To Access Your Equity

If you want to access funds from the equity in your home, consider a cash-out refinance. With this type of refinance, you borrow more than you owe on your existing mortgage and take the difference in cash. You can then use the money for any purpose, like renovating your home or paying off high-interest debt.

Keep in mind, though, that this type of refinancing may come with higher interest rates, as one of our reviewers from California notes.

Td Offers A Range Of Mortgage Choices

If mortgage interest rates have gone down or you want to tap some of the equity in your home, TD Mortgages offer you a range of options. Open or closed, fixed rate or variable interest rate, with a range of amortization choices, a TD Mortgage Specialist will be happy to help you choose the mortgage thats right for you.

How Can I Lower My Refinancing Costs

Focus on improving your credit score and debt-to-income ratio before refinancing your mortgage. Youll be in a strong position for negotiation to get the best possible rate. Its worth asking if you can waive the appraisal fee, which could save you hundreds.

If a property has been appraised fairly recently and prices have not significantly changed, your mortgage lender might be able to waive a new appraisal. Also, dont hesitate to comparison shop to find discounted third-party fees.

You May Like: How To Pay Mortgage Online Rbc

Its Becoming Increasingly Common How To Refinance Your Home And Spend $0 At Closing To Do It

- Resize icon

With some mortgage refi rates below 3%, many people are likely pondering a refi, but wonder: Can you refinance your home without any money coming out of your pocket at the closing? The short answer is yes, but you will end up paying those closing costs down the road.

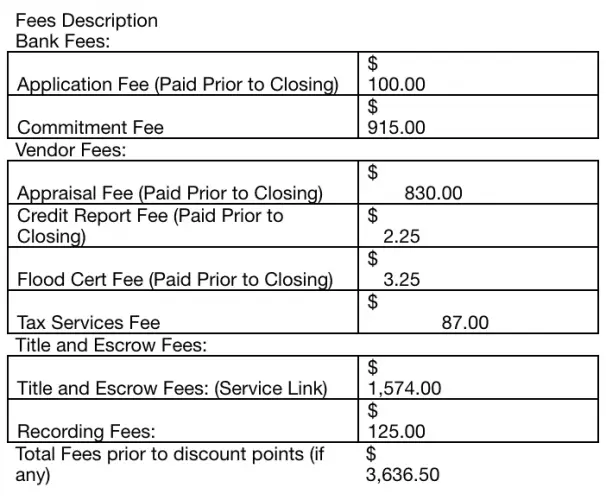

Closing costs associated with refinances tend to run about 2-5% of the total principal amount that you owe, and the average closing costs on a refi are upwards of $5,700, according to data from fintech firm ClosingCorp. Closing costs are generally made up of a variety of fees ranging from an origination fee, which the lender charges upfront to process the loan application an appraisal fee title search credit report fee and more. Needless to say, coming up with an out-of-pocket lump sum might make obtaining a refinance difficult for some people which is why a no-closing-cost refinance can be a helpful option.

But in some cases, those fees can be rolled into the loan in whats called a no-closing-cost refinance meaning borrowers dont have to pay anything upfront out-of-pocket to refinance. Of course, no-closing-cost refinances dont mean a borrower is off the hook for all expenses, instead theyre just transferred to the principal or exchanged for a higher interest rate.

Pros and cons of a no-closing cost refinance

Can a no-closing cost refinance save me money?

Also Check: Reverse Mortgage Mobile Home

How Much Does It Cost To Refinance My Mortgage

Refinancing a mortgage is a good way to lower your monthly payments, and given that today’s refinance rates are sitting near record lows, it could be a good time to get a new home loan. But there are closing costs involved in refinancing. Here’s what you need to know.

Jump To

Don’t Miss: Is My Homeowners Insurance Included In My Mortgage

Refinancing Can Cost Big Bucks But There Are Ways To Save

Lindsay VanSomeren is a credit card, banking, and credit expert whose articles provide readers with in-depth research and actionable takeaways that can help consumers make sound decisions about financial products. Her work has appeared on prominent financial sites such as Forbes Advisor and Northwestern Mutual.

But here’s what the lenders aren’t so quick to say: Refinancing can be costly. It can cost between 3% and 6% of your remaining mortgage balance. Refinancing costs are made up of several different fees youll pay at different points in the process, but you may be able to shop around to save money. Here’s how much refinancing could cost you.

Can You Negotiate Closing Costs On A Refinance

As mentioned above, there’s no way of getting around certain mortgage refinance fees such as appraisal fees and credit report charges. But it is possible to negotiate closing costs on such a loan. In fact, many borrowers who don’t have a large down payment saved choose to waive their closing costs.

You’ll still be responsible for these costs just not at the time of closing. So if you opt for a no-closing cost refinance, know that you’re probably looking at a slightly higher interest rate. Ask your lender how much it would cost you in the long run to roll these funds into your loan.

Read Also: How Much Mortgage Can I Get On 50k Salary

S To Lower Your Refinance Costs

STEP 1: Improve your credit score. A of at least 740 will typically get you the lowest rate and costs and may even make the refinance approval process easier. To boost your score, pay your bills on time, pay down or pay off your credit card balances and dispute any credit report errors you find.

STEP 2: Shop around with multiple lenders. You wont know whether youre getting the best refinance deal if you dont comparison shop. Apply for a loan with three to five lenders and compare their refinance fees.

STEP 3: Negotiate your refi costs. Dont be afraid to ask for a better deal. You can negotiate some of the fees associated with refinancing. A lender might reduce or waive some fees, especially application or origination fees.

STEP 4: Consider a no-closing-cost refi. If you dont have the cash to pay the full cost to refinance your mortgage up front, ask your lender about a no-closing-cost refinance option. Dont be fooled by the name though your lender will either charge you a higher interest rate or add the closing costs to your new loan balance, which spreads your closing costs payment over your loans term.

Why Use A Mortgage Refinance Calculator

Refinancing your mortgage can be a really valuable option as a homeowner. However, there are costs associated with refinancing that can outweigh any potential savings you might build. As a result, it’s important to understand how much a mortgage refinance will cost you before you pull the trigger – that’s where a mortgage refinance calculator comes in handy.

The mortgage refinance calculator above will do the hard work for you, estimating the penalties associated with refinancing as well as the potential savings you’ll make from getting a new mortgage at today’s rates. While there are some non-financial reasons you might want to refinance your mortgage, our calculator gives you the information you need to start making a decision.

Read Also: Do Credit Unions Offer Reverse Mortgages

Where Are Interest Rates Heading

One of the most common reasons homeowners refinance is to take advantage of lower interest rates. Taking the above $480,000 example, even a 1% difference can save hundreds of dollars a month. The long-term savings with the new rate may be worth the upfront cost of refinancing.

Interest rates are predicted to start rising soon from their historic low, but slowly. If you bought or last refinanced your mortgage in 2017, refinancing at a 5-year fixed rate could still mean lower interest, if you refinance at the right time.

What Are The Most Common Reasons To Refinance A Mortgage

Don’t Miss: Can My Llc Pay My Mortgage

Blend And Extend Your Existing Mortgage

Your existing mortgage lender may offer you a âblended rateâ, which is essentially, a âblendâ of your current mortgage rate plus any additional money you borrow at current market rates. Blended rates are almost always higher than the most competitive mortgage rates on the market, so make sure you compare the blended rate against the savings if you break your mortgage.

Shop Around For Lenders

You can refinance with the same company that gave you your original mortgage, but you dont have to. All mortgage lenders charges different fees, so pick your lender carefully.

Choose your top three or four lenders and ask each for a loan estimate, which is an itemized list of fees that make up your closing costs. Youll be able to compare how much youd pay with each lender.

Read Also: 70000 Mortgage Over 30 Years

Read Also: Can There Be A Cosigner On A Mortgage

Too Busy To Visit A Branch

Meet with a Mortgage Specialist at your home, workplace, coffee shop or other convenient location.

Need to talk to us directly?Contact us

Follow TD

Super: TD presents Asking for a FriendWhy Would You Refinance?

Welcome to Asking for a Friend. Lets see who could use some financial advice today.

Dear Asking for a Friend,My neighbour was talking about refinancing her home so she can borrow more money to build an extension, and it got me wondering…what exactly IS refinancing and why do people refinance?Sincerely,Next Door Nancy

I hear you, Nancy. First, what is refinancing?

Refinancing means renegotiating your existing mortgage loan agreement, usually to use any available equity in your home.

So what does that mean in real terms? Let’s say the value of your home is $500,000.

Super: $500,000

80% of home value 0.8 x $500,000 $400,000Outstanding balance of your mortgage $300,000How much you can borrow $100,000

Subject to the bank’s approval, you could borrow up to 80% of the value of your home less the outstanding balance of your mortgage.

That means if your home is worth $500,000 and you have an outstanding balance of $300,000 on your mortgage, you may be able to borrow an additional $100,000 .

So WHY do people refinance?

Super: To consolidate debts.

Super: Provide flexibility to pay for big ticket items.

Book an appointment and get financial advice for what you feel is most essential, through TD Ready Advice

Endslate: Visit td.com/readyadvice

Closing Costs Are Usually 2 To 5 Percent Of Your Loan Amount

The average cost to refinance your your mortgage is generally 2 to 5 percent of the remaining amount left on your loan. It also depends on where you live.

“If you live in a relatively rural location with low property rates, you’re going to pay less than someone living among million-dollar homes,” says Cliff Auerswald, president of All Reverse Mortgage. While the amount varies based on location and loan amount, the average closing cost of refinancing your mortgage is about $5,000 according to Freddie Mac.

“For example, you can expect your closing costs to be around $2,000 to $6,000 for a $100,000 mortgage refinance,” says Leonard Ang, GEO of iPropertyManagement, an online guide for real estate investors, landlords, and tenants. You can use this mortgage refinance calculator by Freddie Mac as a starting point to calculate your estimated refinancing costs.

You May Like: What Is Loan To Value Mortgage

What Are Refinance Closing Costs

Closing costs are lender fees and third-party fees you pay when getting a mortgage. You have to pay these on a refinance just like you did on your original mortgage.

Closing costs arent a set amount, though. They vary depending on where you live, your loan amount, your lender, the loan program, whether or not youre cashing out your home equity, and other factors.

Should You Refinance Your House

It can be difficult to decide whether its a good time to refinance your house or whether its better to stick with the current terms of your mortgage. Understanding the associated costs can help you learn whether or not refinancing will make financial sense for you and your family.

If youre planning on moving out of your home soon, refinancing might not be worth the time, money, and effort. If youre thinking about selling in the near future, you might want to take advantage of the current sellers market.

Are you wondering how much money you could sell your house for? Are you hoping to avoid the headaches of repairs, showings, and selling on the traditional market? If so, check out our home valuation tool here!

Recommended Reading: Do Mortgage Lenders Make Commission

Can You Refinance Without Paying Closing Costs

It is possible to refinance without paying closing costs up front. Instead, you’ll pay for the costs over the life of the loan.

Lenders make up for the closing costs in two ways, according to the Consumer Financial Protection Bureau. Some lenders will charge higher interest rates for borrowers who opt for loans without closing costs. Other lenders will add the closing costs to the loan’s principal, increasing the total amount you owe, and the total amount you’ll pay interest on.

While closing costs might seem high, it’s generally cheaper to pay them up front, even if you’re paying them a second time around while refinancing.

Common Mortgage Refinancing Fees

If youre planning to refinance your mortgage, expect to pay closing costs. Some of the most common mortgage refinancing fees include:

- Loan origination fee Lenders charge an origination fee to cover the costs of processing the mortgage loan. Loan origination fees cost about 0.5% to 1.5% of the loan amount.

- Mortgage points Mortgage points are an optional fee that you can pay at closing to lower your interest rate. One mortgage point usually costs 1% of the total loan amount.

- Appraisal fee Youll need to have your home appraised when applying for a mortgage refinance so the lender knows the home is worth the amount its lending. Appraisal fees are paid to the appraiser and costs can vary based on location.

Don’t Miss: Should I Refi To A 15 Year Mortgage

Will The Investment Pay For Itself

Ask yourself how long it will take you to earn back the cost of refinancing your home. Consider your ability to break even in a timely fashion. For example, it makes sense if youre planning on staying in your home for the long haul and you can break even in a few years. If you might move in a year or two anyway, maybe you should reconsider refinancing.

Shop For The Best Rate

Having a good credit score will help you get a better rate. But even if youre still working on improving your score, some lenders will still offer better rates than others.

Try checking your rate with as many lenders as you can. Rate-shopping websites are useful, but remember to also reach out to local credit unions to get the full range of options available to you.

You May Like: Reverse Mortgage For Mobile Homes

Also Check: What Is The Mortgage On A 3 Million Dollar Home

Youve Decided To Refinance Now What

If you’ve decided to refinance, then its time to prepare for the paperwork necessary. Most of the documents that you needed for your first mortgage will once again be required for a refinance, including tax returns, W-2s and pay stubs. If youre self-employed or receiving alimony or child support, you may have to provide additional documentation.

If youre working with a specific lender, your loan officer will help you understand which documents you need and communicate a timeline. Youll be working with this person for several weeks, so be sure to choose a mortgage lender that you both trust and enjoy working with.

You Want To Save On Interest

If youre considering refinancing to save money over the life of your loan like by getting a lower interest rate or shortening your term do the math to see how much money youll truly save after all of the fees and costs are accounted for.

Find your breakeven point, and work backward from there to figure out whether refinancing makes sense. If it will take you five years to break even, and you expect to sell your house before then, refinancing could end up costing you more than you would save.

To calculate your breakeven point:

You should be able to see a timeline of when your interest savings will finally overcome the closing costs. The longer you plan to stay in your home, the more likely you are to recoup your refinancing costs and come out ahead.

If you think refinancing is the right move, Credible can help you get started. You can compare multiple lenders and see prequalified rates in as little as three minutes without leaving our platform.

Find out if refinancing is right for you

- Actual rates from multiple lenders In 3 minutes, get actual prequalified rates without impacting your credit score.

- Smart technology We streamline the questions you need to answer and automate the document upload process.

- End-to-end experience Complete the entire origination process from rate comparison up to closing, all on Credible.

Read Also: How Much Per Thousand On A Mortgage