Affordability Declined And Sales Slowed

The rate on the 30-year fixed went up almost three-quarters of a percentage point from the end of July to the end of August. The increase eroded borrowers’ buying capacity.

Take the hypothetical example of a borrower who can afford to pay $2,000 a month in principal and interest . On a 30-year loan with a 5.125% interest rate, the buyer could afford to borrow $367,300. But with a 5.875% interest rate, the buyer could afford to borrow $338,100. That’s $29,200 less that the buyer could pay for a house.

As interest rates and home prices have risen this year, home sales have slowed. In turn, sellers are more accommodating. According to a Realtor.com survey of recent home sellers, almost all sellers nowadays are making upgrades and repairs before they list their homes. And 69% of sellers in August sold their homes at or above the asking price, compared to 82% in February through April.

How Do I Get The Best Mortgage Rate

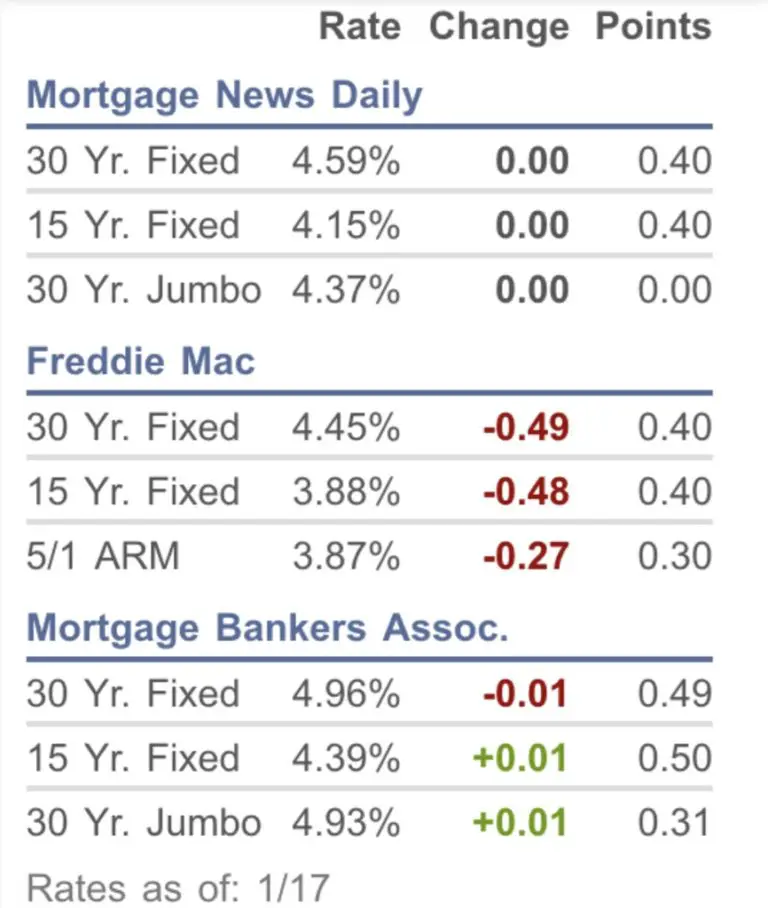

Shopping around for the best mortgage rate can mean a lower rate and big savings. On average, borrowers who get a rate quote from one additional lender save $1,500 over the life of the loan, according to Freddie Mac. That number goes up to $3,000 if you get five quotes.

The best mortgage lender for you will be the one that can give you the lowest rate and the terms you want. Your local bank or credit union is one place to look. Online lenders have expanded their market share over the past decade and promise to get you pre-approved within minutes.

Shop around to compare rates and terms, and make sure your lender has the type of mortgage you need. Not all lenders write FHA loans, USDA-backed mortgages or VA loans, for example. If you’re not sure about a lender’s credentials, ask for its NMLS number and search for online reviews.

Current Mortgage Rates Are Shooting Up Again

Leslie CookKristen Bahler19 min read

Mortgage rates continued trending higher this week. Freddie Mac’s average rate on a 30-year fixed-rate mortgage increased 0.23 percentage points to 5.89%, which is the highest that rate has reached since 2008.

This is the third straight week of increases, following a seesawing rate that carried through the better part of July and August.

For homebuyers, there is a bright side. Different lenders are now offering a variety of competing rates, and applicants can save anywhere between $1,500 and $3,000 per year on their mortgage payments by getting multiple quotes, noted Sam Khater Freddie Mac’s chief economist in a statement

As a result, “Borrowers can benefit from shopping around,” Khater said.

Both the 15-year fixed-rate loan and the 5/1 adjustable-rate mortgage also saw higher rates this week, according to Freddie Mac’s weekly survey. Rates for those loan categories are now averaging 5.16% and 4.64%, respectively.

If you are offered a rate that is higher than you expect, make sure to ask why, and compare offers from multiple lenders.

Recommended Reading: Can I Use My Partner’s Income For A Mortgage

What Is A Good Mortgage Interest Rate

The best mortgage rate for you will depend on your financial situation. A home loan with a shorter term may have a lower interest rate but a higher monthly payment, while a home loan with an adjustable interest rate may have a lower interest rate at first but then change annually after a set period of time. For example, a 7-year ARM has a set rate for the initial 7 years then adjusts annually for the remaining life of the loan , while a 30-year fixed-rate mortgage has a rate that stays the same over the loan term.

Canadian Interest Rate Forecast To 2023

HIGHLIGHTS

-

Five-year government bond rates have risen from 0.3% to 3.3% since January 2021. This has had a knock-on effect on mortgage rates.

-

The Bank of Canada has continued raising short-term interest rates due to high inflation.

-

Bond markets are pricing in more rate hikes in 2022, the TD and National Bank forecasts are the most optimistic for the economy and project the Bank of Canada target rate could reach 3.5% by the end of 2022.

-

5-year mortgage rates are expected to continue rising.

According to a May 26 Reuters poll, many economists expected the rate to be 2.50% by the end of 2022on July 13 the Bank of Canada raised its target rate to 2.50% and implied more increases could follow.

There areconcerns about inflation which is currently around 7.7%and is eroding retirement savings. Generally, lending rates are higher than average inflation.

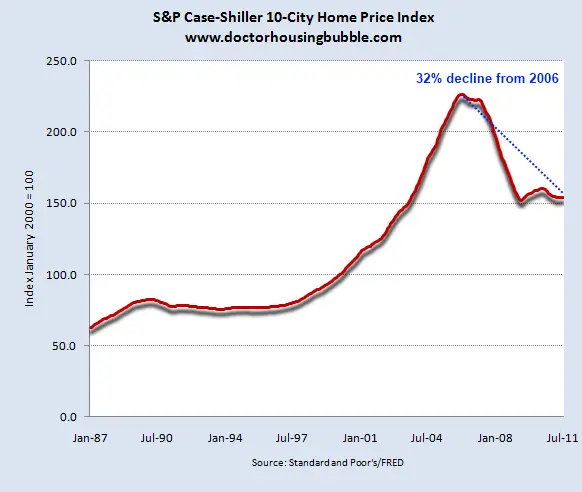

While low rates were intended to help borrowers weather the economic storm, they also appeared to fuel a real estate boom and potentially a housing bubble. Asset bubbles in real estate and other assets put pressure on the BoC and the government to dial down the stimulus, and in response, the Bank of Canada has increased rates to a neutral level.

This article will explain the forecasts for the variable and 5-year fixed rates. Keep reading to learn what the big banks are saying about rates.

Also Check: Should I Have A Lawyer Review My Mortgage

How Much Can I Borrow For A Mortgage

The amount of money you can borrow is affected by the property, type of loan, and your personal financial situation.

During the mortgage preapproval process, the lender will look at your overall financial profile to determine how much it will lend to you. A big factor in this process is your debt-to-income ratio . Your DTI is calculated by dividing your total monthly debt payments by your monthly income. In most cases, the maximum DTI is typically 43%. So if you make $5,000 a month, your mortgage payment and other monthly debt payments cant exceed $2,150.

To protect its investment, a lender will typically only let you borrow a certain percentage of a propertys value. So the value of the property can also limit how much you can borrow. Most mortgage loans require a down payment of anywhere from 3% to 20%. You may be able to borrow 100% of the propertys value with certain government-backed loans, like Department of Veterans Affairs Loans or U.S. Department of Agriculture Rural Development loans.

Also Check: What Does Icd Stand For In Mortgage

What Credit Score Do Mortgage Lenders Use

Most mortgage lenders use your FICO score a credit score created by the Fair Isaac Corporation to determine your loan eligibility.

Lenders will request a merged credit report that combines information from all three of the major credit reporting bureaus Experian, Transunion and Equifax. This report will also contain your FICO score as reported by each credit agency.

Each credit bureau will have a different FICO score and your lender will typically use the middle score when evaluating your creditworthiness. If you are applying for a mortgage with a partner, the lender can base their decision on the average credit score of both borrowers.

Lenders may also use a more thorough residential mortgage credit report that includes more detailed information that wont appear in your standard reports, such as employment history and current salary.

Also Check: How Long Does Mortgage Underwriting Take

The Best Way To Find Out Your Mortgage Options

Consumers are unaware of the new rules and the fact they could leave some people stranded on their current deals. At best their mortgage repayments will increase in line with the Bank of England base rate, at worst at the whim of their lender.

Most consumers will wrongly assume that using a price comparison site is the best thing to do when looking to remortgage. However, bear in mind

- many mortgage deals are only available via mortgage advisers so don’t appear on price comparison sites

- not everyone can get the rates quoted on price comparison sites

- price comparison sites don’t take into account your credit rating or personal circumstances which will determine whether a lender will actually lend to you. For example you may not be eligible for the deals quoted by comparison sites and won’t find out until they credit check you. That in itself will then hinder future mortgage applications

That is why you are almost always better off dealing with an independent mortgage adviser rather than going it alone. This is why 70% of borrowers now use a mortgage adviser to find the best deal from a lender who will actually lend to them. Therefore, we recommend getting in contact with a mortgage advisor yourself. You can arrange a free remortgage review in just 30 seconds using this online tool*.

If you already have an independent mortgage broker that you trust then I suggest you get in touch with them as there has never been a better time to remortgage.

Mortgage Rates This Week

Mortgage rates for fixed-rate loans jumped in the week ending Sept. 8, with the weekly average for the 30-year fixed climbing past 6% for the first time in the history of NerdWallet’s survey, which goes back to 2016.

-

The 30-year fixed-rate mortgage averaged 6.02% APR, up 25 basis points from the previous week’s average.

-

The 15-year fixed-rate mortgage averaged 5.19% APR, up 16 basis points from the previous week’s average.

-

The five-year adjustable-rate mortgage averaged 5.22% APR, down one basis point from the previous week’s average.

This month’s upcoming meeting of the Federal Reserve is one major reason rates are on a roller coaster. Fed-watchers expect another increase to the federal funds rate, but were waiting to learn the size of the increase.

On Wednesday, the Fed’s summary report known as the Beige Book, which collects commentary from each Federal Reserve district, described some moderation in price increases and wage growth while forecasting softening demand and weak economic growth. These signs indicate that inflation may be slowing down. You might think central bankers would conclude that their inflation-fighting measures are on the right track and that further major rate hikes aren’t necessary.

» MORE:How to get preapproved for a mortgage

You May Like: How To Calculate Mortgage Insurance On A Conventional Loan

Anticipated Fed Interest Rate Hike Already Being Felt

The Federal Reserve began its two-day meeting today, and pretty much everyone expects it to announce a half-point hike in its benchmark interest rate tomorrow as it tries to get inflation under control.

The hope is that Fed interest rate hikes will eventually calm spending and hold down prices. That raises a question: What will be different the day after those rates rise?

You may have missed it the first response to the rate hikes has already happened.

Mortgage rates have gone up by all the way to 5% now, so theyve gone up two percentage points in just the past couple of months, according to Kenneth Kuttner, an economics professor at Williams College.

Thirty-year mortgages take into account not just what interest rates are, but what we think theyll be. And it was pretty clear months ago that the Fed would be raising rates.

Youre probably not going to see any additional movement in that mortgage rate unless the Fed starts moving faster than markets have previously anticipated, Kuttner said.

Another effect of tomorrows probable interest rate hike thats already old news? The effect on the stock market. The S& P 500 is down by over 12% this year, some of which is because of the interest rates everybody saw coming.

Stocks are, in effect, a promise to pay dividends out in the future somewhere, but if interest rates are high, those future dividends are worth less today and so stock prices fall, said Bill English, finance professor at Yale.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

You May Like: How Do I Get A Second Mortgage

Todays Mortgage Rates In Arizona

Whether youre ready to buy or refinance, youve come to the right place. Compare Arizona mortgage rates for the loan options below.

Compare current refinance rates today.

The mortgage rates shown assume a few basic things, including:

- You have very good credit and a specific down payment amount for your loan type.1

- Your loan is for a single-family home as your primary residence.

- You will purchase up to one mortgage discount point in exchange for a lower interest rate. Connect with a mortgage loan officer to learn more about mortgage points.

How The Bank Of England Base Rate Is Set

The MPC is the nine-person committee, within the BOE, that determines the BOE base rate. Usually, every six weeks the Bank announces the MPC’s interest-rate decision. You can find a full schedule of decision dates on the Bank of England website. Whenever a decision is announced the MPC meeting minutes are also published. These minutes are scrutinised by investors for any hints of when rates might go up or down in the future. For example, they would see how many of the nine-person committee voted for interest rates to go up, down or stay the same.

The forecasting of the Bank of England base rate has been transformed in recent years. The former Governor of the Bank of England , Mark Carney, originally created a notional link between the UK unemployment rate and the BOE base rate before replacing this with 18 economic indicators which still inform the BOE’s interest rate decision making today, under current Governor, Andrew Bailey.

Recommended Reading: What Is A Good Ratio Of Mortgage To Income

More: Consumer Prices Rise Unexpectedly In August Sending Stock Market Tumbling

Less competition is leading to fewer bidding wars for those who are able to afford to buy, multiple real estate agents said.

“The good news is that you can get your offer accepted much more easily now because you’re not facing as much competition,” Fairweather, Redfin’s chief economist, said. “But the bad news is that the mortgage is going to be much more expensive.”

There are signs the housing market is beginning to cool in some parts of the country.

Redfin said Wednesday in a new report, provided first to ABC News, that Seattle’s housing market is slowing faster than any other in the United States, followed by Las Vegas and San Jose, California. The firm looked at changes from February to August, comparing metrics ranging from home prices and the number of pending sales to the total supply and the speed of sales.

The top 10 markets cooling the quickest were “almost all either West Coast markets that have long been expensive, or places that became significantly less affordable during the pandemic because they attracted scores of relocating homebuyers,” according to Redfin.

What Is A Mortgage Rate Lock

Locking in or agreeing to the interest rate for your mortgage is known as a mortgage rate lock. Whether you lock in your interest rate early on, or closer to closing, it has to be agreed upon before the mortgage can be finalized.

Lenders offer this locking service to borrowers because interest rates often fluctuate while your home loan application is being finalized. The purpose of the mortgage rate lock is to secure the loan at a specific interest rate and avoid changes before you close.

Various factors influence interest rate changes, such as the stock market, the Federal Reserve, inflation, worldwide events and politics. Interest rate changes may happen during the mortgage application process. If interest rates go up after youve locked yours in, you wont be impacted by the increase.

Don’t Miss: Can You Apply For A Mortgage Before Finding A House

Should You Refinance Your Mortgage When Interest Rates Drop

Determining whether it’s the right time to refinance your home loan or not involves a number of factors. Most experts agree you should consider a mortgage refinancing if your current mortgage rate exceeds today’s mortgage rates by 0.75 percentage points. Some say a refi can make sense if you can reduce your mortgage rate by as little as 0.5 percentage points . It doesn’t make sense to refinance every time rates decline a little bit because mortgage fees would cut into your savings.

Many of the best mortgage refinance lenders can give you free rate quotes to help you decide whether the money you’d save in interest justifies the cost of a new loan. Try to get a quote with a soft credit check which won’t hurt your credit score.

You could increase interest savings by going with a shorter loan term such as a 15-year mortgage. Your payments will be higher, but you could save on interest charges over time, and you’d pay off your house sooner.

How much does the interest rate affect mortgage payments?

In general, the lower the interest rate the lower your monthly payments will be. For example:

- If you have a $300,000 fixed-rate 30-year mortgage at 4% interest, your monthly payment will be $1,432 . You’ll pay a total of $215,608 in interest over the full loan term.

- The same-sized loan at 3% interest will have a monthly payment of $1,264. You will pay a total of $155,040 in interest a savings of over $60,000.