How Are Different Types Of Mortgages Affected

Different mortgage types are impacted by the Bank of Englands base rate in different ways.

According to UK Finance, over 6.5 million of the UKs mortgage holders have a fixed-rate mortgage, while 895,000 are on standard variable mortgages, and 715,000 are on tracker mortgages.

Tracker mortgages are most directly impacted by the Bank of Englands decisions, as this type of mortgage tracks a base rate, which is usually the one set by the Bank of England. This means the interest rates being paid by homeowners will change soon after the Bank of England changes the base rate.

Standard variable rate mortgage holders also often feel the immediate impact of the Bank of Englands base rate decisions. Lenders have the power to change the interest rate on these mortgages each month, and usually take the decision to increase interest payments when the base rate goes up.

Interest rates on fixed-rate mortgages are also impacted by the Bank of Englands base rate, however, homeowners are protected from any immediate change to the base rate and only feel the impact when they have to remortgage at the end of their fixed term.

Conforming Loans Vs Non

Conforming loanshave maximum loan amounts that are set by the government and conform to other rules set by Fannie Mae or Freddie Mac, the companies that provide backing for conforming loans. A non-conforming loan is less standardized with eligibility and pricing varying widely by lender. Non-conforming loans are not limited to the size limit of conforming loans, like a jumbo loan, or the guidelines like government-backed loans, although lenders will have their own criteria.

The Caveat: Average Mortgage Payments Don’t Really Matter

Its important to keep in mind that statistics are just broad, overall trends. The truth is, every mortgage payment is unique. Two homebuyers with identical properties can have very different payments, whether theyre across the country from each other or just down the street.

Thats because mortgage payments are based on a whole slew of factors that vary from one buyer to another. Here are just a few of the things that can make one homeowners mortgage payment different than the next:

- Down payment size

| $1,100 | $1,450 |

In this scenario, Buyer A has a stellar credit score of 760. She qualifies for a 3.75% interest rate as a result. And she makes a 20% down payment of $60,000. Not including property taxes and home insurance, shed see a monthly mortgage payment of $1,111.

On the other hand, Buyer B has not-so-great credit . He qualifies for a 4.25% interest rate and puts down just 10% . His mortgage payment would come out to $1,443 .

Thats a difference of $332 per month or $3,984 per year. Buyer B would also see significantly more paid in interest over the life of the loan.

Recommended Reading: Can You Get Extra Money On Your Mortgage For Furniture

Brief History Of Mortgages In The Us

In the early 20th century, buying a home involved saving up a large down payment. Borrowers would have to put 50% down, take out a three or five-year loan, then face a balloon payment at the end of the term.

Only four in ten Americans could afford a home under such conditions. During the Great Depression, one-fourth of homeowners lost their homes.

To remedy this situation, the government created the Federal Housing Administration and Fannie Mae in the 1930s to bring liquidity, stability, and affordability to the mortgage market. Both entities helped to bring 30-year mortgages with more modest down payments and universal construction standards.

These programs also helped returning soldiers finance a home after the end of World War II and sparked a construction boom in the following decades. Also, the FHA helped borrowers during harder times, such as the inflation crisis of the 1970s and the drop in energy prices in the 1980s.

Government involvement also helped during the 2008 financial crisis. The crisis forced a federal takeover of Fannie Mae as it lost billions amid massive defaults, though it returned to profitability by 2012.

The FHA also offered further help amid the nationwide drop in real estate prices. It stepped in, claiming a higher percentage of mortgages amid backing by the Federal Reserve. This helped to stabilize the housing market by 2013. Today, both entities continue to actively insure millions of single-family homes and other residential properties.

Mortgage Payments By State

While some states have relatively low home values, homes in states like California, Hawaii, and New Jersey have much higher home costs, meaning people pay more for their mortgage each month. Additionally, mortgage interest rates vary by state.

Data from the 2019 American Community Survey shows that homeowners paid a median amount of $1,609 per month. This figure includes a mortgage payment, as well as insurance costs, property taxes, utilities, and HOA fees where necessary.

Here’s how all 50 US states stack up:

| State |

| $1,417 |

Recommended Reading: What Do You Need To Refinance Your Mortgage

How Much Does The Average Mortgage Cost

22 September 2021

Knowing when youve got a good mortgage deal is hard, isnt it? Every house is different, every households income and outcomes are differentbut if you know some of the average costs and interest rates when it comes to mortgages, youd at least have a start.

So, thats what weve gone away and done collected some averages and written up some pointers to help you decide how to manage your mortgage.

Loan Term And Interest Rate Structure

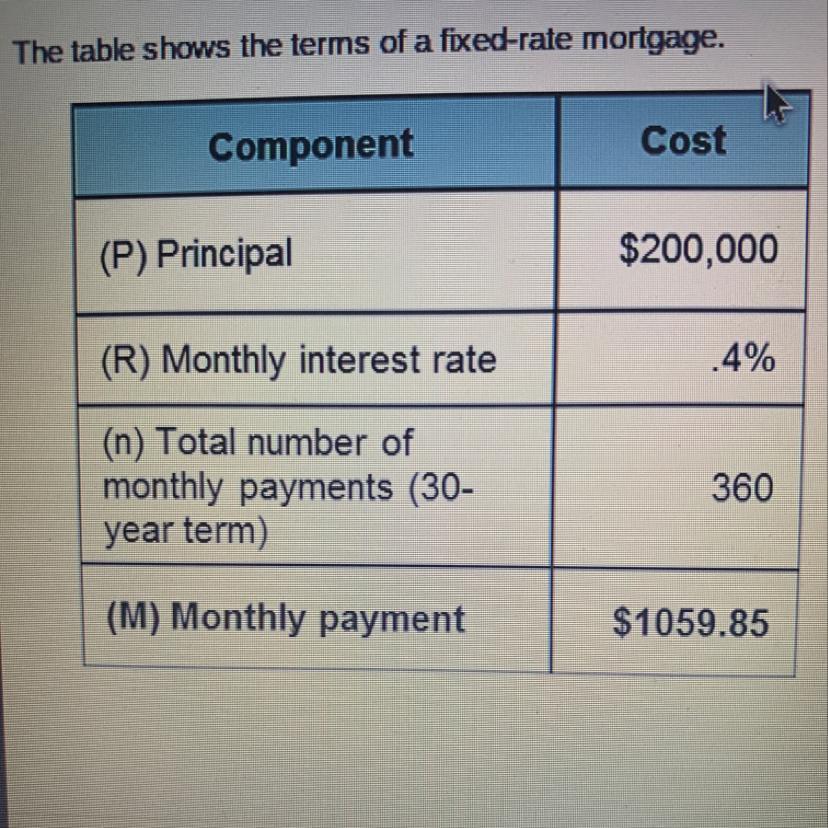

Certain loan characteristics may mean larger monthly payments than others.

Loan term, or the amount of time you have to pay back your loan, will directly impact on the size of your monthly payment. For example, borrowers with a 30-year loan term have more time to pay back their loan, so their monthly payments will be lower than someone with a comparable 15-year loan term.

Your monthly payment will also be impacted by whether you have a fixed interest rate or an adjustable-rate mortgage . With ARMs, your interest rate will be fixed for a period of time, and then adjust periodically. When your rate changes, your payment amount will change, too.

Also Check: What Does A Mortgage Loan Officer Make

Whats Included In A Monthly Mortgage Payment

Dont be tricked here. What we call a monthly mortgage payment isnt just paying off your mortgage. Instead, think of a monthly mortgage payment as the four horsemen: Principal, Interest, Property Tax, and Homeowners Insurance .

How do these guys ride together in your monthly mortgage payment? You can find out by using our mortgage calculator.

Tips For Getting Out Of Debt

- When you have multiple loans and are trying to figure out how best to tackle them, you should usually prioritize paying them off in order of highest interest rate to lowest. The higher an interest rate you are paying on a loan the more expensive it in in the long term. So as a rule of thumb, it makes sense to prioritize debt from over student loan debt and then student loans over mortgages.

- Even as youre prioritizing certain debts, make sure to always pay the minimum monthly payment on all your loans. This will ensure you dont face any late payment penalties, further adding to your debt.

Also Check: How Much Is A Habitat For Humanity Mortgage

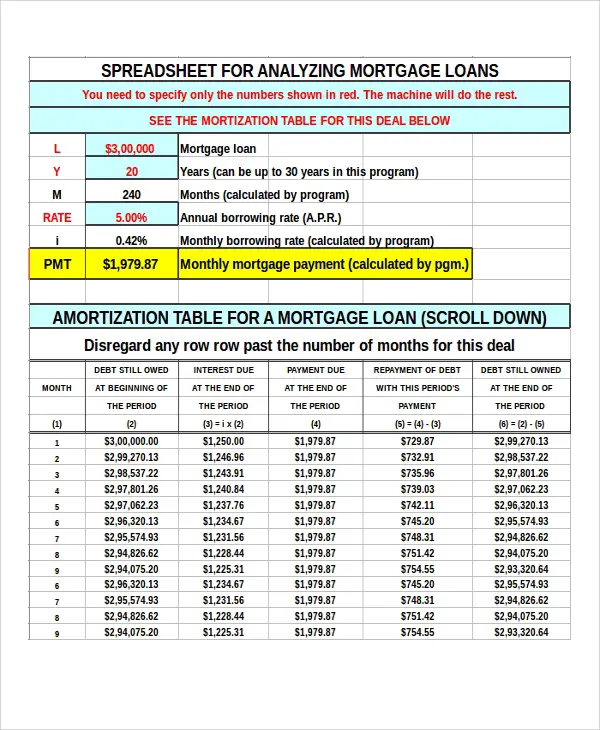

Also Check: What Is The Amortization Schedule For A 30 Year Mortgage

Mortgage Payments By Age

Americans in their prime owe the highest average mortgage debt, our stats show. So, it makes sense that this age group also deals with the highest average house payments too.

You can find the median payments rather than the typical monthly mortgage payment for each age group in the table below. Namely, the median amount gives a better picture, and hence the US Census Bureau provides these statistics instead.

As you can see in the table, Americans aged 35-55 pay the highest mortgage of $1,192. Homeowners aged 75+, by contrast, pay significantly lower monthly installments of $696. This age group also has the lowest average mortgage payment in the US.

The difference between the highest and the lowest cost is always interesting to analyze. In this category, its only $496 or much lower than the difference of payments by income. The only Americans whose median monthly payments are above $1,000 range from 30 to 54 years. These are some amusing trends we spotted analyzing the median and average monthly house payments by age.

This Is The Average Us Mortgage Payment Can You Swing It

by Maurie Backman | Updated July 19, 2021 First published on June 18, 2021

Many or all of the products here are from our partners. We may earn a commission from offers on this page. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

Heres what the typical homeowner pays each month for a mortgage. Does it sound affordable to you?

Housing is the typical Americans largest monthly expense. And taking on too high a mortgage payment could wreck your finances and lead you to rack up a lot of debt.

But whats considered too high? The average U.S. homeowner spends $1,067 a month on a mortgage payment, according to the National Association of Realtors. Thats a pretty big jump, however, from the average monthly payment of $995 one year ago.

The reason for that increase? Home prices have soared over the past year as low mortgage rates and limited inventory have pushed buyer demand through the roof. As such, a lot of recent home buyers may have taken on higher payments that are skewing the national average upward and thats with mortgage rates being extremely competitive over the past several months.

Recommended Reading: How To Find Out Who Owns A Mortgage

Costs Included In A Monthly Mortgage Payment

In the Census Bureau’s American Community Survey’s data, the monthly mortgage payment includes things like insurance and taxes. In part, it’s because that’s how mortgages actually work oftentimes, you pay for more than just the loan’s principal and interest in your monthly payment.

If your mortgage includes an escrow account, you’ll pay for two costs each month in your monthly mortgage payment:

- Property taxes: You’ll pay tax on your home to your state and local government, if necessary. This cost is included in your monthly payment if your mortgage includes escrow.

- Home insurance: To keep your home covered, you’ll need to purchase a homeowner’s insurance policy. The average cost of homeowners insurance is about $1,200 per year.

Your monthly mortgage payment will also be impacted by how much money you borrow, and what your lender charges you for that money. Here’s how those two factors can get you a higher or lower monthly payment:

Another monthly cost to consider should be how much you’ll need to save for repairs. In general, the older your home is, the more you should keep on hand for repairs. Utilities like internet, garbage removal, and electricity will also add to your monthly costs of homeownership.

What Is The Best Mortgage Term For You

A mortgage term is the length of time you have to pay off your mortgagestated another way, its the time span over which a mortgage is amortized. The most common mortgage terms are 15 and 30 years, though other terms also exist and may even range up to 40 years. The length of your mortgage terms dictates how much youll pay each monththe longer your term, the lower your monthly payment.

That said, interest rates are usually lower for 15-year mortgages than for 30-year terms, and youll pay more in interest over the life of a 30-year loan. To determine which mortgage term is right for you, consider how much you can afford to pay each month and how quickly you prefer to have your mortgage paid off.

If you can afford to pay more each month but still dont know which term to choose, its also worth considering whether youd be able to break evenor, perhaps, saveon the interest by choosing a lower monthly payment and investing the difference.

Don’t Miss: What Percentage Of Income Can Be Used For Mortgage

Average Length Of A Mortgage

As mortgages are the biggest loan youre likely to get, theyre often the longest, too.

Mortgages normally take 25, 30 or 35 years to pay back. Historically, the most popular length people opt for is 25 years, but in recent years the 30- and even 35-year mortgages are becoming more popular.

The reason longer mortgages are attractive is because they lower your monthly mortgage repayments. This makes is easier for people to afford a mortgage, helping people to get on the property ladder. Remember though, a longer mortgage means you end up paying substantially more over the lifetime of the mortgage.

Mortgage pay-off times actually vary a bit. This is for a few reasons.

Often people will remortgage every few years. This means you go back to a mortgage lender and thrash out a new mortgage deal, taking into consideration how much of your homes value youve paid off. Sometimes its possible to knock a couple of years off the total time youre paying your mortgage, as you could get a better deal.

Most people though will take the chance to lower their monthly repayments instead of shortening their mortgage term.

Some people also overpay each month on their mortgage. This means that the overall mortgage is lower, which makes the interest charged against it lower. All this means the mortgage itself can be paid off earlier.

Be careful though. Some mortgages charge fees for overpayments, or have a limit of how much can be paid. Go over the limit and you could get charged a fee.

Average Monthly Mortgage Loan Payment In Canada In 3rd Quarter 2020 And 3rd Quarter 2021 By Metropolitan Area

| Characteristic |

|---|

You need a Statista Account for unlimited access.

- Full access to 1m statistics

- Incl. source references

- Available to download in PNG, PDF, XLS format

You can only download this statistic as a Premium user.

You can only download this statistic as a Premium user.

You can only download this statistic as a Premium user.

As a Premium user you get access to the detailed source references and background information about this statistic.

As a Premium user you get access to background information and details about the release of this statistic.

As soon as this statistic is updated, you will immediately be notified via e-mail.

…and make my research life easier.

You need at least a Starter Account to use this feature.

Also Check: What Is The Ideal Income To Mortgage Ratio

What Is A Good Interest Rate On A Mortgage

A good mortgage rate is one where you can comfortably afford the monthly payments and where the other loan details fit your needs. Consider details such as the loan type , length of the loan, origination fees and other costs.

That said, todays mortgage rates are near historic lows. Freddie Macs average rates show what a borrower with a 20% down payment and a strong credit score might be able to get if they were to speak to a lender this week. If you are making a smaller down payment, have a lower or are taking out a non-conforming mortgage, you may see a higher rate. Moneys daily mortgage rate data shows borrowers with 700 credit scores are finding rates around 6.5% right now.

Mortgage Payments By Income

Just like the average mortgage payment in Utah is different from payments elsewhere, this segment varies by income, as well. According to the data provided by the US Census Bureau, Americans making the most money have the highest average house payments per month. People from this income group, interestingly, dont have the highest median interest rate.

The highest mortgage interest rates are reserved for Americans making between $10,000 and $39,999. Those from the $10,000-19,999 income group are among the consumers paying the highest interest rate. Yet, they boast the lowest typical mortgage payment per month.

As you can see in the table above, households making $120,000 or more pay the highest median mortgage of about $1,600. Those making $10,000-19,999 meanwhile pay the lowest median mortgage payment per month of $607.

The difference between the highest and lowest median payments is an impressive $993. The first group gets better median rates of 4%, while the latters median mortgage rate is 5%.

Don’t Miss: How Many Mortgages Can You Have For Rental Property

Auto Loan Interest: $769 To $895

The average new car loan in the fourth quarter of 2016 worked out to $30,621, according to a recent Experian survey, while the average used car loan was $19,329. These loans extended for an average of 68 months and 63 months, respectively, with average interest rates of 4.74% and 8.50%.

Put all these figures together, and the average new car owner pays $4,356 in interest over the course of a 68-month loan, or $769 a year. The average used car buyer, on the other hand, despite borrowing less money, would pay $4,700 in interest all told, or $895 a year.

Donât Miss: What Will Be My Mortgage

How Are Mortgage Rates Impacting Home Sales

The housing market continues to slow as mortgage rates keep climbing higher. Existing home sales, based on the number of closed transactions, decreased for the eighth consecutive month according to the National Association of Realtors.

Sales in September were at a seasonally adjusted annual rate of 4.71 million homes, down 1.5% from August and nearly 24% lower than September 2021.

The housing sector continues to undergo an adjustment due to the continuous rise in interest rates, which eclipsed 6% for 30-year fixed mortgages in September and are now approaching 7%, said Lawrence Yun, chief economist at NAR, in a press release.

Also Check: How Do You Sell A House That Has A Mortgage