Major Factors That Influence Mortgage Eligibility

When qualifying for a mortgage, lenders rely on standard indicators that determine whether a borrower can repay a loan. These financial factors also influence how much they are willing to lend borrowers. Lenders will thoroughly evaluate your income and assets, credit score, and debt-to-income ratio.

What Data Do You Want Earlier Than You Apply

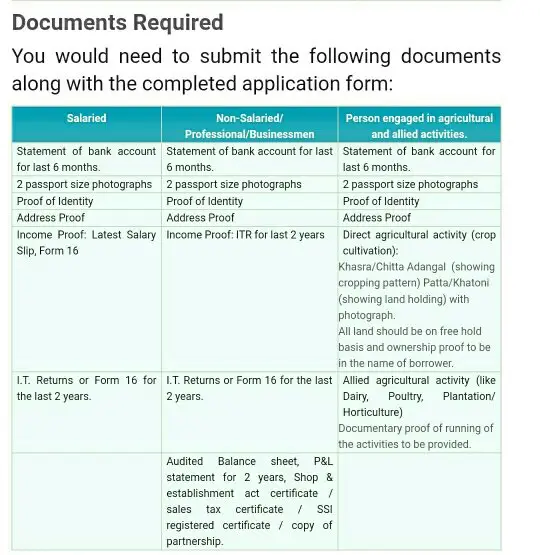

Earlier than you begin up your mortgage utility its good to collect collectively all of the documentation you will have for the method, have it useful earlier than you start the method.

You may transfer by the applying course of extra effectively and get your cash sooner if in case you have all this on the prepared earlier than you start.

Listed below are a number of the issues its possible youll want:

- ID. E.g. Social safety, drivers license, passport, and so on.

- Proof of residence. E.g. named utility invoice, lease settlement with title and handle, and so on.

- Proof of your earnings. E.g. tax returns, W-2s, pay stubs, and so on.

- Info of employer. E.g. title of firm, title of supervisor, telephone variety of supervisor.

How Does Where I Live Impact How Much House I Can Afford

Where you live plays a major role in what you can spend on a house. For example, youd be able to buy a much bigger piece of property in St. Louis than you could for the same price in San Francisco. You should also think about the areas overall cost of living. If you live in a town where transportation and utility costs are relatively low, for example, you may be able to carve out some extra room in your budget for housing costs.

You May Like: What Is Apr In Mortgage Interest Rate

How Much Youre Looking To Borrow

Of course, another important factor the lender will need to consider is how much youre looking to borrow. The lender will generally pay attention to the amount you need to borrow and how this compares to the homes value. This comes into play when it comes to the loan-to-value ratio and potentially needing to pay lenders mortgage insurance , as well as whether you can afford to repay your mortgage.

Lets quickly look at an example. Lets say you want to borrow $300,000 on a $400,000 property. This means you have a deposit of $100,000 and a 75% LVR. Since you have more than a 20% deposit on the home, you wont need to pay LMI. This is because you could be considered a less risky borrower.

With this in mind, the lender will decide whether the loan is suitable for you based on your financial situation, property details and any other eligibility requirements.

If youre ready to apply for a home loan, chat to one of our lending specialists or see if you qualify today.

Exactly What Are The Needs To Be Eligible For A A Small

Exactly what are the needs to be eligible for a a Small-Business mortgage?

A minimum of two years, and that have solid financials while requirements to qualify for financing with traditional banks may vary in the details from one lender to another, in general, they look for companies that have been in business. They will wish to have a look at bank statements and taxation statements. They could additionally require monetary statements, such as for example a profit that is up-to-date loss declaration or a stability sheet. They might require also company intend to guaranteed approval payday loans Joliet have a feeling of your company economic health insurance and methods for development.

Many banking institutions would rather read annual profits of $1 million or higher, along with a minimal individual debt-to-credit ratio. As a whole, youll need that is likely credit ratings in the 700s, many banking institutions will accept a debtor with your own get of 680+ supplied more company metrics show an excellent company additionally the capacity to program financial obligation. The SBA will approve a loan sometimes to a debtor having a FICO get of 660.

Read Also: Can You Have More Than One Mortgage

What Documents Do You Need To Prove Your Eligibility For A Mortgage

When you apply for a mortgage, lenders wonât just take you at your word. You need to prove you are who you say you are â and that the figures in your application are accurate and up to date.

To do that, youâll need to gather several different documents. â

To prove your identity,youâll need to show your lender:

- Your passport or driving licence

- Proof of address

To prove your income, youâll need to give the lender:

- Payslips from the past three to six months

- Your most recent P60

- Evidence of any bonuses or commission, received or due

- Bank statements from the past three to six months for the account your salary is paid into

To prove your income from self-employment, youâll need:

- Two years of accounts

- Your SA302 tax calculations and tax year overviews for at least the last two years

- If youâre a contractor, youâll have to show proof of upcoming contracts

- If youâre a company director, youâll have to provide evidence of dividend payments or your share of net profits after corporation tax.

To prove your expenditure, youâll need:

- Three to six months of bank and credit card statements

- Information about any outstanding loans or credit agreements

Current Minimum Mortgage Requirements For Usda Loans

Down payment. The USDA loan doesnt require a down payment.

Mortgage insurance. Rather than mortgage insurance, USDA loans require guarantee fees that work much like FHA mortgage insurance. Youll pay an upfront guarantee fee of 1% of your loan amount, which is typically rolled into your loan amount. Youll also pay an annual fee of 0.35% of your loan amount thats divided by 12 and added to your monthly mortgage payment.

The USDA doesnt set a minimum score, but USDA-approved lenders usually require at least a 640 score to qualify.

Employment. The USDA requires documentation of employment for all adult members of a household.

Self-employment. Self-employment guidelines require a two-year history, along with a year-to-date profit and loss analysis and proof the business is still operating.

Income. There are two unique income-qualifying requirements with USDA loans:

Debt-to-income ratio. The DTI limit is set at 41%, with exceptions up to 44% with a 680 credit score, cash reserves and job stability for the past two years.

You May Like: What Are Prepaids On A Mortgage Loan

Coronavirus Pandemic Mortgage Requirement Changes In 2021

Lenders have added additional mortgage requirements that may be very different from what youre used to if you havent taken out a mortgage in the past year.

Outside-only home appraisals. Conventional, FHA, VA and USDA-approved lenders may allow exterior-only appraisals, meaning the appraiser will value the home without inspecting the inside.

Extra asset documents. Because of the volatility in the financial markets, lenders may ask for updated documentation of any retirement, stock and mutual funds needed to qualify for a mortgage to confirm the value just before closing.

Virtual closings. Many lenders require notary signings, power of attorney signings or electronic signings, especially in states heavily affected by COVID-related restrictions.

Final tip:

Dont Miss: How Much Is The Average House Mortgage

The Key Principles Of Mortgage Approval Are As Follows:

- Your income should be secure .

- You can provide evidence of affordability from recent rent and savings patterns that you can afford repayments

- You have an adequate cash deposit

- You have a good credit history, well managed finances and typically no loans or credit card debt.

1. What is the maximum mortgage limit.

- Central Bank rules place a limit of 3.5 times your normal gross income as your maximum mortgage.

- Exemptions above 3.5 times gross income are difficult to secure at present but are available in limited circumstances.

2. How much of a deposit do you need?

- First time buyers 10%

- Second time buyers 20% of the purchase price

- Some lenders are comfortable to have the deposit requirement provided by way of a gift, but as a general rule lenders preference is to see a steady savings pattern contributing to 5% of the purchase price – some tolerance for larger gifts is evident with long rental history

- Deposit exemptions are available at present so that second time buyers with strong incomes are not restricted to a minimum 20% deposit. Each case is assessed on its own merits.

3. Can you afford the repayments?

4. Is your income secure?

5. Can you demonstrate good financial management?

- Good regular savings record

- Minimum of personal debt and credit cards cleared monthly

- Prudent spending habits

- If you have taken out loans in the past – there should be no missed payments

- No online gambling

Also Check: Do Mortgage Lenders Look At Medical Collections

What Mortgage Terms Are Best For Me

Different mortgage terms can have a radical impact on your monthly payments and the overall interest you’ll pay. For instance, you may consider:

-

How long will I live in this home? That can greatly impact your decision on whether to choose a 30-year fixed rate loan or a shorter term. The longer term will provide a more affordable monthly payment, but youll pay a lot more interest over the long term. A 15-year fixed-rate mortgage will cost you way less interest over the life of the loan, but your monthly payment will be considerably more.

-

Should I pursue an adjustable-rate mortgage or a conventional mortgage? If you plan on being in this home for just a few years, a 5-year ARM could be a good option. Youll enjoy a lower initial interest rate thats fixed for five years, but the rate changes every six months after that.

Two Types Of Conventional Loans

- Conforming Conventional Loans: Conventional mortgages follow assigned loan limits established by the Federal Housing Finance Agency . In 2022, the maximum conforming limit for a single-unit home in the U.S. continental baseline is $647,200. If this is the maximum conforming limit in your area, and your loan is worth $600,000, your mortgage can be sold into the secondary market as a conventional loan. We publish maximum conforming limits by county across the country.

- Non-conforming Conventional Loans: Also called jumbo loans, non-conforming conventional mortgages exceed the assigned conforming loan limits set by the FHFA. These loans are used by high-income buyers to purchase expensive property in high-cost locations. The conforming loan limit for high-cost areas are 50% higher than the baseline limit, which is $970,800 for single-unit homes as of 2021. Jumbo mortgages have stricter qualifying standards than conventional loans because larger loans exact higher risk for lenders.

PMI on Conventional Loans

Private mortgage insurance or PMI is required for conventional mortgages when your down payment is less than 20% of the homes value. This is an added fee that protects your lender if you fail to pay back your loan. PMI is typically rolled into your monthly payments, which costs 0.5% to 1% of your loan per year. Its only required for a limited time, which is canceled as soon as your mortgage balance reaches 78%.

Read Also: What Do I Need For A Mortgage Loan Pre Approval

Work On Boosting Your Credit Score

You can work on improving your credit score, reducing your debt, and increasing your savings. Of course, you need to first obtain your credit score and get a copy of your . The Consumer Financial Protection Bureau, which is a government agency, has helpful information on their website to obtain a free credit report. The report will list your credit history, your open loans, and credit card accounts, as well as your track record for making timely payments. Once you have the report, youll be able to obtain your credit score from one of the three .

Individuals are allowed one free credit report a year from each of the three credit rating agencies.

Calculating The Income Required For A Mortgage

You’ve got a home or a price range in mind. You think you can afford it, but will a mortgage lender agree? Our calculator helps take some of the guesswork out of determining a reasonable monthly mortgage payment for your financial situation.

Mortgage lenders tend to have a more conservative notion of what’s affordable than borrowers do. They have to because lends must ensure the mortgage gets repaid.

Lenders don’t only take into account the mortgage payments but must also look at the other debts you’ve got that take a bite out of your paychecks each month.

Determining this comes down to the debt-to-income ratio. DTI is the percentage of your total debt payments as a share of your pre-tax income. A common benchmark for DTI is not spending more than 36% of your monthly pre-tax income on debt payments or other obligations, including the mortgage you are seeking.

Some lenders and loan types may allow DTI to exceed 41%. In these cases, the borrower typically receives additional financial scrutiny.

When calculating your debt-to-income ratio, lenders also consider what makes up the entire mortgage payment, including property taxes, homeowner’s insurance, mortgage insurance and condominium or homeowner’s association fees.

Don’t Miss: How Much Would A 100k Mortgage Cost Monthly

How Much Youve Saved For A Deposit

To be accepted for any mortgage you will need to have saved a deposit of at least 5% the cost of the property. The more youve saved the more likely you are to be approved for a mortgage and the lower the interest rate will be. This means its a good idea to start saving as far in advance before you make your application.

What Factors Impact The Amount You Can Borrow

Lenders consider several factors in determining the amount you qualify for, including:

-

Your debt-to-income ratio. Our How much can I borrow calculator? depends on an accurate input of your income and recurring debt. Youll want to really hone those figures down to a fine point, because lenders will be using them too.

-

Your loan-to-value ratio. This ratio is a function of the amount of money you put down. If you want to drill down on this calculation, use NerdWallets loan-to-value calculator.

-

Your credit score. This number impacts the pricing of your loan, more than how much youll qualify for. But thats really important. If you dont know your score, get it here.

Read Also: How Much Does A Mortgage Broker Make Off A Loan

Determining How Much Mortgage I Can Afford

When buying a home, the question, How much can I borrow? should be the second question you ask. The most important consideration is, How much house can I afford? Thats because even with all the angst involved in applying for and being approved for a home loan, lenders are often inclined to loan you more money than you expect.

Thats a surprising and important reality.

As much as you want to buy a home, lenders want to loan you money. And the bigger the loan, the happier they are. Youll know why when you see the estimate of the interest youll pay over the life of the loan. Its a really big number. But if you know how much home you can afford, of course, youll want to learn how much you can borrow.

Consider Other Lenders And Fha Loans

Banks dont all have the same credit requirements for a mortgage. A large bank that doesnt underwrite many mortgage loans will likely operate differently than a mortgage company that specializes in home loans. Local banks and community banks are also great options. The key is to ask a lot of questions regarding their requirements, and from there, you can assess which financial institution is right for you. Just remember, banks cant discourage you from applying .

In other words, sometimes one lender may say no while another may say yes. However, if every lender rejects you for the same reason, youll know that its not the lender and youll need to correct the problem.

Some banks have programs for low-to-moderate-income borrowers, and they could be part of the FHA loan program. An FHA loan is a mortgage insured by the Federal Housing Administration , which means the FHA reduces the risk for banks to issue mortgage loans. Youll have to find a local bank thats an FHA-approved lender. The advantage of FHA loans is that they require lower down payments and credit scores than most traditional mortgage loans.

Don’t Miss: What Does A Mortgage Rate Mean

How To Estimate Affordability

There is a rule of thumb about how much you can afford, based on the calculations your mortgage provider will make. The rule of thumb is that you can afford a mortgage where your monthly housing costs are no more than 32% of your gross household income, and where your total debt load is no more than 40% of your gross household income. This rule is based on your debt service ratios.

Lenders look at two ratios when determining the mortgage amount you qualify for, which generally indicate how much you can afford. These ratios are called the Gross Debt Service ratio and Total Debt Service ratio. They take into account your income, monthly housing costs and overall debt load.

The first affordability guideline, as set out by the Canada Mortgage and Housing Corporation , is that your monthly housing costs â mortgage principal and interest, taxes and heating expenses – should not exceed 32% of your gross household monthly income. For condominiums, P.I.T.H. also includes half of your monthly condominium fees. The sum of these housing costs as a percentage of your gross monthly income is your GDS ratio.