What Happens If Only One Spouse Is On The Title And They Pass Away

The laws here can get very complex depending on where you live, when the house was purchased, whether your spouse had a will or not, whether you live in the home or not, and more. If this might happen to you, it’s a good idea to know how estate planning for property works so you can make sure you’re protected.

Buying As Tenants In Common

This is an alternative to buying as joint tenants and it involves buying a property with another person where both parties dont own equal portions of it and can decide what to do with their share if they die. If you get a joint mortgage with friends, most experts would recommend getting a Deed of Trust written up with the help of a solicitor, outlining who owns what between you.

Yes Everyone Needs To Consent

Lets imagine you own a property together with four other people

Three of you want to borrow against that property, but the last person doesnt.

In this case, youll need the last friends consent to apply for the loan.

This just makes sense, what if you were to experience financial hardship and had to sell the property? Its not fair on your friend if they have to sell their property because of a loan they never consented to and possibly didnt know even existed.

Read Also: How Much Would A 60000 Mortgage Cost

How To Remove A Name From A Joint Mortgage

Although most homes are purchased using mortgage loans, few borrowers completely understand the details involved with adding and subtracting owners from the mortgage or deed. Situations like marriages and divorces can prompt borrowers to want to change the names on their mortgages, but the situations in which banks will allow you to modify your deed or mortgage are very limited.

How Can You Protect Yourself As A Co

Before you agree to apply for a mortgage with other people it is a good idea to make sure you know all that you can and your options for protecting yourself. It is a good idea to consult with a business or real estate attorney to help explain your options, your risks, and your responsibilities in becoming a co-borrower on the loan.

If you are becoming a co-borrower in an investment property with friends or family members forming an LLC can help protect members from liability if there is a dispute or lawsuit in regards to the investment property or if someone stops paying their portion of the mortgage payments and wants to sell the property when you want to retain it. If you are forming an LLC after getting preapproval on a mortgage it is a good idea to see if forming this LLC will inhibit your ability to qualify for the mortgage that you were seeking as some lenders will see this as a deal-breaker for final approval.

For more information on your mortgage options in Mission Viejo and surrounding areas please contact me any time.

You May Like: How Much Mortgage Can I Afford Nerdwallet

Who Can Buy A House Together

The most common type of co-ownership is when a married couple buys a home together. But other types of co-buyers are also allowed by mortgage lenders. These include:

- Non-married couples

- Relatives

- Investor partners who want to rent out or flip a home

Many times, adult siblings will look to purchase a home that will better fit their needs of caring for an elderly parent. In my area, its also common for multiple generations of a family to purchase a single-family home due to the convenience of what that home can offer, says Jason Gelios, a Realtor in Southeast Michigan.

Ive also had friends and dating couples look to purchase a home together because they did not like what an apartment was offering them, he adds.

Eric Chebil is founder and CEO of Cher, a real estate company that promotes shared homeownership. And he says co-ownership is more popular today than many would-be buyers believe.

For example, if you have a friend who has been saving up for their first home but they dont want the responsibility of being the sole owner of the house, you could purchase it with them as joint owners, he says.

Assessment By The Lender

In addition to the Central Banks lending limits, its ConsumerProtection Code 2012 requires all regulated lenders to assess your personalcircumstances and financial situation thoroughly before agreeing to offer you amortgage.

The lender must carry out detailed assessments of the affordability of theproduct being offered and of its suitability for you. When offering you amortgage, the lender must give you a written statement, setting out the reasonswhy the mortgage product being offered is considered suitable for your needs,objectives and circumstances.

Read Also: Will Section 8 Help Pay Mortgage

Benefits Of Buying A House With Two People

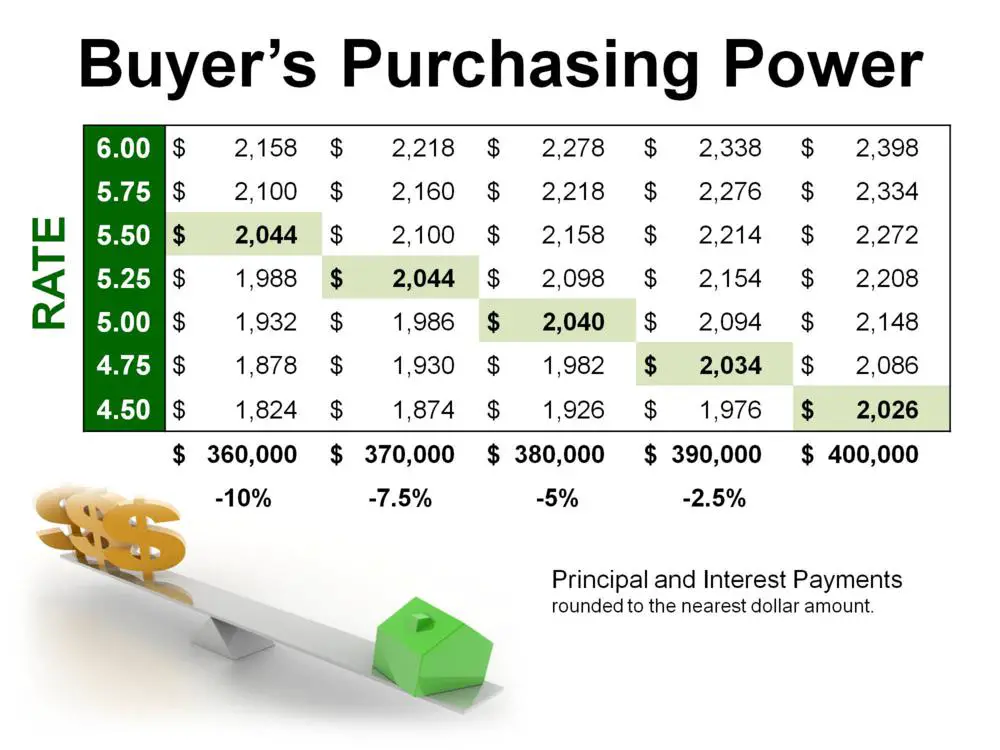

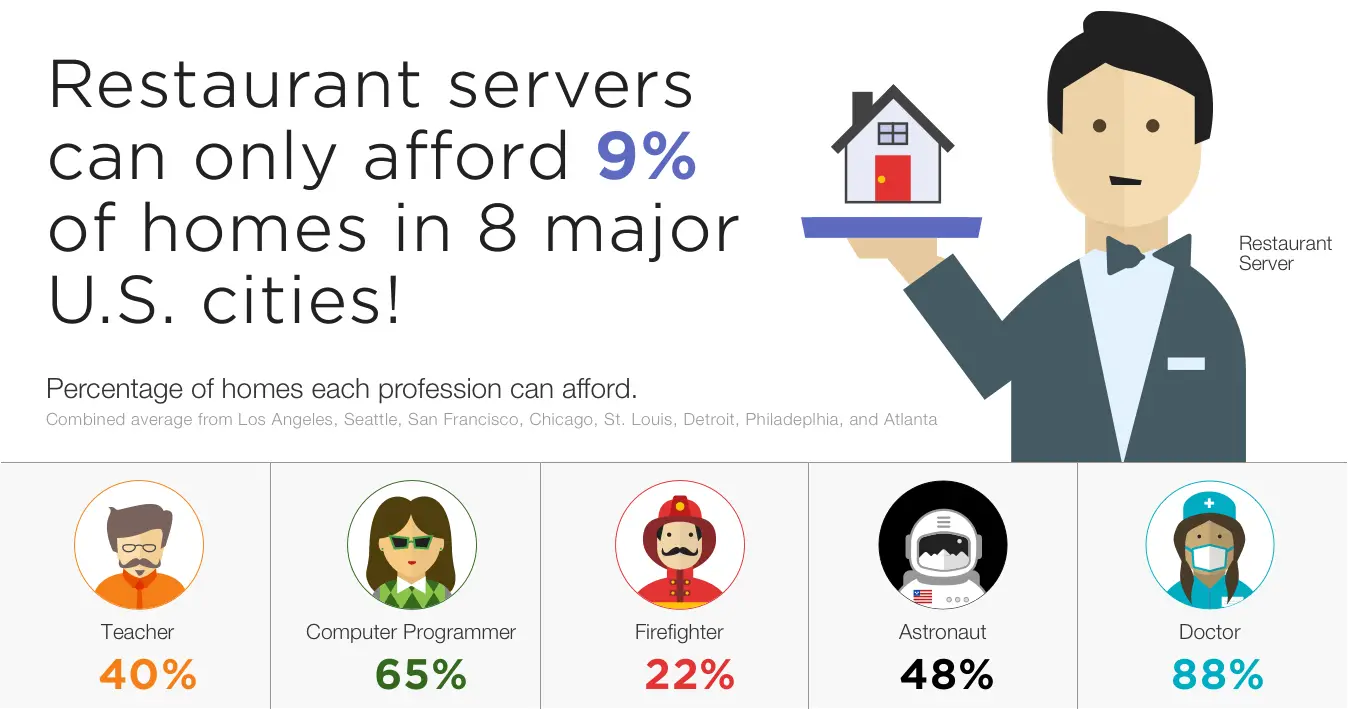

One advantage of purchasing a home with another borrower is that it may lower your mortgage rate and increase your home buying budget. It can also be easier to qualify for a loan if youre on the borderline of being eligible.

For loan qualification purposes, your two incomes will simply be combined to determine how much you can borrow, although your collective existing debts will be considered, too, notes Jon Meyer, The Mortgage Reports loan expert and licensed MLO.

, founder of Rent To Own Labs, agrees.

The big financial plus of getting a co-borrower is that your combined income is considered when applying for a mortgage if you so choose, meaning that youll be more likely to be approved for a higher loan amount, he says.

Whats more, together you can probably make a larger down payment than you would be able to if you purchased alone. Youll also be sharing in the costs of ownership, including maintenance, repairs, and home improvements.

Risks Of Sole Ownership

In most cases the risks inherent in putting a jointly owned house in one person’s name far outweigh the benefits. If your partner is the only one named on the deed , you may be out of luck if your partner sells the house and pockets the money, or dies and leaves it to someone else. Sure, you can sue your ex-partner in an attempt to recover the amount of your financial interest in the property, but this type of lawsuit is often difficult to win, as most states have a strong legal presumption that the person whose name appears on the deed is the owner. In any case, a lawsuit designed to prove that a person whose name does not appear on the deed is a co-owner is likely to be expensive, stressful, and time-consuming.

If one person’s credit will absolutely doom a loan application, it may be possible to take out the loan and purchase the property in one partner’s name alone, and then add the second partner’s name to title immediately thereafter. But be very careful here: Make sure you actually follow through and add the partner’s name officially, and be aware that in some places transfer taxes and fees may apply to the transfer. In some instances the lender may be entitled to “call in the loan” if you add someone to title like this, but in our experience this rarely happens as long as you stay current on the loan payments.

Read Also: Can You Get A Mortgage To Buy A Foreclosed Home

What You Need To Know When Looking For Fha

FHA loans are a common source of funding not just for first-time homebuyers, but also for any homebuyer. This program offers flexible financing

The Convertible Mortgage is one of the many options available to you, helping you to make home ownership as affordable as possible. This mortgage

Buying a Home Articles

Do Both Owners Names Need To Be On A Mortgage

No you can have only one spouse on the mortgage but both on title. Both owners of the home, typically being spouses listed on the deed, do not have to both be listed on the mortgage. Remember that the mortgage does not indicate who the owner of the home is, so not being listed on the mortgage will have no effect on your ownership of the home.

In certain situations, having one spouse on the mortgage and both on the deed is ideal. This is oftentimes the case where one spouse has very poor credit, such that listing that spouse on the mortgage will result in a much higher interest rate than simply listing the other spouse alone. Listing only one spouse on the mortgage may save significant interest over the long term.

There are numerous other reasons to list only one spouse on a mortgage. Common reasons include:

- Income Requirements If including both spouses would cause the couple to fail the income requirements, perhaps because he or she has not had an income in the past few years, that spouse may be best left off the loan application.

- Timing It is oftentimes quicker to approve one spouse on a loan than both when time is of the essence.

- Limiting Credit Score Impact If there is a foreclosure and only one spouse is listed on the mortgage, only his or her credit score will be affected.

- Pending Divorce The spouses are pending divoce and one wishes to buy a home without the other.

Don’t Miss: What Is A Good Ltv For Mortgage

Can More Than Two People Buy A House Together

What if you want to buy a home with multiple family members or a small group of friends? The good news is that you may be allowed to have three or more co-borrowers on the loan, title, and deed.

A conventional mortgage backed by Freddie Mac will allow up to five co-borrowers and a Fannie Mae-backed loan allows up to four co-borrowers.

When it comes to VA, USDA, and FHA mortgage loans, there is no set limit on the number of co-borrowers permitted. However, you can expect a lot of scrutiny from lenders if youre hoping to buy with a large group of people.

While there is no set limit as to how many people can apply together for certain mortgage loans, it would be challenging to find a lender that will allow an excessive amount of people on one loan. The most Ive seen apply for a mortgage together in my career has been four applicants, Gelios says.

Full Responsibility For Mortgage Payment

Remember, if the other borrower on your loan can’t afford their half of the payment, you will be responsible for the entire mortgage payment and your credit will be impacted by their inability or refusal to pay. Similarly, if your co-borrower passes away, the responsibility for the entire loan falls to you.

With that in mind, remember that just because you can afford a more expensive home with the help of a co-borrower doesn’t mean you should always go for it. Before agreeing to any loan, you should always research how much house you can afford and discuss all possible outcomes with your co-applicant in advance.

Read Also: How Much Do I Need For A Mortgage

Can Three People Be On A Mortgage

There is no legal limit to how many people can be on a mortgage, but your lender may have restrictions in place. Remember that everyone on the loan also has to be able to qualify for it to be approved, and some lenders may see a big group of names as a potential risk.

Even if multiple people aren’t on a loan, keep in mind multiple parties can still own a property through joint tenancy or tenancy in common.

How Much Can You Borrow With A Joint Mortgage

The average mortgage taken out in Q3 2021 was just under £193,000, according to Statista.

The amount you can borrow with a joint mortgage will generally be higher than the sum you could borrow alone.

Generally, most lenders will offer to lend you around three to five times your combined income.

The exact amount will also depend on:

-

The size of your deposit

-

Whether you are employed or self-employed

-

The outgoings and credit records of both parties

Recommended Reading: What Is Llpa In Mortgage

Is A Joint Mortgage The Right Option For You

| Joint Mortgage | ||

| Maintenance, upkeep, and general responsibilities that come with owning a house can be shared. | All expenses involved in owning a house will fall on your shoulders. | |

| Fewer Fees | Due to your ability to provide a larger down payment, your mortgage default insurance premium will be smaller or nonexistent. | With a smaller down payment, your mortgage default insurance premium will be bigger. |

| Better Rate | With two incomes, youll look less risky and be more likely to receive a better rate. | Considering all other things equal, a single income may lead to higher rates being charged. |

How To Protect Yourself

Before you agree to a mortgage with other people, protect yourself and consult with a business or real estate attorney who can explain your options and outline the risks you face.

Contact an attorney to work out what type of entity is going to take title to the property. This could be an LLC, a corporation, a trust or a partnership, says Jim Finn, an attorney at Clark, Hunt, Ahern & Embry in Cambridge, Massachusetts. Once you decide what would work best for your particular situation, then the attorney can draft the legal documents.

If youre going in on an investment property with a few friends or family members, forming an LLC can protect members from liability if theres a dispute or lawsuit, or someone stops paying the mortgage or wants to sell the property.

If its an investment, I would suggest they do an LLC because thats going to give them insulation from personal liability, Finn says. They would have an operating agreement which would spell out how theyre going to split proceeds and share costs.

Before you form an LLC, however, make sure your lender is open to giving mortgages to LLCs or similar entities, Finn says.

Some lenders do not want trusts or LLCs to be on the mortgage they want individuals, Finn says.

You May Like: How Much Is The Average Monthly Mortgage

How Do Joint Mortgages Work

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage or any other debt secured on it.

If you want to buy a home with someone else, you need a joint mortgage.

You can take out a joint mortgage with your partner, a friend or a relative.

Some lenders even offer joint mortgages for groups, meaning you could buy a property with two or three friends.

Each borrower has to meet the mortgage lending criteria and is jointly liable for the mortgage payments – which means you have to cover the whole amount if the person or people with whom you have joint liability dont pay their share.

Ownership of the house or flat is also shared the percentage owned by each person should be stated in the property deeds.

According to the Financial Conduct Authority, joint mortgages accounted for more than a third of the mortgages taken out in the UK in the last three months of 2021.

Reasons To Include More Than One Name On A Mortgage

There are a few reasons a borrower might want to include more than one name on a mortgage:

- Applying with a co-borrower might make it easier to qualify for a loan. If the co-borrower has good credit and steady income, for example, this can help strengthen your application and improve your chances of getting approved.

- Applying with a co-borrower allows you to put the co-borrowers name on the title. This is important if you plan to jointly own the home. .

Remember co-borrowers are both wholly responsible for loan payments. If one borrower stops paying their share of the loan, the other must continue to pay to avoid damaging their credit or losing the home.

Read Also: How Much Will I Be Loaned For A Mortgage

Three Or Four Is Usually The Maximum

The number of applicants may vary from lender to lender. Many lenders lend not only to married couples or couples in a civil partnership but also to friends who buy together, who will both live in the property, to two applicants.

Some suppliers, where only one person lives on the property, will lend to joint purchasers. This works well if youre looking for a mortgage for 3 or 4 family members.

Joint Mortgages With Your Parents

You can get a joint mortgage with a parent or family member who has the means to help you afford a property or buy part of one as an investment.

But is it better to do a joint mortgage, or should you use another type of home loan, such as a guarantor mortgage?

When taking out a joint mortgage with your parents, there are two main choices:

-

A standard joint mortgage where each party has joint ownership of the property

-

A joint-borrower-sole-proprietor mortgage where the family member accepts joint responsibility for the payments but does not become a joint owner of the property

With guarantor mortgages, on the other hand, a loved one puts up their own property or savings as a guarantee that you will meet your repayments. This means that they risk losing their assets if you default.

Don’t Miss: What Does A Mortgage Lawyer Do

Ownership Agreement For Co

Although Venable is not in the business of giving legal advice, hes seen those who go into home-sharing situations have agreements drawn up by a lawyer so its specifically laid out as to who is responsible for what.

For example, there could be different percentages of ownership, and therefore, that might affect how the loan is paid back. In the case of an unmarried couple that breaks up, how will that work? In other words, its a good idea to really have a plan in place thats outlined in writing before you move forward with such a transaction.

Consider hiring the services of an attorney to help you lay the framework for the rules surrounding your joint mortgage.