The Bank Of Canada Influences Interest Rates

The Bank of Canada also affects interest rates, mainly through changes in our policy interest rate.

The Bank of Canada doesnt set mortgage rates. But it does have some impact on them.

When the economy is strong, we may raise this rate to keep inflation from rising above our target. Likewise, when the economy is weak, we may lower our policy rate to keep inflation from falling below target. Changes in the policy interest rate lead to similar changes in short-term interest rates. These include the prime rate, which is used by the banks as a basis for pricing variable-rate mortgages. A policy-rate change can also affect long-term interest rates, especially if people expect that change to be long-lasting.

In the past, high and variable inflation eroded the value of money. In response, investors demanded higher interest rates to offset those effects. This increased funding costs for mortgage lenders. But since the Bank of Canada began targeting inflation in the 1990s, interest rates and uncertainty about future inflation have declined. As a result, funding costs are now much lower.

Pay Attention To Mortgage Insurance

If your down payment is less than 20% of the purchase price, youll typically have to pay private mortgage insurance . And those premiums can add significantly to your monthly payments.

The cost of mortgage insurance will be reflected in your APR but not in your interest rate. The same goes for the mortgage insurance premiums on an FHA loan. So make sure you learn about the cost and benefits of mortgage insurance before you commit to a loan.

How Are Mortgage Rates Set

Lenders use a number of factors to set rates each day. Every lender’s formula will be a little different but will factor in the current federal funds rate , competitor rates and even how much staff they have available to underwrite loans. Your individual qualifications will also impact the rate you are offered.

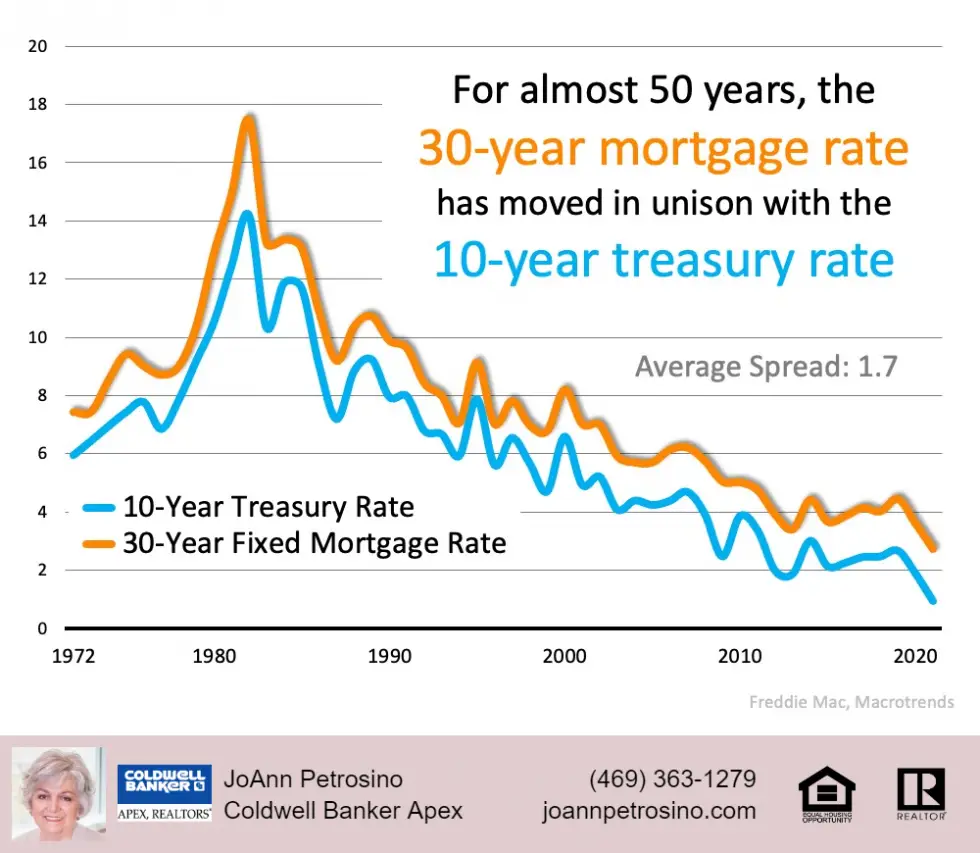

In general, rates track the yields on the 10-year Treasury note. Average mortgage rates are usually about 1.8 percentage points higher than the yield on the 10-year note.

Yields matter because lenders don’t keep the mortgage they originate on their books for long. Instead, in order to free up money to keep originating more loans, lenders sell their mortgages to entities like Freddie Mac and Fannie Mae. These mortgages are then packaged into what are called mortgage-backed securities and sold to investors. Investors will only buy if they can earn a bit more than they can on the government notes.

Read Also: Should I Refinance My Mortgage Or Make Extra Payments Calculator

Do I Need To Pay A High Mortgage Interest Rate

You can usually pay discount points to lower the interest rate you’re offered. These points are essentially a form of prepaid interest. One point equals 1% of the total loan balance, and it lowers your interest rate for the life of your mortgage. The amount it lowers your rate depends on your individual lender and the market at the time.

This is often referred to as âbuying down your rate.â Calculate your break-even point to determine whether this is the right move for you. Will you be in the home long enough to make it worthwhile? The longer you plan to live there, the more paying discount points makes sense.

You can also negotiate your mortgage interest rate. It doesn’t hurt to ask whether the lender can make a better offer. You could save a significant amount of money over the term of the loan.

The Constant Maturity Treasury Rate

Constant Maturity Treasury rates, or CMT rates, refer to a yield thats calculated by taking the average yield of different types of U.S. Treasury securities with varying maturity periods, and using it to adjust for a number of time periods.

Some mortgage lenders will use this rate to determine interest for adjustable-rate mortgages . If the CMT rate goes up, you can expect any loans tied to it to increase their interest rates as well.

Read Also: Do You Pay Closing Costs To Refinance Mortgage

How Mortgage Interest Deduction Works

Bills, taxes and other living expenses can stack up, especially as a homeowner. But did you know that its possible to use your mortgage to reduce your taxable income? Every year that you pay your mortgage, you can take advantage of the mortgage interest deduction.

Essentially, this tax incentive allows you to count interest paid on your mortgage against your taxable income. As a result, you can lower the overall taxes you owe. This is good for the first $1 million of mortgage debt for a primary or secondary home bought between October 13, 1987, and December 16, 2018. However, homeowners who bought their property after 2017 may only deduct interest paid on the first $750,000 of the mortgage. That becomes $500,000 and $375,000, respectively, if married and filing separately, though.

You may need to see what qualifies as mortgage interest for your taxes, though. A debt you use to purchase your home may not qualify if it isnt secured by the home. There are also rules that determine your eligibility. For instance, you cannot deduct mortgage interest if you take the standard deduction. You must itemize your deductions. And it isnt a dollar-for-dollar reduction. Instead, the mortgage interest deduction depends on your tax bracket.

Lets go over an example. Say you spent $10,000 on mortgage interest and paid taxes at an individual income tax rate of 22%. You would be allowed to exclude $10,000 from your income tax liability, saving you $2,200 .

The State Of The Economy

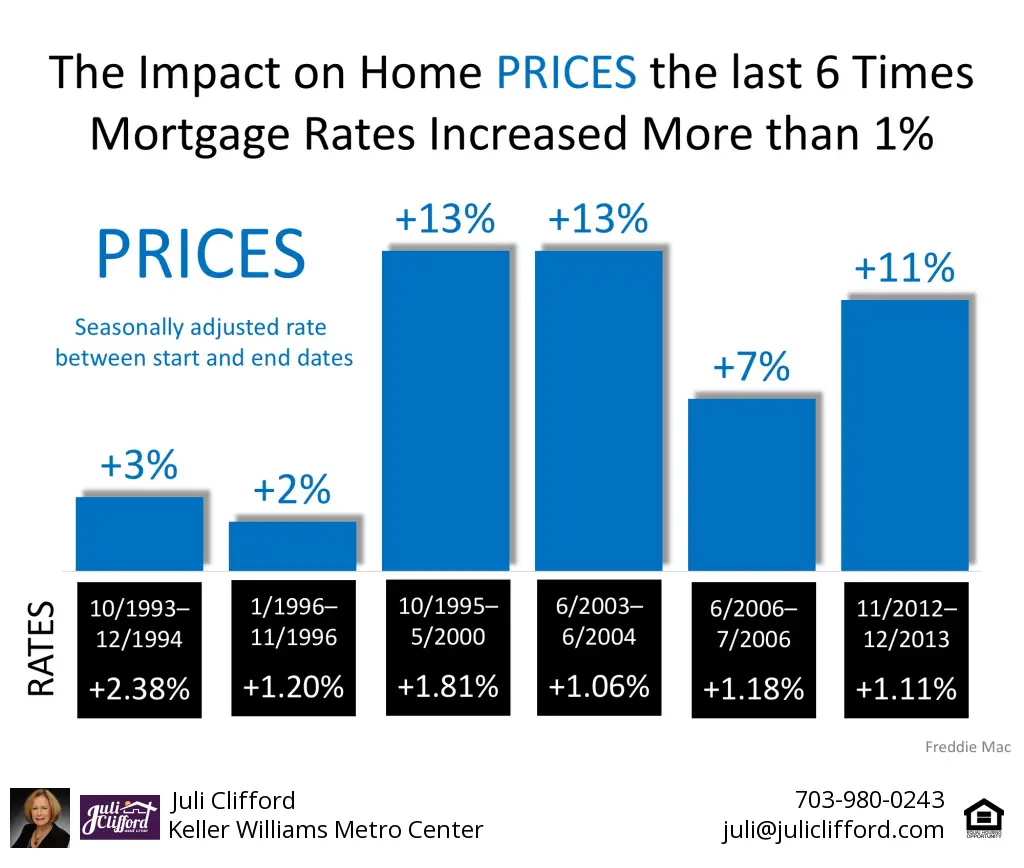

Mortgage rates vary based on how the economy is doing today and its outlook. When the economy is doing well meaning unemployment rates are low and spending is high mortgage rates increase. When the economy isn’t doing as well, like when unemployment rates are high and the demand for oil is low, mortgage rates fall.

Also Check: What Is Monthly Mortgage Payment On 100k

Buyers Have More Breathing Room

With fewer buyers actively looking for a home, those that remain have more power.

In September, 17% of home sales under contract were canceled and a record-high 22% of homeowners slashed list prices, according to brokerage Redfin.

The typical home spent a median of 50 days on the market in September, three days longer than in the previous month and a full week longer compared to a year ago, according to Realtor.com. In March, when rates were in the 4% range, homes spent about 30 days on the market.

Bidding wars have also been declining. Roughly 45% of purchase offers in August faced at least one competing bid down from nearly 70% of offers during the first two months of the year, according to brokerage Redfin.

All this means slower price growth. The median sales price for all types of homes in September was $384,800, down from a record-high of $413,800 in June, according to NAR. Compared to September 2021, however, prices were 8.5% higher.

Those who can afford to buy in this environment have some breathing room, says Divoungay.

Todays Mortgage Rates And Your Monthly Payment

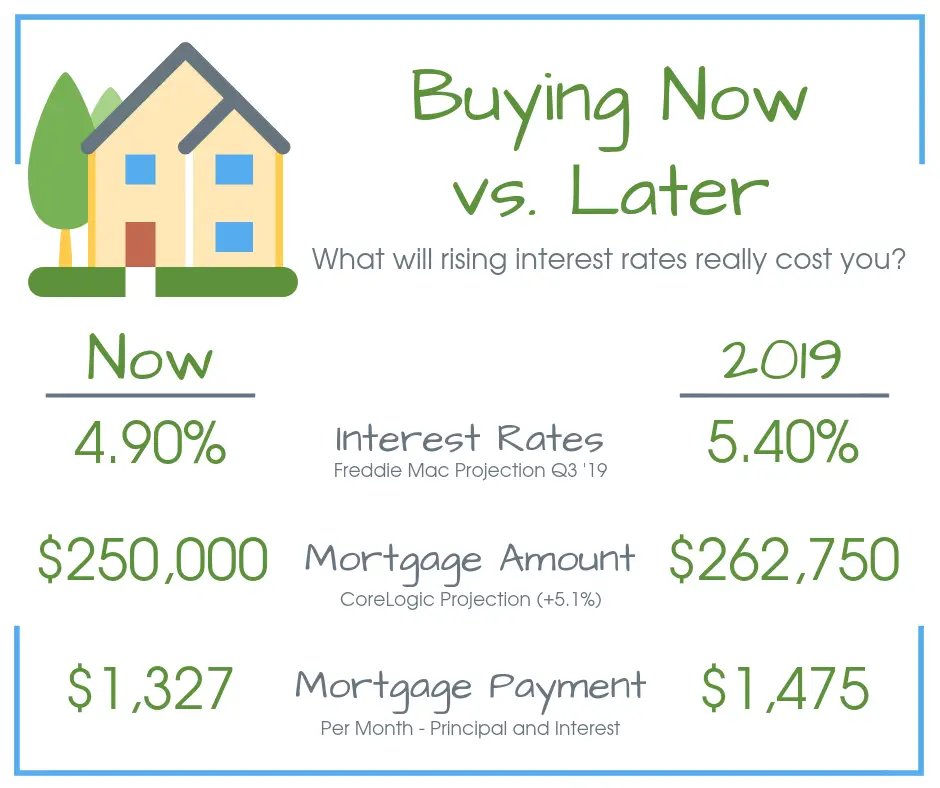

The rate on your mortgage can make a big difference in how much home you can afford and the size of your monthly payments.

If you bought a $250,000 home and made a 20% down payment $50,000 you would end up with a starting loan balance of $200,000. On a $200,000 home loan with a fixed rate for 30 years:

- At 3% interest rate = $843 in monthly payments

- At 4% interest rate = $955 in monthly payments

- At 6% interest rate = $1,199 in monthly payments

- At 8% interest rate = $1,468 in monthly payments

You can experiment with a mortgage calculator to find out how much a lower rate or other changes could impact what you pay. A home affordability calculator can also give you an estimate of the maximum loan amount you may qualify for based on your income, debt-to-income ratio, mortgage interest rate and other variables.

Other factors that determine how much you’ll pay each month include:

Loan Term:

Choosing a 15-year mortgage instead of a 30-year mortgage will increase monthly mortgage payments but reduce the amount of interest paid throughout the life of the loan.

Fixed vs. ARM:

The mortgage rates on adjustable-rate mortgages reset regularly and monthly payments change with it. With a fixed-rate loan payments remain the same throughout the life of the loan.

Taxes, HOA Fees, Insurance:

Homeowners’ insurance premiums, property taxes and homeowners association fees are often bundled into your monthly mortgage payment. Check with your real estate agent to get an estimate of these costs.

Also Check: What Is The Longest Mortgage Term Available

How Do I Find The Best Mortgage Rate

Finding the best home mortgage rate is a matter of knowing your goals and picking the right tool to get the job done. The best mortgage for you may not always be the one with the lowest interest rate. Factors like how long you keep your home loan will impact your decision.

If you plan on keeping your home loan long-term, then a fixed-rate mortgage is ideal. Mortgage rates today are very reasonable for fixed-rate 10-, 15-, or 30-year mortgages. Locking in a low rate is a smart choice. But you can get lower mortgage rates with some adjustable-rate loans too. If you plan on only keeping your home for a short period of time, then you may be able to pay less interest with an ARM.

Mortgage Rate Lock: When Do I Lock In My Interest Rate

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

It’s tough to keep up with mortgage rates when they’re climbing as fast as they have this year.

But once you’ve been approved for a home loan, you can stop your rate from increasing with a mortgage rate lock a move that could save you thousands of dollars over the course of the loan.

Here’s what you need to know about locking in a rate.

Don’t Miss: How Many Times Can Refinance A Mortgage

What Does A 7 1 Arm Mean

A 7/1 ARM is a mortgage that has a fixed interest rate in the beginning, then switches to an adjustable or variable one. The 7 in 7/1 indicates the initial fixed period of seven years. After that, the interest rate adjusts once yearly based on the index stated in the loan agreement, plus a margin set by the lender.

A Note On Discount Points

Heres an insider tip when comparing mortgage rates: lenders often advertise rates based on the assumption youre going to buy discount points. Those discount points are an extra sum you can choose to pay at closing to shave a little off your mortgage rate.

Often, you pay 1% of the loan amount to reduce your interest rate by about 0.25 percent. So, on a $200,000 loan, you might pay $2,000 to reduce your 6% rate offer to 5.75 percent.

Theres nothing wrong with these points , and theyre often a good idea. But comparing an advertised rate that assumes youll buy discount points with ones that dont make the same assumption is like comparing apples with oranges. You wont get a fair answer.

Also Check: Which Credit Score Is Used For Mortgage Loans

Borrowing For Commercial Real Estate Is Different From A Home Loan

Commercial real estate is income-producing property used solely for business purposes. Examples include retail malls, shopping centers, office buildings and complexes, and hotels. Financingincluding the acquisition, development and construction of these propertiesis typically accomplished through commercial real estate loans: mortgages secured by liens on the commercial property.

Advantages And Disadvantages Of A Fixed

Varying risks are involved for both borrowers and lenders in fixed-rate mortgage loans. These risks are usually centered around the interest rate environment. When interest rates rise, a fixed-rate mortgage will have lower risk for a borrower and higher risk for a lender.

Borrowers typically seek to lock in lower rates of interest to save money over time. When rates rise, a borrower maintains a lower payment compared to current market conditions. A lending bank, on the other hand, is not earning as much as it could from the prevailing higher interest ratesforegoing profits from issuing fixed-rate mortgages that could be earning higher interest over time in a variable-rate scenario.

In a market with falling interest rates, the opposite is true. Borrowers are paying more on their mortgage than what current market conditions are stipulating. Lenders are making higher profits on their fixed-rate mortgages than they would if they were to issue fixed-rate mortgages in the current environment.

Of course, borrowers can refinance their fixed-rate mortgages at prevailing rates if those rates are lower, but they have to pay significant fees to do so.

Recommended Reading: What Are The Current Best Mortgage Rates

What Other Factors Should I Consider When Looking For A Mortgage

While the APR makes it easier to compare mortgage offers, there are many factors to consider when getting a mortgage loan. These include the size of your down payment, closing costs and money you’ll need to set aside to furnish and maintain your home. The mortgage rate and payment calculator is a good place to start.

The Global Economy Matters

Many Canadian banks borrow money in other countries, particularly the United States. And keep in mind that the worlds financial markets are interconnected. Interest rates in Canada respond to what happens elsewhere. For example, foreign interest rates fell during 2019. Interest rates for Canadian five-year fixed mortgages dropped in response.

Also Check: Can I Get A Mortgage Without A Tax Return

Mortgage Rate Factors That You Control

Lenders adjust mortgage rates depending on how risky they judge the loan to be. A riskier loan has a higher interest rate.

When judging risk, the lender considers how likely you are to fall behind on payments , and how much money the lender could lose if the loan goes bad. The major factors are credit score and loan-to-value ratio.

How Does Interest On Payday Loans Work

You may have heard about payday loans and their unreasonably high interest rates. But how can these loans have rates that are so high?

A payday loan is a small, short-term loan used when money is needed immediately. Borrowers are expected to repay the loan when they receive their next paycheck. To encourage quick repayments, lenders will often use extremely high interest rates as service fees.

For example, apayday loan might be as low as $100 with repayment due in 2 weeks. If this loan carries a $15 fee, then the APR will be around 400%.

Unlike credit cards and mortgages, this fee is not repaid over the course of a year. Although $15 may not seem like much, it is a high interest rate compared to the $100 you initially borrowed.

How does $115 result in an approximate 400% APR rate?

$15 is 15% of the $100 borrowed. The APR is the annual percentage rate, so 15% must be multiplied by the number of days in a year:

.15 = 54.75

Divide the answer by the length of the loan .

54.75/14=3.910.

Move the decimal point to the right two places to get your APR. So a $15 charge for a 2-week loan of $100 means the APR is 391%.

Read Also: Does Rocket Mortgage Offer Usda Loans

Are Mortgage Rates The Same For All Lenders

Mortgage rates vary from lender to lender because lenders have different appetites for risk and different overhead costs.

When a lender reaches its capacity of loan applications its employees can process, it might keep rates slightly higher than necessary to keep from being overwhelmed when business is slow, the lender might charge slightly lower rates to drum up business.

Why Does The Bank Of England Base Rate Change

The Bank of England base rate is usually voted on by the MPC eight times a year.

However, the committee has the power to make unscheduled changes to the base rate if they think it necessary. The MPC used this power in March 2020, when it reduced the base rate due to the potential effects of the coronavirus on the economy.

The MPC can adjust the base rate up or down. Its decision is based on current economic circumstances, with the MPC aiming to keep inflation as close as possible to the target of 2%.

If the MPC feels that the economy would benefit from higher borrowing and spending by businesses and consumers, it lowers the base rate.

On the other hand, if spending levels are increasing too quickly and inflation is in danger of soaring, the MPC may raise the base rate.

Read Also: What Is The Mortgage On A 1.5 Million Dollar House

How To Get A Home Mortgage

To obtain a mortgage, the person seeking the loan must submit an application and information about their financial history to a lender, which is done to demonstrate that the borrower is capable of repaying the loan. Sometimes, borrowers look to a mortgage broker for help in choosing a lender.

The process has several steps. First, borrowers might seek to get pre-qualified. Getting pre-qualified involves supplying a bank or lender with your overall financial picture, including your debt, income, and assets. The lender reviews everything and gives you an estimate of how much you can expect to borrow. Pre-qualification can be done over the phone or online, and theres usually no cost involved.

Getting pre-approved is the next step. You must complete an official mortgage application to be pre-approved, and you must supply the lender with all the necessary documentation to perform an extensive check on your financial background and current credit rating. Youll receive a conditional commitment in writing for an exact loan amount, allowing you to look for a home at or below that price level.

After youve found a residence that you want, the final step in the process is a loan commitment, which is only issued by a bank when it has approved you as the borrower, as well as the home in questionmeaning that the property is appraised at or above the sales price.

Also Check: Can A Student Get A Mortgage