The Bottom Line: No Limits On Va Loan Use But Understand Your Entitlement

The most important takeaway is that, as long as youre eligible and youre able to qualify with a lender, theres no limit to how many times you can take out a VA loan in your lifetime.

However, there are a few circumstances where there may be limits on how much you can borrow without having to make a down payment. If youre planning to get another VA loan without paying off your current one, or if youve paid off a previous VA loan but didnt sell the house, you might have a reduced entitlement or have to apply for one-time entitlement restoration. Dont worry, Rocket Mortgage will explain all of this to you and make sure you understand everything and qualify for exactly what youre eligible for. The VA loan is a benefit youve earned for serving your country, and we will make sure you get every penny youve earned.

If youre thinking about applying for a VA loan, get started by preparing for one of the first steps in the approval process: securing your certificate of eligibility. We can also help you secure this if you apply online or give us a call at 326-6018.

VA loan rates are dropping!

Get approved online and lock in your low rate.

Two Va Home Loans At The Same Time

Many VA borrowers who buy ordinary family homes use way less than their full entitlement. And some can use whats leftover to acquire a second VA loan.

If youre posted away from your existing home in a permanent change of station , you can typically apply to use your remaining entitlement to purchase a different property close to where youre moving. And you can then rent out your existing home.

Sometimes, the remaining entitlement isnt quite enough to cover the loan required. But if you can scrape together a modest down payment, you can use that to bridge the gap.

The math can get complicated with this. If you think you may want to apply, you should talk to a VA mortgage loan specialist early on in the process.

What Is The Va Loan Limit For 2020

The limit in 2020 is $ 510,400 in a typical American county and higher in expensive housing markets, such as San Francisco County. If you are subject to VA loan limits, the lender will demand an advance payment if the purchase price is above the loan limit.

What is the maximum amount you can borrow for a VA loan?

About VA loan limits. The standard VA loan limit in 2022 is $ 647,200 for most U.S. counties, increasing from $ 548,250 in 2021. VA loan limits also increased for high-cost counties, topping $ 970,800 for detached houses. VA loan limits do not represent a ceiling or maximum loan amount.

Can I get a VA loan for $1000000?

2022 VA loan limits and house prices. Since the Blue Water Navy Vietnam Veterans Act from 2019, more veterans can benefit from VA loans with zero down even in expensive housing markets. If you are fully entitled, the maximum VA guarantee is simply 25% of your loan amount even if your loan is $ 1,000,000 or more.

Will VA loan limits increase in 2021?

Across the majority of the United States, the maximum lending limit for 2022 for one-unit properties will be $ 647,200, an increase from $ 548,250 in 2021. This means that in the majority of the United States, the maximum VA lending limit for 2022 for single-unit properties will be be $ 647,200.

Don’t Miss: Is A Heloc Considered A 2nd Mortgage

Benefits Of A Va Loan

The VA loan program offers a multitude of benefits, including:

Whether youre on your first, second, or 16th home purchase, a VA home loan is highly likely to be the very best mortgage you can find assuming youre eligible.

Please contact our support if you are suspicious of any fraudulent activities or have any questions. If you would like to find more information about your benefits, please visit the Official US Government website for theDepartment of Veteran Affairs or the US Department of Housing and Urban Development.

MilitaryVALoan.com is owned and operated by Full Beaker, Inc. NMLS #1019791.

How Many Times Can I Take Out A Va Loan

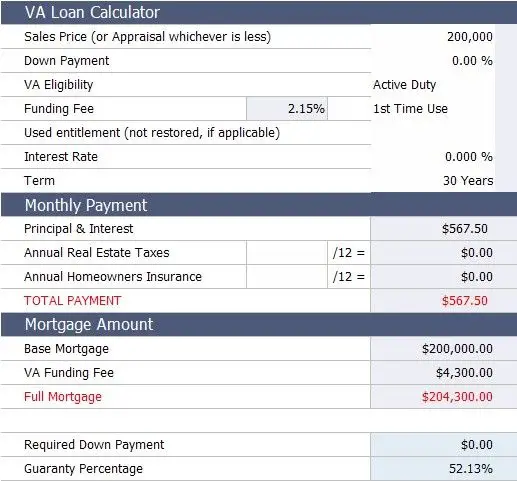

You can take out a VA loan a seemingly limitless amount of times. However, the VA funding feefee the VA charges to guarantee the loancan be higher after the first home loan, depending on your down payment amount.

For instance, if you put down less than 5% of your loan amount, youd pay 2.3% on the first use versus 3.6% for the second time and beyond. However, if you put down 5% or more of the loan amount, youll pay the same VA funding fee no matter whether its your first or seventh loan.

You may be exempt from paying the VA funding fee, though, if one of the following applies:

- Youre eligible to or are receiving compensation for a service-connected disability.

- Youre a surviving spouse of a veteran who died while serving, or from a service-connected disability or was totally disabled. You must receive Dependency and Indemnity Compensation to qualify.

- Youre a service member with an in-process or memorandum rating of eligibility for compensation because of a pre-discharge claim before the date the loan closes.

Also, you can apply for a refund of the VA funding fee if youre awarded VA compensation for a service-connected disability after the closing date if awarded retroactively.

Related:VA Loan Closing Costs: Everything You Should Know

Recommended Reading: Why Do You Want To Work In The Mortgage Industry

Can I Have Two Va Loans At One Time

Though uncommon, it can be possible to have more than one VA loan home at the same time. The simplest case is if your VA mortgage is already paid in full. You may be able to get one-time permission to restore your entitlement and keep the home as a rental property.

The VA may also allow a one-time exception if you need to buy another home due to specific circumstances. For example, letâs say you receive a permanent change of station order and have to move to a different city.

In this scenario, you may be able to get permission to use your remaining entitlement and buy a new home without having to sell your old home and pay off the loan. However, even if you get the VAâs approval, your lender will still be looking to see if youâre financially able to handle two mortgages at once.

Tip: If you sell your house to a fellow veteran who has enough entitlement, they can assume your VA loan and free up your own entitlement. A non-VA home buyer can also assume your loan, but they must pay off the mortgage before your entitlement can be restored.

Understanding The Va Loan Entitlement

Your VA loan entitlement is the amount the VA is willing to pay your lender if you default on your loan. Its generally 25% of your loan amount.

Your COE has an entitlement code, which shows your lender how you earned your entitlement. Itll also show your basic entitlement amount of $36,000. The 25% rule means that if your basic entitlement amount is $36,000, the VA will guarantee 25% of a loan up to $144,000.

This doesnt mean your loan amount has to be $144,000 or less. It can be higher, and it just means youll use your bonus entitlement. However, your lender will have their own qualifications for you to meet to determine your loan amount. With limited exceptions below, the VA doesnt set loan limits of its own.

Bonus entitlement kicks in when your loan is over $144,000. If you have full entitlement, the VA will cover 25% of your loan amount, even if its more than $144,000. If youve got reduced entitlement because youve already used some of it, the VA will guarantee up to 25% of your countys conforming loan limit. The conforming loan limit is the maximum dollar amount of a mortgage that Fannie Mae or Freddie Mac would guarantee if this was a conforming loan.

Recommended Reading: What Is A Good Dti For Mortgage

How Do I Restore Va Entitlement After Foreclosure

The only way to get it back is to repay the VA in full. But many buyers probably have the right to spare to pursue another VA loan. Lenders need to see the veterans Certificate of Eligibility to find out how much right they have left.

How is VA entitlement calculated after foreclosure?

To get your basic right, take $ 36,000 and multiply by four. This is the first amount you can borrow using a VA loan. To get your bonus, take the corresponding loan limits for your county and divide by four: $ 647,200 / 4 = $ 161,800.

Can VA entitlement be restored?

VA rights restoration Veterans can restore previously used VA rights by: Selling the original property, repaying their current VA loan in full and disposing of the home. To allow a qualified veteran to take out their current loan and replace their rights.

Can you still get a VA loan after a foreclosure?

VA loans also allow veterans and active military to return faster after a bankruptcy, forced sale or card sale. You may be eligible for a VA loan two years after a Chapter 7 bankruptcy filing one year after filing for Chapter 13 bankruptcy and two years after an outlay.

Is A Va Loan Worth It

A VA loan usually isnt worth it in the long run. The main reason is because people mostly get them to skip saving for a down payment.

A low or no down payment makes your loan tens of thousands of dollars more expensiveand that can lead to all sorts of money problems down the road.

We dont want that for you. Thats why at Ramsey we teach home buyers how to save a big down payment of 20% or more on a 15-year fixed-rate conventional loanthis is your overall lowest cost mortgage option.

Also Check: Can A 70 Year Old Get A 30 Year Mortgage

How Many Va Loans Can I Have At Once

Generally, you cant take out more than two VA home loans at once, as youre supposed to reside or have resided in a home to take out a VA mortgage. This can happen when selling one home to buy another, or if keeping one home and then buying a home when assigned to a different military base. You cant borrow VA loans for investment properties you dont live in, however.

When borrowing money to buy the second home, your VA eligibility is reduced by the amount owed on the first mortgage. For example, in Phoenix the limit is $647,200. So, if your current mortgage is for $400,000, you could potentially borrow up to $247,200 on your second home.

When it comes to a second VA loan, theres still a maximum amount you can borrow in total between the two homes. If you need more than the VA home loan limit, you may want to consider refinancing the mortgage on the first home to a conventional loan and then using the VA loan for the second loan. You can get a seemingly limitless number of VA loans if you pay off one VA loan and sell the home before taking out the next mortgage.

What If I Want To Purchase A Condo With A Va Loan

The Department of Veterans Affairs has a condo database of approved developments. If your dream condo is not on the VAs list, your lender can ask the VA to approve this development. Keep in mind that the VAs process for adding a new condo development to their approved list can take months and is not guaranteed to be approved once the process is over.

Also Check: How Many Mortgage Lenders Should I Apply To

How To Take Out A Second Va Loan

If your entitlement is reduced, its possible to have your full entitlement restored in certain circumstances. If this isnt possible, youll be limited by the amount of entitlement you have left.

Keep in mind, when we say limited, we dont mean you cant take out a larger loan than what your entitlement will guarantee, but that you wont be able to take out that loan without making a down payment. This is because lenders will typically require that 25% of your loan amount is covered either by your entitlement, a down payment or a combination of the two.

Can A Va Loan Be Used For A Second Va Loan

Yes, you can use the VA loan benefit to buy a home more than one time. However, veterans seeking a second VA loan will need to consider the various stipulations. The VA loan program was designed to help military borrowers get into primary residences, not to purchase vacation homes or investment properties.

One way to buy another home with a VA loan is to prove a net tangible benefit. These reasons may include moving closer to a new duty station or downsizing your mortgage payment due to a financial change.

Additionally, you may use a reduced entitlement to acquire a second VA loan. Or apply for a restoration of your entitlement to take out a second VA loan.

Also Check: How Does The Fed Rate Affect Mortgage Rates

Does My Home Qualify For A Va Loan

Your VA appraiser will have final say in whether your home qualifies for a VA loan. To ensure the best chances for your property to be approved by the VAs Minimum Property Requirements , make sure your home covers the following:

Property condition:

- Mechanical systems are operating safely and are deemed to have reasonable future utility.

- Adequate heating supply that is in good working order.

- Roofing must be in good condition with no major leaks.

- Property must be free of any structural threats such as termites, rot, or fungus.

- Generally speaking, it is best to avoid homes listed as is as these homes tend to have one or more of the above listed issues.

Conventional property:

Your property must be a conventional family home. VA appraisers tend to dislike unique properties due to the complications they can create when trying to find recent comparable homes. In addition, your lender may have additional restrictions to certain unique homes including but not limited to: ranches, converted churches, and homes with geodesic domes.

How Many Times Can I Use A Va Loan

VA loans are not a one-time benefit you can use them multiple times so long as you meet eligibility requirements. You can even have multiple VA loans at the same time. Heres how it might work:

You sell your home and pay off the existing VA loan. Then you can either restore your entitlement or use your remaining entitlement to cover a new VA loan.

You can keep your current home and rent it out as an investment property. You could buy a second home using your remaining entitlement. This results in having two VA loans outstanding at the same time.

Youve repaid your previous VA loan in full but kept the sold the home you bought with it. In this case, you restore your entitlement, but you can only do this one time.

Recommended Reading: How Much Time Is Left On My Mortgage

The Va Loan Guaranty Program

The VA Loan Guaranty Program is a government-backed loan guarantee that allows veterans, active service members, and surviving dependents to purchase homes with no money down. The program makes it easier for qualified borrowers to finance their dream homesits that simple. This program has been in the lives of military members and their families since 1944, making homeownership accessible and more affordable.

Despite the change in lenders regulations and underwriting standards, the benefits of the VA Guaranty Program arent going to change. So if you have an interest in homeownershipnot to mention if you already own a homeyou must understand the process and whats in there for you. Whether youre in the process of purchasing your first home or refinancing an existing mortgage, be sure to do as much research as possible to avoid future surprises.

In addition, qualifying for a VA loan does not require you to put any money down or pay private mortgage insurance . These are two of many reasons why VA loans are attractive financing tools for first-time homebuyers, especially those who have served in war zones. All you need to do is go with your gut and pick the best financing option, bearing in mind that VA loans were created to honor and reward you for your sacrifices. So, gravitate to the mortgage companies, loan officers, and realtors who honestly embrace that spirit.

Dont Miss: How Long It Takes For Sba To Approve Loan

Who Qualifies For A Va Loan

Active Duty servicemembers, veterans and their families are eligible. You or your spouse must meet at least one of the following requirements:

- Served 90 consecutive days of active service during wartime

- Served 181 days of active service during peacetime

- Served more than 6 years with the National Guard or Reserves

- Are the spouse of a military member who lost their life in the line of duty, or as the result of a service-related disability. You usually cannot have remarried.

According to a recent report released by Navy Federal Credit Union,* not all eligible military members are aware that they can buy a home with a VA loan. Nearly 15% of respondents who had recently taken out a non-VA loan mortgage said they weren’t aware of the VA loan benefit.

Read Also: How Much A Month Is A 500k Mortgage