A Look Into The Consumer Financial Protection Bureau

The Consumer Financial Protection Bureau, just like the SAFE Act and NMLS system, was put in place to protect consumers. From discovering unfair practices to enhancing financial education, the CFPB equips consumers with the tools and information they need to make smart decisions. This organization prevents companies from playing by different rules, making comparison shopping easy in the financial market.

Mortgage Defaults In The United States

There has always been a small percentage of mortgages that slip into delinquency or default, regardless of the prevailing economic climate. From 1979 through to 2006, the share of mortgage loans that were classed as âseriously delinquent’ averaged 1.7% with a low of 0.7% in 1979 and a high of 2.4% in 2002 when the country experienced its first recession of the new century. However, the rise of âsub-prime’ or ânear-prime’ lending in the middle of the decade led to an inevitable increase in mortgage defaults and delinquencies. Indeed, by 2008 the number of home loans determined to be âseriously delinquent’ or in default rose to 4.5%, nearly double the levels seen in 2002. The increased level of delinquencies preceded a sharp rise in home foreclosures, peaking at 1.2 million by the first quarter of 2008. To put that in perspective, that’s an increase of 79% over the first quarter of 2007.

What Do I Need To Do If I Use A Bill Payment Service Or An Internet Banking Site To Make My Mortgage Payments

Contact your bill payment service and arrange to have the payee changed. You will need to provide the following:

- Your new mortgage company: Wells Fargo Home Mortgage

- The effective date payments need to be sent to Wells Fargo: Your transfer date

- Your Wells Fargo Home Mortgage loan number

- The payment address listed on the coupon section of your Wells Fargo Home Mortgage statement or welcome letter

Recommended Reading: Does Carmax Pre Approval Affect Credit Score

You May Like: Can You Pay Off Mortgage Early Without Penalty

Use If Statements In Amortization Formulas

Because you now have many excessive period numbers, you have to somehow limit the calculations to the actual number of payments for a particular loan. This can be done by wrapping each formula into an IF statement. The logical test of the IF statement checks if the period number in the current row is less than or equal to the total number of payments. If the logical test is TRUE, the corresponding function is calculated if FALSE, an empty string is returned.

Assuming Period 1 is in row 8, enter the following formulas in the corresponding cells, and then copy them across the entire table.

Payment :

=IF, “”)

Interest :

=IF, “”)

Principal :

=IF, “”)

Balance:

For Period 1 , the formula is the same as in the previous example:

=C5+D8

For Period 2 and all subsequent periods, the formula takes this shape:

As the result, you have a correctly calculated amortization schedule and a bunch of empty rows with the period numbers after the loan is paid off.

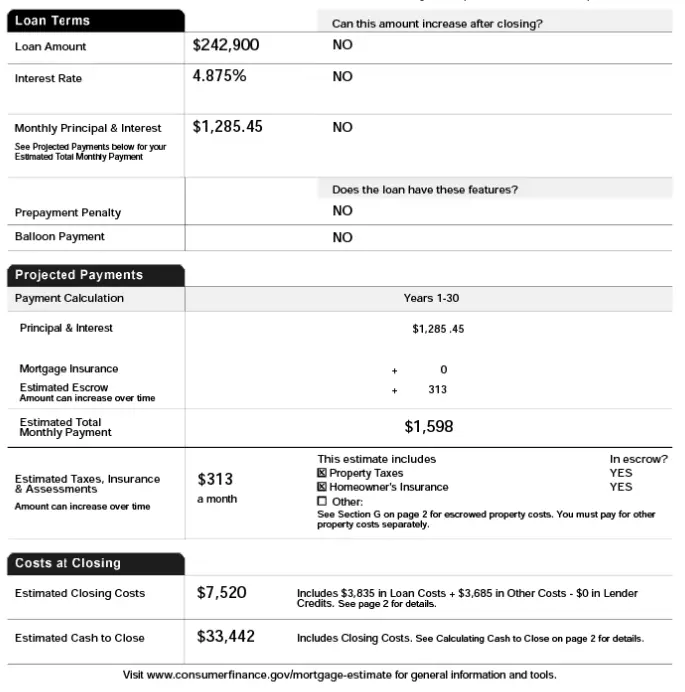

How To Compare Mortgage Rates

You can check current mortgage rates to see the average of what lenders are offering. Then get initial quotes online from some lenders based on your location, loan term, purchase price, down payment amount and other factors.

To get a firm quote, youll need to apply for preapproval. During the preapproval process, the lender will check your credit and verify your financial information, such as income, assets and debts.

Don’t Miss: How To Qualify For Mortgage Refinance

What Are Points On A Mortgage

Discount points are a way for borrowers to reduce the interest rate they will pay on a mortgage. By buying points, youre basically prepaying some of the interest the bank charges on the loan. In return for prepaying, you get a lower interest rate which can lead to a lower monthly payment and savings on the overall cost of the loan over its full term.

A mortgage discount point normally costs 1% of your loan amount and could shave up to 0.25 percentage points off your interest rate. The exact reduction varies by lender. Always check with the lender to see how much of a reduction each point will make.

Discount points only pay off if you keep the home long enough. Selling the home or refinancing the mortgage before you break even would short-circuit the discount point strategy.

In some cases, it makes more sense to put extra cash toward your down payment instead of discount points if a larger down payment could help you avoid paying PMI premiums, for example.

Current Conforming Loan Limits

On November 30, 2021 the Federal Housing Finance Agency raised the 2022 conforming loan limit on single family homes from $548,250 to $647,200 – an increase of $98,950 or 18.05%. That rate is the baseline limit for areas of the country where homes are fairly affordable. In higher-cost areas like San Francisco or New York City the single-family home loan limit can go as high as $970,800.

Here is an overview of the current limits based on the number of units in a building. Limits in the third row apply to Alaska, Guam, Virgin Islands, Washington D.C & Hawaii.

| Units |

|---|

Also Check: Can I Be Added To A Mortgage

How To Look Up An Nmls Number

Looking up mortgage lenders via NMLS ID is simple. Just visit the NMLS consumer access website and enter the NMLS identification number. If a number or identifier is entered correctly but fails to produce any results , then the person you are trying to find is not registered and might be conducting business illegally.

Why Its Important To Know Who Owns Your Mortgage

One of the major requirements for receiving mortgage forbearance under the CARES Act is that your home loan is owned by Fannie Mae or Freddie Mac. If it isnt, you may still be eligible for mortgage relief if your loan is guaranteed by the FHA, VA, or USDA.

Other reasons you may need to know who services, owns, or backs your mortgage include:

- Youre seeking basic information about your loan account, like the amount of your monthly payment, when your next payment is due, or information on late fees that you owe contact your loan servicer.

- Youve fallen behind on your payments and want to discuss alternatives to foreclosure contact your loan servicer first.

- Youre having trouble making monthly mortgage payments and want to take advantage of mortgage relief programs like payment deferral or forbearance contact the owner of your mortgage.

- Youre interested in learning more about other loss mitigation options available to you these options vary based on the entity that backs your loan.

Read Also: Do You Need Mortgage Insurance With An Fha Loan

How Do Mortgages Work

Mortgage debt is referred to as the equity in your home, the loan amount , and a combination of the interest rates paid on the mortgage loan.The amount borrowed from the lender is called collateral. It includes your home, personal items such as jewelry and electronics, and any other assets that you can mortgage as collateral. A mortgage refers to a legally binding contract, which establishes the right of the lender to take security specified in the collateral system.

The government program allows borrowers to take advantage of mortgage rates that are half those under the traditional mortgage program and, in some cases, even lower. While you may not be available under the home affordable Morgan program, you will not have many benefits, such as avoiding the large monthly mortgage payment and additional taxes often charged under Morgan rates.

What Is Merss Role In Foreclosures

If you stop making your mortgage payments, your lender has the right to begin foreclosure proceedings against your property. In a foreclosure, your lender takes over ownership of your home, forcing you to move. The lender will then try to sell the home to recover its costs.

In 2011, MERS enacted a rule stating that foreclosures cannot be started in its name, even if MERS is listed as the mortgagee or beneficiary of a loan. If these MOM loans do go into foreclosure, MERS will usually assign the loan back to the actual lender or the current owner of the mortgage. That lender will then be named as the party initiating foreclosure procedures.

You May Like: How To Calculate Your Monthly Mortgage Payment By Hand

Mortgage Rates By Region

Of course, mortgage rates are also influenced by region, and where you buy a home will have a big impact on the available interest rates. Currently, rates are lowest on the upper East coast, with New York and New Jersey leading the country in most affordable mortgage rates. Arizona, New Mexico, and Florida continue to have the highest rates in the country, following the historical trends. To see where your state ranks among the national averages, check out this handy interactive map. It’s updated regularly so you can track the rise and fall of mortgage rates in your region of the country.

How Much Do Lenders Make Per Originated Loan

Loan production expenses have increased significantly due to tigher regulation after the 2008-2009 financial crisis. The MBA stated loan production expenses rose to $8,278 in 2018 from $8,028 in 2017. Lenders have averaged around $1000 of profit per loan over the past decade, with tighter margins recently as net income fell from 31 basis points in 2017 to 14 basis points in 2018.

âSince the inception of the Annual Performance Report in 2008, net production income by year has averaged 49 bps .â ⦠âIn basis points, the average production profit was 14 basis points in 2018, compared to 31 basis points in 2017. In the first half of 2018, net production income averaged 18 basis points, then dropped to 9 basis points in the second half of 2018,â reports Marina Walsh of the MBA.

Don’t Miss: Why Switch To A 15 Year Fixed Mortgage

Tip: Return Payments As Positive Numbers

Because a loan is paid out of your bank account, Excel functions return the payment, interest and principal as negative numbers. By default, these values are highlighted in red and enclosed in parentheses as you can see in the image above.

If you prefer to have all the results as positive numbers, put a minus sign before the PMT, IPMT and PPMT functions.

For the Balance formulas, use subtraction instead of addition like shown in the screenshot below:

How Does A Mortgage Loan Work

When you get a mortgage, your lender gives you a set amount of money to buy the home. You agree to pay back your loan with interest over a period of several years. The lender’s rights to the home continue until the mortgage is fully paid off. Fully amortized loans have a set payment schedule so that the loan is paid off at the end of your term.

The difference between a mortgage and other loans is that if you fail to repay the loan, your lender can sell your home to recoup its losses. Contrast that to what happens if you fail to make credit card payments: You dont have to return the things you bought with the credit card, though you may have to pay late fees to bring your account current in addition to dealing with negative impacts on your credit score.

Don’t Miss: Can You Do A 20 Year Mortgage

How A Car Insurance Company Uses Your Vin

When issuing a new policy, car insurance companies check VIN numbers to ensure they have the correct vehicle details on file. Online quoting tools make getting quotes fast and easy, and you can sometimes get an online quote without providing a VIN.

But before the car company actually issues the policy, theyll want to see the VIN. That way the provider can verify the information you gave to get the quote. The VIN also ensures the provider knows about the cars history, including whether its a stolen vehicle or has a title thats been branded with something like flood damage or salvage. The VIN will also identify any prior accidents or repairs completed on the car.

Although you usually dont need your VIN to get a car insurance quote, it can be a good idea to provide it during the quoting process to ensure you get the most accurate quote possible.

First Lien Information By Ethnicity & Income

| Borrower race & ethnicity, borrower income & neighborhood income | 2004 |

|---|

| 3.71% | 6,114,421 |

When interest rates rise much of the demand to refinance dissipates, as homeowners prefer to maintain their existing loans with lower rates. In 2017 there were over a million fewer refinances than during 2016 as interest rates rose. In 2018 there will once again be fewer refinancing loans as interest rates continue rising.

Home equity loans & home equity lines of credit allow homeowners to borrow against a portion of their home equity while maintaining their first mortgage at its existing low rate. TransUnion published a study in 2017 which suggested there will be an average of 2 million HELOCs per year between 2018 and 2022.

Here is a breakdown of refinancing activity by ethnicity & income.

| Borrower race & ethnicity, borrower income & neighborhood income | 2004 |

|---|

| $166 |

You May Like: How To Pay Off 80000 Mortgage In 5 Years

What Well Need From You

Rocket Mortgage® takes your personal information and privacy very seriously. We want to make sure were working with the right person. Whether youre getting the payoff quote yourself or being assisted by a third party, youll need the following information:

- Your Social Security number

- Phone number on file with Rocket Mortgage

- Your Rocket Mortgage loan number

Make sure to have this information ready when you call 373-7433.

Why Is An Nmls Number Important

Before the enactment of the Secure and Fair Enforcement for Mortgage Licencing Act , there were almost no resources to help consumers stay safe from predatory lenders. Consumers can now use an MLOs Unique Identifier to verify their credentials. This can significantly prevent them from making a costly mistake when trying to obtain a mortgage loan. Not only does this provide peace of mind, but it also allows consumers to compare the professional experience and expertise of multiple MLOs.

Without an NMLS number, consumers may be wary of your services and decide to move forward with another MLO.

Read Also: Can I Roll My Down Payment Into My Mortgage

How To Avoid And Fix Problems With Your Servicer

Typically, the servicer must credit a payment to your account the day they get it. That way, you dont owe extra fees and the payment doesnt look late to the lender. Late payments show up on your credit report and may affect your ability to get credit in the future. Too many late payments can lead to default and foreclosure.

Also Check: How To Transfer A Car Loan To Someone Else

More About Your Mortgage Loan Transfer

- You may have received a goodbye letter from your previous mortgage servicer that includes the effective date of the mortgage loan transfer. This letter includes your new Freedom Mortgage loan number.

- Youll receive a welcome letter from Freedom Mortgage approximately 8 business days after the effective date of the transfer.

- Youll be able to set up your new Freedom Mortgage online account five to seven days after the effective date of the transfer. You will need your new Freedom Mortgage loan number to create this account.

- With your Freedom Mortgage online account, you can make one-time payments or you can set up recurring payments.

- You can also review your loan details, view and download statements and payment histories, send and receive secure messages, and sign up for paperless statements.

- Automatic payments setup with your prior servicer or bank will not transfer. Its easy to setup automatic payments with your new Freedom Mortgage online account.

You May Like: A 30 Year Mortgage Payment Chart

What Is A Mortgage Preapproval

When youre shopping for a mortgage, you can compare options offered by different lenders.

Mortgage lenders have a process which may allow you to:

- know the maximum amount of a mortgage you could qualify for

- estimate your mortgage payments

- lock in an interest rate for 60 to 130 days, depending on the lender

The mortgage preapproval process may be divided in various steps. It may also be called mortgage prequalification or mortgage preauthorization. Different lenders have different definitions and criteria for each step they offer.

During this process, the lender looks at your finances to find out the maximum amount they may lend you and at what interest rate. They ask for your personal information, various documents and they likely run a credit check.

This process does not guarantee your approval for a mortgage.

Understand What Information Youll Receive

Its a good idea to know what information you can expect to walk away with when conducting a public mortgage records search. Depending on the specific county, youll most likely discover the borrowers name, the property address, maps or surveys of the property, the square footage of any dwellings and the propertys assessed value. Youll also be able to see previous sales listings and the propertys tax assessment history.

Read Also: What Does A Mortgage Consist Of

How To Make A Mortgage Payment

Most lenders provide multiple ways of making your mortgage payments, including:

- Online: The simplest way to make payments is online through your loan servicers website. Consider setting up automatic payments to ensure you pay on time. You can also set up the payment through your banks bill pay system. Just keep an eye on your mortgage statements for any changes to the address or loan number if your loan servicing is sold, so your payments go to the right place.

- : Your mortgage statement will probably have a portion that you can detach and return by mail with your payment. If paying by mail, allow enough time before your mortgage due date. If youre close to the due date or the end of the grace period, get a receipt from the post office or consider using next-day delivery.

- : Some lenders provide an option to call and make your mortgage payments over the phone. Just be sure your loan servicer doesnt charge a fee for this service.

- In person: If your lender or bank has brick-and-mortar locations, you can make your mortgage payments in person. And you should be sure to get a receipt: The law requires your payment to be credited the day you make it, so if your servicer charges a late fee, then the receipt is your proof to reverse the late charge.