Can I Move Money Before Closing

Moving money is OK as long as you’re open to doing more work Each account needs to be traced with at least two months’ worth of history, and any transferred money needs to be traced back to the account where it came from. Moving money just means that you have more loose ends to tie up in collecting your documentation.

The Underwriter Will Make An Informed Decision

The underwriter has the option to either approve, deny or pend your mortgage loan application.

- Approved: You may get a clear to close right away. If so, it means theres nothing more you need to provide. You and the lender can schedule your closing. However, if your approval comes with conditions, youll need to provide something more, such as a signature, tax forms or prior pay stubs. The process may take a little longer, but nothing to worry about if youre prompt in responding to any requests.

- Denied: If an underwriter denies your mortgage application, youll need to understand why before deciding on next steps. There are many reasons for the denial of an application. Having too much debt, a low or not being eligible for a particular loan type are some examples. Once you know the reason for the decision you can take steps to address the issue.

- If you dont provide enough information for the underwriter to do a thorough evaluation, they may suspend your application. For example, if they can’t verify your employment or income. It doesnt mean you cant get the loan, but youll need to provide further documentation for them to decide.

Save For A Larger Down Payment

Borrowers who offer a large down payment, specifically 20%, are more attractive candidates to lenders. A higher down payment significantly decreases your LTV ratio. This reduces overall credit risk for the lender, and is also beneficial to the borrower. As mentioned previously, paying 20% down bypasses private mortgage insurance for conventional mortgages, which helps borrowers save on their loan.

Before buying a house, give yourself enough time to gather down payment. You can render overtime work to increase your savings, or get a part-time job. If you can, ask family members who are willing to shoulder a portion of your funds. A higher down payment increases your chances of securing a mortgage, even if your credit score might be a little low.

Also Check: Can I Pay My Mortgage Twice A Month

Stay In Touch With Your Lender

During the underwriting process, there may be questions or the need for more information. Responding promptly to these requests will keep your application moving forward. Our online loan application makes it easier for you to gather the information they need while staying connected with a trusted mortgage loan officer throughout the process.

Have An Appraisal Of The Home And Property Done

A lender never wants to approve a loan amount that is in excess of the value of the home being purchased this is the chief reason that an underwriter will order an appraisal to be conducted. The lender wants to be absolutely certain that the loan being offered is commensurate to the value of the home.

Recommended Reading: What Are The Current Best Mortgage Rates

What Do Mortgage Underwriters Consider

Mortgage underwriters consider the three Cs in an application: credit, capacity and collateral. When underwriters review your credit, theyre looking at your loan history. When they review your capacity, theyre looking at your current finances. And when they consider the collateral, theyre looking at what your house is worth in case, in the future, youre unable to make the payments. All of this information is used to determine if providing you a loan is a good investment choice for them.

Lenders will pull your credit report from one or more of the three major U.S. credit bureaus. But theyll look at more than just your credit score to get a holistic view, theyll also consider your:

- Payment history

- Type of accounts

Its more favorable if you have a long history with several types of loans that youve paid on time every month. Underwriters look at this to help determine if youre likely to repay a mortgage loan. You can check your credit score and history at freecreditreport.com.

Capacity

Underwriters will also evaluate your budget capacity, which is your ability to handle the mortgage payment. They will look at your:

Collateral

The value and condition of the house youre buying matters to you and the lender.

What Decisions Does The Underwriter Make

After an underwriter evaluates the documents provided, he/she will provide one of the following decisions:

- Approved: This really means “approved with conditions.” It’s rare that a borrower gets a final approval without submitting further documentation. The conditions in the approval generally have to do with the home itself, such as the appraisal or title work. They may also contain conditions that pertain to your financial worth too. For example, the underwriter may need to perform a verbal Verification of Employment to confirm your dates of employment and income. He/she may also want clarification on an item on a pay stub or your asset statement. The “approved with conditions” status is as close as it gets to a final approval, though.

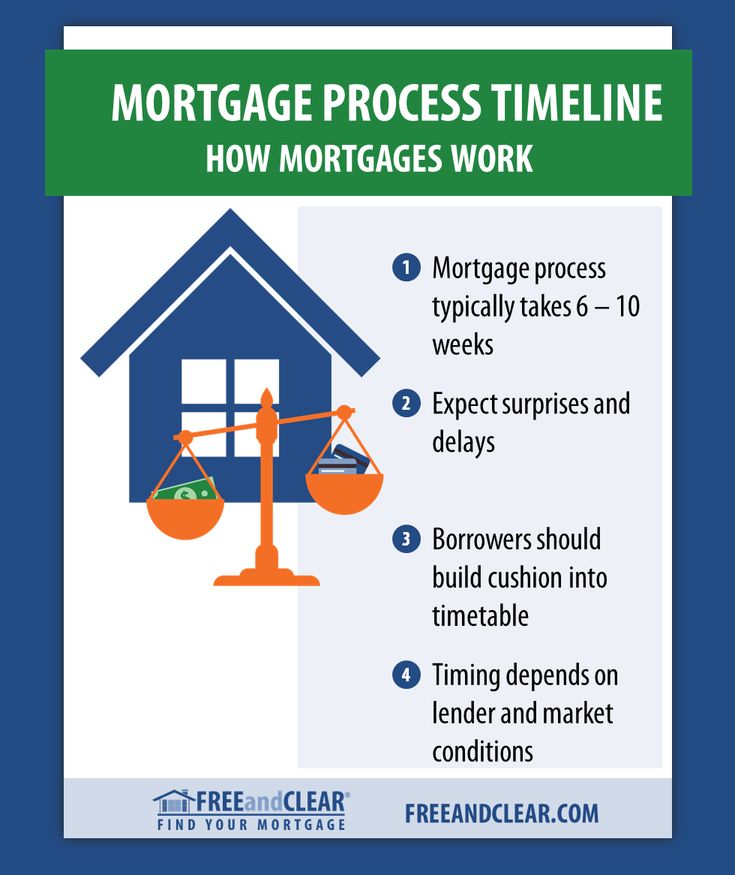

How Long Does Underwriting Take on a Conventional Loan?

Also Check: Is It Worth Refinancing My Mortgage

Property Valuation And Underwriting

The valuation provided by a mortgage lender differs from an estate agents property valuation. The goal of an estate agents valuation is to estimate a propertys market value based on its size, location, condition, and a number of other variables. However, a mortgage lenders valuation is substantially shorter and is intended purely for the mortgage lenders use.

Primarily, this process helps to check that the property is worth what the borrower says it is. It is therefore an important indicator of the amount of risk that an application entails. In other words, this procedure will help an underwriter to ensure that it is in the lenders best interest to supply a mortgage for the property. As such, there are some properties that some lenders will be less keen to provide a mortgage for.

Generally, the cost of the survey will be added to the mortgage fee by the lender.

What Can Go Wrong With Mortgage Underwriting

The main thing that could go wrong in underwriting has to do with the home appraisal that the lender ordered: Either the assessment of value resulted in a low appraisal or the underwriter called for a review by another appraiser. … You can contest a low appraisal, but most of the time the appraiser wins.

Also Check: How Late Can You Be On Your Mortgage

What Can Go Wrong In The Underwriting Process

The main thing that could go wrong in underwriting has to do with the home appraisal that the lender ordered: Either the assessment of value resulted in a low appraisal or the underwriter called for a review by another appraiser. … You can contest a low appraisal, but most of the time the appraiser wins.

What Is A Mortgage Underwriter And Why Does A Mortgage Application Go To An Underwriter

A mortgage underwriter works for a mortgage lender.

In mortgage underwriting you can imagine with £100,000s involved, the risk can get high, really quickly, so the process can be firm and lengthy.

Your income, affordability, debts, credit profile and property will all be assessed before you get your mortgage approval â and it’s the underwriter’s job to do this.

Once the mortgage underwriter has given your application an approval, you’re pretty much home and dry: a mortgage offer’s almost certainly on the way, but if your circumstances do change between the offer and completion, the lender does reserve the right to decline your request for funds.

Don’t Miss: How Much Is Mortgage On 1 Million

What Do Mortgage Underwriters Do Make Or Break Your Loan Approval

Heres some Q& A with regard to the home loan approval process: What do underwriters do?

Once you actually apply for a home loan, your mortgage application will be organized by a loan processor and then sent along to a loan underwriter, who will determine if you qualify for a mortgage.

The underwriter can be your best friend or your worst enemy, so its important to put your best foot forward.

The expression, youve only got one chance to make a first impression comes to mind here.

Trust me, youll want to get it right the first time to avoid going down the bureaucratic rabbit hole.

Tip #: Dont Apply For Any New Credit Lines During Underwriting

Any major financial changes and spending can cause problems during the underwriting process. New lines of credit or loans could interrupt this process.

Also, avoid making any purchases that could decrease your assets. Once the underwriting decision has been made, you can go forward with any planned purchases.

You May Like: How Much To Pay Mortgage Off Early

What Is The Mortgage Underwriting Process

12 Min Read | Jun 20, 2022

So, youve been looking at homes for weeks and you finally found one you just loved. Kitchen with granite counters? Check. Open floor plan? Check. Big backyard for the dog? Check! It was all fun and games until you started the mortgage process.

Welcome to adulthood.

Now you have to choose the right lender, gather your documents, and start the mortgage underwriting process. Sounds boring, but understanding all this underwriting stuff is an important step in the process of getting your home sweet home. Ready? Time to rip off the Band-Aid.

You Have A History Of Missed Mortgage Payments

If youve previously been a homeowner, your underwriter will want to see evidence that you paid your mortgage consistently and on time, otherwise they may not feel its worth the risk to approve your loan for this new home.

Having a short sale or foreclosure on your record may also prevent you from getting approved for a certain length of time.

You May Like: Which Credit Report Do Mortgage Lenders Use

What To Do If Your Loan Application Is Denied

When the lender does not approve your mortgage loan application, they will typically tell you why if they dont, you should ask. Knowing why you were denied can help you take the necessary steps to get approved in the future.

For example, if you were denied because of a high debt-to-income ratio, you can take time to pay down your debts. If you were denied because of inconsistent income history, then you might wait until you get a steady job. Borrowers with low income or a subpar credit score might consider an FHA loan, a government-insured mortgage that has lower barriers to entry.

Learn more about FHA loans here.

Ready to shop for life insurance?

Clear Any Loan Contingencies

This is when youll work with your lender to make sure youve cleared any of those contingencies they found in step 4. Also, your lender locks in your interest rate. Once the conditions have all been met, youll receive a clear to close from your lender. That means your mortgage loan is ready to be finalized on closing day.

Read Also: What Should My Mortgage Be

Render A Decision On Whether To Approve Or Deny The Loan

It all boils down to this: Can you afford the costs of the home given your income and assets? Does your financial history indicate that you are a low-risk candidate for the lender to extend funds to?

A good underwriter works diligently to compile a complete portrait of your financial history, including all streams of income, assets, debts and credit behavior over an extended period of time. Its an evaluation that demands patience, knowledge, thoroughness and full access to all relevant documents.

What Is The Purpose Of Underwriting

At its core, underwriting is about identifying risk. Underwriters use your past financial behavior, data from past transactions and mathematical models to make predictions about your future financial behavior.

Once theyve determined how much of a risk you present, lenders can figure out how much theyll need to charge in interest to make that risk worthwhile to them. Keep in mind that there are two aspects to risk: the general risk associated with economic factors and the cost of money, and the likelihood that you, as an individual, are likely to repay debt. When you see posted mortgage rates, they are typically the lowest possible rate available to borrowers with excellent credit.

If you have an excellent credit score and history, your mortgages interest rate will be close to those posted rates. Your history and low debt load present a low risk of future default. If youve had financial difficulties in the past or are carrying a large amount of debt, however, your interest rate will be higher. Lenders need to make more money on your mortgage to incentivize them to take on the greater risk that you will default.

Don’t Miss: How Much To Earn For 200k Mortgage

Prepare And Organize All Required Documents

Preparing your mortgage requirements early is the best way to keep your application on track. Make sure to request paperwork from your bank and employer as soon as you can. If you have pending documents, send them as quickly as possible. You should also respond to questions from your underwriter in a timely manner.

If you intend to use gift money as down payment, you should have the funds in your account before the application. You must also provide a letter that proves the money is a gift that does not necessitate repayment.

Before you file your application, gather a folder of the following documents:

- W-2 forms from the last 2 years

- Pay stubs from the last 1 or 2 months

- Employment info. from the last 2 years

- Account info.: Savings accounts, checking accounts, retirement accounts, etc.

- If youre self-employed: Includes business records and tax returns in last 2 years

- Additional income info.: Bonuses, overtime payments, commissions, dividends, pension, Social Security, alimony or child support

What Information Do I Need For Underwriting

Once you complete your loan application and we’ve provided you with a loan estimate, youll be asked to provide including:

- A copy of your drivers license

- Last 2 years of W2 statements from your employer

- Last 30 days of pay stubs

- Last 2 months of bank statements

- Last quarter of stocks/bonds/mutual funds/401

and potentially more.

This is the information your underwriter will use to determine your loan eligibility. Your loan originator will also pull your credit report and provide that to the underwriting team as well.

Don’t Miss: What Is The Current Interest Rate For Interest Only Mortgages

Thoughts On What Do Mortgage Underwriters Do Make Or Break Your Loan Approval

My husband recently switched from employee to contractor that receives 1099. We are being told that regardless of credit score and down payment we will have to show 2 years of Self Employment tax returns in order to be considered. Is there any way around this and if we apply will we considered at all?

Hi Renee,

Changes in employment can present challenges, especially going from W-2 to self-employed, and certainly if its less than two years. But if hes been doing it over a year and its in the same line of work and an equal or better position than his former one, it may be possible to get financing. It might be best to speak with a broker or two so they can scan their range of offerings to see what lenders might be willing to help. And maybe also reach out to some portfolio lenders who keep their loans and thereby underwrite a bit differently.

if i have less than stella credit and a student loan in default, which is now being rehabilitated, how can i get my pre approval from a lender, ??

Rad,

You may still be able to get approved but its probably better to apply when your credit score is higherlower rate, more options.

I included my home in a bankruptcy 5 years ago but the mortgage company has failed to foreclose on the loan, I have reestablished my credit and have a good credit score can I still buy a home?

Kay,

I have money save will the underwriters want to know how I got the money

Want An Expert In Your Corner

Think Plutus will go over your application with a fine-toothed comb and inform the lender of any special circumstances in your application. We also have access to the full market of mortgage providers and products, so we can place your mortgage application with the most suitable lender. With Think Plutus in your corner, you give yourself the best possible chances of success. Get in touch today.

Also Check: A 30 Year Mortgage Payment Chart

What Happens During The Underwriting Process

Underwriting is one facet of the mortgage process.

Many people get preapproved for a mortgage, which is just an estimate of what the bank is willing to lend you. Afterall, you may end up choosing to buy a house thats more or less expensive than the estimated loan included in the preapproval letter.

Once you put in a purchase offer on the home and the seller accepts, youll reach out to your mortgage broker who gives you the loan estimate including the monthly mortgage payment, interest rate, and closing costs.

Next youll provide your loan officer with all the necessary paperwork like, paystubs, tax returns, bank statements, and more and then the underwriter will get to work.

The lender wants to know that you can repay the loan, so the underwriter will assess your financial situation and ability to do so. Its the underwriters job to do all of the following: