How Can You Improve Your Debt

Improving your debt-to-income ratio can significantly improve your chances of getting a mortgage and a lower interest rate. This can add up to a lot of money saved over time. Thankfully, your debt-to-income ratio isnt set in stone. You can do a few easy things to improve your ratio before you apply for a mortgage.

To start, take a hard look at all your monthly debt payments. Reducing your monthly debt will lower your minimum payments and your debt-to-income ratio. Start with your high-interest credit cards. Make a plan for paying these down. Even a little more than your minimum payment will help. You should also avoid using these cards if you can. The less you spend on them, the less debt youll have.

Next, take a look at the smaller debts you have. This refers to small student loans or credit card bills you have. It can really help you lower your debt-to-income ratio and boost your credit score if you can pay these off. This means fewer monthly debt payments and more money saved on interest each month. Make a plan to cut spending in other places to make this a reality. Anything extra you can spare will help reduce your debt and debt-to-income ratio. This will help you qualify for a mortgage, get a better interest rate, and get into the home you want.

What Is An Automated Underwriting System

Themortgage underwriting processis almost always automated using an Automated Underwriting System . The AUS uses a computer algorithm to compare your credit score, debt and other factors to the lender requirements andguidelines of the loanyou’re applying for. While lenders use to manually underwrite loans, only a few do so today and usually only under a few special circumstances like:

- If you do not have aFICO scoreor credit history

- If you’re new to building credit

- If you’ve had financial problems in the past like a bankruptcy or foreclosure

- If you’re taking out ajumbo loan

Pros And Cons Of This Metric

The biggest advantage to using the rent-to-income ratio is that it is easy to calculate for both the landlord and prospective tenants. If the tenants know they dont have enough income to qualify for the rental, they wont spend money on the application fee or waste the landlords valuable time.

On the other hand, the rent to income ratio measures a tenants ability to pay the rent, but not necessarily their willingness to pay in full and on time.

Sometimes, renters with lower income levels are much more conscientious about paying the rent than are higher wage earners. In some cases, lower income renters believe they have nowhere else to go, so they do their best to pay their rent on time and to take good care of the home they are living in.

Also, the RTI ratio doesnt take into account the fact that in many markets rents are rising faster than income levels are. In Miami, for example, the RTI is nearly 47% based on the median market rents and median household income levels.

Read Also: Rocket Mortgage Vs Bank

Dti Ratio And Home Equity

DTI ratio affects how much of your home equity you can access. In addition to loan-to-value and combined loan-to-value ratios, lenders will consider your DTI when you apply for a home equity loan or line of credit.

Home equity loans have more stringent requirements than mortgages. Borrowers must have a 43% DTI or lower to qualify, in most cases, and some lenders may even require DTIs as low as 36%. Here are some examples:

- Because of the stricter requirements for home equity loans, Quicken Loans recommends that potential borrowers maintain a DTI of 43% or lower.

- Veterans United does not impose a maximum DTI ratio for Veterans and military members. However, those with a DTI above 41% may encounter additional financial scrutiny.

- Rocket Mortgage will not offer home equity loans to anyone with a DTI higher than 43%.

Real World Example Of The Dti Ratio

Wells Fargo Corporation is one of the largest lenders in the U.S. The bank provides banking and lending products that include mortgages and credit cards to consumers. Below is an outline of their guidelines of the debt-to-income ratios that they consider creditworthy or needs improving.

- 35% or less is generally viewed as favorable, and your debt is manageable. You likely have money remaining after paying monthly bills.

- 36% to 49% means your DTI ratio is adequate, but you have room for improvement. Lenders might ask for other eligibility requirements.

- 50% or higher DTI ratio means you have limited money to save or spend. As a result, you won’t likely have money to handle an unforeseen event and will have limited borrowing options.

Recommended Reading: Rocket Mortgage Payment Options

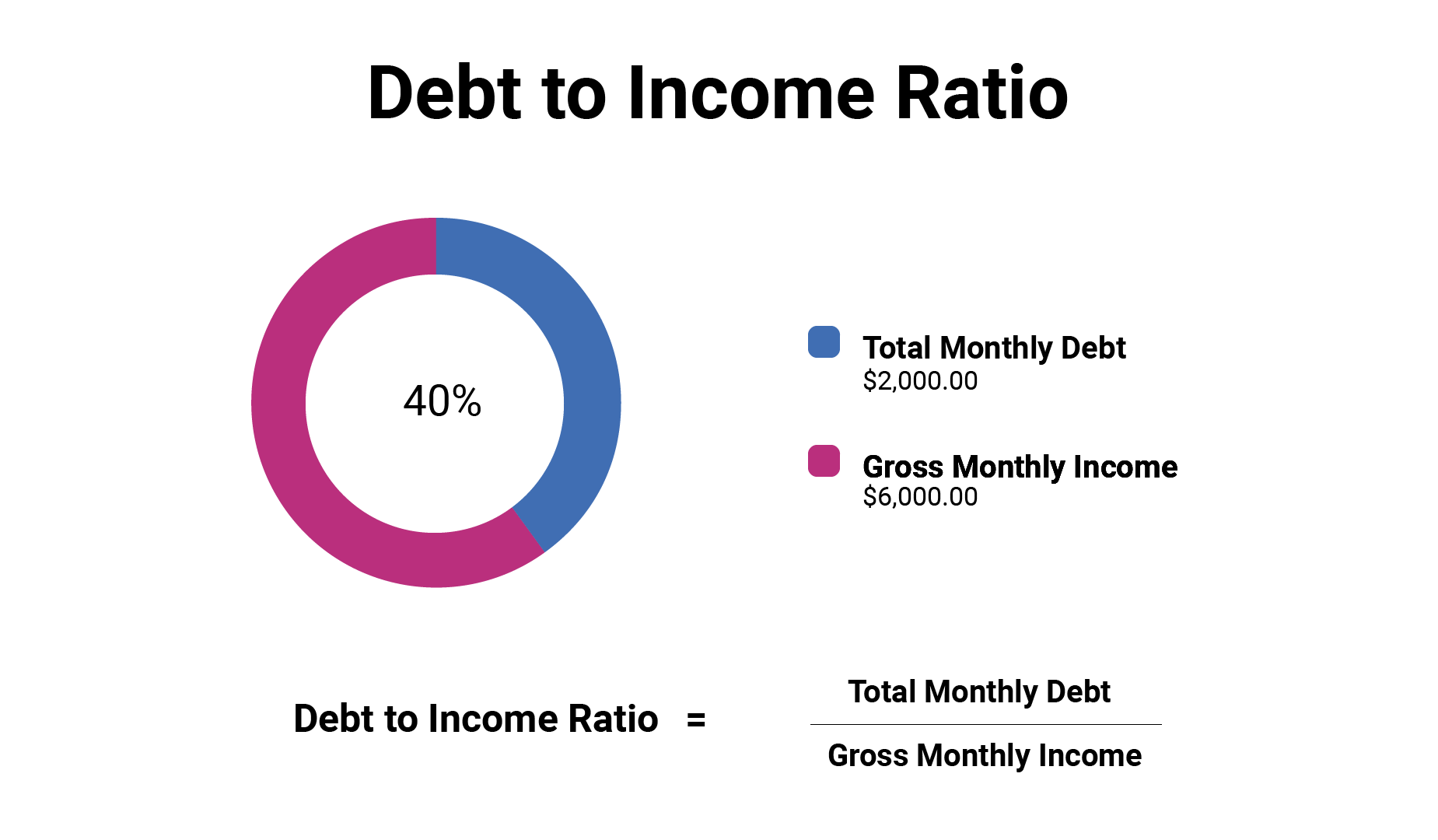

How To Calculate Your Debt

To calculate your debt-to-income ratio, add up your recurring monthly debt obligations, such as your minimum credit card payments, student loan payments, car payments, housing payments , child support, alimony and personal loan payments. Divide this number by your monthly pre-tax income. When a lender calculates your debt-to-income ratio, it will look at your present debt and your future debt that includes your potential mortgage debt burden.

The debt-to-income ratio gives lenders an idea of how youre managing your debt. It also allows them to predict whether youll be able to pay your mortgage bills. Typically, no single monthly debt should be greater than 28% of your monthly income. And when all of your debt payments are combined, they should not be greater than 36%. However, as we stated earlier, you could get a mortgage with a higher debt-to-income ratio .

Its important to note that debt-to-income ratios dont include your living expenses. So things like car insurance payments, entertainment expenses and the cost of groceries are not included in the ratio. If your living expenses combined with new mortgage payments exceed your take-home pay, youll need to cut or trim the living costs that arent fixed, e.g., restaurants and vacations.

Know How Much House You Can Afford

Terri Williams is an expert in mortgages, real estate, and home buying. As a journalist she’s covered the “homes” corner of personal finance for more than a decade, with bylines in scores of publications, including Realtor.com, Bob Vila, Yahoo, Time/Next Advisor, The San Francisco Chronicle, Real Homes, and Apartment Therapy.

The 28/36 rule of thumb is a mortgage benchmark based on debt-to-income ratios that homebuyers can use to avoid overextending their finances. Mortgage lenders use this rule to decide if theyll approve your mortgage application.

Heres how the 28/36 rule of thumb works, as well as what it includes and excludes, plus example calculations and some caveats for using the rule.

Don’t Miss: Can You Refinance A Mortgage Without A Job

Why Is Dti Important In Personal Finance And Loans

Lenders want to know the percentage of your gross monthly income that goes to paying your monthly debt payments because they use it to determine how risky you are as a borrower as well as the monthly payments you can afford and rates for which you may be eligible. The lower your debt-to-income ratio, the better, because lenders use your DTI to calculate your interest rates and terms.

How Do You Calculate Your Debt

Now that you know what a debt-to-income ratio is, how do you go about calculating it? Thankfully, it is a fairly simple process and shouldnt take you that long at all to figure out. It is calculated by dividing the debt payments you make each month by how much money you make each month, the number is normally presented as a percentage.

For example, if you make $4,000 a month and have debt that includes a $1,000 mortgage payment and a $500 car loan payment, you will have a debt-to-income ratio of 37.5%. So, the calculation we made for that was $1,500 divided by $4,000 . We got .375, and then we turn that number into a percentage and get 37.5%!

But the question you are probably asking is what does that number mean? If you have a low DTI ratio, you have a good balance between debt and income and are in no real danger of not being able to keep up with your debt, even if an emergency comes up. However, if you have one that is high, it can sometimes signal that you are carrying too much debt for how much money you are making. Also, having a high DTI ratio can simply make it hard for you to pay bills every month with so much of your income going to your debt payments.

Is your car loan payment worth more than your car? Heres what to do.

What is a Good Debt-to-Income Ratio?

Interested in getting serious about paying down your debt? Check out this infographic.

Read Also: Chase Mortgage Recast Fee

Speak To A Mortgage Expert About Debt

If you have questions and want to speak to an expert for the right advice, make an enquiry.

The expert brokers we work with are whole-of-market, meaning that they can find the best deals for you from a wide selection of mortgage lenders.

We dont charge a fee, theres no obligation to invest, and there are no marks made against your credit rating.

Ask a quick question

We know everyone’s circumstances are different, that’s why we work with mortgage brokers who are experts in all different mortgage subjects.Ask us a question and we’ll get the best expert to help.

Onlinemortgageadvisor.co.uk is an information website all of our content is written by qualified advisors from the front line, for the sole purpose of offering great, relevant, and up-to-date information on all things mortgages.

Online Mortgage Advisor is a trading name of FIND A MORTGAGE ONLINE LTD, registered in England under number 08662127. We are an officially recognised Introducer Appointed Representative and can be found on the FCA financial services register, number 697688.

The Financial Conduct Authority does not regulate some forms of buy to let mortgage.

Think carefully before securing other debts against your home. As a mortgage is secured against your home, it may be repossessed if you do not keep up with repayments on your mortgage.

Maximise your chances of approval, whatever your situation. Find your perfect mortgage broker

Fannie Mae Highltv Refinance Option

Customers with an existing Fannie Maebacked mortgage might be able to refinance using the HighLTV Refinance Option . This program is specifically designed to help homeowners with a high loantovalue ratio refinance into a lower mortgage rate.

Theres no debttoincome check or credit check required to qualify for Fannie Maes refinance option. However, if you own a singlefamily home, your loantovalue ratio must be over 97%.

Fannie Maes HLRO is a replacement for the popular HARP , which ended in 2018.

Also Check: Reverse Mortgage Manufactured Home

How Much Should My Mortgage Be In The Real World

All this math can come across as a bit theoretical. And your goal when deciding on your mortgage amount should be more practical. You want a loan that will fit neatly within your lifestyle, needs, and ambitions.

The fact that a lender will give you $x amount because of your DTI, credit score, down payment, and personal finances doesnt necessarily mean you should borrow $x amount.

Yes, most of us borrow up to the maximum were allowed. But that doesnt mean you should.

What are your spending priorities?

It all depends on your lifestyle and priorities. Suppose you love foreign travel or gourmet eating or sailing or shopping. Borrowing the max amount might mean youre sacrificing other luxuries for years to come.

It could be best to settle on a more modest home and a smaller mortgage if that allows you to maintain your current lifestyle.

How secure is your income?

You should also bear in mind how secure your earnings are.

You likely dont want to be saddled with the biggest mortgage possible if youre in a job where firings are commonplace or if you plan to change jobs soon and youre not sure youll earn the same amount.

Lenders have these questions in mind, too. Thats why they typically want to see two years employment history on your mortgage application. They also want to know any income youre using to qualify for the loan will continue for at least three years.

How To Calculate Your Dti

We talked a lot about debttoincome ratios in this article. Knowing yours is key to learning how much house you can afford.

So, in case you were wondering, heres how you can calculate your own DTI ratio for mortgage qualifying.

First, add up all the monthly expenses included in your DTI:

- Estimated monthly housing expenses

- Minimum credit card payments

- Obligations like alimony and child support

Next, you need to know your gross monthly income.

Remember, thats the highest figure on your pay stub, before deductions for tax and so on. If your income varies considerably perhaps seasonally use an average over the last year or two.

Now, divide the first figure by the second .

Federal regulator the Consumer Financial Protection Bureau gives an example:

If you pay $1,500 a month for your mortgage and another $100 a month for an auto loan and $400 a month for the rest of your debts, your monthly debt payments are $2,000.

If your gross monthly income is $6,000, then your debttoincome ratio is 33 percent.

If you use a calculator, youll need to multiply the result by 100 to get a percentage. So your display says 0.3333 but your DTI is 33.33% .

Don’t Miss: Does Prequalifying For A Mortgage Affect Your Credit

The Va Interest Rate Reduction Refinance Loan

The is another refinance program which waives traditional home loan DebttoIncome requirements. Similar to the FHA Streamline Refinance, IRRRL guidelines require lenders to verify a strong mortgage payment history in lieu of collecting W2s and pay stubs.

The VA Streamline Refinance is available to military borrowers who can show that theres a benefit to the refinance either in the form of a lower monthly payment or a change from an ARM to a fixedrate loan.

What Is My Mortgage

If you have more debt, you might struggle to keep your DTI low while also paying off a mortgage. In this case, it can be useful to work backward before you decide on a percentage of income for your mortgage payment.

Multiply your monthly gross income by .43 to determine how much money you can spend each month to keep your DTI ratio at 43%. Youll then subtract all of your recurring, fixed monthly debt obligations and minimum payments on credit cards and other lines of credit. The dollar amount you have left after subtracting all of your debts lets you know how much you can afford to spend each month on your mortgage.

Lets take a look at an example. Imagine that your household brings in $5,000 in gross monthly income. Your recurring debts are as follows:

- Rent: $500

- Minimum student loan payment: $250

- Minimum credit card payment: $200

- Minimum auto loan payment: $200

- Homeowners association fees: $100

In this example, your total monthly debt obligation is $1,250.With quick math, we find that 43% of your gross income is $2,150, and your recurring debts take up 25% of your gross income. This means that if you want to keep your DTI ratio at 43%, you should spend no more than 18% of your gross income on your monthly payment. Use a mortgage calculator and your estimated monthly payment to calculate how much money you can borrow and stay on budget.

Don’t Miss: Does Rocket Mortgage Sell Their Loans

How To Determine The Percentage Of Income For Mortgage

When you purchase a home, its vital to know what percentage of your income will be saved for your mortgage . Housing ratios and debt-to-income ratios are ways of calculating the percentage of gross income for mortgage payments and who qualifies for mortgage loans. Debt to income ratios work using the 28/36 rule , which well explain in detail later in this post.

What is the housing ratio? Simply put, the housing expense ratio is a ratio that compares your pre-tax income to housing expenses on the real-estate market. Lenders use this calculation when they decide who will qualify to borrow for a loan.Understanding what percentage of your monthly income should go to your mortgage payments can help you budget and live comfortably. Nobody wants to be house poor, struggling to make ends meet in order to make mortgage payments.

If youre wondering what is another term for housing ratio ? Its sometimes referred to as the front-end ratio as it is a partial component of a borrowers total debt-to-income. Therefore, it should be considered early in the underwriting process for a mortgage loan.

Dont worry, well be explaining front-end ratios, back end ratios, gross income, net income, and mortgage percentage payments as you read on. We will follow this up with some essential guidelines for obtaining an affordable mortgage.

But first, lets answer a fundamental question:

Comparing Frontend Vs Backend Ratios

Now that you have your average monthly income you can use that to figure out your DTIs.

- Front end ratio is a DTI calculation that includes all housing costs As a rule of thumb, lenders are looking for a front ratio of 28 percent or less.

- Back end ratio looks at your non-mortgage debt percentage, and it should be less than 36 percent if you are seeking a loan or line of credit.

Also Check: Can You Do A Reverse Mortgage On A Mobile Home

How To Calculate Your Income

Calculate your monthly income by adding up income from all sources. Start with your base salary and add any additional returns you receive from investments or a side business, for example. If you receive a year-end bonus or quarterly commissions at work, be sure to add them up and divide by 12 before adding those amounts to your tally.

Don’t Forget Your Spouse!

Your spouse’s income is also included in your income calculation provided you are applying for the loan together.

What if Your Spouse Has Poor Credit?

If one spouse has poor credit and the other buyer would still qualify without including their spouse on the loan, then it can make sense to have the spouse with better credit apply for the mortgage individually. If the spouse with poor credit is included on a joint application the perceived credit risk will likely be higher. Bad credit mortgages charge higher interest rates.