No Tax Return Cdfi And Bank

The Ideal Mix of Customized Products and Core Expertise for the Self-Employed and Recently Retired.

Insignia Mortgage structures customized no-tax return loan programs for the self-employed, real estate professionals, and retired borrowers who have excellent credit and strong liquid reserves, and/or other balance sheet assets. Whether you are looking to purchase a new home, refinance an existing home, or take cash out from your home, Insignia Mortgage has access to a variety of lending sources to match clients unique financials with the most discerning lenders.

CDFI Loans

No Income Verification Required

CDFIs are community development financial institutions and aim to offer financial products to low-income and/or self-employed people who are difficult for traditional banks to underwrite and also underserved communities. Rates are competitive and loans are available up to $3 million with as little as a 30% down payment.

CDFIs tend to offer simpler products that dont require the borrower to provide proof of income and the focus is on borrowers who meet the criteria. Funding may take a bit longer than with traditional lending sources.

Please contact us to discuss this program.

Business Owners Mortgage Without Tax Returns

If you are self-employed and show significant tax write-offs, you may have been told you dont qualify for a mortgage.

It is extremely common for business owners to take advantage of the write-offs available to them. The only problem is: when its time to get a traditional mortgage, their debt-to-income ratio on paper looks too high.

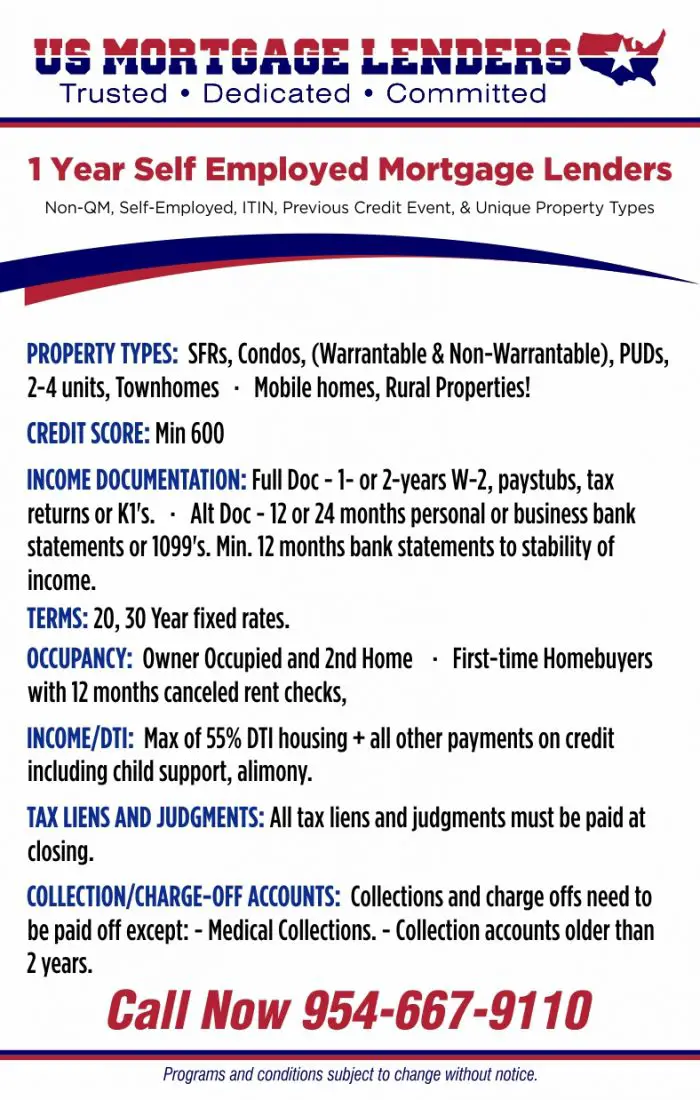

The solution would be to get a bank statement mortgage. These require at least 600 credit score.

A bank statement loan is a mortgage approval process that allows self-employed borrowers to have income calculated based on bank deposits. With this type of loan, tax returns are excluded from the equation.

Personal Bank Statements

When using personal bank statements to qualify, you do not have to be 100% owner of the business.

You must be in business for at least 2 years. Income will be calculated based on 12 months deposits, minus any non-business related deposits.

In addition, youll need to provide up to 3 months business bank statements to show that the deposits are coming from a business account into your personal account.

Business Bank Statements

If looking to use business bank statements to qualify, you must be 100% owner of the business.

You can either:

Showing Ability To Repay A Loan Using Bank Statements

As a result of the housing market crash of 2008, TheAbility to Repay Rulewas put in place for all lenders when originating a loan.

This rule states that the lender is responsible to make sure that the borrower can cover the loan payments by verifying income and existing debt. They must add together the borrowers existing debt obligations and the new mortgage payments and ensure they do not go above a certain percentage of the borrowers current verified income.

With a bank statement loan, a lender will request anywhere from 12 to 24 months of bank statements for them to look over and verify a steady income in the monetary amount that meets the percentage from the Ability to Repay Rule.

For more information on bank statement loans and all loan options for self-employed borrowers in Mission Viejoand California, please contact me at any time.

You May Like: How To Get First Mortgage

Whats The Plan If You Are Trying To Buy A Home With Irs Debt

If youre gearing up to buy a home, the time to address unfiled or unpaid taxes is now. The necessary steps will depend on where you stand with your ability to pay what you owe. The type of loan youll be applying for will also impact how to approach the application process. However, this is the general blueprint to follow when trying to obtain a mortgage with tax problems:

- Work with a tax professional to enter into a repayment plan with the IRS. Make sure to get a copy of the repayment agreement that details what your monthly payment amount will total. You may need to provide this documentation to your lender.

- Next, focus on making payments on time. Most lenders require between three and 12 consecutive payments on your record before they approve you for a mortgage.

- When applying for mortgages, inform your lender about the agreement that is in place. The lender may ask for a copy of your tax repayment agreement with proof of payment attached.

- If youre applying for a mortgage but have a tax lien, you may need to obtain something called a Subordination Agreement from the IRS. This document confirms that the IRSs lien will be secondary to the lien placed on your home by the mortgage company in the event of a foreclosure.

How Does A Bank Statement Loan Work

A bank statement loan is a mortgage loan product that uses bank statements to obtain a picture of the borrowers income and analyzes the stability of that income instead of using the standard traditional method of verifying income for mortgage applicants.

Lenders who offer these types of loans will look over anywhere from 12 to 24 months worth of monthly bank statements to verify factors such as net income. Net income is the amount of money a potential borrower has earned after they pay taxes and any other business-related expenses.

Read Also: What Is The Current Interest Rate For A Reverse Mortgage

Can I Get A Mortgage Without Tax Returns

Most conventional mortgages require tax return income verification for the past two years to prove income. But there are many instances where a borrower may not want to provide tax returns.

Aside from privacy, many people simply dont show enough annual income to qualify for a mortgage on their official tax returns, especially if they are self-employed and take numerous write-offs and business deductions.

Fortunately, there are lenders who offer mortgage products that dont require that you submit tax returns.

Investor Cash Flow Loan

Similar to business owners, real estate investors commonly take full advantage of the tax write-offs available to them. In many cases, this results in significantly lower income shown on tax returns.

For investors looking to purchase or refinance their rental property without tax returns, a cash flow loan is a perfect option to consider.

With a cash flow loan, the income approval portion of the loan is based on property cash flow, NOT personal income.

For this loan product, you dont even fill in the employment section of the application.

Heres how it works:

A 1007 rent schedule is ordered with the appraisal. A 1007 rent schedule is an analysis of what fair market rent is in your area.

When the fair market rent covers the mortgage/taxes/insurance/HOA dues, then the income is approved.

For a refinance: if the property is rented out, the underwriter is going to want to see the lease to confirm what is being collected. If the rent is less, youll need to qualify based on what the current lease agreement is showing.

The basic documentation needed for a cash flow loan:

- 1007 rent schedule to confirm fair market rent

- Current lease

- Proof of ownership in a home in the last 3 years

Allowed on investment purchase, refinance, and cash out refinance.

For property purchase, the minimum down payment you can expect on the cash flow product is 20%.

This cash flow mortgage even applies to short term rentals.

See how this works for AirBnb/VRBO properties here.

Also Check: What Is Deferred Interest On A Mortgage

How Do Lenders Know You Owe Taxes

Any outstanding tax liens or current payments you make for back taxes should appear on your account transcript. Returning to your question, if you checked box 6B or 6C on the 4506-C form then the lender gains access to your tax account transcripts and may become aware of the back taxes you owe and any ongoing payments.

Best Ways To Get Approved For A No Tax Return Mortgage

Many different scenarios allow borrowers to purchase or refinance a home without having to provide tax returns.

The problem is: most lenders routinely ask for tax returns when they are not required. As a result, this leads to unnecessary documentation, and often unnecessary complication.

Our goal is to minimize confusion, and simplify the process.

The most popular programs available for a no tax return mortgage are:

There is no one size fits all scenario. Well go through each option individually to help you sort through which option might make the most sense for you.

Also Check: Can Someone Be Added To A Mortgage

Get Ready For Take Off

Rocket Mortgage® is an online mortgage experience developed by Quicken Loans®, Americas largest mortgage lender. Rocket Mortgage® makes it easy to get a mortgage you just tell the company about yourself, your home, your finances and Rocket Mortgage® gives you real interest rates and numbers. You can use Rocket Mortgage® to get approved, ask questions about your mortgage, manage your payments and more.

You can work at your own pace and someone is always there to answer your questions 24 hours a day, 7 days a week. Want a fast, convenient way to get a mortgage? Give Rocket Mortgage® a try.

What Is A Bank Statement Loan For Self Employed Borrowers

A bank statement loan for those who are self-employed can be referred to as a few other names including a NON-QM loan or a portfolio loan. These loans are not eligible to become traditional conforming loans because they do not meet standards set by Fannie Mae and Freddie Mac to be sold and bought by these federal mortgage entities.

These loans stay with the lender that originates them. As such lenders are able to set a wider number of qualifications. Many bank statement loans allow a self-employed borrower to apply for a mortgage without having to submit proof of net income through tax returns or pay stubs. Instead, income is verified through a requested amount of monthly bank statements.

You May Like: How Long To Be Approved For Mortgage

Mortgage Without Proof Of Income: Usda Home Loan With Zero

Having helped over 1 million American families become home owners since its inception in 1949, the USDA home is an American staple.

How Far Back Can Irs Go For Unfiled Taxes

The IRS can go back to any unfiled year and assess a tax deficiency, along with penalties. However, in practice, the IRS rarely goes past the past six years for non-filing enforcement. Also, most delinquent return and SFR enforcement actions are completed within 3 years after the due date of the return.

Also Check: What Mortgage Can You Afford Based On Salary

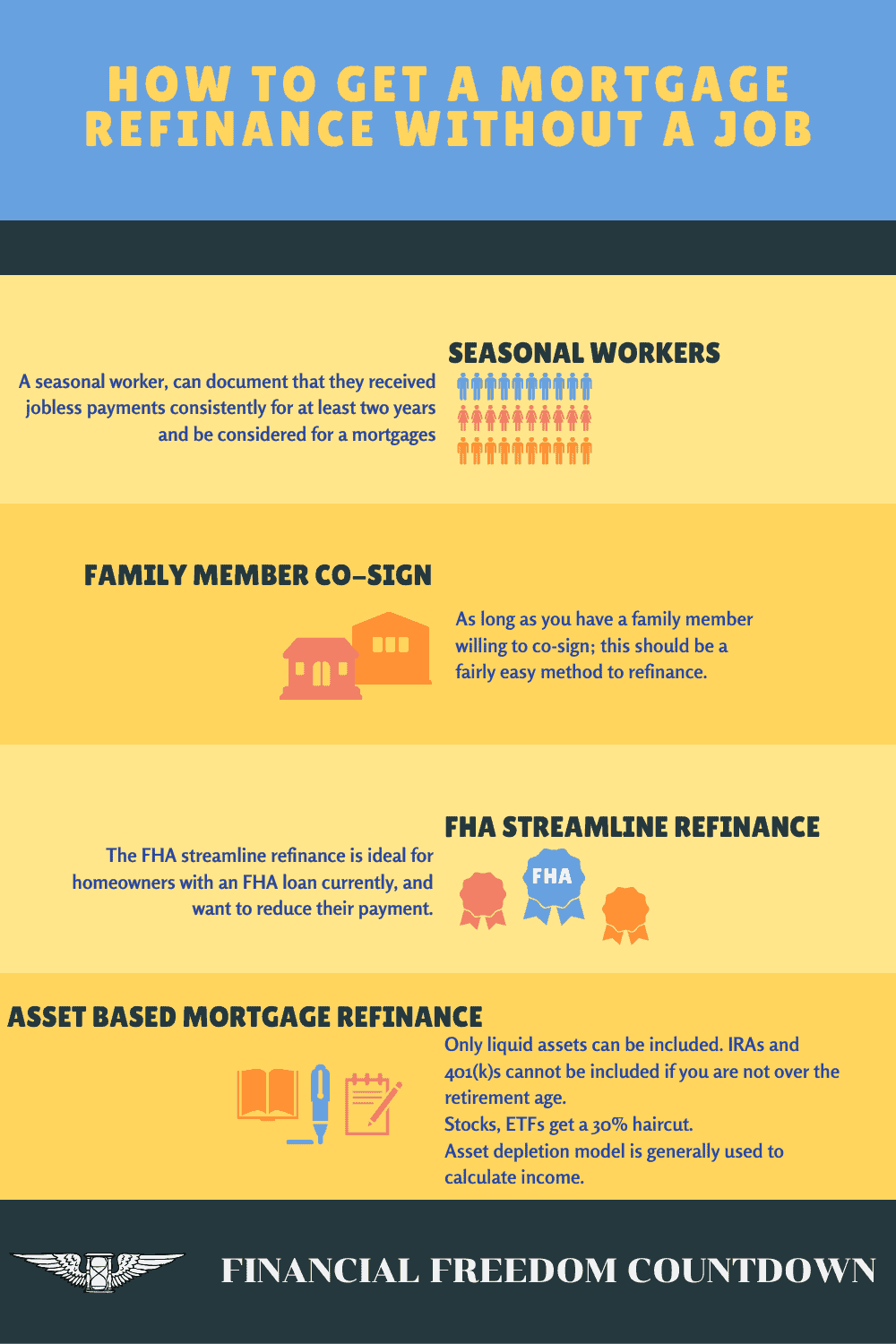

Types Of Loans You Can Get Without A Job

As mentioned, many of those who want a loan without employment verification are those who are unemployed or those who dont have a regular income. Some may be living on government benefits such as the child tax benefit, maternity benefits, employment insurance, and other non-traditional forms of income like RRSP withdrawals. Luckily, there are many lenders who dont require you to have a job, so long as you have some sort of income coming in.

However, those with non-traditional income and bad credit are likely to been seen as high-risk borrowers. This, in turn, will lead to high-interest loans with short repayment periods. As such, you may get the loan you want, however, youll be paying a much higher cost for it.

Note:

Getting A Mortgage With An Irs Tax Lien

If you owe a large amount of back taxes and havent set up an agreement with the IRS to pay, defer payment, or settle the taxes, the IRS can eventually pursue collection actions like issuing levies and liens. A tax lien in particular can hurt your chances of buying or selling a home. When the IRS files a tax lien, it means the IRS is letting all other creditors know that it has a debt to collect from you first.

If you have an IRS lien on your income or assets, youll have a hard time getting approved for a mortgage. Tax liens do not show up on credit reports, but they are likely to come up when your lender does a search for any liens. Lenders can see unpaid taxes as an indicator that the mortgage will also go into arrears. While a tax lien will not disqualify you from getting an FHA loan, it may disqualify you from standard private mortgages, or drastically increase your interest rate. You also cant apply for a Fannie Mae loan if you have a federal tax lien.

If you owe back taxes to your state, you can also have liens or lien equivalents from your state tax agency. Many states have short deadlines to pay before they file a lien or lien equivalent, so state tax debt can quickly affect your ability to borrow.

Recommended Reading: Is 5.5 Percent Interest Rate Good For Mortgage

Research The Types Of Home Loans Available Nationwide

A traditional mortgage may or may not be an option for your situation so you should consider other types of loans. For example, in many states a Bank Statement Loan Program may be available. This type of loan is wonderful for the self-incorporated individual. It does not require a W2 but looks instead at your bank deposits for the last 12-24 months, credit score and other assets. If you are a first time buyers, FHA loans could still be within in your grasp if you furnish additional documentation like 2 years of tax returns and 1099s.

Alexander Viafore Iii Mortgages Perfected

OwnerNMLS 17594

Registered Mortgage Broker with the: NYS Department of Financial Services, NJ Department of Banking & Insurance, CT Department of Banking, FL Office of Financial Regulation. Mortgage Company License with the TX Department of Savings & Mortgage Lending and Mortgage Lender with MD Commissioner of Financial Regulation.

Also Check: What Is The Monthly Payment On A 50000 Mortgage

Have Investment Income We Have You Covered

With TurboTax Live Premier, talk online to real experts on demand for tax advice on everything from stocks, cryptocurrency to rental income.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Will I Be Able To Buy A House If I Owe Taxes

Home \ Mortgage \ Will I Be Able to Buy a House if I Owe Taxes?

Join millions of Canadians who have already trusted Loans Canada

In Canada, two things are certain. Its going to get colder in the winter, and when the snow finally thaws in April, youre going to have to deal with tax season. Then again, what happens if you dont pay your income taxes? What if you have no income to declare? What if youre earning an income, but arent declaring it to the Canada Revenue Agency? Life isnt without its consequences and failing to pay your taxes comes with consequences of its own.

In fact, paying your income taxes is an important part of your financial well being. Not only are you contributing to our country, something that every good Canadian should do, but keeping up to date on your taxes also demonstrates your financial stability for anyone who cares to examine it. Nevertheless, what many would-be homeowners want to know is this: if the Canada Revenue Agency hasnt been receiving my yearly tax contributions, will I be able to secure a mortgage and move on with my life?

In this article, well provide you with some information about the consequences of not paying your income taxes, whether its because youre self-employed and arent sure about how to, have been forgetting to pay them, or have been avoiding them altogether. Then, well talk about how not paying those taxes will affect your ability to get a mortgage.

Read Also: What Does Buying Mortgage Points Mean

How To Buy A House Without Tax Returns

How can I get a mortgage without a tax return?

- The solution would be to get a bank statement mortgage. These require at least 600 credit score. A bank statement loan is a mortgage approval process that allows self-employed borrowers to have income calculated based on bank deposits. With this type of loan, tax returns are excluded from the equation.

Requirements For Mortgage Without Tax Returns

Borrowers are typically self-employed The no tax return lender will need to verify this either with a business listing or a business license, a letter from your accountant, your website, etc. They may require one or more of these to prove that you are in business. 1099 borrowers may also qualify.

Down Payment Some no tax return mortgage lenders may ask for a 10% down payment, but it all depends upon your unique scenario. In most instances, the down payment may be higher. Other factors will impact your down payment such as credit score, assets, and more.

There are no specific credit score requirements, but your credit score will play a major role in what your down payment and interest rate will be. Let us help you to figure all of this out without having to run your credit.

No Tax Return Requirements Most of our lenders will ask for your last 12-24 months bank statements. The bank statements will be used as income verification. They will use the average monthly deposits and will treat them as income. They typically use 100% of the deposits from your personal bank accounts and a portion of your business accounts.

Other Assets It is important to list as many assets as possible to help with the approval of your mortgage application. Underwriters always look at compensating factors and assets is one of them.

Property Types Single family up to 4 units, second homes and investment properties.

Also Check: How Do Mortgage Rates Work