Executing The Pmt Function

The formula now reads:

Once youve entered all of the data points, you can press enter to execute the function. This will tell you your monthly payment amount:

As you can see above, the monthly principal and interest payment for this mortgage comes out to $1,342.05. This is shown as a negative figure because it represents monthly money being spent.

If this calculator isnt the right fit for you, you can try to determine how rates, terms, and loan amounts impact your payment.

Also Check: Mortgage Recast Calculator Chase

Pro Tip: Refinance Closing Costs

For a new mortgage, you will have to pay upfront fees totaling 3% to 6% of the loan amount. It is a significant expense that needs to be taken into account in the refinancing process. Your monthly savings may not have exceeded the upfront fees if you refinance too often or sell your home soon after refinancing.

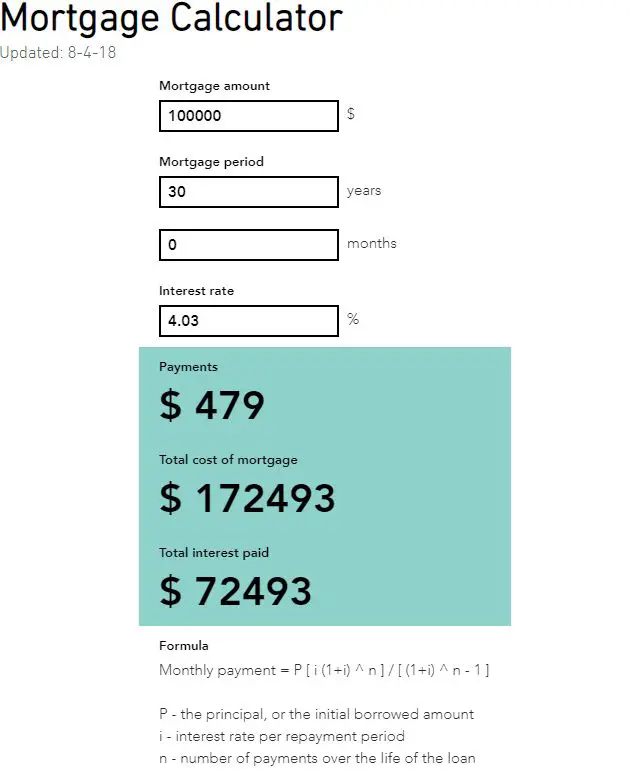

Calculations For Different Loans

The calculation you use depends on the type of loan you have. Most home loans are standard fixed-rate loans. For example, standard 30-year or 15-year mortgages keep the same interest rate and monthly payment for their duration.

For these fixed loans, use the formula below to calculate the payment. Note that the carat indicates that youre raising a number to the power indicated after the carat.

Payment = P x x ^n] / ^n – 1

Recommended Reading: Can A Trust Take Out A Mortgage

What Taxes Are Part Of My Monthly Mortgage Payment

The taxes portion of your mortgage payment refers to your property taxes. The amount you pay in property taxes is based on a percentage of your property value, which can change from year to year. The actual amount you pay depends on several factors including the assessed value of your home and local tax rates.

What Are My Monthly Costs For Owning A Home

There are five key components in play when you calculate mortgage payments

-

Principal: The amount of money you borrowed for a loan. If you borrow $200,000 for a loan, your principal is $200,000.

-

Interest: The cost of borrowing money from a lender. Interest rates are expressed as a yearly percentage. Your loan payment is primarily interest in the early years of your mortgage.

-

Property taxes: The yearly tax assessed by the city or municipality on a home that is paid by the owner. Property taxes are considered part of the cost of owning a home and should be factored in when calculating monthly mortgage payments. However, lenders dont control this cost and so it shouldnt be a major factor when choosing a lender.

-

Mortgage insurance: An additional cost of taking out a mortgage, if your down payment is less than 20% of the home purchase price. This protects the lender in case a borrower defaults on a mortgage. Once the equity in your property increases to 20%, you can stop paying mortgage insurance, unless you have an FHA loan.

-

Homeowners association fee: This cost is common for condo owners and some single-family neighborhoods. Its money that must be paid by owners to an organization that assists with upkeep, property improvements and shared amenities.

You May Like: Will Mortgage Pre Approval Hurt Credit Score

What Is A Fixed

A fixed-rate mortgage is a home loan that has the same interest rate for the life of the loan. This means your monthly principal and interest payment will stay the same. The proportion of how much of your payment goes toward interest and principal will change each month due to amortization. Each month, a little more of your payment goes toward principal and a little less goes toward interest.

Example Of How Mortgage Points Can Cut Interest Costs

If you can afford to buy discount points on top of the down payment and closing costs, you will lower your monthly mortgage payments and could save lots of money. The key is staying in the home long enough to recoup the prepaid interest. If you sell the home after only a few years, or refinance the mortgage or pay it off, buying discount points could be a money-loser.

Here is an example of how discount points can reduce costs on a $200,000, 30-year, fixed-rate mortgage:

| Loan principal | |

|---|---|

| None | $20,680 |

In this example, the borrower bought two discount points, with each costing 1 percent of the loan principal, or $2,000. By buying two points for $4,000 upfront, the borrowers interest rate shrank to 3.5 percent, lowering their monthly payment by $56, and saving them $20,680 in interest over the life of the loan.

Also Check: How Much Does Paying Mortgage Bi Weekly Save

Should I Include Anticipated Utility Costs In My Monthly Payment Calculation

You shouldnt include utilities in your monthly mortgage payment calculation, but its important to consider and include them as part of your budget. If youre used to renting a 900-square-foot apartment, expect your utility expenses to go up significantly in a 2,000-square-foot home, in addition to new utilities such as trash, water, and sewer that you may not be used to paying directly, depending on where you currently live.

Nper: The Number Of Payments Youll Make On A Loan

Once youve established your monthly interest rate, youll need to enter the number of payments youll be making. Since were calculating the monthly payment, we want this number in terms of months.

For example, a 30-year mortgage paid monthly will have a total of 360 payments , so you can enter 30*12, 360, or the corresponding cell *12. If you wanted to calculate a five-year loan thats paid back monthly, you would enter 5*12 or 60 for the number of periods.

You May Like: Can You Do A Reverse Mortgage On A Condo

Recommended Reading: What Are Mortgage Interest Rates At

Can You Afford The Loan

Lenders tend to offer you the largest loan that theyll approve you for by using their standards for an acceptable debt-to-income ratio. However, you dont need to take the full amountand its often a good idea to borrow less than the maximum available.

Before you apply for loans or visit houses, review your income and your typical monthly expenses to determine how much youre comfortable spending on a mortgage payment. Once you know that number, you can start talking to lenders and looking at debt-to-income ratios. If you do it the other way around , you might start shopping for more expensive homes than you can afford, which affects your lifestyle and leaves you vulnerable to surprises.

Its safest to buy less and enjoy some wiggle room each month. Struggling to keep up with payments is stressful and risky, and it prevents you from saving for other goals.

Whether The Home Is Too Expensive

Another thing a mortgage calculator is very good for is determining how much house you can afford. This is based on factors like your income, credit score and your outstanding debt. Not only is the monthly payment important, but you should also be aware of how much you need to have for a down payment.

As important as it is to have this estimate, its also critical that you dont overspend on the house by not considering emergency funds and any other financial goals. You dont want to put yourself in a position where youre house poor and unable to afford retiring or going on vacation.

Don’t Miss: What Is The Average Time To Pay Off A Mortgage

What Can A Mortgage Calculator Help Me With

Whether you use the formula or a mortgage calculator, calculating your potential mortgage payment should help you feel more informed on how to get a mortgage and your budget for buying a home, or to decide whether to move forward with a refinance. It all depends on your lifestyle and personal goals.

Below are some of the questions a mortgage calculator can answer.

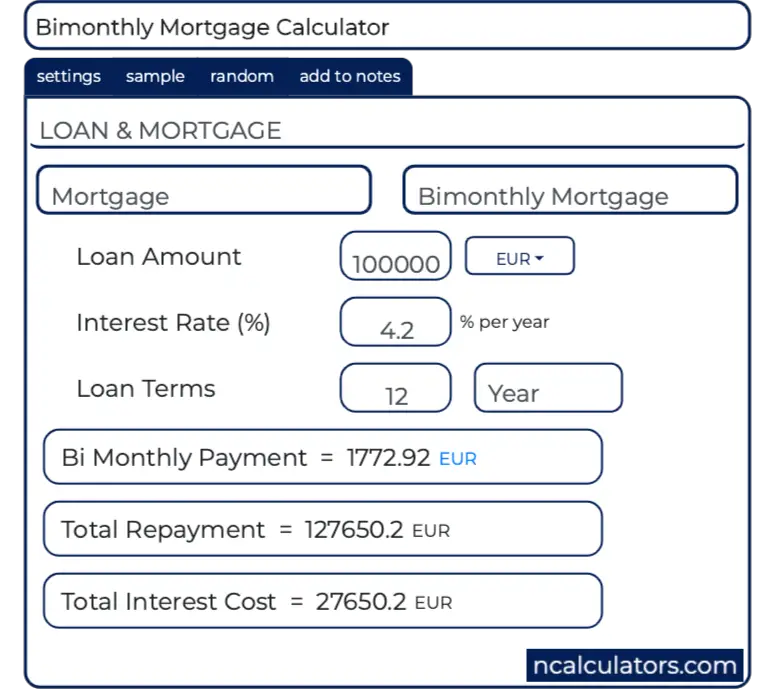

Exercising Additional Payment Options

![Biweekly mortgage calculator with extra payments [Free Excel Template] Biweekly mortgage calculator with extra payments [Free Excel Template]](https://www.mortgageinfoguide.com/wp-content/uploads/biweekly-mortgage-calculator-with-extra-payments-free-excel-template.png)

When you sign on for a 30-year mortgage, you know you’re in it for the long haul. You might not even think about trying to pay off your mortgage early. After all, what’s the point? Unless you’re doubling up on your payments every month, you aren’t going to make a significant impact on your bottom line right? You’ll still be paying off your loan for decades right?

Not necessarily. Even making small extra payments over time can shave years off your loan and save you thousands of dollars in interest, depending on the terms of your loan.

Also Check: How Do You Choose A Mortgage Lender

How Do Property Taxes Work

When you own property, youre subject to taxes levied by the county and district. You can input your zip code or town name using our property tax calculator to see the average effective tax rate in your area.

Property taxes vary widely from state to state and even county to county. For example, New Jersey has the highest average effective property tax rate in the country at 2.42%. Owning property in Wyoming, however, will only put you back roughly 0.57% in property taxes, one of the lowest average effective tax rates in the country.

While it depends on your state, county and municipality, in general, property taxes are calculated as a percentage of your homes value and billed to you once a year. In some areas, your home is reassessed each year, while in others it can be as long as every five years. These taxes generally pay for services such as road repairs and maintenance, school district budgets and county general services.

Calculate Your Monthly Payment

Its finally time to calculate your mortgage payment. You can use an online mortgage calculator with extra payments, a traditional mortgage payment calculator, or the formula listed above if you want to calculate the number by hand.

Calculate the payment a few times to ensure you did it correctly. The closer you can get, the better your financial future.

Once you have your monthly payment, you can determine if the mortgage is affordable. Its helpful to calculate this estimate ahead of time to steer clear of sticky situations.

Read Also: How Do You Figure Out Your Monthly Mortgage Payment

How Much Interest Will I Pay On My Mortgage Over 30 Years Calculator

A mortgage is often a necessary part of buying a home, but it can be difficult to understand what you can actually afford. A mortgage calculator can help borrowers estimate their m

A mortgage is often a necessary part of buying a home, but it can be difficult to understand what you can actually afford. A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price, down payment, interest rate and other monthly homeowner expenses.How is my monthly payment calculated?

Principal and interest$1,216

Private mortgage insurance

Disclaimer: Calculator results and default inputs are estimates. Enter numbers that match your location and situation for best results. Additional data sources: Quadrant Information Services, The Tax Foundation and CoreLogic, a property data and analytics company.

The amount in this box is based on the average annual homeowners insurance premium for your state. To get a more accurate calculation, enter your monthly premium.

The amount in this box is based on the median property tax amount paid in your state.

Use A Mortgage Calculator

As a practical matter, youre much better off using a mortgage calculator to calculate your mortgage payment because its very hard to even input that formula properly in a regular calculator. Using a mortgage calculator takes the guesswork out of the formula for you and can help you calculate your mortgage payments much faster. There are several types of mortgage calculators, so its important to understand the purpose of each one so that you can be sure youre using the right one for your needs.

Save money with a lower interest rate.

Lock in your rate today before they rise.

You May Like: What Would The Mortgage Be On A 500 000 House

Estimating How Much House You Can Afford

How much house you can afford depends on several factors, including your monthly income, existing debt service and how much you have saved for a down payment. When determining whether to approve you for a certain mortgage amount, lenders pay close attention to your debt-to-income ratio .

Your DTI compares your total monthly debt payments to your monthly pre-tax income. In general, you shouldnt pay more than 28% of your income to a house payment, though you may be approved with a higher percentage.

Keep in mind, however, that just because you can afford a house on paper doesnt mean your budget can actually handle the payments. Beyond the factors your bank considers when pre-approving you for a mortgage amount, consider how much money youll have on-hand after you make the down payment. Its best to have at least three months of payments in savings in case you experience financial hardship.

Along with calculating how much you expect to pay in maintenance and other house-related expenses each month, you should also consider your other financial goals. For example, if youre planning to retire early, determine how much money you need to save or invest each month and then calculate how much youll have leftover to dedicate to a mortgage payment.

Ultimately, the house you can afford depends on what youre comfortable withjust because a bank pre-approves you for a mortgage doesnt mean you should maximize your borrowing power.

Whats A Homeowners Insurance Premium

A homeowners insurance premium is the cost you pay to carry homeowners insurance a policy that protects your home, personal belongings and finances. The homeowners insurance premium is the yearly amount you pay for the insurance. Many home buyers pay for this as part of their monthly mortgage payment.

Lenders typically require you to purchase homeowners insurance when you have a mortgage. The coverage youre required to purchase may vary by location. For example, if you live in a flood zone or a state thats regularly impacted by hurricanes, you may be required to buy additional coverage that protects your home in the event of a flood. If you live near a forest area, additional hazard insurance may be required to protect against wildfires.

You May Like: What Happens To Mortgage Rates During Inflation

How Much House Can You Afford

Before doing business with you, lenders also consider your other monthly debt obligations along with your projected housing expenses. For example, if your monthly expenses include $300 for a car loan, $75 in student loan payments and $125 in credit card bills, you would add these to your $2,000 housing expenses for a total of $2,500. Divide that figure by your $7,000 gross income to arrive at a 35.7 percent ratio. Lenders prefer this so-called “back-end” debt-to-income ratio to be 36 percent or less.

Generally, the smaller your monthly mortgage expense relative to your income, the easier it will be for you to keep up with your payments.

How To Lower Your Monthly Mortgage Payment

If the monthly payment you’re seeing in our calculator looks a bit out of reach, you can try some tactics to reduce the hit. Play with a few of these variables:

- Choose a longer loan. With a longer term, your payment will be lower .

- Spend less on the home. Borrowing less translates to a smaller monthly mortgage payment.

- Avoid PMI. A down payment of 20 percent or more gets you off the hook for private mortgage insurance .

- Shop for a lower interest rate. Be aware, though, that some super-low rates require you to pay points, an upfront cost.

- Make a bigger down payment. This is another way to reduce the size of the loan.

Also Check: What Age Can You Do A Reverse Mortgage

Why Use A Mortgage Payment Calculator

When planning to buy a home, its easy to focus on the headline figures, like the final purchase price or your overall mortgage amount. But in many way, the most relevant number for your mortgage will be your regular repayments. After all, your mortgage payments are the amount that youll need to take from your pay cheque each month to keep your mortgage under control.

Using a mortgage payment calculator like the one above takes the guess work out of your mortgage payments. Our calculator lets you understand how much youll need to pay each month for any size of mortgage, with any rate. This means you can compare homes and mortgage products with confidence, all the while knowing exactly how much youll be on the hook for in each scenario.

You May Like: Chase Recast Calculator

Getting Started With Calculating Your Mortgage

People tend to focus on the monthly payment, but there are other important features you can use to analyze your mortgage, such as:

- Comparing the monthly payment for several different home loans

- Figuring how much you pay in interest monthly and over the life of the loan

- Tallying how much you actually pay off over the life of the loan versus the principal borrowed, to see how much you actually paid extra

Use the mortgage calculator below to get a sense of what your monthly mortgage payment could end up being,

You May Like: Are Mortgage Rates Based On Credit Score

Figuring Out Your Unpaid Principal Loan Balance

If you want to know your unpaid principal loan balance that is remaining after you make your first mortgage payment, you can use our amortization calculator. But if you’d like to understand how to figure it out on your own, read on.

First, take your principal loan balance of $100,000 and multiply it by your 6% annual interest rate. The annual interest amount is $6,000. Divide the annual interest figure by 12 months to arrive at the monthly interest due. That number is $500.

Since your December 1 amortized payment is $599.55, to figure the principal portion of that payment, you would subtract the monthly interest number from the principal and interest payment . The result is $99.55, which is the principal portion of your payment.

Now, subtract the $99.55 principal portion paid from the unpaid principal balance of $100,000. That number is $99,900.45, which is the remaining unpaid principal balance as of December 1. If you are paying off a loan, you must add daily interest to the unpaid balance until the day the lender receives the payoff amount.

You know now that your unpaid principal balance after your December payment will be $99,900.45. To figure your remaining balance after your January 1 payment, you will compute it using the new unpaid balance: