Some Interesting Takeaways From The Mortgage Rate Charts

- Monthly payment differences are larger when interest rates are higher

- Higher mortgage rates may be worse than larger loan amounts

- Small loan amounts are less affected by interest rate movement

- Those with smaller loan amounts have a higher likelihood of affording 15-year payments

The lower the interest rate, the smaller the difference in monthly payment. As rates move higher, the difference in payment becomes more substantial. Something to consider if youre looking to pay mortgage discount points.

If you look at the 30-year mortgage rate chart, the monthly payment difference on a $500,000 loan amount between a rate of 3.5% and 3.75% is $70.36, compared to a difference of $77.93 for a rate of 5.25% vs. 5.5%.

Additionally, higher mortgage rates can be more damaging than larger loan amounts. Again using the 30-year mortgage rates chart, the payment on a $400,000 loan amount at 3.50% is actually cheaper than the payment on a $300,000 loan at 6%.

So you can see where an individual who purchases a home while mortgage rates are super low can actually enjoy a lower mortgage payment than someone who buys when home prices are lower.

However, for someone purchasing a really expensive home, upward interest rate movement will hurt them more than someone purchasing a cheaper home.

Sure, its somewhat relative, but it can be a one-two punch for the individual already stretched buying the luxury home.

What Is A Good Mortgage Interest Rate

Mortgage rates are typically based on the prime rate. The prime rate set on March 16, 2020, for example, was 3.25%. That rate for a mortgage right now would be considered a good mortgage interest rate.

However, if a lender is using the prime rate as an index, it would add on fractions of percentage points or more based on factors in your specific credit profile. Those factors can include your credit, how much you are borrowing, the value of the home, and other data.

The prime rateand mortgage rates in generalcan rise or fall on average for many reasons. At one point during the COVID-19 pandemic, for example, the Federal Reserve lowered the federal funds rate to 0 to 0.25%, which could have impacted mortgage loans issued during that time.

The Consumer Financial Protection Bureau provides a tool that lets you explore what the average lender is offering at various times. You enter a credit score range, state, home price, down payment amount, and terms of the loan. The CFPB uses its database of lenders to let you know what rates banks are offering on those loans at that time.

What Credit Score Do You Need To Get A Mortgage

Most conventional loans require a credit score of 620 or higher, but Federal Housing Administration and other loan types may accommodate lenders with scores as low as 500, depending on your down payment. If you have a high credit score, you may be offered a lower interest rate and more modest down payment. Improving your credit score before applying for a mortgage can save you money even if you already qualify for a loan.

” is the biggest factor in interest rates on both mortgages and all other lending products, so making sure credit balances are below 30% is key to maximizing a credit score,” says Lotz. “If a person finds errors on their credit report, they should dispute them to ensure the most accurate history.”

You May Like: Can You Refinance A Mortgage Without A Job

Why You Need A Good Credit Score For A Mortgage

In order to qualify for a mortgage, you have to show the lender how your credit score stands. Your credit score is based on how well you handle managing debt and how much of it you have outstanding at any given time. You can request a free credit report from each of three major credit reporting agencies Equifax®, Experian®, and TransUnion® once each year at AnnualCreditReport.com or call toll-free 1-877-322-8228.

Its important that these numbers are good in order to get approved for a mortgage so make sure there are no late payments on your credit report and that youre paying off any balances as soon as possible.

Fairway Independent Mortgage Corporation: Best For First

With more than 700 branches, Fairway Independent Mortgage Corporation can offer an in-person experience to both first-time and repeat homebuyers across the U.S.

Strengths: TIf youve never taken out a mortgage before, Fairway has an extensive glossary of mortgage terms you can read up on, several mortgage calculators and a homebuyer guide with a checklist, dos and donts and more. The lender also offers first-time homebuyer-friendly loans, including FHA loans, and a mobile app, FairwayNow, where you can send direct messages and track your loan status.

Weaknesses: Youll have to talk to a loan officer to find out rates and fees these arent available readily on Fairways website.

You May Like: Recast Mortgage Chase

What Is A Good Apr

A good APR depends on several factors. One of the most important considerations is the prevailing interest rate at this particular time. Lenders base the APR they offer on an index rate such as the U.S. prime rate published in The Wall Street Journal.

Each lender or bank charges a margin on top of the prime rate to determine the APR they will offer borrowers. Lenders offer different rates based on , payment history, and so on.

Its important to shop around for loan products rather than going with the first offer. Two lenders can offer you different APRs on the same product, such as a mortgage, even if you apply with the same information .

Keep in mind that the APR differs between loan products. Dont expect to get the same APR for an auto loan that you would get for a mortgage or a credit card.

Therefore, its important to look at apples to apples loans when comparing APRs. For example, compare two auto loans with the same loan terms and for the same amount but from different lenders. It will give you an idea of what a good APR is for your credit score and history.

Our Mortgage Rate Methodology

Moneys daily mortgage rates show the average rate offered by over 8,000 lenders across the United States the most recent business day rates are available. Today, we are showing rates for Tuesday, April 5, 2022. Our rates reflect what a typical borrower with a 700 credit score might expect to pay for a home loan right now. These rates were offered to people putting 20% down and include discount points.

Also Check: Mortgage Recast Calculator Chase

How Does Interest Work On A Car Loan

When you apply for a car loan, the car is used as collateral.Most lenders will require you to have auto insurance to protect the collateral while the loan is being repaid. If you miss any payments, the bank can repossess the car to cover the costs of the loan.

Because the process of repossessing a car is fairly straightforward and doesnt cost the lender very much in fees, borrowers can expect lower interest rates on car loans. Auto loans typically have interest rates in the 4-5% range.

High Rates Affect High Loan Amounts The Most

As you move to higher purchase prices, the sheer dollar amount that is shaved off your purchase price by rising rates is pretty incredible.

You could buy a $420,000 home at 5.0% if your budget were $1,800 per month. But at 6.0%, your purchase price is $375,000, a reduction of $45,000.

At a $2,000 per month payment, your maximum purchase price is cut by over $50,000 by a 1% increase in rates.

These are big numbers and could affect your ability to get into the home you wanted, or into a home at all in higher-priced areas.

Don’t Miss: Recasting Mortgage Chase

Use These Mortgage Charts To Easily Compare Rates

One of the things prospective home buyers and existing homeowners seem to care most about is mortgage rates.

And for good reason the interest rate you receive on your home loan dictates what youll pay each month, sometimes for as long as the next 30 years. Thats 360 months!

The rate you receive can also completely make or break your home purchase, or sway the .

As such, I decided it would be prudent to create a mortgage rate chart that displays the difference in monthly mortgage payment across a variety of interest rates and loan amounts.

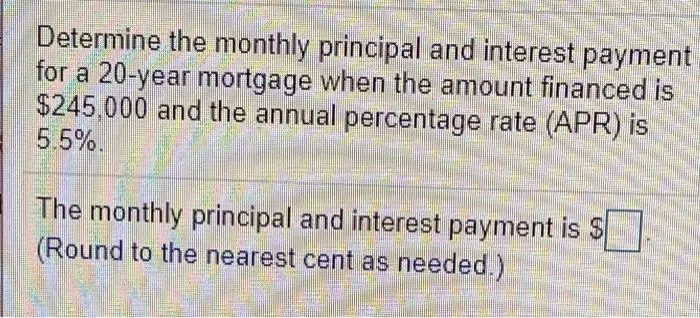

Monthly Mortgage Payment Calculator

| Your loan |

|---|

Fill out the form and click on Calculate to see yourestimated monthly payment.

Based on your loan terms

| Principal |

|---|

-

How to use this mortgage repayment calculator

- Enter how much you want to borrow under Loan amount.

- Type in your mortgage term in years under the Loan terms field.

- Enter the loans interest rate if it doesnt come with any fees under Interest rate. Note that your monthly mortgage payments will vary depending on your interest rate, taxes, PMI costs and other related fees. If you have this information available, you can enter the annual percentage rate , which includes interest and fees combined.

- Click Calculate.

You May Like: Chase Recast

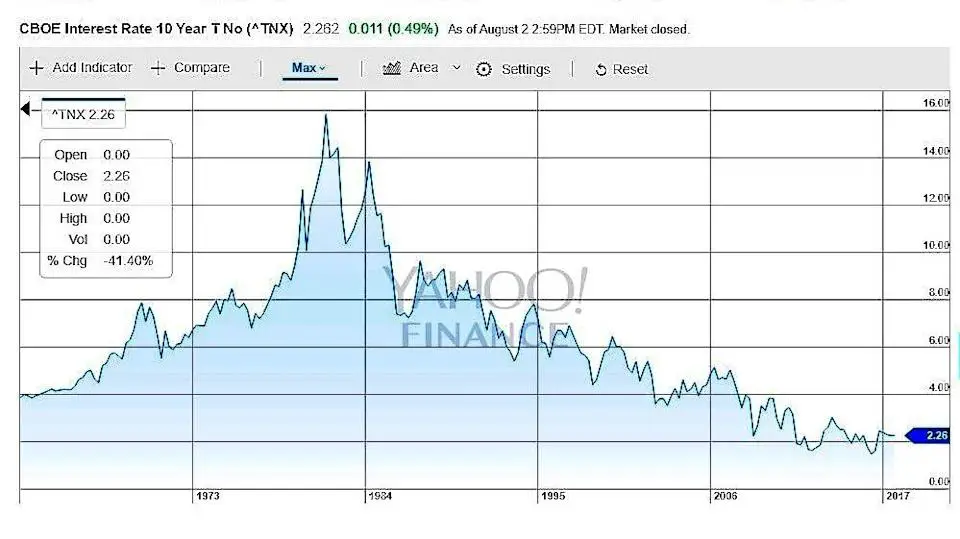

Where Are Mortgage Rates Heading This Year

Mortgage rates sank through 2020. Millions of homeowners responded to low mortgage rates by refinancing existing loans and taking out new ones. Many people bought homes they may not have been able to afford if rates were higher. In January 2021, rates briefly dropped to the lowest levels on record, but trended slightly higher through the rest of the year.

Looking ahead, experts believe interest rates will rise more in 2022, but also modestly. Factors that could influence rates include continued economic improvement and more gains in the labor market. The Federal Reserve has also begun tapering its purchase of mortgage-backed securities and raised the federal funds rate for the first time in March to combat rising inflation. The Fed has signaled six more hikes are likely this year.

While mortgage rates are likely to rise, experts say the increase wont happen overnight and it wont be a dramatic jump. Rates should stay near historically low levels through the first half of the year, rising slightly later in the year. Even with rising rates, it will still be a favorable time to finance a new home or refinance a mortgage.

Factors that influence mortgage rates include:

How Your Loan Term And Apr Affect Personal Loan Payments

When you take out a personal loan, two notable factors that will impact your loan payment include the loan term and APR. When you begin to compare loans from different lenders, a personal loan calculator will show different amounts for your monthly loan payment should the APR and loan terms differ.

Using a personal loan APR of 7.63% as an example, heres a simple breakdown of what the personal loan payment calculator can show you for a $5,000 loan and $10,000 loan.

| Your payments on a $5,000 personal loan | |

|---|---|

| Loan balance | |

| $5,610 | $6,030 |

In another scenario, the $10,000 loan balance and five-year loan term stay the same, but the APR is adjusted, resulting in a change in the monthly loan payment amount.

| Your payments on a $10,000 personal loan |

|---|

| Loan balance |

| $22,712 |

You May Like: Chase Recast Mortgage

What Is Considered A High Interest Rate

Every loan type has its own average amount of interest. The rate is calculated based on a number of factors, including:

- The principal amount

- The borrowers credit-worthiness

Because no two loans are alike, it can be hard to determine what a good interest rate is. Your credit cards, auto loans, personal loans and mortgages all have unique factors that are used to determine your interest rate.

How To Shop For And Compare Mortgages

Shopping around and comparing offers is critical to get the best deal on your mortgage refinance. Make sure to get quotes from at least three lenders, and pay attention not just to the interest rate but also to the fees they charge and other terms. Sometimes its a better deal to choose a slightly higher interest loan if the other aspects are favorable.

Also Check: Chase Mortgage Recast Fee

How Does Credit Card Interest Work

Unlike auto and home loans, banks and lenders have no collateral to collect in the event that a borrower defaults or stops making payments on their credit card. As a result, credit cards will have a higher interest rate than other loan types to offset overall losses. The average credit card interest rate is in the 14-24% range.

Credit card balances are limited. If you handle them correctly, you can avoid paying significant amounts of interest. Credit cards are a great tool if you know how to manage them, but you dont want to end up with too many credit cards that you cant manage the balances.

Paying Off The Mortgage Early

Some homeowners choose to pay off their mortgage early, and the benefits can vary, depending on a person’s financial circumstances.

For example, retirees may want to reduce or eliminate their debt since they’re no longer earning employment income. In other cases, people may want to free up their monthly cash outflows by paying off their mortgage.

Don’t Miss: Requirements For Mortgage Approval

Tips For Getting The Lowest Mortgage Rate Possible

There is no universal mortgage rate that all borrowers receive. Qualifying for the lowest mortgage rates takes a little bit of work and will depend on both personal financial factors and market conditions.

Check your credit score and credit report. Errors or other red flags may be dragging your credit score down. Borrowers with the highest credit scores are the ones who will get the best rates, so checking your credit report before you start the house-hunting process is key. Taking steps to fix errors will help you raise your score. If you have high credit card balances, paying them down can also provide a quick boost.

Save up money for a sizeable down payment. This will lower your loan-to-value ratio, which means how much of the homes price the lender has to finance. A lower LTV usually translates to a lower mortgage rate. Lenders also like to see money that has been saved in an account for at least 60 days. It tells the lender you have the money to finance the home purchase.

Shop around for the best rate. Dont settle for the first interest rate that a lender offers you. Check with at least three different lenders to see who offers the lowest interest. Also consider different types of lenders, such as credit unions and online lenders in addition to traditional banks.

Finally, lock in your rate. Locking your rate once youve found the right rate, loan product and lender will help guarantee your mortgage rate wont increase before you close on the loan.

The Fed Versus The Mortgage Marketplace

It can be argued that the Feds position is especially weak in the mortgage marketplace. Sure, the Fed can raise bank rates but mortgage borrowers increasingly dont get financing through a bank. According to the Mortgage Bankers Association , a majority of loans 54 percent in 2017 are now originated by non-banks.

While the Fed raised bank rates four times in 2018, for a 1 percent increase, mortgage rates went up by just .51 percent.

Non-banks get much of their money from investors. Their rates reflect the free-market supply and demand for capital. Sometimes the free market and the Fed value money very differently. For instance, while the Fed raised bank rates four times in 2018, for a 1 percent increase, mortgage rates went up by just .51 percent.

What we have today at least with mortgages is not the Fed leading the marketplace. Its the mortgage market leading the Fed and that suggests still-lower rates ahead.

Read Also: Rocket Mortgage Conventional Loan

How We Make Money

Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

Bankrate, LLC NMLS ID# 1427381 |NMLS Consumer AccessBR Tech Services, Inc. NMLS ID #1743443 |NMLS Consumer Access

Percent Mortgage Are Baaack But They Arent Zombies

The 5 percent mortgage is back. Its not as though some magical barrier existed at 4.875 percent, our average mortgage rates on . Then they hit 5 percent on

The real estate world will not end, but borrowers may want to rethink their mortgage options. As we shall see, there are strategies to reduce mortgages rates and interest costs.

Read Also: Mortgage Rates Based On 10 Year Treasury

How To Deal With The 5 Percent Mortgage

In this article:

- Mortgage rates are rising overall. Thats a fact we cant ignore

- However, many are overestimating the effect on home affordability due to small increases in interest rates

- There are options for those who want to buy but are concerned about financing costs

Information is power. The more you know, the less worried youll be when buying a home.

Todays Mortgage Rates In New York

Whether youre ready to buy or refinance, youve come to the right place. Compare New York mortgage rates for the loan options below.

Compare current refinance rates today.

The rates below assume a few basic things:

- You have very good credit

- Your loan is for a single-family home as your primary residence

Read Also: Can You Do A Reverse Mortgage On A Condo