My Result Shows I Can Afford My New Home What Should I Do Next

First of all, congratulations! You are now one step closer to owning the home you desire. The next step is to reach out to our team of top-notch mortgage lenders and get started on securing yourself the perfect deal.

Click Get FREE Quote, and answer a few simple questions about yourself and the loan you are seeking to obtain personalized rate quotes from lenders doing business in your area. This service is totally FREE of charge and makes it easy to comparison shop for your best deal on a home loan. Take your next step today – it couldnât be simpler!

Down Payment Assistance In 2022

Down payment assistance programs make the mortgage process more affordable for eligible applicants who are interested in purchasing a home but need financial help to do so. Money is usually provided in the form of a non-repayable grant, a forgivable loan, or a low interest loan. Homebuyer education courses may be required.

Typically, a property being purchased must serve as the applicants primary residence and must be located within a specific city, county, or state. It may also need to fall within a program’s maximum purchase price limits. Income limits may apply, and will look something like this :

- 1 person household: $39,050

Work On Your Credit Score

Since your is a major factor in your ability to get a home loan, its worth your time and effort to improve it. To do so, pay all of your bills on time as even one late or missed payment can ding your score. Also, catch up on any past-due accounts and make payments on any revolving accounts like credit cards and lines of credit. In addition, limit how often you apply for new accounts.

Read Also: Does Fha Require Mortgage Insurance

Boost Your Credit Score

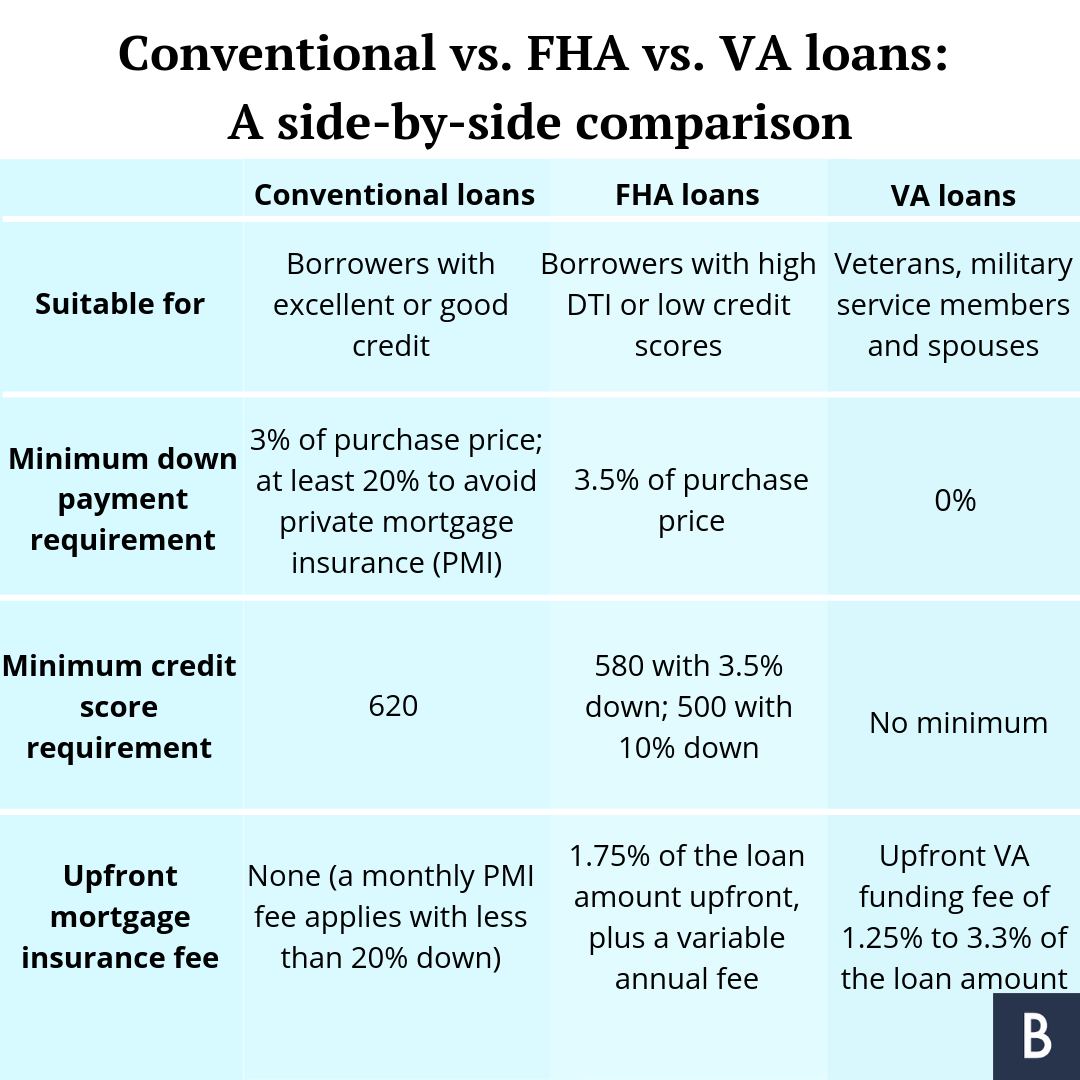

Your credit score speaks to how responsible you are as a borrower, and so it makes sense mortgage lenders would take that number into account when deciding if you qualify for a home loan. You need a minimum credit score of 620 to get a conventional mortgage, but for a competitive interest rate on a home loan, you’ll want a score that’s much higher .

To raise your credit score quickly, try paying off some credit card debt, which will bring down your utilization ratio. That ratio measures the amount of credit you’re using at once, and the lower it is, the more it’ll help your score.

At the same time, be sure to check your credit report for errors. Mistakes are pretty common, and if there’s one on your credit report that reflects poorly on you , correcting it could raise your score substantially.

Can I Apply For A Mortgage Online

The short answer is yes. You can apply for a mortgage loan online faster than filling out and processing an in-person mortgage application.

If youre having trouble getting a mortgage loan in your community, try an online lender. Online mortgage lenders can process your mortgage loan much quicker.

Electronic documents move almost instantly, so a mortgage loan company can receive and process your information faster.

You May Like: What If I Pay Extra On My Mortgage

What Documentation Do You Need

Throughout the entire application process, you’re proving your creditworthiness to lenders by providing official statements that outline your financial status, along with other legal and certifiable documentation.

Youâll need to verify your annual income, which means supplying tax returns, recent pay stubs, or other proof of income. Lenders might also request the following: bank statements, credit history, rental history, and assets and debts. Additional documents you should have on hand include a signed copy of the sale agreement between you and the seller, identification, and, if necessary, documents that explain credit blemishes like late payments and run-ins with collections.

Fha Loan Credit Issues

Your FHA lender will review your past credit performance while underwriting your loan. A good track record of timely payments will likely make you eligible for an FHA loan. The following list includes items that can negatively affect your loan eligibility:

- No Credit History If you don’t have an established credit history or don’t use traditional credit, your lender must obtain a non-traditional merged credit report or develop a credit history from other means.

- Bankruptcy Bankruptcy does not disqualify a borrower from obtaining an FHA-insured mortgage. For Chapter 7 bankruptcy, at least two years must have elapsed and the borrower has either re-established good credit or chosen not to incur new credit obligations.

- Late Payments It’s best to turn in your FHA loan application when you have a solid 12 months of on-time payments for all financial obligations.

- Foreclosure Past foreclosures are not necessarily a roadblock to a new FHA home loan, but it depends on the circumstances.

- Collections, Judgements, and Federal Debt In general, FHA loan rules require the lender to determine that judgments are resolved or paid off prior to or at closing.

Also Check: Should You Get Mortgage Insurance

Estimate How Much House You Can Afford

To help you get started, you can use our calculator on top to estimate the home price, closing costs, and monthly mortgage payments you can afford based on your annual income. For our example, lets suppose you have an annual income of $68,000. Youre looking to get a 30-year fixed-rate loan at 3.25% APR. For your down payment and closing costs, youve saved $55,000. See the results below.

- Annual income: $68,000

| Total Monthly Mortgage Payment | $1,587 |

Based on the table, if you have an annual income of $68,000, you can purchase a house worth $305,193. You may qualify for a loan amount of $252,720, and your total monthly mortgage payment will be $1,587. Since your cash on hand is $55,000, thats less than 20% of the homes price. This means you have to pay for private mortgage insurance . Take note: This is just a rough estimate. The actual loan amount you may qualify for may be lower or higher, depending on your lenders evaluation.

The following table breaks down your total monthly mortgage payments:

| Monthly Payment Breakdown | |

|---|---|

| Total Monthly Mortgage Payment | $1,587 |

According to the table, your principal and interest payment is $1,099.85. When we add property taxes and home insurance, your total monthly mortgage payment will be $1,481.34. But because you must pay PMI, it adds $105.30 to your monthly payment, which results in a total of $1,587 every month.

How Much Mortgage Can I Qualify For

Lenders have apre-qualification processthat takes your finances into account to determine how much they are willing to lend you. Once the lender has completed a preliminary review, they generally provide a pre-qualification letter that states how much mortgage you qualify for. Get pre-qualified by a lender toconfirm your affordability.

Don’t Miss: How Much Loan Can I Get For Mortgage

The Basics Of Qualifying For A Mortgage Loan

Your home may be the largest purchase you ever make. Deciding to buy a home is a big decision, so its essential to ensure its a thoughtful choice too. Taking the time to understand how qualifying for a mortgage loan works will help make the process as rewarding as exciting.

When you apply for your loan, mortgage lenders will look at a variety of information. But it ultimately comes down to these three things: your credit, income, and assets.

Where Are Refinance Trending

In July, annual inflation was 8.5% based on the Consumer Price Index . And that means refi rates are likely to see more increases as long as inflation remains high.

With high inflation lingering longer than initially expected the Federal Reserve has raised interest rates three times. A prolonged period of high inflation would make the Federal Reserve more likely to increase rates even more dramatically.

Don’t Miss: Can I Get A Mortgage If Self Employed

You Should Avoid Making Financial Changes Until Your Mortgage Is Finalized

Every financial decision you make before you close. While it can be tempting to finance some furniture for your new home, resist the urge to splurge. And it’s not just credit your lender has their eye on. Your bank account should stay stable, so don’t withdraw or deposit large amounts of money. Once you close, you can spend what you want to make your new home yours. But not until the paperwork is signed and the keys are in your hand.

Becoming a homeowner is part of the great American dream. Understanding how mortgages work and how yours will affect your financial health can help you manage and make the most of your mortgage.

What Is A Good Dscr Ratio

Most commercial lenders demand that their clients have a DSCR ratio of 1. The average minimum for most lenders is 1.

A DSCR ratio of 1.00 indicates that the borrower will have adequate cash flow from the subject property to pay off the loan. If the DSCR ratio is 1.25, the borrower can make loan payments with some extra room. A percentage of 1.50 would provide even more breathing room for the borrower and so on. Again, lenders typically require a minimum DSCR ratio of 1 to process your DSCR loan.

Recommended Reading: How To Increase Your Mortgage Credit Score

Does Refinancing Still Make Sense

Whether or not you refinance isnt dependent on just the numbers, such as the refinance rate. Your personal circumstances are also an important consideration. The simple question to ask yourself is: Will refinancing help me achieve my financial goals?

Generally speaking, refinancing makes sense if you can lower your interest rate by 1% or more. But sometimes the purpose of a refinance isnt to reduce your mortgage rate. With home values rising, many homeowners are choosing to turn their new found equity into cash with a HELOC. The money you receive from a HELOC can be used for anything, but HELOCs usually have higher interest rates than other mortgage loans. So its important to have a plan before you decided to take on more debt.

Overall, now is still an excellent time to refinance as long as it make sense for your situation.

A Little Preparation Goes A Long Way

Finding the right home takes time, effort, and a bit of luck. If you’ve managed to find a property that’s right for you and your budget, then it’s time to get one step closer to homeownership by applying for a mortgage loan. And though this is one of the biggest financial decisions you can make, knowing how to start and what you need will put you one step ahead of other potential homebuyers.

Recommended Reading: How To Get Mortgage Statement Online

Fha Loan Qualifications Checklist

Before you contact an FHA-approved mortgage lender, review these guidelines to make sure you fulfill the minimum requirements to qualify as a borrower and that you can afford the required costs:

- FICO credit score minimum of 580 with a 3.5% down payment or credit score between 570 and 579 with a 10% down payment

Two Types Of Conventional Loans

- Conforming Conventional Loans: Conventional mortgages follow assigned loan limits established by the Federal Housing Finance Agency . In 2022, the maximum conforming limit for a single-unit home in the U.S. continental baseline is $647,200. If this is the maximum conforming limit in your area, and your loan is worth $600,000, your mortgage can be sold into the secondary market as a conventional loan. We publish maximum conforming limits by county across the country.

- Non-conforming Conventional Loans: Also called jumbo loans, non-conforming conventional mortgages exceed the assigned conforming loan limits set by the FHFA. These loans are used by high-income buyers to purchase expensive property in high-cost locations. The conforming loan limit for high-cost areas are 50% higher than the baseline limit, which is $970,800 for single-unit homes as of 2021. Jumbo mortgages have stricter qualifying standards than conventional loans because larger loans exact higher risk for lenders.

PMI on Conventional Loans

Private mortgage insurance or PMI is required for conventional mortgages when your down payment is less than 20% of the homes value. This is an added fee that protects your lender if you fail to pay back your loan. PMI is typically rolled into your monthly payments, which costs 0.5% to 1% of your loan per year. Its only required for a limited time, which is canceled as soon as your mortgage balance reaches 78%.

Recommended Reading: What Are Essential For Completing An Initial Mortgage Loan Application

Factors That Impact Affordability

When it comes to calculating affordability, your income, debts and down payment are primary factors. How much house you can afford is also dependent on the interest rate you get, because alower interest ratecould significantly lower your monthly mortgage payment. While your personal savings goals or spending habits can impact your affordability,getting pre-qualified for a home loancan help you determine a sensible housing budget.

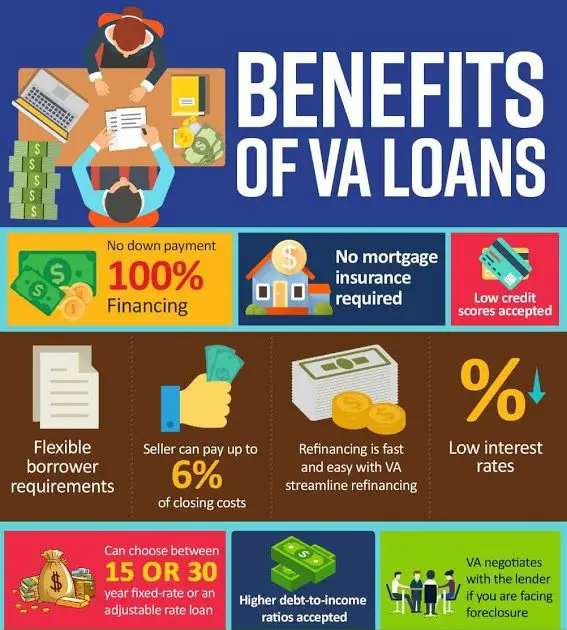

Benefits Of An Fha Loan

- Easier to Qualify FHA provides mortgage programs with lower requirements. This makes it easier for most borrowers to qualify, even those with questionable credit history and low credit scores.

- Competitive Interest Rates FHA loans offer low interest rates to help homeowners afford their monthly housing payments. This is a great benefit when compared to the negative features of subprime mortgages.

- Bankruptcy / Foreclosure Having a bankruptcy or foreclosure in the past few years doesn’t mean you can’t qualify for an FHA loan. Re-establishing good credit and a solid payment history can help satisfy FHA requirements.

- Determining Credit History There are many ways a lender can assess your credit history, and it includes more than just looking at your credit card activity. Any type of payment such as utility bills, rents, student loans, etc. should all reflect a general pattern of reliability.

After learning about some features of an FHA mortgage, undecided borrowers often choose FHA loans over conventional loans because of lower down payment requirements, better interest rate offerings, and unique refinance opportunities.

Read Also: Is Mortgage Interest Rate Going Up Or Down

Other Mortgage Requirements Changes Worth Knowing In 2022

There were some important changes that could affect your mortgage application in 2022.

New condo and co-op rules. After the collapse of a poorly maintained condo complex in 2021, Fannie Mae added additional requirements that bars any loans for condominium or cooperative units with significant deferred maintenance. The new requirements may result in additional hoops to jump through for condo or co-op buyers.

Self-employed borrower documents. Besides standard tax return requirements, self-employed borrowers will need to provide three months worth of business account statements, plus a profit and loss statement as additional proof of year-to-date earnings.

What Is A 6

The 6 Month SOFR DSCR Loan is a loan that uses the Secured Overnight Financing Rate as its interest rate. The SOFR is the rate at which large depository institutions lend to each other overnight.

The SOFR is a daily reference rate that the New York Federal Reserve publishes. The interest rate on the loan will be reset every six months, and the loan will be due in full at the end of the loan tenure. The borrower will be required to make monthly payments during the loan term, and the payments will be applied to the loans outstanding balance. At the end of the loan term, the borrower will be responsible for paying off the remaining balance of the loan. These loans are ideal for borrowers who need a short-term loan and who are comfortable with variable interest rates.

The loan has a maximum maturity of 5 years and a maximum loan-to-value ratio of 75%.To be eligible for the 6 Month SOFR DSCR Loan, borrowers must have a minimum debt service coverage ratio of 1.25x.

Read Also: What Are The Current Mortgage Rates In North Carolina

Can I Apply For A Home Loan Without My Spouse

Being married means sharing your life together. Still, there may be some circumstances in which one person may want to apply for a home loan without their spouse. Perhaps you and your spouse have chosen to keep your finances separate. Or maybe youd like to leave the home to children you had from a previous marriage after you pass away. But is it possible to obtain a home loan without your spouse, even though youre married? Heres what you need to know.

How Can You Get A Lower Interest Rate On A Mortgage

There are several strategies that could help you get a good interest rate on a mortgage, such as:

- Comparing lenders. Be sure to shop around and compare your options from as many mortgage lenders as possible. This will help you find a good deal more easily.

- Improving your credit score. In general, the higher your credit score, the better your rate will be. If you have less-than-stellar credit, consider working to build your credit score to qualify for more optimal rates in the future. There are many ways to do this, such as paying all of your bills on time or paying down debts.

- Picking a shorter term. Itâs usually a good idea to choose the shortest repayment term you can afford to keep your interest costs as low as possible. Additionally, many lenders offer better rates on shorter terms.

- Putting more money down. The more money you put down on a property, the less of a risk you look like to the lenderâwhich can translate to a lower interest rate. On top of this, if you put at least 20% down on a conventional loan, you can avoid getting stuck with PMI.

Also Check: How Much Is A 600000 Mortgage