What You Need To Apply For A Mortgage

Start collecting all the documents youll need for the mortgage application process. This might include:

- P60 form from your employer

- your last three months payslips

- passport or driving licence

- bank statements of your current account for the last three to six months

- statement of two to three years accounts from an accountant if self-employed

- tax return form SA302 if you have earnings from more than one source or are self-employed

- self-employed people should look to provide information alongside their tax return, which supports what the SA302 says about their income, such as bank statements.

Be accurate. Make sure the information on the application form matches the documents you give them.

For example, dont round up your salary if the amount on the payslips differs from this figure.

Provide details of the address of the property you want to buy, the estate agent and your solicitor.

These are the basics some lenders might ask for more paperwork.

Bear in mind lenders might have different criteria around income and outgoings.

Ask your lender or independent mortgage adviser what else you might need.

Please note, printouts of online statements of your current account and utility bills might not be acceptable.

You will either need hard copies or to have copies certified by your solicitor, your bank or your utility provider.

Consider The Ongoing Costs

Now you own your home. You love it. You never want to leave it, and then the roof begins to leak. When youre deciding how much home you can afford, dont forget about ongoing repairs and maintenance.

A good rule of thumb is to set aside at least 1% of your homes value every year for repairs and maintenance. So, to keep a $250,000 home in great shape, that means you should plan to save $2,500 per year.

Also keep in mind that prices for everything tend to go up, not down. Property taxes, homeowners insurance and utilities these are expenses that will continue as long as you own your home.

Minimum Credit Score For A Heloc

Most HELOC lenders want to see a minimum credit score of at least 680, although some will go as low as 620. Keep in mind that your FICO score directly impacts your interest rate. Youll typically get the lowest HELOC rates with a score above 700.

Those with lower credit scores could pay appreciably higher interest rates. In addition, if your FICO score is in the low/mid 600 range, you might need to be a strong borrower in other respects to qualify for a HELOC. That could mean having a lower debt-to-income ratio or borrowing a smaller portion of your equity.

Also Check: What Was The Lowest 15 Year Mortgage Rate

How To Qualify For A Loan With Guild Mortgage:

Minimum credit score requirements:

- Jumbo loan 43%

Certain compensating factors may prompt the lender to accept higher debt-to-income ratios: excellent credit history, significant cash reserves, a sizable down payment and a stable job history.

Minimum down payment requirements:

- Conventional loan 3% to 25% depending on the property type and whether its a secondary residence or investment property

- FHA loan 3.5% to 10%, depending on your credit score

- Manufactured home loan 0%, 3.5% or 5% depending on the loan type

Consider A Shorter Loan Term

When you take out a 15-year fixed-rate mortgage instead of a 30-year fixed-rate mortgage, the interest rate will normally be lower. In mid-September 2020, for example, the 30-year rate was 2.87%, and the 15-year rate was 2.35%.

You also could consider an adjustable-rate mortgage. Its introductory rate may be lower than what you could get on a fixed-rate mortgage. It depends on the market, though: In mid-September, a 5/1 ARM had an interest rate of 2.96%.

Even if you can get a lower rate on an ARM, youâre taking a risk. It might be cheaper in the short term, but it could be more expensive in the long term. Why?

- No one knows what interest rates will look like when the ARMâs introductory period ends.

- Thereâs no guarantee youâll be able to refinance or sell when the ARMâs introductory period ends.

Read Also: What Is The Current Interest Rate For A Reverse Mortgage

Recommended Reading: Do Mortgage Lenders Look At Closed Accounts

Short Example Of First Time Buyer Mortgage

You spot a house for sale for 300,000 and wonder can you afford it.

As a first time buyer the highest level of mortgage facilities you can get is 90% of the purchase price i.e. 270,000.

This is calculated at purchase price 300,000 multiplied by 90% = 270,000

second hand

If the property is newly built and will be used as your home and you are a qualifying first time buyer , you may qualify for the help to buy scheme of up to 10% of the purchase price – 30,000!

Mortgage Calculator: How Much Can I Borrow

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Don’t Miss: Is Chase A Good Bank To Refinance My Mortgage

What Does The Mortgage Qualifying Calculator Do

This mortgage qualifying calculator takes all the key information for a mortgage and lets you determine any of three things: 1) How much income you need to qualify for the mortgage, or 2) How much you can borrow, or 3) what your total monthly payment will be for the loan.

To do this, the calculator considers your mortgage rate, down payment, length of the loan, closing costs, property taxes, homeowners’ insurance, points you want to pay and more. You don’t need to input all information to receive a ballpark figure.

You can also enter information about your current debts, like your car payments, credit cards and other loans to figure out how those affect what you can afford. This Mortgage Qualifying Calculator also gives you a breakdown of what your monthly mortgage payments will be, shows how much you’ll pay in mortgage interest each month and over the life of the loan, and helps you figure how you might allocate your upfront cash on hand toward closing costs. On top of that, it also lets you easily adjust any of the figures by using a sliding scale, making it simple to see how changing one or more affects the result, so you can identify where how reducing one thing or increasing another affects the final result.This Mortgage Qualifying Calculator also summarizes all your information in a detailed report, including an amortization table, for easy reference.

Checking Your Credit Score

You should check your credit score well before you begin the mortgage process so you will know where you stand and the mortgage rate you could qualify for. You can check your credit score for free through several online services. Many banks, credit unions, and credit card providers offer credit scores as a regular feature. Since most major mortgage lenders use your credit score in their decision, its worthwhile to obtain all three of your reports to make sure the information on your record is accurate.

Its a good idea to research your credit score and your credit reports well in advance of making a major purchase so you have time to address any errors or other issues you might discover.

Read Also: How Much Is A Mortgage On A 265 000 Home

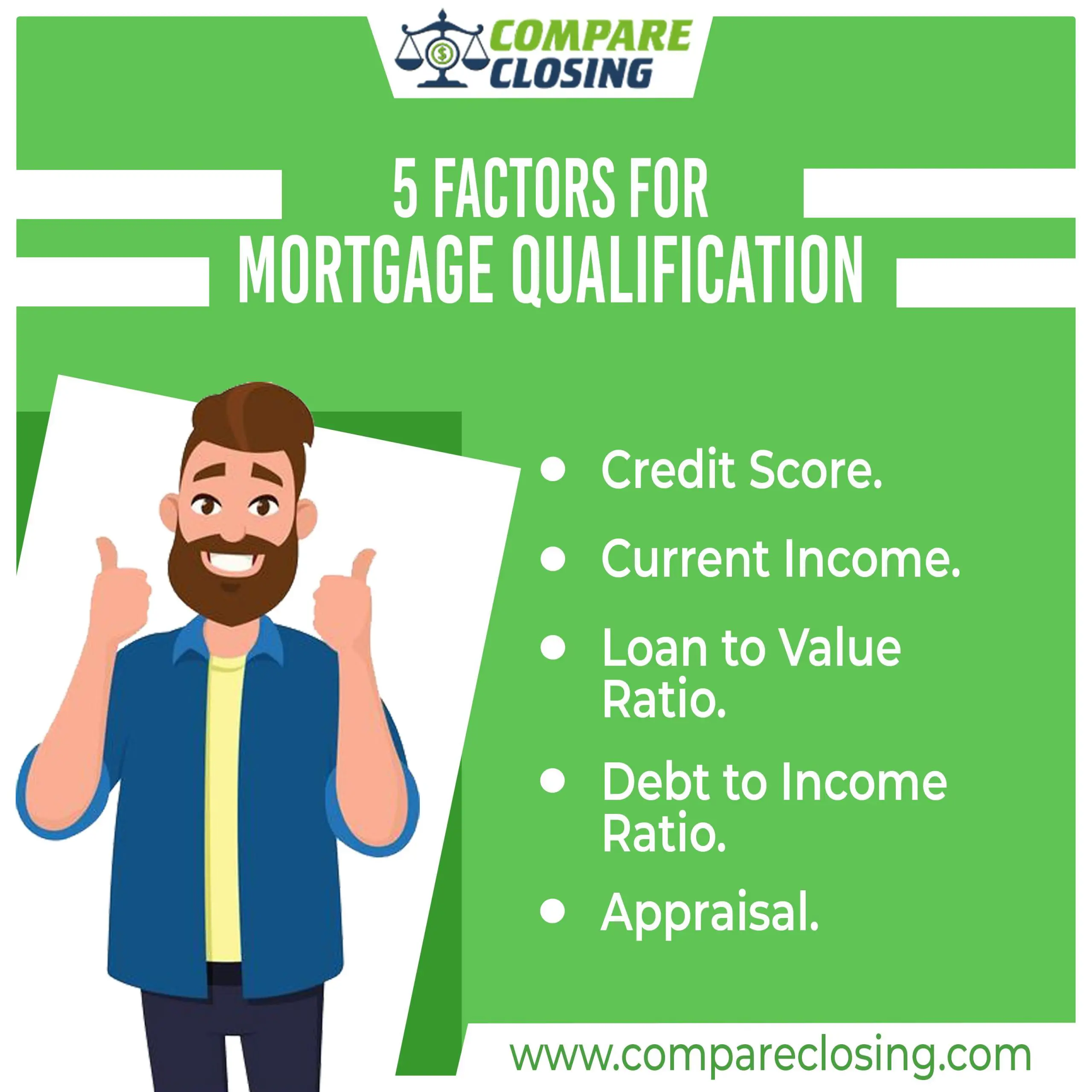

Factors That Impact Affordability

When it comes to calculating affordability, your income, debts and down payment are primary factors. How much house you can afford is also dependent on the interest rate you get, because alower interest ratecould significantly lower your monthly mortgage payment. While your personal savings goals or spending habits can impact your affordability,getting pre-qualified for a home loancan help you determine a sensible housing budget.

What Income Is Considered When Applying For A Mortgage

Determining whether your income is sufficient to get a home loan isnt as simple as just looking at your pay stub.

Lenders will assess all of your income sources and monthly debts to figure out what mortgage you can afford and have the likely ability to pay back. Weve put together a list of sources, variables and debts to help you determine if you may be eligible for a loan.

Regular Income Calculations

For salary and wage earners, a lending partner will want to see current pay stubs as well as W-2 tax forms for the past two years. If youve recently had a change in pay, such as a raise, youll also need to get a statement from your boss confirming that the change is permanent.

You may also be able to use special-case income, such as overtime and commissions, as part of the income calculation for your mortgage. To qualify these items, youll need to document that youve received them for at least two years and provide confirmation from your boss that theyre expected to continue.

If this income comes from a source outside of your primary employersuch as part-time work or side jobs that pay only commissionyoull need W2 forms for these as well.

|

Income Type |

|---|

Read Also: Can I Refinance My 2nd Mortgage

A Little Preparation Goes A Long Way

Finding the right home takes time, effort, and a bit of luck. If you’ve managed to find a property that’s right for you and your budget, then it’s time to get one step closer to homeownership by applying for a mortgage loan. And though this is one of the biggest financial decisions you can make, knowing how to start and what you need will put you one step ahead of other potential homebuyers.

How To Calculate Affordability

Zillow’s affordability calculator allows you to customize your payment details, while also providing helpful suggestions in each field to get you started. You can calculate affordability based on your annual income, monthly debts and down payment, or based on your estimated monthly payments and down payment amount.

Our calculator also includes advanced filters to help you get a more accurate estimate of your house affordability, including specific amounts of property taxes, homeowner’s insurance and HOA dues . Learn more about the line items in our calculator to determine your ideal housing budget.

Don’t Miss: How Do You Get Your Name Off A Mortgage

Can I Afford A $360k House

To afford a mortgage loan worth $360k, you would typically need to make an annual income of about $100k and be able to afford monthly payments worth $2,000 and upwards. For example, with a 30-year loan term, 5% interest rate and 5% down, you’d need an annual income exceeding $105,000 to afford the $2,478 monthly mortgage payment

Conventional Fha Or Va Loan

The only real debate is whether to get a conventional, FHA or VA loan on the house, but once again, there is a runaway leader.

Conventional loans are any mortgage that is not part of a government program. They account for 64% of the market. They are offered by banks, credit unions, mortgage brokers and online lenders. Theyre popular because they usually offer the best mortgage interest rates and terms.

FHA loans, offered by the Federal Housing Administration, account for 22%. VA loans, offered by the Veterans Administration, account for 10%.

FHA loans are popular because its easy to qualify, you can make a down payment as low as 3.5% and your credit score can be under 580.

VA loans are for active or retired service members and their families. You dont need a down payment and there is no minimum credit score.

Read Also: How To Pay Off 30 Year Mortgage Early

How Much Income Do You Need To Buy A Home

Your income is one of the most important factors lenders consider when you apply for a mortgage. But theres no minimum amount of income youll need to buy a home. Instead, lenders look at your debt-to-income ratio, which shows the percentage of your gross monthly income that goes toward debt obligations.

What the lender would be reviewing when issuing a pre-approval is what we call DTI, which stands for debt to income ratio, said Polina Solis, a Realtor in Texas. There are certain loan packages, such as conventional versus FHA, which have different DTI requirements. Generally speaking, you dont want to have your home monthly payment be more than 30% of your gross income.

There are two ratios lenders will look at. Your front-end DTI is your future monthly housing expenses compared to your gross monthly income. Your back-end DTI is all of your debt payments, including your housing payments, compared to your gross monthly income.

An acceptable DTI to purchase a home depends on other factors, including your credit score. But according to Solis, lenders generally require that borrowers have a DTI of no more than 45%. In some cases, they may be willing to allow for as high as 50% if the borrower has exceptional credit and additional cash reserves.

Its Not What You Can Borrow Its What You Can Afford

In some respects, the mortgage lending industry is working against your best interest. If you are deemed a qualified borrower, a lender is prone to approve you for the maximum it believes you can afford. But in some cases, that amount may be too generous.

Buying a home always means dealing with big numbers. And the impact to your budget may seem to be a stretch, particularly in the beginning. The challenge is buying a home that meets your current and future needs, without feeling like all of your money is in your home leaving you without the financial freedom to travel, save for other priorities and have a cash flow cushion.

Now that the NerdWallet How much can I borrow calculator has given you an idea of your buying power, you may want to gut-check the number by:

-

Run affordability scenarios. You can get another view of your home-buying budget by running some what-ifs through the NerdWallet home affordability calculator.

-

Talk to more than one lender. You are more likely to get a better interest rate by comparing terms offered by multiple lenders, and it might be illuminating to see the loan amounts different lenders will qualify you for.

-

Consider all homeownership expenses. Its not just whats built into your monthly payment such as insurance, taxes and the rest but the other having-a-home expenses, like structural upkeep, new furniture, maybe even yard maintenance equipment.

Don’t Miss: What Percent Down Payment To Avoid Mortgage Insurance

Which Mortgage Is Right For Me

There are almost as many ways to pay for a house as there are houses to pay for, but the gold-standard has been and apparently always will be the 30-year fixed mortgage.

Lenders have dressed up rates, terms and conditions on 15-year, 20-year, fixed and variable rate offers, but more than 85% of mortgages in 2016 were 30-year fixed rate.

Pay Attention To Loan Fees

The catchall term for the fees you pay to get a mortgage is closing costs. Everything from the prepaid property taxes to your appraisal fees fall into this category. Certain closing costs vary by loan size, but overall you can expert to pay 3% to 6% of the total loan balance.. Your closing costs play a crucial role in determining your annual percentage rate . In other words, the higher your closing costs, the higher your APR will be..

Read Also: Can I Get A Mortgage With A 730 Credit Score

Can You Receive Money For A Down Payment From A Friend Or Relative

Lenders generally allow homebuyers to receive gift money from loved ones for their down payment. Under Fannie Mae and Freddie Macs requirements, these gifts can only come from a family member related by blood, marriage, adoption, or legal guardianship. The gift may also come from a fiancé or domestic partner.

If you receive your down payment money as a gift, youll also have to provide a gift letter written by the donor. The gift letter should specify the dollar amount of the gift, the date, and confirmation that the gift isnt a loan and no repayment is expected.

The Key Principles Of Mortgage Approval Are As Follows:

- Your income should be secure .

- You can provide evidence of affordability from recent rent and savings patterns that you can afford repayments

- You have an adequate cash deposit

- You have a good credit history, well managed finances and typically no loans or credit card debt.

1. What is the maximum mortgage limit.

- Central Bank rules place a limit of 3.5 times your normal gross income as your maximum mortgage.

- Exemptions above 3.5 times gross income are difficult to secure at present but are available in limited circumstances.

2. How much of a deposit do you need?

- First time buyers 10%

- Second time buyers 20% of the purchase price

- Some lenders are comfortable to have the deposit requirement provided by way of a gift, but as a general rule lenders preference is to see a steady savings pattern contributing to 5% of the purchase price – some tolerance for larger gifts is evident with long rental history

- Deposit exemptions are available at present so that second time buyers with strong incomes are not restricted to a minimum 20% deposit. Each case is assessed on its own merits.

3. Can you afford the repayments?

4. Is your income secure?

5. Can you demonstrate good financial management?

- Good regular savings record

- Minimum of personal debt and credit cards cleared monthly

- Prudent spending habits

- If you have taken out loans in the past – there should be no missed payments

- No online gambling

Also Check: How Much Money Do You Get With A Reverse Mortgage