Get Matched With A Mortgage Broker

There are brokers who specialise in arranging mortgages worth £1 million and more, and the best way to begin your application is by speaking to one of them about your options.

These brokers have the knowledge and experience you need to get the best deal available. For mortgages worth £1 million and up, there are specialist lenders who offer bespoke deals with much better terms than whats available on the high street, but you often need a broker to access these mortgages.

We offer a free broker-matching service that will quickly assess your needs and circumstances to pair you with an advisor who specialises in £1 million mortgages. Call us on 0808 189 2301 or make an enquiry to get started today.

Target Your Annual Salary Income

Generally speaking, if you want to buy a million dollar home. Youll need at least $225,384 in annual household income to make the payments. A persons down payment and interest rate determine how much money you need to put down on a house.

For a small down payment, youll need to earn nearly $300,000 a year to cover your housing costs, but for a large one, youll only need to earn about $207,000.

According to the 28/36 rule, you should not spend more than 28 percent of your gross monthly income on housing costs or 36 percent of your total debt payments.

Also Check: Is It Better To Use A Mortgage Broker

Factors In Your Massachusetts Mortgage Payment

On top of your principal and interest payment, you have to pay property taxes to the city or town your home is in four times a year in Massachusetts. While the Massachusetts average property tax rate seems manageable at 1.17%, the median property tax bill is $4,899. Thats due to the states strong housing market and high home values, which lead to a higher overall tax bill.

Your property taxes are based off of your homes assessed value and the areas tax rate. The Bay State assesses residential real estate each year to determine the market value. Your property bill will be based off of that number, so if you have any issue with the assessment, you can file an abatement application. This isnt guaranteed to get accepted but if it is, youll receive a refund for a portion of your property taxes. Senior citizens, veterans and blind residents can apply for property tax exemptions. The complete list of qualifying exemptions can be found on Massachusetts Department of Revenue property tax information website.

Another ongoing cost that accompanies your property tax and mortgage payments is homeowners insurance. In Massachusetts, the average annual premium is $1,485, according to Insurance.com data. That makes it one of the most expensive states for homeowners insurance premiums.

Recommended Reading: What Determines Your Mortgage Interest Rate

Dont Ask For Several Loans At Different Banks

You can request information from different banks to choose the most appropriate one, but it is not advisable to apply to several banks simultaneously.

The different financial companies will investigate if you have any inquiry history. If they find something out of the ordinary, they will deduce that you are desperate to get a loan. This will undoubtedly lower your credibility and your chances of being approved for credit.

You Could Get Better Terms And Better Access

A professional whole of market broker has a network of connections that spans high-value teams at the biggest lenders to major players on the private banking scene.

All of this means more choice and more options. A great broker can help you find products with more flexible term lengths, higher LTV ratios and lower interest rates.

Don’t Miss: How Much Would Mortgage Payment Be On 250 000

Do Mortgage Lenders Accept Income From Commission And Bonuses

Since the COVID pandemic in 2020, lenders will accept income from commission and bonus but will look to see current commission levels earned in the last 3 months.

Where annual bonuses are paid lenders will seek to gain some form of confirmation of the current years bonus. As high net worth brokers our job is to place the business with a lender that understands and appreciates our clients total compensation package.

Other assets are taken into consideration including vested shares and allowances such as car and living allowances.

The Mortgage On A $1 Million Home Vs A $2 Million Home

The first thing to know about a mortgage loan on a $1 million or $2 million home is that your homes value isnt the same as your mortgage. When you buy a home, mortgage lenders generally require that you provide a down payment.

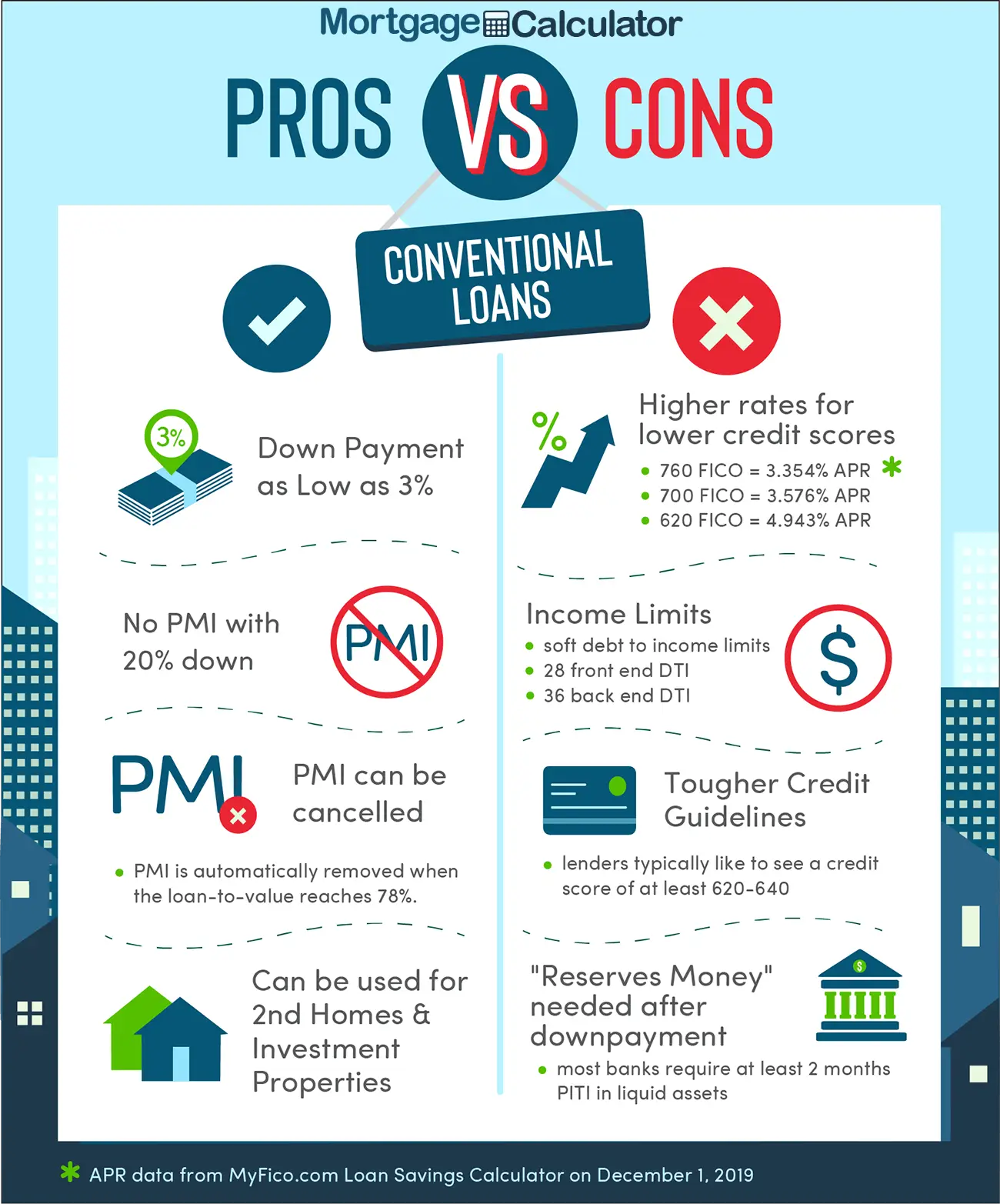

For a conventional loan, lenders require a down payment of at least 3% for anything less than 20%). However, for the mortgage on a $1 million or $2 million home, you can expect a lender to require closer to 20%. As a result, the mortgage on a $1 million home would be closer to $800,000. Meanwhile, a $1 million mortgage would actually be for a home priced at about $1.25 million.

Obviously, the numbers for a $2 million home are even greater. With a 20% down payment, the mortgage on a $2 million home would actually be about $1.6 million. And for a $2 million mortgage, you could purchase a $2.5 million home.

Recommended Reading: Do 15 Year Mortgages Have Lower Interest Rates

Details Of New York Housing Market

Many people who arent familiar with New York assume that the state is mostly comprised of cities. That viewpoint of the Empire State couldnt be further from the truth. Much of the state is rural, with over 35,000 farms covering seven million acres, as well as the Adirondack Park, which encompasses six million acres.

New York is only the 30th-largest state by size. At 47,200 square miles, its right behind North Carolinas 48,700 and above Mississippis 46,900. However, it has the fourth-largest population in the U.S., with an estimated 19.8 million residents. New York long held the third-largest population until 2014, when Florida surpassed it.

Despite those numbers, New York still contains the largest city in the U.S. by population. Almost 8.8 million people reside in New York City. After New Yorks five boroughs, most of the population is housed in the counties surrounding New York and Long Island. After that comes the western part of the state, including the cities of Buffalo, Syracuse and Rochester.

According to our Healthiest Housing Markets study, the best areas for homeowners are Cheektowaga, West Seneca, Buffalo and Tonawanda, based on a number of factors. The study looked at the average number of years the homeowner lived in the home, negative equity, days on market and a few more indicators. Overall, the state ranked 27th in our study.

How Much Mortgage Do You Have To Pay For A $ 1 Million House

The house you have wanted so much has a monetary value of $1,000,000. If despite the price, you want to get it anyway and you do not have enough liquidity to acquire it, the most sensible thing to do is to apply for a mortgage loan.

Lets consider this example: The deposit available right now is 20%, which corresponds to $200,000, so you will need the other 80% from the bank, which is $800,000.

Assuming that the interest rate is 3% and the payment term established by the lender is 25 years, we would believe that the monthly payment on the $1 million mortgages would be $3,794.

However, some variables will determine the amount you will pay each month to reduce your debt to the bank. One of them is the level of competition of the offer presented to you.

Read Also: How To Get Help With Mortgage

Don’t Miss: Can You Consolidate Credit Card Debt Into Mortgage

The Benefits Of Using A Private Bank Or Specialist Broker

Reasons to go private for a £1 million mortgage include

A more flexible affordability criteria

The reason why private banks have traditionally dominated the high-value mortgage space is their ability to be more flexible in their acceptance criteria.

Private banks are often more willing to take risks, and will look more holistically at your assets, not just your income. Theyll factor in things like shares, bonuses and a variety of assets that a regular lender may not. There are also private lenders who offer mortgages based on pension income.

This means that, if you have unusual income streams, are self-employed or hoping to get UK mortgage based on foreign income, they may be a better option than a high street bank.

2. They usually offer more financing options

The flexibility of the private bank often extends to the kind of terms it offers. Youre more likely to obtain an interest-only mortgage, or a higher loan to value ratio.

3. They often specialise in mortgages for £1 million and over

The premium you pay is reflected in the service you receive. Aside from giving you a more tailored customer experience, niche private banks can be more efficient when it comes to pushing the deal through. After all, its what they specialise in.

How Does The Mortgage Repayment Calculator Work

Your Mortgages mortgage calculator considers a variety of factors to determine how much your regular repayments will be over the loan term.

While there are many factors that can influence this calculation such as changes in interest rates, a decision to refinance, or using a redraw facility, the calculator will still be able to give you an estimate of how much your regular repayments could be and the total interest paid over the life of the loan.

By changing the interest rate, loan term, and repayment frequency fields, you can compare how these differences can impact your repayments.

Disclaimer: The results yielded by the calculator assume no changes in interest rates over the loan term. This means whatever interest rate you use will be applied for the whole loan term.

Read Also: How Much Interest Do I Pay On A Mortgage

Also Check: How To Calculate Upfront Mortgage Insurance Premium

How Do You Apply For A Mortgage

Mortgages are available through traditional banks and credit unions as well as a number of online lenders. To apply for a mortgage, start by reviewing your credit profile and improving your credit score so youll qualify for a lower interest rate. Then, calculate how much home you can afford, including how much of a down payment you can make.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: Can There Be A Cosigner On A Mortgage

What Other Factors To Consider About The $1 Million Monthly Mortgage Payment

Another important consideration is the possibility that the interest rate will not remain fixed for the life of the mortgage loan. Interest charges will remain stable for up to 5 years.

But once this period ends, the interest rate will become variable, something that will impact both your budget and your expenses.

You can also apply for a new mortgage loan or refinancing the existing one however, it is necessary to consider that the costs exceed the interests of the previously granted loan.

How We Make Money

Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

You May Like: Rocket Mortgage Requirements

Don’t Miss: How Much Do Mortgage Underwriters Make

The Ideal Mortgage Amount Differs For Everyone

If you live parts of the country which have wonderful $500,000 homes, then awesome! There is never a need to borrow $750,000. The standard deduction of $12,550 for singles and $25,100 for married couples in 2021 is probably good enough for most.

For those of you who live in expensive coastal cities, then consider $750,000 as the cap on how much you should borrow to purchase your primary residence.

Once done, consider taking advantage of investing in lower cost areas of the country through real estate crowdsourcing. You goal should be to diversify your real estate investments and take advantage of long-term trends. As a San Francisco property owner, Im actively trying to buy heartland real estate.

Some of you reading this have liquid assets north of $1 million dollars. A $750,000 mortgage is therefore nothing to be afraid of because everything is just accounting.

Your goal in this low interest rate environment is to minimize your debt interest expense by refinancing your mortgage. You should also maximize your government subsidies with the ideal mortgage amount.

Imagine refinancing your mortgage to 2.5% while making a 2.5% or greater return on your investments? Youre essentially borrowing money for free and then some!

Dont be afraid of mortgage debt. Mortgage debt is one of the best types of debt there is. So long as you can take out the ideal mortgage amount that is right for you, you should do well.

Dont Overextend Your Budget

Banks and real estate agents make more money when you buy a more expensive home. Most of the time, banks will pre-approve you for the most that you can possibly afford. Right out of the gate, before you start touring homes, your budget will be stretched to the max.

Its important to make sure that you are comfortable with your monthly payment and the amount of money youll have left in your bank account after you buy your home.

You May Like: How To Cut Your Mortgage Term In Half

Details Of Massachusetts Housing Market

Home of Plymouth Rock and the famed Mayflower landing, Massachusetts has a long history as one of the 13 original colonies. Nicknamed the Bay State for its coastline, Massachusetts has 1,519 shoreline miles and 7,800 square land miles. According to the U.S. Census Bureau, the states population sits at almost 6.9 million. The largest cities by population include Boston, Worcester, Springfield, Lowell and Cambridge.

Currently, the median home value is $418,600. But the housing market is currently hot in certain areas, like in Suffolk County, home to the capital city of Boston, where the median home value is $496,500.

You May Like: Reverse Mortgage For Condominiums

Total Debt Service Ratio:

Now letâs look at the next debt service ratio: your total debt service ratio. This ratio takes the factors above into account, but also adds in any debt obligations you may have. Hereâs the official formula:

Housing expenses + Credit card interest + Car payments + Loan expenses

divided by

Required income to afford a 2 or 3 million dollar house

The same requirements apply to buying homes that cost more than $1 million. Hereâs a table showing exactly who can buy a $2 million dollar home, how much you need to buy $3 million dollar home, and a $5 million dollar home.

*Required income calculated using TDS assuming $600 car loan and $600 student loan payments.

As you can see, the income to afford a $2-million home and the income needed for a $3-million home are quite high. This is because at these prices, even with a 20% down payment, your mortgage will be very large.

Recommended Reading: Can You Do A 40 Year Mortgage

Get Approved By An Underwriter

After you complete your mortgage application, an underwriter will review it along with supporting documents you must supply, such as bank statements, pay stubs, and tax returns. The faster you provide this additional information, the sooner your mortgage can close.

The lender will also send an appraiser out to evaluate the condition and value of the home you want to buy. If all goes well, it will appraise for the purchase price or higher.

How Can I Afford A 5 Million Dollar House

That means you should be making between $70,000 and $90,000 per month to afford the payments safely. This translates to an annual income of $840,000 to $1,080,000. That’s the bare minimum lenders will accept, assuming that you can make the full down payment and have stellar credit and financial history.

Recommended Reading: What Do You Need For Pre Qualifying Mortgage

Add All Fixed Costs And Variables To Get Your Monthly Amount

Figuring out whether you can afford to buy a home requires a lot more than finding a home in a certain price range. Unless you have a very generous and wealthy relative who’s willing to give you the full price of your home and let you pay it back without interest, you can’t just divide the cost of your home by the number of months you plan to pay it back and get your loan payment. Interest can add tens of thousands of dollars to the total cost you repay, and in the early years of your loan, the majority of your payment will be interest.

Many other variables can influence your monthly mortgage payment, including the length of your loan, your local property tax rate and whether you have to pay private mortgage insurance. Here is a complete list of items that can influence how much your monthly mortgage payments will be:

What Salary Do I Need For A Million

The maximum income multiple across many mortgage lenders is 5 times income. Therefore, you would need a salary of £200,000 to afford a million-pound house.

Lenders will need you to contribute a deposit, usually at least 10% for a million-pound property. Therefore, for a loan of 90% you would require a salary of £180,000.

The mortgage may be set up on an interest-only basis. Interest-only loans will cost less per month, but the capital must be repaid at the end of the mortgage term.

Don’t Miss: How Long Should My Mortgage Be