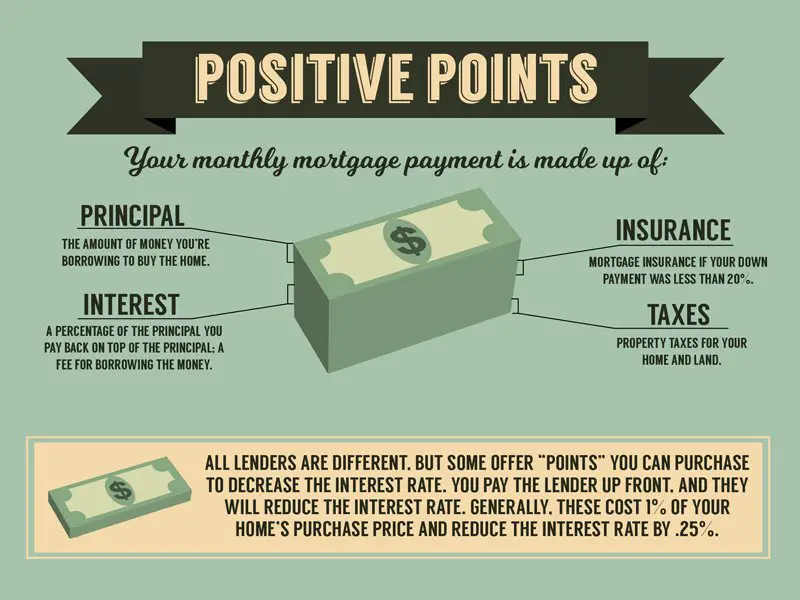

Mortgage points can lower the interest rate you pay on your mortgage loan, as well as your monthly payment.

Edited byChris JenningsUpdated October 29, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. By refinancing your mortgage, total finance charges may be higher over the life of the loan. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

Mortgage points, also called discount points, are an option for homebuyers looking for the lowest interest rate on their loan. They offer a trade-off: Pay an extra fee at closing and get a lower rate over the course of your loan term.

Heres what you need to know about mortgage points:

How To Lower Your Monthly Mortgage Payment

If the monthly payment youre seeing in our calculator looks a bit out of reach, you can try some tactics to reduce the hit. Play with a few of these variables:

- Choose a longer loan. With a longer term, your payment will be lower .

- Spend less on the home. Borrowing less translates to a smaller monthly mortgage payment.

- Avoid PMI. A down payment of 20 percent or more gets you off the hook for private mortgage insurance .

- Shop for a lower interest rate. Be aware, though, that some super-low rates require you to pay points, an upfront cost.

- Make a bigger down payment. This is another way to reduce the size of the loan.

Read Also: What Is An Investment Mortgage

Don’t Miss: Can You Split Your Mortgage Payment

How Do Mortgage Points Work

Mortgage points, also known as discount points, are a form of prepaid interest. You can choose to pay a percentage of the interest up front to lower your interest rate and monthly payment. A mortgage point is equal to 1 percent of your total loan amount. For example, on a $100,000 loan, one point would be $1,000. Learn more about what mortgage points are and determine whether buying points is a good option for you.

Estimated monthly payment and APR example: A $225,000 loan amount with a 30-year term at an interest rate of 3.875% with a down payment of 20% would result in an estimated principal and interest monthly payment of $1,058.04 over the full term of the loan with an Annual Percentage Rate of 3.946%.1

What Are Todays Interest Rates

Current mortgage rates depend, in part, on what home buyers are willing to pay for a home loan. In general, higher interest rates go to those who pay less.

And remember, the lowest rate isnt always the best deal. A good loan officer should be able to help you sort through your home-purchase options and choose the lowest-cost program for your needs.

Don’t Miss: How To Know If I Should Refinance My Mortgage

When Should You Pay Points On A Mortgage

Mortgage points are fees that you pay your mortgage lender upfront in order to reduce the interest rate on your loan and, in turn, your monthly payments. A single mortgage point equals 1% of your mortgage amount. So if you take out a $200,000 mortgage, a point is equal to $2,000. By doing this, youll pay more now, but youll be reducing your long-term costs. Like any financial decision, this isnt necessarily a good move for everyone, though. As you decide if paying for mortgage points makes sense for you, speak with a local financial advisor about how a home loan can affect your financial plan.

Can You Negotiate Points On A Mortgage

You can decide whether or not to pay points on a mortgage based on whether this strategy makes sense for your specific situation. Once you get a quote from a lender, run the numbers to see if its worth paying points to lower the rate for the length of your loan.

Sometimes, origination points can also be negotiated. Homebuyers who put 20 percent down and have strong credit have the most negotiating power, says Boies.

A terrific credit score and excellent income will put you in the best position, Boies says, noting that lenders can reduce origination points to entice the most qualified borrowers.

Recommended Reading: Do Multiple Mortgage Applications Hurt Credit

About Negative Points And Fractional Points

Negative discount points are an option a lender may offer to reduce closing costs. They work just opposite of positive discount points instead of paying money to receive a lower rate, you are essentially given money in return for a higher rate.

These are often a feature of “no closing cost” mortgages, where the borrower accepts a higher rate in return for not having to pay closing costs up front. This Mortgage Points Calculator allows you to use either positive or negative discount points.

Fractional points are commonly used by lenders to round off a rate to a standard figure, such as 4.75 percent, rather than something like 4.813 percent. Mortgage rates are typically priced in steps of one-eighth of a percent, like 4.5, 4.625, 4.75, 4.875 percent, etc., but the actual pricing is more precise than that. So lenders may charge or credit a fractional point, like 0.413 points or 1.274 points to produce a conventional figure for the mortgage rate.

When Paying Points Is Worth It

When you buy discount points, you decrease your monthly payment, but you increase the upfront cost of your loan. Due to the difference in monthly payments, it usually takes between five and 10 years to recoup the upfront cost of discount points.

Instead of buying points, many borrowers instead choose to make larger down payments in order to build equity in their homes quicker and pay off their mortgages early, another way to save money on interest payments.

Still, in some cases, buying points may be worthwhile, including when:

- You need to lower your monthly interest cost to make a mortgage more affordable

- Your credit score doesnât qualify you for the lowest rates available

- You have extra money to put down and want the upfront tax deduction

- You plan to keep your home for a long time, so you may recoup the cost

Of course, this really only applies to discount points. Origination points, on the other hand, are closing costs paid to a lender in order to secure a loan. While these fees are sometimes negotiable, borrowers usually have no choice about whether to pay them in order to secure a loan.

You May Like: How Do I Qualify For A Zero Down Mortgage

Are Mortgage Points Tax Deductible

Mortgage points may be tax-deductible as mortgage interest on your primary residence if you meet the IRS requirements. First off, youll need to itemize your taxes, which is less common since the standard deduction was increased for 2022. Unless all of your deductions are greater than the standard deduction, you wont have any tax savings from paying discount points.

As with anything related to your taxes, its a good idea to consult with a tax advisor to ensure that you are taking advantage of every deduction available to you and properly documenting everything.