Thinking Of Skipping A Home Inspection Dont Make That Mistake

In hyper-competitive housing markets, some home buyers may consider waiving their right to inspection in an effort to make their offer more attractive and ultimately secure their dream home. In other words, buyers are risking it all just to get their offers acceptedregardless of whether or not a home has major issues, from broken appliances to structural issues to termite or mold damage. Those who make the decision to forego an inspection will have to deal with the consequences, whatever they may be. And the result could cost thousands of dollars.

In the year after the pandemic hit, when we were all sheltering in place, some homeowners were buying houses site unseen. A Redfin survey showed that 25% of home buyers skipped the home inspection step for a variety of reasonsmainly, to speed up the closing process. Now that open houses are back and home inspectors are once again reporting for duty, its not necessary to go to such extremes. One thing the home inspection does thats invaluable is let you know whether or not you are financially prepared to cover a worst-case scenario after buying a home, from fixing a dishwasher to repairing a damaged roof. Opting out of a home inspection completely is never recommendedeven if it means your offer is rejected.

How A Good Credit Score Can Lower Your Interest Rate

Buying mortgage loan points isn’t the only way to get a low interest rate. Your credit will have a direct impact on the rate you’ll get. In theory, the higher your credit scores, the less likely you’ll default. So, low scores can affect your ability to get a loan, or the lender might decide to charge you a higher interest rate. If your aren’t good, it might make sense to pay points for a lower rate after considering all other factors. Or you could take steps to improve your credit before applying for a mortgage loan.

There Are Two Types Of Mortgage Points

- The word points can be used to refer to two completely different things

- Either the loan officer or mortgage brokers commission for providing you with the loan

- Or discount points, which are entirely optional and can lower your interest rate

- Know what theyre actually charging you for to ensure you make the correct decision

There are two types of mortgage points you could be charged when obtaining a mortgage.

A mortgage broker or bank may charge mortgage points simply for originating your loan, known as the loan origination fee. This fee may be in addition to other lender costs, or a lump sum that covers all of their costs and commission.

For example, you might be charged one mortgage point plus a loan application and processing fee, or simply charged two mortgage points and no other lender fees.

Additionally, you also have the choice to pay mortgage discount points, which are a form of prepaid interest paid at closing in exchange for a lower interest rate and cheaper monthly payments.

They are used to buy down your interest rate, assuming you want a lower rate than what is being offered. Generally, you should only pay these types of points if you plan to hold the loan long enough to recoup the upfront costs via the lower rate.

You can use a mortgage calculator to determine how many monthly mortgage payments itll take for buying points to make sense. This is essentially how long you need to keep the home loan to come out ahead.

Also Check: Could I Qualify For A Mortgage

Appeal To The Seller For Help

You might be able to get a seller to either lower the purchase price or cover a portion of your closing costs. This is more likely if the seller is motivated and the home has been on the market for a long time with few offers. In many hot housing markets, though, conditions favor sellers, so you might get pushback or a flat-out no if you ask for a sellers help. But it doesnt hurt to ask.

An Example Of Seller Concessions In Practice

How does this work in practice? Lets say that you take out a conventional loan worth $200,000. If its a conventional loan and you made a down payment of less than 10%, the seller could only contribute a maximum of 3% toward your closing costs. If your closing costs come to less than 3% of your loan value, the seller can only contribute up to 100% of the closing cost value. This means that if your closing costs on the same loan were to equal $2,500, the seller can only offer up to $2,500. These limitations help prevent fraud.

Take the first step toward the right mortgage.

Apply online to see how much you can get approved for and determine your closing costs.

Don’t Miss: Will Mortgage Rates Stay Low

Should I Pay Discount Points To Get A Lower Rate

That depends. Paying for discount points to get a lower interest rate could be a good financial strategy if you plan to live in the home long enough to cover the breakeven period. The upfront costs need to bake out before the savings can kick in. If you move or refinance before that period is up, they are worthless.

This article was updated on Sept. 4, 2020, to remove comments made by a source whose credentials do not meet NextAdvisor editorial standards.

Whats The Point Of Buying Mortgage Points

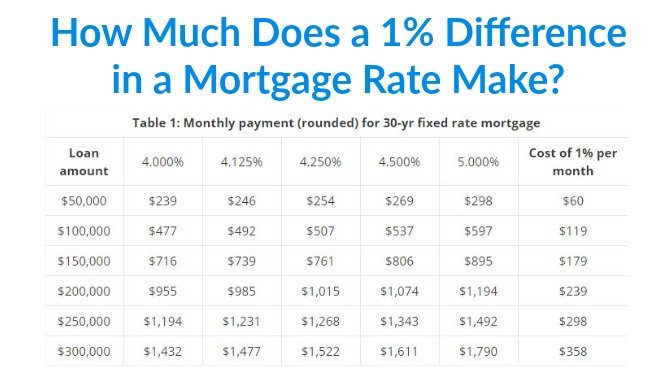

When mortgage rates rise, borrowers scramble to find ways to get the lowest possible interest rate. One option is to pay mortgage points to buy down your rate.

Buying down the rate means paying extra upfront fees to your mortgage lender, called discount points, to get a lower interest rate and monthly payment.

When interest rates are very low, few borrowers pay higher closing costs to get a discount. But as mortgage rates rise, borrowers are more likely to weigh the pros and cons of buying points to lower their mortgage rate.

In this article

Don’t Miss: How Long Is The Mortgage Process

What Are Todays Interest Rates

Current mortgage rates depend, in part, on what home buyers are willing to pay for a home loan. In general, higher interest rates go to those who pay less.

And remember, the lowest rate isnt always the best deal. A good loan officer should be able to help you sort through your home-purchase options and choose the lowest-cost program for your needs.

The Bottom Line: Mortgage Points Can Save You Money

Though mortgage points and prepaid interest are right for some borrowers, they dont make financial sense for everyone. To determine whether you can save with discount points, you have to crunch the numbers.

Sit down and assess your budget, down payment, loan terms and future plans before you close. Determine your breakeven point and your likelihood of staying in the home to understand if discount points will save you money in the long run when refinancing or buying a home.

If youre ready to buy a new home or need to refinance your existing home loan, dont wait. Apply online with Rocket Mortgage®.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Also Check: Are There 20 Year Mortgage Loans

How Much Money Can You Save Buying Mortgage Points

Is purchasing points beneficial if you keep your new home for five years? You can figure it out by using a mortgage calculator.

Suppose it costs two points to reduce the interest rate on a $400,000 30-year fixed-rate loan from 4.5% to 4.0%. Your monthly mortgage payment for principal and interest would drop by $117 with the lower rate .

After five years, with the 4.0% home loan, youll have paid $76,370 in interest payments, plus $8,000 in mortgage points, for a total of $84,370. Youll have reduced your principal balance by $38,210.

With the 4.5% loan, youll have paid $86,236 in interest. Youll have reduced your principal balance by just $35,368.

In this case, then, it will cost you $1,888 less over five years if you pay the discount points. But thats not all. Youll have reduced your balance by an extra $2,842. So your total savings in five years is $4,730.

One more advantage of paying mortgage points is that, since they represent prepaid interest, they are typically tax-deductible

When Paying Points Is Worth It

When you buy discount points, you decrease your monthly payment, but you increase the upfront cost of your loan. Due to the difference in monthly payments, it usually takes between five and 10 years to recoup the upfront cost of discount points.

Instead of buying points, many borrowers instead choose to make larger down payments in order to build equity in their homes quicker and pay off their mortgages early, another way to save money on interest payments.

Still, in some cases, buying points may be worthwhile, including when:

- You need to lower your monthly interest cost to make a mortgage more affordable

- Your credit score doesnât qualify you for the lowest rates available

- You have extra money to put down and want the upfront tax deduction

- You plan to keep your home for a long time, so you may recoup the cost

Of course, this really only applies to discount points. Origination points, on the other hand, are closing costs paid to a lender in order to secure a loan. While these fees are sometimes negotiable, borrowers usually have no choice about whether to pay them in order to secure a loan.

Also Check: How Does A Conventional Mortgage Work

What Are Typical Closing Costs

Closing costs typically range from 3%6% of the homes purchase price. Thus, if you buy a $200,000 house, your closing costs could range from $6,000 to $12,000. Closing fees vary depending on your state, loan type, and mortgage lender, so its important to pay close attention to these fees.

Homebuyers in the U.S. pay, on average, $5,749 for closing costs , according to a 2019 survey from ClosingCorp, a real estate closing cost data firm. The survey found the highest average closing costs in parts of the Northeast, including the District of Columbia , Delaware , New York , Maryland , and Pennsylvania . Average closing costs in Washington State were also among the highest. The states with the lowest average closing costs included Indiana , Montana , South Dakota , Iowa , and Kentucky .

A lender is required by law to provide you with a loan estimate within three business days after receiving your mortgage application. This key document outlines the estimated closing costs and other loan details. Though these figures might fluctuate by closing day, there shouldnt be any big surprises.

How Many Mortgage Points Can You Buy

Theres no one set limit on how many mortgage points you can buy. However, youll rarely find a lender who will let you buy more than around 4 mortgage points.

The reason for this is that there are both federal and state limits regarding how much anyone can pay in closing cost on a mortgage. Because limits can change from state to state, the number of points you can buy may vary slightly.

According to a survey of lenders conducted weekly by Freddie Mac, for about the last 5 years, the average number of points reported on a 30-year fixed conventional loan was between 0.5 0.6 points.

Its important to note you dont have to pay for a full point to get a lower rate. Points are sold in increments all the way down to 0.125%.

Recommended Reading: How Do I Apply For A Mortgage

How We Make Money

Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

Bankrate, LLC NMLS ID# 1427381 |NMLS Consumer AccessBR Tech Services, Inc. NMLS ID #1743443 |NMLS Consumer Access

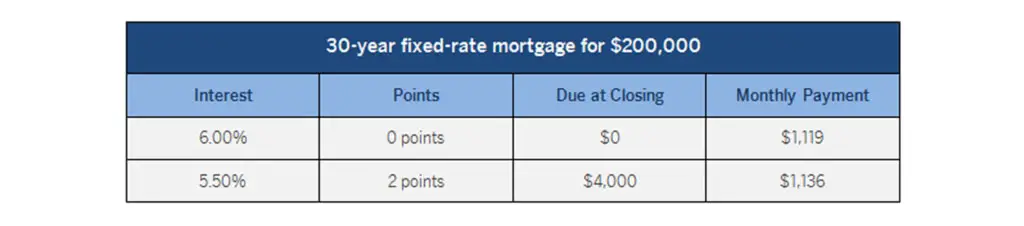

Should You Pay For Discount Points

There are two primary factors to weigh when considering whether or not to pay for discount points. The first involves the length of time that you expect to live in the house. In general, the longer you plan to stay, the bigger your savings if you purchase discount points. Consider the following example for a 30-year loan:

- On a $100,000 mortgage with an interest rate of 3%, your monthly payment for principal and interest is $421 per month.

- With the purchase of three discount points, your interest rate would be 2.75%, and your monthly payment would be $382 per month.

Also Check: How Much Should I Mortgage

Who Should Buy Points

People who are likely to keep their current mortgage for a long time. They would have the following attributes:

- Likes the local area and plans to live in the area for at least a half-decade or more.

- Stable family needs, or a home which can accommodate additional family members if the family grows.

- Homebuyer has good credit & believes interest rates on mortgages are not likely to head lower.

- Stable employment where the employer is unlikely to fire them or request the employee relocate.

Lets Look At Some Examples Of Mortgage Points In Action:

Say youve got a $100,000 loan amount and youre using a broker. If the broker is being paid two mortgage points from the lender at par to the borrower, it will show up as a $2,000 origination charge and a $2,000 credit on the HUD-1 settlement statement.

It is awash because you dont pay the points, the lender does. However, a higher mortgage rate is built in as a result of that compensation to the broker.

Now lets assume youre just paying two points out of your own pocket to compensate the broker. It would simply show up as a $2,000 origination charge, with no credit or charge for points, since the rate itself doesnt involve any points.

You may also see nothing in the way of points and instead an administration fee or similar vaguely named charge.

This could be the lenders commission bundled up into one charge that covers things like underwriting, processing, and so on.

It could represent a certain percentage of the loan amount, but have nothing to do with raising or lowering your rate.

Regardless of the number of mortgage points youre ultimately charged, youll be able to see all the figures by reviewing the HUD-1 , which details both loan origination fees and discount points and the total cost combined.

*These fees will now show up on the Loan Estimate and Closing Disclosure under the Loan Costs section.

Don’t Miss: How Do You Estimate A Mortgage Payment

How Mortgage Points Affect Apr

Banks will sometimes use a mortgage shopping tool known as APR to make a loan with discount points look more attractive than it really is.

APR, which stands for Annual Percentage Rate, is a calculation that shows the long-term cost of holding a mortgage.

But APR also assumes youll hold your loan for 30 years and pay off the total loan amount on schedule. Very often, you will not, which nullifies the APR math.

This is why its important to remember that your APR is not your mortgage rate.

Comparing loan estimates using the lowest APR method is rarely a good plan. It uses discount points against you.If youre not clear how much youll pay to borrow, ask your loan officer to walk you through your Loan Estimate or a truth-in-lending disclaimer.

What Are Todays Mortgage Rates

Todays mortgage rates are at historic lows. Mortgage points allow borrowers to buy down their interest rate even further, which can generate huge savings.

However, mortgage points arent always worth it. And if you opt not to pay for them, youre still likely to get a great deal in todays ultra-low rate environment.

Don’t Miss: What Is The Current Interest Rate For A Reverse Mortgage

When To Buy Mortgage Points

Buying mortgage points might make sense if any of the following situations apply to you:

- You want to stay in your home for a long time. The longer you stay in your home, the more it makes sense to invest in points and a lower mortgage rate. If youre sure youll have the same mortgage for the long haul, mortgage points can lessen the overall cost of the loan. The longer you stick with the same loan, the more money youll save with discount points.

- Youve determined when the breakeven point is. Do some math to figure out when the upfront cost of the points will be eclipsed by the lower mortgage payments. If the timing is right and you know you wont move or refinance before you hit the breakeven point, you should consider buying points.

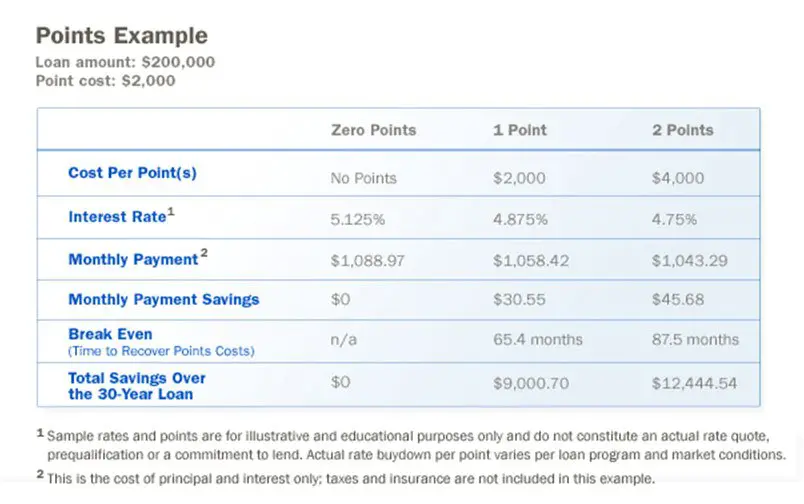

How To Calculate Your Breakeven Point

Lets run through a quick example using the numbers referenced earlier.

If you have a $200,000 loan amount, going from a 5.125% interest rate to a 4.75% interest rate saves you $46 per month. As mentioned earlier, the cost of 1.75 points on a mortgage with a $200,000 loan amount is $3,500. If you divide the upfront cost of the points by your monthly savings, youll find that your breakeven point is about 76 months , which is equal to roughly 6 years and 3 months. So, if you plan to stay in your house for longer than that amount of time and pay off your loan according to the original schedule, it makes sense to buy the points because youll save money in the long run.

What Are Origination Points

A different type of mortgage point that you might have to pay is an “origination point.” Origination points won’t reduce your interest rate they’re fees you pay to the lender for agreeing to provide and process your loan. Sometimes origination points are called an “origination fee.” These points vary from lender to lender and are sometimes negotiable, but not usually.

This article focuses mainly on discount points.

Also Check: What Documents Are Required For A Mortgage Loan