Costs Associated With Home Ownership And Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the “Include Options Below” checkbox. There are also optional inputs within the calculator for annual percentage increases under “More Options.” Using these can result in more accurate calculations.

Non-Recurring Costs

These costs aren’t addressed by the calculator, but they are still important to keep in mind.

The Interest Rate You Secure

Securing the lowest rate possible is always the most preferred outcome, particularly if youre working to a strict monthly budget. A £90,000 mortgage repayment mortgage, over 25 years, based on an interest rate of 2.5% would mean monthly repayments of £404. If that rate were to increase to 5%, repayments would increase to £526.

In order to get a lower rate, a lender needs to receive a strong mortgage application that shows you to be a reliable borrower. This is something a broker can support you on.

Mortgage Calculator With Taxes And Insurance

Information and interactive calculators are made available to you only as self-help tools for your independent use and are not intended to provide investment or tax advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.

You May Like: Does Refinancing Your Mortgage Hurt Your Credit

Get A More Accurate Estimate

Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment.

-

How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home.

- Pig

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Award Ribbon VA mortgage calculator

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

Homebuyers Face Most Volatile Mortgage Rates In Over 30 Years Redfin Says

Single-family homes under construction in the Lakeview Estates community in Lehi are pictured on Tuesday, July 19, 2022.

Kristin Murphy, Deseret News

As the U.S. standard 30-year fixed mortgage rate has blown past 6%, and now flirts with 7%, its chipping more and more away at what a would-be homebuyer might actually be able to afford.

Consider this:

Say your budget was $2,500 a month. At todays rates, you can now probably afford a house that costs about $476,000. Rewind to early 2021, when pandemic-era rates fell to record lows below 3%, and for that same $2,500 a month you could have purchased a home with a price tag of over $758,000.

Thats according to a calculator put together by Michael McDonough, Bloombergs chief economist for financial products.

It depicts the shock from just how fast mortgage rates have risen amid the Federal Reserves fight with record inflation and how much that shock is impacting homebuyer affordability. No wonder demand is down, reflected in plummeting sales and, in some areas, tempering home prices.

David Doyle, Mcquaries head of economics, called the impact of those rising rates the most severe deterioration in affordability on record, with the average monthly payment of a typical mortgage jumping by about $1,000 over the last year, Bloomberg reported.

Redfin, in a report published Wednesday, declared homebuyers today are grappling with the most volatile mortgage rates in more than 30 years.

Also Check: Which Mortgage Lenders Use Fico Score 2

What Credit Score Do Mortgage Lenders Use

Most mortgage lenders use your FICO score a credit score created by the Fair Isaac Corporation to determine your loan eligibility.

Lenders will request a merged credit report that combines information from all three of the major credit reporting bureaus Experian, Transunion and Equifax. This report will also contain your FICO score as reported by each credit agency.

The Term Length You Opt For

Opting to repay the £90,000 over a longer period of time, for example 40 years, reduces repayments. However, lengthening the term could mean your mortgage ends up costing you more than if you secured a shorter term such as the 25 years.

In some cases, lenders are willing to go lower than the typical 25 years to 15 or even 10 years, but this would depend on your specific circumstances. Take a look at the example calculations below, along with our repayment calculator to see how different terms can affect how much you pay each month.

Recommended Reading: What Is Usda Mortgage Insurance

How Are Mortgage Rates Impacting Home Sales

After a brief uptick last week, the overall volume of mortgage applications decreased by nearly 4% for the week ending September 23, according to the Mortgage Bankers Association.

Applications for both purchase and refinances declined last week as mortgage rates continued to increase to multi-year highs following more aggressive policy measures from the Federal Reserve to bring down inflation, said Joel Kan, MBAs associate vice president of economic and industry forecasting. Additionally, ongoing uncertainty about the impact of the Feds reduction of its and Treasury holdings is adding to the volatility in mortgage rates.

- Purchase applications saw a slight week-over-week decrease of 0.4 percent. Compared to the same week last year, purchases were 29% lower.

- Refinance applications were down by 11% from the previous week and 84% lower than a year ago, reaching a 22-year low.

Dont Overextend Your Budget

Banks and real estate agents make more money when you buy a more expensive home. Most of the time, banks will pre-approve you for the most that you can possibly afford. Right out of the gate, before you start touring homes, your budget will be stretched to the max.

Its important to make sure that you are comfortable with your monthly payment and the amount of money youll have left in your bank account after you buy your home.

Don’t Miss: What Does A Mortgage Payment Consist Of

The Mortgage Type You Select

When it comes to securing a mortgage of any size, youll have some decisions to make and these will be reflected in your repayments. For example, opting for a fixed rate mortgage can mean slightly higher interest but that comes with consistency whereas a tracker interest rate will see the monthly amount fluctuate depending on a particular market index.

Youll also have to decide on whether to opt for an interest-only £90,000 mortgage or a capital repayment model. Selecting interest-only will mean lower repayments as the full loan is repaid at the end of the term, but to qualify for this a lender would require evidence that shows you have a way of paying back the loan as a lump sum at that later date. Capital repayment combines both interest and repayment of the loan, increasing the monthly cost but ensuring the loan is fully repaid by the end of the term.

See More Personal Loan Options: From $10000 To $100000

Get instantly pre-qualified for a $25k personal loan apply below today!

You can do just about anything with a 90k personal loan, just as long as there are no spending restrictions. One of the biggest attractions to a personal loan is the flexibility of how you can use the money. Most lenders do not have spending restrictions for personal loans. This means you can use the money however you want to. While this is a huge freedom, you will want to spend responsibly. One of the most common uses for a personal loan is home improvements. Here are some ways to spend your 90k personal loan:

Also Check: What Is Loan Servicing In Mortgage

How Are Mortgage Rates Set

Lenders use a number of factors to set rates each day. Every lenders formula will be a little different but will factor in the current federal funds rate , competitor rates and even how much staff they have available to underwrite loans. Your individual qualifications will also impact the rate you are offered.

In general, rates track the yields on the 10-year Treasury note. Average mortgage rates are usually about 1.8 percentage points higher than the yield on the 10-year note.

Yields matter because lenders dont keep the mortgage they originate on their books for long. Instead, in order to free up money to keep originating more loans, lenders sell their mortgages to entities like Freddie Mac and Fannie Mae. These mortgages are then packaged into what are called mortgage-backed securities and sold to investors. Investors will only buy if they can earn a bit more than they can on the government notes.

Summary Of Current Mortgage Rates

This weeks mortgage rates moved higher

- The current rate for a 30-year fixed-rate mortgage is 6.70% with 0.9 points paid, 0.41 percentage points higher than a week ago. The 30-year rate averaged 3.01% a year ago this week.

- The current rate for a 15-year fixed-rate mortgage is 5.96% with 1.3 points paid, increasing by 0.52 percentage points week-over-week. The 15-year rate averaged 2.28% this same week a year ago.

- The current rate on a 5/1 adjustable-rate mortgage is 5.30% with 0.4 points paid, up by 0.33 percentage points from last week. The average rate on a 5/1 ARM was 2.48% a year ago.

© Copyright 2021 Ad Practitioners, LLC. All Rights Reserved. This article originally appeared on Money.com and may contain affiliate links for which Money receives compensation. Opinions expressed in this article are the author’s alone, not those of a third-party entity, and have not been reviewed, approved, or otherwise endorsed. Offers may be subject to change without notice. For more information, read Moneys full disclaimer.

Recommended Reading: Who Is A Lender In Mortgage

Should I Lock In My Mortgage Rate Today

Locking in a rate as soon as you have an accepted offer on a house can help guarantee a competitive rate and affordable monthly payments on your home mortgage. A rate lock means that your lender will guarantee you an agreed-upon rate for typically 45 to 60 days, regardless of what happens with average rates. Locking in a competitive rate can protect the borrower from rising interest rates before closing on the mortgage

It may be tempting to wait to see if interest rates will drop lower before getting a mortgage rate lock, but this may not be necessary. Ask your lender about float-down options, which allow you to snag a lower rate if the market changes during your lock period. These usually cost a few hundred dollars.

Determine What Your Ideal Down Payment Amount Should Be

A down payment is a portion of the cost of a home that you pay up front. It demonstrates your commitment to investing in your new home. Generally, the more you put down, the lower your interest rate and monthly payment. There are also low or no-down payment options available on certain types of mortgage products, to qualified home buyers. Use this down payment calculator to help you answer the question how much should my down payment be?.

Estimated monthly payment and APR example: A $225,000 loan amount with a 30-year term at an interest rate of 3.875% with a down-payment of 20% would result in an estimated monthly payment of $1,058.04 with an Annual Percentage Rate of 3.946%.1

Read Also: How Much Take Home Pay For Mortgage

How Do I Get The Best Mortgage Rate

Shopping around for the best mortgage rate can mean a lower rate and big savings. On average, borrowers who get a rate quote from one additional lender save $1,500 over the life of the loan, according to Freddie Mac. That number goes up to $3,000 if you get five quotes.

The best mortgage lender for you will be the one that can give you the lowest rate and the terms you want. Your local bank or credit union is one place to look. Online lenders have expanded their market share over the past decade and promise to get you pre-approved within minutes.

Shop around to compare rates and terms, and make sure your lender has the type of mortgage you need. Not all lenders write FHA loans, USDA-backed mortgages or VA loans, for example. If youre not sure about a lenders credentials, ask for its NMLS number and search for online reviews.

Should You Refinance Your Mortgage When Interest Rates Drop

Determining whether its the right time to refinance your home loan or not involves a number of factors. Most experts agree you should consider a mortgage refinancing if your current mortgage rate exceeds todays mortgage rates by 0.75 percentage points. Some say a refi can make sense if you can reduce your mortgage rate by as little as 0.5 percentage points . It doesnt make sense to refinance every time rates decline a little bit because mortgage fees would cut into your savings.

Many of the best mortgage refinance lenders can give you free rate quotes to help you decide whether the money youd save in interest justifies the cost of a new loan. Try to get a quote with a soft credit check which wont hurt your credit score.

You could increase interest savings by going with a shorter loan term such as a 15-year mortgage. Your payments will be higher, but you could save on interest charges over time, and youd pay off your house sooner.

How much does the interest rate affect mortgage payments?

In general, the lower the interest rate the lower your monthly payments will be. For example:

- If you have a $300,000 fixed-rate 30-year mortgage at 4% interest, your monthly payment will be $1,432 . Youll pay a total of $215,608 in interest over the full loan term.

- The same-sized loan at 3% interest will have a monthly payment of $1,264. You will pay a total of $155,040 in interest a savings of over $60,000.

You May Like: What Happens If You Miss A Mortgage Payment

How Much Is A $90k Loan

The monthly payments for a $90K loan are $530.95 and $101,140.86 in total interest payments on a 30 year term with a 5.85% interest rate. There might be other costs such as taxes and insurance.Following is a table that shows the monthly mortgage payments for $90,000 over 30 years and 15 years with different interest rates.

Why Is My Mortgage Rate Higher Than Average

Not all applicants will receive the very best rates when taking out a new mortgage or refinancing. Credit scores, loan term, interest rate types , down payment size, home location and loan size will all affect mortgage rates offered to individual home shoppers.

Rates also vary between mortgage lenders. Its estimated that about half of all buyers only look at one lender, primarily because they tend to trust referrals from their real estate agent. Yet this means that they may miss out on a lower rate elsewhere.

Freddie Mac estimates that buyers who got offers from five different lenders averaged 0.17 percentage points lower on their interest rate than those who didnt get multiple quotes. If you want to find the best rate and term for your loan, it makes sense to shop around first.

Read Also: Is Sebonic A Good Mortgage Company

What Are Points On A Mortgage

Discount points are a way for borrowers to reduce the interest rate they will pay on a mortgage. By buying points, youre basically prepaying some of the interest the bank charges on the loan. In return for prepaying, you get a lower interest rate which can lead to a lower monthly payment and savings on the overall cost of the loan over its full term.

A mortgage discount point normally costs 1% of your loan amount and could shave up to 0.25 percentage points off your interest rate. The exact reduction varies by lender. Always check with the lender to see how much of a reduction each point will make.

Discount points only pay off if you keep the home long enough. Selling the home or refinancing the mortgage before you break even would short circuit the discount point strategy.

In some cases, it makes more sense to put extra cash toward your down payment instead of discount points if a larger down payment could help you avoid paying PMI premiums, for example.

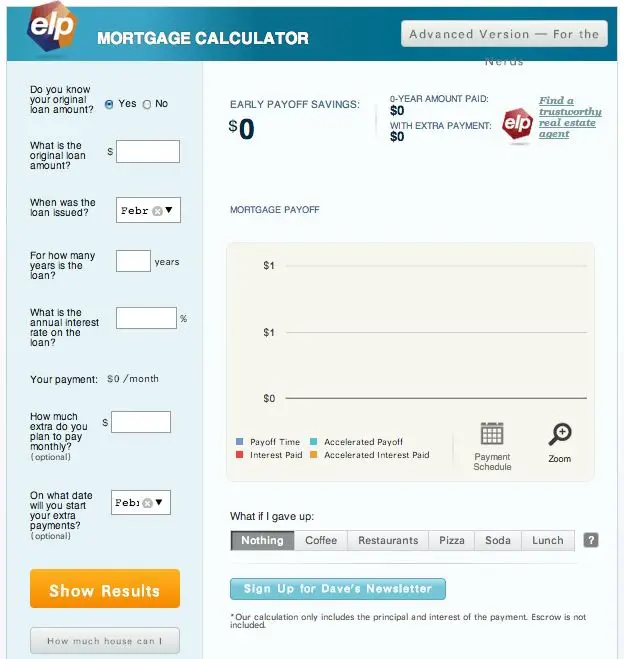

What Are My Monthly Payments

Use the Mortgage Calculator to get an idea of what your monthly payments could be. This calculator can help you estimate monthly payments with different loan types and terms. You may be able to afford more depending on factors including your down payment and/or the purchase price. The calculator will estimate your monthly principal and interest payment, which represents only a part of your total monthly home expenses. Additional monthly costs may include: real estate taxes, insurance, condo or homeowners association fees and dues, plus home maintenance services and utility bills.

Recommended Savings

Add All Fixed Costs and Variables to Get Your Monthly Amount

Calculator Disclaimer

Also Check: Can You Mortgage A Condo