What Portion Of Your Income Should Go To Your Mortgage

Many lenders and mortgage experts adhere to the 28% limit meaning your monthly mortgage repayments should not exceed 28% of your gross monthly income or the amount you earn before taxes are deducted.

This percentage also puts you below the mortgage stress threshold of 30%.

According to some experts, if you are spending more than 30% of your pre-tax monthly income on mortgage payments, then you may be at risk of mortgage stress.

To illustrate, the average weekly income of full-time working adults in Australia is $1,714, according to last Mays seasonally adjusted figures from the Australian Bureau of Statistics .

To get the median monthly income, we need to multiply this number by four the number of weeks in a month then multiply the product by .28 to get the 28% limit and .3 to find the mortgage stress threshold.

$1,714 x 4 x 0.28 = $6,856 x 0.28 = $1,919.68

$1,714 x 4 x 0.28 = $6,856 x 0.3 = $2,056.80

Given these, an average working Australian should ideally allocate about $1,920 to their monthly mortgage repayment and not pay more than $2,057 to avoid falling into mortgage stress.

However, it is worth noting that each persons financial situation is different and there are some who can allot more than 30% of their income to their monthly mortgage and still live comfortably.

How Credit Score And Down

Every lenders priority is to maximize its chances of getting its money back with as little expense as possible. They want to be as sure as they can that borrowers are ready, able and willing to make timely monthly payments.

Luckily, this protects most borrowers from taking on mortgages that they cant afford or are incapable of maintaining.

Know Which Mortgage Option Is Right For You

Okay, now lets talk about types of mortgages. Most of them are garbage designed to help you pay for a home even if you cant afford it.

But when you do the math, you find that these mortgages charge you tens of thousands of dollars more in interest and fees and keep you in debt for decades longer than the option we recommend.

Thats why getting the right mortgage is so important! Setting boundaries on the front end makes it easier to find a home you love thats in your budget.

Here are the guidelines we recommend:

- A fixed-rate conventional loan. With this option, your interest rate is secure for the life of the loan, keeping you protected from the rising rates of an adjustable-rate loan.

- A 15-year term. Your monthly payment will be higher with a 15-year term, but youll pay off your mortgage in half the time of a 30-year termand save tens of thousands in interest.

Your mortgage lender will most likely approve you for a bigger mortgage than you can actually afford. Do not let your lender set your home-buying budget. Ignore the banks numbers and stick with your own.

Knowing your house budget and sticking to it is the only way to make sure you get a mortgage you can pay off as fast as possible.

You May Like: How Does 10 Year Treasury Affect Mortgage Rates

Pay Off Your Mortgage Faster

Try to pay more each month:

- Increase your regular payment amount. Pay $675 rather than $652, for example.

- Make lump sum payments to your mortgage principal. An extra $1,000 here and there can make a big difference.

- Make accelerated payments. Instead of making 2 payments per month , make payments every two weeks .

- Speak to your mortgage professional about other options.

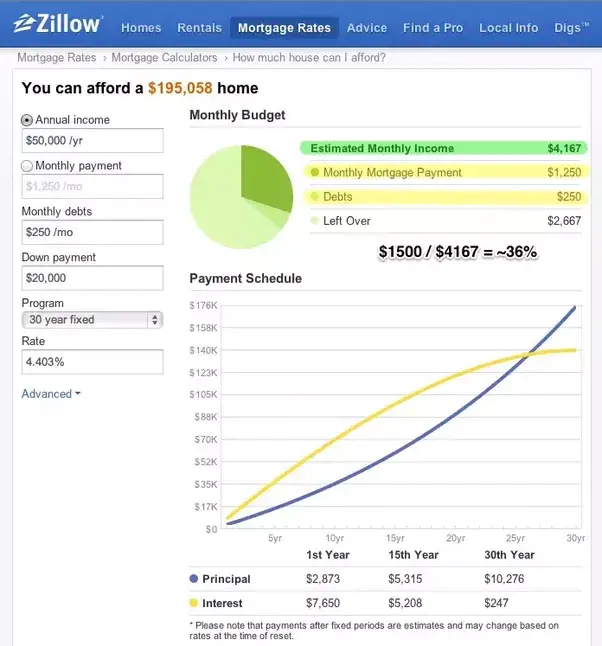

The Bottom Line: How Much Home Can You Afford

So, what percentage of your income should go toward your mortgage? The answer will vary depending on your income and how much debt you have. But your income is only one of the many factors that determine how much home you can afford. Lenders look at everything from your credit score to your liquid assets when they decide how much to offer you.

To learn more about how much of a mortgage loan you can afford to borrow, check out our home affordability calculator. If youre ready to get started, you can apply online or give us a call at 452-0335.

You May Like: How Much Is Mortgage On A 1 Million Dollar House

What Is Your Gross Monthly Income

Before we dig into the details of the guidelines mortgage lenders use, lets get a handle on gross monthly income. Gross income is the money you earn whether it be from sources such as salary, profits, tips, alimony or freelance work before taxes and deductions for benefits such as health insurance are taken out.

For an employee who is paid a salary, calculating your gross monthly income takes one simple step:

Annual Salary Before Taxes / 12 = Gross Monthly Income

If you are paid hourly, there are a few extra steps required to calculate gross monthly income:

Step 1: Hourly Rate x Number of Hours Worked Per Week = Weekly SalaryStep 2: Weekly Salary x 52 = Annual SalaryStep 3: Annual Salary / 12 = Gross Monthly Income

Check Your Credit History

When you apply for a mortgage, lenders usually pull your credit reports from the three main reporting bureaus: Equifax, Experian and TransUnion. Your credit report is a summary of your credit history and includes your credit card accounts, loans, balances, and payment history, according to Consumer.gov.

In addition to checking that you pay your bills on time, lenders will analyze how much of your available credit you actively use, known as credit utilization. Maintaining a credit utilization rate at or below 30 percent boosts your credit score and demonstrates that you manage your debt wisely.

All of these items make up your FICO score, a credit score model used by lenders, ranging from 300 to 850. A score of 800 or higher is considered exceptional 740 to 799 is very good 670 to 739 is good 580 to 669 is fair and 579 or lower is poor, according to Experian, one of the three main credit reporting bureaus.

When you have good credit, you have access to more loan choices and lower interest rates. If you have poor credit, you will have fewer loan choices and higher interest rates. For example, a buyer who has a credit score of 680 might be charged a .25 percent higher interest rate for a mortgage than someone with a score of 780, says NerdWallet. While the difference may seem minute, on a $240,000 fixed-rate 30-year mortgage, that extra .25 percent adds up to an additional $12,240 in interest paid.

Dont Miss: How Much Would I Get Pre Approved For A Mortgage

Recommended Reading: Does Rocket Mortgage Sell Their Loans

What Should I Do If The Lender Refuses To Give Me A Big Enough Mortgage

If various lenders reject your application, its a sign that they dont think you can afford such a big mortgage. Should this be the case, its best to scale down your aspirations rather than desperately search for the one lender that will say yes.

This may be frustrating, but its in your best interest to ensure that youre not financially overstretched because you dont want to have your home repossessed in the future.

Related guides

How Much Should My Mortgage Be In The Real World

All this math can come across as a bit theoretical. And your goal when deciding on your mortgage amount should be more practical. You want a loan that will fit neatly within your lifestyle, needs, and ambitions.

The fact that a lender will give you $x amount because of your DTI, credit score, down payment, and personal finances doesnt necessarily mean you should borrow $x amount.

Yes, most of us borrow up to the maximum were allowed. But that doesnt mean you should.

What are your spending priorities?

It all depends on your lifestyle and priorities. Suppose you love foreign travel or gourmet eating or sailing or shopping. Borrowing the max amount might mean youre sacrificing other luxuries for years to come.

It could be best to settle on a more modest home and a smaller mortgage if that allows you to maintain your current lifestyle.

How secure is your income?

You should also bear in mind how secure your earnings are.

You likely dont want to be saddled with the biggest mortgage possible if youre in a job where firings are commonplace or if you plan to change jobs soon and youre not sure youll earn the same amount.

Lenders have these questions in mind, too. Thats why they typically want to see two years employment history on your mortgage application. They also want to know any income youre using to qualify for the loan will continue for at least three years.

Recommended Reading: Rocket Mortgage Conventional Loan

Calculate Your Monthly Income

The first thing you need to do is to calculate your monthly income. A mortgage broker will usually look at your gross monthly income, or your income before taxes. If you are self-employed or work on commission, a broker may look at your adjusted gross income based on your tax returns. When calculating your income, a broker will usually review your past two years of W-2s and determine the average earned over these two years.

Example:

2015 $90,0002016 $98,000

Most brokers would compute this as an income of $94,000 per year, or $7,833 a month.

Limit All Discretionary Spending

If youve experienced a recent financial shock like a job loss or unexpected big bill, you may be able to help yourself by limiting or eliminating discretionary spending for a while. Budget only for the things you must have.

This definitely isnt fun, but it may be a necessary measure for you to take until a long-term solution is in place and the urgency that led to an austerity budget has passed.

Also Check: Bofa Home Loan Navigator

When Buying A House Should I Use My Gross Income Or Net Income To Determine What I Can Afford

Theres a big difference between your gross income and your net income. Your gross income is the money you earn each month before taxes are removed. Your net income is that same income after taxes are removed.

No surprise, your net monthly income is usually much lower than your gross monthly income.

When its time to buy a house, though, which figure should you use when deciding how much home you can afford?

This is an interesting question. When you apply for a mortgage loan, your lender will rely on your gross monthly income to determine how many mortgage dollars to lend to you. This doesnt mean, though, that you should rely on gross income to determine how much of a house payment you can comfortably afford each month.

Look at it this way: Your net monthly income is your realistic income. This is how much money you are bringing into your house each month. If you want to make sure that you can afford a monthly mortgage payment of $1,500, $2,000 or $3,000, its more realistic to consider how much of your actual take-home pay your mortgage payment will consume each month.

Heres another tricky matter: Most mortgage lenders today say that your total monthly debt including your mortgage payment should total no more than 43 percent of your gross monthly income. Again, thats your income before taxes are removed.

How To Calculate A Down Payment

The down payment is the amount that the buyer can afford to pay out-of-pocket for the residence, using cash or liquid assets. Lenders typically demand a down payment of at least 20% of a homes purchase price, but many let buyers purchase a home with significantly smaller percentages. Obviously, the more you can put down, the less financing youll need, and the better you look to the bank.

For example, if a prospective homebuyer can afford to pay 10% on a $100,000 home, the down payment is $10,000, which means the homeowner must finance $90,000.

Besides the amount of financing, lenders also want to know the number of years for which the mortgage loan is needed. A short-term mortgage has higher monthly payments but is likely less expensive over the duration of the loan.

Homebuyers need to come up with a 20% down payment to avoid paying private mortgage insurance.

Recommended Reading: Can You Get A Reverse Mortgage On A Manufactured Home

Dont Forget To Factor In Closing Costs

Alright, dont freak out here. But a down payment isnt the only cash youll need to save up to buy a home. There are also closing costs to consider.

On average, closing costs are about 34% of the purchase price of your home.1 Your lender and real estate agent buddies will let you know exactly how much your closing costs are so you can pay for them on closing day.

These costs cover important parts of the home-buying process, such as:

- Appraisal fees

- Attorneys

- Home insurance

Dont forget to factor your closing costs into your overall home-buying budget. For example, if youre purchasing a $200,000 home, multiply that by 4% and youll get an estimated closing cost of $8,000. Add that amount to your 20% down payment , and the total cash youll need to purchase your home is $48,000.

If you dont have the additional $8,000 for closing costs, youll either need to hold off on your home purchase until youve saved up the extra cash or youll have to shoot a little lower on your home price range.

Whatever you do, dont let the closing costs keep you from making the biggest down payment possible. The bigger the down payment, the less youll owe on your mortgage!

Realize That Other Expenses May Come Up

Even if your mortgage doesn’t stretch your budget, an unexpected job loss or other event could cause you to struggle to make your mortgage payments. The more affordable a home is in the first place, the better chance youll have of recovering.

Building up an emergency fund is easier if you limit your mortgage payment to 25 percent of your take-home pay. The more cash you have on hand, and the lower your monthly obligations, the better chance youll have of staying afloat if difficult times strike.

Also Check: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Try The 30% Rule First

If you have a high income or live in an affordable area. Try keeping your rent and utility costs below 30% of your take-home pay.

Following this guideline means you have more money to pay off debt and save for future expenses.

Renting instead of owning a home gives you the flexibility to move at short notice and not be responsible for property maintenance. But, youre also not building net worth through home equity once you pay off the mortgage.

Of course, you should choose an unsafe place to live to simply keep rent below 30% of your income.

Loan Term And Adjustable Vs Fixed Rate Mortgage

Loans with short terms usually have lower interest rates than loans that are paid off over a longer period of time.

An adjustable-rate mortgage might have a lower rate than a fixed-rate mortgage at first. But over time, the rate on an adjustable-rate mortgage could go up by a lot, while the rate on a fixed-rate mortgage would remain the same.

Also Check: Recasting Mortgage Chase

What Percentage Of Your Salary Should Go For A Mortgage

Buying and owning real estate usually involves having a mortgage loan. If youâre contemplating becoming another happy homeowner, you should have an idea what mortgage lenders look for as a percentage of your compensation. Along with acting as a major qualification component, statistics prove that spending this percentage â or less â for your mortgage payment predicts your success at meeting your loan obligations.

How To Determine The Percentage Of Income For Mortgage

When you purchase a home, its vital to know what percentage of your income will be saved for your mortgage . Housing ratios and debt-to-income ratios are ways of calculating the percentage of gross income for mortgage payments and who qualifies for mortgage loans. Debt to income ratios work using the 28/36 rule , which well explain in detail later in this post.

What is the housing ratio? Simply put, the housing expense ratio is a ratio that compares your pre-tax income to housing expenses on the real-estate market. Lenders use this calculation when they decide who will qualify to borrow for a loan.Understanding what percentage of your monthly income should go to your mortgage payments can help you budget and live comfortably. Nobody wants to be house poor, struggling to make ends meet in order to make mortgage payments.

If youre wondering what is another term for housing ratio ? Its sometimes referred to as the front-end ratio as it is a partial component of a borrowers total debt-to-income. Therefore, it should be considered early in the underwriting process for a mortgage loan.

Dont worry, well be explaining front-end ratios, back end ratios, gross income, net income, and mortgage percentage payments as you read on. We will follow this up with some essential guidelines for obtaining an affordable mortgage.

But first, lets answer a fundamental question:

Recommended Reading: Rocket Mortgage Qualifications

Read Also: Requirements For Mortgage Approval

How Will My Debt

When you apply for a mortgage, lenders usually look at your debt-to-income ratio your total monthly debt payments divided by your gross monthly income written as a percentage.

Lenders often use the 28/36 rule as a sign of a healthy DTImeaning you wont spend more than 28% of your gross monthly income on mortgage payments and no more than 36% on total debt payments .

If your DTI ratio is higher than the 28/36 rule, some lenders will still be willing to approve you for financing. But theyll charge you higher interest rates and add extra fees like mortgage insurance to protect themselves in case you get in over your head and cant make mortgage payments.