Get Help If Youre Struggling

If youre struggling to make your home loan payments, ask for help. Most lenders are offering the program that has helped millions of borrowers keep their homes while making their loans more affordable.

Its essential to contact your lender as soon as you know youre struggling.

Dont wait and let the home go into foreclosure.

If you wait too long, it could leave you without any options. Discuss your options with your lender, ask as many questions as you need, and figure out the plan to help you keep your home during these trying times.

To get free help online, visit our online mortgage forum at this link.

For those out there who need some housing counseling, please visit the Consumer Financial Protection Bureaus Find a Counselor tool to search for counseling agencies in your area.

Call the HOPE Hotline at 995-HOPE or for other mortgage and financial resources, visit:

What Is A Mortgage Loan Modification

Simply put, loan modification is a change that lenders make to the terms of an existing mortgage.

Such changes usually are made because the borrower is unable to repay the original loan. Most successful loan modification processes are negotiated with the help of an attorney or a settlement company. Some borrowers are eligible for government assistance in loan modification.

Whats in it for the mortgage company?

Loan modification isnt nearly as costly to the lender as default and/or foreclosure. The mortgage company wants to keep you in the house just as much as you want to stay.

Flex Modification: An Outline Of Hamp’s Replacement

The Home Affordable Modification Program comes to a close on December 31, 2016.

A replacement program is set to begin, called Flex Modification. As with HAMP, it will be available for loans owned or backed by Fannie Mae or Freddie Mac.

However, it may be some months until the new program is fully in place new hardship cases can be submitted to Fannie or Freddie as early as March 1, 2017 but lenders aren’t required to be fully up to speed until October 1, 2017. Until then, servicers will generally use existing guidelines from Fannie Mae and Freddie Mac in dealing with troubled borrowers.

Flex Modification combines featured of three programs: HAMP, Fannie/Freddie’s “Standard Modification” and “Streamlined Modification” programs.

As with HAMP, homeowners having trouble making mortgage payments are encouraged to engage their servicer as soon as they can. Flex Mod allows a homeowner to start a modification process before the loan is even as much as 90 days late by requesting and completing a Borrower Response Package . Homeowners must request these from their mortgage servicer typically, the servicer’s contact information can be found on the homeowner’s mortgage statement. This begins the process.

If the borrower is already more than 90 days behind on payments, he or she does not need to complete a Borrower Response Package in order to get the process underway, but they will need to contact their servicer, of course.

Also Check: Mortgage Recast Calculator Chase

S In The Flex Modification Program

Flex Modification requires the mortgage servicer to reduce the homeowners payments on the loan by adjusting the interest rate, adding overdue payments to the remaining loan balance, extending the term of the loan, or setting aside part of the remaining principal. Any part of the principal that has been set aside is not eliminated but instead allocated to a balloon payment. The homeowner will need to pay this amount in a lump sum at the end of the loan term, or when they sell the home or refinance it if this happens before the end of the term. Each of these techniques will reduce the amount of the monthly payment.

If you miss payments on a Fannie Mae or Freddie Mac loan over a period of 90 to 105 days, the mortgage servicer must determine whether you are eligible for the Flex Modification program. This means that your mortgage servicer may offer it to you regardless of whether you have applied for it. Also, you can apply for the Flex Modification program at any time before the foreclosure sale. As long as you apply for the Flex Modification program at least 38 days before the foreclosure sale, the lender cannot proceed with the sale until it reviews your application.

Government Programs For Loan Modification

In the past, the Home Affordable Modification Program was the primary government program for loan modifications. Since HAMP expired, many government programs for loan modifications have arisen to replace it. Yet, for you to be eligible for these government programs, you need a government-backed loan.

The good news is the great majority of all new mortgages in America are government-backed. Banks, private mortgage companies, and credit unions “originate” most mortgages. The originators are the ones who make the mortgage loans to you. These loans may be backed by the Federal Housing Administration , the U.S. Department of Veterans Affairs , the United States Department of Agriculture , or they may not be government-backed.

It may sound strange, but these non-government-backed loans usually become government-backed in a way. Most of these private loans are sold to the Federal Nation Mortgage Association or the Federal Home Loan Mortgage Corporation . Both of these companies are publicly traded companies. That makes them private companies, right? Not exactly. These companies were created by an act of Congress and are subject to special oversight by Congress.

You May Like: Can You Get A Reverse Mortgage On A Manufactured Home

How To Apply For Modification

To find out if you qualify for the Flex Modification Program, start by verifying whether your loan is owned by Fannie or Freddie. You can do this online . Then contact your loan servicer to find out your next steps. The conditions for obtaining this type of alteration are lengthy and complex, Harder said. Your servicer can walk you through the exact qualifications.

Note that when a borrower is 90 to 105 days behind on payments, servicers automatically send them a trial plan offer based on their existing information on file. Even if you dont accept the initial offer, the lender can continue to offer you a trail plan until shortly before foreclosure.

How Do I Apply For A Flex Modification

Your lender or mortgage servicer is supposed to reach out to you if you are more than 30 days delinquent on your home loan, but if you are concerned that you’ll soon become delinquent or you are exiting forbearance and know you can’t resume payments, reach out to your lender.

Your mortgage servicer will provide the paperwork you need to be evaluated for a Flex Modification. This is called the Borrower Response Package, which includes:

-

A signed and completed Borrower Assistance Form.

-

A signed and completed Request for Individual Tax Return Transcript IRS form.

-

Proof of a financial hardship, such as a job loss, divorce, death or illness.

-

Proof of income, which varies depending on your employment status. Note that funds received from unemployment benefits are not counted as income, though other forms of government assistance are.

If you are not currently behind on your mortgage, you may need to provide documentation that shows that you face imminent default in other words, that even though you’re able to pay the loan now, within the next 60 days you will no longer be able to do so.

Also Check: Can You Get A Reverse Mortgage On A Manufactured Home

How Does Loan Modification Work

The goal of a loan modification is to lower your monthly payments and help you avoid foreclosure. There are several ways a loan modification can accomplish this.

A loan modification might include a three-month trial period in which you demonstrate you can make the new monthly payment.

Your lender might agree to reduce your interest rate or trade your adjustable rate for a fixed rate. A fixed, lower rate means your payments will be lower and wont change for the remainder of the loan term, which can help you budget your mortgage payments more effectively.

Another way to lower your monthly payment is to extend the loan term. Adding years to your term reduces your monthly payment but requires you to pay more interest over the life of the loan, which increases the loan’s total cost.

Its also possible your lender will offer principal forbearance though most of the time, lenders wont use this option unless its a last resort to avoid foreclosure.

Principal forbearance is when your lender agrees to defer a portion of your principal to be paid back at a later time. This lowers your current principal amount, which in turn reduces your mortgage payment.

Pros Of A Loan Modification

If your situation qualifies you, a loan modification can:

- Stop an in-progress foreclosure

- Prevent foreclosure before the process begins

- Lower your monthly payments

- Help you catch up on late payments

- Stop you from falling behind on payments

- Resolve delinquency status

- Cause less damage to your credit than foreclosure

Don’t Miss: Can You Get A Reverse Mortgage On A Manufactured Home

Home Loan Modification Vs Refinance

Loan modification vs. refinance: Which is best? Both a loan modification and a loan refinance would change your mortgage, but the distinct differences between them may make one option better for your circumstances. Take a look:

- Loan modification: Getting a loan modification enables you to make a change to your existing mortgage. Your current lender must agree to change the conditions of your mortgage.

- Refinance: Refinancing replaces your existing mortgage with a new loan. You must submit an application to the lender of your choosing and qualify for the new loan.

How Can I Apply For A Loan Modification

Homeowners who are facing financial hardship that makes it impossible to fulfill the mortgage contract should get in touch with their lender or servicer immediately, as they might be eligible for a loan modification.

Typically, lenders will ask you to complete a loss mitigation form. Because foreclosures are so costly for investors, a loss mitigation form helps them look at alternatives, such as loan modifications, to figure out what makes the most financial sense.

Be prepared to submit a hardship statement mortgage and property information recent bank statements and tax returns profit and loss statements and a financial worksheet that demonstrates how much youre earning versus spending.

If your loan modification application is denied, usually, you have the right to appeal it. Because rules vary by lender, find out when the appeal deadline is. Next, youll want to get precise information on why your loan was denied, as this will help you prepare a better case in your appeals.

There are many reasons why you might not qualify, from not providing sufficient proof of hardship to having a high debt-to-income ratio . A high DTI means that you have a lot of debt relative to your income, which might signal that you cant afford your mortgage, even at a modified amount.

Working with a housing counselor or attorney who specializes in mortgage modifications can improve your chances of getting approved for a loan modification.

You May Like: Chase Recast

What Does The Flex Modification Program Offer

Eligible borrowers may get a more affordable mortgage payment so they arent at risk of losing their home.

Lenders have a few options when modifying your mortgage, including:

- Adjusting your interest rate

- Extending your loan term

- Adding the past due amount to the back of the loan and re-amortizing your loan over the new extended term

One final option is setting up a forbearance agreement for part of the loan . The lender would then amortize the loan using the current balance without the past due amounts, and the past due amount would become a balloon payment thats due at the end of the loan. So if you keep the loan for the entire term, your final payment would be the full amount of what is due.

These Are Some Of The Cons Of A Loan Modification:

- You may be offered a lower monthly payment in exchange for a higher amount due overall if the payment term is extended, for example from 30 years to 40 years.

- The total amount you would owe in a loan modification agreement may be a lot more than the house is really worth. In other words, you would be repurchasing your home for more than market value.

- There are processing and legal fees associated with the loan modification. These charges may be added to the principal of the loan, but you would still be responsible to pay. If you have any late fees, back taxes or escrow due, those charges may be added to the principal as well.

- If the lender writes off a portion of the principal by reducing the debt you may still be liable for income tax on that portion, although this option does not generally apply to a primary residence.

- The loan modification agreement the bank offers may be reported as a debt settlement and show that you did not honor the original mortgage contract. If it reports the loan modification that way, your credit score would suffer.

- There are no guarantees that you will be able to stay in your home. The lender may decide to encourage you to sell the property if they feel you will not be able to make the payments in the future, or they may deny the loan modification and begin foreclosure immediately.

- If you miss a loan modification payment, the bank may put you right back into foreclosure and escalate the process, creating a very stressful situation

Don’t Miss: What Does Gmfs Mortgage Stand For

The Pros Of A Loan Modification

There are several benefits to a loan modification. The Fannie Mae Flex Modification program that replaced HAMP allows you to reach an agreement with your lender and change the terms of your original mortgage. To qualify you may have to be ineligible to refinance your existing mortgage, face long-term hardship and/or be behind or likely to fall behind on your mortgage payments in the near future.

The Pros And Cons Of A Loan Modification

Homeowners who are having a hard time making their mortgage payments may decide to fight to hold on to their home. A loan modification may lower monthly payments and make them more affordable, but for many Long Island homeowners and residents of the five boroughs a loan modification is not a good solution. The bank may offer a bad deal where you wind up owing the lender far more than the house is really worth. If you are in this situation, it is a good idea to weigh the pros and cons of a loan modification to determine if it is really the best option in the long run. If not, there are other alternatives to help you avoid foreclosure, such as a short sale.

Recommended Reading: Recasting Mortgage Chase

What Is Considered A Hardship For A Loan Modification

Under normal circumstances, lenders can accept any of the following forms of financial hardship:

- Unemployment

- Reduction of income due to circumstances outside of your control

- Increase in housing expenses due to circumstances outside of your control

- Natural or man-made disasters that impacted your property or place of employment

- Long-term or permanent disability

- Serious illness of the borrower, co-borrower or a dependent family member

- Divorce or legal separation

- Death of a borrower or the primary or secondary wage earner

- Employment relocation of more than 50 miles

- Other hardships as described by the borrower

The Federal Housing Finance Agency expanded these terms to include homeowners who have permanent financial hardship related to the pandemic, as well.

Regardless of the type of financial hardship youre dealing with, youll need to provide documentation during the application process to prove eligibility.

The Short Sale Alternative

In many situations, homeowners who are struggling to meet mortgage payments and facing foreclosure would be better off selling the home in a short sale and making a fresh start. This is especially true if you owe more than your house is worth taking the market value, back payments, fees and interest into consideration. The bank may be offering you an opportunity to buy back your home for a lot more than the house is actually worth.

For example, if the market value of your home is $500,000 but you owe more than $700,000, the bank may offer a deal where you will be paying $700,000 over the term of the mortgage for a $500,000 house, even if the monthly payments are lower. A short sale, where you sell the house and the bank agrees to accept less than what you owe and forgive the difference, is often a much better alternative to avoid foreclosure. It allows you to walk away debt free and move onto a fresh start!

Also Check: How Much Is Mortgage On A 1 Million Dollar House

What Types Of Loan Modification Programs Exist

If nothing else, the Great Recession and mortgage crisis made lenders and mortgage-servicing companies more attuned to the needs of at-risk homeowners.

Nowadays, most lenders have programs designed to see borrowers through tough times while keeping them in their homes. If your lender doesnt, ask them or a Housing and Urban Development approved counselor about your eligibility for programs that can assist you through the modification process.

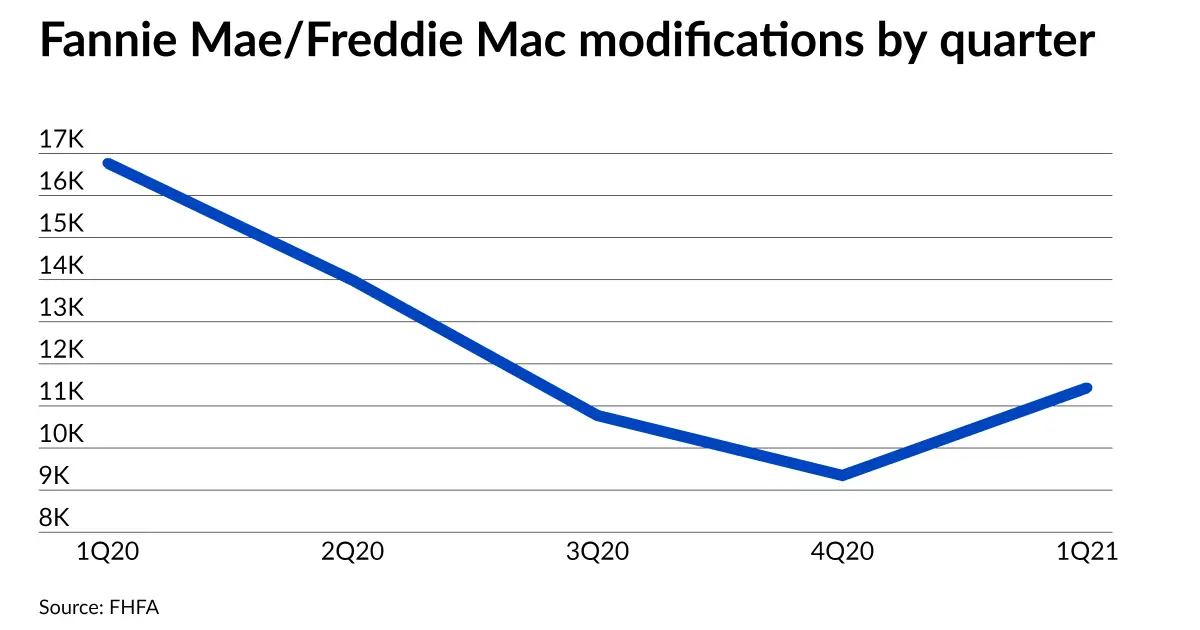

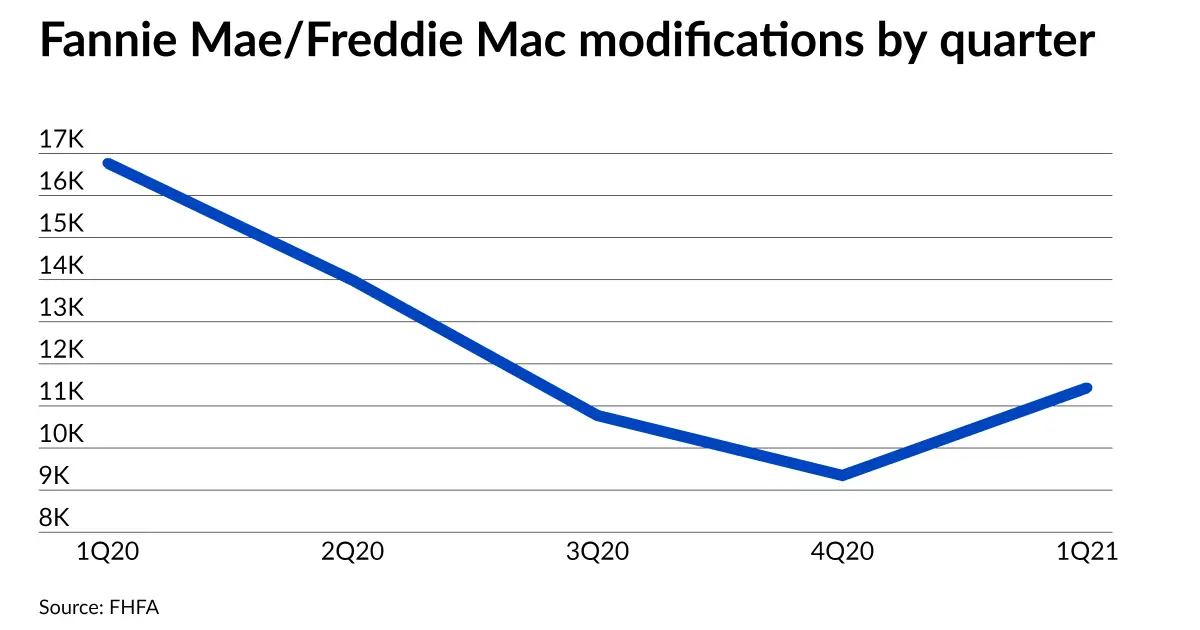

HAMP the Home Affordable Modification Program expired at the end of 2016. Its successor is the Flex Modification program, overseen by Fannie Mae and Freddie Mac. Borrowers whose mortgages are subject to Fannie or Freddie may qualify.

HARP the Home Affordable Refinance Program helped refinance underwater homeowners into new, more affordable mortgages. HARP expired at the end of 2018. Now there are Fannie Maes High Loan-to-Value Refinance Option and, from Freddie Mac, the Enhanced Relief Refinance program.