What Happens When You Pay Off Your Mortgage

Once your mortgage is paid off, your lender wont be collecting payments from you anymore. At that point, paying property taxes becomes your responsibility.

Sometimes lenders let their borrowers start paying their taxes directly before their mortgages are paid off. This might happen if youve paid down a significant portion of your principal loan balance.

Paying Taxes With A Mortgage

Lenders often roll property taxes into borrowers monthly mortgage bills. While private lenders who offer conventional loans are usually not required to do that, the FHA requires all of its borrowers to pay taxes along with their monthly mortgage payments.

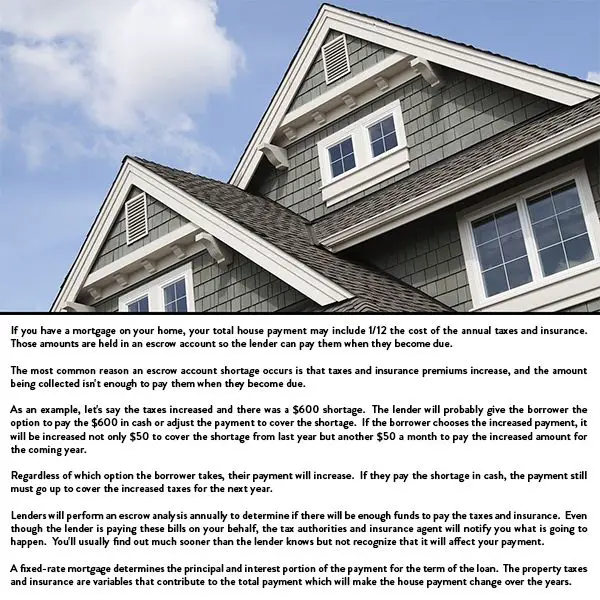

To determine how much property tax you pay each month, lenders calculate your annual property tax burden and divide that amount by 12. Since their numbers are estimates, some lenders require their borrowers to pay extra money each month in case the property tax payments come up short. If you end up paying more property taxes than you need to, youll receive a refund. If you underpay your property taxes, youll have to make an additional payment.

When you pay property taxes along with your mortgage payment, your lender deposits your property tax payment into an escrow account. When your property taxes are due to the county, your lender uses the funds in that escrow account to pay the taxes on your behalf.

Both you and your lender should receive a notice from your local tax authority. If you dont, its best to contact your lender and your tax authority to make sure your property taxes are being paid on time.

Have More Questions About Your Property Taxes

Trying to understand how much you owe in property taxes can be tricky, especially since the numbers are different in every county. The good news is you dont have to figure it out on your own!

Our friends at Churchill Mortgage can give you a clear picture of how property taxes affect your monthly mortgage payments. And they can help you get a mortgage that will put you on the path to debt-free homeownership. Thats one of the many reasons we call them RamseyTrustedbecause we trust them to help you win with money and pay off your home!

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.Learn More.

Don’t Miss: Do Mortgage Brokers Get Commission

What Is Principal And Interest

Your principal is the money that you originally agreed to pay back. Interest is the cost of borrowing the principal. For example, if the interest rate on a $100,000 mortgage is 6%, the combined principal and interest monthly payment on a 30-year mortgage would be about $599.55$500 interest + $99.55 principal.

Find The Assessed Value Of The Property

To find your propertys assessed value, the local government will order an appraisal on the property. Some areas conduct annual appraisals. Others do them every 3 years or less frequently .

Some localities use the market value and others use the appraised value . Either way, they take a percentage of this value to come up with the assessed value.

The percentage they use is called the assessment ratio or the percentage of the homes value thats taxable. The ratios vary drastically around the country.

For example, if your homes market value is $300,000 and your local government taxes 60% of the value, youd pay taxes on $180,000 rather than $300,000.

Recommended Reading: How Much Loan Can I Get For Mortgage

Common Exemptions On Property Taxes

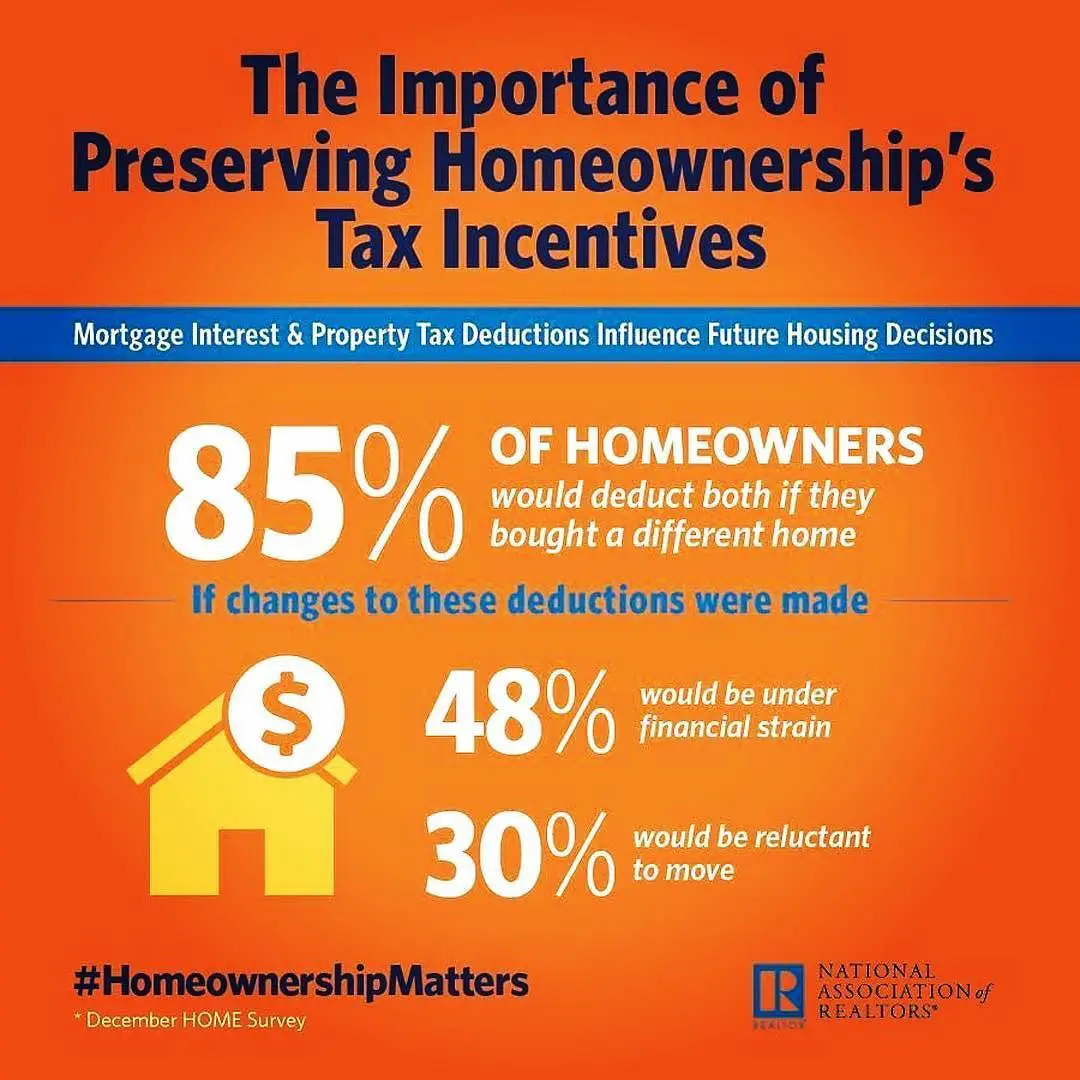

Property taxes can be a financial burden for some, but deductions, credits and exemptions can potentially lower property taxes. However, not every exemption is available to all homeowners.

Common exemptions available to homeowners include the homestead exemption and circuit breaker programs. The homestead exemption reduces the taxable value of a primary residence by a predetermined amount. The rules for this exemption vary by state.

Property tax circuit breaker programs reduce property tax liabilities for seniors, disabled people, low-income residents and others who qualify. Circuit-breaker tax programs also vary widely among the states that offer them.

Additionally, there are tax deferrals that allow seniors, disabled homeowners and others who qualify to defer property tax payments until the sale of the property or the death of the owner.

You can get details on the programs mentioned above, and other deductions, credits and exemptions, from your local tax authority or by talking to a tax professional.

What Happens To Property Tax If You Pay Off Your Mortgage

If you pay off your mortgage, your property tax stays the same. The difference is you no longer have a mortgage servicer administering the escrow account for you. If you do have money left in your escrow account, it will be refunded to you once the mortgage is paid off.

Now that you no longer have an escrow account, you need to contact the taxing entity and have the tax bill sent to you.

Don’t Miss: How Soon You Can Refinance Your Mortgage

How To Remove An Existing Escrow Account

In some cases, you might be able to cancel an existing escrow account, though every lender has different terms for removing one. In some cases, the loan has to be at least one year old with no late payments. Another requirement might be that no taxes or insurance payments are due within the next 30 days.

If you decide that you want to get rid of your escrow account, call your servicer to find out if you qualify for a deletion of the account.

Also Check: How To Decide When To Refinance A Mortgage

Can You Choose To Pay Your Property Taxes Yourself

If youre a first-time homebuyer or have very little equity in your home, your lender may require that you pay your property taxes through your mortgage. Thats because if you fail to pay your property taxes on your own, your lender may be at risk. In this case, your lender will collect your property taxes along with your monthly mortgage payments and pay the city on your behalf.

Failing to pay your property taxes could result in a lien being placed on the title of your home. A lien is a legal claim against your home. If you were to ever file for bankruptcy, the city could claim your unpaid taxes against your property. This isnt a good scenario for your lender because the lien would have to be paid off before your mortgage debt.

In this case, the lender may not be able to get their entire investment back. For this reason, they may require that riskier borrowers include their property taxes in their mortgage payments.

Additional Reading

Don’t Miss: What Is The Average Mortgage Payment In Florida

Paying The Property Taxes Without Mortgage

Paying off the house is one of the most satisfying feelings in the world. It is somewhat freeing, knowing that you no longer have debts related to your house. But just because you have finished paying off the monthly mortgages, it doesnt mean that you are finished with the property taxes. As it was mentioned before, you are responsible for the property taxes for good, as long as you own the property.

When you have paid off your mortgage, you have to pay the taxes to your local government directly. How often you pay it relies on your location because the local governments may have different policies are regulations about how you should do it. Some local governments may ask you to pay a lump sum directly, which means you do it once in every year. Its also possible that they may ask you to break the taxes into smaller payments for several months apart.

The exact date or day when your taxes due rely on your location, so its always a good idea to pay attention to your tax bill when it comes in your mail. This kind of tax isnt something that you can skip. If you are behind your payments , your local government has the right to take your house and then sell it to repay the debt that you owe. They have the legal rights to do so even when you have completely paid off your house.

Why Do I Have To Pay Property Taxes

In all 50 U.S. states, the majority of property owners are required to pay real estate taxes. These taxes are vital to making sure local governments can provide the infrastructure and public services their communities need. Most citizens in the community rely on the government to provide at least one important public service.

Additionally, in many areas of the country, local property taxes make up the lions share of funding for public schools.

Read Also: Could I Qualify For A Mortgage

Don’t Miss: How To Figure Out Mortgage Rates

New Homebuyers Need Help Calculating Your Mortgage Payments

As a new homeowner, with one easy monthly payment, youll cover a number of expenses associated with your new home.

At Maple Tree Funding, we make sure that you completely understand every component of your monthly mortgage payment. Unlike other mortgage lenders, we will review everything with you thoroughly and disclose every cost you should expect ahead of time, so you dont encounter any surprises when it comes to paying for your home.

Wondering how much you can afford to spend on a home? Interested in a New York home and wondering what your monthly mortgage payment would be? We can help you figure it out!

At Maple Tree Funding, we have decades of experience helping first time homebuyers. We know the ins and outs of the mortgage process and can guide you every step of the way as you work to purchase your first home.

Interested in learning more? Give us a call at or contact us online to find out how we can help make the home buying process easier for you.

Looking for more information to guide you as you purchase your first home?Check out our First Time Homebuyer Resources!

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Don’t Miss: Should I Refinance My Mortgage Or Not

Paying Property Taxes Is Essential If Youre A Home Owner Find The Least Painful Way To Do It

As homeowners, paying our property taxes in full and on time is essential and one could argue, so is finding the least painful way to do it. Some people choose not to pay their taxes in small increments, either at their financial institution or through their municipality because they want to earn interest in their tax account. While some institutions may pay a bit of interest, many dont. This is in lieu of charging a fee for the service. If you are disciplined enough to save the money for your property tax bill on your own, that is the way to go. However, good intentions arent enough. If when the bill comes you pay it using your line of credit, you will likely pay more interest than if you had made small payments along with your mortgage all year.

Related articles:

Read Also: How Much Would A Million Dollar Mortgage Cost

Why Do You Need To Pay Property Taxes

Local governments rely on property taxes as a revenue source. Over 70% of local tax collections come from property taxes.

Property taxes pay for government services like schools, roads, law enforcement, and emergency services. If you have a mortgage, a portion of your payment will go into your escrow account to be paid when your taxes come due.

Don’t Miss: What Is Considered A High Interest Rate On A Mortgage

How Are Property Taxes Paid

Property tax is included in most mortgage payments . So if you make your monthly mortgage payments on time, then youre probably already paying your property taxes!

Heres how you pay property taxes as part of your mortgage payment:

Lets say Jim and Pam decide to buy a home, and their mortgage lender estimates theyll owe $1,600 in property taxes each year.

Instead of letting Jim and Pam get smacked with a huge tax bill at the end of the year , their lender will divide their total property tax amount by 12 months. Then theyll charge Jim and Pam that amount of their property taxes as part of their mortgage payment each month. Lets look at the math:

$1,600 ¸ 12 months = $133 per month

The lender sets that $133 a month aside in a separate account and uses it to pay Jim and Pams property taxes to the local government when theyre due.

Just remember, the mortgage lender gives you estimates of what you owe in property tax, so you might get a refund or you might have to pay a little extra if the amount comes up short. Be prepared for either scenario!

Dont have a mortgage? How you pay property taxes will be a little different.

How To Pay Your Property Taxes Online

This topic is too detailed and requires its own post but suffice it to say, the best way to pay your taxes online is by first googling for your states website . If you would like us to write a much more detailed post about how to pay online, send us a note and well publish a detailed step-by-step. In the meantime, good luck with your search and hope this article helped clear up some information.

Also Check: What Mortgage Can I Get With My Salary

Are Property Taxes Included In Mortgage In Texas

There is no definitive answer to this question as it can vary depending on the mortgage lender and the specific terms of the mortgage agreement. However, it is generally speaking, property taxes are not included in the mortgage payment in Texas. Homeowners are responsible for paying their property taxes directly to the county tax office.

If you make monthly property tax payments, you will be able to reduce your property tax payments financial strain, especially if you are unable to pay on time. Payments for property taxes in Texas must be made on or before the fifth business day of the month following the taxs due date. If you are late on your payments, the tax collector may take actions such as issuing a tax lien or seizing your property to recover the funds. If you are having trouble making your property tax payment, it may be a good idea to pay your taxes monthly rather than waiting until the annual payment is due. You will not have to pay any penalties or fines as a result of this, and you will have less of a financial burden overall.

What Is Homeowners Insurance

Homeowners insurance, also known as home insurance, is coverage that is required by all mortgage lenders for all borrowers. Unlike the requirement to buy PMI, the requirement to buy homeowners insurance is not related to the amount of the down payment that you make on your home. It is tied to the value of your home and property.

Also Check: What Is The Best Refinance Mortgage Company

Understanding The Difference Between Tax Rates And Home Value

Your home value is how much your home is currently worth. The tax rate is a percentage of your home value. Even if your tax rate remains the same next year, you still may owe more property taxes if the value of your home increased.

Lets say your home was worth $200,000 last year and the tax rate was 2%. You owed $4,000 last year in property taxes. This year, your tax rate stays the same at 2% but your home is now assessed to be worth $215,000. That means youll owe $4,300 this year.

How Do I Calculate What I Owe In Property Tax

The amount you pay in property tax is based on two things: your local governments tax rate and your propertys assessed value. All you have to do is take your homes assessed value and multiply it by the tax rate.

Assessed Value x Property Tax Rate = Property Tax

Lets say your home has an assessed value of $200,000. If your county tax rate is 1%, your property tax bill will come out to $2,000 per year. Thats $167 per month if your property taxes are included in your mortgage or if youre saving up the money in a sinking fund.

Heres how to do that math, by the way:

$200,000 x 1% tax rate = $2,000 taxes owed

$2,000 / 12 months = $167 per month

Read Also: Can You Reverse Mortgage A Condo

Can A Mortgage Servicer Foreclose

Servicers are not permitted to begin foreclosures on properties unless the borrowers and servicers have entered into a loss mitigation agreement, which the borrowers have not done.

Mortgage Servicers: The Good, The Bad, And The Debt Collectors

Even though mortgage servicing companies are not technically lenders, they play an important role in the mortgage industry. They take care of the loan and are in charge of collecting payments, ensuring they are sent on time, and monitoring its progress. As a result, mortgage servicers may be considered debt collectors under this law. They may also have access to personal information of the borrowers due to the fact that these companies acquire mortgages that are already in default. It is unlikely that mortgage servicers are exempt from collecting debts under the law, even if there is no clear cut answer. As a result, you may receive correspondence from them about your loan, as well as the possibility of them attempting to collect on it.