How Historical Mortgage Rates Affect Refinancing

A refinance replaces your current loan with a new loan, typically at a lower rate. When rates go up, theres less financial benefit to refinancing. Youll need to ensure youll stay in your home long enough to recoup closing costs. To do this, divide the total loan costs by your monthly savings. The result tells you how many months it takes to recoup refinance costs, called the break-even point. The quicker you reach your break even, typically, the more cost-effective the refinance becomes.

When mortgage interest rates slide, refinancing becomes more attractive to homeowners. The extra monthly savings could give you wiggle room in your budget to pay down other debt or boost your savings.If the equity in your home has grown, you can tap it with a cash-out refinance. With this type of refinance, youll take on a loan for more than you owe. You can use the extra funds as cash to make home improvements or consolidate debt. Lower rates may help minimize the larger monthly payment.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

Recommended Reading: How Much Of My Budget Should Go To Mortgage

Is It Worth Refinancing To A 15

You can save money and build home equity faster with a 15-year mortgage than with a 30-year mortgage. But the monthly mortgage payment will be higher on a 15-year mortgage because there is less time to pay off the loan.

Its worth comparing 15-year mortgage rates if youll be able to afford the monthly payments and still have enough money for other needs, such as saving for retirement.

Getting a lower interest rate could save you hundreds of dollars over a year of mortgage payments and thousands of dollars over the life of the mortgage.

When you compare 15-year refinancing offers using the Loan Estimates you receive from lenders, youll feel confident when you identify the offer that has the best combination of rate and fees.

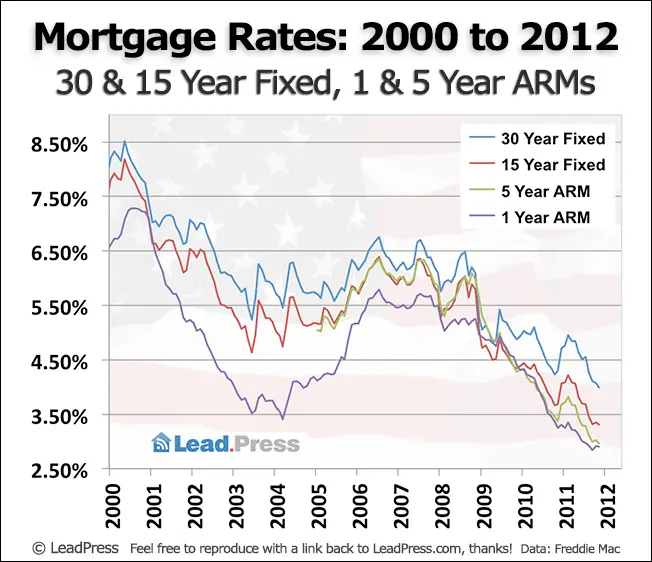

Should I Get An Adjustable Rate Mortgage Or A Fixed Rate Loan

While fixed rate loans have interest rates that stay the same over the life of the loan, an adjustable rate mortgage fluctuates depending on the market, but usually has a cap limiting fluctuation.

While both offer advantages, your circumstances can determine which might be right for you.

An adjustable rate mortgage:

- Can be a popular option for new homeowners as they offergreat upfront savings.

- Have an initial fixed interest period.

- Cap how much a loan can adjust so borrowers can try to plan accordingly.

Consider an ARM if you expect to make more money in the future, plan to move early in the life of your loan,or refinance before your loan adjusts.

There are many types of fixed-interest rate mortgages, including 30-Year and 15-Year mortgages. They offer a clear view of the future, as borrowers are able to more accurately account for costs over the life of the loan. For those who want greater stability when planning their monthly costs, fixed-interest mortgages are popular.

You May Like: Does Mortgage Modification Affect Credit Score

Forbes Advisors Insight On The Housing Market

Predictions indicate that home prices will continue to rise and new home construction will continue to lag behind, putting buyers in tight housing situations for the foreseeable future.

To cut costs, that could mean some buyers would need to move further away from higher-priced cities into more affordable metros. For others, it could mean downsizing, or foregoing amenities or important contingencies like a home inspection. However, be careful about giving up contingencies because it could cost more in the long run if the house has major problems not fixed by the seller upon inspection.

Another important consideration in this market is determining how long you plan to stay in the home. People who are buying their forever home have less to fear if the market reverses as they can ride the wave of ups and downs. But buyers who plan on moving in a few years are in a riskier position if the market plummets. Thats why its so important to shop at the outset for a realtor and lender who are experienced housing experts in your market of interest and who you trust to give sound advice.

How Long Can You Lock In A Mortgage Rate

Locks are usually in place for at least a month to give the lender enough time to process the loan. If the lender doesnt process the loan before the rate lock expires, youll need to negotiate a lock extension or accept the current market rate at the time.

Even if you have a lock in place, your interest rate could change because of factors related to your application such as:

- A new down payment amount

- The home appraisal came in different from the estimated value in your application

- There was a sudden decrease in your credit score because you are delinquent on payments or took out an unrelated loan after you applied for a mortgage

- Theres income on your application that cant be verified

Talk with your lender about what timelines they offer to lock in a rate as some will have varying deadlines. An interest rate lock agreement will include: the rate, the type of loan , the date the lock will expire and any points you might be paying toward the loan. The lender might tell you these terms over the phone, but its wise to get it in writing as well.

You May Like: How Long Does It Take To Get Your Mortgage Approved

When You Should Refinance Your Home

You may want to refinance your home mortgage, for a variety of reasons: to lower your interest rate, reduce monthly payments or pay off your loan sooner. You may also be able to use a refinance loan to get access to your homes equity for other financial needs, like a remodeling project or to pay for your childs college. If youve been paying private mortgage insurance , refinancing also may give you the opportunity to ditch that cost.

A home loan refinance may make sense particularly if you plan to remain in your home for a while. Even if you score a lower interest rate, you need to take the loan costs into consideration. Calculate the break-even point where your savings from a lower interest rate exceed your closing costs by dividing your closing costs by the monthly savings from your new payment.

Our mortgage refinance calculator could help you determine if refinancing is right for you.

Closing Costs & Loan Fees

When you take out a home loan, youll want to be aware of the closing costs. There are typically 3 to 6% of the loan amount in closing costs, including origination charges, prepaid interest, and property taxes.. Choosing a higher interest rate in exchange for lender credit can reduce your upfront costs. This strategy can save you money in the short-term, so its worth looking into if there is a chance youll be selling the home or refinancing in five to eight years.

Recommended Reading: How To Add Someone To Your Mortgage

What Is The Difference Between The Interest Rate And Apr On A Mortgage

Borrowers often mix up interest rates and an annual percentage rate . Thats understandable since both rates refer to how much youll pay for the loan. While similar in nature, the terms are not synonymous.

An interest rate is what a lender will charge on the principal amount being borrowed. Think of it as the basic cost of borrowing money for a home purchase.

An represents the total cost of borrowing the money and includes the interest rate plus any fees, associated with generating the loan. The APR will always be higher than the interest rate.

For example, a $300,000 loan with a 3.1% interest rate and $2,100 worth of fees would have an APR of 3.169%.

When comparing rates from different lenders, look at both the APR and the interest rate. The APR will represent the true cost over the full term of the loan, but youll also need to consider what youre able to pay upfront versus over time.

Whats The Difference Between Interest Rate And Apr

The interest rate is the percentage that the lender charges for borrowing the money. The APR, or annual percentage rate, is supposed to reflect a more accurate cost of borrowing. The APR calculation includes fees and discount points, along with the interest rate.

A major component of APR is mortgage insurance a policy that protects the lender from losing money if you default on the mortgage. You, the borrower, pay for it.

Lenders usually require mortgage insurance on loans with less than 20% down payment or less than 20% equity .

Recommended Reading: What Is The Mortgage Rate On Investment Property

They Have Been Popular In Other Countries For Some Time And Now 15 Year Fixed Rate Mortgages Are Available In The Uk

If you like the peace of mind of facing no surprise interest rate hikes, and are confident you arent going to move house, then a 15 year fixed rate mortgage could be good option for you to consider.

Traditionally, UK lenders only offered fixed term mortgages of up to 10 years, but 2019 saw several providers introduce 15 year deals for the first time.

Virgin Money was the first to debut its range of products for a 15 year term, and currently offers residential mortgages over this timeframe for loan-to-value ratios of up to 90%.

Yorkshire Building Society then followed suit with its own 15 year fixed rate mortgages, and will also consider lending to would-be-buyers who are looking at LTVs of up to 90%.

Still Have Questions Or Need More Information Below Is An Overview Of What This Article Covers

Topics Covered

As you weigh your mortgage options, its important to understand how getting a 15-year home loan will affect your monthly payments and how much you end up paying for your home over the long run. Its also important to understand how a fixed interest rate differs from an adjustable rate. Get all the details on a 15-year fixed mortgage so you can determine if its the right option for you.

Read Also: How Much Is Mortgage For A Million Dollar Home

What Are Points On A Mortgage

Discount points are a way for borrowers to reduce the interest rate they will pay on a mortgage. By buying points, youre basically prepaying some of the interest the bank charges on the loan. In return for prepaying, you get a lower interest rate which can lead to a lower monthly payment and savings on the overall cost of the loan over its full term.

A mortgage discount point normally costs 1% of your loan amount and could shave up to 0.25 percentage points off your interest rate. The exact reduction varies by lender. Always check with the lender to see how much of a reduction each point will make.

Discount points only pay off if you keep the home long enough. Selling the home or refinancing the mortgage before you break even would short circuit the discount point strategy.

In some cases, it makes more sense to put extra cash toward your down payment instead of discount points if a larger down payment could help you avoid paying PMI premiums, for example.

What Is The Difference Between A 15

The main difference between a 15-year mortgage and a 30-year mortgage is that a 15-year mortgage will ultimately cost you less by saving you up to tens of thousands of dollars over the lifetime of the loan. You also pay a lower interest rate for a shorter amount of time, thereby lessening the overall cost of your loan. But paying off the loan in half the time means that your monthly payments can be almost double what they are for a 30-year loan.

Also Check: Should I Refinance With My Current Mortgage Company

Pros And Cons Of A 15 Year

Pros

- Easier to budget. With a 15-year fixed rate mortgage, youll know exactly how much your mortgage repayments will be for the next 15 years, so theres no need to worry about interest rate rises.

- Lower remortgaging costs. You wont need to remortgage as often with a 15-year deal, which means youll save on remortgaging costs.

- Option to overpay. Many fixed rate mortgage deals let you make overpayments, typically up to 10% a year.

Cons

- Higher interest rates. 15-year fixed rate mortgages usually have higher rates of interest compared to two, three or five-year deals.

- No benefit if rates fall. A 15-year deal locks you in for a long time and if interest rates fall during that time, you wont see any reduction in your mortgage repayments.

- High early repayment charges. If you need to get out of your mortgage deal early, fees can be expensive.

- Availability is limited. Only a handful of providers offer 15-year deals.

Is It Better To Get A 15

This depends on your individual situation and financial goals. If you have a sizable emergency fund and can comfortably afford the higher payments, then choosing a 15-year mortgage to take advantage of a lower rate and save on interest could be a good idea.

However, if you dont have much in savings and the larger required payments would stretch your budget thin, then a 30-year mortgage might be a better option. While picking a longer term means paying more in interest, youll have the flexibility of deciding when youd like to pay extra toward your loan.

Don’t Miss: How Much Mortgage Can I Get Usa

What Is A 15

A 15-year fixed mortgage is a home loan with an interest rate that stays the same over a 15-year period. For example, a 15-year fixed rate mortgage for a home valued at $300,000 with a 20% down payment and an interest rate of 3.75%, the monthly payments would be about $1,745 . Because the mortgage is fixed, the monthly payment and interest rate will stay the same for the life of the loan.

How Much House Can I Afford

Income is the most obvious factor in how much house you can buy: The more you make, the more house you can afford.

However, it also depends on how much of your income is already spoken for through debt payments as well as your credit score and history. The more debt you have, the less likely you will be approved for a mortgage or one at a lower interest rate. Your credit score also plays a role in that the higher your score, the better loan rate and terms you will receive.

And of course, if you have a larger down payment, it will help you in all these factors for affording a home.

Recommended Reading: Does Usaa Have Mortgage Loans

How Accurate Is The Estimate Of Your Monthly Mortgage Payment

The results can be enhanced with just a little more information. Your 15-year mortgage calculation will be most accurate when you supply:

-

A customized 15-year mortgage interest rate.

-

The annual property tax due on the property you are buying or refinancing. For a house you’re looking to buy, your real estate agent can provide you this information.

-

The annual homeowners insurance premium. Again, on a purchase, you may be able to get this from your real estate agent or your Loan Estimate.

-

Monthly homeowners association dues. Your agent likely has this, too.

How To Pay Off A 30

It is possible to pay off your 30-year mortgage sooner. Heres how you can accomplish that:

- Make extra payments each month. This will not only help you chip away at your loan more quickly, but it will also lower the amount of interest you pay over the life of the loan.

- Make bi-weekly payments. Instead of making monthly contributions toward your principal and interest, this will result in 26 half-payments , translating to one extra payment per year. But check with your lender first to confirm they accept bi-weekly payments.

- Make an additional monthly payment each year. The bulk of the interest you are charged usually accumulates in the first 10 years of your loan. So, if you can make just one extra payment a year, youll get ahead.

- Refinance into a shorter term. You can refinance your home loan and get a new 15-year mortgage loan to shorten your repayment. Just keep in mind this would result in a higher monthly payment.

- Recast your mortgage. By recasting, youll reduce your mortgage balanceand your monthly paymentsvia a lump-sum payment toward the principal amount.

- Sell your house and move. If making the monthly payments is becoming too much of a burden, you could sell the house to pay off the mortgage and move to a more affordable home or area.

Recommended Reading: How To Get Approved For A Mortgage With Low Income

More Mortgage Tools And Resources

You can use CNET’s mortgage calculator to help determine how much you can afford for a house and work out how to manage financially. The tool takes into account your monthly income, expenses and debt payments. In addition to those factors, your mortgage rate will depend on your credit score and the zip code where you are looking to buy a house.

Get the CNET Personal Finance newsletter

How Do You Calculate A Mortgage Payment

In addition to your principal and interest payments, a monthly mortgage payment may also include several fees, like private mortgage insurance , taxes and homeowners association fees.

Your lender will be able to provide you with a line-item breakdown of your mortgage payment. Using a mortgage calculator is an easy way to find out what your monthly payments will be. You can also look at an amortization schedule, which shows you how much youll pay over time.

Read Also: What Banks Look For When Applying For A Mortgage