Your Minimum Down Payment

Particularly if you have a conventional loan, an extra 20% down payment on your house means that you may not have to pay PMI, which can save you a lot in interest over the long haul.

When you have more saved to pay upfront, financial lenders understand that youre a scrupulous saver. This can help you sign and seal the deal and get the keys to your new home quicker.

Work With A Real Estate Investor

A real estate investor invests in properties and then sells them. They typically work one on one with clients, which means that there is more room for negotiating a lower price.

If a real estate investor cant provide you with a house, they can still be helpful. Real estate investors are full of information regarding the real estate market, working with real estate agents, and how to afford a house. If you cant purchase a home from your local real estate investor, consider asking them for advice.

How To Check Home Loan Eligibility

Individuals can easily check their home loan eligibility criteria on the official website of their preferred lending institution. Although most key requirements are usually the same, certain eligibility criteria may differ from lender to lender. These eligibility criteria are basically a set of parameters based on which a lender can assess a borrowers creditworthiness and past repayment behaviour. It depends on several factors, including credit history, age, credit score, financial obligations of an individual along with FOIR and financial status.Another easier and quick way to determine loan eligibility is to use an online home loan eligibility calculator. One can use this calculator to work out a personalised quote that can possibly meet the loan amount requirement on favourable and affordable means.

Dont Miss: How Much Do I Pay For Student Loan

Recommended Reading: How Do You Buy Points On A Mortgage

Whats The Rule Of Thumb For Mortgage Affordability

Now that you have a better understanding of all the factors you should consider, another way to calculate what mortgage you can afford is by using generally accepted rules that bring these elements together. Like the home affordability calculator, these should be taken as guidelines only. However, theyre another helpful tool to answer the all-important question of how much mortgage can I afford.

What Are The Income Requirements For Refinancing A Mortgage

Mortgage refinancing options are reserved for qualified borrowers, just like new mortgages. As an existing homeowner, youll need to prove your steady income, have good credit, and be able to prove at least 20 percent equity in your home.

Just like borrowers must prove creditworthiness to initially qualify for a mortgage loan approval, borrowers have to do the same for mortgage refinancing.

Also Check: Would I Be Eligible For A Mortgage

Learn About Your Mortgage Options

Home buyers can typically choose from two main types of mortgages:

- A conventional loan that is guaranteed by a private lender or banking institution

- A government-backed loan

When choosing a loan, youll want to explore the types of rates and the terms for each option. There may also be a mortgage option based on your personal circumstances, like if youre a veteran or first-time home buyer.

Conventional loans

A conventional loan is a mortgage offered by private lenders. Many lenders require a FICO score of 620 or above to approve a conventional loan. You can choose from terms that include 10, 15, 20 or 30 years. Conventional loans require larger down payments than government-backed loans, ranging from 5 percent to 20 percent, depending on the lender and the borrowers credit history.

If you can make a large down payment and have a credit score that represents a lower debt-to-income ratio, a conventional loan may be a great choice because it eliminates some of the extra fees that can come with a government-backed loan.

Government-backed loans

Buyers can also apply for three types of government-backed mortgages. FHA loans were established to make home buying more affordable, especially for first-time buyers.

Rate types

First-time homebuyers

Make Sure Your Credit Score Is As High As Possible

The first thing that mortgage lenders look into when you are applying for a loan with them is your credit score. They use this number to determine how likely you are to make your monthly payments on time. The higher your score, the better chance you have of getting approved for a loan.

If your credit score is not as high as you would like it to be, there are things you can do to improve it.

For starters, you can pay all of your bills on time each month. This will show lenders that you are responsible when it comes to handling your financial obligations and are more likely to make your mortgage payments on time as well.

You can also try to pay down any outstanding debts that you may have. This will help reduce your DTI ratio, which is another factor that mortgage lenders take into consideration.

Last but not least, try to avoid opening any new lines of credit before applying for a mortgage. This could have a negative impact on your credit score and make it more difficult to get approved.

Also Check: Can You Get A Mortgage With Less Than 20 Down

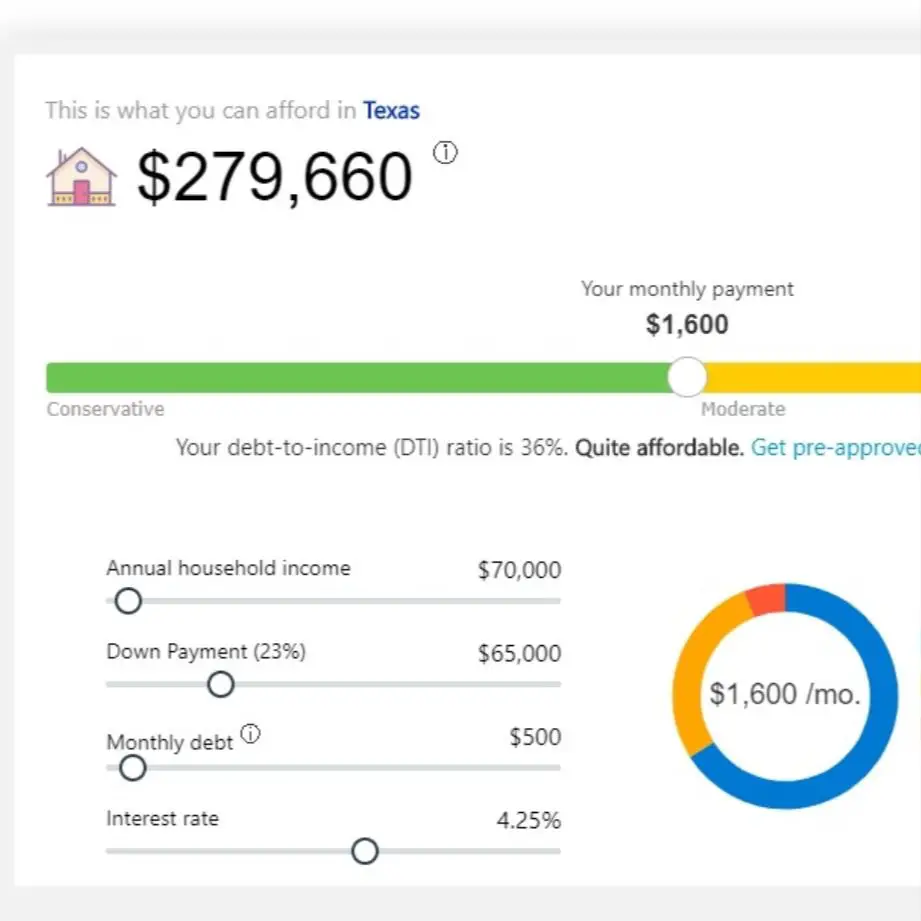

I Make $70000 A Year How Much Home Can I Afford

The home affordability calculator will give you a rough estimation of how much home can I afford if I make $70,000 a year. As a general rule, to find out how much house you can afford, multiply your annual gross income by a factor of 2.5 – 4. If you make $70,000 per year, you can afford a house anywhere from $175,000 to $280,000.

The Duration Of Your Mortgage

How long you sign on to pay off your mortgage will impact two things:

- The monthly payments you make on your mortgage.

- The total interest you pay over the life of your loan.

If you sign on to a 15-year loan, your mortgage payment will be higher than on a 30-year loan. However, in the latter example, youre paying the lender interest to borrow the money for twice as long. Over the full loan term, your monthly payment in interest could end up costing you many tens of thousands more.

Recommended Reading: How Do You Get Out Of A Mortgage With Someone

How Is Mortgage Affordability Calculated

Each lender calculates mortgage affordability indifferently, which means there is no hard and fast rule to work out exactly how much you will be able to borrow until you go to apply for pre-approval with your preferred lender or preferably through an investment savvy finance broker.

But generally, there are five key things thatbanks will take to assess how much you can afford to borrow.

On top of the above, some lenders also includea non-existent expense called a buffer to ensure your borrowing power isconservative to cover any unforeseen circumstances.

Banks will generally then use all the collected information to work out how much money is remaining in your budget and available to go towards your monthly mortgage repayment.

How To Determine How Much Home You Can Afford

Buying a house is exciting, especially as you tour new places and eventually fall in love with a home. But how do you determine your price range? To set realistic expectations, consider your personal finances, borrowing options, and the total costs of buying.

Heres what well cover:

Recommended Reading: What To Look Out For With Mortgage Lenders

How Much Income Do I Need For A 200000 Mortgage

Lets say your ideal home is worth £225,000 and youre able to put up a £25,000 deposit. For a £200,000 mortgage youll need to earn a minimum of £44,500, though to be more comfortably offered this level of mortgage youd probably need to earn closer to £50,000 or above. Its also worth noting that this mortgage would equate to a loan-to-value of 88.9% in this scenario, which means first-time buyer mortgage dealswould be your best bet.

Need to work out your LTV, use our LTV calculator.

How Much Mortgage Can I Qualify For

The 28/36 rule used by many finance experts states that your monthly mortgage payment shouldn’t be higher than 28% of your gross monthly income. Your total debt shouldn’t exceed 36% of your monthly income.

ð¡ Gross income = How much you make before taxes and deductions.

Many lenders use this rule too. They want to see housing expenses below 25â28% of your monthly pre-tax income and a total debt-to-income ratio below 33â36%.

Don’t Miss: What Is A Good Fixed Mortgage Rate

The Importance Of The 28/36 Rule

In real estate investing, there is what’s called the 28/36 rule. This rule is a guideline that states that you should not spend more than 28% of your gross monthly income on housing expenses, and no more than 36% on all debts combined. When you read “I Make $70,000 a Year. How Much House Can I Afford?” article, you will learn that this rule is what lenders will use to determine what mortgage you qualify for.

According to this rule, your monthly income before taxes should be at least three times the amount of your proposed monthly mortgage payment. To calculate it, divide your yearly salary by 12. So, if you make $70,000 a year, it comes out to $5,833 per month. Therefore, your monthly mortgage payment should typically be no more than $1,633-$5,833 x 0.28.

The main reason this rule exists is that, if you’re spending more than 28% of your income on housing, it could become difficult for you to afford other important things, like food, clothes, transportation, and healthcare. Additionally, if your total debt payments exceed 36% of your income, you may have a hard time qualifying for a home loan or getting approved for a mortgage.

So, before you start looking for a home for sale, make sure you understand all the components of the 28/36 rule. This way, you can be sure that you’re looking for a home within your budget.

Average Salaries In The Usa

The average salary in the USA stood at $51,168 in 2020, says a report compiled by Indeed.com, one of the biggest job boards in the world. This salary is higher by 5.1 per cent compared to 2019.

The average salary was calculated on the basis of those in various US states drawn by an estimated 111.5 million persons working 52 weeks a year. While in some states, the salary could be higher than this amount, in some, it can be lower too.

Recommended Reading: How Do You Assume A Mortgage

How Much House Can I Afford

Financial experts suggest that rent or mortgage payments should account for between 25% and 33%, or , of your monthly gross income. Before taxes and other withholdings, the average person who makes around $70,000 a year will take home around $5,800 each month.

Monthly mortgage payment of $1,450 would fall within this range because its 25% of the persons take-home pay . Using the rule, the ideal monthly payment should be a little under $2,000. If you can afford to pay 40% of your gross income on mortgage payments, you could afford a $2,300 monthly mortgage payment.

How To Calculate Your Home Affordability

There are several methods for figuring out your home affordability. The easiest way is to enter your information into our calculator above. Our home affordability calculator works with either your debt-to-income ratio or your proposed housing budget.

For the first method, youll need your gross monthly income and monthly debts for the second, youll need your desired monthly payment amount. Both methods will require your down payment amount, state, credit rating, and home loan type.

Once youve input all the information according to the method you chose, our calculator will let you know the maximum amount you can pay for a house, as well as your estimated monthly payment.

Also Check: Can A Cosigner Be Removed From A Mortgage

How Much Home Can I Afford

Purchasing a home is a decision that will impact your financial situation for the next 15 to 30 years. Its important to calculate your monthly income and expenses carefully to avoid winding up with a mortgage loan you cant pay in the long run.

And, if youre ready to buy, visit our best mortgage lenders page to find the right lender for you.

How much house you can afford will mainly depend on the following:

- Your loan amount and mortgage term

- Your gross monthly and annual income

- Your total monthly debt or monthly expenses, including credit card debt, student loan payments, car payment, child support, and other expenses

- State property taxes, which are paid annually or biannually and vary by state

- Current mortgage rates and closing costs, which vary by location

- Homeowners association and condo fees

Generally, most new homebuyers will consider taking out a conventional mortgage loan. These loans typically require a down payment of no less than 3% of the property value, a minimum credit score of 620, a debt-to-income ratio of 36% and that the monthly payment doesnt exceed 28% of the buyers pre-tax income.

Lenders will also look at a buyers ability to deal with all the fees and upfront costs associated with buying a home, such as closing costs and insurance fees.

I Make $70k A Year Whats My Max House Payment

Personal finance experts recommend spending between 25% and 33% of your gross monthly income on housing.

Someone who earns $70,000 a year will make about $5,800 a month before taxes.

- One-fourth rule: Spending 25% of $5,800 on housing would mean a total monthly payment of about $1,450

- One-third rule: Spending 33% of that $5,800 on housing would put the payment right under $2,000 a month

- Even more: If you could afford to spend 40% of your income on housing expenses, youd have a $2,300 monthly mortgage payment

Of course, your monthly payment is only half the equation. Next, well estimate how much house you can afford based on your monthly budget.

You May Like: Should You Apply For Multiple Mortgage Loans

Maximum Amount Of Salary For Mortgage

A maximum of 43 per cent of your salary can be paid towards the mortgage, according to the rules of the Consumer Finance Protection Bureau. This means that if youre earning $70,000 a year, you can pay a maximum of $30,100 per year for your mortgage. This leaves you with $39,900 per year for household expenses.

All these amounts are before taxes. This means youll have to deduct the amount of taxes youre paying every year from the $70,000 income to arrive at the exact figure. Understandably, this would be lesser than the amounts that I mentioned above.

Read: Renting Vs. Buying a House

Mortgage Required Income Calculator

The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit a mortgage payment plus your other debts to a certain percentage of your monthly income, which can be approximately 41%.

The amount a borrower agrees to repay, as set forth in the loan contract.

Recommended Reading: How Much Mortgage On 200k

How Does The Home Loan Borrowing Calculator Work

A home loan borrowing calculator takes several important factors into account to determine your borrowing capacity or which size loan you may be eligible for.

The calculator takes into account your annual income and any other income which is then compared against your outgoing monthly expenses, number of dependents, any debt and other financial commitments.

You can then adjust the interest rate and loanterm on the calculator to see how it would affect your borrowing capacity whichwould help to determine what type and size of loan would suit your budget andincome.

Its important to note that our borrowing calculator does not factor in interest rate fluctuations which are inevitable at some point over the 25-30 year term of your loan.

How Your Payment Affects Your Price Range

Some mortgage calculators dont factor in all the costs included in your monthly payment. This can give you an unrealistic estimate of how much house youre able to afford based on your household income.

The reason? You have a set monthly budget, and when your other homeownership costs are higher, theres less of that budget leftover for your house itself. In turn, this reduces how much house you can afford.

To get a more accurate estimate of your home buying budget, use a mortgage calculator with taxes, insurance, and PMI included.

Also remember to factor in monthly living expenses like cell phone bills, internet bills and utilities. Lenders dont look at these when determining your eligibility. But theyll impact your monthly budget and how affordable your mortgage is.

Or, talk to a lender. They can give you a free mortgage loan estimate with the most accurate number based on your finances and current mortgage rates.

Recommended Reading: Why Pay Additional Escrow On Mortgage

Work With A Financial Advisor

A financial advisor can help you understand what type of loan would be best for your situation and guide you through the application process.

With these tips, you should be well on your way to taking out a loan for your home purchase. Just remember to shop around and compare different options before making a decision.