Why Should I Use A Mortgage Calculator

Should I Include Projected Repair Costs In My Monthly Payment Calculation

Repair costs arent something that you should include in your monthly payment calculation, but you absolutely should keep them in mind. If the property that you are considering is in need of significant repairs or renovations, then you absolutely will need to consider how you will cover those costs before you sign on to a mortgage on the home.

How Much House Can I Afford On My Salary

Lets say you earn $70,000 each year. By using the 28 percent rule, your mortgage payments should add up to no more than $19,600 for the year, which equals a monthly payment of $1,633. With that magic number in mind, you can afford a $305,000 home at a 5.35 percent interest rate over 30 years. But youd need to make a down payment of 20 percent.

Recommended Reading: What Does Prequalification For A Mortgage Mean

Monthly Payment: Whats Behind The Numbers Used In Our Mortgage Payment Calculator

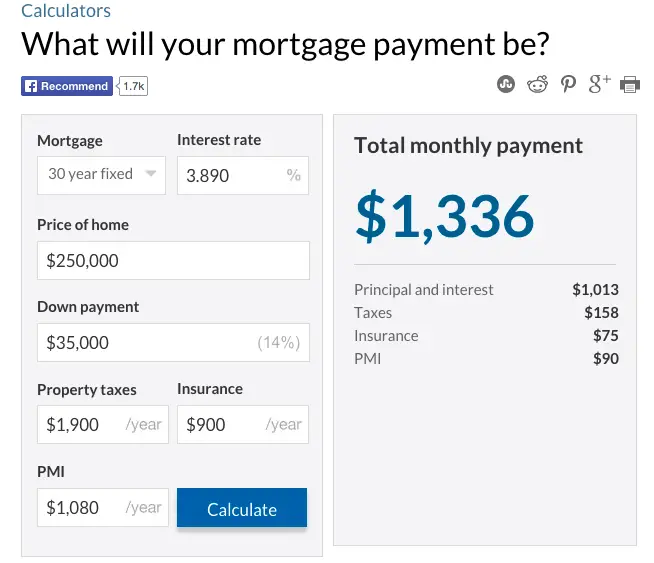

The NerdWallet mortgage payment calculator cooks in all the costs that are wrapped into your monthly payment, including principal and interest, taxes and insurance. Youll just need to plug in the numbers. The more info youre able to provide, the more accurate your total monthly payment estimate will be.

For example, you may have homeowners association dues built into your monthly payment. Or mortgage insurance, if you put down less than 20%. And then theres property taxes and homeowners insurance. It helps to gather all of these additional expenses that are included in your monthly payment, because they can really add up. If you dont consider them all, you may budget for one payment, only to find out that its much larger than you expected.

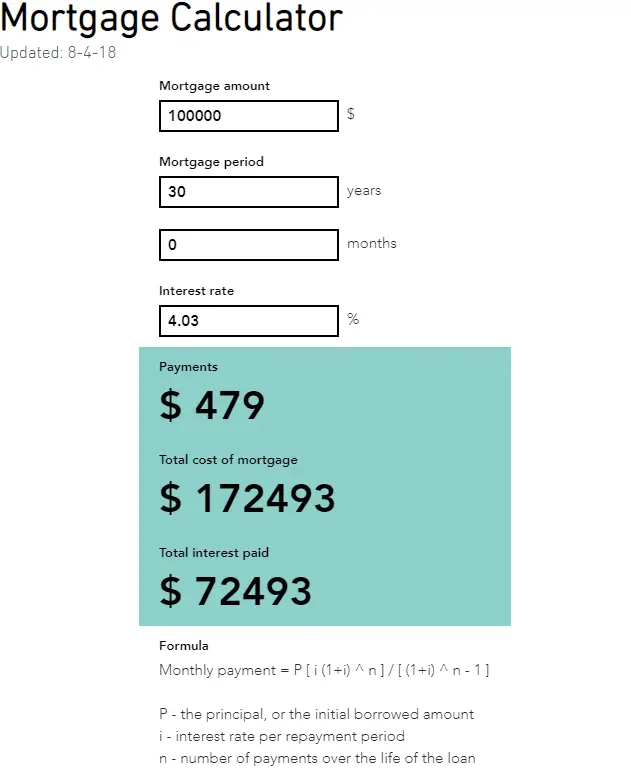

For you home gamers, heres how we calculate your monthly mortgage payments on a fixed-rate loan:

M = P /

The variables are:

-

M = monthly mortgage payment

-

P = the principal, or the initial amount you borrowed.

-

i = your monthly interest rate. Your lender likely lists interest rates as an annual figure, so youll need to divide by 12, for each month of the year. So, if your rate is 5%, then the monthly rate will look like this: 0.05/12 = 0.004167.

-

n = the number of payments over the life of the loan. If you take out a 30-year fixed rate mortgage, this means: n = 30 years x 12 months per year, or 360 payments.

Principal And Interest Of A Mortgage

A typical loan repayment consists of two parts, the principal and the interest. The principal is the amount borrowed, while the interest is the lender’s charge to borrow the money. This interest charge is typically a percentage of the outstanding principal. A typical amortization schedule of a mortgage loan will contain both interest and principal.

Each payment will cover the interest first, with the remaining portion allocated to the principal. Since the outstanding balance on the total principal requires higher interest charges, a more significant part of the payment will go toward interest at first. However, as the outstanding principal declines, interest costs will subsequently fall. Thus, with each successive payment, the portion allocated to interest falls while the amount of principal paid rises.

The Mortgage Payoff Calculator and the accompanying Amortization Table illustrate this precisely. Once the user inputs the required information, the Mortgage Payoff Calculator will calculate the pertinent data.

Aside from selling the home to pay off the mortgage, some borrowers may want to pay off their mortgage earlier to save on interest. Outlined below are a few strategies that can be employed to pay off the mortgage early.:

Also Check: What Does Buying Mortgage Points Mean

What Is Homeowners Insurance

Homeowners insurance is a policy you purchase from an insurance provider that covers you in case of theft, fire or storm damage to your home. Flood or earthquake insurance is generally a separate policy. Homeowners insurance can cost anywhere from a few hundred dollars to thousands of dollars depending on the size and location of the home.

When you borrow money to buy a home, your lender requires you to have homeowners insurance. This type of insurance policy protects the lenders collateral in case of fire or other damage-causing events.

Should I Overpay My Mortgage Or Invest The Extra Cash

Working out what to do with a big lump sum or a spare bit of cash is one of the nicer financial problems to have.

Rather than paying off your mortgage you could invest instead. This gives you the opportunity to build a nest-egg through the returns generated by assets such as shares perhaps to help fund a more comfortable retirement.

If you have grand plans for your future or simply want to generate bigger financial returns, investing any extra cash can be a very sensible strategy.

But there are risks to bear in mind too which we outline below.

Recommended Reading: What Is The Hiro Mortgage Program

What Happens After You Get Preapproved For A Home Mortgage Loan

Getting preapproved for a mortgage is just the beginning. Once the financial pieces are in place, its time to find your perfect home! While its one of the most exciting stages of the process, it can also be the most stressful. Thats why its important to partner with a buyers agent.

A buyers agent can guide you through the process of finding a home, negotiating the contract, and closing on your new place. The best part? Working with a buyers agent doesnt cost you a thing! Thats because, in most cases, the seller pays the agents commission. Through our Endorsed Local Providers program, our team can match you with the top real estate agents we recommend in your area.

Estimate Your Interest Rate

Any loan officer will tell you that you wont really know the interest rate until you lock it in, which doesnt happen until youre well into the process. For this mortgage calculator, you need to make your best guess based on the interest rates other people are currently getting. Check the news. Ask your real estate agent, or talk to friends and neighbors who recently moved or refinanced.

You May Like: What Would My Mortgage Be On A 200 000 House

Whats Included In A Mortgage Payment

Your mortgage payment consists of four costs, which loan officers refer to as PITI. These four parts are principal, interest, taxes, and insurance.

- Principal: The amount you owe without any interest added. If you buy a home for $400,000 with 20% down, then your principal loan balance is $320,000

- Interest: The amount of interest youll pay to borrow the principal. If the same $320,000 loan above has a 4% rate, then youll pay $12,800 for the first year in interest repayment

- Taxes: Property taxes required by your city and county government

- Insurance: Homeowners insurance and, if required, private mortgage insurance premiums on a conventional loan

When determining your home buying budget, consider your entire PITI payment rather than only focusing on principal and interest. If taxes and insurance are not included in a mortgage calculator, its easy to overestimate your home buying budget.

How Do Property Taxes Work

When you own property, youre subject to taxes levied by the county and district. You can input your zip code or town name using our property tax calculator to see the average effective tax rate in your area.

Property taxes vary widely from state to state and even county to county. For example, New Jersey has the highest average effective property tax rate in the country at 2.42%. Owning property in Wyoming, however, will only put you back roughly 0.57% in property taxes, one of the lowest average effective tax rates in the country.

While it depends on your state, county and municipality, in general, property taxes are calculated as a percentage of your homes value and billed to you once a year. In some areas, your home is reassessed each year, while in others it can be as long as every five years. These taxes generally pay for services such as road repairs and maintenance, school district budgets and county general services.

Don’t Miss: How Much Is A Mortgage On A 250k House

Early Repayment And Extra Payments

In many situations, mortgage borrowers may want to pay off mortgages earlier rather than later, either in whole or in part, for reasons including but not limited to interest savings, wanting to sell their home, or refinancing. Our calculator can factor in monthly, annual, or one-time extra payments. However, borrowers need to understand the advantages and disadvantages of paying ahead on the mortgage.

Early Repayment Strategies

Aside from paying off the mortgage loan entirely, typically, there are three main strategies that can be used to repay a mortgage loan earlier. Borrowers mainly adopt these strategies to save on interest. These methods can be used in combination or individually.

Reasons for early repayment

Making extra payments offers the following advantages:

Drawbacks of early repayment

What To Do After Paying Off Your Mortgage

Well done! Youve paid off your mortgage debt. But dont put your feet up just yet. There are a few things to consider next:

Don’t Miss: How Much Of Your Income Should Go To Your Mortgage

How Lenders Decide How Much You Can Afford To Borrow

Mortgage lenders are required to assess your ability to repay the amount you want to borrow. A lot of factors go into that assessment, and the main one is debt-to-income ratio.

Your debt-to-income ratio is the percentage of pretax income that goes toward monthly debt payments, including the mortgage, car payments, student loans, minimum credit card payments and child support. Lenders look most favorably on debt-to-income ratios of 36% or less or a maximum of $1,800 a month on an income of $5,000 a month before taxes.

Conforming Loans Vs Non

Conforming loanshave maximum loan amounts that are set by the government and conform to other rules set by Fannie Mae or Freddie Mac, the companies that provide backing for conforming loans. A non-conforming loan is less standardized with eligibility and pricing varying widely by lender. Non-conforming loans are not limited to the size limit of conforming loans, like a jumbo loan, or the guidelines like government-backed loans, although lenders will have their own criteria.

You May Like: How To Remove Mortgage From Credit Report

Los Angeles Homebuyers Can Take Advantage Of Historically Low Mortgage Rates Today

Own your very own piece of Los Angeles. Lock in low rates currently available in and save for years to come! In spite of the recent rise in rates current mortgage rates are still below historic averages. If you secure a fixed mortgage rate your payments won’t be impacted by future rate hikes. By default we show 30-year purchase rates for fixed-rate mortgages. You can switch over to refinance loans using the radio button. Adjustable-rate mortgage loans are listed as an option in the check boxes. Alternate loan durations can be selected and results can be filtered using the button in the bottom left corner. You can select multiple durations at the same time to compare current rates and monthly payment amounts.

Help your customers buy a home today byinstalling this free mortgage calculator on your website

As Seen In

How Much Mortgage Can I Qualify For

Lenders have apre-qualification processthat takes your finances into account to determine how much they are willing to lend you. Once the lender has completed a preliminary review, they generally provide a pre-qualification letter that states how much mortgage you qualify for. Get pre-qualified by a lender toconfirm your affordability.

Don’t Miss: How Many Times Can A Mortgage Company Pull Your Credit

Disadvantages To Investing Your Money

When you overpay your mortgage, you will get an instant boost to your finances. Your debt will shrink straight away and you will have more disposable income.

The catch with investing is that your returns are not guaranteed.

Much will depend on the performance of the investment you choose and even if the long-term growth potential is good, you could still suffer short-term losses.

In other words, if you really want to see your money grow, you need to be prepared to tie it up for a longer period so that the investment can ride out market downturns and benefit from the good times.

If youre new to investing, we have a guide for beginners.

There are also charges associated with investing from the platform you use to buy assets such as funds, to the management of those funds.

Then there is the time and effort required in choosing the right investments for you.

We can help you out by listing the best stocks and shares ISAs.

Advantages To Investing Your Money

If you investthen, over time, it is likely that your money will grow much faster than it would if you left it in a savings account paying a low interest rate.

To really harness the power of the stock market and enjoy the benefit of compounded returns, you need to leave your money invested for a minimum of five years .

Another advantage to investing is that you dont have to lose access to that cash if you need it in an emergency. This is because you can sell your investment if you need to.

Find out: When should I sell my stocks?

What about investing through my pension?

Paying more into your pension is also a form of investing. In this case, you will get the added bonus of tax relief on your contributions.

If you are in a workplace scheme you get employer contributions on top, so you will benefit even further.

Although this could be an excellent way to boost your retirement pot, the downside is that you wont be able to gain access to the money until you turn 55 .

For more information read our guide on pensions.

Read Also: Can You Refinance An Arm Mortgage

How Does This House Payment Calculator Work

This is a comprehensive calculator designed to help you determine the total monthly effort you will have to make to payout your mortgage and your own house related costs, thus it requires knowing the following details:

- House price meaning the value you will pay for the property you buy.

- Down payment which is the amount of money you have available for a one time deposit at the beginning of the real estate transaction. While the level required depends on the lenders policy, it usually varies between 15 to 30% .

- Term of the loan usually expressed in years or months. Most of the home mortgages are taken for a period which varies between 15 and 30 years, while the most common term is 25 years.

- A constant interest rate level the lender offers.

- A desired payment frequency which most probably will be monthly, but can be any value from the provided drop down list.

- Annual property tax rate which is by default estimated to 1.2% but it is editable, so whenever the case it can be changed to any level.

- Annual home insurance value you assume you will pay. For that you may contact a specialized broker and as for a quote for a similar property.

- Annual PMI insurance rate which is automatically estimated by considering the values you input within the previous fields, but it is changeable with any percentage.

- Annual HOA dues where applicable.

- Other costs related to the home purchase.