Fixed Rate Vs Adjustable Rate

A fixed rate is when your interest rate remains the same for your entire loan term. An adjustable rate stays the same for a predetermined length of time and then resets to a new interest rate on scheduled intervals. A5-year ARM, for instance, offers a fixed interest rate for 5 years and then adjusts each year for the remaining length of the loan. Typically the first fixed period offers a low rate, making it beneficial if you plan to refinance or move before the first rate adjustment.

Calculating Your Businesss Monthly Principal Payments

If your business is dealing with loan repayments, understanding how to calculate your principal is likely to be beneficial. After all, according to a study we conducted, 21% of borrowers say that not knowing how much they need to pay is the most likely cause of their missed payments. So, how do you calculate your scheduled principal payments?

Theres a relatively complicated formula you can use, which is as follows:

a / / = p

Note: a = total loan amount, r = periodic interest rate, n = total number of payment periods, p = monthly payment).

If youre looking for an easier way to work out your principal payments, a principal payment calculator may be the way to go.

You May Like: How Is Home Mortgage Interest Calculated

What Is Your Principal Payment

The principal is the amount of money you borrow when you originally take out your home loan. To calculate your mortgage principal, simply subtract your down payment from your homes final selling price.

For example, lets say that you buy a home for $300,000 with a 20% down payment. In this instance, youd put $60,000 down on your loan. Your mortgage lender would then cover the cost of the remaining amount on the loan, which is $240,000. In this case, your principal balance would be $240,000.

Your principal is the most important factor in deciding how much home you can afford. The principal you borrow accumulates interest as soon as you take it out.

If you arent sure how much home you can afford, a good place to begin is with our mortgage calculator. Simply enter your purchase price, down payment and a few other factors. The calculator will then give you a rough estimate of your monthly mortgage payment. When deciding on a mortgage payment thats in your comfort zone, dont forget that youre also responsible for maintenance, repairs, insurance, taxes and more.

Recommended Reading: Is Mortgage Interest Rate Going Up Or Down

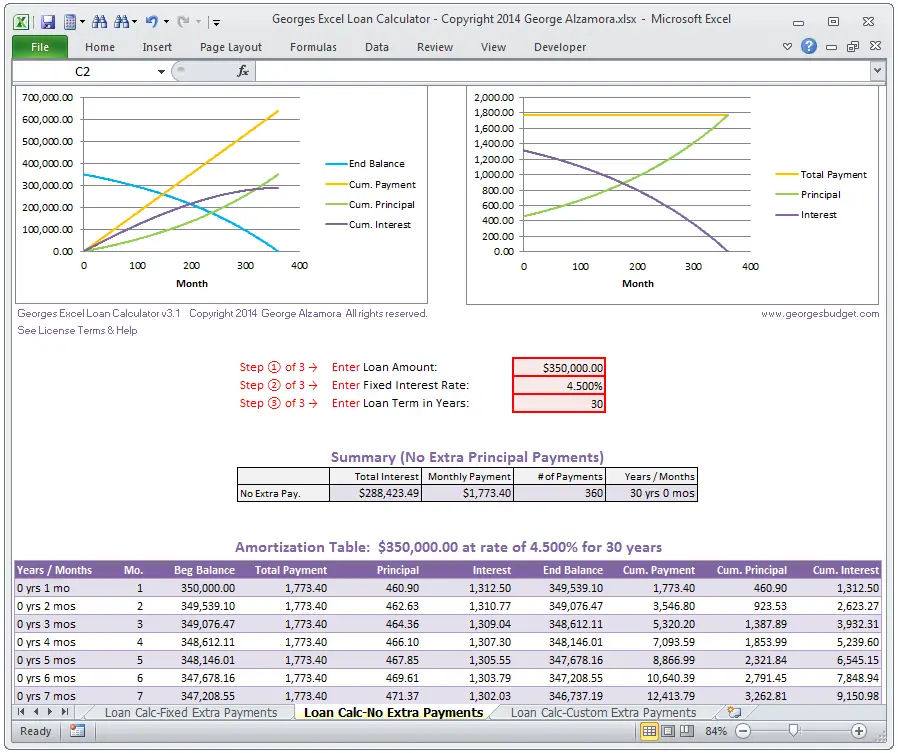

How Do You Calculate Amortization

An amortization schedule calculator shows:

This means you can use the mortgage amortization calculator to:

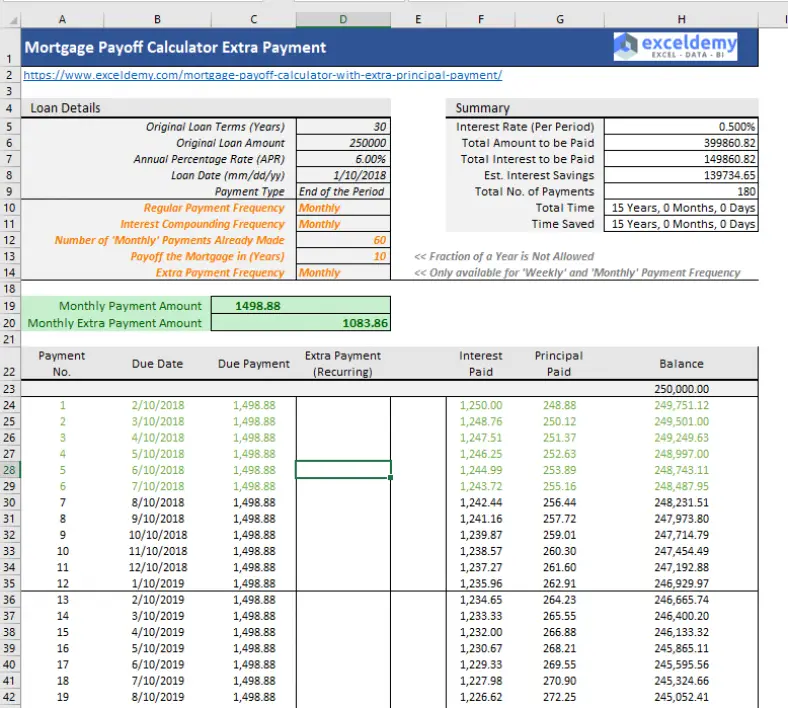

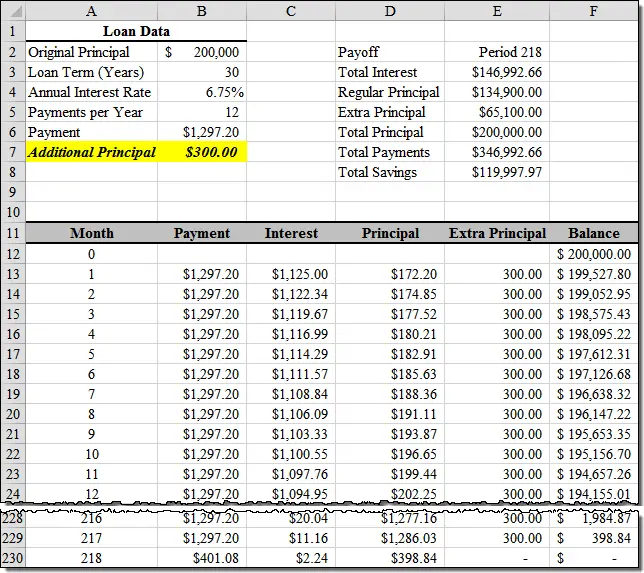

To use the calculator, input your mortgage amount, your mortgage term , and your interest rate. You can also add extra monthly payments if you anticipate adding extra payments during the life of the loan. The calculator will tell you what your monthly payment will be and how much youll pay in interest over the life of the loan. In addition, youll receive an in-depth schedule that describes how much youll pay towards principal and interest each month and how much outstanding principal balance youll have each month during the life of the loan.

How Is My Interest Payment Calculated

Lenders multiply your outstanding balance by your annual interest rate, but divide by 12 because youre making monthly payments. So if you owe $300,000 on your mortgage and your rate is 4%, youll initially owe $1,000 in interest per month . The rest of your mortgage payment is applied to your principal.

Read Also: What Are The Risks Of A Reverse Mortgage

Mortgage Calculator Principal And Interest

To calculate the savings click the Amortization Payment Schedule link and enter a hypothetical amount into one of the payment categories monthly yearly or one-time then. How to Use the Mortgage Calculator.

Free Mortgage Calculator Mn The Ultimate Selection Home Equity Loan Calculator Mortgage Amortization Calculator Home Equity Loan

How Do I Pay Off My Mortgage Early

Collecting less interest over time by paying off your mortgage early may achieve financial stability and save money in the long run. Here are some suggestions for speeding up mortgage repayment:

1. Consider a mortgage refinance

2. Increase mortgage repayments

Making additional monthly repayments is another possible option to lower your loans term and save money on interest. Consider using the early mortgage payback technique if your lender doesnt impose a fee for doing so.

Just remember to let your lender know that your additional payments should go toward principal rather than interest. Otherwise, your lender could use the payments against the planned monthly payments, which wont cost you anything.

Additionally, strive to pay off the debt early when the interest rate is the greatest. You may not be aware of it, but during the first few years, the bulk of your monthly payment goes toward interest rather than principle. The interest accumulates, meaning the total amount owed determines the interest charged monthly. Principal plus interest equals that.

3. Increase your yearly mortgage payment by one.

A yearly increase in your mortgage payment might drastically shorten the length of your loan.

Paying an additional 1/12 each month is the most cost-effective approach. You would have made the equivalent of an additional payment at the end of the year, for instance, by paying $975 a month on a $900 mortgage payment.

4. Increase your mortgage payments by one.

Also Check: How Much Is Average Mortgage Insurance

Proportion Down The Road

The reason interest makes up such a big chunk of your payments at the start is that you’re paying interest on the entire loan amount the entire principal. As you reduce the principal with each payment, the interest due declines, so you have more “room” in your monthly payment for principal.

It takes time, though a lot of time. On a 30-year loan at 5 percent interest, you have to make payments for more than 16 years before each payment includes more principal than interest. At 8 percent, it takes more than 21 years.

Consider The Cost Of Homeowners Insurance

Almost every homeowner who takes out a mortgage will be required to pay homeowners insurance another cost that’s often baked into monthly mortgage payments made to the lender.

There are eight different types of homeowners insurance, so when you buy a policy, ask the company about which type of coverage is best for your situation. The insurance policies with a high deductible will typically have a lower monthly premium.

Recommended Reading: Does It Matter What Mortgage Lender You Use

Refinance To A Shorter Term

Another option involves refinancing, or taking out a new mortgage to pay off an old loan. For example, a borrower holds a mortgage at a 5% interest rate with $200,000 and 20 years remaining. If this borrower can refinance to a new 20-year loan with the same principal at a 4% interest rate, the monthly payment will drop $107.95 from $1,319.91 to $1,211.96 per month. The total savings in interest will come out to $25,908.20 over the lifetime of the loan.

Borrowers can refinance to a shorter or longer term. Shorter-term loans often include lower interest rates. However, they will usually need to pay closing costs and fees to refinance. Borrowers should run a compressive evaluation to decide if refinancing is financially beneficial. To evaluate refinancing options, visit our Refinance Calculator.

Payoff In 14 Years And 4 Months

The remaining term of the loan is 24 years and 4 months. By paying extra $500.00 per month, the loan will be paid off in 14 years and 4 months. It is 10 years earlier. This results in savings of $94,554.73 in interest.

If Pay Extra $500.00 per month

| Remaining Term | 14 years and 4 months |

| Total Payments |

| 24 years and 4 months |

| Total Payments |

The Mortgage Payoff Calculator above helps evaluate the different mortgage payoff options, including making one-time or periodic extra payments, biweekly repayments, or paying off the mortgage in full. It calculates the remaining time to pay off, the difference in payoff time, and interest savings for different payoff options.

You May Like: Is The Payoff Amount On A Mortgage Less Than Balance

What Is Homeowners Insurance

Homeowners insurance is a policy you purchase from an insurance provider that covers you in case of theft, fire or storm damage to your home. Flood or earthquake insurance is generally a separate policy. Homeowners insurance can cost anywhere from a few hundred dollars to thousands of dollars depending on the size and location of the home.

When you borrow money to buy a home, your lender requires you to have homeowners insurance. This type of insurance policy protects the lenders collateral in case of fire or other damage-causing events.

How Do Property Taxes Work

When you own property, youre subject to taxes levied by the county and district. You can input your zip code or town name using our property tax calculator to see the average effective tax rate in your area.

Property taxes vary widely from state to state and even county to county. For example, New Jersey has the highest average effective property tax rate in the country at 2.42%. Owning property in Wyoming, however, will only put you back roughly 0.57% in property taxes, one of the lowest average effective tax rates in the country.

While it depends on your state, county and municipality, in general, property taxes are calculated as a percentage of your homes value and billed to you once a year. In some areas, your home is reassessed each year, while in others it can be as long as every five years. These taxes generally pay for services such as road repairs and maintenance, school district budgets and county general services.

Don’t Miss: Can I Have Multiple Mortgages

Year Vs 30 Year Loans

If a borrower makes an extra annual payment, the savings on interest can be quite substantial. On a 30-year mortgage with the original principal total of $250,000 and an interest rate of 6.5 percent, the monthly payment is $1,580, including both principal and interest. By making the scheduled payments over the life of the loan, the total amount paid in interest will be $319,000. However, if the homeowner pays one additional monthly payment per year, the total interest paid declines to $249,000, a difference of $70,000. This payment strategy shortens the loan from 30 years to just over 24 years.

An alternative to making one extra monthly payment per year is to make a higher monthly payment. For example, on a 15-year loan of $300,000 at 5 percent interest, adding $200 to each monthly payment reduces the interest costs substantially. If the monthly payment is $2,372, making a payment of $2,572 saves $15,376 in interest over the life of the loan. The loan is paid in full in 13.4 years instead of 15 years.

Get A Handle On What A Loan Costs You Each Month

If you own a home, you probably know that a portion of what you pay the lender each month goes toward the original loan amount while some gets applied to the interest. But figuring out how banks actually divvy those up can seem confusing.

You may also wonder why your payment stays remarkably consistent, even though your outstanding balance keeps going down. If you understand the basic concept of how lenders calculate your payment, however, the process is simpler than you might think.

Read Also: How Much Is A Mortgage A Month

S To Calculating How Much A Mortgage Payment Would Cost You Every Month

Personal Finance Insider writes about products, strategies, and tips to help you make smart decisions with your money. We may receive a small commission from our partners, like American Express, but our reporting and recommendations are always independent and objective. Terms apply to offers listed on this page. Read our editorial standards.

- You can calculate a monthly mortgage payment by hand, but its easier to use an online calculator.

- Youll need to know your principal mortgage amount, annual or monthly interest rate, and loan term.

- Consider homeowners insurance, property taxes, and private mortgage insurance as well.

More often than not, a homeowner who borrowed money to buy a house is making one lump-sum monthly payment to their mortgage lender. But while it may be called the monthly mortgage payment, it includes more than just the cost of repaying their loan and interest.

For many of the millions of American homeowners carrying a mortgage, the monthly payment also includes private mortgage insurance, homeowners insurance, and property taxes.

Its possible to estimate your total monthly payment by hand using a standard formula, but its often easier to use an online calculator. Either way, heres what youll need:

How To Choose A Mortgage Lender

You have many options when it comes to choosing a mortgage lender. Banks, credit unions and online lenders all offer mortgages directly, while mortgage brokers and online search tools help you compare options from different lenders.

Its important to make sure you feel comfortable with the broker or company youre working with because youll need to communicate with them frequently during the application processand in some cases, after the loan closes.

You may want to start with the banks or other institutions where you already have accounts, if you like their service. Also, ask your network of friends and family, and any real estate professionals youre working with, for referrals.

You May Like: What Does Cash Out Mortgage Mean

Accelerate Your Mortgage Payment Plan

Get creative and find more ways to make additional payments on your mortgage loan. Making extra payments on the principal balance of your mortgage will help you pay off your mortgage debt faster and save thousands of dollars in interest. Use our free budgeting tool, EveryDollar, to see how extra mortgage payments fit into your budget.

Get A More Accurate Estimate

Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment.

-

How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home.

- Pig

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Award Ribbon VA mortgage calculator

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

Don’t Miss: Which Lender Has The Best Mortgage Rates

What Is Amortization

Amortizing a mortgage allows borrowers to make fixed payments on their loan, even though their outstanding balance keeps getting lower. Early on, most of your monthly payment goes toward interest, with only a small percentage reducing your principal. At the tail end of repayment, that switchesmore of your payment reduces your outstanding balance and only a small percentage of it covers interest.

What Are Hoa Fees

Homeowners association fees are common when you buy a condominium or a home thats part of a planned community. Generally, HOA fees are charged monthly or yearly. The fees cover common charges, such as community space upkeep and building maintenance. When youre looking at properties, HOA fees are usually disclosed upfront, so you can see how much the current owners pay per month or per year. HOA fees are an additional ongoing fee to contend with, they dont cover property taxes or homeowners insurance in most cases.

Don’t Miss: Does Shopping For A Mortgage Hurt Your Credit Score

Calculate Principal And Interest Formula

You may be able to see a breakdown of how much you’re paying in interest and principal on your mortgage statement or through your lender’s online banking site. If you don’t see it, you can use a relatively simple formula to calculate the number yourself.

Take your total outstanding balance on your mortgage . Then, take your annual interest rate and divide by 12 to find your monthly interest rate, since there are 12 months in a year. Multiply the balance by the monthly rate to find your current monthly interest payment.

Subtract the monthly interest payment from your total monthly payment. Also subtract any special amounts paid for things like property tax, homeowners’ insurance or other costs. The rest of your monthly payment is the principal.