Do Both Owners Names Need To Be On A Mortgage

No you can have only one spouse on the mortgage but both on title. Both owners of the home, typically being spouses listed on the deed, do not have to both be listed on the mortgage. Remember that the mortgage does not indicate who the owner of the home is, so not being listed on the mortgage will have no effect on your ownership of the home.

In certain situations, having one spouse on the mortgage and both on the deed is ideal. This is oftentimes the case where one spouse has very poor credit, such that listing that spouse on the mortgage will result in a much higher interest rate than simply listing the other spouse alone. Listing only one spouse on the mortgage may save significant interest over the long term.

There are numerous other reasons to list only one spouse on a mortgage. Common reasons include:

- Income Requirements If including both spouses would cause the couple to fail the income requirements, perhaps because he or she has not had an income in the past few years, that spouse may be best left off the loan application.

- Timing It is oftentimes quicker to approve one spouse on a loan than both when time is of the essence.

- Limiting Credit Score Impact If there is a foreclosure and only one spouse is listed on the mortgage, only his or her credit score will be affected.

- Pending Divorce The spouses are pending divoce and one wishes to buy a home without the other.

Will I Have To Pay Stamp Duty

In some cases, stamp duty is not payable when a partner is added to a property title. This includes married, de facto and same sex couples. To get this exemption, youll need to fill out an exemption form, which is available from your state office of revenue.

There are a number of conditions you need to meet to qualify for this exemption, and these can change from state to state. As mentioned above, always check with your lender before carrying out any transfer of title or mortgage.

More helpful guides on property ownership and titles

Read Also: How Much Usda Mortgage Can I Qualify For

Who Is Responsible For What

When you take out a home loan, you, as the borrower, assume the responsibility of paying the loan back in full and on time. Your monthly mortgage payment will include principle, interest, taxes, and insurance. Taking out a loan and making payments affects your credit. If you make late payments or miss payments, your credit will be negatively effected, and vice versa.

A co-borrower is basically a co-owner and the borrowers equal in the mortgage loan process. The co-borrower is just as responsible as the borrower is for repaying the full loan amount on time.

A co-borrower assumes the same credit risk as the borrower.

If the mortgage payments arent made on time, it will hurt the credit scores of both borrowers. If theyre made correctly, it will benefit both scores.

Don’t Miss: Can You Get A Mortgage If You Have Debt

How Can I Buy A House Without A Co

Buyers who qualify for financing can purchase a house without a co-signer. Using a variety of online tools, homebuyers might be able to determine their buying power. Buyers can contact credit union representatives, bankers and mortgage companies to apply for a home loan. A loan officer can review a buyers qualifications for a home loan.

Read Also: What Is Mortgage Insurance Vs Homeowners Insurance

Can One Spouse Be On The Mortgage But Both On The Title

If the main reason for purchasing a house in your own name is to have a cheaper mortgage, or to qualify for a mortgage, you can always add your significant other to the homes title after the loan is finalized. This would officially make you co-owners of the home.

Just note, the person on the mortgage loan is solely responsible for repayment.

The co-owners name listed on the title does not give them any legal responsibility to help with mortgage payments. And in the event of a foreclosure, only the spouse whose name is on the loan will have their credit damaged.

Keep in mind that if you ever refinance or sell the home, you will need consent from the co-owner.

Read Also: Can I Refinance My Mortgage With No Closing Costs

Can I Add My Spouse To My Mortgage Without Refinancing

Yes, you can add your spouse to your mortgage without refinancing, and the process can be a helpful way to tap into home equity or increase your borrowing power.

When adding your spouse or partner to your mortgage, there are several things you should keep in mind. For one, adding someone to a mortgage typically involves refinancing your existing loan.

One of the first steps in this process is to speak with your lender about whether they will allow you to add another person to your mortgage. This can depend on several factors, including the amount of debt you currently have and your credit history.

If your lender is willing to approve this change, you must prepare certain documents, such as proof of income and employment for yourself and your spouse. You may also need to provide information about any assets you own jointly with your partners, such as bank accounts or investments.

Once these documents have been submitted, it will be necessary for you and your spouse to sign the new loan documentation. This typically involves having lenders re-assess your eligibility for a mortgage based on the combined incomes and debts of both spouses or partners involved in the transaction.

Adding a spouse or partner to your mortgage can be a valuable way to tap into home equity or increase your borrowing power. However, you must approach this process carefully and do due diligence before making significant financial decisions about your home.

Prepare A New Deed To Avoid Probate

Ideally, you won’t just “add” your child’s name to your existing deed. Instead, you’ll create a new deed with a group of owners, perhaps you, your spouse, and your child. You’ll become joint tenants with rights of survivorship.

If you simply add your child’s name to your existing deed, they won’t necessarily have rights of survivorship. They won’t automatically inherit your share of the property when you die. Adding the name only gives them an ownership interest in the house both currently and in the future, while your ownership interest would still be subject to probate.

Creating a whole new deed with rights of survivorship sidesteps this problem. “Survivorship” means that when one owner dies, their share of the property shifts by law to the owner or owners who survive them.

Read Also: How Long Can You Go Without Paying Mortgage Before Foreclosure

Drawbacks Of Having Only One Spouse On The Mortgage

There are a couple of reasons it may be best to have both spouses name on a new mortgage application:

If both spouses have comparable credit and shared estate planning, it often makes sense to use a joint mortgage application. Thats because leaving a creditworthy spouse off the mortgage can sharply decrease your borrowing power.

Dont Miss: How Much Would An 85000 Mortgage Cost

Would Selling A House Work To Remove A Name From The Mortgage

Finally, in many situations involving a divorce, the couple may decide that neither one of them wants to keep the home, there is always the option of selling the home. This would essentially remove all parties obligations to the mortgage. If the mortgage is considered underwater, a short sale may be necessary to move the property. However, the short sale can significantly impact your credit score, and there are times loan companies request that you pay the difference between the short sale and the balance of the loan.

Don’t Miss: What Is A Mortgage Holder

Get A Free Consultation If You Have More Questions About Mortgages Title And Homeownership

Distinguishing between homeownership and liability under a mortgage can be difficult, especially for homeowners who do not buy and sell real estate frequently. There are many advantages and disadvantages to the different ownership structures.

At the Moshes Law, P.C. we are proficient in real estate titling and conveyances. If you have a question regarding ownership of your home or the best approach to take on a future purchase, one of our experienced real estate attorneyswould love to help you.

Can A Family Member Be Added To A Reverse Mortgage

Can a Family Member Be Added to a Reverse Mortgage?

People seem to enjoy making additions of one sort or another. Homeowners might add an extra bedroom to accommodate visiting in-laws. Golfers might add a solo player to complete a foursome. Or magicians might add a routine to improve their act.

Unfortunately, however, you cant add a family member to an existing reverse mortgage. Lets look at some specific questions and scenarios to further illustrate this point.

Don’t Miss: What Is The Minimum Down Payment Required For A Mortgage

Can I Remove Someone From My Mortgage

The desire to remove someone from a mortgage is unfortunately as common as adding someone to a mortgage.

Relationships break down and people can find themselves trapped in financial agreements with an ex-partner they no longer want to be associated with.

It is common for one person to move out of the property and the other to wish to buy out the others share.

There are two ways of removing someone from a mortgage and they are the same as adding someone.

You can approach your lender and ask for someone to be removed however this is not likely to succeed as lenders are loath to release people of their financial commitments to them.

In rare cases, your lender may assist you with this.

The other way is to remortgage. This poses problems for many though for a number of reasons:

- When you initially got the mortgage the affordability calculation would have been conducted on two peoples income. When you remortgage to remove someone, you will need to pass the affordability calculation on your own.

- You will need to have enough equity in the property to cover a deposit and also have enough funds in the loan to repay the party youre removing from the property which can lead to additional costs.

- The UK housing market is now cooling and property prices are stagnating, potentially reaching pre-pandemic levels. This means you could find that youre unable to remortgage due to negative equity or will have to put more money down to achieve your goal.

Add Beneficiary To Mortgage

Another instance that inspires adding a name to a mortgage is if youre considering what will happen after youre gone. It only becomes more complicated when you realize the many things that can happen to a home after someone dies. You dont need to add an heir to your mortgage before you die since it will usually automatically transfer to your heirs. However, if you have unpaid debts, your creditors may come after your estate to pay those debts.

Adding someone to a mortgage without refinancing could seem like a viable option to ensure your house ends up in the hands of a child or spouse. Since lenders wont do that, it may be wise to refinance the loan in both your names before you die. You can also consider simply deeding the home to your beneficiary in your will, although its important to note whatever choice you make, your heirs should refinance the loan in their names to take over the mortgage.

Read Also: How To Write A Hardship Letter For Mortgage Modification

Why Do You Want To Add A Co

Apart from just sharing the responsibility, some people may want to share the ownership of the property with other people. The person could be anyone, your spouse, child, parent, or friend. Instead of adding this person as a co-borrower, you can add this person to your mortgage deed. This is because when you give someone a share of your property, you may also want them to share your loans or debts. The person may even agree to it, but there has to be proof of this agreement to make the other person obligated towards the repayment. This is why adding the co-borrowers name to the mortgage is considered better.

But adding a co-borrower to a mortgage is not a piece of cake. One has to pay a fee and add the name to a deed. Some situations may restrict adding a co-borrower, while some may assert you to the co-owners name as a co-borrower.

Ways To Hold The Title

The way the names appear on the title affects ownership interest and how the property is transferred upon a co-owners death.

- Joint Tenancy means two or more individuals own the home together. An owners interest automatically passes to the surviving owner upon death.

- Tenants in Common allows two or more individuals to each** **have a separate, undivided interest in the home. There are no survivorship rights, so the owners can designate beneficiaries to receive their shares of the home upon death. If there are no designated beneficiaries in the will, the court determines which of the decedents heirs receive the share of the home based on the states laws.

- Community Property is a form of** **joint tenancy only available to married couples in community property states. Each spouse owns half the home and can will their shares to anyone they choose.

- Tenancy by the Entirety is another form of ownership reserved for married couples. Not all states recognize it. Each spouse owns half of the property and can only sell or transfer ownership with the others consent. The surviving spouse receives the decedents share of the property upon death.

You May Like: Why Reverse Mortgages Are A Bad Idea

Things To Know Before Adding Someone To The Deed

Disclaimer: This site contains affiliate links from which we receive a compensation . But they do not affect the opinions and recommendations of the authors.

Wise Bread is an independent, award-winning consumer publication established in 2006. Our finance columns have been reprinted on MSN, Yahoo Finance, US News, Business Insider, Money Magazine, and Time Magazine.

Like many news outlets our publication is supported by ad revenue from companies whose products appear on our site. This revenue may affect the location and order in which products appear. But revenue considerations do not impact the objectivity of our content. While our team has dedicated thousands of hours to research, we arent able to cover every product in the marketplace.

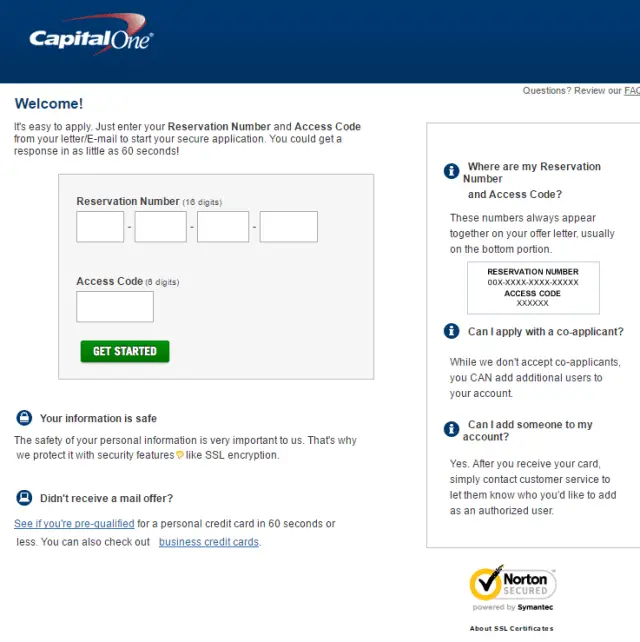

For example, Wise Bread has partnerships with brands including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi, Discover, and Amazon.

Sharing is caring at least thats what has been drilled into our minds. And for the most part, its true.

Here are five things you should consider before adding someone to your deed.

Do You Need To Pay A Transfer Tax On A Title Deed When Adding A Name

Transfer taxes will depend on where you live and if the transfer of the deed is a sale, such as if you were selling your home. If you’re adding a name to a deed, but not selling the home to this other person , you may be exempt from paying a transfer tax. If you’re not sure, consult a real estate lawyer and/or your county or state’s recorder of deed’s office.

Also Check: What Happens If You Pay Your Mortgage Twice A Month

Can I Add Someone To My Mortgage Without Refinancing

Yes, you can add someone to your mortgage without refinancing. In that case, you need to submit a new mortgage loan application and provide information about the co-borrower related to the co-borrowers employment status, credit scores, and any existing debts.

When considering refinancing your mortgage to add a co-borrower, its essential to consider the costs associated with this process. These costs can include an appraisal of your home and closing costs, typically ranging from 2-5% of your total loan balance. Additionally, some lenders may allow you to finance these costs into your loan balance, so you wont have to pay them upfront.

While adding a co-borrower can benefit certain situations, some potential downsides should also be considered. For example, adding a new person to the mortgage will increase your monthly payments and may also increase the overall length of the loan term. This could mean that you pay more interest over time and may even extend the size of your mortgage beyond what you originally planned.

Overall, its essential to consider all the costs and benefits of refinancing your mortgage to determine whether adding a co-borrower is right for you. Suppose you decide that adding a co-borrower is the right decision for your situation. In that case, choosing a lender with experience working with joint loans is essential to navigating this process smoothly without any significant setbacks or complications.

Can I Get A Joint Mortgage With My Parents

Buying TogetherIf your parents are still working, you could take out a joint mortgage. This means both names are on the deeds and both you and your parents are responsible for the mortgage payments. A joint mortgage should make it easier for you to get a mortgage and borrow a larger sum than you would otherwise.

Also Check: Does It Make Sense To Pay Points On A Mortgage

Remortgaging To A Joint Policy

Another option is to remortgage and apply for a joint mortgage, this will essentially entail signing up for an entirely new mortgage policy.

If youre not tied into the fixed-term with your current lender, then remortgaging should be relatively straightforward. You can look for a new mortgage policy either with your current lender or a new lender altogether . You can compare the market with Habito .

If you are tied into a fixed-term, then remortgaging probably wont be the best option, because youll likely be subject to early repayment charges. In this case, you could either add someone to your existing policy or wait until your fixed term expires, and then look at remortgaging to a joint mortgage.