What Is Ltv Ratio

The loan-to-value ratio is an assessment of lending risk that financial institutions and other lenders examine before approving a mortgage and compares the loan value to the market value of the property. Typically, loan assessments with high LTV ratios are considered higher-risk loans. Therefore, if the mortgage is approved, the loan has a higher interest rate.

Income And Employment Requirements To Buy A House

Before approving your mortgage, the lender must confirm that your income could support a mortgage payment.

For this reason, most lenders need to see 24 months of consecutive employment before you apply for a home loan.

This applies to self-employed mortgage borrowers, too, in which case youll provide your business and personal tax returns for the previous two years. Tax returns must show consistent income over the previous 24 months, either remaining roughly the same or increasing.

Theres no minimum income to get a mortgage, but some loan programs have a max income limit.

Since a self-employed borrowers income can fluctuate from year to year, mortgage lenders often average out their income over a twoyear period, and then use this figure for qualifying purposes.

Be mindful, too, of possible income requirements for the type of loan you want. Theres typically no minimum income requirement, but you can earn too much money for some homebuyer programs.

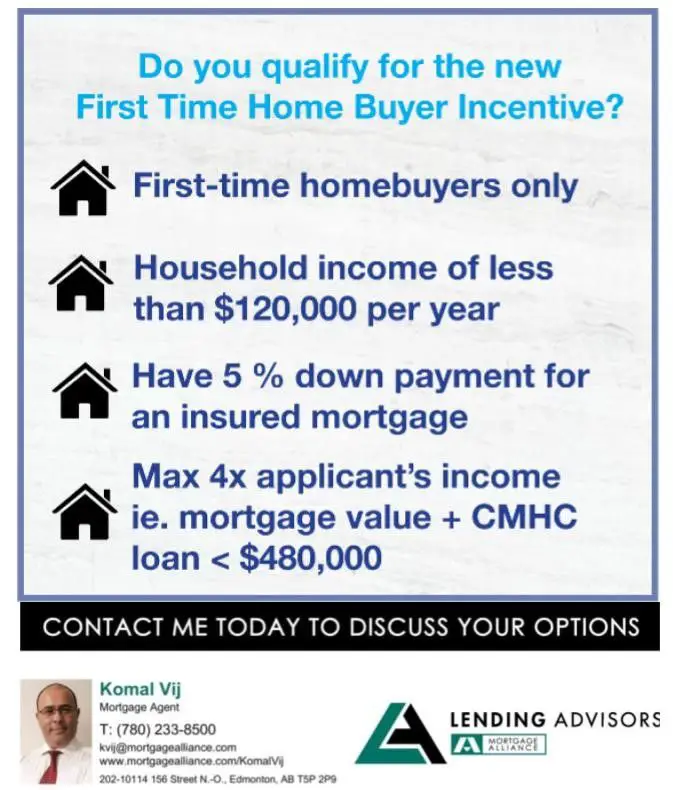

With USDA, for example, your total household income must be at or below 115% of the median household income for the area. And if applying for Fannie Maes HomeReady or Freddie Macs Home Possible, your income must not exceed the limit set for your area.

What Income Can Be Used To Qualify For A Mortgage

Lenders will look more closely at how you earn your income than at how much you earn. A lender is looking for a solid track record and evidence that you will continue to earn a steady income in the future. Provided you can show this, lenders are prepared to consider a wide variety of income types including:

- Earnings by self-employed contractors, freelancers, and business owners

- Dividend income from stocks or other investments

- Retirement income from a pension fund or annuity

- Some types of social security income

- Alimony and child support payments

Recommended Reading: Can You Sell A Home That Has A Reverse Mortgage

Eligibility Requirements For Va Home Loan Programs

Learn about VA home loan eligibility requirements for a VA direct or VA-backed loan. Find out how to request a Certificate of Eligibility to show your lender that you qualify based on your service history and duty status. Keep in mind that for a VA-backed home loan, youll also need to meet your lenders credit and income loan requirements to receive financing.

Capacity To Pay Back The Loan

Lenders look at your income, employment history, savings and monthly debt payments, and other financial obligations to make sure you have the means to comfortably take on a mortgage.

One of the ways that lenders verify your income is by reviewing several years of your federal income tax returns and W2s, along with current pay stubs. They evaluate your income based on:

- The source and type of income

- How long you’ve been receiving the income and whether it’s been stable

- How long that income is expected to continue into the future

Lenders will also look at your recurring monthly debts or liabilities, such as:

- Other debts that you ‘re obligated to pay

Don’t Miss: How To Pick The Best Mortgage Lender

How To Interpret The Results

The calculator shows two sets of results:

Most lenders require borrowers to keep housing costs to 28% or less of their pretax income. Your total debt payments cant usually be more than 36% of your pretax income.

Some mortgage programs – FHA, for example – qualify borrowers with housing costs up to 31% of their pretax income, and allow total debts up to 43% of pretax income.

Use our Debt-to-income Calculator to find your DTI ratio and learn more about debts role in your home purchase.

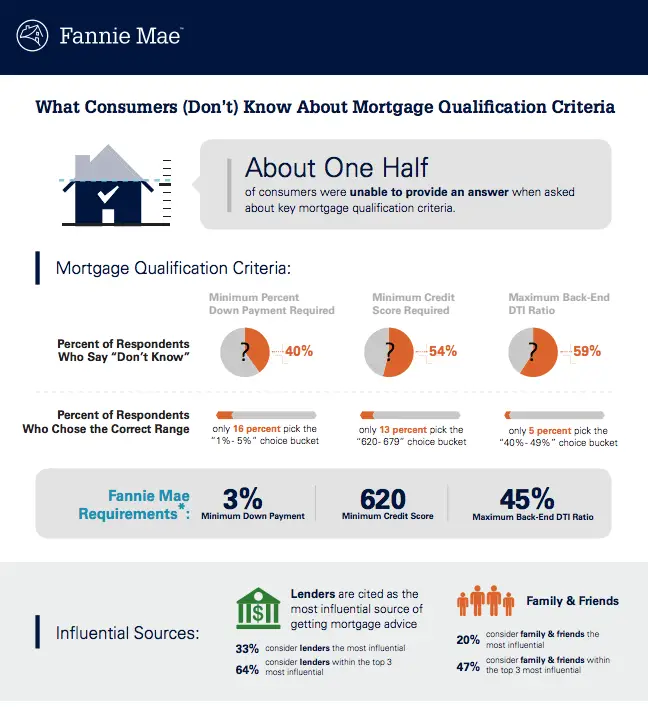

What Must Your Credit Score Be To Qualify For A Mortgage

Conventional Loan Requirements It’s recommended you have a credit score of 620 or higher when you apply for a conventional loan. If your score is below 620, lenders either won’t be able to approve your loan or may be required to offer you a higher interest rate, which can result in higher monthly payments.

You May Like: Do Mortgage Inquiries Hurt Your Credit

Find A Property And Make An Offer

Now comes the best part finding the home thats right for you. To help you with your search, try connecting with a real estate agent in your area when you start viewing properties, especially if youre buying your first home. A real estate agent can help you narrow your search and show you properties that fit both your budget and needs.

Once you find the right home, your real estate agent will also help you submit an offer, and potentially begin negotiating with the seller. Once the seller accepts your offer, its time to move to the final stages of the home buying process.

Mortgage Prequalification And Mortgage Preapproval Aren’t The Same Thing

Mortgage prequalification and mortgage preapproval are steps most people take before making an offer on a house. However, they aren’t the same thing.

Being prequalified or conditionally approved for a mortgage is the best way to know how much you can borrow. A prequalification gives you an estimate of how much you can borrow based on your income, employment, credit and bank account information.

Preapproval comes from a lender who has analyzed your finances carefully. They’ll tell you how much you may be able to borrow and what your interest might be. Mortgage preapproval is usually done after prequalification, but before you find a home. Preapproval doesnt guarantee you’ll get a mortgage, but if all key factors stay the same it’s very likely.

Don’t Miss: What Percent Down Payment To Avoid Mortgage Insurance

Check Your Credit Reports

Before you get too deep into the mortgage application process, itâs a good idea to take a step back and check your credit reports first. The health of your credit will play a big part in getting a good deal on a home loan, or even getting approved at all.

Start by pulling your credit reports from each of the three major credit bureaus: Experian, Equifax and TransUnion. The easiest way to do this is by visiting annualcreditreport.com, the only website thatâs authorized by federal law to provide free credit reports once per year.

Next, review your reports to ensure there are no errors or accounts that arenât yours listed that may have damaged your credit. For example, review your personal information such as name, address and Social Security number for accuracy. Also check that the credit accounts and loans listed on your reports have been reported properly, including the balance and status. Double-check that there are no mysterious accounts opened, which would signal possible identity theft.

If you find an error, you can dispute it with the bureau thatâs reporting the incorrect information by visiting its website. Once you submit a dispute, the bureau is required to investigate and respond within 30 days.

How Much Mortgage Loan Insurance Would You Need To Pay If You Offer The Minimum Down Payment

Mortgage loan insurance protects the lender if you start missing payments and cant make them up within a reasonable timeframe. As mentioned, most lenders require you to buy CMHC insurance if you put less than 20% of a homes price down.

Your premium will usually be 0.6% 6.5% of your total borrowed amount, based on your loan-to-value ratio or LTV . It can be paid upfront in a lump sum or divided amongst your mortgage payments. Essentially, if you offer a lower down payment, youll have to pay a higher mortgage insurance premium.

So, if youre only able to make a minimum 5% down payment on a $300,000 house, the Canada Mortgage and Housing Corporation will charge you $11,400 for insurance.

Loans Canada Lookout

Also Check: Whats Needed To Apply For A Mortgage

You May Like: Can I Be Approved For A Mortgage

Mortgage Payments Must Fit Your Budget

We all have ideas of our dream home, whether its a swimming pool in the backyard or lots of space for relaxing and hosting family and friends. However, these homes may not be in your budget. Before you start looking at houses, you should know what you can realistically afford. As a rule, you shouldn’t spend more than 43% of your income on your monthly debts. Run your numbers through a mortgage calculator before you start looking for a home so you can see what’s in your budget.

You’ll Pay More Without A Minimum 20% Down Payment

Experts continue to encourage buyers to save a down payment of at least 20% before applying for a mortgage. It makes sense, as the larger your down payment, the smaller your mortgage and the less interest you’ll pay over the life of your loan. However, with the rise of FHA loans, which require as little as 3.5% down, and VA loans, which may not need any down payment, many buyers wonder whether a 20% down payment is as important as it used to be.

Keep in mind that you must pay private mortgage insurance if you put less than 20% down on a conventional loan. PMI covers the lender if you stop paying your mortgage and default on your loan. The yearly cost of PMI is about 1% of your outstanding loan balance and is added to your monthly mortgage payment. You can request to have PMI removed once your outstanding balance reaches 80% of the original loan amount. You also might not realize that applicants with smaller down payments usually have a higher interest rate. A small down payment might let you enter the homeowner market sooner, but it can cost you in the long run.

Read Also: How Long Before I Pay Off My Mortgage

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Boost Your Credit Score

Your credit score speaks to how responsible you are as a borrower, and so it makes sense mortgage lenders would take that number into account when deciding if you qualify for a home loan. You need a minimum credit score of 620 to get a conventional mortgage, but for a competitive interest rate on a home loan, you’ll want a score that’s much higher .

To raise your credit score quickly, try paying off some credit card debt, which will bring down your utilization ratio. That ratio measures the amount of credit you’re using at once, and the lower it is, the more it’ll help your score.

At the same time, be sure to check your credit report for errors. Mistakes are pretty common, and if there’s one on your credit report that reflects poorly on you , correcting it could raise your score substantially.

Don’t Miss: Will Mortgage Prequalification Affect Credit Score

Do You Qualify For A Home Loan

Numerous factors determine whether youll qualify for a home loan. Your mortgage lender will look closely at your credit history, your debts, cash on hand, and income to gauge affordability.

Mortgage approval isnt one-size-fits-all, so its also important to get pre-approved for a loan before house hunting. This way, youll know your qualifying amount with your current income. You can then search for properties within this price point.

How To Calculate Your Required Income

To use the Mortgage Income Calculator, fill in these fields:

-

Mortgage interest rate.

-

Recurring debt payments. Heres where you list all your monthly payments on loans and credit cards. If you dont know your total monthly debts, click No and the calculator will ask you to enter monthly bill amounts for:

-

Car loan or lease.

-

Personal loan, child support and other regular payments.

Monthly property tax .

Monthly homeowners association fee .

Don’t Miss: Can I Get A Mortgage If Self Employed

Bottom Line: Can You Qualify For A Home Loan

If youre planning to buy a home, the mortgage products available to you will depend largely on your credit score, your ability to provide a down payment and your debt-to-income ratio. Your options also vary depending on whether you are a veteran or a buyer in a rural area.

For borrowers with excellent credit and the ability to offer a significant down payment, conventional loans may offer lower interest rates. However, for first-time homebuyers without much cash reserved, FHA loans may be enticing because they dont require a big down payment or a high credit score.

If youre a veteran, VA loans are a great option unlike conventional loans, they dont have a mortgage insurance requirement, even if you put down less than 20%. USDA loans also provide an affordable option for many, though these are only available in specific rural areas.

Buying a house is a huge move, and its smart to get in touch with a trusted loan officer at your financial institution who can help evaluate your situation to find which loan options youre eligible for.

How Much Should You Make A Year To Afford A 300k House

A person earning $ 50,000 a year might be able to afford a home worth between $ 180,000 and nearly $ 300,000. This is because salary is not the only variable that determines the budget for buying a home. You also need to consider your credit score, current debt, mortgage rates, and many other factors.

How much should I make to buy a 300k house?

This means that to afford a $ 300,000 home, you would need $ 60,000.

Read Also: How Many Years Of W2 For Mortgage

Don’t Miss: Where To Prequalify For A Mortgage

Make Sure You Can Show Where Your Deposit Is Coming From

- Savings will need to be evidenced with bank statements and large lump sum transfers will have to be explained. Online statements can satisfy some lenders here but will need your name and address. Some online facilities dont allow this so check yours now.

- Gifted deposits will typically require a letter from the person giving you the money but the format of this will vary depending on the lender so they will need to be in a position to sign this when you apply for the mortgage.

- If you are raising the money on another property it may make sense to start this process earlier to ensure you have the money available when you need it.

Short History Lessons Of Mortgages

Before the subprime mortgage crisis of 2008-2009, just about anyone could get a mortgage . Lenders pushed sub-prime loans on people with poor credit knowing they probably could not keep up with the payments and would default on their loans and lose their homes.

The lending habits were not healthy and this led to a sharp increase in those high-risk mortgages ending up in default. This contributed to the most severe recession in decades. Some have blamed lenders for inappropriately approving loans for subprime applicants, despite signs that people with poor scores were at high risk for not repaying the loan. By not considering whether the person could afford the payments if they were to increase in the future, many of these loans may have put the borrowers at risk of default.

I used to work in the Underwriting Department at SunTrust in 2012, and the criteria they used to determine whether to make a loan is more rigorous.

However, that does not mean that millennials would have a tough time getting a mortgage it is just important to do your research first and make sure youre financially prepared to take on a mortgage payment.

In order to get a solid grasp on the terms and processes of buying a home. Take the time to understand the process and requirements of being a first-time home buyer.

1. Do the research

Your credit score and any credit issues in the past few years:

How much cash you can put down:

Shop for loan programs:

3. Find a lender

Don’t Miss: What Are 30 Year Mortgage Rates

How To Qualify For A Mortgage: 6 Factors To Consider

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey. Read more We develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right. Read less

Do you lie awake thinking: Will I qualify for a mortgage? If youre not crystal-clear about every loan program, down payment requirement, and credit threshold, join the vast club.

Lets take some of the mystery out of how to qualify for a mortgage.