Mortgage Rate Strategies For September 2022

Mortgage rates grew fast and furiously to open 2022. The pace slowed in the second quarter, then interest rates shot up after the Feds 0.75% federal funds rate hike in mid-June. The central bank said it anticipates multiple similar hikes in 2022. Mortgage rates could climb throughout the rest of the year as a means to offset inflation. However, opportunities to lock in a low interest rate do still exist for home buyers and refinancing homeowners.

Here are just a few strategies to keep in mind if youre mortgage shopping in the coming months.

Mortgage Critical Illness Insurance

Mortgage critical illness insurance provides a benefit if you suffer a life-threatening issue, such as cancer, heart attack, or stroke. Critical illness insurance usually has a smaller coverage benefit, and it has slightly higher premiums. Some policies might not cover pre-existing conditions up to 24 months before the start of your coverage. You might also need to complete a health interview.

Comparing Mortgage Amortization Periods

| $165,315 |

When comparing 20-year and 30-year amortizations to the 25-year amortization at a 2% mortgage rate:

- A 20-year amortization increases your monthly mortgage payment by $412/month, but reduces your total interest cost by $28,116

- A 30-year amortization reduces your monthly mortgage payment by $269/month, but increases your total interest cost by $30,139

If you can handle higher monthly mortgage payments, a shorter amortization period can save you thousands of dollars. Many banks and mortgage lenders also allow you to shorten your amortization period by making additional mortgage prepayments, such as through lump-sum principal prepayments, doubling your regular payment amount, and increasing your payment schedule.

The payment frequency determines how often you will make mortgage payments.

Recommended Reading: How Much Do Mortgage Points Usually Cost

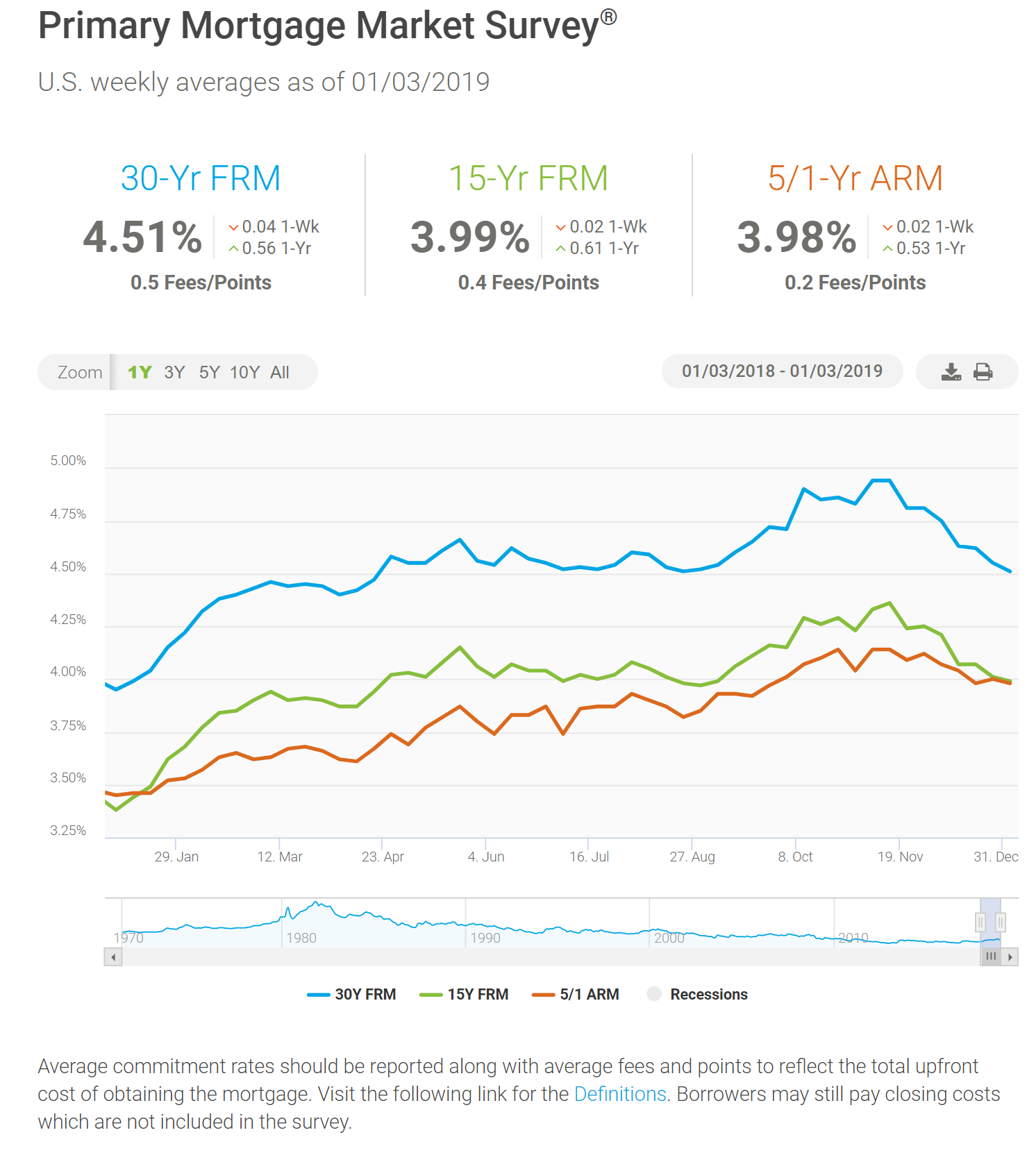

Average Mortgage Interest Rate By Type

There are several different types of mortgages available, and they generally differ by the loan’s length in years, and whether the interest rate is fixed or adjustable. There are three main types:

- 30-year fixed rate mortgage: The most popular type of mortgage, this home loan makes for low monthly payments by spreading the amount over 30 years.

- 15-year fixed rate mortgage: Interest rates and payments won’t change on this type of loan, but it has higher monthly payments since payments are spread over 15 years.

- 5/1-year adjustable rate mortgage: Also called a 5/1 ARM, this mortgage has fixed rates for five years, then has an adjustable rate after that.

Here’s how these three types of mortgage interest rates stack up:

| Mortgage type |

Can I Get Pre

The short answer is yes. You can be pre-approved for a mortgage when a lender looks at your finances and informs you of the amount they will lend you and what interest rate theyre willing to offer you. Getting pre-approved for a mortgage can accelerate the process of moving into your new home when you find it. This is because if youre pre-approved, the seller might choose your bid over another offer.

Youll want to shop around for the best pre-approval rate you can find. While this can be a challenging and trying process, comparison sites like LowestRates.ca can make it a whole lot easier. Fill out our form to see what brokers are willing to offer you, and a broker will be in touch with you shortly to secure the rate you select on the site.

Don’t Miss: Does It Make Sense To Pay Off Mortgage Early

Pay Attention To Mortgage Insurance

If your down payment is less than 20% of the purchase price, youll typically have to pay private mortgage insurance . And those premiums can add significantly to your monthly payments.

The cost of mortgage insurance will be reflected in your APR but not in your interest rate. The same goes for the mortgage insurance premiums on an FHA loan.

So make sure you learn about the cost and benefits of mortgage insurance before you commit to a loan.

Are Low Frills Mortgages Worth It

Restricted mortgages have boomed in popularity the last five years. Lenders realize that consumers want the lowest rate, so theyve tried to strip out features from their mortgages to get the pricing lower. For some borrowers who plan no financing changes for five years, low-frills mortgages may make sense. For most Canadians, the small rate savings isnt worth the much higher potential costs after closing. Those costs can bite you if you break, port, increase or otherwise refinance before your mortgage maturity date. Hence, for the majority of homeowners, its worth the small premium for a full-featured mortgage

Don’t Miss: How To Get A Conventional Mortgage

How Much Will I Need For A Down Payment

The minimum youll need to put down will depend on the type of mortgage. Many lenders require a minimum of 5% to 20%, whereas others like government-backed ones require at least 3.5%. The VA loan is the exception with no down payment requirements.

Generally, the higher your down payment, the lower your rate may be. Homeowners who put down at least 20 percent will be able to save the most.

What Is A Mortgage Rate Hold

Rate holds allow you to hold today’s current mortgage rates for 60-120 days, depending on the lender. This can be done prior to renewal or closing, to lock in a favourable rate. This protects you if rates rise, and if rates fall, your lender will typically honour the lower rate.

Remember that if you opt for a variable rate, youâll be locking the rateâs relation to prime, not the rate itself. Also note that while youâre guaranteed a rate for a given amount of time, your final mortgage approval is not guaranteed.

Recommended Reading: How Much Is The Mortgage On A $300 000 House

Canada’s Most Popular Mortgage: The 5

There were $1.4 trillion CAD in outstanding residential mortgages in May 2022. Out of this, the 5-year fixed rate mortgage accounted for over $624 billion, or 44%, of all mortgages in Canada. There are more 5-year fixed rate mortgages than all variable rate mortgages combined. The 5-year fixed rate mortgage is so popular that the CMHC uses the Bank of Canada’s 5-Year Benchmark Posted Rate for itsmortgage stress test.

How Much Mortgage Can I Afford

There are many ways to determine how big a mortgage you can afford. However, there are some guidelines Canadian lenders use when evaluating your eligibility for a mortgage.

Your down payment: How much you are able to put down upfront will inevitably impact how big a mortgage you can afford. This is because there are minimum requirements for a down payment in Canada, depending on the cost of the home.

On a home thats $500,000 or less, youre required to put down at least 5% upfront. On a home thats between $500,000 and $1 million, youre required to put down 5% of the first $500,000, and 10% of the rest of the principal. On a $1 million home, youre required to put down at least 20%.

Down payments that amount to less than 20% of a propertys value are called high ratio mortgages and homebuyers need to purchase insurance to guarantee their mortgage. The price of the insurance premium is added to the monthly mortgage payment. Down payments that are at least 20% or more are called conventional mortgages and not require insurance.

Having a down payment that exceeds 20% will help you pay off your loan sooner and save you money in the long run. However, interest rates on high-ratio mortgages tend to be lower than the rates on conventional mortgages. Thats because the added insurance reduces the risk of the bank losing its investment.

Read Also: How Mortgage Pre Approval Works

When Should I Lock My Mortgage Rate

It can be tricky to time any market, and mortgage rates are no exception. If conditions are choppy, and interest rates are likely to at least stay the same, if not rise, it may be smart to lock in a rate that works with your budget and seems fair to you.

Be sure to ask your lender about the consequences of not closing within the timeframe specified in a rate lock agreement and also about what could happen if rates fall after you lock in a rate.

What Is A Mortgage Rate Lock

A mortgage rate lock is a guarantee that the rate youre offered in your mortgage application acceptance is the one you will eventually pay, assuming you close within a normal period of time and make no changes to your application.

In a period of rising or volatile interest rateslike the current oneit may be wise to lock in a rate that seems affordable for you.

Recommended Reading: Can You Get A Mortgage With No Credit

How To Navigate The World Of Mortgage Rates

The trick is knowing what a good mortgage rate looks like for you. And that will depend on a few different factors, including:

Clearly, there are a lot of variables affecting your interest rate. Whats an attractive rate for one borrower may be way too high for another.

And all lenders weigh these factors differently. So making the same application with three different lenders will most likely get you three different rates and sets of fees.

How Banks & Mortgage Lenders Determine Their Mortgage Rates

Mortgage rates in Canada are determined by a range of factors.

On one hand, external economic forces have considerable effect, on the other, the profile of the mortgage applicant is significant.

External factors include:

| 7.7% | 7.5% |

*All rates presented in this table are the most typical of those offered by the six major Canadian chartered banks in the beginning of each year.

Read Also: Is Citizens Bank Good For Mortgages

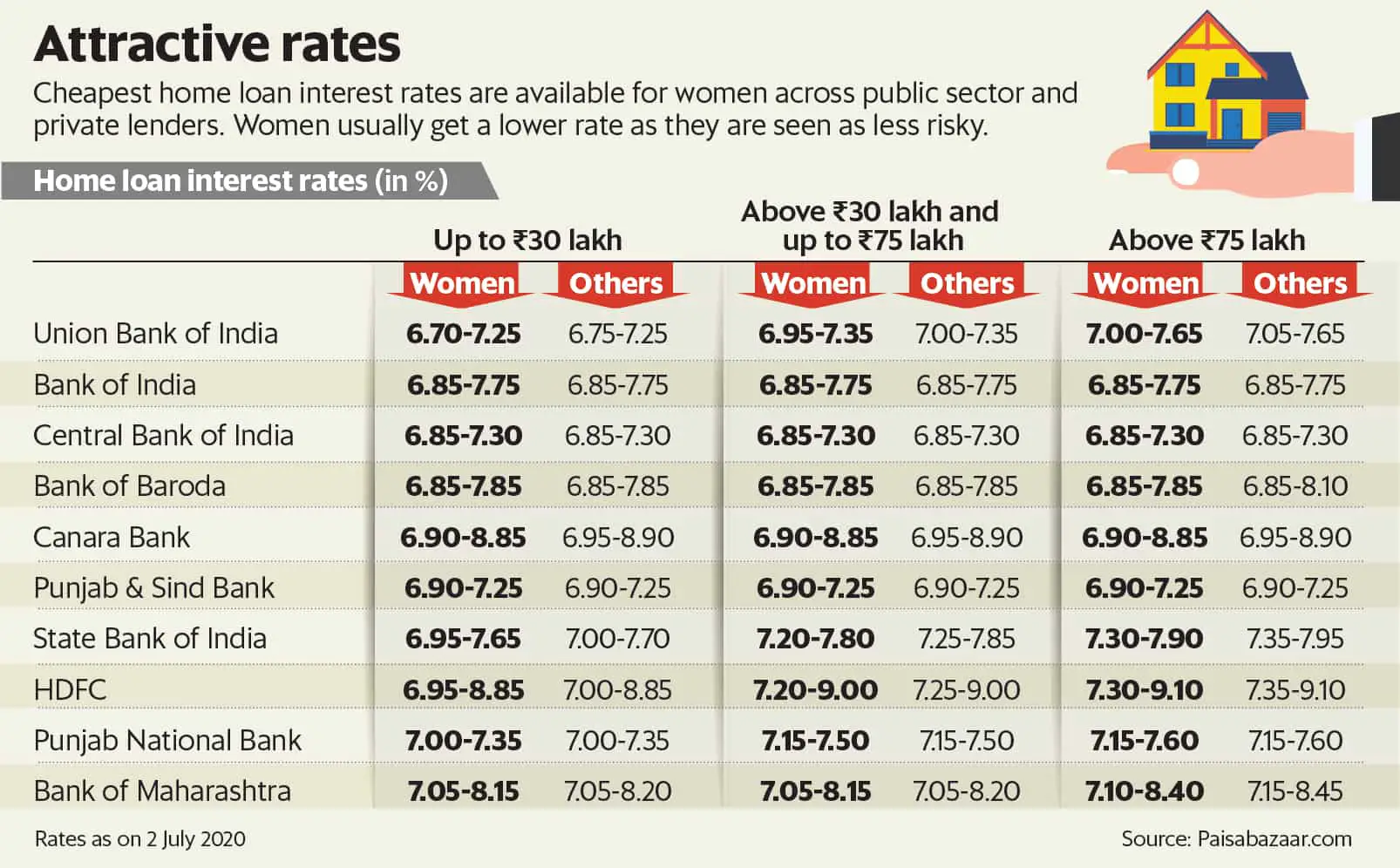

Whats A Good Mortgage Rate Today

Mortgage rates change all the time. So a good mortgage rate could look drastically different from one day to the next.

Right now, a good mortgage rate for a 15-year fixed loan might be in the high-3% or low-4% range, while a good rate for a 30-year mortgage is generally in the high-4% or low-5% range.

At the time this was written in August 2022, the average 30-year fixed rate was 4.99% according to Freddie Macs weekly survey. That represents all sorts of borrowers, and those with strong finances can often get rates well below the average.

Of course, these numbers vary a lot from one home buyer to the next. Top-tier borrowers could see mortgage rates around 4.5% at the same time lower-credit and non-QM borrowers are seeing rates above 6 percent.

In addition, looking forward in 2022, interest rates are likely to increase. So a good mortgage rate later this year could be substantially higher than what it is today.

The Driving Force Behind Mortgage Rates

Mortgage rates are a substantial element of the home buying process. While you likely know what a mortgage rate is if you have begun your home purchase journey, understanding what drives those rates may not be familiar territory.

The average interest rates affixed to home mortgages often fluctuate based on a few different factors. Understanding these can help you better comprehend when your chances increase for a lower interest rate.

You May Like: What Is Mortgage On A 500k House

How Do I Get The Lowest Mortgage Rates

There are six steps you can take get the lowest rate:

Scoring A Low Interest Rate

If you are looking to purchase a home, applying for a home mortgage now might be a good idea. Currently, interest rates are historically low, but as the employment situation and economy improve, you can expect those rates to spike soon.

While the aforementioned factors impact the average interest rate, you can control certain elements and help secure a lower interest rate for a home loan.

Don’t Miss: How Much Money Can I Be Approved For A Mortgage

What Is The Difference Between Interest Rate And Apr

While interest rates show the percentage a lender may charge for a loan, it gives an incomplete look at total costs.

An annual percentage rate includes the interest rate as well as other fees, including origination fees, mortgage insurance, closing costs, mortgage points and more.

The APR gives borrowers greater insight into what theyre actually paying for their mortgage. For more on what you need to know, visit our Interest Rates vs Annual Percentage Rate page.

How To Get Low Mortgage Rates

If you want to get the lowest possible monthly mortgage payment, taking the following steps can help you secure a lower rate on your home loan:

- Making a bigger down payment

Its also a good idea to compare rates from different lenders to find the best rate for your financial goals. According to research from Freddie Mac, borrowers can save $1,500 on average over the life of their loan by shopping for just one additional rate quote and an average of $3,000 by comparing five rate quotes.

If youre trying to find the right mortgage rate, consider using Credible. You can use Credible’s free online tool to easily compare multiple lenders and see prequalified rates in just a few minutes.

Have a finance-related question, but don’t know who to ask? Email The Credible Money Expert at and your question might be answered by Credible in our Money Expert column.

As a Credible authority on mortgages and personal finance, Chris Jennings has covered topics that include mortgage loans, mortgage refinancing, and more. Hes been an editor and editorial assistant in the online personal finance space for four years. His work has been featured by MSN, AOL, Yahoo Finance, and more.

Read Also: How Are Home Mortgage Rates Determined

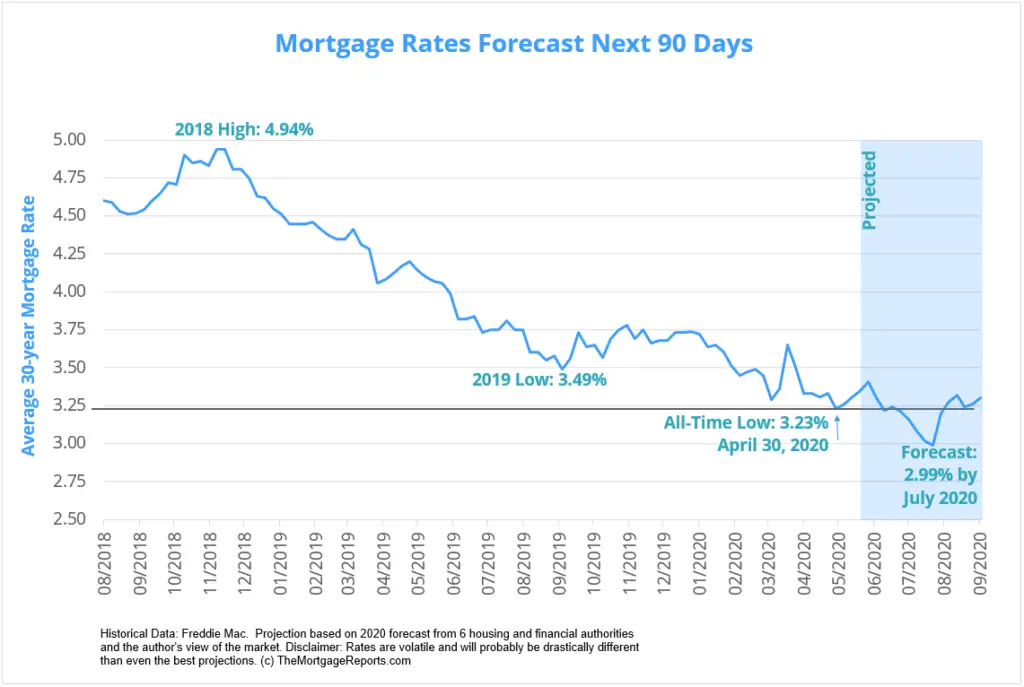

Mortgage Interest Rates Forecast Next 90 Days

The Federal Reserve made an aggressive policy plan to bring inflation down. While that would normally lead to mortgage rate growth, the lending market may have already accounted for the Feds rate hikes.

Because of this, many experts currently believe mortgage interest rates will move within a tighter range in the fall compared to the big weekly swings we saw throughout the year.

Of course, the Russian-Ukrainian war or a new wave of Covid-19 could create economic uncertainty and cause more rate volatility in the coming months.

Canada Vs Usa Mortgage Terms

Canadaâs mortgage term lengths are relatively short when compared to mortgages in the United States. The most common mortgage in the U.S. is the 30-year fixed mortgage, which means that homeowners donât need to renew their mortgage for the entirety of their amortization. This is a large departure from the Canadian mortgage market, where homeowners expect to renew and renegotiate their mortgage rates often.

Read Also: Is A Mortgage A Line Of Credit

How Do I Find The Best Mortgage Rate

Finding the best home mortgage rate is a matter of knowing your goals and picking the right tool to get the job done. The best mortgage for you may not always be the one with the lowest interest rate. Factors like how long you keep your home loan will impact your decision.

If you plan on keeping your home loan long-term, then a fixed-rate mortgage is ideal. Mortgage rates today are very reasonable for fixed-rate 10-, 15-, or 30-year mortgages. Locking in a low rate is a smart choice. But you can get lower mortgage rates with some adjustable-rate loans too. If you plan on only keeping your home for a short period of time, then you may be able to pay less interest with an ARM.

How Do I Get A Mortgage

To get a mortgage, you need to start by getting your finances in order. Having a strong financial profile will a) increase your chances of being approved for a loan, and b) help you score a lower interest rate. Here are some steps you can take to beef up your finances:

- Figure out how much home you can afford. The general rule of thumb is that your monthly home expenses should be 28% or less of your gross monthly income.

- Find out what credit score you need. Each type of mortgage requires a different credit score, and requirements can vary by lender. You’ll probably need a score of at least 620 for a conventional mortgage. You can increase your score by making payments on time, paying down debt, and letting your credit age.

- Save for a down payment. Depending on which type of mortgage you get, you may need as much as 20% for a down payment. Putting down even more could land you a better interest rate.

- Check your debt-to-income ratio. Your DTI ratio is the amount you pay toward debts each month, divided by your gross monthly income. Many lenders want to see a DTI ratio of 36% or less, but it depends on which type of mortgage you get. To lower your ratio, pay down debt or consider ways to increase your income.

Then, it’s time to shop around and get quotes from multiple lenders before deciding which one to use.

Don’t Miss: How To Pay Off Mortgage In 15 Years Calculator